Searching for the highest yield CDs can feel like a full-time job. With hundreds of banks and credit unions constantly adjusting their annual percentage yields (APYs), finding the best rate is a moving target. Manually checking individual institution websites is inefficient and often leads to missed opportunities. This guide solves that problem by spotlighting the top platforms that aggregate and compare CD rates for you, saving you time while maximizing your returns.

We’ll dive into the best resources for finding top-tier certificate of deposit rates, from dedicated financial comparison sites to trusted news outlets. You will get a clear, actionable overview of each platform's strengths, helping you choose the right tool for your specific savings goals. Whether you are a retiree seeking stable income, an investor diversifying your portfolio, or a saver looking to park cash securely, this list is your shortcut to making an informed decision.

For each resource listed, we provide a direct link, a screenshot for easy recognition, and a breakdown of why it's a go-to for rate hunters. Forget endless searching; this curated roundup brings the most competitive, highest yield CDs directly to you, so you can lock in a great rate and start earning more on your savings today.

1. Cd Rates

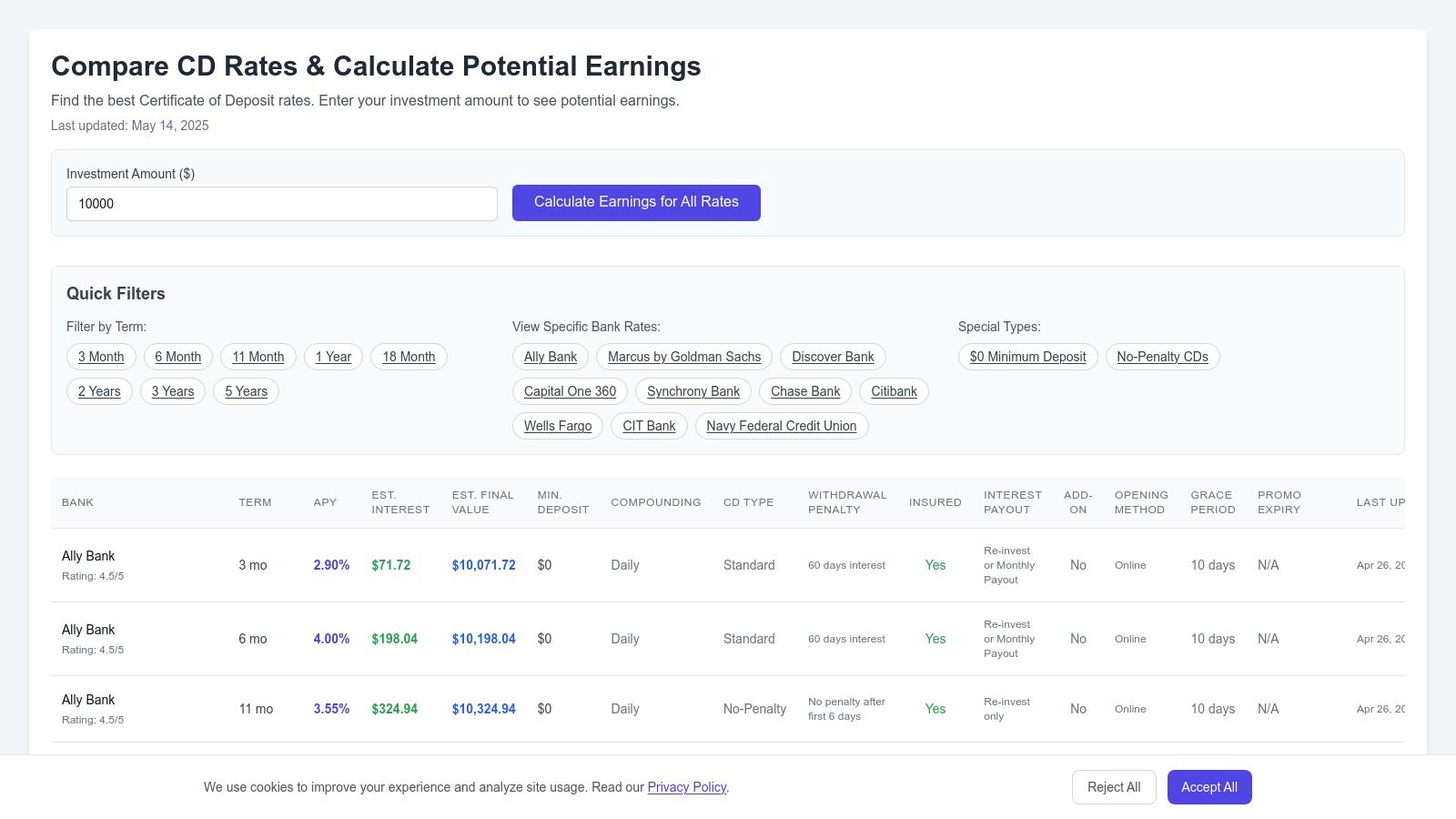

BankDepositGuide.com's "Cd Rates" page distinguishes itself not as a static list, but as a dynamic financial modeling tool. It transforms the often-tedious process of finding the highest yield CDs into an interactive, personalized experience. Rather than simply presenting a table of rates, this platform empowers users to actively project and understand their potential earnings through a sophisticated, yet user-friendly, calculator. This approach is ideal for savers who want to move beyond generic rate shopping and gain a deeper understanding of how their money can work for them.

Why It's Our Top Choice

The platform’s strength lies in its comprehensive calculator, which serves as the central hub for all analysis. Users can input specific variables, including their initial deposit amount, desired term length, and the advertised Annual Percentage Yield (APY) from any institution they are considering. The tool immediately generates detailed projections, including the final maturity value and total interest earned. This instant feedback loop is invaluable for making swift, informed decisions.

A key differentiator is the ability to factor in compounding frequency (daily, monthly, quarterly, or annually). This critical detail, often overlooked by simpler calculators, can significantly impact overall returns, allowing for a more precise comparison between different CD products.

Key Features and Practical Applications

BankDepositGuide.com provides a suite of features designed for both novice and experienced investors seeking to maximize their returns on high-yield CDs.

