Understanding What Really Drives Your CD Returns

Before we dive into the formulas, it’s important to get a feel for the moving parts that determine your earnings. A Certificate of Deposit (CD) isn't just a savings account with a fancy name. It's a specific agreement you make with a bank: you lock in your money for a set period, and in return, they give you a fixed, predictable return. That predictability is what makes them so attractive.

Before we dive into the formulas, it’s important to get a feel for the moving parts that determine your earnings. A Certificate of Deposit (CD) isn't just a savings account with a fancy name. It's a specific agreement you make with a bank: you lock in your money for a set period, and in return, they give you a fixed, predictable return. That predictability is what makes them so attractive.

The numbers you'll eventually plug into a calculator are shaped by a few key factors. Getting these right is the difference between a rough guess and an accurate projection of how you can calculate CD returns.

Key Drivers of Your Earnings

Knowing what these terms mean is the first practical step toward figuring out your potential profit. They are the essential inputs for any calculation you'll do.

- Annual Percentage Yield (APY): This is the most important figure to focus on. APY shows your true rate of return over a year because it includes the effect of compound interest. It’s always a more accurate yardstick than a simple interest rate.

- Term Length: This is simply how long your money is committed, which can range from a few months to several years. Traditionally, longer terms earned higher rates, but in some market conditions, that can flip.

- Compounding Frequency: This is how often the interest you've earned gets added back to your initial deposit, at which point it also starts earning interest. The more frequently interest is compounded (say, daily versus annually), the faster your money grows.

- Principal Investment: This one's straightforward—it’s the lump sum you deposit into the CD at the very beginning.

These fundamentals not only get you ready for the math but also help you select the right CD for your goals. For anyone wanting to learn more about different investment options and financial tools, checking out some broader finance discussions can provide valuable context.

The Math That Actually Matters for CD Returns

Let’s get into the part that actually makes your money grow: the calculation itself. It might look a little intense at first, but once you understand the moving parts, figuring out your future earnings becomes second nature. The core of how to calculate CD returns comes down to a standard formula that every financial institution uses.

Let’s get into the part that actually makes your money grow: the calculation itself. It might look a little intense at first, but once you understand the moving parts, figuring out your future earnings becomes second nature. The core of how to calculate CD returns comes down to a standard formula that every financial institution uses.

Cracking the CD Return Formula

The engine behind every CD is the power of compound interest. Here’s the equation that does all the work, along with what each piece means for your savings:

Future Value = Principal × (1 + (APY / n))^(n×t)

It's less complicated than it seems. Let's break it down piece by piece:

- Principal: This is your starting deposit—the cash you put into the CD on day one.

- APY (Annual Percentage Yield): This is the total interest you'll earn in a single year, which already includes the effect of compounding. Always use the APY for your calculations, not the simple interest rate.

- n (Number of Compounding Periods): This tells you how often your interest is calculated and added to your balance each year. Common options are annually (n=1), quarterly (n=4), or monthly (n=12).

- t (Term in Years): This is simply the length of your CD. For a 6-month CD, t would be 0.5. For a 2-year CD, t would be 2.

How Compounding and Term Length Work Together

The term length and compounding frequency are key because they determine how many times your interest gets to grow on itself. For instance, historical data has shown one-year CDs with a 1.92% APY and five-year CDs with a 1.29% APY. While longer terms often secure better rates, that's not always the case, making accurate math even more important for choosing the right product. You can learn more about historical CD rate trends on NerdWallet.

Let's run a quick example. Imagine you invest $5,000 in a one-year CD at 2% APY that compounds quarterly. The math would be: $5,000 × (1 + 0.02/4)^(4×1), which comes out to about $5,101. As you can see, the more frequently interest compounds, the more you stand to earn.

For those who want to get even more hands-on with these figures, we have another resource that dives deeper into this topic. Check out our guide on how to calculate CD interest. Getting comfortable with this formula gives you real control over your financial planning.

Real CD Calculations That Mirror Your Situation

Theory is a good start, but let's put it into practice with numbers that reflect real-world situations. Seeing how different scenarios play out helps you understand what small changes in rates and terms can mean for your bottom line. We’ll use a common investment amount, $10,000, to see how it performs under different conditions.

