The CD Ladder Strategy: Your Path to Smarter Savings

Finding the right balance between growing your savings and keeping your money accessible can be a challenge. The CD ladder strategy offers a practical solution by combining growth potential with liquidity. Financial advisors are increasingly recommending this approach, which involves strategically distributing your investment across several Certificates of Deposit (CDs).

These CDs have different maturity dates. This setup allows you to take advantage of the higher interest rates typically associated with longer-term CDs. At the same time, you maintain access to a portion of your money at regular intervals.

Understanding the Mechanics of a CD Ladder

Visualize a ladder where each rung represents a CD. You invest equal sums into multiple CDs, each with a distinct maturity term. For example, you might choose terms of one, two, three, four, and five years.

As the shortest-term CD matures, you reinvest both the principal and the earned interest into a new, longer-term CD, typically with the longest term available in your ladder. This creates the "ladder" effect. This means that every year (or at your chosen interval), you gain access to a portion of your invested funds.

Why Choose a CD Ladder?

A CD laddering strategy offers several key benefits:

- Predictability: You lock in interest rates for each CD, allowing you to forecast your investment growth accurately.

- Liquidity: Unlike investing in a single, long-term CD, a ladder provides regular access to your money as the CDs mature. This can be invaluable for unexpected expenses or evolving financial needs.

- Flexibility in a Changing Market: CD laddering can be particularly advantageous when economic conditions are uncertain or when interest rates are fluctuating.

Learn more about CD ladders and their effectiveness in volatile markets. Planning your CD ladder should also include considering potential tax implications. Explore resources on protecting your retirement savings for a comprehensive approach to financial well-being.

Example of a CD Ladder

Suppose you have $5,000 to invest. You could divide this amount evenly into five CDs, each with terms of one, two, three, four, and five years.

As each CD matures, reinvest the total amount into a new five-year CD. This ongoing cycle lets you benefit from potentially higher, long-term interest rates while still having access to some of your funds annually. This strategy also positions you to capture potentially higher rates as they become available in the market.

Why CD Ladders Outperform Traditional Savings Methods

A CD ladder strategy offers several benefits over traditional savings, especially during times of economic uncertainty. While regular savings accounts offer immediate access to your money, their interest rates are often much lower than CDs. This can result in smaller returns, especially when you factor in inflation. CD ladders, however, combine the stability of CDs with better access to your funds and the opportunity for greater returns.

Higher Returns and Reduced Interest Rate Risk

One key reason CD ladders outperform traditional savings is their ability to secure higher interest rates. Longer-term CDs generally offer higher Annual Percentage Yields (APYs) than shorter-term CDs or standard savings accounts. By setting up a ladder with different maturity dates, you can lock in these higher rates while still being able to access some of your money at regular intervals. This structured approach minimizes the risk of being stuck with a low rate for a long time. You can use a CD calculator to estimate your potential earnings.

Liquidity and Predictability

Traditional savings accounts offer immediate access to funds, but CD ladders offer strategic liquidity. As each CD matures, you have the choice to withdraw or reinvest the money. This regular access provides more flexibility than a single, long-term CD. Plus, the fixed interest rates of CDs offer predictable returns, letting you accurately forecast your investment growth.

Historical Performance and Volatility Mitigation

Historically, CD rates have fluctuated significantly. In the early 1980s, CD rates were incredibly high, reaching a peak of 18.65% for some terms during a period of high inflation. However, by the late 2000s and into the 2010s, rates dropped to below 1% APY for most terms following the Great Recession and the COVID-19 pandemic. This volatility highlights the importance of a CD ladder strategy. It allows investors to lessen the impact of rate changes by spreading their investments across various term lengths. For example, a CD ladder with a mix of one-year, two-year, three-year, four-year, and five-year CDs can help investors take advantage of higher rates on longer terms while staying flexible enough to adapt to changing market conditions. Learn more about historical CD rates. This method creates a buffer against interest rate swings.

The Psychological Advantage

Besides the financial benefits, CD ladders offer a psychological advantage. The structured approach encourages regular saving and reinvestment. The anticipation of regular maturities can also be motivating, making long-term saving easier. This disciplined approach can be especially helpful for people who struggle with impulsive spending or have difficulty sticking to a savings plan. This consistent growth, along with the security of FDIC insurance, makes CD ladders a good option for those looking for a balanced approach to saving and investing.

Building Your First CD Ladder: A Step-by-Step Blueprint

Building a CD ladder might seem complicated, but it's a pretty straightforward process. This section offers a simple blueprint to help you get started. First, determine your investment amount. Think about how much you can comfortably set aside without needing it for short-term expenses. CD ladders are accessible even with smaller amounts.

Next, decide on your ladder's time horizon. This refers to the total length of your ladder, usually spanning one to five years. This decision hinges on your financial goals and when you anticipate needing access to the money.

