What Really Drives Your CD Earnings (Beyond The Advertised Rate)

So, you're thinking about CDs and want to figure out the real return. You've seen those advertised APY rates, of course. But let me tell you, after working with CD investors for years, there's more to the story than just that shiny number. The real magic happens when you understand the details.

The frequency of compounding, for example, can make a surprising difference. A 4.5% APY might seem better than 4.3%, but if the 4.3% CD compounds monthly instead of quarterly, you're actually earning interest on your interest more often. Over time, this can add up to a significant amount. I've seen a $10,000 CD earn hundreds more over five years thanks to more frequent compounding, even with a slightly lower APY.

Minimum deposit requirements also play a role. Sometimes, banks offer higher APYs for larger deposits. You might find a 4.2% APY for a $5,000 CD, while another bank offers 4.4% for $10,000 or more. If you can meet the higher deposit requirement, the extra return is worth considering. The Federal Reserve also has a significant impact on CD rates. Historically, these rates have fluctuated greatly, influenced by the Fed's policies. For more information, you can explore historical CD rates on Bankrate.

Then there are promotional rates. These can be great, offering a tempting introductory rate. But it's crucial to understand what happens after the promotional period ends. Does the rate adjust to a competitive market rate, or does it drop significantly? Knowing this is essential for accurate calculations and avoiding surprises down the road.

These are just a few of the things that go beyond the simple advertised rate when it comes to CD earnings. It’s all about looking at the bigger picture.

Getting Real Results From Online CD Calculators

Let's talk about CD calculators. Most people just grab the first one they see, plug in numbers, and call it a day. But after trying out a ton of them, I can tell you that's not the best way to go about it. You could be missing out on some serious earnings. The real trick is finding a good calculator and understanding how to use it properly.

Speaking of which, you might find this helpful: our comprehensive CD calculator

I've found that some smaller credit unions and banks actually have surprisingly good calculators, while some of the big banks' calculators are a bit lacking. One key thing to watch out for is knowing exactly what each field is asking for. Is it the APY (Annual Percentage Yield) or the stated interest rate? Is the compounding frequency already built into the APY, or do you need to specify it separately? Those little details can make a big difference in your results.

This screenshot shows a typical CD calculator. You'll see separate fields for your initial deposit, the interest rate, and the term length. The results usually show the total interest earned and your final balance. This visual breakdown makes it easy to see how your money will grow.

My advice? Always cross-reference. Don't rely on just one calculator, especially if you're looking at promotional rates or unusual compounding schedules. I like to compare results from a few different places—major banks, credit unions, and independent financial sites. That way, you can spot any red flags that might suggest a calculator is giving you overly optimistic numbers. Nobody wants a bad surprise when their CD matures!

And if you really want to be thorough, learning how to calculate CD earnings manually is the best way to double-check those online results. It gives you a solid baseline to compare against.

Calculate CD Earnings By Hand (When You Need To Be Sure)

Sometimes, you just want to know exactly what's going on behind the scenes with your money. Maybe you’re double-checking that online CD calculator or dealing with a CD that has some unusual terms. Either way, figuring out CD earnings yourself is a handy skill. And honestly, it's not nearly as complicated as it might seem.

