Unlocking Tax Savings in Your Golden Years

Retirement should be enjoyable, not a source of financial stress. Minimizing taxes in retirement lets you keep more of your hard-earned money. This listicle provides eight key strategies for minimizing taxes in retirement, helping you achieve financial security. Learn how tax-loss harvesting, Roth conversions, asset location, municipal bonds, QCDs, geographic arbitrage, withdrawal sequencing, and HSAs can significantly reduce your tax burden. Whether you're still planning for retirement or already retired, these strategies can help you build a more tax-efficient future.

1. Tax-Loss Harvesting in Taxable Accounts

Minimizing taxes in retirement is a crucial aspect of financial planning, allowing you to preserve more of your hard-earned savings. One powerful strategy to achieve this is tax-loss harvesting in taxable accounts. This involves selling securities that have decreased in value to offset capital gains incurred from other investments. In retirement, this can be particularly effective because retirees often have greater flexibility in managing the timing of their gains and losses, optimizing their tax liability.

Tax-loss harvesting works by using realized capital losses to offset capital gains. If your losses exceed your gains, you can use up to $3,000 of those excess losses to offset your ordinary income, such as your pension or Social Security benefits. Any remaining losses can be carried forward indefinitely to offset gains or income in future years. This strategy is particularly relevant for individuals with taxable investment accounts, such as brokerage accounts, as it does not apply to tax-advantaged retirement accounts like IRAs or 401(k)s.

Here's how it works in practice. Let’s say you sold some real estate earlier in the year and realized a $10,000 capital gain. Later in the year, some of your stocks decline in value. You could sell those losing stocks to generate a capital loss, offsetting the $10,000 gain. If the losses were greater than $10,000, say $12,000, you could offset the entire gain and then use $3,000 of the remaining loss to reduce your ordinary income. The remaining $1,000 loss can be carried forward to future years.

This strategy offers several key benefits. First, it provides immediate tax savings on your current year's returns. Second, it creates opportunities for portfolio rebalancing. By selling underperforming assets, you can reinvest the proceeds into more promising investments, potentially improving your portfolio’s long-term performance. Third, the ability to carry forward losses indefinitely provides significant flexibility in managing your tax liability over time. This allows for strategic timing of tax events, particularly helpful during retirement when income streams might fluctuate.

However, tax-loss harvesting isn’t without its drawbacks. One significant consideration is the wash-sale rule. This rule prohibits claiming a loss if you repurchase the same or a “substantially identical” security within 30 days before or after the sale. This means you can’t simply sell a losing stock and immediately buy it back to maintain your position. You need to consider investing in a similar, but not identical, security to avoid violating this rule. Another potential downside is that tax-loss harvesting may sometimes force you to sell investments you might otherwise want to hold long-term. Furthermore, it requires active management and diligent tracking of your gains, losses, and carryforwards.

Here are some specific examples of how retirees can utilize tax-loss harvesting:

- Offsetting gains from real estate sales: A retiree who sells a property and realizes a substantial gain can offset that gain by selling losing stocks or bonds in their taxable brokerage account.

- Managing mutual fund distributions: If a mutual fund makes capital gains distributions, a retiree can harvest losses to offset the tax liability from these distributions.

- Taking advantage of rising interest rates: Rising interest rates typically cause bond prices to fall. Retirees holding bond funds in taxable accounts can harvest losses in these funds and reinvest in newer bonds offering higher yields.

To effectively implement tax-loss harvesting, consider these tips:

- Harvest losses throughout the year: Don’t wait until December to review your portfolio for potential losses. Regular monitoring allows you to take advantage of opportunities as they arise.

- Be mindful of the wash-sale rule: Carefully consider your repurchase strategy to avoid violating this rule. Consult a financial advisor if you’re unsure.

- Track your loss carryforwards: Maintain accurate records of your carried-over losses to optimize your tax planning in future years.

Tax-loss harvesting has been popularized by various financial services platforms, including Vanguard Personal Advisor Services, Betterment's automated tax-loss harvesting feature, and the Wealthfront robo-advisor platform, highlighting its growing importance in managing retirement finances. By understanding the mechanics of tax-loss harvesting and implementing it strategically, retirees can significantly reduce their tax burden and maximize their after-tax returns.

2. Strategic Roth Conversions

One of the most powerful tools for minimizing taxes in retirement is the strategic Roth conversion. This strategy involves converting funds from pre-tax retirement accounts, such as traditional IRAs and 401(k)s, into a Roth IRA. While you'll pay income taxes on the converted amount in the year of the conversion, the beauty of this strategy lies in the future: all future growth and withdrawals from the Roth IRA are entirely tax-free. This can significantly reduce your tax burden throughout retirement, especially when factoring in required minimum distributions (RMDs) that begin at age 73. By strategically executing Roth conversions, you can effectively manage your taxable income in retirement and potentially save a substantial amount in taxes over the long term, making it a crucial consideration for minimizing taxes in retirement.

