Understanding Why CD Interest Gets Taxed

To understand why CD interest is taxed, it’s helpful to think of your money as an employee. When you put funds into a Certificate of Deposit (CD), you are essentially loaning your money to the bank to put to work. For letting the bank use your cash, it pays you a wage, which we call interest. The Internal Revenue Service (IRS) views this "wage" as income—and just like the paycheck from your job, it's subject to income tax.

This is a core reason your CD earnings are treated differently than profits from selling a stock. If you sell a stock or a house for more than you paid, you create a capital gain, which often enjoys lower tax rates. CD interest, however, falls into the category of ordinary income. This means it gets added to all your other earnings for the year—like your salary, bonuses, or freelance income—and is taxed at your standard federal income tax rate.

Ordinary Income vs. Capital Gains

The difference between ordinary income and capital gains is critical for any saver to know. Let's imagine two people who each made an extra $1,000 this year. One earned it from CD interest, while the other made it by selling a stock they held for more than a year (a long-term capital gain).

- The CD Saver: Their $1,000 in interest is added to their regular income. If they fall into the 24% federal tax bracket, they will owe $240 in taxes on that interest.

- The Stock Investor: Their $1,000 profit is a long-term capital gain. For most people, this is taxed at a much lower rate, often 15%. Their tax bill on that gain would only be $150.

This example clearly shows why the classification matters. The IRS considers CD interest a predictable payment for the use of your money, not a profit from a risk-based investment. For a more detailed breakdown of your specific situation, our comprehensive guide on CD taxes offers further insights.

Why It's Taxed When Earned, Not When Withdrawn

One rule that often surprises new CD investors is that you owe taxes on interest in the year it is credited to your account, even if you don't withdraw the money. If your CD matures and you roll it over into a new one, the interest earned is still taxable for that year.

This is because the U.S. tax system operates on the principle of constructive receipt. The moment the interest is made available to you without restriction—even if you choose to leave it in the account—it counts as income. This rule prevents taxpayers from delaying taxes on their earnings indefinitely. You can see how different governments approach this by looking at PwC's global tax summaries, which show various approaches to personal income.

Federal Tax Brackets And Your CD Earnings

Once you know that your CD interest counts as ordinary income, the next question is simple: what tax rate applies? Unlike other investments that get special tax treatment, the rate you'll pay on CD interest is tied directly to your federal income tax bracket.

Think of your income like a stack of building blocks. Your salary forms the base, and any CD interest you earn is placed right on top. The government taxes these "top" blocks at your highest marginal rate. This means the more you earn from your job and other sources, the higher the tax percentage you'll owe on your CD interest.

The impact of this is significant. Two people can earn the exact same amount of interest from a CD but pay very different amounts in taxes. For instance, a saver in the 12% tax bracket would pay just $12 in federal tax on $100 of CD interest. Meanwhile, someone in the 32% tax bracket would owe $32 on that same $100.

How Tax Brackets Impact Your Take-Home Interest

The U.S. uses a progressive tax system, where higher slices of your income are taxed at progressively higher rates. Since your CD interest is considered part of the "last dollars" you earn for the year, it's taxed at your highest applicable rate.

Let's see how this plays out with a practical example. Imagine two different people each earn $1,000 in interest from a CD.

- Saver A earns $45,000 a year, which places them in the 12% federal tax bracket. Their tax bill on the CD interest would be $120 ($1,000 x 0.12).

- Saver B earns $200,000 a year, putting them in the 32% federal tax bracket. They would owe $320 on the same $1,000 of interest ($1,000 x 0.32).

