When your Certificate of Deposit (CD) matures, you’ve reached a key moment for your savings. It’s decision time. You enter a short grace period where you can either cash out your principal and interest, roll the money into a brand-new CD, or let the bank handle it by automatically renewing it for you.

Your Options When a CD Matures

Think of your CD's maturity date as a fork in the road. You’ve finished one leg of your savings journey, and now you have to pick the next path for your money. Doing nothing isn't really an option—because inaction itself is a choice. If you don't give instructions, the bank will decide for you. This decision is huge, especially because the interest rate world might look completely different than it did when you first opened the account.

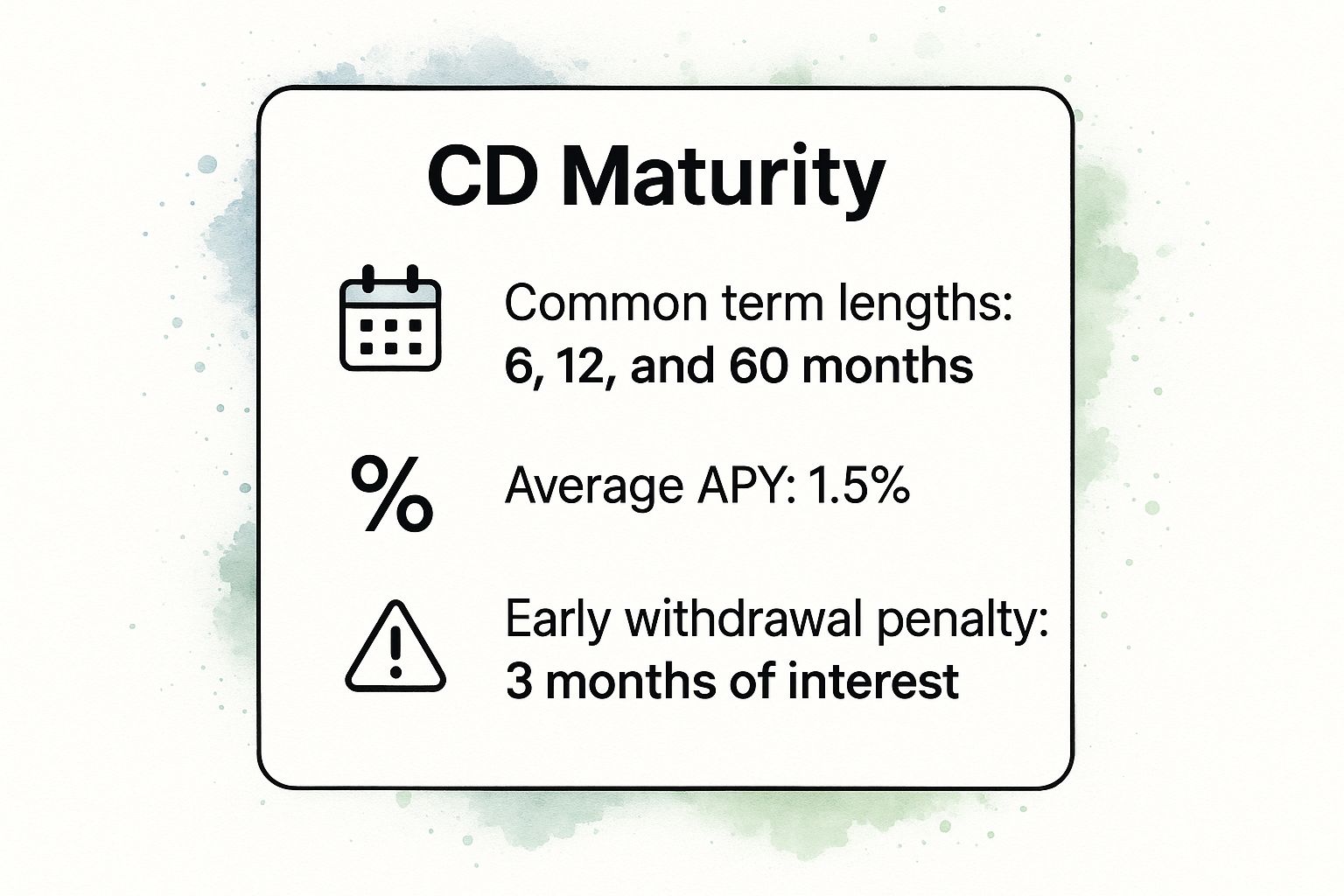

The infographic below gives a quick overview of typical CD features, like common term lengths and what happens if you pull out early, which helps frame the importance of your choice at maturity.