The core principle behind Roth conversions is to pay taxes now at a lower rate in exchange for tax-free withdrawals later, potentially at a higher rate. This is particularly effective during the early years of retirement, often referred to as the "golden years" of tax planning. Before required minimum distributions (RMDs) from traditional retirement accounts kick in, retirees frequently find themselves in a lower tax bracket than they anticipate being in later retirement. This presents a prime opportunity to convert funds strategically and take advantage of these lower tax rates. Moreover, unlike contributions to a Roth IRA, there are no income limitations for Roth conversions, making them accessible to a wider range of individuals.

How it works: You choose a portion (or all) of your pre-tax retirement funds to convert to a Roth IRA. You will owe income taxes on the converted amount for the tax year in which the conversion takes place. However, once the funds are in the Roth IRA, they grow tax-free, and qualified withdrawals in retirement are also tax-free. Each conversion is subject to a five-year rule, meaning that while you can withdraw contributions at any time without penalty, any earnings withdrawn within five years of the conversion may be subject to taxes and a 10% penalty if you are under 59 ½.

Examples of Successful Implementation:

- Filling Lower Tax Brackets: A 65-year-old retiree in the 12% tax bracket could convert $50,000 annually from their traditional IRA to a Roth IRA, maximizing the benefit of the lower tax bracket. By filling up the 12% bracket each year before RMDs begin, they minimize the amount of their retirement savings that will be taxed at higher rates in the future.

- Converting During Market Downturns: When the market experiences a downturn, the value of your retirement accounts may decrease. This presents a strategic opportunity to convert funds at a lower value, meaning you’ll pay taxes on a smaller amount, but still benefit from tax-free growth when the market rebounds.

- Partial Conversions Over Multiple Years: You don’t have to convert your entire traditional IRA balance at once. Spreading conversions over several years can help you manage your taxable income and stay within desired tax brackets.

Actionable Tips for Minimizing Taxes in Retirement with Roth Conversions:

- Calculate and Convert Up to the Top of Your Current Tax Bracket: This allows you to maximize the conversion benefit without pushing yourself into a higher bracket.

- Consider Market Downturns as Conversion Opportunities: Convert funds when they are at a lower value to minimize the tax impact.

- Plan Conversions Before Age 73 (the start of RMDs): This allows for greater control over your tax situation.

- Factor in State Tax Implications: If you plan to move to a state with different income tax rates, consider this in your conversion strategy.

Pros and Cons of Roth Conversions:

Pros:

- Reduces future RMDs.

- Creates a tax-free income source for later retirement.

- Can lower your overall lifetime tax burden.

- Provides tax diversification in retirement.

Cons:

- Increases your current-year taxable income and tax bill.

- May push you into a higher tax bracket.

- Could affect Medicare premiums (IRMAA).

- Converted funds (earnings) are subject to a 5-year waiting period for penalty-free withdrawals if under 59 ½.

Strategic Roth conversions are a powerful tool for minimizing taxes in retirement. By carefully considering your individual financial situation and consulting with a qualified financial advisor, you can determine if Roth conversions are the right strategy for you to achieve your long-term financial goals. This approach is particularly beneficial for individuals seeking to create a predictable and tax-efficient income stream in retirement, offering a way to potentially reduce your lifetime tax burden and enhance your financial security. Experts like Ed Slott, Jeffrey Levine, and the research from Kitces.com have popularized and provided valuable insights into this important retirement tax planning strategy.

3. Asset Location Optimization

Minimizing taxes in retirement is a crucial aspect of maximizing your income and enjoying your golden years. One powerful strategy to achieve this is asset location optimization, a technique that can significantly improve your after-tax returns without requiring you to drastically alter your overall investment strategy. Essentially, it involves strategically placing different types of investments in the most tax-efficient account types. This method recognizes that not all investment income is taxed equally, and by thoughtfully arranging your assets, you can keep more of your hard-earned money.

This approach works by leveraging the different tax treatments of various account types: taxable, tax-deferred, and tax-free. Taxable accounts, like brokerage accounts, are subject to annual taxes on dividends, interest, and capital gains. Tax-deferred accounts, such as traditional 401(k)s and IRAs, defer taxes until withdrawal in retirement. Tax-free accounts, like Roth IRAs, allow investments to grow tax-free, with withdrawals also being tax-free in retirement. Asset location optimization capitalizes on these differences.

The core principle is to hold tax-inefficient investments in tax-deferred or tax-free accounts. These investments typically generate higher taxable distributions, such as interest from bonds, dividends from Real Estate Investment Trusts (REITs), or high-yield dividend stocks. By sheltering these investments within tax-advantaged accounts, you defer or eliminate the tax burden on these distributions, allowing them to compound more effectively. Conversely, tax-efficient investments, like broad market index funds or growth stocks, are better suited for taxable accounts. These investments generally produce lower taxable distributions and benefit from lower capital gains tax rates when held for the long term. Therefore, placing them in a taxable account minimizes the overall tax drag.