- Interactive Projections: The core calculator lets you model "what-if" scenarios instantly. See precisely how a 0.15% APY difference impacts your earnings over a 5-year term.

- Graphical Visualizations: Instead of just numbers, the tool generates charts that illustrate your savings growth over time. This visual aid makes it easier to grasp the power of compounding.

- CD Laddering Strategy: The platform provides strategic guidance on advanced techniques like CD laddering. You can model a ladder by running multiple calculations for different term lengths to see how you can balance liquidity with higher yields.

- Comprehensive Educational Resources: Beyond the numbers, the site offers crucial information on early withdrawal penalties, tax implications for interest income, and the security of FDIC insurance. This holistic approach ensures you understand the full scope of your investment. You can discover more by exploring their analysis of the highest CD rates currently available.

Pros & Cons

| Pros | Cons |

|---|---|

| Interactive Calculator: Offers real-time, customized projections based on your specific deposit, term, and compounding. | No Direct Rate Listings: Users must bring their own rate data to the calculator for analysis. |

| Graphical Visualizations: Clarifies how different rates and compounding schedules impact returns visually. | Requires Current Data: Information accuracy depends on users inputting up-to-date rates, which can fluctuate. |

| Educational Content: Covers essential topics like penalties, taxes, and insurance, providing a well-rounded understanding. | |

| Strategic Guidance: Includes practical advice on advanced savings techniques such as building a CD ladder. |

Ultimately, BankDepositGuide.com provides an exceptional, hands-on toolkit. It’s the perfect resource for anyone who wants to take an active role in financial planning and secure the absolute best returns on their CD investments.

Website: https://www.bankdepositguide.com/cd-rates

2. Bankrate

Bankrate serves as an indispensable research hub rather than a direct provider of CDs. It excels as a comprehensive financial aggregator, compiling and comparing rates from a vast network of banks and credit unions across the nation. This makes it a crucial first stop for anyone looking to find the absolute highest yield CDs without having to manually check dozens of individual bank websites. The platform's primary strength lies in its extensive, constantly updated database, which provides a clear, apples-to-apples view of the current market.

Unlike direct banking platforms, Bankrate is entirely free to use, and you don’t need an account to access its powerful comparison tools. This immediate access allows you to quickly filter CD options based on your specific needs, such as term length, minimum deposit, and desired Annual Percentage Yield (APY).

