So, your Certificate of Deposit (CD) is about to mature. This is the moment you’ve been waiting for—the finish line where you can finally access your initial deposit plus all the interest it has earned without facing any penalties.

When this day arrives, the bank will give you a short window, usually a 7- to 10-day grace period, to decide what to do next with your money.

Your CD Is Maturing: What Happens Now?

Think of your CD's maturity date as the end of a successful savings sprint. Your money is no longer locked up. You'll get a formal maturity notice from your bank outlining your choices, and it's crucial to pay close attention. What you do next determines the next chapter for your hard-earned savings.

If you do nothing? Most banks have a default action: they'll automatically renew, or "roll over," your funds into a new CD. It will usually have the same term length as your old one but will lock in at whatever the current interest rate is. That new rate could be much lower than the one you just enjoyed.

Understanding what happens when a CD matures is the key to making sure your money keeps working for you, not against you.

The Critical Grace Period

That "decision window," or grace period, is your chance to take control. During these few days, you have the flexibility to choose a path without getting hit with an early withdrawal penalty.

To make it simple, we've broken down your main choices in the table below.

Quick Guide to Your CD Maturity Options

| Action | What It Means for Your Money | Ideal for This Goal |

|---|---|---|

| Renew or Reinvest | Your principal and interest are rolled into a new CD. | Continuing to earn a guaranteed, fixed return and you don't need the cash soon. |

| Withdraw the Funds | You cash out the entire balance (principal + interest). | You need the money for a large purchase, another investment, or living expenses. |

| Transfer the Money | The balance is moved to a different account, like a checking or high-yield savings account. | Keeping your cash liquid and accessible while potentially still earning some interest. |

Missing this window is the most common mistake savers make.

The grace period is your most powerful tool at maturity. Missing this window often results in an automatic rollover, potentially locking your money into a rate you wouldn't have chosen.

Don't forget to consider the broader economic picture. Savers whose CDs are maturing now are looking at a very different interest rate environment than when they first opened them a year or two ago. This means new CDs might offer less attractive yields, making a strategic plan more important than ever. Your personal financial goals and the current rate climate should guide your decision.

Choosing Your Path: The Four Core Options

When your CD’s term ends, you’ve reached a fork in the road. It’s a decision point with four distinct paths, and your choice really boils down to one thing: do you need the cash now, or do you want to keep it growing? You’ll need to weigh these options before your grace period runs out.

