Understanding CD Taxes Without The Confusion

Understanding how taxes apply to your Certificate of Deposit (CD) earnings can be tricky. This section clarifies when you owe taxes on those earnings and how they affect your overall return. A key concept is the difference between when interest is earned and when it is paid.

Your CD earns interest continuously, but the actual payment might be deferred until maturity, based on the CD's terms. This seemingly small detail has significant tax implications.

For example, with a 5-year CD, even without annual interest payments, you owe taxes on the interest accrued each year. Even though you haven't received the money, the IRS considers it earned income. This can catch investors off guard. The forms you'll receive (typically a 1099-INT) will reflect this accrued interest for accurate tax filing. You might be interested in: Are CDs Taxable?

Tax Implications of Early Withdrawals

Another important aspect of CD taxes involves early withdrawal penalties. While penalties reduce your overall return, they can sometimes offer a tax benefit.

If you incur a penalty for withdrawing early, this penalty can often be deducted from your total interest earned for tax purposes. This effectively lowers your taxable income, potentially reducing your tax bill. However, it's important to weigh the penalty's impact on your principal against any potential tax savings.

It's important to remember that CD taxation isn't just a federal issue. State taxes also apply and can affect your overall return. Corporate tax rates, while not directly related to CD taxes, offer a helpful comparison for how regional variations create different outcomes.

Corporate tax rates differ significantly globally. Some European countries have rates as high as 35%, while others are as low as 12.5%. The United States averages around 25.6%, while Asian nations like Singapore offer a competitive 17%. These differences reflect different government economic strategies. Learn more about corporate tax rates.

Understanding your state's tax laws is essential for calculating your true after-tax CD returns. This helps you make informed investment decisions.

How CD Interest Impacts Your Overall Tax Picture

Your CD earnings don't just sit idly by; they become part of your overall income, affecting your total tax liability. This can have unexpected consequences depending on your personal finances. Let's explore how CD interest interacts with other income sources and how planning can make a difference.

Considering Your Total Income

CD interest is classified as income, adding to your total taxable income each year. This means if you have substantial income from other avenues, the interest from your CDs could bump you into a higher tax bracket. For example, if you're already near the upper limit of your current bracket, a large CD payout could significantly increase your tax bill. However, if your other income is relatively low, the impact of CD interest might be negligible.

Timing CD Maturities Strategically

One effective strategy for managing taxes is to strategically time your CD maturities. Instead of all your CDs maturing in a single year, consider staggering them. This spreads the interest income over several years, potentially avoiding a large increase in taxable income all at once. This is particularly helpful if you expect changes to your income or tax bracket in the future.

Tax-Efficient CD Strategies

Sometimes, a slightly lower interest rate on a CD can be more beneficial long-term if it aligns with your tax planning. For example, a CD with a slightly lower APY might offer a more advantageous maturity date based on your projected tax liability. This approach prioritizes minimizing your total tax burden, rather than simply maximizing interest.

Planning for Long-Term CDs

Before committing to longer-term CDs, it's crucial to project their potential tax impact. Carefully considering the maturity date alongside your projected income from other sources helps you make informed decisions. This proactive approach can save you money by avoiding unforeseen tax implications. A CD Calculator can be a useful tool for projecting potential returns and factoring in potential taxes.

Thinking strategically about CD taxes isn't just about minimizing what you owe now—it's about maximizing your after-tax returns over the life of your investments. By understanding how CD interest affects your overall tax picture, you can make smarter financial decisions that contribute to your long-term goals.

Smart Account Strategies That Actually Save You Money

Where you hold your Certificates of Deposit (CDs) can significantly impact your after-tax returns. Many investors overlook these opportunities, missing out on potential savings. This section reveals how strategic investors use different account types to minimize their CD tax burden and maximize growth.

CDs in Tax-Advantaged Accounts

Savvy investors often use tax-advantaged accounts like Traditional IRAs and Roth IRAs to shield their CD interest from taxes. Traditional IRAs offer tax-deductible contributions, reducing your current taxable income. However, withdrawals in retirement are taxed.

Conversely, Roth IRA contributions aren't deductible, but qualified withdrawals, including interest earned, are tax-free in retirement. This can be particularly advantageous for long-term CD investments.