Choosing Your CDs and Financial Institutions

Start by researching competitive interest rates from various banks and credit unions, both online and brick-and-mortar. Don't limit yourself to a single institution. Diversifying your CD holdings can often lead to higher overall returns.

Carefully consider early withdrawal penalties. These can significantly impact your earnings if you need to access your funds before the CD matures. CD ladders offer a helpful way to maintain some liquidity while still earning interest. For more financial management tips, check out these ideas to improve cash flow.

After selecting your financial institutions, divide your total investment equally among the "rungs" of your ladder. Each rung represents a CD with a different maturity date. For a five-year ladder, you'd purchase five CDs, maturing in one, two, three, four, and five years, respectively.

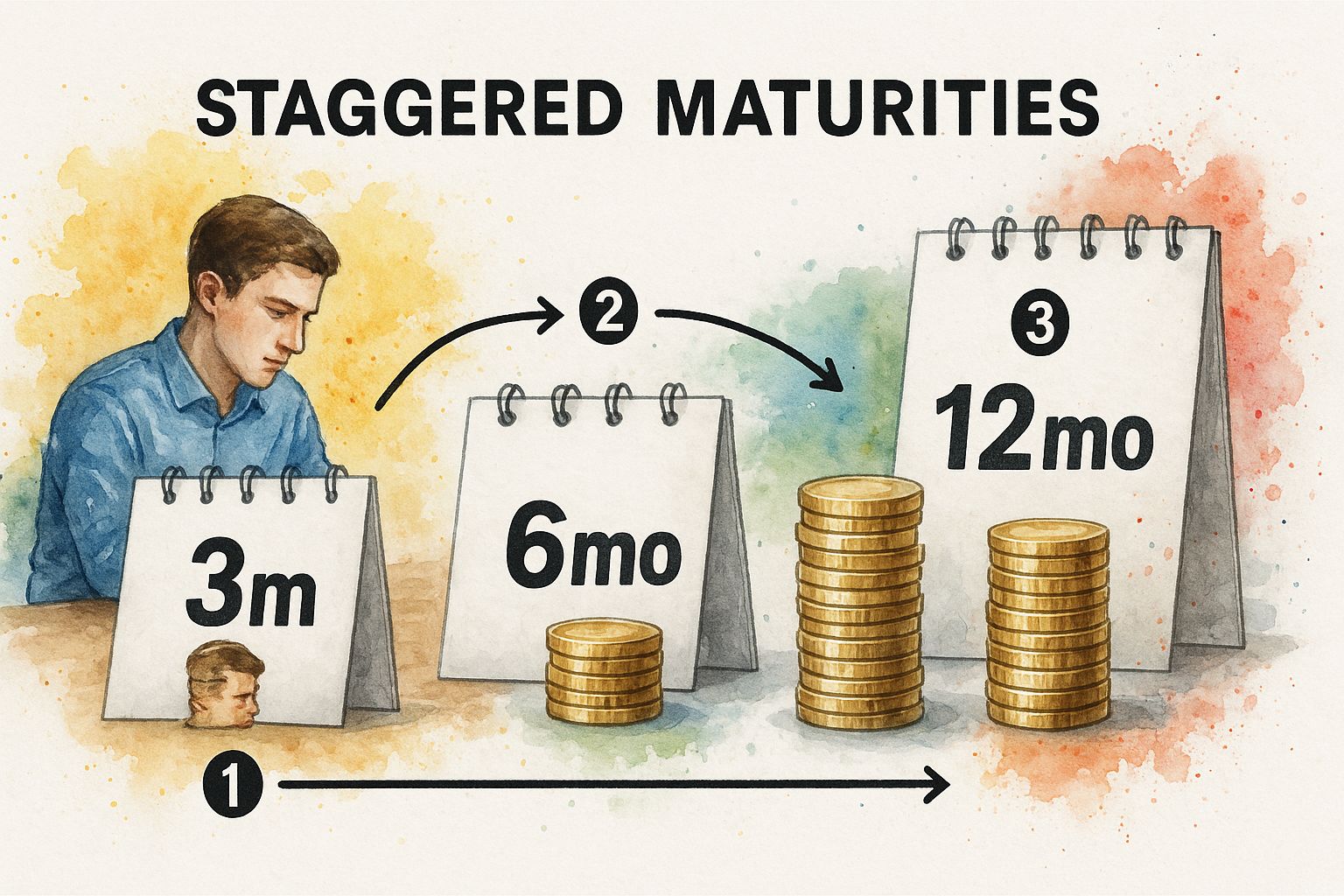

The infographic below visually illustrates this concept of staggered maturities.

