A CD ladder is a classic savings strategy where you split a sum of money into several Certificates of Deposit (CDs), each with a different maturity date. Imagine it like building a small staircase for your savings—each step gives you access to some of your cash while the rest keeps climbing toward higher interest rates. It’s all about balancing earning power with financial flexibility.

Unlocking the Power of a CD Ladder

If you've ever felt torn between locking in a great long-term CD rate and keeping your cash accessible in a short-term one, you've stumbled upon the exact dilemma a CD ladder is designed to solve. It’s a clever way to get the best of both worlds.

The idea is simple. Instead of putting a large chunk of money into a single 5-year CD, you divide it into smaller, equal pieces. Each piece, or "rung," goes into a CD with a different term length, creating staggered maturity dates. To get a better feel for the building blocks, you can read how a single Certificate of Deposit is explained in our foundational guide.

The Staggered Maturity Advantage

The real magic of a CD ladder kicks in as each CD matures. Let's walk through a basic 5-year ladder to see how it works.

Here's a quick look at how you might structure it with $25,000.

Quick Overview of a 5-Year CD Ladder

| Rung (CD #) | Investment Amount | CD Term | Maturity Schedule |

|---|---|---|---|

| Rung 1 | $5,000 | 1-Year | Matures in 1 year |

| Rung 2 | $5,000 | 2-Year | Matures in 2 years |

| Rung 3 | $5,000 | 3-Year | Matures in 3 years |

| Rung 4 | $5,000 | 4-Year | Matures in 4 years |

| Rung 5 | $5,000 | 5-Year | Matures in 5 years |

After the first year, your 1-year CD matures, freeing up $5,000 plus interest. You can either spend that money or—and this is the key to the strategy—reinvest it into a new 5-year CD. This new CD becomes the highest rung on your ladder, likely capturing a better interest rate than your original 1-year CD did.

This cycle repeats every single year. Another rung "matures," giving you a predictable cash infusion and another chance to reinvest at the best available long-term rate.

A CD ladder is a strategic investment technique that involves dividing a sum of money into multiple CDs that mature at staggered intervals. For instance, an investor with $25,000 might split the amount into five CDs of $5,000 each with maturities of 1, 2, 3, 4, and 5 years. This approach became popular as a way to optimize returns while maintaining liquidity.

Balancing Liquidity and Higher Yields

At its core, the appeal of a CD ladder is its elegant trade-off. You get regular, penalty-free access to a portion of your funds without completely giving up the higher yields that longer-term CDs offer.

This structured liquidity is what makes the strategy so powerful for savers who want their money to work harder but aren't comfortable locking it all away for years on end. It’s a disciplined, almost automated way to manage your savings for steady, predictable growth.

The Real-World Benefits of Laddering Your CDs

Knowing how a CD ladder is built is one thing. But seeing what it can do for your money is what really makes the strategy click. Laddering isn't just theory; it delivers a powerful trio of higher earnings, predictable access to your cash, and a smart defense against the ups and downs of interest rates.

It's a disciplined approach that puts your savings to work in a much more resilient way.

The most obvious win is capturing better yields. It's a simple rule of banking: the longer you commit your money, the higher the interest rate you'll be offered. A CD ladder lets you methodically tap into these premium long-term rates without having to lock up all your cash for five years straight.

Once your ladder is up and running, every CD that matures gets rolled into a new long-term one. This simple process ensures your overall portfolio is always taking advantage of the best rates on the menu.

