Understanding The Fundamentals Of CD Interest

Before diving into the calculations, let's establish a solid understanding of CD interest. This knowledge will empower you to make informed choices about your investments. We'll start by exploring two key concepts: Annual Percentage Yield (APY) and simple interest.

APY vs. Simple Interest

APY represents the total interest earned on a CD over a year, factoring in compounding. Compounding means you earn interest not just on your initial principal, but also on any accumulated interest. Simple interest, conversely, is calculated solely on the principal.

For instance, a $1,000 CD with a 5% simple interest rate would yield $50 in a year. With a 5% APY and compounding, however, the return would be slightly higher due to the "interest-on-interest" effect. This difference highlights why APY provides a more accurate picture of your potential earnings.

Key CD Terms and Concepts

Understanding the terminology surrounding CDs is crucial. The principal is your initial deposit. The maturity date marks the end of your CD's term, when you can withdraw your principal plus interest. Compounding frequency indicates how often the interest is calculated (e.g., daily, monthly, quarterly, annually).

The compounding frequency significantly influences your overall return. More frequent compounding results in higher earnings.

CD Types and Their Impact on Calculations

Several types of CDs exist, each with its own implications for interest calculations. Traditional CDs offer a fixed interest rate for a specific term. No-penalty CDs allow penalty-free early withdrawals, but often come with lower interest rates. Step-up CDs offer progressively increasing interest rates over time, requiring a different calculation approach.

Understanding these nuances is crucial. A no-penalty CD might seem attractive for its flexibility. However, a traditional CD could provide higher returns if you're comfortable locking in your funds. This trade-off deserves careful consideration based on your financial objectives. With a firm grasp of these basics, you're well-prepared to delve deeper into CD interest calculations.

Master The Essential CD Interest Calculation Formula

Now that we understand the basics, let's explore the actual calculations involved with Certificates of Deposit. We'll look at both simple interest and compound interest, focusing primarily on compound interest due to its greater importance in CD growth. Compounding allows you to earn interest on your accumulated interest, which is a key driver of returns.

Simple Interest Calculation

Calculating simple interest is straightforward. You simply multiply the principal (your initial deposit) by the interest rate and the term length (the duration of the CD). The formula looks like this: Interest = Principal * Rate * Time.

For example, if you have a $1,000 CD with a 2% annual interest rate held for one year, the simple interest earned would be $20.

Compound Interest Calculation

Compound interest is where your CD earnings really start to grow. The formula for compound interest is: A = P(1 + r/n)^(nt). Let's break down what each part of this formula represents:

- A: This stands for the future value of your investment, including the interest earned.

- P: This represents the principal amount, or your initial deposit.

- r: This is the annual interest rate, expressed as a decimal.

- n: This stands for the number of times the interest is compounded per year.

- t: This is the number of years the money is invested.

Let's illustrate with an example. Suppose you invest $10,000 in a CD with a 4% annual interest rate compounded annually for 5 years. Using the formula: A = $10,000 (1 + 0.04/1)^(1*5) = $12,166.53. This means your total interest earned would be $2,166.53.

Compounding Frequency's Impact

How often your interest compounds can affect your overall return. The following table demonstrates the impact of compounding frequency on a $10,000 principal at a 4% annual interest rate over one year:

To better understand how different compounding frequencies can impact your returns, let's take a look at the following table:

CD Interest Calculation Examples

Comparison of interest earnings across different deposit amounts, rates, and terms.

| Principal Amount | Interest Rate | Term Length | Compounding | Total Interest Earned | Final Balance |

|---|---|---|---|---|---|

| $10,000 | 4% | 1 year | Daily | $408.11 | $10,408.11 |

| $10,000 | 4% | 1 year | Monthly | $407.42 | $10,407.42 |

| $10,000 | 4% | 1 year | Quarterly | $406.04 | $10,406.04 |

| $10,000 | 4% | 1 year | Annually | $400.00 | $10,400.00 |

As you can see, more frequent compounding—such as daily or monthly—results in slightly higher returns compared to quarterly or annual compounding.