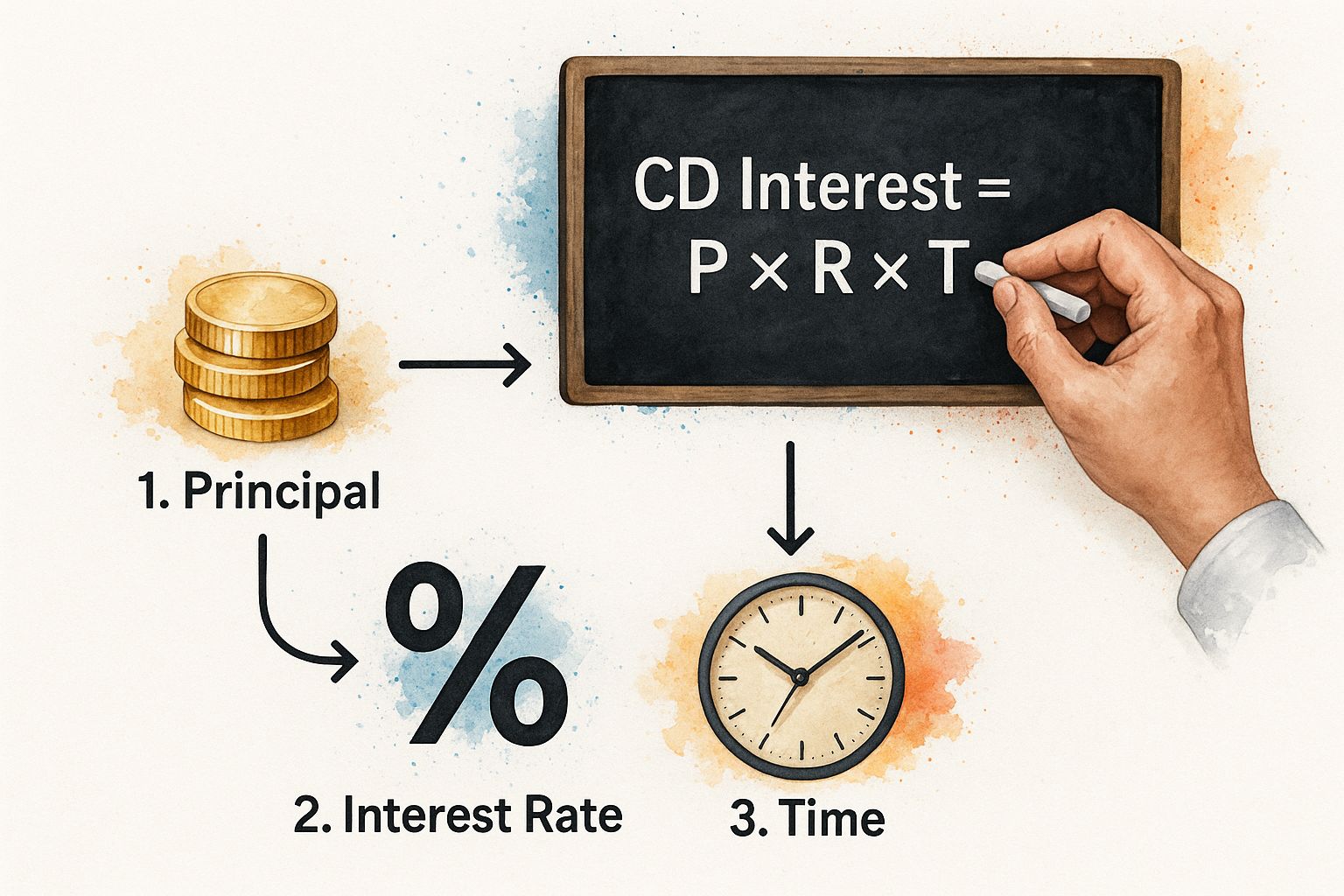

This infographic gives you a nice visual breakdown of how the CD interest calculation works. Seeing those coins, the percentage sign, and the clock all together really helps drive home how these factors combine to determine your earnings.

Simple Interest

Let's start with the basics: simple interest. While it’s not the most common way CDs calculate interest, it’s the easiest to understand and a good foundation to build on. The formula is simple: Principal x Rate x Time. So, imagine you have a $5,000 CD earning 2% simple interest for one year. Your interest would be $5,000 x 0.02 x 1 = $100. Easy peasy.

Compound Interest

Most CDs use compound interest. This means you earn interest on your original principal plus any interest you've already earned. Think of it as a snowball effect! The formula is a bit more complex: A = P (1 + r/n)^(nt). Don’t worry, it’s not that scary.

- A is your final amount.

- P is the principal (your initial deposit).

- r is the annual interest rate (expressed as a decimal).

- n is how many times the interest compounds per year (e.g., quarterly is 4, monthly is 12).

- t is the number of years the money is invested.

Let's say you have a $25,000 CD at 4% interest, compounded quarterly, for two years. The calculation would be: A = $25,000 (1 + 0.04/4)^(4*2) = $27,060.50 (approximately).