For example, consider an investor holding both REITs and a broad market index fund. REITs often distribute high dividends which are taxed annually. By holding REITs in a tax-deferred account like a traditional IRA, the investor avoids paying taxes on those dividends until retirement. On the other hand, a broad market index fund is relatively tax-efficient. Holding it in a taxable brokerage account minimizes the tax impact.

Another example involves international funds. These funds may generate foreign tax credits, which can offset US taxes. Placing international funds in a taxable account allows you to take advantage of these credits, further reducing your tax burden. This strategy can be particularly beneficial for those seeking to minimize taxes in retirement by maximizing the use of available tax credits. Learn more about Asset Location Optimization and consider how different investment vehicles, even seemingly tax-advantaged ones, might have tax implications.

Implementing asset location optimization requires coordination across multiple account types and careful consideration of the tax treatment of different asset classes. It’s more complex than simply diversifying your portfolio within a single account. However, this complexity is often outweighed by the potential benefits. By maximizing after-tax returns across all accounts, you can significantly improve your overall investment outcome, compounding the benefits over time.

Here are some actionable tips to help you get started with asset location optimization:

- Prioritize tax-deferred accounts for: Bonds, REITs, high-yield dividend stocks, and actively managed funds.

- Keep in taxable accounts: Broad market index funds, tax-managed funds, growth stocks, and international funds (for potential foreign tax credits).

- Review and rebalance periodically: Your optimal asset location can change over time due to changes in tax laws, your income, or your investment goals. Regular review and rebalancing are essential to maintain optimization.

While asset location optimization can be a highly effective strategy for minimizing taxes in retirement, it's important to be aware of the potential drawbacks. It can be complex to implement and maintain, requiring sufficient assets across multiple account types. Rebalancing can also be more complicated, necessitating transfers between accounts. In some cases, strict adherence to asset location principles might conflict with your desired asset allocation within individual accounts. However, for those with sufficient assets and the willingness to manage the complexity, the potential for enhanced after-tax returns makes asset location optimization a valuable tool in retirement planning. This technique, popularized by communities like the Bogleheads and experts like William Bernstein, is a testament to the power of thoughtful tax planning in maximizing retirement income.

4. Municipal Bond Strategy

One of the most effective ways to minimize taxes in retirement is by strategically investing in municipal bonds. These bonds offer tax-free interest income at the federal level, and often at the state and local levels as well, making them particularly attractive for retirees seeking to preserve their income. This strategy is especially valuable for those in higher tax brackets, as it helps avoid pushing them into even higher brackets during retirement. By reducing your tax burden, you effectively increase your after-tax return, allowing your retirement savings to stretch further. This makes municipal bonds a powerful tool for building a secure and tax-efficient retirement income stream.

Municipal bonds are essentially loans to state and local governments or their agencies. When you purchase a municipal bond, you're lending money to fund public projects like schools, hospitals, and infrastructure. In return, the issuer promises to pay you a fixed interest rate over a specific period, and then return your principal investment at maturity. The key advantage is that the interest earned on these bonds is generally exempt from federal income tax. Furthermore, if you invest in municipal bonds issued within your state of residence, the interest may also be exempt from state and local taxes, providing a "triple tax-free" benefit. This makes a significant difference in your overall return, especially when compared to taxable bonds with similar yields.

There are two main types of municipal bonds: general obligation bonds and revenue bonds. General obligation bonds are backed by the full faith and credit of the issuing government, while revenue bonds are repaid from the specific project the bond financed (e.g., toll roads, water treatment facilities). Municipal bonds are available as individual bonds or through mutual funds and exchange-traded funds (ETFs). Funds offer instant diversification, while individual bonds allow for customized laddering strategies.

Here are some examples of how retirees can effectively utilize municipal bonds:

- Triple Tax Exemption: A retiree residing in California could invest in California municipal bonds to benefit from federal, state, and local tax exemptions. This maximizes their after-tax income.

- Diversified Exposure: Retirees can utilize municipal bond funds to gain broad exposure to a diversified portfolio of bonds from various issuers and geographic regions, reducing overall risk.

- Laddering Strategy: By purchasing individual municipal bonds with staggered maturity dates, retirees can create a "bond ladder." As each bond matures, the principal can be reinvested, providing a predictable income stream and managing interest rate risk.

To maximize the benefits of municipal bonds, consider the following tips:

- Calculate Tax-Equivalent Yield: Compare municipal bond yields to taxable bond yields by calculating the tax-equivalent yield. This helps determine if the tax advantages outweigh any potential yield difference.

- Consider Your State's Tax Situation: If your state has high income taxes, investing in in-state municipal bonds can offer significant advantages. Otherwise, a national municipal bond fund might be more suitable.

- Diversify Your Holdings: Spread your investments across different issuers, regions, and types of municipal bonds to reduce the impact of any single bond defaulting.