This visual clarifies the core idea behind a CD ladder: by staggering maturity dates, you gain regular access to some of your funds while still benefiting from the typically higher interest rates offered by longer-term CDs. As each shorter-term CD matures, reinvest the principal and earned interest into a new, longer-term CD, effectively keeping the ladder going and maximizing potential returns.

Building a Sample CD Ladder

Let's illustrate with a $10,000 investment and a five-year time horizon. You'd divide the $10,000 into five equal parts of $2,000 each. Invest each $2,000 into a CD with a term corresponding to its position on the ladder (one year, two years, and so on).

As each CD matures, reinvest the entire amount (principal plus interest) into a new five-year CD. This continuous rollover maintains the ladder structure and allows you to capture potentially higher long-term interest rates as they become available.

To better understand the structure, let's look at a sample CD ladder:

The following table illustrates how a $10,000 investment can be distributed across a 5-year CD ladder strategy, with $2,000 allocated to each rung. Note that Typical APY Ranges are illustrative and will vary depending on market conditions and the specific financial institution.

Sample 5-Year CD Ladder Structure

| CD Term | Initial Investment | Typical APY Range | When It Matures | Next Action |

|---|---|---|---|---|

| 1 year | $2,000 | 4.00% - 5.00% | Year 1 | Reinvest in a 5-year CD |

| 2 years | $2,000 | 4.25% - 5.25% | Year 2 | Reinvest in a 5-year CD |

| 3 years | $2,000 | 4.50% - 5.50% | Year 3 | Reinvest in a 5-year CD |

| 4 years | $2,000 | 4.75% - 5.75% | Year 4 | Reinvest in a 5-year CD |

| 5 years | $2,000 | 5.00% - 6.00% | Year 5 | Reinvest in a 5-year CD |

This table demonstrates how each CD matures at a different interval, allowing for regular access to a portion of your investment. By reinvesting the matured amounts into new 5-year CDs, you maintain the ladder and aim for higher long-term returns.

This approach lets you benefit from both the higher returns of longer-term CDs and the liquidity of having a portion of your investment maturing regularly. By following these steps, you can begin building your first CD ladder and take more control of your financial future.

Mastering CD Ladders in Any Interest Rate Environment

Market conditions are constantly shifting, requiring adjustments to your investment strategies. A CD ladder strategy, while inherently stable, can be further optimized by understanding how different interest rate environments impact returns. Actively managing your ladder is key to maximizing returns, whether rates are rising, falling, or holding steady.

Navigating Rising Rates

When interest rates are on the rise, favoring shorter-term CDs allows you to reinvest more frequently as rates climb. Concentrate your ladder rungs at the 1-year and 2-year marks. As these CDs mature, reinvest at the prevailing higher rates, effectively "climbing" the ladder toward increasing returns.

Adapting to Falling Rates

Conversely, when rates are falling, lock in those higher rates by prioritizing longer-term CDs. This secures your returns before rates decline further. Extending some rungs to 3, 4, or even 5 years can help preserve those higher yields. For more insights into CD rate trends, check out this helpful resource: How to master CD rate trends.

Strategies for Stable Rates

In a stable rate environment, a balanced CD ladder with evenly spaced rungs becomes the optimal approach. This offers a blend of consistent returns and regular liquidity. A traditional ladder with CDs maturing every 6 or 12 months ensures predictable access to funds while earning a steady interest rate.

Monitoring Economic Indicators

Regardless of the rate environment, keeping an eye on economic indicators is crucial. Staying informed about factors influencing interest rates, like inflation and Federal Reserve policy, helps anticipate potential changes. This proactive approach allows you to preemptively adjust your CD ladder strategy, positioning yourself to benefit from market shifts.

To help visualize these strategies, let's look at a comparison table:

The following table outlines optimal CD ladder approaches based on the current interest rate trend.

| Strategy Element | Rising Rate Environment | Stable Rate Environment | Falling Rate Environment |

|---|---|---|---|

| CD Term Focus | Short-term (1-2 years) | Balanced (6-12 months) | Long-term (3-5 years) |

| Rationale | Frequent reinvestment at higher rates | Consistent returns and liquidity | Secure higher rates before they decline |

| Example | 1-year and 2-year CDs | 6-month, 12-month, 18-month CDs | 3-year, 4-year, and 5-year CDs |

| Benefits | Maximize returns as rates climb | Predictable income and access to funds | Preserve higher yields for longer periods |

This table illustrates how adjusting your CD ladder strategy to the prevailing interest rate environment can significantly impact your returns. By focusing on short-term CDs during rising rates, balanced terms during stable rates, and long-term CDs during falling rates, you can effectively optimize your investment strategy. Remember to always monitor economic indicators and adjust your ladder as needed.

