The Hidden Mechanics of CD Early Withdrawal Penalties

CD early withdrawal penalties can seem frustrating. They may feel like a barrier to accessing your own funds. However, these penalties play a vital role in the financial system. They balance the needs of financial institutions and, indirectly, the savers themselves. Understanding this balance can help you make smarter choices about your savings.

Why Banks Implement CD Early Withdrawal Penalties

Banks rely on Certificates of Deposit (CDs) as a stable source of funds. They use these funds for lending and investments, often involving long-term commitments. Consistent access to these deposited funds is crucial. It allows banks to maintain necessary liquidity and meet their financial obligations.

Early withdrawals disrupt this stability. Penalties discourage these withdrawals, ensuring banks have the capital they need for lending and operations.

This leads to another important function: promoting long-term savings. CD early withdrawal penalties encourage investors to hold their CDs until maturity. This fosters consistent saving habits, beneficial for individual financial well-being. The guaranteed returns of CDs, combined with the disincentive to withdraw early, provide a secure path for growing wealth over time.

How CD Penalties Are Calculated and Their Impact

CD early withdrawal penalties are usually calculated as a percentage of the earned interest, or a fixed number of months' worth of interest. A study of nearly 17,000 bank branches from 2001 to June 2023 revealed some interesting averages. The average penalty for a 12-month CD was three months of interest. Two-year CDs saw penalties around six months of interest. Five-year CD penalties could reach 8.5 months of interest. More detailed statistics are available here: CD Withdrawal Penalties Often More Than Worth the Risk. These penalty structures vary based on the CD's term and current market conditions.

Understanding these calculations is essential to avoid financial surprises. How to master CD calculations is a helpful resource. While you'll receive some earned interest upon withdrawal, a significant portion could be lost to the penalty. In some instances, the penalty might even exceed the accumulated interest, potentially affecting your principal. Before withdrawing early, carefully assess the penalty and its impact on your investment.

The Real Math Behind Your CD Penalty Costs

Understanding that a CD early withdrawal penalty involves "forfeited interest" is a good starting point, but it doesn't tell the whole story. This section delves into the precise calculations behind these penalties, revealing how they truly affect your returns.

Deciphering the Penalty Structure

CD penalties typically equate to a specific number of months' worth of interest. For example, a common penalty for a 12-month CD might be three months of interest. However, the actual dollar amount depends on several factors, including your initial deposit, the CD's interest rate, and the specific penalty structure of the financial institution.

