Think of a Certificate of Deposit (CD) as a straightforward deal you make with a bank: you agree to park a chunk of money with them for a set amount of time, and they guarantee you a fixed interest rate in return. It’s a simple trade-off—giving up immediate access to your cash for a better, totally predictable return. That basic bargain is the heart of what a CD is all about.

What Exactly Is a Certificate of Deposit?

A Certificate of Deposit is a special type of savings account offered by banks and credit unions. You deposit a lump sum of cash and promise not to withdraw it for a specific period, which is called the term.

In exchange for that commitment, the bank rewards you with interest payments at a rate that's locked in from day one. This makes CDs one of the most reliable savings tools you can find. Unlike a regular savings account where the rate can fluctuate, a CD’s rate is set in stone. You'll know exactly how much you’ve earned when the term ends on its maturity date.

The Core Components of a CD

To really get how CDs work, it helps to see them as having three key parts. Each one defines how your money will grow.

- Principal: This is simply the starting amount of money you deposit into the CD. It’s the foundation of your savings.

- Term Length: This is how long you agree to leave your principal untouched. Terms can be as short as a few months or stretch out for five years or even longer.

- Interest Rate (APY): This is the fixed return the bank pays you. It's almost always shown as an Annual Percentage Yield (APY), which gives you the real picture of your earnings over a year, including the effect of compounding interest.

The real beauty of a CD is its safety and predictability. Your principal is protected—most are FDIC insured up to $250,000—and the fixed rate means your return is guaranteed, completely insulated from the ups and downs of the market.

This predictable nature makes CDs a fantastic fit for financial goals with a hard deadline. Saving for a house down payment you'll need in three years? Funding a wedding 18 months from now? A CD lets you set that money aside, confident it will grow steadily and be ready right when you need it. If you want to dig deeper into the essentials, check out our guide on certificate of deposit basics.

Certificate of Deposit Key Features at a Glance

To tie it all together, this table breaks down the fundamental features of a standard CD. Understanding how these parts interact is key to using them effectively.

| Feature | Description | What It Means for You |

|---|---|---|

| Fixed Principal | The lump sum you deposit at the start. | Your initial investment amount is set and secure. |

| Fixed Term | The predetermined period your money is locked in. | You can't access your funds without a penalty until this period ends. |

| Fixed Interest Rate | The guaranteed rate of return you will receive. | Your earnings are predictable and won't change with the market. |

| Maturity Date | The date your CD term officially ends. | On this day, you can withdraw your principal and interest penalty-free. |

Generally, the longer the term, the higher the interest rate the bank will offer. That's because you're giving them the security of using your funds for a longer stretch. This trade-off between term length and rate is what makes CDs such a versatile savings tool.

Comparing the Different Types of CDs

Once you understand the basic CD, you'll discover the market is full of interesting variations. Banks know that a one-size-fits-all approach doesn't work for everyone's financial life, so they've created specialized CDs for different goals.

Think of the standard CD as the reliable family sedan—predictable and safe. The other types are more like specialized vehicles, each built for a specific job. Picking the right one is about matching its features to what you need, whether that's maximum return, easy access to your cash, or a hedge against changing interest rates.

The Standard or Traditional CD

This is the plain-vanilla CD and the one most people are familiar with. You deposit a lump sum for a set period at a fixed interest rate. No surprises, no complications.

You know exactly what you’ll earn and precisely when your money is available. This makes it perfect for people saving for a goal with a firm deadline, like a down payment on a house you plan to buy in two years. The main downside is that same rigidity—you're stuck with your rate even if better ones pop up.

Rates on traditional CDs follow the wider economy. They've seen some wild swings, tracking the Federal Reserve's policy decisions. Back in the early 1980s, as the Fed jacked up rates to crush inflation, savers could find a three-month CD earning an incredible 18.5% APY. That’s a world away from the near-zero rates we saw in the 2010s. You can see more on these historical trends from sources like Investopedia.

The High-Yield CD

A High-Yield CD isn't a different kind of product; it's simply a standard CD that pays a much better rate than the national average. You'll almost always find these at online-only banks. With no branches to maintain, their overhead is lower, and they pass those savings on to you through better yields.

If your only goal is squeezing the most interest out of your savings and you're comfortable banking online, this is the way to go. Just make sure the bank is FDIC or NCUA insured, and you're all set.

Key Insight: The term "high-yield" is relative. Always compare a bank's offer not just to your local brick-and-mortar but also to other top online banks. That's the only way to know you're getting a genuinely competitive rate.