As you can see, a CD is a commitment. Breaking it early costs you, which makes your decision at the end of the term that much more important.

Comparing Your Three Main Choices

When your CD comes due, you really have three main options. Each has its own pros and cons, and getting a clear picture of them is the first step to making a smart move with your cash.

- Withdraw the Funds: Take your original deposit plus all the interest it earned and move it to your checking or savings account. This makes the cash liquid and ready for whatever you need it for next.

- Roll Over into a New CD: This means you reinvest the whole pot—principal and interest—into a new CD with the same bank. It's often the default if you don't take any action.

- Move to a Different Investment: You might discover a better rate at another bank or decide a different savings tool, like a high-yield savings account, is a better fit for your current goals.

The most important thing is to be proactive. Just letting your CD renew on its own could lock you into a new term with a lousy interest rate, especially if rates have dropped since you first signed up.

To make things even clearer, I've put together a quick summary of your choices.

Your CD Maturity Options at a Glance

This table breaks down the three main paths you can take, what each one involves, and who it’s generally best for.

| Option | What It Means | Best For |

|---|---|---|

| Withdraw | Cashing out your principal and interest into a liquid account like checking or savings. | People who need cash for a big purchase, want to rebalance their funds, or have found a better investment opportunity. |

| Roll Over | Automatically renewing your CD for another term at the bank's current interest rates. | Savers who are happy with their bank, find the new rate competitive, and value the convenience of doing nothing. |

| Reinvest Elsewhere | Moving the money to a new CD at a different bank or into another investment entirely. | Smart savers who are actively shopping for the best rates or whose financial goals have shifted and want to maximize their returns. |

Looking at your options this way helps you match your next move to your financial situation. The key is to actively choose the path that works best for you right now, rather than letting the default option choose for you.

Navigating the CD Grace Period

When your CD’s term finally ends, a brief but critical window opens up: the grace period. Think of it as a small, penalty-free break between rounds. It’s a short timeframe where you get to decide your money’s next move before the bank makes a choice for you.

This period is your chance to take control. If you let it pass without giving instructions, the bank will almost always renew your CD automatically. That means your entire balance gets locked into a brand-new term at whatever rate is on offer that day—a rate that might not be the best one available.

Understanding the Clock

Grace periods aren't one-size-fits-all; the exact length is set by your bank or credit union. The most common window is about seven to ten calendar days right after your CD matures. But treat that as a guideline, not a guarantee. Some institutions might give you a little more time, while others could offer less.

So, how do you find out your specific timeframe? Your bank will send you a maturity notice, usually a few weeks before the big day. This document will spell out the maturity date and the exact end of your grace period. If you’ve misplaced the notice, you can always find the details in your online account or by giving customer service a quick call. For a more detailed look at the rules, check out our guide on the Certificate of Deposit grace period.

The grace period is a strategic pause, not a reason to panic. It’s designed to give you just enough time to assess your options and make a thoughtful choice without feeling rushed. Missing it means losing your opportunity to direct your funds.

Why This Window Is So Important

This short window is arguably the most important moment in your CD's life after the day you open it. It’s your single point of control. If you fail to act within the grace period, the consequence is almost always an automatic renewal.

Here's what’s on the line if you miss your chance:

- Automatic Rollover: The bank will likely reinvest your entire balance—the original principal plus all the interest you’ve earned—into a new CD.

- New Term and Rate: This new CD will typically have the same term length as your old one but will lock in the current interest rate, which could be much lower than what you had.

- Locked-In Funds: Once that rollover happens, your money is tied up again. If you need to access it before the new maturity date, you'll be facing early withdrawal penalties all over again.

The grace period is your built-in time to shop around. Use these few days to compare the rates at other banks and credit unions. You might discover a much better deal elsewhere that could significantly boost your earnings on the next go-around. Treat this time as a strategic opportunity to make sure your money is working as hard for you as it possibly can.

How Interest Rates Impact Your Decision

The decision you make when a CD matures isn't just about your personal financial plan; it’s deeply connected to the wider economy. Think of the rate you locked in on your original CD as a financial snapshot in time. The world might look very different now, and interest rates are almost always the biggest reason why.

Interest rates are never set in stone. They rise and fall based on big-picture economic forces, especially the policies coming from the Federal Reserve. When the Fed moves its benchmark rate, banks and credit unions adjust the Annual Percentage Yield (APY) they offer on everything from savings accounts to CDs. This means that great 5.00% APY you secured 18 months ago probably isn't on the table today.

The Current Rate Environment

Getting a handle on the current rate environment is the single most important step in making a smart choice. If rates have tanked since you opened your CD, letting it automatically roll over could mean locking in a new term at a disappointingly low return. But if rates have climbed, a rollover might be a fantastic move, securing you an even better yield.