- Be Aware of Call Provisions: Some municipal bonds have call provisions, allowing the issuer to redeem the bond before maturity. Understand these provisions to avoid unexpected reinvestment challenges.

While municipal bonds offer significant tax advantages, it's important to be aware of the potential drawbacks:

- Lower Yields: Generally, municipal bonds offer lower yields than comparable taxable bonds. However, the tax benefits can often offset this difference, especially for higher-income retirees.

- Interest Rate and Credit Risks: Like all bonds, municipal bonds are subject to interest rate risk (prices fall when interest rates rise) and credit risk (the risk that the issuer defaults).

- Liquidity: Individual municipal bonds can sometimes have limited liquidity, making it harder to sell them quickly if needed.

- Alternative Minimum Tax (AMT): While less common now, some municipal bonds may be subject to the AMT, which could negate some of the tax advantages.

Municipal bonds, popularized by providers like Nuveen, Vanguard, and BlackRock, represent a valuable tool for minimizing taxes in retirement. By understanding the features, benefits, and potential risks, retirees can effectively integrate municipal bonds into their portfolios to create a more tax-efficient and secure income stream. By carefully considering your individual tax situation and financial goals, and by implementing strategies like diversification and laddering, you can leverage the power of municipal bonds to help achieve a comfortable and financially sound retirement.

5. Qualified Charitable Distribution (QCD)

Minimizing taxes in retirement is a crucial aspect of financial planning, allowing you to stretch your savings further and enjoy a more comfortable lifestyle. Among the various strategies available, the Qualified Charitable Distribution (QCD) stands out as a powerful tool for charitably inclined retirees. A QCD allows individuals age 70½ and older to directly transfer funds from their Individual Retirement Account (IRA) to a qualified charity. This transfer counts towards your required minimum distributions (RMDs) while simultaneously excluding the distributed amount from your taxable income. This unique combination of benefits makes the QCD a particularly effective method for minimizing taxes in retirement.

How QCDs Work

The mechanics of a QCD are relatively straightforward. Once you reach age 70½ and are required to take RMDs, you can instruct your IRA trustee to transfer funds directly to a qualified 501(c)(3) organization. It's important to emphasize directly. You cannot withdraw the money yourself and then donate it to the charity. The transfer must originate from the IRA and be made payable to the charitable organization. The maximum annual amount you can transfer via QCD is $100,000 per person. Married couples can each make a QCD up to this limit, potentially excluding $200,000 from their taxable income.

Why QCDs Deserve a Place in Your Retirement Tax Strategy

The benefits of utilizing QCDs are substantial, particularly for retirees who are already charitably inclined. By excluding the distribution from your taxable income, you effectively reduce your tax burden dollar-for-dollar. This can be especially advantageous if the QCD keeps you in a lower tax bracket or helps you avoid Medicare surcharges, which are partially based on income. Furthermore, QCDs satisfy your RMD requirements without increasing your taxable income. This means you can fulfill your legal obligation to withdraw funds while simultaneously minimizing the tax implications.

Illustrative Examples

Let’s look at a few examples to demonstrate the power of QCDs:

Example 1: A 75-year-old retiree has an RMD of $40,000. They decide to donate $15,000 to their favorite charity via a QCD. This directly reduces their taxable income by $15,000, potentially saving them thousands of dollars in taxes.

Example 2: A married couple, both over 70½, have RMDs totaling $100,000. They each donate $50,000 to their chosen charities using QCDs. This completely eliminates the tax burden on their entire RMD amount for that year.

Example 3: A retiree wishes to support multiple charities but also wants to manage their tax bracket. By strategically utilizing QCDs, they can distribute funds to various organizations while simultaneously keeping their taxable income lower.

Pros and Cons of QCDs

While QCDs offer compelling advantages, it's essential to understand the limitations:

Pros:

- Reduces taxable income dollar-for-dollar.

- Satisfies RMD requirements without tax consequences.

- May help avoid higher tax brackets and Medicare surcharges.

- Allows charitable giving while minimizing taxes.

Cons:

- No charitable deduction can be claimed on your tax return for the QCD amount.

- The transfer must be direct from the IRA trustee to the charity; you cannot reimburse yourself.

- Limited to IRAs; 401(k)s are not eligible unless the funds are rolled over to an IRA.

- Age and annual limit restrictions apply.

Actionable Tips for Utilizing QCDs

- Direct Transfer: Ensure the transfer goes directly from your IRA trustee to the charity. Do not receive the funds personally.

- Documentation: Obtain written acknowledgment from the charity for your tax records. This documentation should specify the amount of the donation and confirm that no goods or services were received in exchange.

- Early Planning: Plan your QCDs early in the year to effectively manage your total income and potentially avoid estimated tax penalties.

- Itemizing vs. Standard Deduction: Consider using QCDs even if you don't itemize deductions. The tax benefit comes from the exclusion of the distribution from your income, not from a charitable deduction.

