The Truth About CD Taxation: What You Need to Know

Certificates of Deposit (CDs) offer a secure and predictable path for growing your savings. But to truly maximize your returns, it's essential to grasp the tax implications. This involves understanding when and how the interest earned on your CDs is taxed. Let's address the common question: are CDs taxable?

Understanding CD Interest as Taxable Income

The interest earned on most CDs is considered taxable income. This means the interest earned is added to your other income and taxed at your ordinary income tax rate, much like your wages or salary. However, the specific rules can vary depending on the type of CD and where it's held. Understanding these nuances is key.

For example, Certificates of Deposit (CDs) issued by governments or financial institutions are generally recognized as taxable investments. In the US, interest earned on CDs held in a taxable account is subject to both federal and state income taxes, just like regular income. This differs from investments like stocks or bonds, which may be subject to capital gains taxes. In the UK, the Bank of England monitors holdings of certificates of tax deposit due to their role in tax strategies. These international variations highlight the importance of understanding the specific rules governing CDs in your region. Learn more about CD taxation.

Federal and State Tax Frameworks

CD interest is typically subject to both federal and state income taxes. Your federal tax rate depends on your total income and tax bracket. The higher your income, the higher your tax bracket, and the more tax you'll pay on your CD interest.

State tax rates, however, can differ significantly. Some states have no income tax, while others have graduated rates similar to the federal system. Understanding both federal and state tax implications is essential for accurately calculating your total tax liability. Maintaining good records of your CD interest earnings can simplify tax reporting. Careful planning and awareness of these tax implications will help you make sound decisions about your CD investments. This knowledge empowers you to choose the best CD for your financial goals while minimizing your tax burden, ultimately leading to smarter investment choices.

Navigating CD Interest Taxation: Federal and State Rules

Earning interest on your Certificates of Deposit (CDs) is a rewarding experience. However, understanding the tax implications is crucial for maximizing your returns. This involves knowing how CD interest appears on your tax return and how it affects your overall tax liability. Let's explore the essential tax forms, the impact of federal tax brackets, and the varying state tax approaches to CD interest.

Federal Taxation of CD Interest

At the federal level, CD interest is treated as ordinary income. This means it's taxed at the same rate as your wages or salary, according to your specific federal tax bracket. The higher your income, the higher your tax bracket, and consequently, the larger percentage of your CD interest goes towards taxes. For example, if you're in the 22% tax bracket, $100 of CD interest will result in $22 of federal income tax.

The interest income is reported to you and the IRS on Form 1099-INT. You'll receive this form from the financial institution holding your CD. The information on the 1099-INT is then used to complete Schedule B (Form 1040), Interest and Ordinary Dividends, which is filed with your annual tax return.

State Taxation of CD Interest: A Varied Landscape

While federal tax rules are consistent nationwide, state tax laws regarding CD interest vary significantly. Some states have no income tax at all. These states include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Residents of these states are not required to pay state taxes on their CD interest.

Other states have income tax systems, some with graduated rates similar to the federal system, while others impose a flat tax rate. For example, California's state income tax can be as high as 13.3%, while Pennsylvania has a flat rate of 3.07%. This difference underscores the importance of understanding your state's specific tax laws.