Why Bankrate Stands Out

Bankrate’s value proposition is its efficiency and breadth. Instead of locking you into a single institution's offerings, it presents a panoramic view of the competitive landscape. This is especially useful for uncovering top-tier rates from online-only banks or smaller credit unions you might not have otherwise discovered.

Key Insight: Use Bankrate to set a benchmark. Before committing to a CD with your primary bank, quickly cross-reference its rate on Bankrate to see how it stacks up against the national leaders. You might find a significantly higher yield elsewhere for the same term.

How to Maximize Your Search on Bankrate

To get the most out of the platform, leverage its powerful filtering capabilities. Here are some practical tips:

- Filter by Term: Start by selecting your desired CD term, whether it's a short-term 3-month CD or a long-term 5-year option.

- Adjust for Deposit Amount: Some of the highest yield CDs require larger minimum deposits. Use the deposit amount filter to narrow down options that fit your investment capital.

- Check Institution Details: Click on a promising offer to view details about the financial institution, including its FDIC or NCUA insurance status and any special requirements.

While Bankrate provides an excellent starting point, remember that it redirects you to the bank's website to open an account. It's also important to note that some listings may be sponsored, so always scan the entire list to ensure you're seeing all the best non-sponsored rates as well.

Website: https://www.bankrate.com

3. Investopedia

Investopedia operates as a premier educational resource and an expert guide, rather than a direct rate aggregator. It shines by providing in-depth analysis and curated lists of the best CD rates, contextualizing them within a broader financial strategy. For investors who want to understand why a particular CD is a good choice, not just what the rate is, Investopedia offers unparalleled depth, making it an essential platform for informed decision-making.

Similar to other informational hubs, Investopedia is completely free to access, with no account or registration required to view its rich content. This allows users to seamlessly explore detailed reviews of top-performing CDs, understand the nuances between different types of CDs, and learn how to effectively ladder them. The platform’s value lies in combining rate listings with comprehensive financial education.

Why Investopedia Stands Out

Investopedia’s primary advantage is its expert-driven analysis. Instead of just presenting a list of numbers, it provides detailed reviews explaining the pros and cons of each financial institution and its specific CD offerings. This is invaluable for conservative investors and retirees who prioritize institutional stability and product transparency alongside finding the highest yield CDs.

Key Insight: Use Investopedia to understand the "how" and "why" behind your CD strategy. Its articles can help you decide between a no-penalty CD and a traditional one, or show you how to build a CD ladder to balance liquidity with high returns.

How to Maximize Your Search on Investopedia

To get the most value from the platform, pair its lists with its educational resources. Here are some effective tips:

- Read the Full Reviews: Don't just skim the rate tables. Read the full analysis for each recommended CD to understand early withdrawal penalties, institutional reputation, and customer service feedback.

- Explore Related Content: Use their extensive library to deepen your knowledge. For instance, if you are new to CDs, you can find helpful resources to understand the basics of certificates of deposit before you commit.

- Check for Updates: The financial landscape changes quickly. Pay attention to the "updated on" date on their articles to ensure the information and rates are current.

While Investopedia offers expert-curated lists, it's not a real-time comparison tool. Rates can change, so you must always click through to the bank's official website to verify the latest APY before opening an account.

Website: https://www.investopedia.com

4. Kiplinger

Kiplinger is an educational powerhouse for investors, offering deep financial journalism and analysis rather than direct rate aggregation. It shines by providing context behind the numbers, helping you understand why CD rates are moving and how to strategically position your savings. For those looking to find not just the highest yield CDs but also to grasp the economic forces at play, Kiplinger is an invaluable resource. Its articles and guides are geared toward building long-term financial literacy.

Unlike comparison tools, Kiplinger is an editorial platform. Most of its insightful content is available for free, without needing an account or subscription. This access allows you to read expert analysis on the best current CD rates, learn about different CD types, and explore investment strategies that align with your financial goals.

Why Kiplinger Stands Out

Kiplinger’s unique value is its focus on financial education and strategy. While other sites give you the "what" (the rates), Kiplinger explains the "why" and "how." This is particularly beneficial for investors who want to do more than just chase the highest number; they want to build a coherent savings plan. The platform excels at breaking down complex topics like CD laddering, jumbo CDs, and the impact of Federal Reserve policies.