Comparing and Calculating in Real-World Scenarios

Just like you’d compare different options when using online CD calculators, or when looking for something like online vehicle insurance UAE, you need to compare different CD options. Now, things get a little trickier with promotional rates or changing interest rates. Let’s say you have a $50,000 CD with a promotional 5% rate for the first year, dropping to 3% for the following two years, compounded annually.

You have to break it down year by year. Year one: $50,000 x 0.05 = $2,500 in interest. Your new principal for year two is $52,500. To calculate the rest, check out this helpful guide: how to calculate CD interest. It walks you through those next steps. The key takeaway here is to break complex scenarios into smaller, manageable chunks.

Let's look at some examples to illustrate how term length impacts your CD earnings. The following table compares different CD terms using a $10,000 deposit and a 5% APY.

CD Interest Calculation Examples by Term Length Comparison of earnings calculations for different CD terms using a $10,000 deposit at 5% APY

| CD Term | Interest Type | Calculation Method | Total Earnings | Final Balance |

|---|---|---|---|---|

| 1 Year | Compound | Annual | $500.00 | $10,500.00 |

| 2 Years | Compound | Annual | $1,025.00 | $11,025.00 |

| 5 Years | Compound | Annual | $2,762.82 | $12,762.82 |

As you can see, the longer the term, the greater your total earnings, thanks to the magic of compound interest. This table makes it clear how time plays a crucial role in your CD returns.

Real-World CD Situations That Test Your Skills

Okay, so we've talked about the basics of calculating CD earnings, both with online calculators and by hand. But let's be real, life rarely goes exactly as planned. Let's look at a few scenarios that might not fit perfectly into those neat calculator boxes. Believe me, I’ve seen these situations trip people up, so let's get ahead of the curve.

Bump-Up CDs

Bump-up CDs sound fantastic, right? You get to increase your interest rate if rates climb higher. However, you’ve got to pay attention to the fine print. How often are you allowed to bump up the rate? Is there a limit to how many bumps you can get? And, importantly, what determines that new rate? Let's say you snag a 1-year bump-up CD at 3%, and six months later, rates jump to 4%. Can you bump? If so, your calculations for the remaining six months need to use that shiny new 4% rate. This means calculating the earnings from each period individually and then adding them together.

No-Penalty CDs

No-penalty CDs offer a lot of flexibility, letting you withdraw early without the typical penalty. But here's the catch: they often start with lower interest rates. The real trick is comparing what you could earn with a standard CD. Sometimes the difference isn’t as dramatic as you’d expect, and having that easy access to your cash might be worth it.

Jumbo CDs

Jumbo CDs usually require a hefty deposit, often $100,000 or more, and sometimes come with special promotional periods. These promotions tend to be short-term and quite tempting, but you absolutely must know what happens when the party's over. The rate can take a nosedive, impacting your long-term earnings. Don't be fooled by that initial high rate; calculate your potential earnings over the entire term, factoring in the post-promotional rate.

Early Withdrawal Penalties

Let’s face it, sometimes you need to break a CD early. Life happens. The penalty is usually a certain number of months' worth of interest. Here's the important bit: the penalty isn't just calculated on the interest you've earned; it can be based on your principal. Imagine a $10,000 CD with a 6-month interest penalty. You could lose a substantial chunk of your principal even if you haven't earned that much interest yet. Always crunch the numbers before you break a CD, and don't forget to factor in taxes, too.

Add-On and Variable-Rate CDs

Add-on CDs are a cool feature because they let you make additional deposits. This is a great way to boost your savings! Just remember to recalculate your earnings after each deposit, considering your new balance and the remaining term. Then there are variable-rate CDs, where the rate changes periodically, based on an index. Your calculations need to account for these ups and downs. It’s not as simple as plugging in one rate and calling it a day.

Tax Implications

Let’s not forget about taxes. The interest you earn on CDs is taxable. When calculating your CD earnings, remember you're looking at your gross return, not your net return. The amount you’ll actually have after taxes will be smaller. Keep this in mind when comparing CDs to other investment options.

By understanding these real-world scenarios and mastering the calculations, you'll be well-equipped to make informed CD decisions, no matter how complicated they seem. The goal is optimizing your actual take-home returns, not just chasing the highest advertised rate.

