The CD Ladder Emergency Fund Advantage

Traditional savings accounts often struggle to keep up with inflation, leaving your emergency fund feeling a bit stagnant. A CD ladder emergency fund, however, offers a more dynamic approach. This strategy involves spreading your savings across multiple Certificates of Deposit (CDs) with different maturity dates, creating a “ladder” of investments. This helps address the classic challenge of balancing readily available funds with earning a decent return.

Balancing Liquidity and Returns With CD Laddering

Unlike a single CD that locks up all your emergency funds, a CD ladder provides regular access to a portion of your savings. As each CD matures, you can withdraw the money without penalty or reinvest it at potentially higher rates. This flexibility is essential for an emergency fund, which needs to be both accessible and profitable. A CD ladder strategy shines when building an emergency fund because of its balanced approach.

By investing in multiple CDs with staggered maturity dates, you can ensure access to a portion of your emergency fund at regular intervals without those pesky early withdrawal penalties. For example, if you have $5,000 to invest, you could distribute it across five CDs with maturities of 6 months, 1 year, 1.5 years, 2 years, and 2.5 years.

This setup lets you earn potentially higher yields from the longer-term CDs while still having access to some funds as each CD matures. This aligns perfectly with the dual goals of an emergency fund: accessibility and growth. In the United States, a common strategy is to ladder CDs with terms ranging from a few months to several years. This ensures some funds become available every few months, which can be reinvested or used as needed. Learn more about CD ladder strategies. For a deeper dive, check out this resource on how to master the CD Ladder Strategy.

The Benefits of a CD Ladder for Emergencies

This approach offers several key benefits:

- Higher Returns: CDs typically offer better interest rates than traditional savings accounts, helping your emergency fund grow more quickly.

- Predictable Growth: With fixed interest rates, you know exactly how much your investment will grow over the CD's term.

- Disciplined Saving: The structured nature of a CD ladder can help discourage dipping into your emergency fund for non-emergency spending.

Mitigating Risk and Staying Informed

While CD ladders offer stability, it’s wise to keep an eye on external factors. Staying up-to-date on economic trends through financial news can help you make more informed decisions. This allows you to adjust your strategy as needed. For example, if interest rates are expected to rise significantly, you might consider shorter-term CDs initially to take advantage of higher rates later on.

Why Your Emergency Fund Deserves Better Than Savings

Traditional savings accounts are great for easy access, but the interest they offer is often minimal. This can leave your emergency fund stagnating, barely keeping pace with inflation. A CD ladder emergency fund offers a more compelling alternative, blending the security of a traditional emergency fund with the growth potential of Certificates of Deposit (CDs). This approach allows you to earn more while still having access to your money when you need it.

The Power of CD Laddering for Emergencies

One of the biggest advantages of a CD ladder is its ability to balance growth and liquidity. CDs offer a guaranteed rate of return, making them appealing for those who prefer to avoid risk. A CD ladder allows you to reinvest funds from maturing shorter-term CDs into new CDs with higher Annual Percentage Yields (APYs), especially when interest rates are rising. This strategy can be especially valuable during times of economic uncertainty. In the U.S., FDIC-insured CDs provide up to $250,000 in protection per depositor, offering significant security for your emergency funds. A CD ladder lets you earn competitive APYs while ensuring you have some funds readily available. Learn more about using CDs for your emergency fund here.

Breaking Down the Benefits

Using a CD ladder for your emergency fund presents some clear advantages. Unlike a standard savings account, a CD ladder provides higher interest rates, helping your money grow faster. The structured approach of a CD ladder also encourages disciplined saving. Since your funds are committed for specific terms, you're less tempted to dip into them for non-emergencies. However, unlike a single, long-term CD, a ladder gives you access to portions of your funds as the CDs mature. This prevents you from being entirely locked in should an unexpected need arise. It's all about finding the right balance between growth and accessibility. Compare savings accounts and CDs here.

Real-World Application of CD Ladders

Imagine facing an unexpected medical bill. With a CD ladder, a portion of your emergency fund is immediately accessible without penalty. The remaining funds continue to earn the higher interest rates of the longer-term CDs. This allows you to address the urgent financial need while maximizing the growth potential of the rest of your emergency fund. This combination of accessibility and growth makes the CD ladder a practical and effective approach to managing emergency savings.

Creating Your CD Ladder Emergency Fund Blueprint

Building a CD ladder for your emergency fund is simpler than it sounds. It's a practical strategy that combines the security of CDs with the accessibility you need in an emergency. This involves figuring out how much you need in your emergency fund and then spreading that amount across several CDs.

