Demystifying Certificate of Deposit Early Withdrawal Penalties

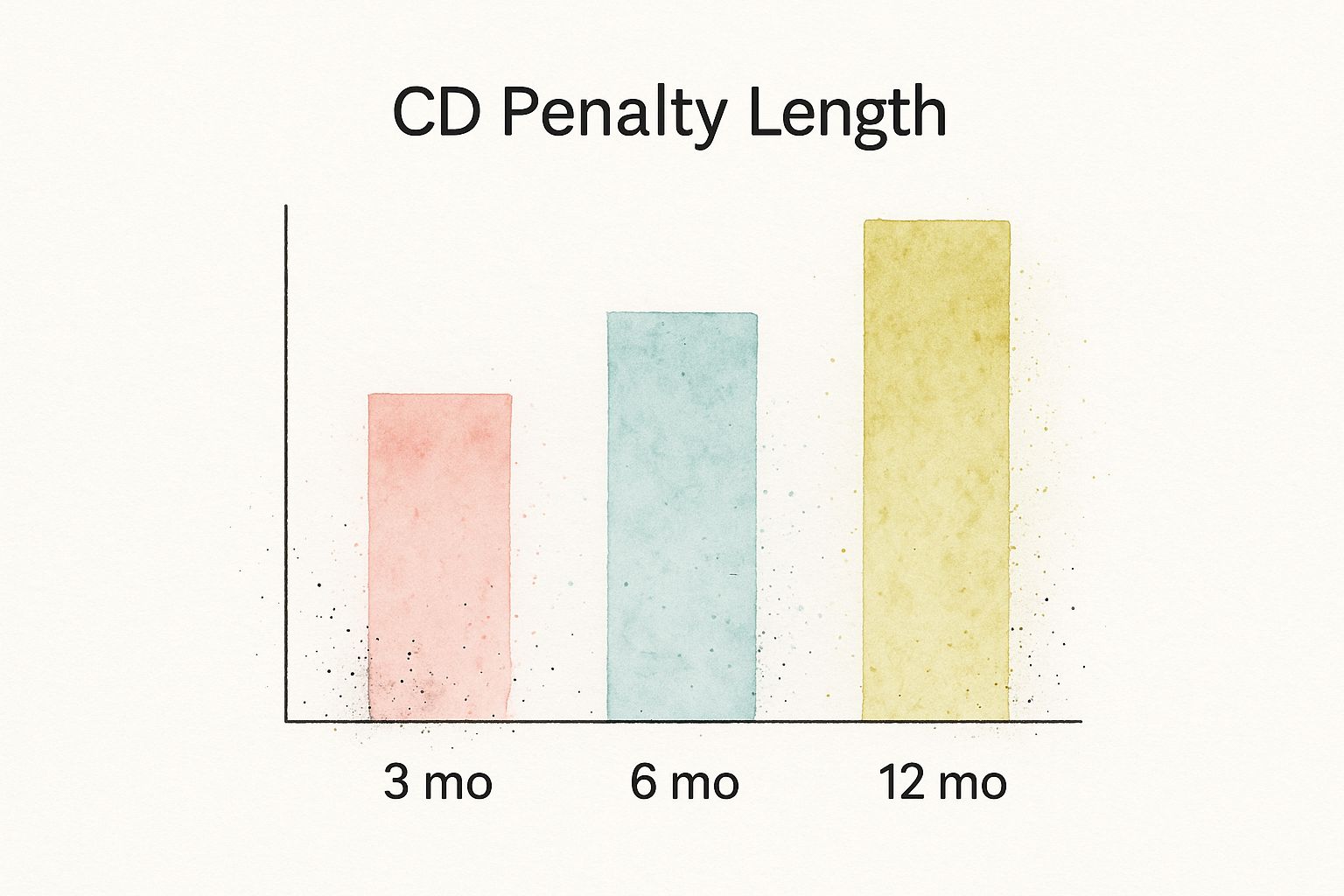

This infographic illustrates the average early withdrawal penalties for CDs with terms of 3, 6, and 12 months. Notice how the penalties increase alongside the term length. This visualizes the trade-off: longer terms offer potentially higher interest, but come with a greater cost if you need your money early. It's essential to understand these penalties before investing in a CD.