Maximize Earnings and Maintain Flexibility

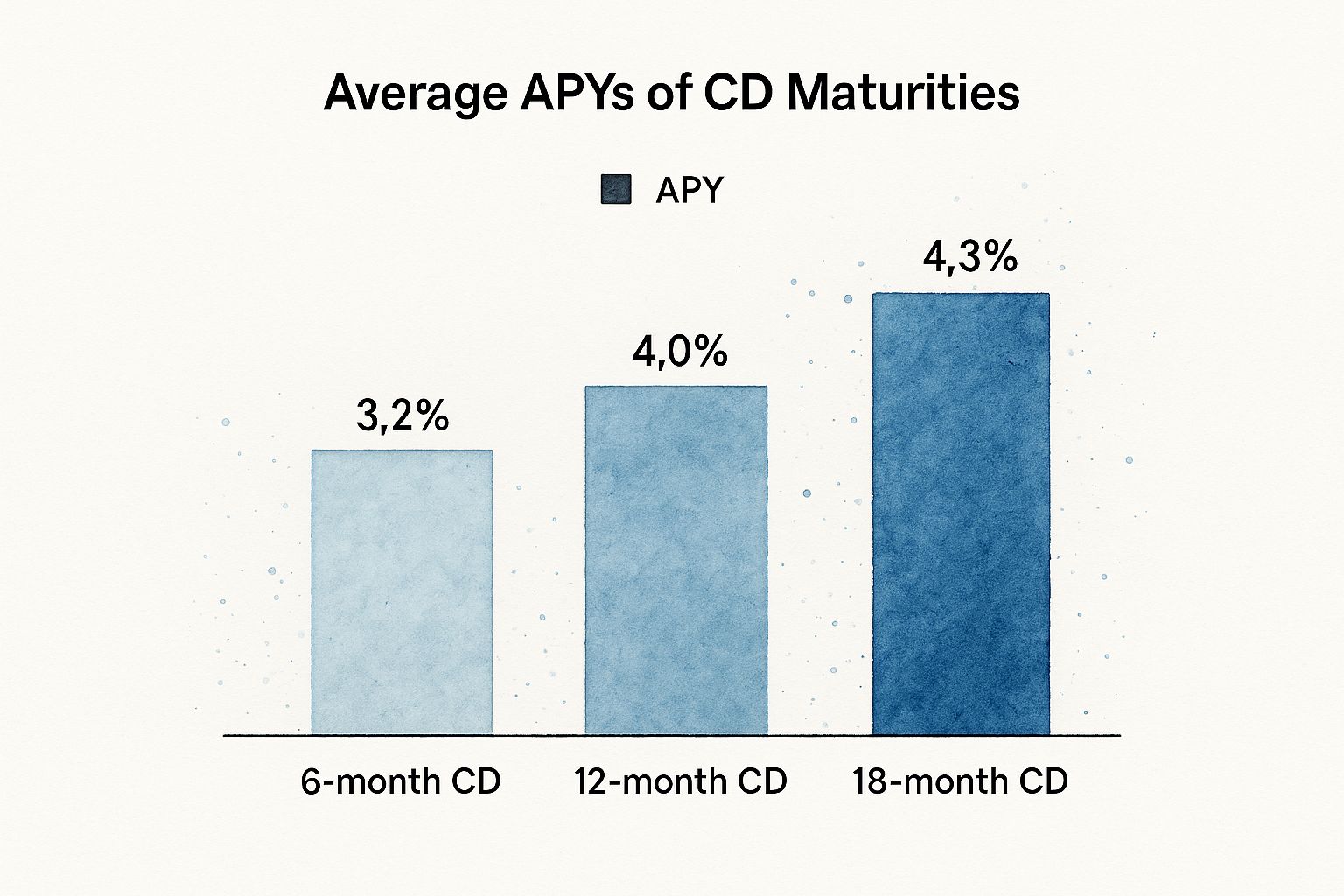

This strategy has a direct and measurable impact on your returns. Savers who build a ladder with terms from one to five years can earn a blended APY that easily beats what they'd get by sticking to short-term CDs alone.

That's because long-term rates can be 0.5% to 2% higher per year. For instance, you might see a one-year CD paying 3.2% while a five-year CD at the same bank is offering closer to 5.1%. If you want to dig deeper into the numbers, Vanguard offers some great insights on CD laddering.