For instance, the rate environment today is a world away from just a few years ago. After a period of historically high CD rates in 2023 and early 2024—where yields often topped 5%—the Fed began trimming rates. Even so, returns are still quite attractive. In mid-2025, you can still find online banks offering around 4.00% APY for 1-year CDs, showing that while the peak may be over, good deals are still out there. You can dig into more data on CD rate forecasts and trends on NerdWallet.com.

This constantly shifting landscape is exactly why your grace period is so valuable. It gives you that crucial window to pause, look around, and decide if the current rates work for you.

When your CD matures, you're not just deciding what to do with your money. You are actively responding to the current economic climate and positioning your savings for the future.

Strategic Choices Based on Rate Trends

This is where you get to shift from being a simple saver to a financial strategist. Your gut feeling—and research—on where rates are headed should directly shape your next move.

Think about these two main scenarios and the strategy for each:

- If you think rates will fall further: This is the time to lock in the best long-term CD rate you can find, right now. By securing a 3-year or even a 5-year CD, you guarantee that return for yourself, even if market rates keep dropping. It's a defensive move to protect your future earnings.

- If you think rates will rise soon: In this case, you might go for a shorter-term CD, like a 6-month or 1-year term. This approach keeps your money flexible. It frees you up to reinvest at those potentially higher rates when this new, shorter CD matures in the near future.

There is no single "right" answer here. The best strategy is a blend of what the market is doing and what your personal financial goals demand. By analyzing the trends, you can make a calculated choice between locking in a solid long-term return or staying nimble for better opportunities down the road.

Choosing Your Path: Rollover or Withdraw

Once your grace period starts, you've arrived at the most important moment of your CD's lifecycle. You have a choice to make: roll the money over into a new CD or withdraw the cash.

There’s no universally "right" answer here. The best move is entirely personal, depending on your current financial needs, what you're saving for, and what's happening with interest rates. One option offers pure convenience, while the other gives you complete freedom.

The Case for a Rollover

Opting to roll over your CD is the simplest, most hands-off approach. When you do this, you're reinvesting the entire matured amount—your original principal plus all the interest it earned—into a brand new CD with the same bank or credit union.

This is a great path for savers who are happy with their bank and feel the new rate being offered is competitive. If you don’t need the cash anytime soon and love the "set it and forget it" security of a CD, a rollover is a solid, low-effort way to keep your savings growing.

The Power of Withdrawing

Withdrawing your funds, on the other hand, is all about flexibility. When you cash out, that money is yours to direct as you see fit.

You can move it to a high-yield savings account for easier access, pay down high-interest debt, cover a major expense like a home repair, or jump on a better investment opportunity you've spotted elsewhere. This is the perfect choice if your financial goals have changed since you first opened the CD, or if you've shopped around and found a much better rate at another institution.

Your decision really just comes down to your priorities. A rollover values stability and ease. A withdrawal values liquidity and the freedom to chase higher returns or meet new goals.

To make a smart decision, you have to look at how the market has changed. As of mid-2025, for example, the best CD rates are hovering around 4.60% APY. That’s a noticeable drop from the highs we saw before the Federal Reserve’s 2024 rate cuts. Savers with older, high-rate CDs maturing now are facing a less attractive rate environment, which makes their next move critical. You can see how different rates affect your bottom line with our guide on how to calculate CD interest.

This interest rate shift has led many savers to choose shorter-term CDs to stay more flexible, a trend highlighted in Fortune's analysis of current CD rates.

To figure out your best move, ask yourself a few direct questions:

- Do I need this cash in the near future? If yes, withdrawing is the clear winner.

- Are today's CD rates worth locking in again? If rates feel low, you might be better off keeping your money liquid and waiting for a better opportunity.

- Have my financial goals changed? What made sense two years ago might not fit with your plans today.

Ultimately, what happens when a CD matures is entirely up to you. By weighing the convenience of a rollover against the freedom of a withdrawal, you can confidently point your savings in the right direction.

Understanding the Financial Consequences

Every choice you make when your CD matures creates a financial ripple effect. While your actions during the grace period are penalty-free, the decisions you make about penalties and taxes can seriously eat into your final returns. Getting your head around these outcomes ahead of time is the key to actually keeping what you earned.

One of the most common traps catches people right after an automatic rollover. If you miss your grace period and your CD renews, that money is locked in all over again. If you suddenly need those funds and have to break the newly rolled-over CD, you’ll get hit with an early withdrawal penalty, just like you would have on the original CD.