CDs in Taxable Accounts

Holding CDs in a regular taxable brokerage account means you'll owe taxes on the interest earned annually, even if it's not distributed until maturity. This can impact your overall return, especially for longer-term CDs.

However, taxable accounts offer greater flexibility for accessing your funds without penalties before retirement.

Choosing the Right Account for Your Strategy

The optimal account type depends on your individual circumstances and financial goals. For example, if you anticipate being in a lower tax bracket in retirement, a Roth IRA might be more beneficial for your CD investments.

Conversely, if you're in a high tax bracket now and expect to be in a lower one during retirement, a Traditional IRA might be more suitable.

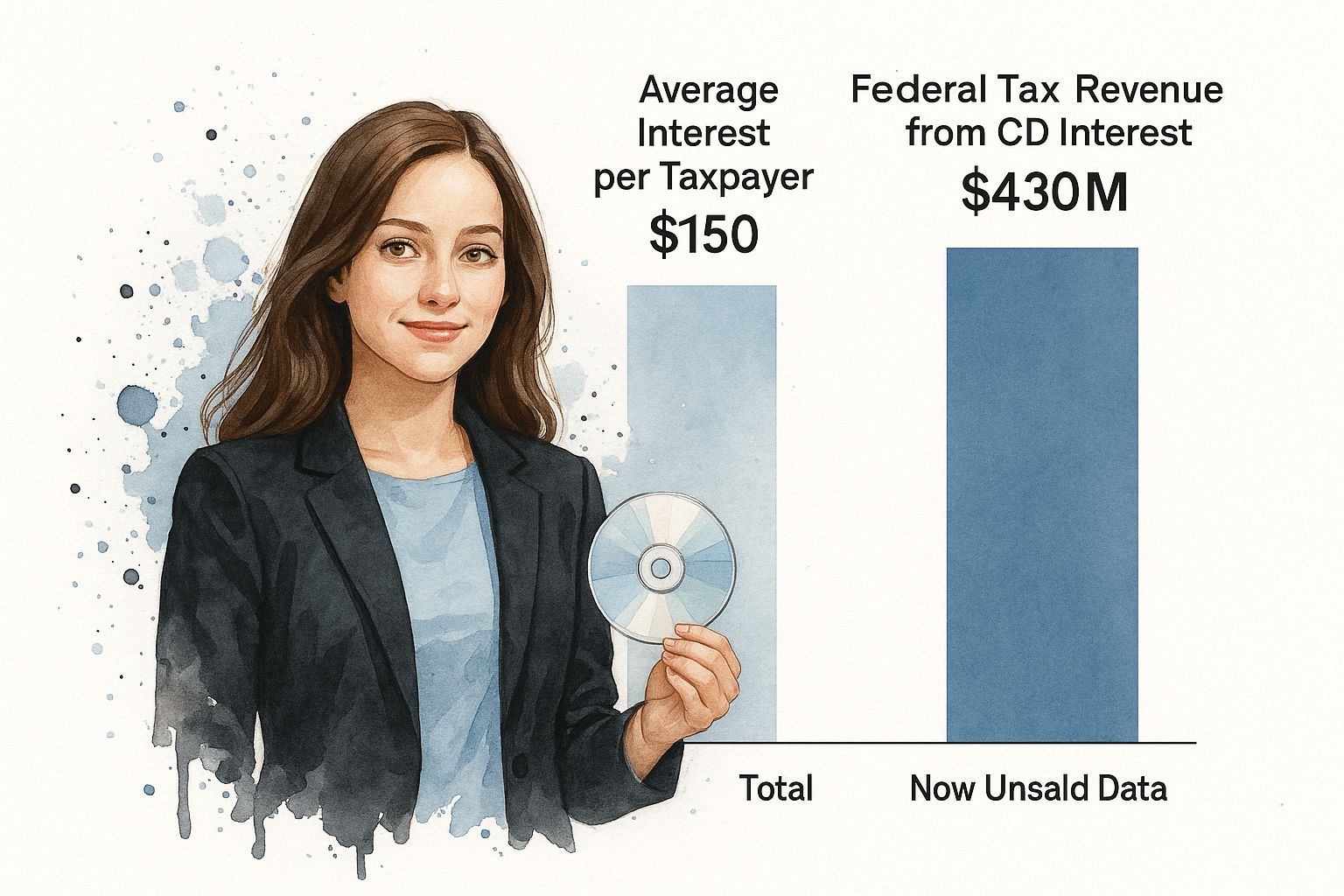

To help visualize the impact of CD taxes, let's look at some data. The infographic below shows the number of taxpayers reporting CD interest, the average interest earned, and the resulting federal tax revenue.