By creating a staggered maturity schedule, a CD ladder provides consistent access to a portion of your funds. This planned liquidity means you can face unexpected expenses without having to break a CD early and pay a penalty.

This scheduled access to cash is a total game-changer for many people. Just knowing a chunk of your money is becoming available every year provides a huge amount of financial peace of mind. It’s a fantastic way to build a stronger safety net, and you can even set up a CD ladder for an emergency fund to give your savings plan another layer of security.

Hedge Against Interest Rate Risk

Finally, a CD ladder is a brilliant way to hedge your bets when you don't know which way rates are headed. It protects you from the two biggest worries savers face.

When Rates Rise: You're not stuck earning a disappointing low yield for years on end. As each "rung" on your ladder matures, you can reinvest that money into a new long-term CD at the new, higher rate. Your ladder automatically starts climbing to capture better returns.

When Rates Fall: You’re shielded from the worst of the drop. Most of your money is still safely locked in at the higher rates from your existing long-term CDs. Only the small portion that's maturing gets reinvested at the new, lower rate, protecting the bulk of your savings.

This built-in adaptability is what makes the CD ladder such an enduringly popular strategy for anyone who wants steady, low-risk growth.

How to Build Your First CD Ladder Today

Theory is one thing, but actually building your first CD ladder is where the confidence really kicks in. Let's walk through the simple, practical steps to turn this powerful savings concept into a reality, starting right now.

Theory is one thing, but actually building your first CD ladder is where the confidence really kicks in. Let's walk through the simple, practical steps to turn this powerful savings concept into a reality, starting right now.

Forget the intimidating jargon. The process is much more straightforward than you might think—it just boils down to a few key decisions about your money and your goals.

Step 1: Decide on Your Total Investment

First, figure out the total amount you want to put into your ladder. This should be money you’re comfortable setting aside for at least a year. Whether it's $5,000, $10,000, or $50,000, the strategy works just the same.

A key benefit of laddering is creating predictable access to your cash, so you don't have to lock up a sum you might need for an emergency. If you want to dig deeper into the nuts and bolts, check out our complete guide to building a CD ladder strategy.

Step 2: Choose Your Rungs and Terms

Next, decide how many "rungs" your ladder will have. A classic setup is a 5-year ladder with five rungs, but you can absolutely customize this. Shorter ladders with fewer rungs just mean you get access to your cash more often.

A common and effective structure uses these terms:

- Rung 1: 1-year CD

- Rung 2: 2-year CD

- Rung 3: 3-year CD

- Rung 4: 4-year CD

- Rung 5: 5-year CD

Now, just divide your total investment by the number of rungs. If you're starting with $10,000 and a 5-rung ladder, you'll fund each CD with $2,000. Simple.

Step 3: Open Your CDs and Start Building

With a plan in hand, it's time to shop around for the best rates and open your accounts. You don't have to use the same bank for every CD. In fact, it pays to look for the financial institutions offering the most competitive Annual Percentage Yields (APYs) for each specific term length.

Let’s bring it all together with a $10,000 example:

- Open a 1-year CD: Deposit $2,000.

- Open a 2-year CD: Deposit $2,000.

- Open a 3-year CD: Deposit $2,000.

- Open a 4-year CD: Deposit $2,000.

- Open a 5-year CD: Deposit $2,000.

Congratulations! You've just built a CD ladder. Your money is now set up to earn higher interest rates while giving you access to $2,000 (plus interest) every single year.

Step 4: Plan for Maturing CDs

This final step is the most critical for long-term success: have a plan for what to do when each CD matures.

To keep the ladder going and truly maximize your earnings, the standard move is to take the cash from the maturing CD and reinvest it into a new 5-year CD. Why a 5-year? Because it typically offers the best rate.

This disciplined cycle of reinvestment is the engine that drives your earnings over time. After a few years, your entire ladder will be made up of high-yield 5-year CDs, with one maturing like clockwork every year.