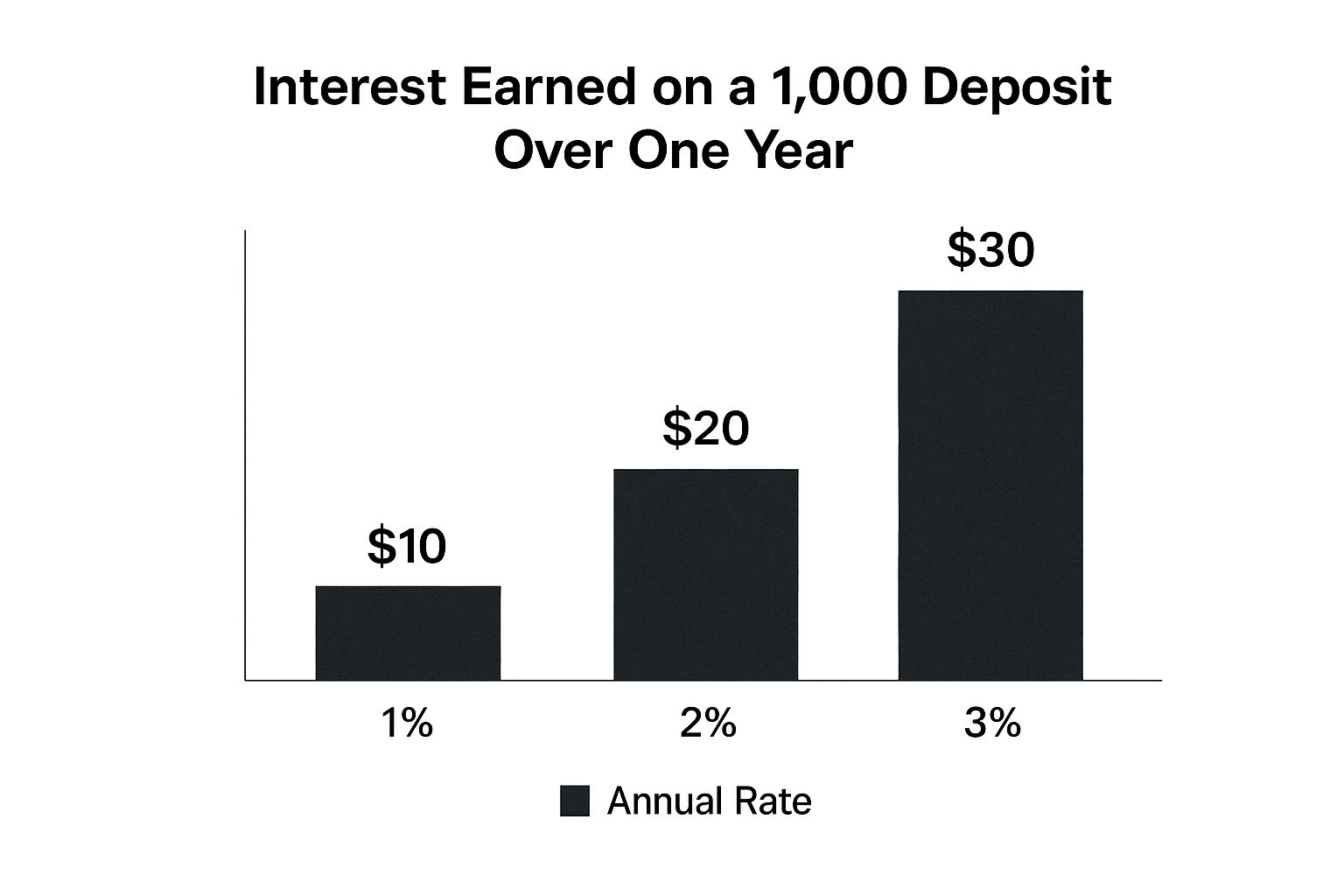

Understanding the Infographic

The infographic below visually represents the interest earned on a $1,000 deposit at varying annual rates over one year.