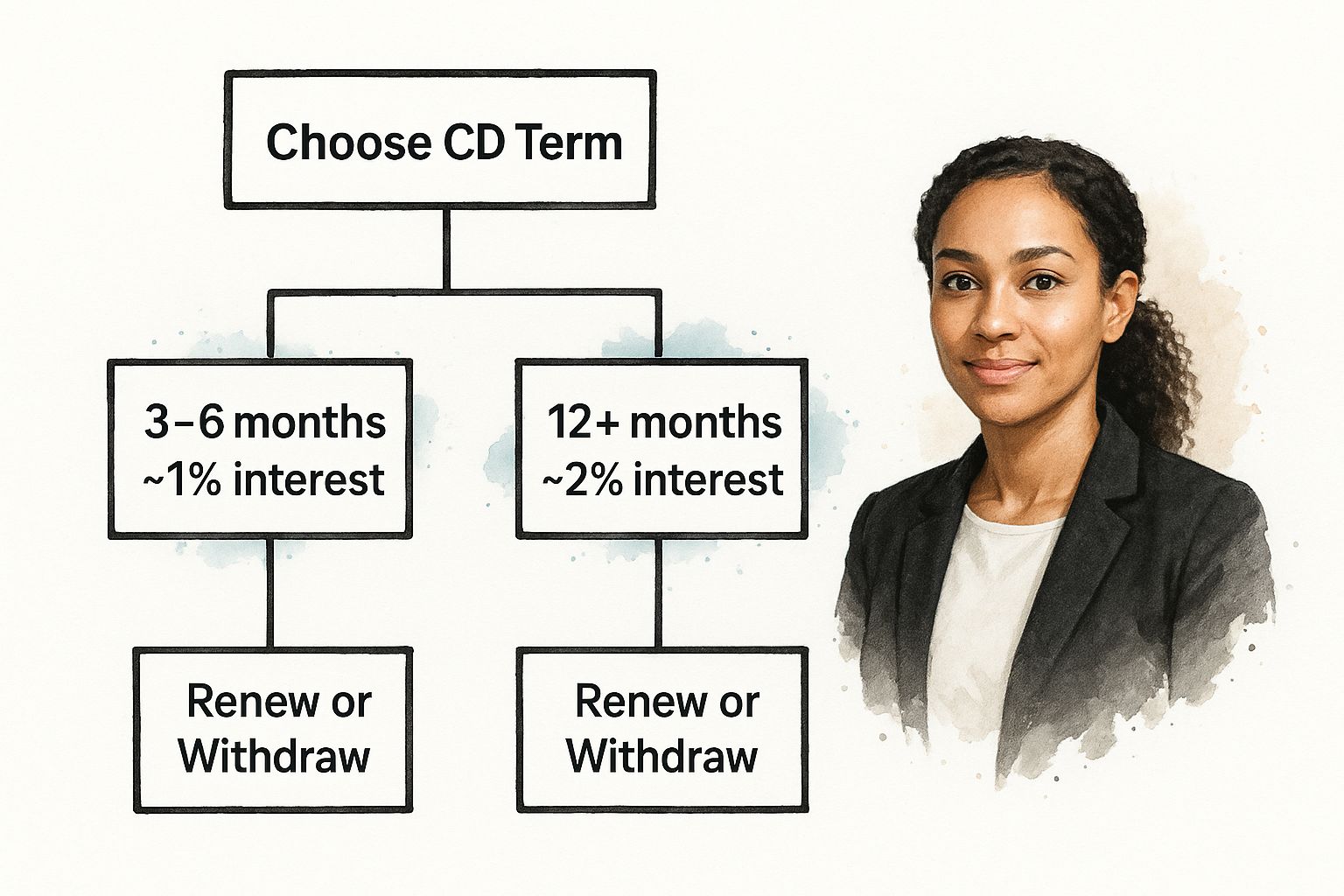

This infographic lays out how the term length you originally chose can shape your thinking when it’s time to renew or cash out.

The key takeaway is that longer CD terms usually come with higher interest rates, but they lock up your money for longer. This trade-off is front and center when you're deciding if another term is the right move.

Your Four Main Choices Explained

So, what can you do with your matured funds? Here’s a breakdown of the primary directions you can take.

Roll It Over into a New CD: This is the default, set-it-and-forget-it choice. Your original principal plus all the interest you earned gets reinvested into a brand new CD. It’s perfect if you don’t need the cash and want to keep earning a predictable, guaranteed return.

Withdraw the Entire Amount: You can simply cash out. The bank will transfer the full balance to your checking or savings account, giving you penalty-free access to your money for whatever you need—a big purchase, another investment, or paying down debt.

Transfer to a Different Account: Maybe a CD isn't the right fit anymore, but you still want your money to work for you. You could move the funds into a more flexible account, like a high-yield savings or money market account, which often earn competitive rates without the long-term commitment.

Make a Partial Withdrawal: This is the hybrid option. You can pull out a portion of the money for immediate needs and roll the rest over into a new CD to keep it growing. It’s a great way to get the best of both worlds.

Every choice you make here directly affects your financial flexibility and earning power. A full withdrawal gives you maximum liquidity, while a rollover prioritizes continued, stable growth.

Matching these options to your immediate and long-term goals is the key to making the right call. For a refresher on how these savings tools work from day one, check out our guide on understanding certificates of deposit. It’s a great starting point for mastering the terms and features that make CDs so effective.

Should You Roll Over Into a New CD?

So your CD has matured. Deciding to roll the funds into a new CD means you’re committing to another term, but you might be reinvesting in a totally different financial world. The interest rate your bank offers is a direct reflection of the current economic climate and Federal Reserve policy—things that can change a lot in just a year or two.

