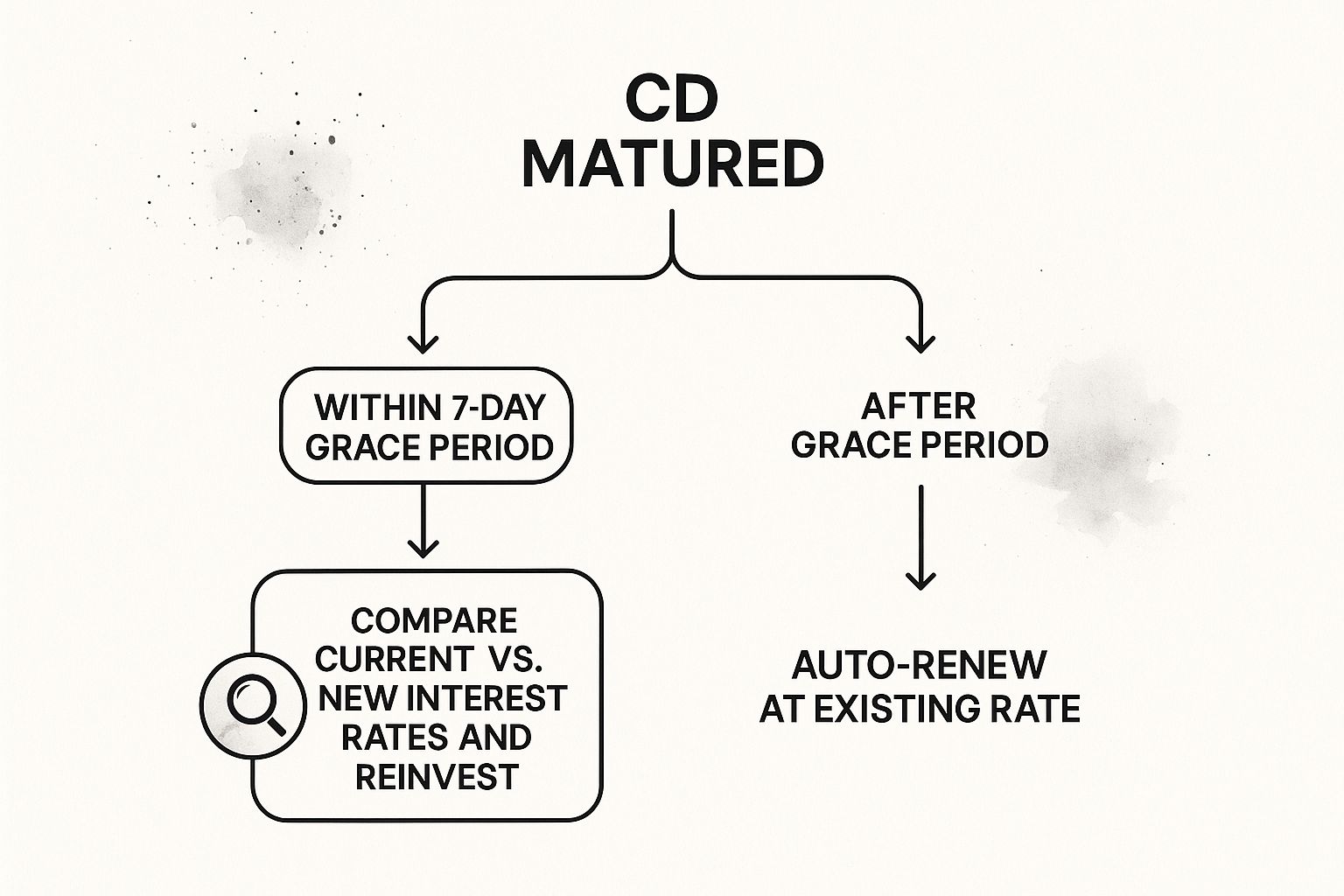

When your Certificate of Deposit (CD) finally matures, the clock starts ticking on a very important, and very brief, window of opportunity. This is the CD grace period.

It's a short stretch of time, usually 7 to 10 days, that the bank gives you to make a decision about your money without facing any early withdrawal penalties.

What Is a CD Grace Period

Think of the CD grace period as your personal decision-making window for your savings. The moment your CD's term officially ends, this grace period kicks in, putting you back in the driver's seat. It’s not just some detail buried in the fine print; it's a critical moment where you can take control of your cash.

During this limited time, you hold all the cards. You can cash out your original principal plus all the interest it earned, you can add more funds to the pot, or you can roll the entire balance into a brand-new CD. Knowing how to use this period is the key to making your savings work harder for you.

Why This Period Matters

The grace period exists to give you flexibility. Without it, your money would probably be automatically locked right back into a new CD on the day it matures—often at whatever the current, potentially lower, rate is. This window prevents an automatic, and possibly poor, decision from being made for you.

Once the grace period begins, you have a handful of choices to make. The table below breaks down your three main options and what they mean for your money.

