Understanding CDs: The Foundation You Need

A certificate of deposit (CD) is a savings agreement with a bank or credit union. You lend them a set amount of money, your principal, for a specific timeframe, called the term. In return, the institution pays you back your principal plus interest at the end of the term, the maturity date. This predictable return makes CDs attractive to conservative investors.

CDs offer a reliable way to grow your savings with minimal risk. Unlike market-based investments, CDs provide a fixed return, making them a safe haven for funds you don't need immediate access to.

How CDs Work: A Simple Analogy

Think of planting a seed (your principal). It grows for a specific time (the term), and at harvest (maturity date), you get your seed back plus the fruit (the interest). With a CD, you know exactly how much "fruit" you'll receive upfront, unlike the stock market's unpredictable nature. This makes CDs appealing for those seeking stability.

This predictability allows for careful financial planning, especially when saving for specific goals like a down payment on a house or funding a future expense.

Key Features of a Certificate of Deposit Explained

Understanding CD features is essential for maximizing your returns. Here's a breakdown:

- Fixed Term: Your money is committed for a set period, ranging from months to years.

- Fixed Interest Rate: The interest rate is locked in upon opening the CD, ensuring predictable returns regardless of market changes, unlike savings accounts where rates fluctuate.

- Principal Protection: CDs are generally FDIC-insured up to $250,000 per depositor, per insured bank, safeguarding your initial deposit.

- Compounding Interest: Earned interest is added back to your principal, and future interest is calculated on this larger amount. Compounding over time can significantly boost your earnings.

Why Banks Offer CDs

Banks offer CDs to secure a stable funding source for lending and operations. Locking in your money provides the bank with predictable capital, allowing them to offer higher interest rates on CDs than on standard savings accounts, which offer greater liquidity. This benefits both the bank and the saver.

This arrangement helps banks maintain a balance between liquidity needs and offering competitive returns to customers seeking secure savings options.

Understanding Interest and Payouts

CD interest is calculated based on principal, interest rate, term, and compounding frequency. Some CDs pay interest at maturity, while others offer regular payouts. A 5-year CD with a 2% APY and a $1,000 principal compounded annually will yield more than a simple interest calculation. A CD Calculator can help you project potential returns. This knowledge empowers you to choose the right CD for your financial objectives. The predictable returns simplify financial planning and help achieve savings goals.

Navigating CD Rates and Market Conditions

Understanding how CD rates work is crucial for maximizing your returns. These rates are constantly changing, responding to various market forces. This creates both opportunities and challenges for investors. By understanding these influences, you can make smarter decisions about when to invest and which CDs are the best fit.

Factors Influencing CD Rates

Several key factors influence the interest rates offered on certificates of deposit. The federal funds rate, set by the Federal Reserve, is a major one. This rate impacts borrowing costs for banks, which then affects the rates they offer on savings products like CDs.

Individual bank strategies and competition also play a role. Banks sometimes offer promotional rates to attract new customers. They might also adjust rates based on their specific funding needs.

For example, when loan demand is high, banks may offer higher CD rates to attract deposits. This competition allows consumers to shop around for the best rates. You might be interested in: How to master CD rate trends.

Historical Trends in CD Rates

Historical data reveals the fluctuating nature of CD rates. During the 1980s, CD rates reached double-digit annual percentage yields (APYs), sometimes exceeding 11% for one-year CDs. However, after 2009, rates fell below 1%. Even during the pandemic, five-year CDs struggled to hit that mark.

More recently, in 2022 and 2023, one-year CD APYs at competitive banks briefly rose above 5%. As of early 2025, the average one-year CD APY is around 1.95%, with the best offers reaching 4.40%. These changes show how sensitive CD rates are to economic conditions and central bank policies. You can find more detailed statistics here: Historical CD Interest Rates.

This volatility makes it important to time your CD investments wisely.

Term Length and Its Impact on Rates

The term length of a CD significantly affects its interest rate. Longer-term CDs generally offer higher rates than shorter-term CDs. This is because banks are willing to pay a premium for the certainty of having your funds for an extended period.

This higher return comes with a trade-off – reduced liquidity. It’s crucial to choose a CD term that aligns with your financial goals and time horizon. Understanding this relationship lets you optimize your returns while ensuring you can access your money when needed.