Understanding The Penalties

Early withdrawal penalties (EWPs) are a fundamental aspect of Certificates of Deposit (CDs). They encourage you to leave your money invested for the full term. This allows banks to lend the funds for extended periods, enabling them to offer competitive interest rates. Typically, these penalties are calculated based on a certain number of months of interest earned on the CD. The exact amount, however, can change significantly.

The CD's term length significantly impacts the EWP. A 5-year CD, for example, might have an EWP anywhere from 90 to 540 days—a considerable 450-day difference. The average EWP for a 5-year CD is around 242 days, a critical factor for potential investors. This means accessing your funds early could cost you almost two-thirds of a year's worth of interest. Learn more about CD early withdrawal penalties.

You might also find this helpful: How to master CD early withdrawal penalties. Knowing how these penalties are calculated is just as crucial as understanding their potential range.

Factors Affecting Penalties

Beyond the CD term, several factors influence EWPs. The policies of the specific bank or credit union play a substantial role. Some institutions have stricter penalties than others, even for CDs with the same term. The current interest rate environment also plays a part. When interest rates are high, banks might increase penalties to discourage early withdrawals and retain funds for lending.

To help visualize typical penalty periods, let's look at a comparison across major banks:

The following table shows a breakdown of typical penalty periods for different CD terms across major banks.

CD Early Withdrawal Penalty Comparison by Term Length

| CD Term | Minimum Penalty | Maximum Penalty | Average Penalty |

|---|---|---|---|

| 3 months | 1 month interest | 2 months interest | 1.5 months interest |

| 6 months | 2 months interest | 3 months interest | 2.5 months interest |

| 12 months | 3 months interest | 6 months interest | 4.5 months interest |

| 24 months | 6 months interest | 9 months interest | 7.5 months interest |

| 36 months | 9 months interest | 12 months interest | 10.5 months interest |

| 60 months | 12 months interest | 18 months interest | 15 months interest |

This table represents typical examples and may not reflect the specific penalties imposed by every bank. Always refer to the institution’s official disclosure for accurate information.

As you can see, longer-term CDs typically carry higher penalties. It's crucial to compare these penalties when choosing a CD.

Minimizing The Impact

Before investing, thoroughly review the terms and conditions regarding early withdrawals. Compare offerings from multiple banks to find the best penalty structures. Consider creating a CD ladder to stagger your maturity dates. This gives you access to some funds regularly without incurring penalties, balancing liquidity with maximized returns.

The Real Math Behind Certificate of Deposit Early Withdrawal Costs

Understanding how banks calculate early withdrawal penalties on Certificates of Deposit (CDs) is essential for informed decision-making. This process involves specific calculations, not mere estimations. Let's explore the math behind these costs.

Calculating the Penalty

The first step involves determining the penalty period. This period, typically measured in months of interest, is pre-set based on the CD's term length. A common example is a three-month interest penalty for a 12-month CD.

Banks also impose penalties on longer-term CDs. For example, a 2-year CD might carry a six-month interest penalty, while a 5-year CD could have a penalty of approximately 8.5 months of interest. These penalties encourage investors to hold their CDs until maturity. For more information on historical CD rates, you can explore resources like Hedge Fund Alpha.

Next, the bank calculates the amount of interest lost during this penalty period. This calculation utilizes the Annual Percentage Yield (APY), which represents the total interest earned annually, including the effects of compounding. The bank determines the interest earned up to the withdrawal date and then applies the penalty period to calculate the forfeited interest.

Finally, the penalty is subtracted from your accrued interest to determine your final payout. The penalty affects your earned interest, not the principal. However, with shorter-term CDs or low interest rates, the penalty can significantly reduce your earnings, potentially even impacting your initial principal.

Real-World Examples

Consider a $10,000 CD with a 5% APY and a 12-month term. If you withdraw after six months and the penalty is three months' interest, the bank will calculate the interest earned over six months and then deduct three months' worth of interest from that amount.

Let's look at another scenario: a $5,000 CD with a 2% APY and a 24-month term. Withdrawing after 12 months with a six-month interest penalty involves similar calculations. However, the lower interest rate combined with the longer penalty period can significantly affect your final payout.