Determining Your Emergency Fund Target

The first step is determining the right size for your emergency fund. While 3-6 months of living expenses is a common guideline, your specific situation matters. A freelancer might need more set aside than someone with a steady paycheck, for example. Think about things like your health insurance coverage and the job market. A larger emergency fund can provide extra security during uncertain times.

Structuring Your CD Ladder

Once you know your emergency fund target, you can build your CD ladder. This means dividing your money among CDs with different maturity dates. You could choose terms like 3, 6, 9, 12, and 18 months. This staggered approach gives you access to some of your money every few months as the CDs mature. You get both liquidity and the higher returns that come with longer-term CDs. This balance is the core advantage of a CD ladder emergency fund.

Let's illustrate a sample CD ladder structure:

This table shows how to distribute $10,000 across multiple CDs with different maturity dates to create an effective emergency fund ladder.

Sample CD Ladder Structure for a $10,000 Emergency Fund

| CD Term | Amount | Typical APY Range | When Available | Purpose |

|---|---|---|---|---|

| 3 months | $1,000 | 0.01%-0.50% | 3 months | Immediate access |

| 6 months | $1,500 | 0.01%-0.75% | 6 months | Short-term needs |

| 9 months | $2,000 | 0.01%-1.00% | 9 months | Bridging the gap |

| 12 months | $2,500 | 0.01%-1.25% | 12 months | Covering essential expenses |

| 18 months | $3,000 | 0.01%-1.50% | 18 months | Addressing larger emergencies |

This structure provides a balance of accessibility and return, allowing you to access portions of your emergency fund at different intervals while still benefiting from potentially higher returns on longer-term CDs. Remember that APY ranges can vary significantly between financial institutions and over time.

Finding the Best CD Rates

Shopping around for the best CD rates is key. Don't just look at traditional banks. Consider online banks and credit unions, which often have more competitive APYs (Annual Percentage Yields). Even a small difference in interest rates adds up over time. A 0.5% higher APY on a $5,000 CD can earn you an extra $25 per year. So, compare rates from several financial institutions before deciding where to put your money.

Managing Your CD Ladder

Managing your CD ladder is straightforward. When a CD matures, you can either withdraw the money if you need it for an emergency or reinvest it in a new CD at the top of your ladder. This keeps the ladder going and allows you to continue earning interest. Choose a renewal strategy that aligns with your financial goals. Reinvesting at the top of the ladder, with the longest term, maximizes your returns. If you think you might need access to more funds soon, you could reinvest in shorter-term CDs.

CD Ladder vs. Traditional Approaches: What Works When

Building an emergency fund is crucial for financial stability. But with so many options available, how do you choose the right strategy? This section explores CD ladders, comparing them to other common choices like high-yield savings accounts, money market funds, and Treasury bills. We'll also consider how economic conditions and your personal finances can influence your decision.

Weighing the Pros and Cons of CD Ladders

CD ladders offer a compelling blend of liquidity and return. By spreading your funds across CDs with varying maturity dates, you gain regular access to a portion of your money while still earning interest. In a rising interest rate environment, CD ladders allow you to reinvest maturing CDs at higher rates, maximizing your returns.

However, CD ladders aren't perfect. If interest rates fall, you might be locked into lower rates on your existing CDs. This means potentially missing out on better returns with other short-term investments.