Smart CD Shopping Using Your Calculation Skills

Now that you've got a handle on calculating CD earnings, let's talk strategy. Finding the best CD isn't just about chasing the highest rate. It's about maximizing your actual return based on your specific financial goals. Just like getting your ducks in a row for a mortgage, having your financial documents organized is key. A helpful resource I often recommend is this home loan document checklist.

Comparing Apples to Apples (and Oranges)

Let's be honest, comparing CDs can feel overwhelming. You've got brick-and-mortar banks, credit unions with their membership requirements, and then the whole world of online banks. How do you even start?

First things first: FDIC insurance. You absolutely want to ensure your deposits are protected up to $250,000 per depositor, per insured bank, for each account ownership category. This is non-negotiable.

Then, think about what kind of banking experience you prefer. Do you value face-to-face interactions at a local branch? Or are you happy managing everything online? Customer service is a personal preference, but it definitely impacts your overall experience. Don't forget to check those renewal policies too. What happens when your CD matures? Does it automatically renew, or do you have to manually reinvest?

The Liquidity Factor: Short vs. Long Terms

One of the biggest decisions you'll face is choosing the right term length. Shorter terms give you more liquidity – you can access your money sooner. Longer terms typically offer juicier rates, but you're locked in for a while.

Here's a real-world scenario: imagine you have $10,000 to invest. A 6-month CD might offer 4%, while a 5-year CD offers 5%. That 5-year CD has a higher rate, but you're committing for five years. The 6-month CD offers less interest, but you can reinvest at a potentially higher rate in just six months if rates climb. This balance between liquidity and return is the core of every CD decision.

Decoding Promotional Rates

Those flashy promotional rates can be tempting, right? But remember, they're temporary. Always read the fine print to see when the promotional period ends and what the regular rate will be. I've seen promotional rates drop significantly after the initial period, negating any extra earnings. Make sure you calculate your earnings over the entire term, not just the promotional period.

Let's take a look at a few different CD options to illustrate these points.

CD Comparison Analysis

Side-by-side comparison of different CD options showing calculated earnings over various time periods

| Bank/Credit Union | Term | APY | Minimum Deposit | 6-Month Earnings | 1-Year Earnings | Total Return |

|---|---|---|---|---|---|---|

| Example Bank A | 6 months | 4.00% | $1,000 | $200 | N/A | $1,0200 |

| Example Bank B | 1 year | 4.50% | $500 | N/A | $450 | $1,0450 |

| Example Credit Union C | 5 years | 5.00% | $2,500 | N/A | N/A | $1,2500 (after 5 years) |

As you can see, even small differences in APY and term length can significantly impact your total return. Choosing the right CD depends on your individual circumstances and financial goals.

Small Differences, Big Impact

When comparing CDs, pay attention to the details. Even a 0.1% difference in APY can add up, especially on larger deposits. Similarly, different compounding frequencies can lead to surprisingly different results. By carefully calculating your potential earnings across various scenarios, you'll be able to pinpoint the CD that truly maximizes your returns.

Advanced Strategies For Maximizing CD Returns

Ready to level up your CD game? Let's dive into some smart strategies that can really boost your returns. These aren't just textbook theories; they're tactics I've seen work firsthand.

CD Laddering: Keeping It Simple

CD laddering gets a reputation for being complicated, but it's really quite straightforward. Think of it like building a staircase with your CDs, each step representing a CD with a different maturity date. This setup gives you regular access to some of your cash while still letting you snag those potentially higher rates that come with longer-term CDs.

Let's say you have $15,000 ready to invest. Instead of locking it all away in a single 5-year CD, you could split it into five separate $3,000 CDs. Set these up to mature after 1, 2, 3, 4, and 5 years, respectively. As each CD matures, you can reinvest the money at the current rate, which hopefully will be higher than before. This way, you can benefit from rising interest rates over time. Figuring out your total return means projecting the earnings for each CD individually and considering the likely rates when you reinvest. It takes a little more effort upfront, but it can really pay off. You might also want to check out how often CDs compound, since that directly impacts your ladder's overall return.