The No-Penalty CD

What if you love the idea of a CD's guaranteed return but get nervous about locking your money away? The No-Penalty CD (sometimes called a liquid CD) is your answer. It lets you pull your entire principal out before the maturity date without getting hit with an early withdrawal penalty.

There's usually a small waiting period, often just seven days after you open the account, before you can make a withdrawal. The trade-off for this fantastic flexibility is a slightly lower interest rate compared to a traditional CD of the same term. This makes it a powerful alternative to a high-yield savings account for an emergency fund or for saving toward a goal with a fuzzy timeline.

The Bump-Up CD

A Bump-Up CD is a clever tool designed to protect you from seeing interest rates rise right after you’ve locked yours in. It gives you a one-time option to "bump up" your CD's interest rate to whatever the bank is currently offering for a similar term.

This is a smart move if you think rates are heading north but you still want the security of a long-term CD today. The catch? The starting APY on a bump-up CD is usually a bit lower than on a traditional one—that's the price you pay for the rate-hike option.

To make sense of these options side-by-side, it helps to see them in a table. Each CD type serves a different purpose, and seeing their core features and trade-offs can help you pinpoint the best fit for your money.

Comparing Different Certificate of Deposit Types

A side-by-side comparison of common CD types to help you choose the right option for your financial goals.

| CD Type | Best For | Key Feature | Primary Consideration |

|---|---|---|---|

| Standard CD | Savers with a fixed time horizon who want a predictable, guaranteed return. | Simplicity and a locked-in rate. | You can't benefit if market rates rise, and early withdrawal incurs a penalty. |

| High-Yield CD | Maximizing interest earnings and comfort with online-only banking. | Offers an APY significantly above the national average. | "High-yield" is relative; you must compare rates across multiple online banks. |

| No-Penalty CD | Building an emergency fund or saving for a goal with an uncertain timeline. | Allows penalty-free withdrawal before the maturity date. | The interest rate is typically lower than a comparable standard CD. |

| Bump-Up CD | Savers who believe interest rates will rise during their CD's term. | A one-time option to increase your rate to the current market rate. | The initial interest rate is usually lower than on a standard CD. |

Ultimately, choosing the right CD isn't about finding the single "best" one, but the best one for you. By matching your financial situation and your outlook on interest rates with the features of each CD, you can make a strategic choice that helps your money work harder.

The Pros and Cons of Investing in CDs

Like any financial tool, a Certificate of Deposit has its own distinct personality—a set of strengths and weaknesses you need to understand. Getting a handle on this trade-off is the key to figuring out if, and how, a CD fits into your savings strategy.

CDs deliver a powerful one-two punch of safety and predictability. But that stability comes at a cost. This isn't about finding a perfect, one-size-fits-all investment. It’s about finding the right tool for the right job.

The Clear Advantages of CDs

The biggest reason people turn to CDs can be summed up in one word: security. This isn't just a vague feeling of safety; it's baked into the product in a few very specific ways.

First and foremost is the government-backed insurance. CDs from banks are insured by the Federal Deposit Insurance Corporation (FDIC), while those from credit unions are covered by the National Credit Union Administration (NCUA).

This means every penny of your money is protected up to $250,000 per depositor, per insured institution, for each account ownership category. If the bank fails, your money is safe. Period. This makes CDs one of the lowest-risk places to park your cash.

The other major draw is predictability. When you open a CD, you lock in a fixed interest rate for the entire term. You know exactly what you’re getting.

- No Market Volatility: Your return is guaranteed. It doesn't matter if the stock market is soaring or sinking; your rate won't budge.

- Clear Goal Planning: You know the exact dollar amount you'll have on the maturity date. This makes it incredibly easy to plan for a specific goal, like a down payment on a house or a new car.

This "set it and forget it" nature removes all the guesswork. Your money grows at a steady, known pace without any surprises along the way.

The Potential Downsides to Consider

While CDs are incredibly safe, that security comes with trade-offs. The very features that make them so stable—the fixed terms and fixed rates—are also their biggest limitations.

The most significant risk is interest rate risk. Imagine you lock your money into a five-year CD. A year later, the Fed raises rates and new CDs are paying a full percentage point more. You're stuck earning that original, lower rate. This can be a real source of frustration in a rising-rate environment. You can learn more about how to evaluate if CDs are a good investment right now.

Then there's inflation risk. If your CD pays a 4% APY but inflation for the year hits 3.5%, your "real" return—your actual gain in purchasing power—is just 0.5%. Your money is growing, but just barely faster than its value is eroding.