With 20 million taxpayers reporting CD interest, and an average of $150 in interest per taxpayer, the federal government collects approximately $430 million in tax revenue from CD interest. This highlights the significant impact of CD taxes.

The following table summarizes the tax treatment of CDs across different account types. It provides a clear comparison to help you choose the best strategy for your financial goals.

CD Tax Treatment by Account Type

| Account Type | Current Tax Treatment | Withdrawal Tax Rules | Best Use Case |

|---|---|---|---|

| Taxable Brokerage Account | Taxes paid annually on interest earned | No penalty for withdrawals of principal and interest after maturity; penalties may apply for early withdrawals | Flexibility to access funds before retirement |

| Traditional IRA | Tax-deductible contributions; tax-deferred growth | Taxes paid upon withdrawal in retirement | Reduce current taxable income; suitable for those expecting to be in a lower tax bracket in retirement |

| Roth IRA | No tax deduction for contributions; tax-free growth | Qualified withdrawals are tax-free in retirement | Tax-free withdrawals in retirement; suitable for those expecting to be in a higher tax bracket in retirement |

This table clarifies the key differences in how CD interest is taxed and when withdrawals are taxed. Understanding these distinctions is vital for making informed investment decisions.

Coordinating With Retirement Planning

It's crucial to coordinate your CD investments with your broader retirement plan. CDs can provide a stable, predictable income stream during retirement, but they shouldn't be your only investment.

Diversifying your portfolio with a mix of stocks, bonds, and other assets can help manage risk and maximize your overall returns.

Common Mistakes to Avoid

One common mistake is failing to consider the tax implications of CD placement. Another is focusing solely on the interest rate without evaluating the tax implications of different account types.

By understanding how CD taxes work within various account structures, you can make more informed decisions and potentially save significant money over the long term. Use our CD Calculator to explore different scenarios and determine the best strategy for your situation.

Navigating State Taxes On Your CD Investments

While most conversations about CD taxes revolve around federal taxes, state taxes can also play a significant role in your actual returns. Depending on where you live, these state taxes can either reduce your earnings or offer valuable opportunities. This means understanding your state's approach to CD interest is critical for maximizing your investment.

Understanding State Tax Structures and CDs

Each state has its own unique tax structure. Some states, like Alaska, Delaware, Montana, New Hampshire, and Oregon, have no income tax. This generally means CD interest earned by residents of these states isn't subject to state tax. However, most other states do tax interest income, although the rates and rules vary significantly.

Some states have a flat income tax rate, while others use a graduated system, where higher income leads to higher tax rates. This means that if you live in a state with a graduated income tax, your CD interest might be taxed at different rates based on your total income. Some states also offer specific deductions or credits that can lessen the state tax burden on CD interest, making it important to understand your state's specific rules.

State Residency and CD Taxation

The state where you live usually determines which state taxes apply to your CD income. This means that if you move from a high-tax state to a no-tax state, you might benefit from reduced tax obligations on your existing CDs. Conversely, moving from a no-tax state to a high-tax state could increase your tax burden. Understanding these implications is important for making informed decisions.

Also, consider the location of the bank issuing your CD. While your state of residency usually determines the tax liability, some complications can arise with out-of-state banks. It’s always wise to consult with a tax professional for personalized advice, especially if you hold CDs from institutions outside your state. The broader financial landscape also varies regionally. The global average corporate income tax rate has decreased over the past few decades. As of 2024, this rate stood at approximately 23.51% across 181 jurisdictions. This decline is worth noting, as the average has plateaued in recent years. Learn more here.

Strategies for Minimizing State Tax Burden

Several strategies can help reduce state tax burdens on your CD interest. One effective method is using tax-advantaged retirement accounts like Traditional or Roth IRAs. These accounts allow your CD interest to grow either tax-deferred or tax-free, depending on the account type.

Another strategy is exploring state-specific tax deductions or credits. Some states provide deductions for certain investments or for taxpayers meeting specific criteria. These deductions could potentially reduce the amount of CD interest subject to state tax. For example, some states offer credits for retirement savings contributions, which could indirectly benefit CD investors.