Resources and Further Information:

Organizations like AARP, Fidelity, and American Funds provide comprehensive guidance on retirement planning and charitable giving strategies, including information on QCDs. Consulting with a qualified financial advisor can also help you determine if a QCD is a suitable strategy for your individual circumstances. By carefully considering the features, benefits, and limitations of QCDs, you can make informed decisions to minimize your taxes in retirement and support the causes you care about.

6. Geographic Arbitrage for State Taxes

Minimizing taxes in retirement is a top priority for many, and geographic arbitrage offers a potentially powerful strategy. This involves relocating to a state with a more favorable tax environment to reduce your overall tax burden during your retirement years. While it requires a significant lifestyle change, the potential savings can be substantial, making it a worthwhile consideration for those seeking to maximize their retirement income. This strategy is particularly appealing for individuals with significant retirement income or substantial investment portfolios, as the tax savings can be quite significant in such cases.

Geographic arbitrage works by leveraging the differences in state tax laws. Some states have no state income tax at all, while others offer exemptions on certain types of retirement income, such as Social Security benefits, pensions, or distributions from 401(k)s and IRAs. By establishing legal residency in a tax-friendly state, you can potentially eliminate or drastically reduce your state income tax liability. This can free up thousands of dollars annually, boosting your disposable income and enhancing your retirement lifestyle.

For example, a retiree leaving high-tax New York and establishing residency in Florida could eliminate their state income tax burden entirely, as Florida has no state income tax. Similarly, a California resident relocating to Nevada or Texas could achieve similar savings. Even relocating to a state like New Hampshire, which doesn't tax earned income but does tax dividends and interest, can be advantageous for those whose retirement income primarily comes from Social Security or pensions. These savings can significantly impact your retirement budget and allow you to maintain a higher standard of living.

However, geographic arbitrage isn't without its complexities. It requires more than just changing your mailing address; you must establish genuine residency in your chosen state. This means meeting specific requirements, such as obtaining a new driver's license, registering to vote, and updating your bank accounts. You also need to spend a significant portion of the year in your new state of residence, meticulously tracking your time to avoid challenges from tax authorities. Consult a tax professional specializing in multi-state issues to ensure a smooth and legally sound transition.

Furthermore, consider the potential impact on other areas of your finances. While some states may offer lower income taxes, they might have higher property taxes, sales taxes, or other costs of living. Weighing these factors is crucial to determine the true net benefit of relocation. For instance, while Florida offers no state income tax, property insurance costs can be significantly higher than in other states.

Here are some key tips for successfully implementing geographic arbitrage:

- Establish clear evidence of residency change: Go beyond simply changing your address. Obtain a new driver's license, register to vote, and open local bank accounts in your new state.

- Maintain detailed records of time spent in each state: Keep a meticulous log of your travels, including dates and locations, to demonstrate compliance with residency requirements. This documentation will be crucial if your residency is ever questioned.

- Consider hiring a tax professional familiar with multi-state issues: Navigating the complexities of multi-state taxation can be challenging. A qualified tax advisor can help you navigate these intricacies and ensure you're complying with all applicable laws.

- Research beyond income tax: Explore the overall tax landscape of your prospective state, including property taxes, sales taxes, and estate taxes. A lower income tax might be offset by higher costs in other areas.

- Evaluate lifestyle implications: Relocating for tax purposes involves a significant lifestyle change. Consider factors like proximity to family and friends, climate, access to healthcare, and cultural amenities.

Geographic arbitrage is not a quick fix for minimizing taxes in retirement. It requires careful planning, thorough research, and a willingness to embrace significant lifestyle changes. However, for those seeking substantial tax savings and who are prepared to navigate the complexities involved, it can be a highly effective strategy for maximizing retirement income and enjoying a more financially secure future. Resources like Kiplinger's retirement state rankings, SmartAsset tax-friendly state research, and AARP state-by-state tax guides can provide valuable insights as you evaluate this option. Remember, consulting with a financial advisor and a tax professional specializing in multi-state issues is crucial to making an informed decision and ensuring a smooth transition.

7. Tax-Efficient Withdrawal Sequencing

Minimizing taxes in retirement is a crucial aspect of financial planning, allowing you to stretch your savings further and enjoy a more comfortable retirement. Tax-efficient withdrawal sequencing is a powerful strategy that can significantly reduce your lifetime tax burden by strategically withdrawing from different retirement accounts in a specific order. This approach coordinates withdrawals across multiple account types—taxable, tax-deferred, and tax-free—to optimize your tax liability each year. It deserves a place on this list because it offers a proactive way to manage your retirement income and potentially save substantial amounts in taxes over the long term.