Finally, there’s the liquidity problem. Your cash is tied up until the CD matures. If you need it sooner, you’ll have to pay an early withdrawal penalty, which usually means giving up several months' worth of interest. This makes CDs a poor choice for an emergency fund or any cash you might need at a moment's notice.

This dynamic became crystal clear in recent years. After a long period of near-zero yields following the Great Recession and the pandemic, rates shot up as the Federal Reserve fought inflation. This suddenly made CDs much more attractive, but it also highlighted the interest rate risk for anyone who had locked in rates just before the jump. You can see just how much rates have moved by looking at historical CD rate trends on Bankrate.com.

Ultimately, deciding on a CD means weighing the promise of a guaranteed return against the cost of limited access and the risk of missing out on better opportunities.

How To Use CD Strategies In Your Financial Plan

Once you move beyond owning just a single Certificate of Deposit, a whole new world of financial strategy opens up. Instead of just parking your money and waiting, you can arrange several CDs into a smart system. This lets you balance easy access to your cash with the better rates you get from long-term commitments, turning CDs from a simple savings product into a powerful part of your financial toolkit.

By being thoughtful about how you structure your CD investments, you can create a reliable flow of maturing funds, protect yourself against shifting interest rates, or even laser-focus on a big savings goal. These methods give you all the safety and guaranteed returns of CDs without making you feel like your money is completely locked away.

The CD Laddering Strategy for Liquidity and High Rates

By far, the most popular CD strategy is CD laddering. It's a brilliant way to get the best of both worlds: the high interest rates that come with long-term CDs and the frequent access you get from short-term ones. The idea is to split your money into several smaller CDs with staggered maturity dates instead of dumping it all into one big, long-term CD.

It's simpler than it sounds. Here’s a classic example:

- You have $5,000 to invest.

- You divide it into five equal $1,000 portions.

- You open five different CDs: a 1-year, 2-year, 3-year, 4-year, and a 5-year.

Every year, one of your CDs matures. You can grab the cash if you need it, or—if you don't—reinvest it into a new 5-year CD at whatever the current rate is. After a few years, you'll have a "rung" of your ladder maturing every single year, all while the bulk of your money is earning those attractive long-term yields. To really get into the weeds on this powerful method, check out this detailed guide on the CD ladder strategy.

The CD Barbell and Bullet Strategies

While laddering is fantastic for creating steady, ongoing liquidity, some situations call for a different approach. Two other effective strategies are the CD barbell and the CD bullet.

- The Barbell Strategy: This one is all about putting your money at opposite ends of the timeline. You might invest half your funds in very short-term CDs (think 3-6 months) and the other half in long-term CDs (5+ years), with nothing in between. The goal here is to balance immediate liquidity from the short-term CDs with the high-yield muscle of the long-term ones.

- The Bullet Strategy: This strategy is tailor-made for saving for a big, one-time expense with a specific deadline, like a wedding or a down payment on a house. You open several CDs with different term lengths that are all set to mature around the same time. For example, if your goal is five years away, you could open a 5-year CD today, a 4-year CD next year, and so on. This creates a big "bullet" of cash that becomes available right when you need it most.

Strategic Takeaway: The right CD strategy is all about your personal financial goals. A ladder gives you steady cash flow. A barbell balances risk and return. A bullet focuses all your savings firepower on a single target date.