The CD ladder strategy has been particularly beneficial during periods of fluctuating interest rates, such as the Federal Reserve rate hikes in 2022 and 2023. These hikes resulted in a substantial increase in CD yields. For example, the average one-year CD rate climbed from below 1% APY in the early 2020s to around 4.40% APY by early 2025 for competitive banks. This rise allowed CD ladder investors to capture higher returns on longer-term CDs while maintaining liquidity through staggered maturities. You can find more detailed statistics on historical CD rates here.

Advanced CD Ladder Techniques for Maximizing Returns

Building a basic CD ladder is a solid foundation for improving your savings strategy. But more sophisticated techniques can further optimize your returns. These strategies, often used by seasoned investors, let you respond to changing market conditions and potentially earn well above typical CD rates.

The Barbell CD Ladder Strategy

One such technique is the barbell strategy. This involves focusing your investments at the shortest and longest maturities within your ladder. For example, you might allocate a larger portion of your funds to 1-year and 5-year CDs, with smaller amounts in the 2, 3, and 4-year terms. This approach allows you to benefit from the higher rates offered by longer-term CDs while still having access to a portion of your funds annually as the shorter-term CDs mature. This strategy is especially useful in fluctuating interest rate environments, offering both stability and the chance to reinvest quickly if rates climb.

The Perpetual CD Ladder

Another advanced approach is the perpetual ladder. This involves consistently reinvesting the proceeds of maturing CDs into new, longer-term CDs. This sets up an ongoing cycle of reinvestment that takes full advantage of compounding interest. Over time, a perpetual ladder can generate substantially higher returns than a standard ladder where funds may be withdrawn upon maturity.

Leveraging Specialty CD Products

Beyond standard CDs, exploring specialized CD products can further boost your ladder's performance. Bump-up CDs, for example, allow you to increase your interest rate once during the CD's term if market rates improve. This offers protection against rising rates and the chance to benefit from better market conditions. You might be interested in: How to master CD early withdrawals.

No-penalty CDs offer the flexibility to withdraw your funds before maturity without the usual early withdrawal penalty. This can be helpful for unexpected costs or if you need quick access to your money during a market downturn.

Strategic Institution Hopping

Don't feel limited to a single financial institution. Institution hopping, or strategically moving your money between banks and credit unions that offer promotional rates and signup bonuses, can increase your CD ladder’s overall return. Remember to maintain FDIC insurance protection when shifting your funds.

Case Study Example

Consider an investor who combined a barbell strategy with institution hopping. By taking advantage of promotional rates and focusing investments in 1-year and 5-year CDs, they achieved an average APY of 5.5% over five years. This was significantly higher than the average CD rate during that time. It highlights how advanced techniques can considerably enhance CD ladder returns. By using these techniques and actively managing your CD ladder, you too can potentially achieve similar results and unlock higher yields for your savings.

Avoiding the Costly Mistakes That Derail CD Ladder Success

Even a well-designed CD ladder strategy can fall short if you're not careful. Understanding common pitfalls is crucial for maximizing returns.

Overlooking Fees and Penalties

One common mistake is forgetting about fees and penalties. Some banks charge fees for managing CDs. Early withdrawal penalties can significantly impact your earnings if you need access to your money prematurely. Always compare fees and penalties at different institutions before investing. Understanding the terms and conditions is vital.

Misunderstanding Compounding

Another oversight is not fully grasping compounding. The frequency of compounding (daily, monthly, annually) significantly impacts your overall return. Opting for more frequent compounding, when available, allows you to earn interest on your accumulated interest, resulting in a higher yield over time.

Timing Errors During Reinvestment

Incorrect timing during reinvestment can also hurt your ladder’s performance. Failing to reinvest matured CDs promptly can leave your money earning minimal interest in a regular savings account. Set reminders for maturity dates to ensure timely reinvestment and maximize compounding benefits. A CD calculator can help project potential returns and plan reinvestments.

Ignoring Inflation

Failing to account for inflation is a critical error. If the inflation rate exceeds your CD's APY, your real return is negative, meaning your purchasing power decreases. When constructing your ladder, choose CDs with terms and rates that offer a return above the projected inflation rate.

Improperly Reacting to Market Changes

Many investors react emotionally to market fluctuations. Panic selling during downturns or chasing high rates without considering long-term implications can disrupt your ladder’s stability. Sticking to your strategy and adjusting based on your financial goals is essential.

Real-World Examples and Optimization

Small adjustments can significantly impact returns. For instance, optimizing compounding frequency or strategically choosing CD terms based on inflation can sometimes increase overall yield by 15-20%. Many investors overlook these simple yet effective techniques.

By avoiding these common mistakes and proactively managing your CD ladder, you can maximize returns and achieve your financial goals. A well-executed strategy provides a predictable path to financial growth.

Ready to start maximizing your savings? Use our Certificate of Deposit Calculator to plan your strategy and project potential returns. It's a powerful tool for informed decisions.