This brings up the big question: is now a good time to lock in a new rate? It really depends on which way the market winds are blowing. Recent data from online banks and credit unions, for instance, shows a gradual cooling of CD rates. In one recent period, the median APY for a 6-month CD fell from 4.55% to around 3.85%, while 1-year CD rates dipped from 4.6% to about 4.0%. You can learn more about recent CD rate forecasts to get a feel for the trends.

A downward trend like this is exactly why just letting your CD roll over automatically might not be the smartest play. If rates are falling, you may want to act fast to lock in the best long-term rate you can find. But if rates are expected to rise, committing to a long term now could mean missing out on better returns just around the corner.

A Smarter Rollover Strategy: CD Laddering

Instead of dumping all your cash into a single CD, there's a powerful strategy called CD laddering. Think of it like building a financial staircase for your savings, giving you both stability and flexibility.

Here’s the basic idea:

- You split your total investment into several smaller, equal chunks.

- You invest each chunk into a CD with a different maturity date—for example, you could open one-year, two-year, three-year, four-year, and five-year CDs at the same time.

This approach creates a "ladder" where one of your CDs comes up for maturity every single year. When a CD matures, you have a choice: withdraw the money if you need it, or reinvest it into a new, long-term CD at the top of your ladder. This way, you’re regularly capturing what are often the highest available interest rates.

CD laddering is a strategic alternative to a simple rollover. It gives you regular access to your funds while helping you manage interest rate risk, ensuring you aren't completely locked in if rates change.

Penalties, Taxes, and Other Fine Print

It’s great that you can access your money penalty-free during the grace period, but what if an emergency strikes and you need it before your CD matures? This is where you have to understand the fine print.

Breaking your CD contract early almost always triggers a penalty. This isn't some arbitrary flat fee; it's usually calculated as a specific number of months' worth of interest.

- For CDs with terms of one year or less, a common penalty is three months' worth of simple interest.

- For longer-term CDs (over one year), the penalty might be six months' interest or even more.

Let's say you earned $100 in interest on a one-year CD but had to pull the funds out early. A three-month interest penalty would cost you about $25. The bank subtracts this from your interest earnings or, if that’s not enough, from your original principal.

Understanding Your Tax Obligations

Beyond penalties, you also need to think about taxes. The interest you earn from a Certificate of Deposit is not tax-free money—the IRS considers it taxable income, just like wages.

Every year, your bank will mail you a Form 1099-INT. This form shows the total interest your CD earned for the year. You must report that number on your tax return, and it gets taxed at your ordinary income tax rate. For a deeper dive, check out our guide on how CD interest is taxed.

Keep in mind you owe taxes on the interest earned for the year, even if you roll it over into a new CD instead of cashing out.

This is a crucial detail that catches many savers by surprise. It's why looking into broader strategies to reduce taxes in retirement can make a huge difference to your long-term financial picture, helping you keep more of your hard-earned money.

When your CD matures, just letting it automatically roll over into a new one isn't your only move. While CDs are fantastic for their predictable, guaranteed returns, life changes. Your financial needs might be different now than when you first opened it.

This is the perfect moment to step back and re-evaluate. Think of the cash from your matured CD as a free agent. Instead of re-signing with the same team out of habit, you can shop around for the best new contract. Is a CD still the right home for this money? Or could another option serve you better?

Let's look at a few of the most popular and effective alternatives.

High-Yield Savings Accounts (HYSAs)

If you suddenly need more flexibility, a high-yield savings account is a top contender. Unlike a CD that locks your money away for a specific term, an HYSA gives you access to your cash anytime you need it, with no penalties.

While their interest rates are variable—meaning they can go up or down with the market—they often deliver APYs that are very competitive with short-term CDs. Sometimes, they're even higher. This makes an HYSA an excellent spot for an emergency fund or for saving toward a near-term goal where the timing isn't set in stone.