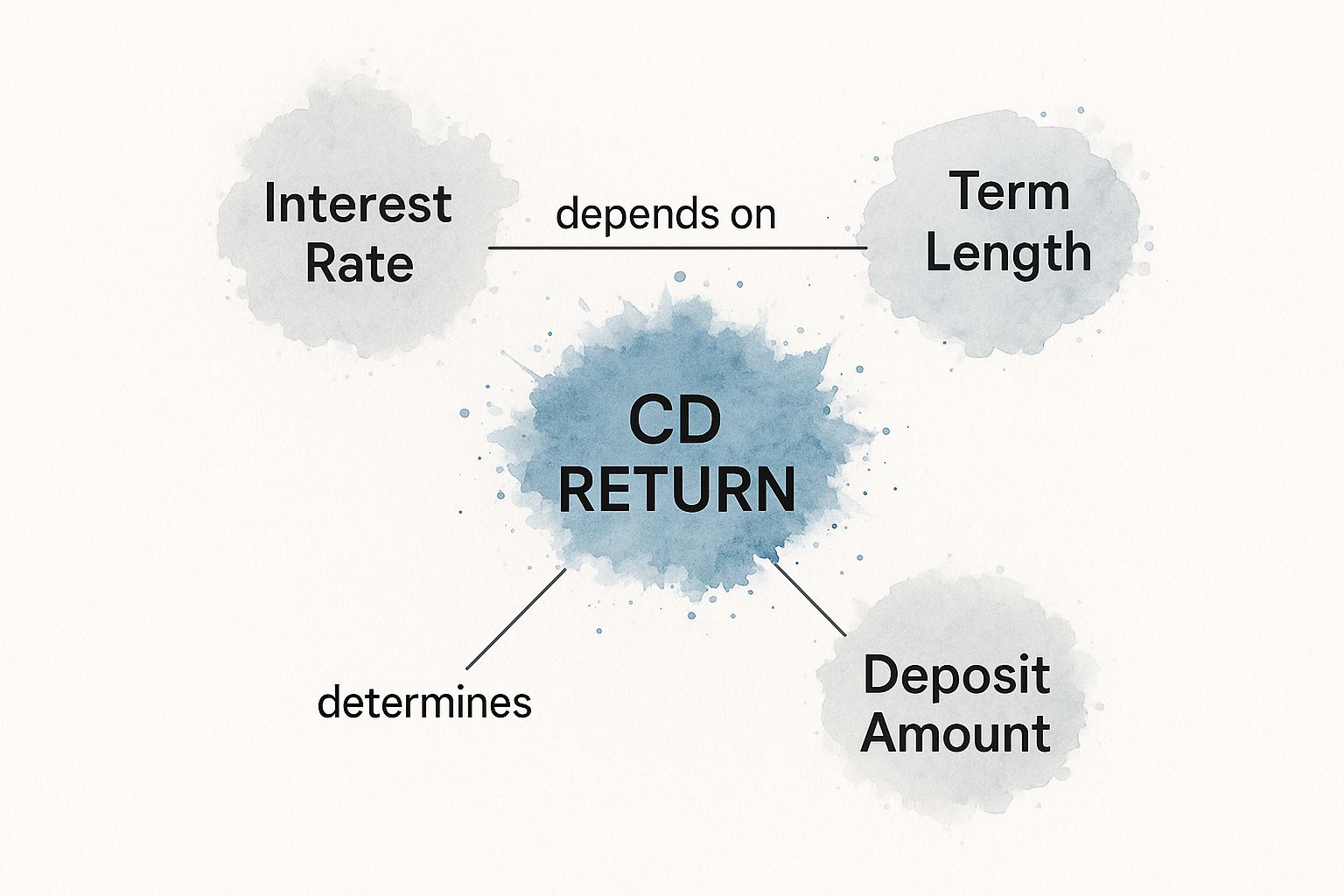

This infographic breaks down how a CD's final payout is determined by its three core parts.

As you can see, the amount you deposit, the interest rate, and the term length are the three levers you can pull to control how much you earn.

Picking the right strategy completely changes how you see CDs—they go from being a basic savings account to a versatile piece of your wealth-building plan. For anyone looking to expand their financial knowledge even further, exploring some of the best personal finance books can provide a much broader perspective on managing your money. When you match these powerful techniques to your own timeline and financial needs, you can make your money work so much harder for you.

How to Open Your First Certificate of Deposit

Alright, you've learned the what and why of CDs. Ready to put your money to work? Opening your first Certificate of Deposit is a lot less intimidating than it sounds. With a bit of groundwork, you can confidently lock in a great rate and get your savings growing.

The first step is simply finding the right home for your money. Think of it like shopping for anything important—you want the best deal, and that means comparing your options before you commit.

Where to Find the Best CD Rates

The best rates usually aren't waiting for you at the big bank on the corner. To really maximize what you earn, you need to cast a wider net. The difference in Annual Percentage Yield (APY) between one bank and another can be surprisingly big, and that gap directly impacts how much interest you pocket.

Here’s where you’ll usually find the best deals:

- Online Banks: These institutions almost always lead the pack with the most competitive rates. They don't have the overhead of physical branches, and they pass those savings on to you in the form of higher yields.

- Credit Unions: As not-for-profit, member-owned organizations, credit unions are known for great rates and customer-focused service. If you're eligible to join one, they are definitely worth a look.

- Traditional Banks: While their standard, everyday CD rates often lag, don't write them off completely. Brick-and-mortar banks sometimes run special promotions on specific CD terms to attract a fresh wave of deposits.