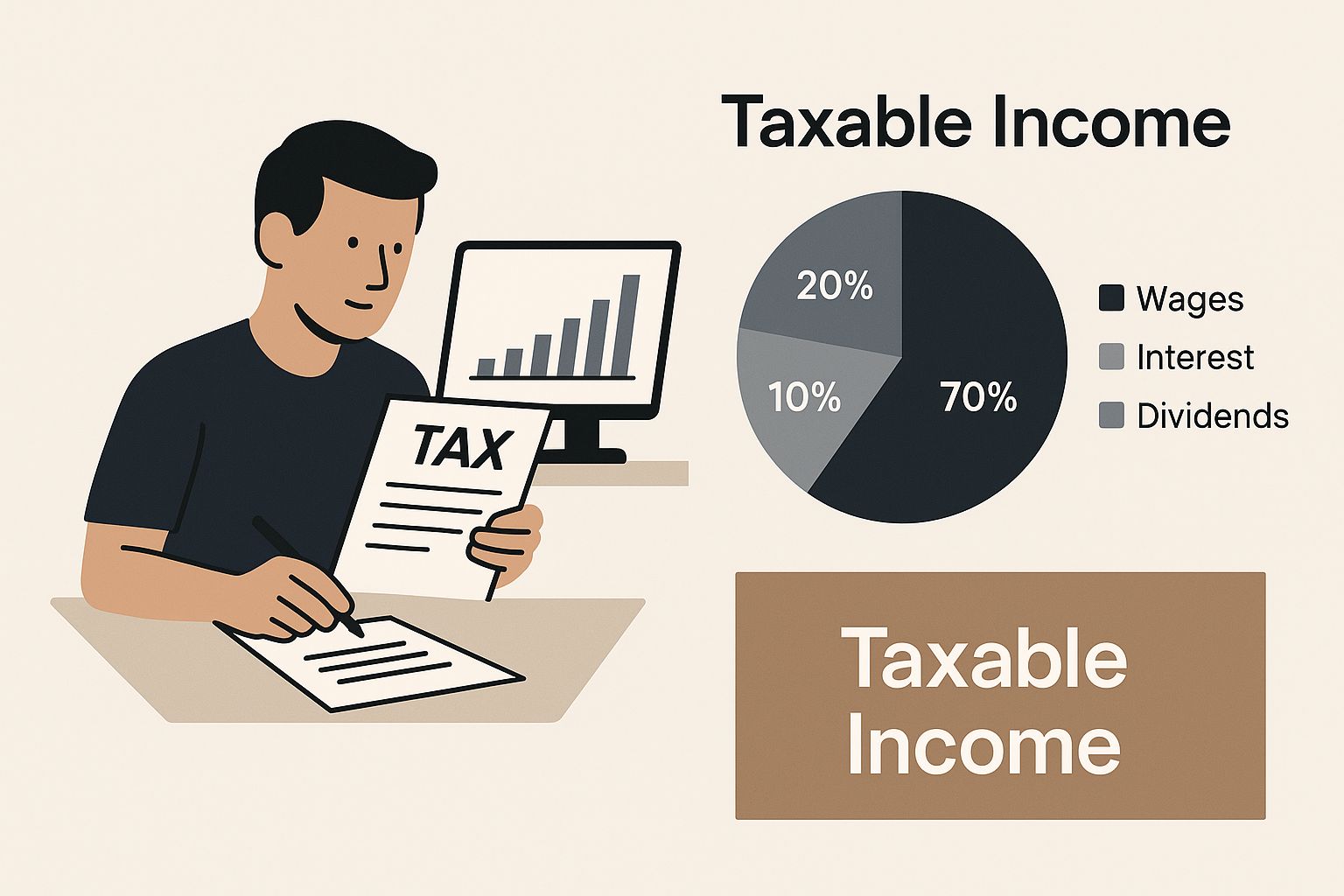

The infographic above visualizes a common tax season scenario: someone reviewing their tax forms, with an emphasis on Taxable Income. This highlights that CD interest contributes to your overall taxable income and requires accurate reporting. Understanding your taxable income is key to proper tax planning and ensures compliance with IRS regulations.

To help illustrate the varying tax treatments, let's look at a comparison table:

CD Interest Tax Treatment by Account Type This comparison table shows how CD interest is taxed differently based on where the CD is held

| Account Type | Federal Tax Treatment | State Tax Treatment | When Taxes Are Due |

|---|---|---|---|

| Standard CD | Ordinary Income | Varies by state (0% to 13.3% or more) | Annually |

| IRA CD | Tax-deferred or tax-free (Roth IRA) | Varies by state (some states may still tax at the state level) | Upon distribution (Traditional IRA) or not at all (Roth IRA) |

This table summarizes the key differences in how CD interest is taxed. Standard CDs are subject to both federal and state taxes annually, while IRA CDs offer tax advantages, with taxes either deferred or eliminated altogether depending on the IRA type.