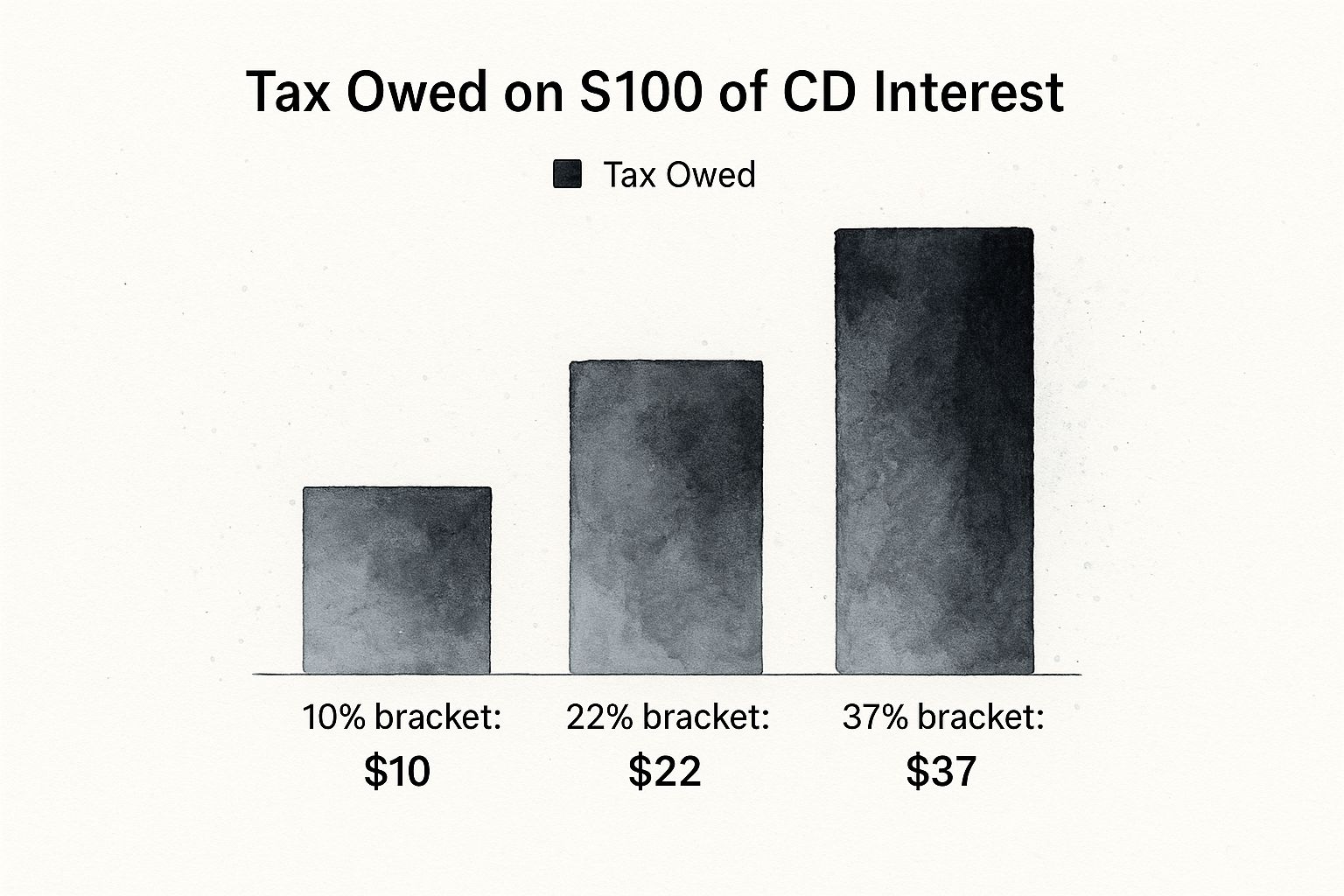

The following infographic clearly shows how much more tax is owed on the same amount of CD interest as your income bracket increases.

To make this even clearer, let's look at how your federal tax bracket can affect the actual return you get from a CD. The table below shows the after-tax amount you would keep from $1,000 in CD interest at different income levels for a single filer in 2024.