Choosing The Right CD Type For Your Goals

Not all certificates of deposit are created equal. Selecting the right type is vital for maximizing returns and maintaining financial flexibility. A misstep here can be costly, especially if unexpected expenses pop up. This section will guide you through various CD options, from the simplicity of fixed-rate CDs to more complex products like bump-up and callable CDs.

Understanding the Variety of CD Options

The CD landscape offers more than just the standard fixed-rate option. Several specialized CD types cater to different investment strategies and comfort levels with risk. Let's explore some of the key variations:

Fixed-Rate CDs: These traditional CDs offer a stable, locked-in interest rate for the entire term. They provide predictable returns, making them a good fit for conservative savers.

Bump-Up CDs: These CDs give you the opportunity to "bump up" your interest rate once during the term, should market rates increase. This offers some protection against rising rates but might come with a slightly lower initial rate.

Step-Up CDs: With step-up CDs, the interest rate increases at pre-set intervals. This can be advantageous in a rising rate environment.

Liquid CDs: Liquid CDs offer some penalty-free withdrawals during the term, providing access to your funds while still earning interest. However, their interest rates are generally lower than standard CDs.

No-Penalty CDs: These CDs allow you to withdraw your principal and interest before maturity without penalty. This flexibility, however, typically comes at the cost of lower returns.

Jumbo CDs: Jumbo CDs require a substantial minimum deposit, often $100,000 or more. They usually offer higher interest rates than standard CDs and are suitable for investors with significant funds.

Callable CDs: Callable CDs give the issuing bank the option to "call" back the CD after a specific period, usually if interest rates decline. While they may offer attractive initial rates, they carry the risk of early redemption.

To help you compare the different CD types, we've compiled the following table:

CD Types Comparison: Features and Best Use Cases

A detailed comparison of different CD types, their minimum deposits, rate structures, and ideal scenarios for each option.

| CD Type | Minimum Deposit | Rate Structure | Flexibility | Best For |

|---|---|---|---|---|

| Fixed-Rate CD | Varies | Fixed | None (penalty for early withdrawal) | Conservative savers, predictable returns |

| Bump-Up CD | Varies | Variable (can increase once) | None (penalty for early withdrawal) | Hedging against rising rates |

| Step-Up CD | Varies | Variable (increases at intervals) | None (penalty for early withdrawal) | Rising rate environments |

| Liquid CD | Varies | Typically lower than standard CDs | Limited penalty-free withdrawals | Savers needing some access to funds |

| No-Penalty CD | Varies | Typically lower than standard CDs | Penalty-free withdrawals | Short-term goals, access to funds |

| Jumbo CD | $100,000+ | Typically higher than standard CDs | None (penalty for early withdrawal) | Investors with large sums, maximizing returns |

| Callable CD | Varies | Typically higher initially, can be called | Risk of early redemption | Potentially higher returns, but with risk |

This table summarizes the key features and ideal use cases for each CD type, allowing for a quick comparison to help you choose the best fit for your financial goals.

Matching CD Features to Your Financial Situation

The ideal CD for you depends on your individual financial goals and circumstances. Consider your investment timeframe, risk tolerance, and need for access to your money.

Short-Term Goals: For short-term goals like saving for a down payment, a shorter-term CD or a no-penalty CD might be suitable.

Long-Term Goals: For long-term goals like retirement, a longer-term fixed-rate CD, a step-up CD, or a bump-up CD could be a good fit.

Liquidity Needs: If you anticipate needing access to your funds, a liquid CD or no-penalty CD may be preferable, even with potentially lower returns.

Risk Tolerance: If you’re risk-averse, fixed-rate CDs are a safe bet. If you’re willing to take on some risk for potentially higher returns, consider bump-up or step-up CDs.