Practical Tips for CD Investors

When considering a CD investment, factor in potential state taxes to determine your true after-tax return. A CD Calculator can help you project your earnings and understand the effect of both federal and state taxes. This allows you to make well-informed decisions based on your personal situation.

Keeping good records of your CD purchases, interest earned, and any state-specific deductions or credits is also crucial. This organized approach simplifies tax preparation and ensures you're claiming all applicable deductions and credits, ultimately maximizing your investment returns.

Early Withdrawal Penalties And Hidden Tax Benefits

Breaking a CD before it matures often comes with an early withdrawal penalty. This penalty, usually a certain number of months' interest, can significantly impact your returns. However, the tax implications of CDs can sometimes create surprising advantages. Let's explore how the IRS handles these situations and how you might benefit.

Understanding IRS Treatment of Early Withdrawal Penalties

The IRS allows you to deduct the early withdrawal penalty from the interest earned on your CD for that year. For example, if you earned $500 in interest but paid a $100 penalty, your taxable interest is reduced to $400. This directly lowers your taxable income.

This deduction can be particularly beneficial if it moves you into a lower tax bracket or reduces your tax liability within your current bracket. While you lose some of your initial return to the penalty, the reduced tax burden softens the financial impact. You can learn more about this at: CD Early Withdrawal Penalty

Calculating the True Cost of Early Withdrawal

To fully grasp the impact of breaking your CD, consider both the penalty and its tax implications. Calculate your net loss after factoring in tax savings. A $100 penalty might reduce your taxes by $20 (depending on your tax bracket), resulting in a net loss of $80, not the full $100.

Reporting Early Withdrawals on Your Tax Return

Accurate reporting of earned interest and penalties incurred is crucial for tax filing. This information is typically on the 1099-INT form from your bank. The penalty is reported as an adjustment to income, lowering your taxable interest.

Offsetting Other Investment Income

Another potential advantage is offsetting other investment income with the penalty deduction. If you have capital gains from selling stocks, the CD penalty deduction can reduce your net investment income, and your overall tax burden.

Minimizing the Financial Impact

While early withdrawals are generally best avoided, unexpected situations can necessitate them. Understanding the tax benefits associated with early withdrawal penalties can minimize the financial impact. Consult a tax advisor or use a CD Calculator for accurate cost assessment and strategy optimization. Careful planning and reporting can significantly affect your final return.

CD Tax Strategies For Every Stage Of Life

Your approach to CD taxes should adapt as your life changes. Smart investors adjust their strategies to align with their evolving financial goals and circumstances. This section explores tailored approaches for various life stages, from young professionals to retirees.

Young Professionals and CD Taxes

For young professionals, CDs can be a valuable tool for establishing an emergency fund or saving for a down payment on a house. The tax implications are relatively straightforward at this stage. Focus on understanding the difference between earned interest and paid interest. Even if your CD doesn't pay interest annually, you still owe taxes on the accrued interest each year. Use a CD Calculator to project your earnings and understand the effects of taxes.

- Key Strategy: Prioritize building a solid financial foundation. Tax implications are important but shouldn't overshadow the benefits of safe, steady growth.

- Tax Tip: Consider using a Roth IRA for some CD holdings. While contributions aren't tax-deductible, qualified withdrawals, including earned interest, are tax-free in retirement.

Building a Family and Educational Savings

As you start a family, your financial priorities shift. College savings become a major consideration, and CDs can play a role. However, a 529 plan, specifically designed for educational expenses, offers significant tax advantages beyond what standard CDs provide.

- Key Strategy: Explore 529 plans for tax-advantaged educational savings.

- Tax Tip: While CDs offer stability, their returns may not keep pace with inflation. Consider diversifying your college savings portfolio with other investment options.

Pre-Retirement Planning and CD Taxes

Nearing retirement requires more strategic CD placement. Managing your tax bracket becomes increasingly essential. Spreading CD maturities across multiple years can prevent a large income spike that could push you into a higher tax bracket.

- Key Strategy: Stagger CD maturities to control income flow and manage your tax bracket during retirement.

- Tax Tip: Consider balancing taxable CD accounts with tax-advantaged retirement accounts like Traditional or Roth IRAs.