This visualization clearly shows the direct relationship between interest rates and earnings. As the interest rate increases, so does the interest earned. Even a small difference in the interest rate can significantly impact your returns over time, highlighting the importance of comparing CD rates from different financial institutions.

These calculations form a strong foundation for understanding how your CD investment can potentially grow. Keep in mind that other factors, such as taxes and early withdrawal penalties, can influence your final return, which we will discuss later.

Learning From Historical CD Rate Patterns

Understanding past CD rate trends offers valuable insights for investors. By examining how economic conditions have influenced these rates, you can make more strategic decisions about your investments. This historical perspective is crucial for maximizing returns when learning how to calculate CD interest.

The Impact of Economic Cycles

Economic cycles play a significant role in shaping CD rates. The 1980s, for instance, saw incredibly high CD rates, reaching nearly 20% at their peak due to high inflation. This contrasts sharply with the period following the Great Recession, where rates dropped to near zero for almost a decade.

Calculating CD interest during these different periods would produce drastically different results. In the 1980s, a $10,000 CD earning 15% annual interest would yield $1,500. However, in the low-rate environment after the recession, the same CD might earn only $50 or less. This illustrates the importance of understanding historical rate fluctuations. Learn more about historical CD rates

Considering Inflation’s Effect

It’s also essential to consider the impact of inflation on CD returns. Nominal returns represent the stated interest earned before adjusting for inflation. Real returns, on the other hand, account for inflation, providing a more accurate picture of your purchasing power growth.

For example, a 5% nominal return with 3% inflation results in a real return of approximately 2%. This distinction helps determine if a CD's return will keep pace with rising prices.

Applying Historical Lessons to Current Decisions

Analyzing historical rate patterns helps you understand how economic factors might influence future CD rates. This knowledge empowers you to make informed choices about when to lock in current rates or wait for potentially better opportunities.

Furthermore, understanding the potential impact of inflation allows you to create realistic projections about the true earning potential of your CD investments. This long-term perspective is crucial for achieving your financial goals through strategic CD investing.

Calculating Returns On High-Yield And Jumbo CDs

Larger deposits often lead to better returns with Certificates of Deposit (CDs). This section explores the calculations behind high-yield CDs and jumbo CDs, showing how they can increase your investment earnings. We'll focus on how higher minimum deposits translate into significantly better yields and how to calculate CD interest effectively.

Understanding Jumbo CDs

Jumbo CDs typically require a minimum deposit of $100,000. This higher entry point often qualifies depositors for premium interest rates compared to standard CDs. Offering some of the best interest rates available, jumbo CDs are often favored by large institutional investors seeking stable, low-risk investments. Calculating interest on jumbo CDs follows the same principles as regular CDs.

For example, a jumbo CD offering a 4.5% APY on a $100,000 deposit would generate $4,500 in annual interest. This is particularly attractive in a low-interest-rate environment. You can learn more about Certificates of Deposit through this resource: Learn more about CDs

Calculating Jumbo CD Returns

The core calculation for jumbo CDs remains the same as for standard CDs: A = P(1 + r/n)^(nt). The significant difference lies in the higher principal, which amplifies the interest rate’s impact.

Consider a $100,000 jumbo CD with a 4.5% APY compounded annually for one year:

- A (Future Value) = $100,000 (1 + 0.045/1)^(1*1) = $104,500

This results in a $4,500 interest gain, substantially more than what a smaller deposit at a lower rate would earn. Even a small increase in the interest rate can significantly affect your overall return with larger principal amounts.

Navigating Step-Up and Callable CDs

Beyond jumbo CDs, other specialized products like step-up CDs and callable CDs exist. Step-up CDs offer increasing interest rates over time. Callable CDs, however, can be redeemed by the issuing bank before maturity, often with a higher initial interest rate.

Calculating returns for these requires a modified approach. With step-up CDs, calculate the interest earned during each rate increase. With callable CDs, consider the possibility of early redemption and its impact on your total return. Understanding the specifics of each CD is crucial for informed investment decisions.