Federal Tax Impact On CD Interest By Income Level How different tax brackets affect your actual CD returns

| Income Range | Tax Rate | $1,000 CD Interest | After-Tax Keep |

|---|---|---|---|

| $11,601 - $47,150 | 12% | $1,000 | $880 |

| $47,151 - $100,525 | 22% | $1,000 | $780 |

| $100,526 - $191,950 | 24% | $1,000 | $760 |

| $191,951 - $243,725 | 32% | $1,000 | $680 |

| $243,726 - $609,350 | 35% | $1,000 | $650 |

| > $609,350 | 37% | $1,000 | $630 |

As you can see, a higher income bracket significantly reduces the net earnings from your CD. The difference between what a saver in the 12% bracket keeps ($880) and what a saver in the 37% bracket keeps ($630) is $250 on the same $1,000 of interest.

Can CD Interest Push You Into a Higher Bracket?

Yes, it absolutely can, and this is a crucial detail to watch. If your total income is already near the upper limit of a tax bracket, the extra interest earned from a CD could nudge you over the threshold.

It's important to remember that only the dollars that fall into the new, higher bracket are taxed at that higher rate—not your entire income. Even so, it will increase your total tax bill. Before you lock your money into a CD, it's a smart move to estimate your total annual income, including the potential interest, to see how it might affect your final tax liability.

Decoding Form 1099-INT Like A Pro

Every January, as tax season gets underway, your bank will mail you a small but important document: Form 1099-INT. Think of this form less like a bill and more like a report card for your savings. It officially summarizes the interest income your investments, including your CDs, earned over the past year. This form is the key to accurately reporting your CD interest.

The bank doesn't just send a copy to you; it sends an identical one directly to the IRS. This system creates transparency and ensures everyone reports the correct earnings. The most important number on this form is usually in Box 1, "Interest Income," which shows the total taxable interest you've earned from that bank.

The $10 Reporting Threshold

You might get a 1099-INT from one bank but not another, and there's a simple reason for that. The IRS only requires financial institutions to send a Form 1099-INT if they paid you $10 or more in interest during the tax year.

However, this is where many people get confused. Even if you earn less than $10 and don't receive a 1099-INT, you are still legally required to report that interest income on your tax return. The responsibility to report all income is on you, the taxpayer.

Here is what a standard Form 1099-INT looks like, directly from the IRS.

The screenshot highlights the different boxes where your financial institution reports various types of interest and any early withdrawal penalties. For CD interest, Box 1 is the one you'll focus on.

Transferring Information to Your Tax Return

Once you have your 1099-INT, the next step is moving that information to your tax forms. You can think of this as a simple data transfer—pulling key numbers from one document to another. The process is straightforward and a basic part of understanding how to manage your financial data.

Here's how it works:

- Locate Box 1: Find the amount listed under "Interest Income." This is your total taxable interest from that source.

- Transfer to Schedule B: If your total interest income from all sources for the year is more than $1,500, you must report this amount on Schedule B (Form 1040), Interest and Ordinary Dividends.

- Report on Form 1040: If your total interest is under $1,500, you can typically report it directly on your main Form 1040 without needing to attach Schedule B.

Before filing, always double-check that the numbers on your 1099-INT are accurate. If you spot a mistake, contact your bank immediately and ask them to issue a corrected form. Getting this right from the start helps you avoid mismatches with the IRS's records and ensures a smoother tax filing experience.

State Tax Rules That Could Save You Money

While the federal government's rules for taxing CD interest are consistent across the country, your home state adds another layer to the calculation. Think of federal tax as a fixed-price item on a menu, while state tax is like a local surcharge that changes from one town to the next.

This is a crucial detail because your state of residence can dramatically change your true after-tax return on the exact same CD investment. The biggest advantage comes from states that don't charge an income tax at all. In these locations, savers keep 100% of their CD interest after federal taxes are paid.

States With No Income Tax

If you're lucky enough to live in one of the nine states without a personal income tax, your CD interest earnings are completely free from state-level taxation. This simplifies your tax planning considerably, as you only need to account for what you owe the IRS.

The states where your CD interest escapes state income tax are:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

- New Hampshire (which only taxes dividends and some investment income, not interest from CDs)

For residents of these states, the question of how CD interest is taxed is much simpler. This significant tax benefit is a major reason many investors and retirees consider relocating.