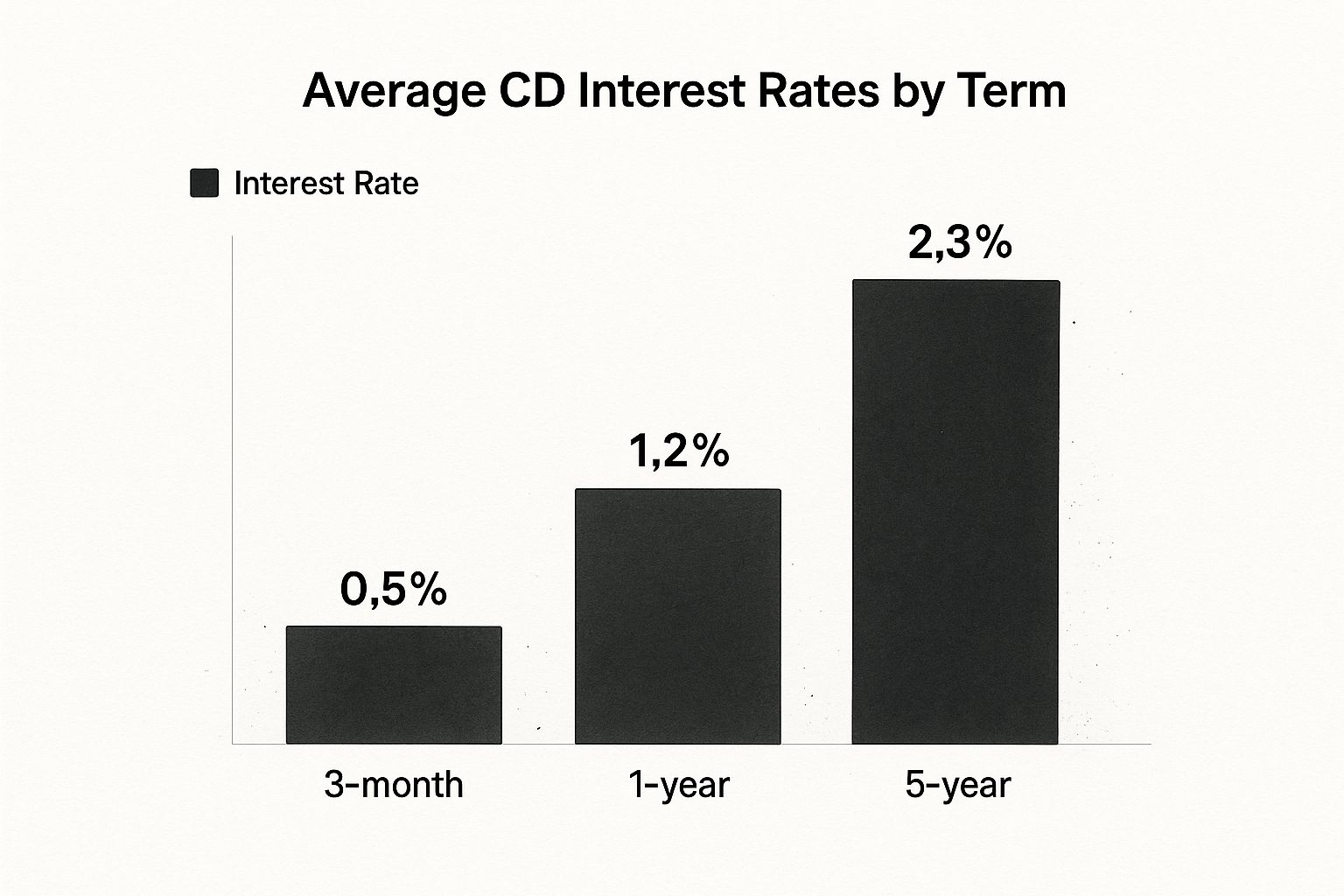

The following infographic illustrates the relationship between CD term length and average interest rates:

As the infographic shows, longer-term CDs generally offer higher average interest rates. A 5-year CD, for example, typically has a significantly higher rate than a 3-month CD, reflecting the trade-off between liquidity and return.

Evaluating Minimum Deposit Requirements and Rate Structures

Before investing in a CD, carefully review the minimum deposit requirements. Some CDs, especially jumbo CDs, have high minimums. Also, understand the rate structure. Is it fixed, variable, or does it step up over time? This will significantly impact your overall return. You can learn more about calculating CD interest with this helpful resource: How to master CD interest calculations. A solid understanding of these factors is crucial for selecting the right CD for your investment strategy.

The Global CD Market: Trends And Opportunities

A solid investment strategy involves understanding the bigger picture. When it comes to Certificates of Deposit (CDs), this means looking beyond individual bank offers and considering global market trends. Examining regional differences and competitive forces can provide valuable insights into rate fluctuations and promising opportunities.

Regional Variations and Market Dynamics

The CD market displays unique characteristics across different regions. Established markets like North America and Europe have mature regulatory frameworks and diverse CD products. However, they also face challenges, including periods of low interest rates and competition from other investment options.