The Inescapable Reality of Taxes

Penalties are avoidable. Taxes are not. The interest your CD earns is considered taxable income by the IRS, and this is a detail you absolutely need to plan for. It makes no difference whether you pull the cash out or roll it over into a new CD—the tax bill is the same.

The key thing to remember is when that interest becomes taxable. Interest is taxed for the year it is credited to your account and made available to you, which is almost always at maturity. This means that even if you let the full amount roll over, you still owe taxes on the interest you earned for that year.

Your bank or credit union will send you a Form 1099-INT after the tax year ends. This form lists all the interest income you earned, which you must report on your tax return.

How CD Interest Shows Up on Your Taxes

Let's walk through a simple, real-world example to see how this plays out.

Imagine you had a $10,000 CD that matured in November. Over its term, it racked up $500 in interest. At maturity, you decide to roll the entire $10,500 into a new CD, never touching a dime of the cash.

Even though you didn't withdraw a single dollar, the bank made that $500 in interest available to you. Because of that, you will receive a 1099-INT form showing $500 of interest income that has to be reported for that tax year.

- Your Action: Rolled over the entire balance.

- The Reality: That $500 in interest is still considered income for the year.

- The Result: You will owe income tax on the $500, even though the cash is now locked away in a new CD.

Anticipating this tax obligation is a crucial part of managing your savings. It prevents a surprise bill come April and ensures your CD strategy doesn't create problems for your overall financial plan. If you're worried about penalties from a recently renewed CD, you can learn more about the rules governing a certificate of deposit early withdrawal to understand your options.

Got More Questions About CD Maturity?

Even with the best-laid plans, you'll probably have a few specific questions when your CD finally comes due. Life is full of curveballs, after all. This is where we get into the nitty-gritty, answering the most common "what if" scenarios savers run into.

Think of this as the troubleshooting guide for your CD's maturity. Knowing the answers ahead of time means you can act quickly and confidently during that short grace period.

Can I Add or Remove Funds During the Grace Period?

Yes, absolutely. The grace period is your one and only window to tweak your investment amount without getting hit with a penalty. You have complete flexibility here.

Let's say your $10,000 CD earned $500 in interest. You could pull out just the $500 profit and let the original $10,000 roll over. Or maybe you need cash for a home repair—you could withdraw $2,500 and roll over the remaining $8,000. You can even add new money to the principal, giving your next CD term a bigger starting balance to compound from.

This flexibility is a core feature of the maturity process, letting you adjust your savings strategy to what your life looks like now, not what it looked like a year ago.

What Happens If a CD Owner Passes Away?

When a CD owner dies before the account matures, what happens next depends entirely on how the account was set up. Banks and credit unions are almost always very helpful and compassionate in these situations.

- Payable-on-Death (POD) Accounts: If the owner named a beneficiary, that person can claim the money directly. They'll just need to provide a death certificate and proper ID. Critically, the bank will almost always waive any early withdrawal penalties.

- No Named Beneficiary: If nobody was designated, the CD becomes part of the deceased's estate. The money will be distributed based on their will or, if there isn't one, by state probate laws. The estate's executor handles this process.

It's a compassionate policy. The goal is to make it as simple as possible for heirs or the estate to access the funds, bypassing the usual penalties for cashing out a CD early.

Is the Process Different for a Brokered CD?

Yes, brokered CDs work very differently. You buy these through a brokerage firm (like Fidelity or Schwab) instead of directly from a bank, and that changes everything at maturity.

A brokered CD doesn't automatically roll over. Instead, it liquidates. The principal and all the interest you earned get deposited as cash into your brokerage account. From there, you're in the driver's seat. You can use that cash to buy another brokered CD, invest in stocks or bonds, or just withdraw it. This setup gives you more direct control but also requires you to be more hands-on, since there’s no default rollover to fall back on.

Will My Bank Notify Me Before Maturity?

Yes, they are required to. Financial institutions must send you a maturity notice before your CD's term is up, usually landing in your mailbox or inbox 15 to 30 days before the big day.

This is a crucial document. It will spell out:

- The exact date your CD matures.

- How long your grace period is (typically 7 to 10 days).

- The terms of the automatic renewal, including the new, often lower, interest rate if you do nothing.

Even though the bank will send a notice, it's always smart to set your own calendar reminder. It’s a simple backup that guarantees you won’t miss your grace period and lose control over your own money.

Deciding on the best path for your matured CD funds requires careful calculation. The Certificate-of-Deposit Calculator from BankDepositGuide can help you project future earnings, compare different APYs, and see how various terms will impact your returns. Take control of your savings strategy by using our free CD calculator today.