Tools and Resources

Several online tools can help you estimate potential early withdrawal costs. Many banks offer CD calculators that factor in these penalties. Resources like the Certificate-of-Deposit Calculator provide a detailed view of potential returns and the effects of early withdrawals. You can also find similar calculators and resources on independent financial websites.

These tools allow you to explore different scenarios, changing withdrawal dates and CD terms. Understanding the underlying math empowers you to make informed decisions about CD early withdrawals. Always consult with your bank for specifics on their penalty policy. Clarity on potential costs facilitates strategic financial planning.

Smart Alternatives to Certificate of Deposit Early Withdrawal

Unexpected expenses can pop up, making you consider dipping into your Certificate of Deposit (CD). But those early withdrawal penalties can sting. Thankfully, there are other ways to access funds without losing your interest. Let's explore some smart alternatives that savvy investors use.

CD-Secured Loans: Borrowing Against Your Investment

A CD-secured loan lets you borrow against your CD. This means you receive a lump sum while your CD continues to earn interest. Because your CD acts as collateral, interest rates are often lower than unsecured personal loans. This offers a potential win-win: access to funds without touching the CD principal or incurring penalties.

However, it's essential to understand the risks. If you default on the loan, the bank can seize your CD.

CD Laddering: Planning for Liquidity

CD laddering involves spreading your investment across multiple CDs with varying maturity dates. For instance, you could invest equal amounts in CDs maturing in 6, 12, 18, and 24 months. As each CD matures, you can reinvest or withdraw penalty-free. This gives you regular access to a portion of your funds. You'll still benefit from higher interest rates often associated with longer-term CDs. Learn more about this strategy: How to master the CD Ladder Strategy.

No-Penalty CDs: Flexibility With a Trade-Off

No-penalty CDs allow penalty-free withdrawals. These CDs usually offer lower interest rates than traditional CDs. This makes them suitable if you might need access to your funds before maturity. Weigh the lower interest rate against the added flexibility before making a decision.

Negotiating With Your Bank: A Potential Solution

Sometimes, talking to your bank can help. Especially with smaller banks or credit unions, explaining your situation might lead to a waived or reduced penalty. A strong banking relationship can make a difference. While not always guaranteed, it's worth a try.

Advanced Strategies: Penalty Arbitrage

Penalty arbitrage is a more complex strategy. It involves withdrawing from a CD despite the penalty if reinvesting in a higher-yielding investment offers greater returns. This requires careful calculations and market awareness. It's generally more suitable for investors comfortable with higher market risk.

When Certificate of Deposit Early Withdrawal Actually Pays Off

While early withdrawal penalties are designed to discourage accessing your CD funds prematurely, certain situations can make a certificate of deposit early withdrawal a financially sound decision. This requires careful cost-benefit analysis, weighing the penalty against potential gains.

Emergency Expenses: Avoiding High-Interest Debt

Unexpected emergencies sometimes necessitate accessing funds quickly. If the cost of high-interest debt, such as credit card debt, outweighs the CD early withdrawal penalty, using your CD funds becomes a sensible move. This prevents accumulating substantial debt that could cost more in the long run.

Consider a large medical bill or essential home repair. In these cases, absorbing the penalty to avoid excessive credit card interest is often justified.

Investment Opportunities: Capitalizing on Higher Returns

A significantly higher-yielding investment opportunity can also justify an early withdrawal. If the potential returns from the new investment exceed the CD's returns, even after the penalty, it might be worth switching.

This requires careful research and understanding the risks associated with the new investment. For instance, a shift in market conditions might create an opportunity to invest in a higher-performing asset class.

Rate Environment Changes: Responding to Rising Rates

Changes in the interest rate environment can make a CD early withdrawal appealing. If interest rates have risen significantly since opening your CD, breaking your current CD and reinvesting in a new one at a higher rate could offset the penalty.

This involves analyzing the break-even point: the point where the new CD’s higher yield surpasses the lost interest from the penalty.

Calculating the Break-Even Point: Making Informed Decisions

To determine the true break-even point, factor in the opportunity cost, the potential return you forfeit by not reinvesting sooner. Imagine market rates rise significantly, making your current CD yield less attractive. Calculate how long it would take for a new CD's higher return to compensate for the early withdrawal penalty.