Additionally, understanding the broader context of taxation is important. The OECD's Global Revenue Statistics Database offers valuable insights into tax revenue sources, including interest income. This database, covering 135 economies with data from 1990 onwards, reveals that personal income tax, including interest from CDs, makes up a substantial portion of total tax revenues in many countries. In the U.S., personal income tax can account for nearly half of total tax revenues. This knowledge allows for better investment and tax planning.

Being aware of both federal and state tax rules concerning CD interest is critical for accurate tax reporting and financial planning. By understanding how these taxes work, you can make informed decisions about your CD investments and ensure compliance while maximizing your after-tax returns.

Beyond the Basics: When Standard CD Tax Rules Don't Apply

While we've covered the general tax implications of Certificates of Deposit (CDs), some situations have different rules. Understanding these exceptions is important because they can significantly affect your tax liability. Let's explore these unique circumstances.

Early Withdrawal Penalties and Their Tax Impact

Early withdrawal penalties are never fun, but they do offer a surprising tax benefit. The penalty itself is deductible as an adjustment to your income on your federal tax return. So, even though you lose money due to the penalty, you can reduce your taxable income by the same amount. This helps soften the financial impact of an early withdrawal.

Zero-Coupon CDs: Understanding the Tax Nuances

Zero-coupon CDs have unique tax implications. Traditional CDs pay interest periodically, but zero-coupon CDs don't pay interest until maturity. However, you’re still taxed annually on the "phantom interest." This is the interest that accrues but isn't paid out yet. Paying taxes on income you haven't received can be confusing, so careful planning is crucial to manage this tax liability.

Inherited and Gifted CDs: Navigating the Tax Maze

Inheriting or receiving a CD as a gift changes its tax treatment. With inherited CDs, the recipient's cost basis is usually the CD's value at the time of the original owner's death. This is called a step-up in basis. Gifted CDs are different; the recipient keeps the original owner's cost basis. Knowing this distinction is vital for figuring out potential capital gains taxes at maturity.

Municipal CDs and Their Tax-Advantaged Status

Municipal CDs offer a significant tax advantage. The earned interest is often tax-free at the federal level. Depending on where you live and where the bond was issued, it might even be tax-free at the state level too. This makes them appealing to investors in higher tax brackets. For instance, buying a California municipal CD while living in California could mean avoiding both federal and state income taxes on the interest. This can result in much higher after-tax returns compared to regular CDs.

Practical Examples: Applying the Exceptional Rules

Let's look at an example. Imagine inheriting a CD worth $10,000 that originally cost $5,000. Your cost basis becomes $10,000. If you redeem the CD at maturity for $12,000, you’ll only pay capital gains tax on the $2,000 difference.

Understanding these special situations and their tax implications is essential for maximizing your CD returns and making sound financial decisions. Mastering these often-overlooked areas helps avoid unexpected tax liabilities and may uncover opportunities for tax savings. Using tools like a CD Calculator can help project potential returns and factor in tax implications for smarter investment choices.

Strategic CD Placement: Tax-Advantaged Account Options

Where you hold your CDs can significantly impact their tax treatment. This section explores the potential of sheltering your CD earnings from taxes by strategically placing them in the right accounts. We'll compare Traditional and Roth IRAs, examine employer-sponsored plans like 401(k)s and 403(b)s, and discuss the potential of HSAs and Education Savings Accounts. For each, we’ll analyze the tax advantages, withdrawal considerations, and ideal investor profiles to help you find the best tax-advantaged home for your CD investments.

Traditional vs. Roth IRAs: Weighing the Tax Benefits

Traditional IRAs offer tax-deferred growth. This means the interest your CDs earn within a Traditional IRA isn't taxed until withdrawal, typically in retirement. This allows your money to grow tax-free, compounding your returns over time. However, withdrawals in retirement are taxed as ordinary income.

Roth IRAs, conversely, are funded with after-tax dollars. You don't receive a tax deduction for contributions. However, qualified withdrawals (both contributions and earnings) are tax-free in retirement. This makes Roth IRAs attractive for younger investors who anticipate being in a higher tax bracket during retirement.