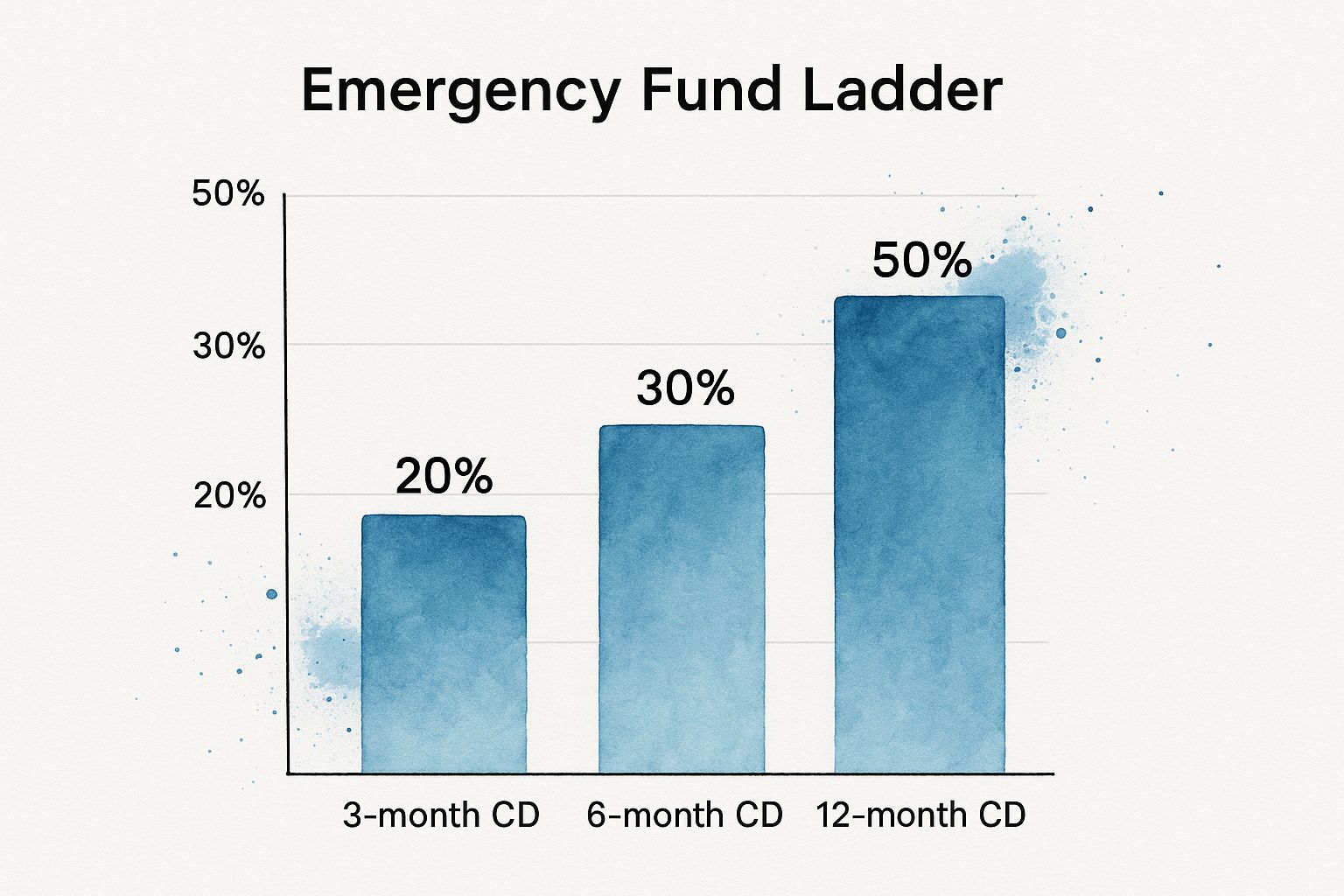

This infographic illustrates a sample CD ladder allocation. With 20% in a 3-month CD, 30% in a 6-month CD, and 50% in a 12-month CD, this strategy balances accessibility and growth. You benefit from both short-term liquidity and the higher returns of longer-term CDs.

Considering Your Financial Landscape

Your individual financial situation plays a significant role in determining the best emergency fund strategy. Factors like risk tolerance, tax bracket, and time horizon are essential to consider.

If you prioritize safety, a CD ladder or a high-yield savings account may be more appropriate than a money market fund. Remember, interest earned on CDs is taxable, unlike interest from certain Treasury securities. If you expect to need quick access to your funds, a high-yield savings account offers more flexibility than a CD ladder.

Comparing Emergency Fund Vehicles

To help you make an informed decision, let's compare the key features of different emergency fund options. The following table summarizes the advantages and disadvantages of each approach.

Emergency Fund Options Comparison: A detailed comparison of different emergency fund strategies highlighting the advantages and disadvantages of each approach.

| Savings Method | Average Return | Liquidity | Risk Level | Inflation Protection | Best For |

|---|---|---|---|---|---|

| CD Ladder | Moderate | Moderate | Low | Partial | Balanced needs |

| High-Yield Savings Account | Low to Moderate | High | Low | Limited | Immediate access |

| Money Market Fund | Variable | Moderate | Low to Moderate | Potential | Higher return potential |

| Treasury Bills | Variable | High | Low | Good | Short-term safety |

As the table illustrates, each option has its own strengths and weaknesses. CD ladders offer a balance of accessibility and return, but might not offer the best inflation protection. Choosing the right strategy depends on your unique circumstances and financial goals.

For further insights into CD planning, use a Certificate-of-Deposit Calculator. This tool can help you estimate potential returns and make informed decisions.

Advanced CD Ladder Tactics for Financial Resilience

Building a basic CD ladder for your emergency fund is a great first step. But you can take it further with some advanced tactics to make your finances even more secure. This section explores some sophisticated strategies often recommended by experienced financial planners.