This calculation helps you make informed, data-driven decisions. Financial advisors often use this type of analysis to determine optimal withdrawal timing.

Navigating a Changing Landscape: The Power of Flexibility

Unforeseen circumstances sometimes demand financial flexibility. While CDs offer stability and predictable returns, liquidity sometimes outweighs a predictable yield. This is where understanding early withdrawal penalties and alternatives, like CD-secured loans and CD laddering, becomes crucial.

These tools empower you to navigate your financial journey strategically, even amid unexpected changes. Understanding how to calculate potential costs and gains in each scenario allows for smart, calculated decisions. Use tools like the Certificate-of-Deposit Calculator to assess potential outcomes before acting. This knowledge is key to leveraging your CD investments effectively.

Advanced Certificate of Deposit Early Withdrawal Optimization

This section explores advanced strategies for managing early withdrawals from Certificates of Deposit (CDs). These techniques can help optimize your returns while minimizing the impact of penalties.

Yield and Penalty Arbitrage

Yield and penalty arbitrage involves balancing the potential returns of a CD against its early withdrawal penalty. The goal is to find CDs with higher yields that offset the potential cost of an early withdrawal.

For example, if market conditions change, a CD with a higher yield and shorter penalty period might offer a better overall return. This is true even if an early withdrawal becomes necessary. Consider a scenario where a shorter-term, higher-yield CD becomes more attractive than a longer-term, lower-yield CD due to shifting market dynamics.

The relationship between CD yields and early withdrawal penalties can present strategic opportunities. Research by Fleckenstein and Longstaff, analyzing CD offerings at nearly 17,000 bank branches, demonstrates this dynamic. Learn more about this research here.

Partial Withdrawals and CD Swapping

Some banks offer partial withdrawals, allowing you to access some of your CD funds without a penalty on the remaining balance. This offers flexibility, especially for smaller, unexpected costs.

CD swapping involves closing an existing CD and opening a new one with a higher yield. While this might incur a penalty on the original CD, the increased returns from the new CD can potentially offset the cost, particularly in a rising rate environment. Think of it as actively managing your CD portfolio to take advantage of better rates.

Market Timing and Laddering Strategies

Market timing is important for CD early withdrawal decisions. Anticipating interest rate changes can inform when to withdraw and reinvest. Withdrawing before a predicted rate increase and reinvesting in a higher-yielding CD can maximize returns.

Laddering involves staggering CD maturity dates for increased flexibility. This allows access to some funds regularly without penalties while potentially benefiting from the higher returns of longer-term CDs.

Use our Certificate-of-Deposit Calculator to model different laddering strategies and assess their impact on liquidity and yield. It's a helpful tool for visualizing the potential benefits of this approach.

These advanced strategies require careful analysis and consideration of individual financial situations. By incorporating these methods into your CD investment plan, you can potentially improve overall returns and manage early withdrawals effectively.

Your Rights in Certificate of Deposit Early Withdrawal Situations

Understanding your rights as a CD holder is crucial, especially if you're thinking about withdrawing your money early. Knowing what you're entitled to helps you make smart choices and avoid potentially unfair banking practices.

Federal Regulations and Disclosures

Federal regulations govern early withdrawal penalties for CDs. Banks are required to clearly disclose these terms upfront. The Truth in Savings Act (TISA) makes sure banks provide clear information about fees, interest rates, and the terms of your CD. This transparency allows you to make informed decisions before committing your funds. You should have easy access to all the important details regarding penalties before signing anything.

Consumer Rights and Protections

As a consumer, you have specific rights regarding CD early withdrawals. While banks can impose penalties, these must be reasonable and clearly disclosed. Some institutions offer grace periods or cooling-off provisions, giving you a short window after purchase to withdraw your funds without penalty. Be sure to ask about these options when opening a CD. In certain special circumstances, like documented financial hardship or death, some banks might waive or reduce penalties.