Your Three Main Choices During a CD Grace Period

| Action | What It Means for Your Money | Best For This Goal |

|---|---|---|

| Withdraw Your Funds | Take out your principal and interest and move it to another account. The CD is closed. | You need the cash now for a specific expense, or you've found a better investment elsewhere. |

| Add or Change Funds | Deposit more money into the CD before it renews, or withdraw just the interest earned. | You want to boost your principal for the next term, or you want to use the interest as income. |

| Renew or "Roll Over" | Let the full balance (principal + interest) automatically renew into a new CD for the same term. | You're happy with the bank's current rates and want to continue saving with minimal effort. |

Making the right choice here is what separates a savvy saver from one who leaves money on the table. If you simply do nothing, the bank will almost always choose the "Renew" option for you.

Key Takeaway: The grace period is your one shot to change the direction of your investment without penalty. If you miss it, the bank makes the decision for you, and that almost always means an automatic rollover into a new CD.

This is also the perfect time to review your interest earnings. Depending on the CD's structure, the interest you've accumulated can give your principal a serious boost for the next term. For a deeper dive on this, you can learn more about how often CDs compound in our detailed guide.

Ultimately, mastering the grace period ensures you don't miss out on better rates somewhere else or accidentally lock your money into a subpar investment for another full term.

What Happens If You Miss The Grace Period

Skipping your action during the certificate of deposit grace period isn’t a neutral move. In most cases, silence equals consent—and your CD balance simply rolls into a fresh term without you lifting a finger.

Automatic Rollover Explained

When you miss that window, here’s what typically happens:

- Your principal and accrued interest lock into a brand-new CD.

- The new term mirrors your old one—say, another year if you had a 12-month CD.

- You’re stuck at whatever current APY the bank offers, not the rate you originally secured.

That default decision feels like being on autopilot, but it can cost you. Market rates shift constantly. What once was a 5.00% APY deal might slip to 3.00% APY or lower by the time your money reinvests.

A Real-World Example: The Cost Of Inaction

Let’s break down a simple scenario:

- You open a 1-year CD with $10,000 at 5.00% APY.

- A year later, your balance grows to $10,500.

- You miss the bank’s maturity alert and the 7-day grace period expires.

- The bank automatically rolls your $10,500 into a new 1-year CD at 3.00% APY.

Now you’re locked in at that lower rate. Need to access cash? You’ll pay a penalty. Read our guide on early CD withdrawal penalties for the details.

The Rollover Trap: Missing the grace period means the bank makes the choice for you. You lose the opportunity to chase higher yields or access your cash without penalty—especially painful when rates are moving up or down.

Lessons From History

CD rates can swing wildly. Back in the early 1980s, one-year CDs topped 11% APY, offering savers a windfall. Failing to shop around during that grace window would have meant missing out on those sky-high returns. For a deeper dive into past rate trends, check out historical charts on Bankrate.com.

By letting your CD auto-renew, you hand over control of your money—and possibly lock in a disappointing return—until the next maturity date rolls around. Stay proactive, compare offers, and make sure your cash works as hard as you do.

Navigating Your Options During The Grace Period

Once your CD matures, the clock starts ticking on its grace period. Think of this as a decision window—a short, specific time when you have total control over what happens next with your money.

It’s your chance to be hands-on. If you do nothing, the bank will likely renew your CD automatically. But taking a few minutes to weigh your options can make a big difference to your savings.

As you can see, acting during the grace period is what gives you the power to shop around and find the best home for your money. Inaction means letting the bank decide for you.

Four Strategic Choices For Your Matured CD

So, what should you do? The right move depends entirely on your financial picture right now. Do you need the cash, or are you focused on earning the highest possible return?

Here are the four main paths you can take.

Cash It Out Completely This is the most straightforward option. You simply withdraw your original principal plus all the interest you’ve earned and close the account. It's the perfect choice if you need the money for a down payment, a big trip, or want to shift it into a different type of investment.

Roll It Over Into a New CD This is not the same as automatic renewal. Instead, you actively shop for the best CD rates available—both at your current bank and elsewhere. You might find that an online bank or a local credit union is offering a much better rate than your current institution. You then direct your matured funds into that new, higher-yielding CD.

Make a Partial Withdrawal Need some cash but not all of it? No problem. You can pull out a portion of the funds and then roll the rest into a new CD. This gives you a nice balance of immediate spending money while keeping the remainder invested for guaranteed growth.

Add More Money and Renew If you've been saving up, you can combine new funds with your matured CD balance and roll the whole, larger amount into a new CD. This boosts your principal, which means you'll earn more interest over the next term.

Pro Tip: Your choice should mirror your current financial goals. If liquidity is your top priority, cashing out makes sense. If maximizing your return is the goal, you should be shopping for new rates and maybe even thinking about building a CD ladder for more flexibility down the road.

While you're weighing these options, it can also be useful to understand general bank policies on repayment delays. This gives you a wider view of how banks approach customer flexibility. Ultimately, the decision you make during this grace period will shape how hard your savings work for you in the coming months or years.

Pro Strategies for Maximizing Your CD Returns

The certificate of deposit grace period isn't just a waiting game. It's your best chance to switch from being a passive saver to a proactive one, making smart moves that can seriously bump up your returns.