Keeping an Eye on the Economy

Savvy CD investors keep their finger on the pulse of the economy. Things like Federal Reserve meetings, inflation reports, and other economic indicators can hint at potential rate changes. While no one can predict the future perfectly, understanding these trends can help you time your CD purchases strategically. If you think rates are about to climb, you might hold off on investing some of your money to lock in those higher rates later. Calculating the potential gain from waiting involves comparing what you'd earn at the current rate versus what you could earn at a higher future rate. It's a bit of a calculated risk, but it can make a real difference if you get the timing right.

The Barbell Strategy and Breaking CDs

The “barbell” strategy is all about balance. You hold both short-term and long-term CDs, giving you both easy access to some of your money and the higher returns that come with longer-term commitments. You could put 70% of your funds into longer-term CDs for maximum yield and keep the remaining 30% in shorter-term CDs for flexibility. Finding the right balance involves weighing your need for liquidity against your desire for higher returns. If you need a bank that accepts an ITIN for your CD investments, here are some banks that accept ITIN.

Sometimes, it might actually be a good move to break an existing CD, even with the penalty. This can be especially true if rates have jumped up significantly since you opened the CD. Figure out the break-even point – the rate at which a new CD, even after the early withdrawal penalty, will earn more than your current CD. This calculation helps you decide if breaking the CD and reinvesting at a higher rate is worth the penalty.

Reinvestment Risk and Opportunity Cost

Finally, there are two important concepts to keep in mind: reinvestment risk and opportunity cost. Reinvestment risk is the chance that when your CD matures, you'll have to reinvest at a lower rate. Laddering helps minimize this risk. Opportunity cost is the potential return you're missing out on by tying up your money in a CD. Calculating this involves comparing the guaranteed CD return to the potential return (and risk) of other investments. By understanding these advanced strategies, along with how to accurately calculate CD earnings, you'll be well-equipped to make smart decisions and maximize your returns, no matter what the market is doing.

Your CD Mastery Action Plan

Now that you've got a handle on calculating CD earnings, let's map out a plan. Think of this as your personal guide to navigating the CD world – the same kind of advice I'd give a friend or family member.

Evaluating CD Opportunities: Key Questions

Before you even think about calculators, take a moment to consider your own needs. It's like choosing the right tool for a job – you need to know what you're building first.

- What are your financial goals? Saving for a down payment is different from building a retirement nest egg. Your goals will determine the CD term that's right for you.

- What's your risk tolerance? CDs are generally low-risk, but locking your money away for a longer term means less flexibility. How comfortable are you with that?

- What are current market conditions? Are interest rates trending up, down, or sideways? This can impact your timing.

My Personal CD Checklist

I've been through this process many times, and I've developed a checklist to help me compare different CDs. Here's what I look at:

- APY: Higher is obviously better, but don't get blinded by the biggest number. Consider the whole picture.

- Term Length: Longer terms usually mean higher rates, but shorter terms offer more flexibility. It's a trade-off.

- Compounding Frequency: More frequent compounding is like getting tiny bonuses more often. It adds up!

- Minimum Deposit: Make sure you can comfortably meet the minimum deposit without straining your finances.

- Early Withdrawal Penalties: Life happens. Know what it will cost if you need to access your money early.

- Renewal Policy: What happens when your CD matures? Will it automatically renew, or do you need to take action?

Timing the Market (Smartly)

Look, nobody has a crystal ball. But keeping an eye on the Federal Reserve and economic news can give you some clues about where interest rates might be going. Sites like Bankrate are great for seeing historical rate trends. If you think rates are about to jump, you might hold off for a bit.

Avoiding Costly Mistakes

I've seen people make these calculation errors, so I want to help you avoid them:

- Forgetting about compounding: Most CDs use compound interest, not simple interest. Make sure you're using the right formula.

- Misinterpreting APY: The APY includes the effects of compounding, while the stated interest rate doesn't. Use the APY for your calculations.

- Ignoring promotional periods: Some CDs offer a great rate for a short time, then a lower rate after. Calculate your earnings over the entire term.

Verification is Key

Double-check everything! Use a few different online calculators, and if you're up for it, do the math yourself. This helps catch errors and avoid surprises later.

Building Relationships for Insider Tips

Here's a little secret: Get to know your banker. They often know about special promotional rates before they're announced publicly. A little inside knowledge can go a long way!

Ready to get started? Our Certificate-of-Deposit Calculator makes it easy to see your potential returns and make smart choices.