Retirement and Managing Fixed Income

In retirement, CDs can provide a predictable income stream to supplement Social Security and other retirement funds. Understanding how CD interest affects your required minimum distributions (RMDs) from retirement accounts is crucial for effective tax planning.

- Key Strategy: Use CDs to supplement retirement income and create a predictable cash flow.

- Tax Tip: Factor in the tax implications of CD withdrawals when planning for RMDs. A financial advisor can help optimize your strategy.

Life Changes and CD Strategies

Major life events such as marriage, divorce, job changes, or relocation can significantly impact your taxes. It's important to re-evaluate your CD strategy to ensure it aligns with your new financial reality.

- Key Strategy: Review your CD portfolio after major life changes to ensure alignment with your overall financial goals.

- Tax Tip: Consult a tax professional for personalized advice after significant life events. Their expertise can help you navigate complexities and optimize your CD tax strategy.

The following table outlines recommended CD strategies and tax considerations for different age groups.

CD Investment Strategies by Age Group

| Age Group | Primary Tax Goals | Recommended CD Strategy | Key Considerations |

|---|---|---|---|

| Young Professional | Minimize tax burden while building savings | Utilize Roth IRAs for tax-free growth, consider CDs for emergency funds | Balance tax efficiency with the need for accessible funds |

| Building a Family | Tax-advantaged education savings | Prioritize 529 plans over standard CDs for education expenses | Diversify college savings to potentially outpace inflation |

| Pre-Retirement | Manage tax bracket in retirement | Stagger CD maturities to smooth income and control tax liability | Balance taxable and tax-advantaged retirement accounts |

| Retirement | Minimize taxes on fixed income | Use CDs for predictable income, consider RMD implications | Factor CD interest into overall retirement income and tax planning |

This table provides a general overview; individual circumstances may require adjustments to these strategies.

By adapting your CD strategies throughout life, you can maximize after-tax returns and build a secure financial future. Remember that tax laws and individual financial situations can be complex. Seeking professional guidance is always a wise step.

Keeping Records That Actually Help At Tax Time

Managing your CD taxes effectively begins with a well-organized record-keeping system. A practical approach helps maximize deductions and minimize potential headaches. Many investors overcomplicate this, but successful CD investors keep it simple. Let's explore some practical systems to help you stay organized.

Essential CD Tax Documents

Knowing which documents are essential simplifies record-keeping. The most critical document is the 1099-INT form, which reports the interest income earned from your CDs. Keep these for at least three years after filing, the typical IRS audit lookback period.

Also, keep records of CD purchase confirmations, including the principal, interest rate, and maturity date. These verify your initial investment and are crucial for calculating your overall returns.

Digital Tools For Streamlined Record-Keeping

Several digital tools can streamline record-keeping. Many banks offer online banking platforms where you can download electronic copies of 1099-INT forms and transaction history. Using spreadsheet software like Microsoft Excel or dedicated financial management apps can help you track accrued interest throughout the year, making tax preparation easier.

Tracking Accrued Interest and Handling Discrepancies

Tracking accrued interest, even if unpaid until maturity, is vital for accurate tax reporting. Use a spreadsheet to monitor the interest earned annually for each CD. This helps reconcile your records with the 1099-INT forms.

If you notice discrepancies or receive incorrect tax forms, contact your bank immediately to request corrected documentation.

Organizing for Easy Tax Preparation

Organize your CD records by tax year. Create folders, physical or digital, for your 1099-INT forms, purchase confirmations, and other relevant documents. This simplifies tax preparation.

One area of increasing importance is international tax law. For example, the OECD's global minimum tax agreement, implemented as of 2025, requires a minimum 15% effective tax rate on corporate profits. Countries with lower rates will need to implement top-up taxes. You can find more detailed statistics here.

Common Reporting Mistakes and How To Avoid Them

One common mistake is failing to report accrued interest, even if not yet received. Remember, the IRS considers interest income earned in the year it accrues. Double-check your 1099-INT forms against your records and contact your bank if you find errors.

By implementing a practical record-keeping system and understanding common pitfalls, you can simplify your CD tax management. This reduces stress during tax season and provides a clear picture of your CD investment performance.

Ready to take more control of your CD investments? Our Certificate-of-Deposit Calculator can help project earnings and understand the impact of taxes.