The Barbell CD Ladder Strategy

One such tactic is the barbell strategy. This approach focuses on the two extremes of the maturity spectrum. You might put 40% of your funds into short-term CDs (3-6 months) and another 40% into longer-term CDs (4-5 years). This leaves just 20% in mid-range CDs.

This setup gives you readily available cash for unexpected expenses and better returns from the longer-term CDs. The barbell strategy helps maximize your earnings while still keeping access to your money when you need it.

Perpetual Rolling CD Ladders

Imagine a CD ladder that practically runs itself. That’s the idea behind a perpetual rolling ladder. When a CD matures, you reinvest the principal and interest into a new CD with the longest term in your ladder.

This creates an ongoing cycle of maturing CDs, providing consistent access to funds and optimizing your returns over the long haul. A perpetual rolling ladder simplifies the management of your emergency fund.

CD Laddering for Community Associations

CD laddering isn’t just for personal finance. It’s also a useful tool for community associations. It offers a safe and efficient way to manage funds while ensuring regular access. For example, a community association could use a CD ladder with different maturity dates. This strategy allows them to access a portion of their funds regularly for reinvestment or community projects. This helps maintain liquidity while benefiting from the higher Annual Percentage Yields (APYs) offered by longer-term CDs. For community associations, CD laddering offers both security and accessibility. Learn more about CD laddering benefits for community organizations here.

Integrating Treasury Securities

You can make your emergency fund even stronger by including Treasury securities. These low-risk investments, backed by the U.S. government, offer competitive yields. Combining Treasury bills with your CD ladder can further stabilize your emergency fund and diversify your investments.

Adapting Your Strategy

Your CD ladder strategy should be flexible, changing as your life and the economy change. If interest rates are on the rise, think about starting with shorter-term CDs so you can reinvest at higher rates when they mature.

During times of economic uncertainty, you might want to shift more funds into short-term CDs for easier access. In a stable economy with lower interest rates, you might extend the maturity ladder to lock in higher rates for longer periods. Regularly reviewing and adjusting your CD ladder strategy ensures your emergency fund stays aligned with your needs and financial goals. Consistent assessment is key to maintaining a resilient emergency fund.

Avoiding The Pitfalls: CD Ladder Emergency Fund Mistakes

A CD ladder can be a powerful tool for building a solid emergency fund. However, even the best-laid plans can go awry. This section highlights common mistakes to avoid when constructing your CD ladder emergency fund.

Misaligned CD Terms

One frequent error is selecting CD terms that don't align with your potential emergency timelines. It's tempting to lock in higher rates with longer-term CDs. However, overdoing it can restrict your access to funds during an emergency. For example, if job loss is your primary emergency concern, concentrating heavily on 5-year CDs might leave you short on cash in a shorter-term emergency. Aim for a balanced ladder with CDs maturing at intervals that match your anticipated needs.

Imbalanced Ladders

Another pitfall is creating an imbalanced ladder with too much money tied up in long-term CDs. While longer-term CDs generally offer higher returns, over-allocating can reduce your financial flexibility. A well-structured ladder staggers maturities, providing access to funds at regular intervals. This ensures you have cash available when needed, preventing costly early withdrawals. Learn more in this article about CD early withdrawal penalties.

Neglecting Rate Shopping

Many savers undermine their CD ladder by neglecting to shop around for competitive rates. While loyalty to a particular institution is commendable, settling for lower interest rates can significantly impact your overall returns. Even small differences in Annual Percentage Yield (APY) accumulate over time, potentially costing you thousands of dollars in interest. Always compare rates across different banks, credit unions, and online platforms before committing to a CD.

Overlooking Renewal Strategies

Failing to plan for CD renewals is another common oversight. When a CD matures, you have a choice: withdraw the funds or reinvest. Without a clear renewal strategy, you risk missing opportunities to optimize your ladder. A rolling CD ladder, where maturing funds are reinvested in a new long-term CD, ensures continued growth and predictable returns. To bolster your strategy, consider incorporating broader financial planning, such as asset protection strategies.

Ignoring Inflation

Finally, it's crucial to consider the impact of inflation. While CD ladders offer predictable returns, they may not always keep pace with rising prices. If the inflation rate exceeds your CD's APY, your money loses purchasing power over time. Factor inflation into your strategy, potentially adjusting CD terms or exploring other investment options that offer better inflation protection.

Ready to build a secure financial future? Use our Certificate-of-Deposit Calculator to plan your CD ladder and maximize your returns.