Pro Tip: Never, ever skip this step: Before you deposit a dime, confirm the bank is insured by the FDIC or the credit union by the NCUA. This is non-negotiable. It’s the guarantee that protects your deposit up to $250,000.

Navigating the Application Process

Once you've found a CD that looks promising, opening the account itself is pretty straightforward. Most banks let you do the whole thing online in just a few minutes, as long as you have your information ready to go.

Here's a quick checklist of what you'll almost certainly need:

- Personal Identification: Your Social Security Number (or Taxpayer ID Number), a valid government-issued photo ID (like a driver's license), and your date of birth.

- Contact Information: Your current physical address, a good email address, and your phone number.

- Funding Source: The bank account details for where the initial deposit will come from. This means having your checking or savings account number and the bank's routing number handy.

After you submit the application and fund the CD, the last step is to review and confirm all the details. Read the agreement carefully. Double-check the maturity date, the exact early withdrawal penalty, and what the bank’s default action is when the CD matures. Most will automatically roll your CD into a new one for the same term if you don’t give them other instructions.

Making an informed choice at maturity is a huge part of understanding certificates of deposit. You can cash out, renew for another term, or roll the money into a different CD that better fits your goals. I always recommend setting a calendar alert for a week or two before the maturity date—it gives you plenty of time to decide without being rushed.

Common Questions About Certificates of Deposit

Once you’ve got a handle on the basics, the practical questions start to pop up. These are the real-world "what-ifs" that can be the difference between feeling good about your savings plan and feeling truly confident.

Let's walk through the most common questions people ask. We'll give you clear, straight answers to fill in any gaps and make sure you have the complete picture before you open a CD.

What Happens if I Need My Money Early?

This is the number one concern for almost everyone. What if a financial emergency hits and you need that cash you locked away? The short answer is you can get it, but it will cost you. If you withdraw your money before the CD’s maturity date, you will almost certainly pay an early withdrawal penalty.

The penalty is almost always a set amount of interest you've earned. For a one-year CD, a typical penalty is three months' worth of interest. For a longer-term, five-year CD, you might forfeit six months' interest or even more.

Crucial Detail: The penalty rules are set by the bank or credit union and are spelled out in your account agreement. Always read this fine print before committing your money, as the terms can vary widely.

The big exception here is the No-Penalty CD. These are designed specifically for this fear, letting you pull out your principal without a fee after a very short initial waiting period, usually just the first week.

Are CDs a Good Idea When Interest Rates Rise?

This is a fantastic question, and the answer is nuanced. Locking your money into a long-term CD right before rates climb can be frustrating. This is called interest rate risk—the risk of being stuck earning 4% APY when new CDs are paying 5%.

But you have some smart ways to manage this:

- Stick to Short-Term CDs: You could open a CD with a shorter fuse, like 6 or 12 months. This lets you grab a solid rate now without a long-term marriage to it, freeing up your cash sooner to reinvest if rates have climbed.

- Use a Bump-Up CD: As we covered earlier, this special CD gives you a one-time "do-over" to raise your rate to whatever the bank is currently offering for a similar term.

- Build a CD Ladder: This is probably the best all-around strategy. By staggering your money across several CDs with different maturity dates, you always have a "rung" coming due. This gives you a steady chance to reinvest a portion of your money at the new, higher market rates.

Is My Money Safe in a Certificate of Deposit?

Yes, absolutely. As long as you stick with an insured institution, CDs are considered one of the safest places you can put your savings. This security is one of their biggest selling points.

Your money is protected by either the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Administration (NCUA) for credit unions. This insurance guarantees your deposits up to $250,000 per depositor, per institution, for each account ownership category. Even in the highly unlikely event that your bank fails, your principal investment is safe up to that limit.

How Is a CD Different from a Savings Account?

The main difference comes down to a simple trade-off: access vs. return.

A traditional savings account is all about liquidity. It's designed for you to move money in and out whenever you need to, without penalty. The price for that flexibility is a lower interest rate that is usually variable, meaning the bank can change it at any time.

A Certificate of Deposit flips that equation. You agree to lock your money away for a specific term, and in exchange, the bank gives you a higher, guaranteed interest rate. Think of it this way: a savings account is for your "anytime" emergency fund, while a CD is perfect for savings goals that have a clear finish line.

Ready to see how these details affect your potential earnings? The Certificate-of-Deposit Calculator can help you instantly project your growth, compare different APYs, and even estimate early withdrawal penalties. Take the guesswork out of your decision and find the perfect CD for your goals by using our free tool at https://www.bankdepositguide.com/cd-calculator.