Money Market Accounts (MMAs)

Think of a money market account as a hybrid, borrowing the best features from both savings and checking accounts. They typically pay much higher interest rates than a standard savings account while adding a layer of convenience.

Many MMAs come with a debit card or even check-writing privileges, which makes getting to your money far easier than with an HYSA. They combine solid interest earnings with everyday practicality, making them a strong choice if you want your savings to grow but also be available for spending.

An easy way to think about it: A CD is for pure saving, an HYSA is for saving with flexibility, and an MMA is for saving with both flexibility and spending power.

Comparing CDs to Other Savings Options

To see how these accounts stack up side-by-side, it helps to compare their core features. A CD is built for one purpose—locking in a rate—while HYSAs and MMAs are designed for different levels of access and convenience.

| Feature | Certificate of Deposit (CD) | High-Yield Savings Account | Money Market Account |

|---|---|---|---|

| Interest Rate | Fixed for the entire term | Variable, changes with market | Variable, changes with market |

| Best For | Locking in a guaranteed return, long-term savings goals | Emergency funds, flexible savings | Blended savings and spending needs |

| Access to Funds | Penalty for early withdrawal | No-penalty withdrawals | Easy access via debit card/checks |

| Typical Yield | Often highest for longer terms (2+ years) | Competitive with short-term CDs | Competitive with HYSAs |

| Key Feature | Predictability and rate security | Liquidity and flexibility | Convenience and access |

Ultimately, the best choice depends entirely on your current financial situation.

If you're willing to take on a little more risk for potentially higher returns, you could also explore things like government-issued I-bonds, which are designed to protect you from inflation, or even short-term bond funds. The key is to weigh the risk, return potential, and accessibility of each option to find the perfect match for what you need now.

Frequently Asked Questions About CD Maturity

As your CD's maturity date gets closer, a few key questions usually pop up. Here are some straightforward answers to the most common things savers wonder about when deciding their next move.

What Happens If I Miss My Grace Period?

If you let the grace period—which is usually just 7 to 10 days—slip by without giving the bank instructions, don't worry, they won't just hold your money in limbo. They'll almost certainly take action on your behalf.

The most common outcome is an automatic renewal. Your entire balance, including the original principal and all the interest you've earned, gets rolled right into a new CD. This new account typically has the same term length as your old one but locks in at whatever the current interest rate is. That new rate might be much lower than what you had, and once it renews, your money is locked up again. Trying to access it before the new maturity date means you'll face an early withdrawal penalty.

Can I Negotiate a Better CD Rate?

Sometimes, you absolutely can. While the eye-catching promotional rates you see advertised are usually set in stone, longtime customers with larger balances often have a bit of negotiating power. It never hurts to pick up the phone and ask.

Before you let the CD roll over, call your bank and see if they can offer you a better "relationship rate" to thank you for your loyalty. The worst they can do is say no. But in some cases, especially if you mention you've seen better rates at competing banks, they might just give you a slight APY bump to keep you from walking away with your money.

How Should I Adapt to Changing Interest Rates?

Your best strategy really depends on which way you think rates are headed.

- When Rates Are Falling: If you think rates are on a downward slide, it’s often a smart move to lock in the best available long-term rate right now. This secures a higher yield for yourself before rates drop even further.

- When Rates Are Rising: In a rising-rate environment, you might be better off with a short-term CD. This gives you the flexibility to reinvest your money sooner and capture those higher rates as they become available. A CD ladder is another fantastic strategy for this scenario.

You're not the only one thinking about this. Financial institutions are bracing for a massive wave of decisions just like yours. An estimated $1.9 trillion in CDs are set to mature soon, forcing banks to manage a huge volume of rollovers and withdrawals. You can read more about how banks are handling these high volumes of maturing CDs on Curinos.com.

Before you lock in your next move, get a crystal-clear picture of what your money could earn. The Certificate-of-Deposit Calculator lets you instantly project your returns, compare different APYs, and see exactly how your savings can grow. Plan your strategy with confidence by visiting the Certificate-of-Deposit Calculator today.