The real key? Start your research weeks before your CD matures. Don't just sit back and wait for the bank's reminder to land in your inbox. Getting a head start gives you plenty of breathing room to compare rates and make a confident, unhurried decision when that grace period window finally opens.

Broaden Your Rate Search

Your current bank might be convenient, but loyalty can be expensive. To really squeeze the most juice out of your savings, you have to look beyond the familiar.

- Online Banks: These banks don't have the overhead of physical branches, and they often pass those savings on to you in the form of much higher Annual Percentage Yields (APYs).

- Credit Unions: Since they're member-owned nonprofits, credit unions frequently beat big banks on rates and offer more saver-friendly terms.

Just a few minutes of online rate shopping can uncover opportunities to add a surprising amount of extra interest to your balance over the next term. Remember, your financial growth should always come first.

Use the Grace Period to Adjust Your CD Ladder

A CD ladder is a brilliant strategy where you divide your money into several CDs with different maturity dates. This gives you regular access to your cash while letting the rest of your money earn the higher interest rates that usually come with longer terms.

Strategic Insight: Your CD grace period is the perfect time to build, extend, or repair a CD ladder. It’s your scheduled opportunity to reinvest a maturing "rung" into a new CD, ideally at a higher rate.

Let's say a 1-year CD in your ladder matures. During its grace period, you can roll that money into a new 5-year CD. This single move keeps your ladder's structure intact—ensuring another CD comes due next year—while locking in the best long-term rates available today. To dig deeper, our complete guide shows you how to maximize your CD returns with more advanced techniques.

When you manage your maturities this way, the grace period transforms from a simple deadline into one of your most powerful financial tools.

Common Mistakes to Avoid During Your CD Grace Period

Your certificate of deposit grace period is a short, critical window to make a smart move with your money. But it’s surprisingly easy to stumble into a few common traps that can cost you real earnings. With a little bit of foresight, you can sidestep them completely.

The single most frequent mistake is simply getting the dates wrong. People often assume the grace period is a standard ten days, but that’s not a given. Some banks and credit unions only give you five or seven days. You can't afford to guess—you need to confirm the exact number of days with your bank when you first open the CD.

Ignoring Your Bank’s Nudge and Sleeping on Rates

Another classic blunder is glossing over the maturity notice from your bank. That email or letter isn't just another piece of mail; it's your official starting gun. Treat it like an urgent alert, because if you miss it, your funds will likely roll over automatically, often into a less-than-stellar new rate.

Forgetting to shop around for better interest rates is just as costly. Banks absolutely count on inertia. By not taking a few minutes to compare your renewal offer with what other institutions are paying, you could be leaving a significant amount of money on the table.

A Proactive Solution: The day you open a new CD, pull out your phone and set two calendar alerts. The first should be for two weeks before the maturity date—this is your signal to start researching rates. The second should be for the day the grace period officially begins. This simple system ensures you never get caught flat-footed.

Finally, don’t wait until the clock is ticking to make a decision. Going into the grace period without a clear plan is a recipe for a rushed, and often poor, choice. Know beforehand whether you need the cash, want to hunt for a higher yield, or plan to add more money to the pot.

To stay ahead of these blunders:

- Confirm Your Grace Period: When you open the CD, ask for the exact number of days and write it down.

- Set Calendar Alerts: Create two reminders—one to shop for rates and one for the day the grace period starts.

- Compare New Rates: Always check what competitors are offering before you agree to renew.

By avoiding these simple pitfalls, you can turn the grace period from a moment of stress into a powerful opportunity to protect and grow your savings.

Your Top Questions Answered

Let's tackle some of the most common questions savers have when their CD is about to mature.

Can I Add Money to My CD During the Grace Period?

Yes, you absolutely can. Think of the grace period as your only window of opportunity to top up your CD before it locks in again for the next term.

Adding more funds is a smart way to boost your principal, which means you'll earn more interest going forward. Just make sure you get it done before that window slams shut.

What Happens If I Close My CD One Day After the Grace Period?

Timing is everything here. If you miss the grace period—even by a single day—your bank has almost certainly rolled your funds into a new CD for the same term.

Trying to close it at that point will be considered an early withdrawal. That means you’ll get hit with a penalty, which could easily wipe out several months of interest earnings.

Do All CDs Have a Grace Period?

Almost all standard CDs you'll find at banks and credit unions come with a grace period, which usually lasts between seven and ten days.

However, it's not a legal requirement. It's crucial to confirm the exact policy with your bank when you first open the account so there are no surprises down the road.

How Will My Bank Notify Me About My CD Maturing?

Banks are required to give you a heads-up before your CD's term is up. You'll receive a formal maturity notice, typically by email or regular mail.

This notice will clearly state the maturity date and outline the dates for your grace period. For more perspectives on different saving and investment strategies, you can find great articles over at Yield Seeker's financial blog.

Ready to see how your savings could grow? Use the Certificate-of-Deposit Calculator to estimate your earnings, compare rates, and plan your next move with confidence. Get started at https://www.bankdepositguide.com/cd-calculator.