Comparing Different CD Ladder Strategies

Once you get the hang of what a CD ladder is, you'll quickly realize they aren't all one-size-fits-all. Just like a carpenter picks the right ladder for the job, you can structure yours to match your specific financial goals—whether that’s steady growth, maximum flexibility, or a bit of both.

The classic 5-year ladder is a popular starting point, especially for savers who want to maximize their returns over the long haul. But other approaches offer unique benefits, and picking the right one is what makes the strategy truly work for you.

The Classic vs. Flexible Ladder

The most common approach is the 5-year ladder. This involves opening five separate CDs with terms of 1, 2, 3, 4, and 5 years. It’s built for predictable, stable growth and is designed to methodically capture the highest long-term interest rates available. After the first four years pass, you'll have a high-yield 5-year CD maturing every single year.

For savers who are a little more cautious about locking up their money for that long, a 3-year ladder is a more nimble alternative. This setup might use three CDs with 1, 2, and 3-year terms. It’s perfect if you think you might need the cash sooner. While the potential earnings are usually a bit lower than a 5-year ladder, the added liquidity can provide valuable peace of mind.

This is the core idea behind laddering: even small extensions in term length can lock in better rates.

As the data shows, committing your funds for longer—even just moving from a 6-month to an 18-month term—is typically rewarded with a higher APY.

The Barbell CD Ladder Strategy

If you want to get more creative, there's the barbell strategy. This is a more advanced technique where you load up your portfolio with very short-term and very long-term CDs, skipping the middle rungs entirely. Picture a weightlifting barbell: heavy on both ends, but nothing in the middle.

For instance, you might put 50% of your cash into a 6-month CD and the other 50% into a 5-year CD.

- The short-term end: This part of your portfolio gives you fantastic liquidity. If interest rates shoot up, you can reinvest this cash quickly to take advantage of the better returns.

- The long-term end: This side locks in a high, fixed yield, protecting a big chunk of your investment if rates were to suddenly fall.

The barbell strategy is a more active approach that hedges against interest rate changes. It’s best for savers who are comfortable managing a less conventional structure to balance high returns with near-term flexibility.

To help you decide which structure is right for you, we've put together a simple comparison.

Comparison of Different CD Ladder Strategies

This table breaks down the three common CD ladder structures to help you weigh the trade-offs between yield, access to your money, and complexity.

| Ladder Type | Best For | Pros | Cons |

|---|---|---|---|

| 5-Year Ladder | Maximizing long-term, steady growth. | Captures highest long-term rates; predictable income. | Less liquidity in early years; longer commitment. |

| 3-Year Ladder | Savers wanting more flexibility and faster access. | Greater liquidity; less intimidating for beginners. | Lower overall yield compared to a 5-year ladder. |

| Barbell Ladder | Hedging against interest rate volatility. | Balances high yields with quick access to cash. | More complex to manage; middle-term rates are missed. |

Ultimately, choosing the right ladder comes down to your personal timeline and financial goals. Whether you’re building a classic staircase for steady gains or a dynamic barbell to play the rates, you’re still using the core principles of what a CD ladder is: a smarter, more resilient way to save.

Mistakes to Avoid When Building Your Ladder

Building a CD ladder is one of the most reliable ways to grow your savings, but a few common missteps can easily undermine your efforts. Knowing these pitfalls ahead of time is the best way to craft a strategy that keeps your money working for you, not against you.

The most frequent mistake is falling for the auto-renewal trap. When a CD matures, most banks will automatically roll your money into a new CD of the same term if you don't give them other instructions. It sounds convenient, but it's a trap. You’ll almost certainly be locked into a standard, non-promotional rate that's far from the best one available.

The Grace Period Is Your Window of Opportunity

To sidestep the auto-renewal trap, you have to watch your CD's maturity date like a hawk. Banks are required to give you a grace period—usually 7 to 10 days after maturity—to withdraw your funds or provide new instructions without a penalty.