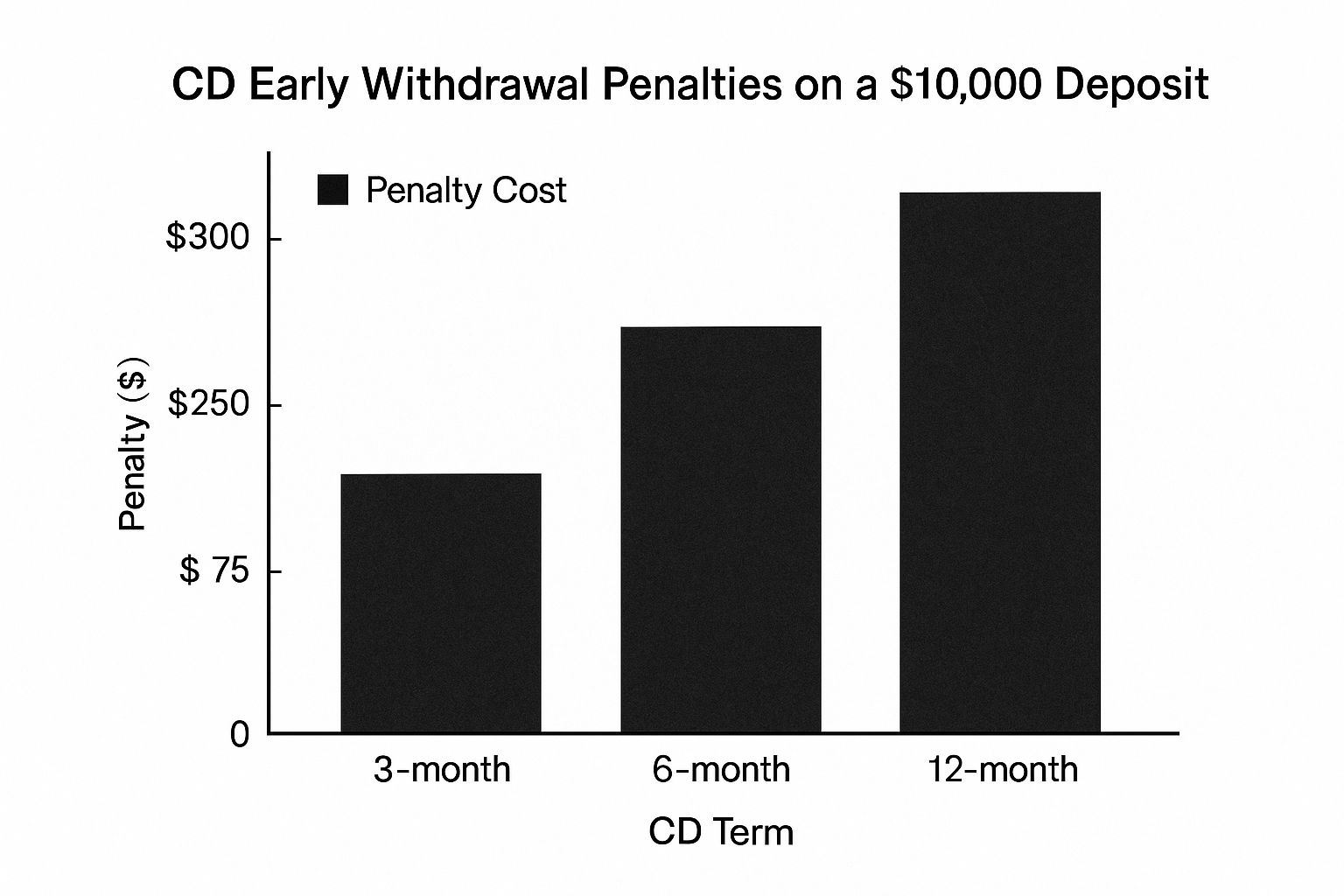

This infographic illustrates the potential penalty costs on a $10,000 deposit for 3-month, 6-month, and 12-month CDs. As you can see, the longer the penalty duration, the higher the cost, showcasing the importance of carefully selecting a CD term that aligns with your financial timeline.

Calculating Your Potential Penalty

Let's imagine you have a $5,000 CD with a 4% annual percentage yield (APY) and a six-month interest penalty. If you withdraw early, the penalty would be calculated based on the interest earned up to that point. This underscores the fact that early withdrawals not only sacrifice future interest but also a portion of what you’ve already earned. To truly secure your online finances and savings, understanding broader aspects of online security is useful. Learn more about web security protocols.

Historically, early withdrawal penalties have been a key component of CD agreements. For CDs with terms of six months or less, the penalty is often equivalent to three months of interest. This penalty structure aims to discourage early withdrawals. According to Regulation D, an early withdrawal penalty must also be charged if part of the time deposit is withdrawn within six days of the most recent partial withdrawal. Given that CDs are insured by the FDIC and are considered low-risk investments, understanding these penalties is essential. Explore this topic further here.

The Impact on Your Principal

In some cases, the accrued interest might not be enough to cover the penalty. This means that the remaining penalty amount could be deducted from your principal, resulting in a net loss of your initial investment. This potential impact on principal is a critical factor often overlooked when considering early withdrawals.

Comparing Penalty Structures

Different financial institutions have varying penalty structures. Some might offer tiered penalties based on the CD term, while others might have a flat penalty regardless of the duration. Comparing these structures across different banks and credit unions is crucial for finding the most favorable terms. Consider factors such as the length of the penalty period and whether partial withdrawals are allowed, as these can significantly influence the total cost. This careful comparison empowers you to make an informed decision, ensuring you're not caught off guard by unexpected costs.

The following table provides a comparison of typical CD early withdrawal penalties:

CD Early Withdrawal Penalties Compared This table compares the standard early withdrawal penalties across different CD term lengths at major financial institutions.

| CD Term | Typical Penalty | Example on $10,000 CD at 3% APY | Potential Impact on Principal |

|---|---|---|---|

| 3 Months | 3 Months Interest | $75 | Possible if interest earned is less than $75 |

| 6 Months | 3 Months Interest | $75 | Possible if interest earned is less than $75 |

| 12 Months | 6 Months Interest | $150 | Possible if interest earned is less than $150 |

| 24 Months | 12 Months Interest | $300 | Possible if interest earned is less than $300 |

Key takeaway: As demonstrated in the table, longer-term CDs often carry steeper penalties, highlighting the importance of aligning your CD term with your anticipated financial needs. Be sure to compare penalty structures across various institutions to find the most suitable terms for your investment strategy.

Why We Fear (And Sometimes Ignore) CD Penalties

The idea of a CD early withdrawal penalty can be unsettling. Nobody wants to lose their hard-earned money. But this feeling is deeply rooted in behavioral economics. Understanding these principles can explain why some savers use penalties as commitment tools, while others pay them despite the cost.