States With Income Tax and Special Rules

For everyone else, state income tax on CD interest is a reality. These tax rates vary widely, from a relatively low 2.9% in states like Indiana to over 13% in high-tax states like California. This means a California resident could owe an extra $133 in state taxes on $1,000 of CD interest, on top of their federal tax bill.

To help you see how different states handle this, the table below compares the tax treatment across various state categories.

| State Category | Tax Treatment | Typical Rate | Special Exemptions |

|---|---|---|---|

| No Income Tax States | CD interest is fully exempt from state tax. | 0% | Not applicable; all interest is exempt. |

| Low-Tax States | CD interest is taxed as ordinary income at a low flat or bracketed rate. | 2% - 5% | May offer limited deductions for seniors or low-income taxpayers. |

| High-Tax States | CD interest is taxed as ordinary income at a high marginal rate. | 5% - 13%+ | Sometimes provide targeted tax credits or deductions, but the overall burden is high. |

| Special Case States | States like New Hampshire tax some investment income but exempt interest. | Varies | Specific rules exempt bank interest from taxation. |

This table shows that where you live has a direct impact on your savings. The difference between paying 0% in Texas and over 13% in California on the same CD earnings is substantial.

However, even in states with an income tax, there can be ways to reduce the bill. Some states offer special exemptions, such as tax deductions or credits on investment income for seniors, military personnel, or taxpayers below a certain income level. It's always a good idea to research your specific state's tax code, as these local rules can provide welcome relief and are just as important as federal guidelines when crafting your savings strategy.

Calculating Your True CD Returns After Taxes

That attractive Annual Percentage Yield (APY) a bank advertises is only half the story. To figure out what a CD will actually earn you, you have to look beyond the headline number and calculate its after-tax return. Think of it like a paycheck: your gross pay is the advertised rate, but your take-home pay—the amount you actually keep—is what truly matters after deductions.

The same idea applies here, and the tax bite can be significant. It often reduces your real earnings by 20% to 40%. The good news is that figuring out how CD interest is taxed and what you'll keep is thankfully straightforward. This simple calculation gives you a clear picture of your investment's actual performance.

The Simple Math of After-Tax Yield

To find your true return, you only need two pieces of information: the CD's interest rate and your marginal federal tax rate. You can find your marginal tax rate based on your income bracket. The formula is:

CD Interest Rate x (1 – Your Marginal Tax Rate) = After-Tax Return

Let's put this into action. Imagine you are in the 24% federal tax bracket and are considering a CD with a 4.5% APY.

- First, calculate the portion you keep after taxes: 1 – 0.24 = 0.76

- Next, multiply this by the CD's rate: 4.5% x 0.76 = 3.42%

In this scenario, your impressive 4.5% CD actually provides an after-tax return of only 3.42%. For a more precise figure, you can use our guide to calculate your CD earnings with these variables. This calculation is a vital step for any investor.

To put this in a global context, while the average deposit interest rate was around 3.5% in early 2025, many economies tax this interest at marginal rates as high as 45%, which drastically cuts into net returns. You can explore more about global deposit interest rates on Trading Economics to see how this compares worldwide.

Tax-Equivalent Yield: Comparing Apples to Apples

This calculation becomes even more powerful when you need to compare a taxable CD to a tax-free investment, like a municipal bond. To do this, we use a concept called tax-equivalent yield. This tells you what interest rate a taxable CD would need to offer to match the return of a tax-free investment.

Here's a common scenario:

- Investment A: A taxable CD offering a 4% APY.

- Investment B: A tax-free municipal bond offering a 3% APY.

A high-income earner in California might fall into a combined federal and state marginal tax bracket of 45%. For them, the CD's after-tax return is just 2.2% (4% x (1 – 0.45)). In this case, the 3% tax-free bond is the clear winner. By understanding your true after-tax return, you can make informed decisions and ensure your savings are working as hard as possible for you.

Smart Tax Strategies For CD Investors

While reporting interest from your Form 1099-INT is standard procedure, several clever strategies and special situations can dramatically change your tax bill. Think of these as the advanced moves for a CD investor, going beyond the basics to actively manage how much of your earnings you get to keep.