Emerging economies in the Asia Pacific region, for example, tell a different story. These markets often see higher growth rates fueled by rising disposable incomes and a growing middle class seeking secure savings. This creates strong demand for CDs. Further supporting this trend, ongoing regulatory reforms and infrastructure improvements are building investor confidence.

The global CD market has seen steady growth, particularly in recent years. Both developed and emerging economies recognize the value of CDs for risk-averse savers. According to Cognitive Market Research, the global CD market was significantly sized in 2024. North America held over 40% of the global market revenue, while Europe accounted for more than 30%. The Asia Pacific region stands out with the fastest growth, projected at a compound annual growth rate (CAGR) of 8% from 2024 to 2031. This growth is driven by factors such as rapid economic expansion and increased financial literacy in countries like China and India. Improved financial infrastructure and regulatory reforms in these emerging economies contribute to the increasing popularity of CDs as a stable investment choice. The global CD market’s expansion reflects broader trends in financial inclusion and the growing desire for secure savings options. Find more detailed statistics here: Global CD Market Report.

The Role of Online Banks

Online banks have significantly changed the CD landscape. Often, they offer more competitive rates than traditional banks due to lower overhead costs. This benefits consumers with more choices and potentially higher returns.

Online banks also typically provide a seamless digital experience. Opening and managing CDs remotely is easier than ever, appealing to tech-savvy investors.

Emerging Trends and Innovations

The CD market is constantly evolving, with new features and investment strategies. This provides exciting opportunities for investors.

One trend is the rise of market-indexed CDs. These offer the potential for higher returns linked to market performance while retaining the principal protection of traditional CDs. This appeals to investors seeking a balance between stability and growth.

Another development is the increasing use of technology for CD management. Mobile banking apps and online platforms now offer sophisticated tools for tracking holdings, comparing rates, and even setting up automated laddering strategies.

Global Economic Impacts on CD Investing

Global economic conditions play a key role in CD markets. Economic downturns can lead to lower interest rates as central banks try to stimulate growth. Conversely, periods of economic expansion often result in higher rates due to increased credit demand.

Understanding these relationships is essential for smart CD investing. If interest rates are expected to rise, waiting before locking into a long-term CD might be wise. When rates are high, securing a long-term CD can lock in those favorable returns. Staying informed about global economic conditions is key to optimizing your CD strategy.

Weighing CD Benefits Against Real-World Drawbacks

Certificates of Deposit (CDs) offer a compelling mix of security and predictable returns, making them an attractive option for savers. But like any investment, CDs have their own set of pros and cons. Understanding these is essential for deciding if CDs fit your financial goals.

The Upsides of CDs: Security and Predictability

CDs offer several key advantages, particularly for those who prioritize safety. FDIC insurance is a major benefit, protecting your principal up to $250,000 per depositor, per insured bank. This guarantee provides peace of mind, knowing your initial investment is secure.

CDs also offer predictable returns. The fixed interest rate, locked in at the outset, ensures you know precisely how much you'll earn by the maturity date. This predictability simplifies financial planning, especially for targeted goals like a down payment or future expenses.

This stability makes CDs a safe harbor for funds you won’t need immediately, allowing your savings to grow steadily. Their simplicity also adds to their appeal for low-maintenance investments.

The Downsides of CDs: Liquidity and Inflation Risk

While security and predictability are enticing, CDs do have potential drawbacks. Liquidity, or the ease of accessing your money, is a key limitation. Your funds are committed for the CD's term, and early withdrawals typically incur penalties.

Early withdrawal penalties can vary, often forfeiting a portion of your earned interest. For instance, a penalty might equal three months' interest. Understanding these penalties is crucial before investing.

Inflation risk is another potential downside. If inflation surpasses your CD's interest rate, your money’s purchasing power could erode. While your money grows nominally, it may not keep pace with rising prices. A 2% interest rate on a CD with 3% inflation effectively loses you 1% of purchasing power annually.

Considering Alternatives and Opportunity Cost

Opportunity cost is another factor to consider. This is the potential return you forgo by choosing a CD over a higher-yielding investment. If stocks or bonds outperform your CD during its term, you miss out on those potential gains.