This method works by prioritizing withdrawals from specific account types based on their tax treatment. Generally, the optimal order involves tapping into taxable accounts first, followed by tax-deferred accounts like traditional IRAs and 401(k)s, and finally, tax-free Roth accounts. This allows your tax-advantaged and tax-free accounts to continue growing and compounding, maximizing their potential benefits. Learn more about Tax-Efficient Withdrawal Sequencing

Consider a few examples of successful implementation: an early retiree might use taxable accounts for the first 5-10 years of retirement, bridging the gap before Social Security or pension income begins and potentially benefiting from lower tax brackets in those early years. Later, they might transition to withdrawing from traditional IRAs and 401(k)s. Another example involves using a combination approach, withdrawing from different account types each year to maintain a desired tax bracket and avoid jumping into a higher bracket unnecessarily. Finally, preserving Roth accounts for later years allows for tax-free withdrawals during periods of potentially higher expenses, such as healthcare costs, or unexpected emergencies.

Here are some actionable tips for implementing tax-efficient withdrawal sequencing:

- Analyze your current and projected future tax brackets: A key element of this strategy is understanding how your tax bracket might change over time. If you anticipate being in a higher tax bracket later in retirement, it’s generally beneficial to withdraw more from tax-deferred accounts earlier, while you’re in a lower bracket.

- Factor in required minimum distributions (RMDs): Starting at age 73 (or 75, depending on your birth year), you’re required to take minimum distributions from your tax-deferred accounts. Factor these RMDs into your withdrawal strategy to avoid penalties.

- Maximize tax-free growth: Leave your Roth accounts untouched for as long as possible to maximize the benefit of tax-free growth and withdrawals.

- Annual review and adjustments: Tax laws and your personal financial situation can change. Review and adjust your withdrawal strategy annually to ensure it remains optimal.

Pros:

- Minimizes lifetime tax burden

- Preserves tax-free Roth assets for longest growth

- Provides flexibility to manage annual income

- Allows for strategic tax planning

Cons:

- May not be optimal in all tax situations

- Requires ongoing monitoring and adjustment

- Can be complex with multiple account types

- May conflict with other financial goals

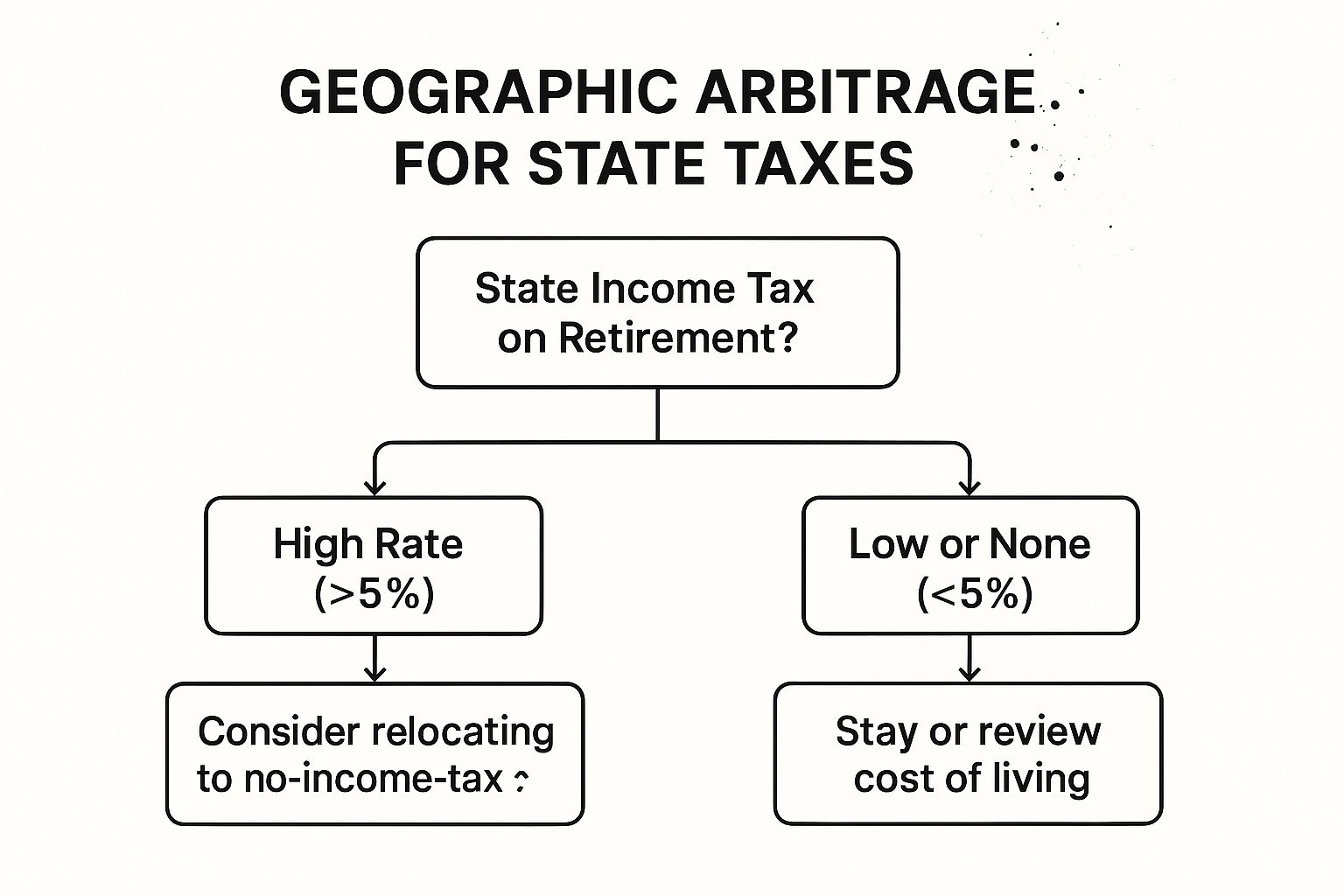

The following infographic illustrates a simplified decision tree for considering geographic arbitrage—relocating to a state with no income tax on retirement income—as a factor impacting your overall tax situation in retirement. This decision, while separate from withdrawal sequencing, can significantly influence the effectiveness of your chosen withdrawal strategy.

The infographic highlights the importance of considering state income tax rates when planning for retirement. If you live in a high-tax state, relocating to a state with no income tax on retirement income can significantly reduce your overall tax burden, amplifying the benefits of a tax-efficient withdrawal strategy. However, even if your current state has low or no income tax, it's wise to periodically review the cost of living in other states to ensure you are maximizing your retirement resources.

By carefully coordinating your withdrawals across different account types and considering factors like future tax brackets and RMDs, you can significantly minimize your taxes in retirement and maximize your income. While tax-efficient withdrawal sequencing requires ongoing monitoring and adjustment, the potential benefits make it a valuable strategy for anyone seeking to optimize their retirement finances.

8. Health Savings Account (HSA) Triple Tax Advantage

Minimizing taxes in retirement is a crucial aspect of financial planning, and a Health Savings Account (HSA) offers a powerful tool to achieve this goal. Unlike most retirement accounts, the HSA boasts a unique "triple tax advantage" that can significantly reduce your tax burden both now and in the future. This makes it a standout option for those seeking to maximize their after-tax retirement income.

So, what exactly is this triple tax advantage and how does it work? The benefits unfold in three distinct stages:

Tax-Deductible Contributions: Contributions you make to your HSA are tax-deductible, meaning they reduce your taxable income in the year you contribute. This is similar to traditional 401(k) or IRA contributions, providing an immediate tax benefit. This lowers your current tax bill, putting more money back in your pocket today.

Tax-Free Growth: The money within your HSA grows tax-free. Any interest earned, dividends received, or capital gains generated within the account are not subject to taxation. This allows your savings to compound significantly faster than in a taxable account, accelerating your progress towards your retirement goals.

Tax-Free Withdrawals: When you use your HSA funds for qualified medical expenses, the withdrawals are tax-free. This includes expenses like doctor visits, prescriptions, hospital stays, and even some over-the-counter medications. This feature provides significant tax savings, especially during retirement when healthcare costs can be substantial.

The HSA's triple tax advantage makes it arguably the most tax-advantaged retirement savings vehicle available. However, it's important to understand that this powerful tool comes with specific requirements and considerations. To be eligible to contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). These plans typically have lower premiums but higher deductibles than traditional health insurance plans. This means you'll pay more out-of-pocket for medical expenses until you meet your deductible.

While the contribution limits for HSAs are relatively low compared to other retirement accounts (in 2023, $3,850 for individuals and $7,750 for families), maximizing your contributions annually can still result in significant tax savings and retirement wealth accumulation.

One of the most attractive features of the HSA is that there are no required minimum distributions (RMDs), unlike traditional IRAs and 401(k)s. This provides greater flexibility in managing your retirement funds. Furthermore, after age 65, you can withdraw HSA funds for non-medical expenses without penalty, although these withdrawals will be taxed as ordinary income, similar to traditional IRA withdrawals.

Here are some examples of how individuals successfully utilize HSAs to minimize taxes in retirement:

- Maximizing Contributions Early: Contributing the maximum amount annually, especially while young and healthy, allows for substantial tax-free growth over time.

- Paying Medical Expenses Out-of-Pocket: Covering smaller medical expenses out-of-pocket and preserving HSA funds allows for greater tax-free growth potential for retirement.

- Medicare Premiums and Long-Term Care: Using HSA funds to pay for Medicare premiums and long-term care expenses can significantly reduce tax burdens during retirement.

- Supplemental Retirement Account: After age 65, the HSA can effectively function as a supplemental retirement account, providing tax-advantaged withdrawals for any expense.

To maximize the benefits of an HSA, consider these actionable tips:

- Maximize Contributions: Contribute the maximum amount allowed each year if possible.

- Pay Out-of-Pocket When Feasible: Consider paying smaller medical expenses out-of-pocket to allow your HSA funds to grow tax-free.