State-Specific Protections and Recourse

Some states offer additional consumer protections beyond federal regulations. These may include limits on penalty amounts or specific disclosure requirements. Researching your state's banking regulations can clarify your rights. It's also crucial to keep records of all communication with your bank about your CD and any potential withdrawals. This documentation is invaluable if disputes arise or you need to file a complaint. Familiarize yourself with the proper channels for filing complaints against unfair banking practices, whether through your state's banking regulator or the Consumer Financial Protection Bureau (CFPB).

Regulatory Developments and Reforms

The regulations surrounding CDs are constantly changing. Staying informed about proposed reforms and recent developments in consumer protection laws is important. This awareness helps you understand how your rights might be affected and allows you to adjust your CD investment strategy. For example, proposed reforms could include stricter rules on how penalties are calculated or increased transparency requirements. Staying informed protects your investments and helps you maximize returns while minimizing the potential risks of early withdrawals. Use tools like the Certificate-of-Deposit Calculator to help plan and adapt your strategy based on the current and anticipated regulatory environment.

Building Your Certificate of Deposit Strategy to Avoid Withdrawal Penalties

Building a successful Certificate of Deposit (CD) strategy involves balancing maximizing returns with maintaining the flexibility you need. This means careful planning and a solid understanding of how CDs work, especially when it comes to early withdrawal penalties.

Assessing Your Liquidity Needs

Before you invest in CDs, take some time to assess both your short-term and long-term financial goals. Figure out how much cash you’ll need readily available for emergencies and upcoming expenses. This assessment will help you decide how to divide your funds between easily accessible accounts and longer-term investments like CDs. For instance, if you plan to make a large purchase in the next year, consider keeping those funds in a readily available savings account instead of locking them up in a CD.

Building an Emergency Fund Strategy

A solid emergency fund reduces the chance you'll have to withdraw from your CDs early. A good target is 3-6 months of essential living expenses in a liquid, easy-to-access account. This financial safety net gives you a cushion for unexpected costs, which takes the pressure off needing to access your CDs and potentially incur penalties. Plus, a dedicated emergency fund provides peace of mind, allowing you to make sound decisions about your investments.

Diversification and Timing Strategies

Diversifying your CD holdings across different terms and financial institutions can increase your flexibility. One strategy is a CD ladder, where you spread your investment across CDs with varying maturity dates. This gives you regular access to some of your money as each CD matures. Diversifying across institutions can also help you take advantage of different interest rates and special offers.

Timing your CD maturities to coincide with your financial goals is another helpful approach. For example, if you know you'll need a certain amount for a down payment in two years, choose a CD with a two-year term. This allows you to access the money without penalty when you need it.

Check out this helpful guide on certificate of deposit rate trends to gain a better understanding of how CD interest rates work.

Monitoring and Optimization

Keep a regular eye on interest rate changes and look for ways to optimize your CD portfolio. If interest rates go up significantly, weigh the potential benefits of reinvesting in a higher-yielding CD against the early withdrawal penalty on your current CD. Set up a system to track your CDs, including maturity dates, interest rates, and any potential penalties. This proactive approach allows you to adjust to market changes.

Practical Planning and Adjustments

Use practical planning tools and checklists to keep your CD portfolio organized and effective. Create a well-defined investment plan that sets out your goals, risk tolerance, and liquidity needs. Periodically review and adjust your strategy as your financial situation or market conditions change. This ongoing evaluation ensures your CD investments continue to align with your overall financial goals. Remember, the ultimate aim is to maximize your returns while reducing the chances of incurring costly penalties.

To help you compare different CD strategies, the following table summarizes key characteristics:

CD Strategy Comparison: Flexibility vs. Returns Analysis of different CD strategies showing trade-offs between liquidity access and yield optimization

| Strategy Type | Liquidity Access | Average Yield | Penalty Risk | Best For |

|---|---|---|---|---|

| Short-Term CDs | High | Lower | Low | Short-term savings goals |

| Long-Term CDs | Low | Higher | High | Long-term savings goals |

| CD Ladder | Medium | Moderate | Medium | Balancing liquidity and returns |

| No-Penalty CDs | High | Lowest | None | Maximum flexibility |

This table gives a general overview and may not represent the specific terms of every CD product. It's always a good idea to consult with a financial advisor for personalized advice.

Ready to start maximizing your CD returns? Use our helpful Certificate-of-Deposit Calculator to explore different scenarios and make informed investment decisions.