The Psychology of Commitment

For some, the penalty acts as a strong deterrent. It's a pre-commitment strategy that reinforces their savings goals. Knowing they'll lose money for early withdrawal helps them focus on the long-term benefits of the CD. This is particularly helpful for people who struggle with impulse spending. The penalty provides an external control, strengthening their resolve. This relates to loss aversion, where the pain of a loss is felt more strongly than the pleasure of an equal gain.

When Penalties Fail

But CD early withdrawal penalties aren’t always effective. Unexpected financial needs can arise. In these cases, immediate access to money can outweigh the fear of a penalty. This is especially true in emergencies when cash flow trumps long-term costs. Some people also underestimate the penalty amount or overestimate their ability to avoid early withdrawal, creating a gap between their intentions and actions.

The Penalty Paradox: Why Stricter Can Be Better

Some investors prefer stricter penalties. A higher penalty reinforces their commitment and reduces the temptation to withdraw early. The size of the penalty can greatly influence investor behavior. A study on commitment accounts and penalties found that people allocated funds differently based on the penalty. A 10% penalty received half the funds compared to an account with no early withdrawals.

Allocations increased as the penalty rose from 10% to 20% or to no withdrawals at all, highlighting the complexity of investment decisions.

Leveraging Behavioral Insights for Better Savings

Understanding these psychological factors is key to creating a good savings strategy. If you tend to spend impulsively, a CD with a higher penalty might be a useful commitment tool. But if you prioritize flexibility, consider no-penalty CDs or building a CD ladder. Recognizing your own behavior helps you tailor your savings approach, maximizing returns and minimizing the risk of penalties.

When Breaking Your CD Actually Makes Financial Sense

While CD early withdrawal penalties are designed to discourage premature withdrawals, certain circumstances can make accepting the penalty a smart financial move. These situations often involve weighing the penalty against potential gains from higher interest rates or avoiding even steeper expenses.

Rising Interest Rate Environments and Opportunity Cost

One key scenario is a rising interest rate environment. If interest rates climb significantly after you lock into a CD, the opportunity cost of keeping your money tied up at a lower rate can outweigh the withdrawal penalty. For example, if your CD earns 2% APY, but new CDs are offering 5% APY, the potential gains from reinvesting at the higher rate might be greater than the penalty. This is especially true for longer-term CDs where the difference in earned interest becomes more substantial over time. Learn more in our article about How to Calculate CD Interest.

Emergency Funding Needs Beyond Your Emergency Fund

Unexpected major expenses can sometimes exceed the limits of your emergency fund. While a dedicated emergency fund is crucial, breaking a CD in these situations might be less costly than accumulating high-interest debt. Imagine needing a sudden, expensive medical procedure. Taking a CD early withdrawal penalty might be preferable to high-interest credit card debt, even with the penalty. This helps avoid escalating debt that could be far more damaging long-term.

Strategic CD Portfolio Restructuring

Market conditions and personal financial circumstances can shift, potentially requiring a restructuring of your CD portfolio. This might involve breaking existing CDs to reinvest in instruments with better returns or terms. For instance, a change in your risk tolerance might lead you to consider CD laddering, offering more flexibility than a single long-term CD. This proactive approach helps you adapt to changing financial needs and capitalize on new market opportunities.

Consulting a Financial Advisor

Navigating these financial decisions can be complex. Financial advisors can provide valuable guidance, helping you analyze the cost-benefit trade-off of breaking a CD. They can assess your specific financial situation, current market trends, and future goals to determine the best course of action. They can also help calculate the true cost of the penalty and the potential benefits of reinvesting, ensuring your decisions align with your long-term financial well-being.

To help illustrate the potential cost-benefit analysis, consider the following table:

Breaking Your CD: The Real Cost-Benefit Analysis This table provides scenarios comparing the cost of paying early withdrawal penalties versus potential benefits in different situations.

| Scenario | Penalty Cost | Potential Benefit | Net Result | Recommendation |

|---|---|---|---|---|

| Rising Interest Rates | $100 | $300 increased earnings over new CD term | +$200 | Consider breaking CD |

| Emergency Expense | $150 | Avoid $500 in high-interest credit card charges | +$350 | Consider breaking CD |

| Portfolio Restructuring | $75 | Increased portfolio diversification and liquidity | Variable, depends on new investments | Consult financial advisor |

As the table shows, breaking a CD can result in a net positive outcome depending on the specific scenario. While there are costs associated with breaking a CD, the potential benefits can sometimes outweigh those costs significantly.

By carefully considering these factors and seeking professional advice, you can transform the CD early withdrawal penalty from a potential loss into a strategic financial tool. A well-informed decision is key to minimizing costs and maximizing returns.

Strategic Approaches to Avoiding CD Penalty Traps

Beyond understanding the basics of CD early withdrawal penalties, maximizing your returns requires a strategic approach. This involves not only choosing the right CD but also employing techniques that offer both attractive yields and financial flexibility.