Short-Term vs. Long-Term Scenarios

Let's compare two popular choices: a short-term CD and a long-term one. The difference in earnings can be significant.

- 6-Month CD at 4.20% APY: For a shorter commitment, your future value would be $10,000 × (1 + 0.042/1)^(1×0.5). This calculation results in $10,207.85, meaning you earn $207.85 in just six months.

- 5-Year CD at 3.50% APY: If you're willing to lock in your funds for longer, the math is $10,000 × (1 + 0.035/1)^(1×5). Your final balance grows to $11,876.86, giving you a total interest of $1,876.86.

As you can see, locking in your money for a longer period, even at a slightly lower APY in this example, can produce much larger returns over the full term.

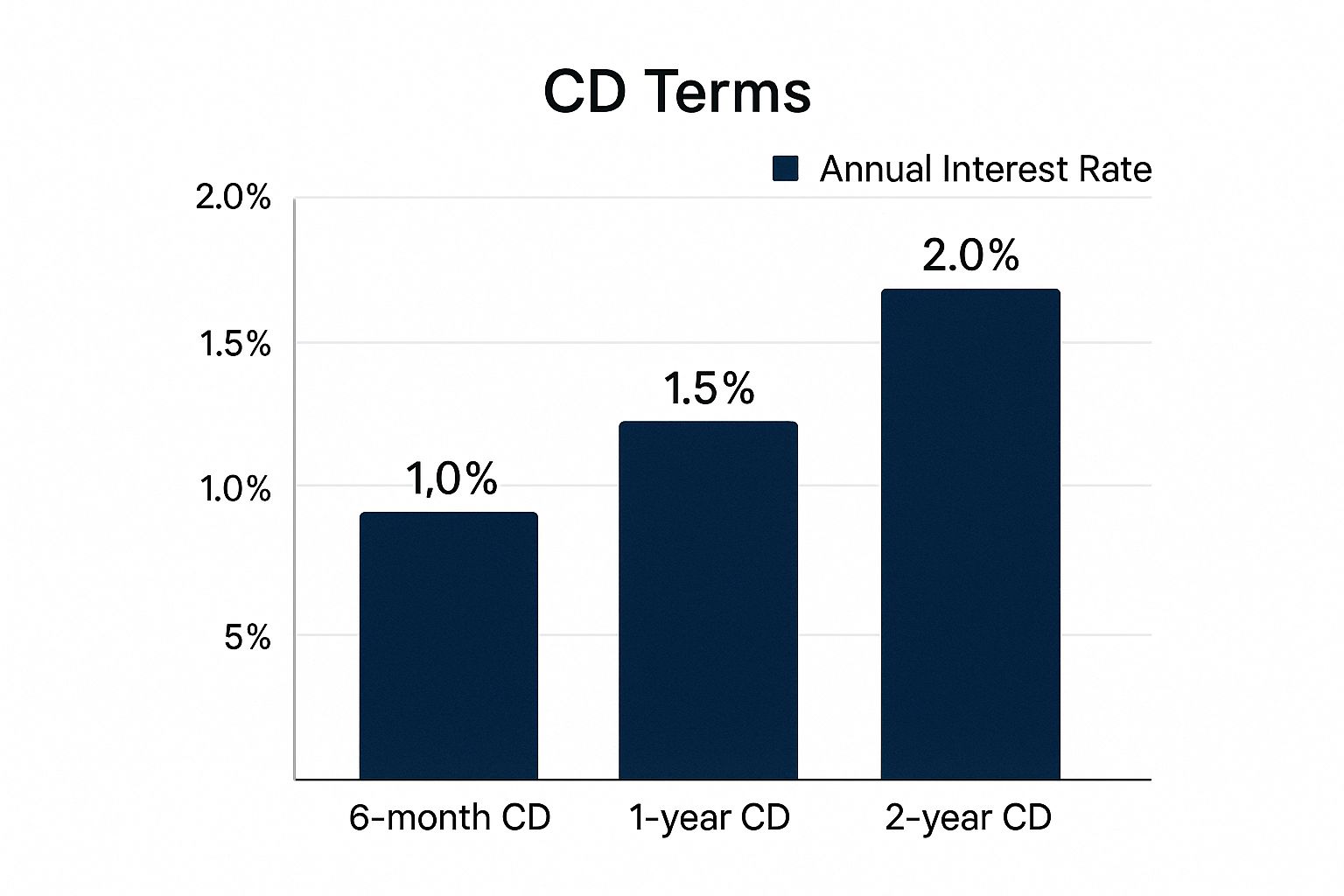

This chart shows a common trend: banks often reward you with higher interest rates for committing your funds for longer periods.