Tax-Advantaged Accounts and Special Situations

One of the most effective ways to manage CD taxes is to choose the right kind of account to hold them in. Placing a CD inside a retirement account can shield its earnings from yearly taxes.

- IRAs and 401(k)s: When you hold a CD within a Traditional IRA or 401(k), the interest it earns grows tax-deferred. This is a huge advantage for long-term growth because you don't pay taxes on the interest each year. The taxes are only paid when you take money out of the account during retirement.

- Roth IRAs: For an even better deal, CDs held in a Roth IRA allow interest to grow completely tax-free. As long as you follow the rules, your qualified withdrawals in retirement are also tax-free.

- Early Withdrawal Penalties: If you have to break a CD early, there's a small silver lining to the penalty the bank charges. This penalty amount is reported on your 1099-INT and is deductible from your gross income, which can lower your overall taxable interest.

Advanced Strategies for Active Management

Beyond using retirement accounts, you can actively shape your tax outcome through smart portfolio management. A common technique is CD laddering, which involves spreading your money across several CDs with staggered maturity dates. This gives you regular access to cash and helps control how much taxable interest you receive each year, which can be useful for avoiding a jump into a higher tax bracket.

Timing is another powerful tool. If you know you'll have a lower-income year—maybe you're retiring or changing jobs—you can plan for your CDs to mature then. This ensures the interest income is taxed at your lower rate. To get a better handle on this, it helps to understand exactly when interest is credited. You can dive deeper by reviewing our guide on how to calculate CD interest.

Ownership and Transfer Considerations

The way a CD is owned or passed to someone else brings its own set of tax rules.

- Inherited CDs: If you inherit a CD, you are only responsible for taxes on the interest earned from the original owner's date of death forward. Any interest that built up before that date is handled as part of the deceased's estate.

- Gifted CDs: When you give a CD to someone else, you might face gift tax rules if the CD's value is over the annual exclusion limit. Once gifted, the recipient is responsible for paying income tax on all interest earned from that point on.

- Joint Ownership: For CDs owned by two or more people, the interest income is usually split among them. The primary owner—whose Social Security number is listed on the Form 1099-INT—reports the full amount but can then allocate the proper share to the other owners when filing their taxes.

Avoiding Costly CD Tax Mistakes

Even the most careful savers can make expensive mistakes when it comes to CD taxes. One of the most common slip-ups is also one of the simplest: forgetting to report the interest earned on a CD that automatically rolled over. Just because the money never hit your checking account doesn't mean it's off the IRS's radar. That interest is considered income for the year it was credited to you.

These seemingly minor oversights can lead to unwelcome letters from the IRS, potentially resulting in penalties or even an audit. This is why keeping good records isn't just for accountants—it's your best line of defense.

Common Pitfalls and How to Handle Them

Learning from the missteps of others is a great way to protect yourself. Here are a few frequent errors and simple ways to manage them:

- Handling Incorrect 1099-INT Forms: Banks are run by people, and people make mistakes. If you get a Form 1099-INT with the wrong interest amount or incorrect personal information, don't just file it and hope for the best. Contact your bank or credit union right away and ask for a corrected form. Filing with inaccurate info can create a mismatch with IRS records, which is a red flag.

- Getting Pushed into a Higher Tax Bracket: A large CD maturing can generate enough interest to nudge your total income into a higher tax bracket. While only the income falling into that new bracket is taxed at the higher rate, it still increases your overall tax bill. You can avoid surprises by estimating your total annual income to see if a maturing CD might have this effect.

- Poor Record-Keeping for Multiple CDs: If you're building a CD ladder or have CDs at several different banks, staying organized is crucial. A simple spreadsheet can be a lifesaver. Track each CD's purchase date, maturity date, interest rate, and the interest earned each year. This not only makes tax prep far less painful but also ensures you report every dollar correctly.

By keeping these records, you'll have all the documentation needed to handle any questions from the IRS with confidence.

Ready to see how different rates and terms will impact your own earnings? Use our free Certificate-of-Deposit Calculator to project your returns and make smarter investment decisions.