Evaluating Promotional Rates

Banks often offer promotional rates to attract new deposits. These short-term, higher-than-usual rates can greatly impact jumbo CD returns. However, it’s important to carefully evaluate these offers. Understand the terms and conditions, including the promotional period and the subsequent rate.

Comparing promotional offers with standard rates elsewhere ensures a well-informed decision. This careful analysis helps maximize your CD investment strategy and potential returns.

Factor In Tax Implications For Real Returns

Understanding how taxes affect your CD returns is crucial for calculating your true earnings. While Certificates of Deposit (CDs) offer predictable returns, the interest earned is considered taxable income. This means a portion of your earnings will go towards taxes, reducing your overall profit.

Calculating After-Tax Returns

To calculate your after-tax return, you need to know your marginal tax rate. This is the tax rate applied to your last dollar of income. You multiply your CD's interest earnings by your marginal tax rate to find the amount you'll owe in taxes. Then, subtract this amount from your total interest earned to find your after-tax return.

For example, if you earn $500 in interest and your marginal tax rate is 22%, you'll owe $110 in taxes. Your after-tax return would be $390.

Comparing With Tax-Advantaged Alternatives

After calculating your after-tax return, it's wise to compare CDs with tax-advantaged alternatives like municipal bonds or retirement accounts. Municipal bonds interest is often tax-free, while retirement accounts like IRAs can offer tax-deferred or tax-free growth, depending on the account type. This comparison helps determine which investment offers the best after-tax return for your individual circumstances. You might be interested in: Are CDs taxable?

Timing of Tax Obligations

Understanding when taxes are due on your CD interest is also important for financial planning. For multi-year CDs, interest is typically reported annually, even if you don't receive the interest until maturity. This means you'll need to pay taxes on the accrued interest each year, even though you haven’t physically received it yet.

State Taxes and IRA CDs

Don't forget about state taxes! Some states also tax CD interest, further impacting your after-tax return. Additionally, IRA CDs held within a traditional IRA can provide significant tax advantages, as the interest grows tax-deferred until retirement. However, contributions to a traditional IRA may be tax-deductible, offering additional tax benefits.

Maximizing Tax Efficiency

Several strategies can help maximize your CD's tax efficiency. Consider holding CDs within a tax-advantaged account like an IRA. Also, explore laddering your CDs, where you invest in multiple CDs with different maturity dates. This strategy helps manage interest rate risk and can provide some flexibility for managing tax liabilities. By factoring in these considerations, you can make more informed decisions about how CDs fit into your overall investment plan and how to calculate CD interest in a way that reflects your true earnings.

Early Withdrawal Penalties And Break-Even Analysis

Breaking a CD early often comes with penalties. However, understanding these penalties and when it might be worthwhile to incur them is key to maximizing your returns. Sometimes, an early withdrawal actually makes financial sense.

Understanding Early Withdrawal Penalties

Early withdrawal penalties discourage you from prematurely accessing funds locked in a CD. These penalties usually involve forfeiting some of the interest earned. For example, a common penalty might be losing six months' worth of interest. The exact penalty and structure depend on the CD's term and the financial institution’s policies. More information on CD early withdrawal penalties can be found at: CD Early Withdrawal Penalty

Calculating the Break-Even Point

The break-even point is when withdrawing early and reinvesting at a higher rate becomes more profitable than holding the CD to maturity, despite the penalty. Calculating this involves comparing the potential returns from both scenarios.

For example, imagine you have a CD earning 3%. Rates rise, and you can now find a 5% CD. If the early withdrawal penalty is less than the extra interest you'd earn over the remaining term of the original CD, it might be worth withdrawing early.

To help illustrate when an early withdrawal makes sense, let's look at a break-even analysis. This table shows how different CD terms, rates, and penalties affect the break-even period – the time it takes for the higher rate to offset the penalty.