- Meticulous Record Keeping: Keep all receipts for qualified medical expenses for potential future reimbursements, providing flexibility.

- Strategic Integration: Integrate your HSA into your overall retirement tax strategy for optimal tax minimization.

While there are numerous advantages, it's essential to be aware of the potential drawbacks:

- HDHP Requirement: You must be enrolled in a high-deductible health plan to be eligible to contribute to an HSA.

- Contribution Limits: Contribution limits are relatively low compared to other retirement accounts.

- Penalty for Early Non-Medical Withdrawals: A 20% penalty applies to non-medical withdrawals before age 65.

- Receipt Tracking: You must keep receipts for qualified medical expenses.

Learn more about Health Savings Account (HSA) Triple Tax Advantage

By understanding the intricacies of HSAs and implementing a strategic approach, you can effectively leverage this powerful tool to minimize taxes in retirement and secure a more financially comfortable future. The combination of tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses makes the HSA an invaluable asset for anyone seeking to optimize their retirement finances.

8 Strategies for Minimizing Retirement Taxes

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Tax-Loss Harvesting in Taxable Accounts | Medium: requires active management and tracking; wash sale rules apply | Moderate: requires regular portfolio monitoring | Moderate tax savings annually; tax deferral and carryforwards | Taxable accounts with capital gains; retirees with flexible tax timing | Immediate tax savings; portfolio rebalancing; loss carryforward |

| Strategic Roth Conversions | Medium: involves tax planning and timing conversions over years | Moderate: tax payment capacity needed upfront | Long-term tax-free growth; reduced RMDs and tax burden | Early retirement years with lower income; before RMD age 73 | Tax-free withdrawals; tax diversification; lifetime tax reduction |

| Asset Location Optimization | High: complex coordination across accounts and asset types | High: multiple account types required | Improved after-tax returns; tax drag minimization | Investors with taxable, tax-deferred, and tax-free accounts | Maximizes tax efficiency; flexibility; compounded benefit over time |

| Municipal Bond Strategy | Low to Medium: select appropriate bonds/funds, monitor risks | Low to Moderate: bond/fund purchases | Tax-free income stream; steady income; tax bracket management | Retirees in higher tax brackets needing income | Tax-free interest; potentially state/local exemptions; steady income |

| Qualified Charitable Distribution (QCD) | Low: direct IRA transfer to charity with compliance required | Low: requires charity selection and IRS rules | Lowers taxable income; meets RMD without tax impact | Retirees age 70½+ making charitable donations | Dollar-for-dollar income reduction; RMD fulfillment; tax-efficient giving |

| Geographic Arbitrage for State Taxes | High: requires relocation and lifestyle adjustment | Moderate: relocation costs, residency management | Significant state tax savings; potential estate tax benefits | Retirees willing to change residency to low/no income tax states | Substantial state tax savings; potential cost of living improvement |

| Tax-Efficient Withdrawal Sequencing | Medium to High: needs ongoing monitoring and tax optimization | Moderate: access to multiple account types | Minimizes lifetime taxes; preserves Roth growth | Retirees managing income sources over time | Tax burden reduction; flexibility; strategic income management |

| Health Savings Account (HSA) Triple Tax Advantage | Medium: requires HSA eligibility and disciplined use | Moderate: contribution limits and qualified expenses | Triple tax benefit: deductible, tax-free growth & withdrawals | Those with HDHPs maximizing retirement medical savings | Best overall tax treatment; no RMDs; tax-free medical withdrawals |

Planning for a Tax-Smart Retirement

Minimizing taxes in retirement is not about avoiding taxes altogether, but about strategically managing them to maximize your income. Throughout this article, we've explored eight key strategies for minimizing taxes in retirement, ranging from tax-loss harvesting and Roth conversions to asset location and the triple tax advantage of HSAs. Mastering these concepts can significantly impact your retirement income, allowing you to keep more of your hard-earned money and enjoy greater financial freedom. By implementing strategies like qualified charitable distributions (QCDs) and understanding tax-efficient withdrawal sequencing, you can optimize your finances for a secure and fulfilling retirement. Remember, considering geographic arbitrage for state taxes and employing a municipal bond strategy can further enhance your tax savings, particularly for those seeking predictable, risk-free returns.

The most important takeaway is that proactive planning is paramount. Minimizing taxes in retirement isn't a one-size-fits-all approach. Your individual circumstances, risk tolerance, and financial goals will dictate the best strategies for you. Consulting with a financial advisor can provide personalized guidance and ensure you're making informed decisions.

A secure retirement is built on a foundation of informed choices. Take the first step towards a tax-smart retirement today by understanding these strategies and putting them into action. Want to see how safe and predictable returns can contribute to your tax-advantaged retirement plan? Explore the potential of Certificates of Deposit with our Certificate-of-Deposit Calculator and discover how CDs can offer a stable foundation for your retirement savings while potentially offering tax benefits within certain retirement accounts.