The Power of CD Laddering

One effective strategy is CD laddering. This involves spreading your investment across several CDs with different maturity dates. For instance, you could divide your funds equally between a one-year, two-year, three-year, four-year, and five-year CD.

As each CD matures, you have the option to reinvest at the current interest rate or withdraw the funds without penalty. This creates an ongoing cycle of maturing CDs, providing regular access to a portion of your money while also taking advantage of potentially higher rates for reinvestments.

Exploring Penalty-Free Alternatives

If you want to completely avoid early withdrawal penalties, several options exist. No-penalty CDs allow you to access your funds at any time without a fee. However, they typically offer lower interest rates compared to traditional CDs. A digital banking platform might offer more flexible terms for those looking to sidestep penalties.

High-yield savings accounts, while not CDs, provide competitive interest rates and penalty-free access to your money. These are particularly valuable if you anticipate needing access to your funds before a traditional CD matures.

Negotiating Penalties and Hardship Waivers

While often overlooked, negotiating the early withdrawal penalty with your financial institution is sometimes possible. This can be especially effective if you have a long-standing relationship with the bank.

Many institutions also offer hardship waivers under certain circumstances, like job loss, medical emergencies, or natural disasters. It's always worthwhile to explore these options. While not guaranteed, they could potentially reduce or eliminate the penalty.

Building a Tiered Liquidity Strategy

Combining CDs with other savings tools creates a tiered liquidity strategy. This involves keeping some funds in easily accessible accounts like high-yield savings accounts for short-term needs, while using CDs for long-term growth.

This approach balances accessibility and growth. You'll have funds available for immediate needs while still earning higher returns on long-term investments. Think of it as having designated funds for everyday expenses and separate funds dedicated to your future.

Case Studies in Strategic CD Management

Consider John, who used CD laddering to fund his daughter’s college education. By staggering the CD maturities, he had access to funds each year without incurring penalties, efficiently covering tuition costs. Or take Sarah, who successfully negotiated a reduced early withdrawal penalty when faced with unexpected medical bills.

These examples highlight how strategic planning can help you achieve your financial goals and navigate unexpected financial challenges. By making informed decisions and planning proactively, you can minimize the impact of CD early withdrawal penalties and maximize your returns.

Finding CD Penalty Sweet Spots Across Institutions

CD early withdrawal penalties can differ significantly between financial institutions. Many investors overlook these variations when deciding where to deposit their funds. This analysis explores which institutions tend to offer better CD early withdrawal penalty structures, highlighting specific banks and credit unions with consumer-friendly approaches.

Online Banks vs. Traditional Banks vs. Credit Unions

Online banks often offer competitive interest rates and sometimes lower penalties than traditional brick-and-mortar banks. This is often attributed to lower overhead costs. Traditional banks may offer slightly lower rates but can sometimes provide more flexibility in negotiating penalties, especially for established customers. You might be interested in: How to master CD calculations. Credit unions, being member-owned, often prioritize customer service and may offer more personalized penalty structures or waivers for hardship.

It's important to remember that no single type of institution is universally better. Comparison shopping and understanding the specific terms offered by each is key.

Identifying Red Flags and Negotiation Leverage

Look for red flags like excessively long penalty periods or penalties that eat into your principal. For example, a penalty of twelve months' interest on a two-year CD can significantly impact your return. Also, be wary of institutions that don't allow partial withdrawals, forcing a complete withdrawal and a larger penalty.

You have negotiation leverage, especially if you're a valued customer or depositing a substantial sum. Don't hesitate to discuss penalty terms with the institution to explore potential flexibility.

Hidden Penalty Variations and Their Impact

Beyond the stated penalty period, other variations can affect your returns. Some institutions base penalties on the original interest rate, while others use the interest earned to date. This can significantly affect the final penalty, especially for longer-term CDs.

For instance, if you withdraw early from a five-year CD with a declining interest rate, a penalty based on the initial, higher rate will be more costly. Be sure you understand how the penalty is calculated before committing to a CD.

Examples of Consumer-Friendly CD Penalty Structures

Several institutions are known for consumer-friendly CD early withdrawal penalties. Some offer reduced penalties for specific CD terms or waive them entirely in certain situations. Others offer tiered penalties, allowing partial withdrawals with smaller penalties.

Researching these options can save you money. Some credit unions may waive penalties for seniors or those facing financial hardship. Certain online banks may offer reduced penalties for loyalty program members.

Strategic CD Placement for Optimal Returns

Understanding CD early withdrawal penalties allows you to strategically place your investments to maximize returns while minimizing risk. This empowers you to choose CDs aligned with your financial goals and risk tolerance. A favorable penalty structure provides peace of mind and flexibility.

Ready to maximize your CD earnings? Try our Certificate-of-Deposit Calculator to project your returns and compare options.