Employer-Sponsored Plans: 401(k)s and 403(b)s

Employer-sponsored retirement plans, like 401(k)s and 403(b)s, can also offer tax advantages for CD investments. Similar to Traditional IRAs, contributions are often tax-deductible, and interest earned on CDs held within the plan grows tax-deferred. Taxes are due upon withdrawal in retirement. Many employers also offer matching contributions, essentially providing "free" money towards your retirement savings.

HSAs and Education Savings Accounts: Specialized Tax Advantages

Health Savings Accounts (HSAs) and Education Savings Accounts (ESAs) offer unique tax benefits. HSAs allow you to save pre-tax dollars for qualified medical expenses. Interest earned on CDs held within an HSA is tax-free. ESAs are designed for educational expenses and offer tax-free growth and withdrawals for qualified education costs. While not exclusively for retirement, these accounts offer significant tax advantages for specific purposes.

Choosing the Right Account: Factors to Consider

Choosing the optimal account type depends on your individual financial goals, time horizon, and risk tolerance. For example, a younger investor saving for retirement might prioritize tax-free growth with a Roth IRA. An older investor nearing retirement might prefer a Traditional IRA or 401(k) for the immediate tax deductions. An investor saving for a child’s education may want to consider an ESA.

To help you understand the tax implications of each account type, let's look at a comparison table:

Tax Implications of CDs in Different Account Types This table summarizes how CD interest taxation differs across various account types, from fully taxable to tax-deferred to potentially tax-free.

| Account Type | Initial Tax Treatment | Tax on Growth | Tax on Withdrawal | Best For |

|---|---|---|---|---|

| Standard CD | Taxed annually | Taxed annually | Taxed upon maturity | Short-term goals |

| Traditional IRA | Tax-deductible contributions | Tax-deferred | Taxed upon withdrawal | Long-term retirement savings |

| Roth IRA | After-tax contributions | Tax-free | Tax-free (qualified withdrawals) | Long-term retirement savings |

| 401(k)/403(b) | Tax-deductible contributions (often) | Tax-deferred | Taxed upon withdrawal | Long-term retirement savings |

| HSA | Tax-deductible contributions | Tax-free | Tax-free (qualified medical expenses) | Medical expenses |

| ESA | After-tax contributions | Tax-free | Tax-free (qualified education expenses) | Education expenses |

As you can see, the tax implications vary significantly. By carefully considering your individual circumstances and leveraging the tax advantages of these accounts, you can maximize your returns and achieve your financial objectives. Tools like a CD Calculator can help project potential returns and factor in tax implications for smarter investment decisions. Are CDs taxable? Yes, but the specifics depend heavily on where you choose to hold them.

Mastering CD Tax Reporting: What the IRS Expects

Tax season doesn't have to be a headache for CD holders. This guide simplifies CD tax reporting with clear instructions and helpful tips. We'll explore the necessary tax forms, discuss reporting requirements, and highlight important deadlines. You'll learn how to accurately document your CD interest income, avoid common mistakes, and handle discrepancies in information from your financial institution.

Understanding Form 1099-INT

Your CD tax reporting journey begins with Form 1099-INT, Interest Income. Your bank or financial institution provides this form, detailing the interest earned on your CDs during the tax year. It includes crucial information like your account number, the total interest earned, and any early withdrawal penalties. This information is essential for accurately completing your tax return.

Completing Schedule B (Form 1040): Reporting CD Interest

Next, use the 1099-INT to complete Schedule B (Form 1040), Interest and Ordinary Dividends. This is where you report the interest from your CDs and any other interest or ordinary dividends. It's a straightforward process, but accuracy matters. Double-check the information transferred from your 1099-INT to Schedule B to avoid errors. For instance, if you hold multiple CDs, ensure the interest from each is correctly reported.

When Is CD Interest Reporting Mandatory?

Reporting your CD interest is generally required if you earn $10 or more in interest during the tax year. Even if you earn less, reporting it is a good practice. Also, any early withdrawal penalties are reportable and deductible.

Key Tax Deadlines for CD Holders

Staying on top of tax deadlines is essential. The deadline for receiving your 1099-INT is typically January 31st. The tax filing deadline is usually April 15th, unless it falls on a weekend or holiday. Missing these deadlines can result in penalties, so mark your calendar and plan accordingly.