To better understand the relative risk and return profile of CDs against other common savings options, let's look at the following table:

CD vs Other Savings Options: Risk and Return Analysis

A comprehensive comparison of CDs against savings accounts, money market accounts, and treasury bills showing risk levels, liquidity, and typical returns.

| Investment Type | Risk Level | Liquidity | Typical Returns | FDIC Protection | Minimum Investment |

|---|---|---|---|---|---|

| Certificates of Deposit (CD) | Low | Low (penalties for early withdrawal) | Moderate (fixed rate) | Up to $250,000 per depositor, per insured bank | Varies, can be as low as $500 |

| Savings Account | Very Low | High | Low (variable rate) | Up to $250,000 per depositor, per insured bank | Varies, often low or none |

| Money Market Account | Low | Moderate (limited withdrawals) | Moderate (variable rate) | Up to $250,000 per depositor, per insured bank | Varies, can be higher than savings accounts |

| Treasury Bills (T-Bills) | Very Low | High | Moderate (determined at auction) | Backed by the U.S. government | $100 |

As shown in the table, CDs offer a balance of risk and return, but their lower liquidity should be considered. While savings accounts offer high liquidity, their returns are typically lower. Money market accounts offer a compromise, but their returns can also fluctuate. T-Bills, backed by the U.S. government, offer security and liquidity with competitive returns.

CDs in a Diversified Portfolio

Despite the potential downsides, CDs hold value in a diversified portfolio. They offer a stable base for your savings, counterbalancing the volatility of higher-risk investments. The key is strategic allocation based on your risk tolerance, financial goals, and overall investment strategy.

A short-term CD might suit a down payment goal in a few years. For long-term goals like retirement, consider longer-term CDs alongside stocks and bonds. Considering a CD ladder? Our CD Calculator can help you project potential returns with various laddering strategies.

Building Your CD Strategy For Maximum Returns

Now that we understand the details of Certificates of Deposit (CDs), let's create a strategy to optimize your returns. This involves considering your personal financial goals, how long you plan to invest, your comfort level with risk, and current interest rates. A well-defined CD strategy can significantly increase your earnings while protecting your initial investment.

CD Laddering: Balancing Access and Yield

A popular strategy, CD laddering, helps maximize returns while still allowing access to your funds. This involves dividing your investment across multiple CDs with different maturity dates. Imagine investing equal amounts in 1-year, 2-year, 3-year, 4-year, and 5-year CDs.

As each CD matures, you can reinvest at the current rate or withdraw the money. This balances the higher returns of longer-term CDs with the ability to access some of your funds regularly. Planning a CD ladder that works for your needs requires careful consideration. Learn more: How to master CD laddering with our calculator.

Opening CDs and Negotiating Rates

Opening a CD is generally a simple process. You'll provide identification, your social security number, and the funds for the deposit. Some banks offer online CD applications, while others require an in-person visit.

Banks advertise their CD rates, but there's often room for negotiation, especially with larger deposits. A good relationship with your bank can lead to better rates. Don't hesitate to ask about special offers or negotiate a higher yield.

Advanced Strategies for Different Rate Environments

Your CD strategy should adapt to the current interest rate environment. When rates are rising, holding cash or investing in shorter-term CDs can be advantageous. This allows you to reinvest at higher rates as they become available.

When rates are high, locking in long-term CDs can secure those favorable returns for an extended time. Keeping an eye on rate trends is essential for getting the best returns.

Monitoring and Managing Your CD Portfolio

Managing your CDs involves tracking your portfolio and making smart renewal choices. Keep tabs on maturity dates and current interest rates to ensure you're maximizing your earnings. As a CD nears maturity, compare current rates to decide whether to renew, reinvest, or withdraw.

Adapting your strategy to market changes is key. If your financial goals or risk tolerance change, adjust your CD portfolio accordingly.

Practical Tips for Maximizing CD Returns

Here are a few tips to help boost your CD returns:

- Shop around: Compare rates from different banks and credit unions.

- Consider online banks: Online banks often have higher rates.

- Negotiate rates: Ask for a better rate, especially with larger deposits.

- Utilize CD calculators: Use online CD calculators to estimate potential returns.

- Build relationships: A good relationship with your banker can be beneficial.

- Stay informed: Follow interest rate trends and financial news.

Use our Certificate-of-Deposit Calculator to plan your savings. This interactive tool helps you project potential returns, compare rates, and create a CD strategy aligned with your financial goals. Visit https://www.bankdepositguide.com/cd-calculator to start maximizing your CD earnings.