Early Withdrawal Penalty Impact Analysis Break-even analysis showing when early withdrawal penalties are worth paying for better rates

| CD Term | Current Rate | New Available Rate | Penalty Amount | Break-Even Period | Net Benefit |

|---|---|---|---|---|---|

| 1 year | 3% | 5% | 3 months interest | ~9 months | Increase in overall return |

| 2 years | 4% | 6% | 6 months interest | ~1 year | Increase in overall return |

| 5 years | 4.5% | 5.5% | 12 months interest | ~ 2 years | Increase in overall return |

As you can see, the break-even point varies considerably. It's essential to run the numbers for your specific situation.

Minimizing Penalty Impact

There are ways to minimize the impact of these penalties. No-penalty CDs allow access to your funds without forfeiting interest. However, their rates are typically lower than traditional CDs. This trade-off between flexibility and return deserves careful thought.

Another approach is CD laddering. By staggering the maturity dates of several CDs, you can access some of your funds regularly without penalties on the entire investment. This strategy offers a balance of liquidity and higher potential returns.

No-Penalty CD Calculations

No-penalty CDs offer flexibility, but their lower rates require careful analysis. Calculating returns is simple, as you won't be factoring in any penalties. Compare the final return from a no-penalty CD to the potential return from a traditional CD, considering a worst-case early withdrawal. This comparison helps you determine if the flexibility outweighs the lower return. This analysis is crucial when access to funds is a higher priority than maximum returns. Understanding early withdrawal penalties and break-even analysis allows you to make smart choices about your CDs. You'll be able to weigh the benefits of higher returns against the potential costs of withdrawing early, improving your overall CD investment strategy.

Essential Tools and Pro Tips For Accurate Calculations

Now that you understand the basics of calculating CD interest, let's explore some helpful resources and strategies. These tools and tips will help you make informed decisions, compare CD offers, and maximize your returns.

Online CD Calculators: Your Best Friend

Online CD calculators are invaluable for quickly and accurately projecting your CD earnings. These tools automate the sometimes complex compound interest formula, saving you time and eliminating potential errors. Simply input the principal, interest rate, term, and compounding frequency, and the calculator instantly generates the projected interest earned and final balance. You might find this helpful: How to master CD calculations

Many online calculators also offer advanced features. These might include APY comparisons, early withdrawal penalty calculations, and even CD laddering simulations. These features offer a comprehensive view of your potential returns in different situations.

Spreadsheet Templates for Advanced Analysis

If you're comfortable using spreadsheets like Microsoft Excel, creating your own templates allows for more customized analysis. You can build formulas to track multiple CDs, experiment with different investment strategies, and visualize the impact of changing interest rates on your portfolio. Spreadsheets also enable more in-depth analysis, such as break-even calculations for early withdrawals.

Verifying Calculations and Avoiding Errors

No matter what tools you use, double-checking calculations is crucial. Even a small error in the interest rate or compounding frequency can significantly impact your projected returns. It's always a good idea to verify calculations using multiple methods. For example, cross-check an online calculator's results against your own spreadsheet calculations.

Factoring in Promotional Rates and Bonuses

Some banks offer promotional rates or relationship bonuses, which can improve CD returns. Make sure these are accurately reflected in your calculations. A promotional rate might only apply for the initial term of a CD, reverting to a different rate afterward. A relationship bonus might require maintaining a certain balance in a linked account.

CD Laddering Strategies

CD laddering is a technique that involves investing in multiple CDs with staggered maturity dates. You can model this strategy using spreadsheet templates or dedicated laddering calculators. These tools help you visualize the impact of laddering on both liquidity and returns, allowing you to fine-tune your strategy.

Tracking Performance and Opportunity Costs

Regularly tracking your CD's performance against your initial projections can help you identify any discrepancies and adjust your investment strategies as needed. Also, consider opportunity costs. This refers to the potential returns you might miss out on by choosing a CD over other investment options. Calculating the opportunity cost of choosing a CD over a potentially higher-risk investment, for example, helps ensure your decision aligns with your overall financial goals.

By using these tools and techniques, you can accurately calculate CD interest, evaluate different investment options, and make sound decisions to maximize your returns. Ready to get started? Try our Certificate-of-Deposit Calculator today: Calculate your CD interest