This is your moment to act. Use that week to shop around, compare the latest rates, and decide on the smartest home for your money. Whether you reinvest in a new long-term CD to keep the ladder going or pull the cash out, being proactive keeps you in the driver's seat.

A very common error is simply ignoring the grace period. Failing to act means the bank reinvests your money on its terms, not yours. This mistake can easily cost you hundreds of dollars in lost interest over the new term.

Understand Early Withdrawal Penalties

Another critical oversight is not fully understanding the early withdrawal penalties before you open an account. The whole point of a ladder is to create liquidity so you don't have to break a CD, but emergencies happen.

You need to know the penalty—often a set number of months' interest—before you commit. A common penalty is three months of interest on a 1-year CD. If there's a chance you might need that specific chunk of cash before a rung matures, consider a shorter-term ladder or a no-penalty CD for that portion of your funds. Planning for this possibility from day one protects your principal and your earnings.

Finally, don't let analysis paralysis stop you from starting. Too many people get bogged down trying to find the absolute "perfect" rate for every single rung and, as a result, never actually build anything.

- Start small. It’s far better to have a small, imperfect ladder working for you than no ladder at all.

- Focus on the process. The real power of this strategy comes from the disciplined cycle of reinvesting, not from hitting a rate jackpot on your first try.

- You can adjust later. Remember, a CD ladder isn't set in stone. It's a living strategy. You can tweak your approach every time a rung matures.

The goal here is progress, not perfection. By sidestepping these common mistakes, you ensure your CD ladder does exactly what it's supposed to: act as a simple, powerful engine for steady, low-risk growth.

Answering Your Top CD Ladder Questions

Even with a perfect plan on paper, it's natural to have a few nagging questions. This is where we tackle the most common "what-ifs" that pop up when people first start laddering CDs, giving you the clear, straightforward answers you need.

Think of this as closing the loop—clearing up any lingering doubts so you can put this powerful savings strategy to work with total confidence. Let's get into the specifics.

What Happens If I Need Money Before a CD Matures?

This is, without a doubt, the number one concern. The short answer is that if you break a CD before its term is up, you'll pay an early withdrawal penalty. This is usually a chunk of the interest you've earned, often equal to three or six months' worth.

But here’s the thing: the whole point of building a CD ladder is to make sure this never happens. The staggered maturity dates are specifically designed to give you predictable, penalty-free access to your cash. You're planning your liquidity ahead of time precisely so you don't have to break a CD and forfeit your earnings.

Can I Build a CD Ladder With a Small Amount?

Absolutely. You don't need to be a high-roller to get started. Many banks and credit unions offer CDs with minimum deposits as low as $500, and some have no minimum at all. The core principles of laddering work exactly the same whether you're investing $1,000 or $100,000.

If you're starting small, you can just build a "mini-ladder." Maybe that means using shorter terms, like 3-month, 6-month, 9-month, and 12-month CDs. The key is to start with what you can and let the disciplined process of reinvesting do the heavy lifting over time.

A common myth is that laddering is only for wealthy investors. The reality is that the methodical process of rolling over maturing CDs benefits savers at any scale, making it one of the most accessible and effective growth strategies out there.

Is a CD Ladder Still Effective When Interest Rates Are Low?

Yes, because the strategy’s two biggest advantages don't depend on high rates. First, even in a low-rate environment, a ladder systematically captures the best yields available—which are almost always better than what you’d get in a standard savings account.

More importantly, a ladder perfectly positions you for when rates eventually rise. As each short-term CD matures, you simply reinvest that money at the new, higher rate. This structure allows your ladder’s overall yield to climb right along with the market, automatically. You get to capitalize on rising rates without ever having to guess when they'll move. That built-in adaptability is its greatest strength.

Ready to see how these strategies could look with your own numbers? Use the free Certificate-of-Deposit Calculator to model different ladder scenarios, compare APYs, and project your total earnings with precision. Take control of your savings strategy and start building a smarter financial future today.