The Impact of Economic Trends

CD rates aren't set in stone; they are heavily influenced by the broader economy. During the high-inflation era of the early 1980s, it wasn't unusual to find CD rates soaring above 11% APY. In contrast, by mid-2025, a competitive one-year CD might offer around 4.40% APY after a series of federal rate adjustments. An investment of $10,000 at that rate would yield about $440 in interest for the year.

This historical fluctuation highlights why it's smart to stay aware of financial news. You can explore more about these historical rate shifts at Bankrate.com.

To give you a clearer picture of potential returns, the table below compares outcomes for a $10,000 investment across different terms and rates.

CD Return Calculations by Term and Rate

Comparison of returns for a $10,000 investment across different CD terms and APY rates

| CD Term | APY Rate | Final Value | Total Interest Earned | Monthly Interest |

|---|---|---|---|---|

| 6 Months | 4.20% | $10,207.85 | $207.85 | $34.64 |

| 1 Year | 4.40% | $10,440.00 | $440.00 | $36.67 |

| 3 Years | 3.80% | $11,182.43 | $1,182.43 | $32.85 |

| 5 Years | 3.50% | $11,876.86 | $1,876.86 | $31.28 |

Looking at the table, you can see how a higher APY over a shorter term can sometimes generate more monthly interest than a lower rate over a longer term. However, the total interest earned is greatest with the long-term CD due to the extended compounding period.

Running these scenarios gives you a practical feel for the numbers involved. For a deeper dive, check out our dedicated guide on how to calculate your CD earnings.

Making Digital Tools Work for Your CD Calculations

While it's smart to know how to run the numbers yourself, you don't have to do it by hand every time. Smart investors lean on digital tools to speed things up and avoid simple math mistakes. Think of an online CD calculator as your go-to assistant for figuring out how to calculate CD returns quickly and with confidence. They're especially useful for comparing a few different scenarios in just seconds.

Using Online Calculators Effectively

Most online CD calculators are pretty intuitive, but the accuracy of the result depends entirely on what you put in. For example, if you're comparing a 1-year and a 5-year CD, the compounding frequency is a detail you can't ignore. A CD that compounds daily will end up with a slightly higher value than one that compounds annually, even if they have the same APY.

The screenshot above shows a typical online CD calculator. You simply enter your initial deposit, the CD's term, and its APY to see your potential earnings. The best part is how these tools instantly show both the total interest earned and the final balance, saving you the trouble of manual work.

Going Beyond Basic Calculators

Online calculators are fantastic for quick checks, but if you're managing several CDs, a simple spreadsheet might be your most valuable tool. While there's specialized financial software out there, you can easily use common spreadsheet applications like Google Sheets to create your own personalized CD investment dashboard.

This gives you complete control to monitor a CD ladder, keep track of maturity dates, and calculate the total return of your entire CD portfolio in one place. Staying this organized is a game-changer when it's time to decide whether to cash out or reinvest.

The Hidden Variables That Change Everything

Calculating your CD returns isn't just about plugging numbers into a formula. Several other factors can dramatically affect what you actually earn, sometimes turning a great-looking APY into a disappointing reality. It's a bit like baking; even if you have the right recipe, small changes like the oven's actual temperature can completely alter the outcome.

To get the full picture when you're learning how to calculate CD returns, you need to account for these real-world variables.

The Real Rate of Return

The number one factor that gets overlooked is inflation. Imagine your CD is earning a solid 3% APY. If inflation for that same year hits 4%, your money is actually losing purchasing power. This is where the real rate of return comes in.

To figure it out, just subtract the inflation rate from your CD's APY. In this case, 3% - 4% gives you a -1% real return. It's a simple but crucial calculation for understanding if your investment is truly growing.

Economic Shifts and Rate Policies

CD rates don't exist in a bubble; they're heavily influenced by the Federal Reserve's decisions. When the Fed raises or lowers its key interest rate to manage the economy, banks almost always adjust their deposit rates in response.