Addressing Discrepancies: Incorrect Tax Information

Sometimes, discrepancies arise between your records and the 1099-INT information. If this happens, promptly contact your financial institution to correct the error. They'll issue a corrected 1099-INT if needed, ensuring the IRS receives accurate information and preventing potential issues with your tax return. Maintaining clear records of your CD transactions will be helpful.

Documenting CD Interest Income: Best Practices

Organized financial records simplify tax reporting. Keep all 1099-INT forms and related CD documents in a secure location, whether digital or physical. Good record-keeping makes tax time less stressful and provides valuable support if questions arise. Consider using a CD Calculator to project your potential interest earnings and plan for taxes.

By understanding these reporting requirements and following these steps, you'll be prepared to handle your CD tax obligations efficiently and accurately, making tax season less of a burden. Remember, CD interest is taxable, but with proper planning and reporting, you can optimize your returns.

CD Tax Minimization: Proven Strategies for Smarter Investing

Are CDs taxable? Yes, the interest earned on most CDs is considered taxable income. However, there are several legitimate strategies you can use to minimize your tax burden and keep more of your returns. This section reveals tested approaches to reducing your CD tax liability through savvy planning.

The Power of CD Laddering

CD laddering involves spreading your investments across CDs with varying maturity dates. This strategy offers two key advantages. First, it provides greater flexibility. When a shorter-term CD matures, you can access a portion of your funds without incurring an early withdrawal penalty on your entire investment. This allows you to strategically time withdrawals to align with lower tax brackets.

Second, staggering maturities allows you to take advantage of potentially rising interest rates. You avoid locking all your money into a lower rate for an extended period. As each CD matures, you have the opportunity to reinvest at the current, potentially higher, rate.

Timing CD Purchases for Optimal Tax Benefits

The timing of your CD purchases can also influence your tax liability. Purchasing a CD near the end of the year can defer the recognition of interest income until the following year. This can be advantageous if you anticipate being in a lower tax bracket in the coming year.

Conversely, if you expect your income to increase, consider purchasing a CD earlier in the year. This locks in your current tax rate on the interest earned. Careful planning can make a difference in your overall tax bill.

Gifting Strategies to Spread Tax Liability

Gifting CDs to family members in lower tax brackets can be a strategic way to reduce your overall tax burden. The recipient will be responsible for the tax on the interest earned, often at a lower rate than you would pay.

However, gifting limits and potential gift tax implications should be carefully considered. Consulting with a financial advisor is highly recommended before implementing this strategy. Understanding the rules and regulations surrounding gifting is crucial.

Tax-Loss Harvesting to Offset CD Interest

Tax-loss harvesting involves selling investments that have lost value to offset gains in other areas of your portfolio, including CD interest income. While this strategy primarily applies to taxable investment accounts, it can be a powerful tool to reduce your overall tax burden.

The realized losses can offset the gains from your CD interest, reducing your taxable income. This strategy can be particularly helpful in years where you have significant CD interest income.

Municipal CDs and Their Tax-Advantaged Status

Municipal CDs, issued by state and local governments, often offer tax-free interest at the federal level. In some cases, they may also be exempt from state and local taxes, depending on your residency and the issuer.

If you're in a higher tax bracket, municipal CDs can significantly enhance your after-tax returns. This is because the interest earned is not subject to federal income tax, making them a valuable addition to a diversified investment strategy.

Putting Tax Minimization Strategies to Work: A Real-World Example

Let's say you have $10,000 to invest. Instead of purchasing one long-term CD, consider creating a CD ladder. Invest $2,000 each in CDs with maturities of 1, 2, 3, 4, and 5 years.

This spreads out your maturities, allowing for flexibility and the opportunity to reinvest at potentially higher rates as each CD matures. To further minimize your tax burden, you could also consider purchasing municipal CDs for a portion of your ladder if your investment goals align with this strategy.

By implementing these strategies and utilizing resources like the Certificate of Deposit Calculator, you can make informed decisions and maximize your returns. This powerful tool helps you project potential returns, evaluate different CD offerings, and assess the impact of taxes on your investment. Start putting these tactics to work today and see the difference they can make in your investment journey.