For example, between 2022 and 2023, the Fed's aggressive campaign of 11 consecutive rate hikes sent some CD yields soaring above 6% for the first time in over a decade. But by early 2025, after the Fed began cutting rates, those same yields had cooled off, settling back into the mid-4% range. This shows that when you open your CD matters a great deal. To learn more about how these trends work, you can explore the history of CD interest rates on Investopedia.com. For a deeper dive into the economic mechanics, consider reading up on strategies for managing interest rate risk.

Before locking in your money, it helps to understand these key variables that can impact your earnings.

| Factor | Impact Level | How It Affects Returns | Calculation Adjustment |

|---|---|---|---|

| Inflation | High | Reduces the purchasing power of your earnings. A high inflation rate can lead to a negative real return. | Subtract the current inflation rate from the CD's APY to find your real rate of return. |

| Federal Reserve Policy | High | Fed rate hikes typically lead to higher CD yields, while rate cuts lead to lower yields. | There is no direct calculation, but you should time your CD purchase based on the current economic cycle. |

| Early Withdrawal Penalty | Medium to High | If you cash out before maturity, the bank will charge a penalty, usually equal to several months of interest. | Subtract the penalty amount from your projected interest earnings to see the worst-case scenario. |

| Compounding Frequency | Low to Medium | The more frequently interest is compounded (e.g., daily vs. annually), the more interest you will earn. | The APY already accounts for compounding, but a calculator can show the precise difference between frequencies. |

Ultimately, these factors determine whether your calculated return matches your real-world earnings. Factoring them into your decision ensures you're making a well-rounded choice.

The Cost of Cashing Out Early

Life is unpredictable, and sometimes you need access to your funds before a CD matures. This is where early withdrawal penalties come into play. Banks will charge a fee, often equal to a few months' worth of interest, if you break the contract.

Before you commit to a CD, always read the fine print to understand exactly what this penalty entails. Factoring this potential cost into your planning protects you from unpleasant surprises and helps keep your return calculations grounded in reality.

Proven Strategies That Boost Your Calculated Returns

Knowing how to run the numbers is a great start, but it's the right strategies that truly grow your money. Now that you understand the math behind CD returns, let's look at a few proven methods that can give your savings an extra edge while maintaining the safety you expect from a Certificate of Deposit.

Build a CD Ladder for Flexibility and Higher Rates

One of the most popular and effective strategies is CD laddering. Instead of locking up a large sum in a single CD, you split your money across several smaller CDs with staggered maturity dates. For instance, if you have $15,000 to invest, you could put $5,000 into a 1-year CD, another $5,000 into a 2-year CD, and the final $5,000 into a 3-year CD.

This approach gives you two major benefits. First, it creates liquidity. With a CD maturing every year, you get regular access to a portion of your cash without facing early withdrawal penalties. Second, it helps you manage interest rate risk. If rates rise, you can reinvest your maturing CD at the new, higher rate. If they drop, you still have your other CDs locked in at the better rates you secured previously. You can learn more about this powerful method in our complete guide to the CD ladder strategy. It’s a smart way to stay flexible and capitalize on market shifts.

Hunt for High-Yield Opportunities

Not every CD is created equal. While the national average APY for a one-year CD might be low, many online banks and credit unions offer high-yield CDs with significantly better rates. These institutions typically have lower overhead costs, which means they can pass those savings on to you as higher returns.

Don’t just settle for what your local brick-and-mortar bank offers. A little bit of shopping around can uncover rates that are a full percentage point higher—a difference that really adds up over the term of the CD. Just make sure any institution you choose is FDIC-insured (or NCUA-insured for credit unions) to keep your principal safe.

Time Your Purchase and Negotiate

A little strategic timing and a quick conversation can sometimes boost your earnings. Pay attention to economic news. When you hear talk that the Federal Reserve might raise interest rates, it could be smart to wait a bit before locking in a long-term CD. On the other hand, if rates are expected to fall, securing a good rate sooner is probably the better move. And remember, it never hurts to ask for a better rate, especially if you have a larger deposit or a long-standing relationship with your bank. A simple question about a "relationship" rate could make a difference.

Ready to see how these strategies could work for your money? Use our Certificate-of-Deposit Calculator to model different scenarios, compare rates, and find the perfect CD to meet your financial goals.