Key Insight: Use Kiplinger to develop your CD strategy. Before you start hunting for rates, read their latest analysis to understand if short-term or long-term CDs are currently more advantageous and why. This strategic foresight can lead to better returns over time.

How to Maximize Your Search on Kiplinger

To leverage Kiplinger effectively, treat it as your financial advisor and news source. Here are some practical tips:

- Search for "Best CD Rates": Use the site's search function to find their latest articles rounding up top CD offers. These often highlight unique features beyond just the APY.

- Explore Strategy Guides: Look for content on "CD laddering" or "investment strategies" to learn how to structure your CD portfolio for liquidity and optimized returns.

- Read Economic Forecasts: Pay attention to articles discussing interest rate trends and economic forecasts to make more informed decisions about when to lock in a CD.

While Kiplinger provides excellent recommendations and context, it is not an interactive tool and you must visit the financial institutions directly to open an account. Think of it as the research and strategy phase of your search for the highest yield CDs.

Website: https://www.kiplinger.com

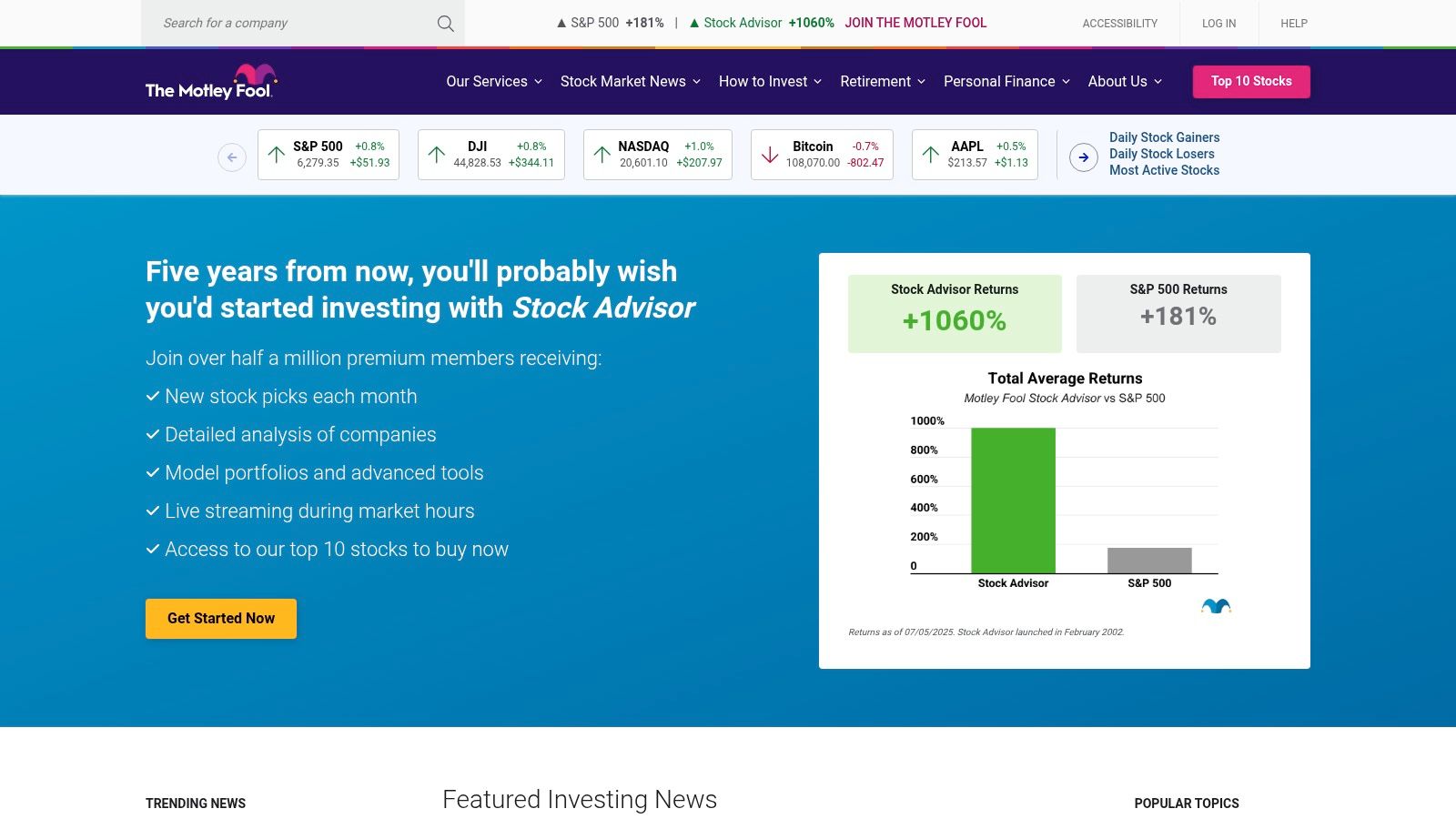

5. The Motley Fool

The Motley Fool moves beyond simple rate aggregation by offering expert commentary and investment context alongside its lists of top CD rates. It serves as an educational resource for investors who want not only to find high yields but also to understand how CDs fit into a broader financial strategy. The platform's strength is its blend of curated data with insightful analysis, helping users make more informed decisions rather than just chasing the highest number.

Unlike a pure comparison tool, The Motley Fool provides detailed reviews and explains the pros and cons of specific bank offerings. Most of this valuable content is available for free without requiring an account, making it an accessible resource for anyone looking to deepen their understanding of fixed-income investments and find some of the highest yield CDs available.

Why The Motley Fool Stands Out

The Motley Fool’s unique value comes from its expert-driven, qualitative approach. Instead of just presenting a list of rates, its writers provide context on the financial health of the issuing institutions and discuss how different CD terms align with various investment goals. This is particularly useful for those new to CDs or anyone looking to build a more complex portfolio.

Key Insight: Use The Motley Fool to understand the "why" behind a high-yield offer. While other sites give you the rates, The Fool often explains what makes a particular bank's CD a strong choice, such as unique features or the institution's stability, adding a layer of confidence to your decision.

How to Maximize Your Search on The Motley Fool

To get the most value, combine their rate lists with their educational content. Here are some practical tips:

- Read the Reviews: Don't just look at the rate tables. Read the accompanying analysis for each recommended CD to understand the nuances of the offer.

- Explore Broader Topics: Use their extensive library of articles to learn about related strategies. For example, you can explore their insights on building a successful CD laddering plan to optimize returns and maintain liquidity.

- Verify Rates: Because The Motley Fool is not a real-time aggregator, it's wise to use its recommendations as a starting point and then click through to the bank’s official site to confirm the current APY before applying.

While it lacks live comparison tools and requires you to visit individual bank sites to open an account, The Motley Fool excels at providing the strategic wisdom needed to choose the right CD with confidence.

Website: https://www.fool.com

6. BankBonus.com

BankBonus.com takes a unique, two-pronged approach to maximizing your savings, setting it apart from typical rate comparison sites. While it diligently tracks and lists some of the highest yield CDs available, its core specialty is identifying lucrative bank bonuses and promotional offers that can be paired with new accounts. This dual focus empowers savers to not only lock in a competitive APY but also to capture an upfront cash bonus, significantly boosting their overall return on investment.

The platform is completely free to use, with no account required to browse its curated lists of CD rates and active bank promotions. Its straightforward interface makes it easy to see top rates at a glance and understand the requirements for earning a bonus, such as minimum deposit amounts and account maintenance periods. This makes it an ideal resource for savers looking to get the most value when opening a new account.

Why BankBonus.com Stands Out

The primary advantage of BankBonus.com is its emphasis on the combined value of interest and cash incentives. While a high APY is crucial, a substantial sign-up bonus can provide an immediate and often greater initial return, especially on shorter-term CDs or with larger deposits. The site effectively does the homework for you, connecting the dots between competitive rates and valuable, limited-time offers.

Key Insight: Always calculate the total effective yield by combining the CD's APY with the cash bonus. A $300 bonus on a $25,000 one-year CD is equivalent to an extra 1.2% return, which could make a slightly lower APY offer more profitable overall.

How to Maximize Your Search on BankBonus.com

To leverage the platform's full potential, think beyond just the interest rate. Follow these steps for a more strategic search:

- Scan Both Sections: Don't just look at the "Best CD Rates" page. Cross-reference it with the "Best Bank Bonuses" section to find institutions that offer both a great rate and a new account promotion.

- Read the Fine Print: Click through to the detailed posts for each offer. BankBonus.com excels at clearly outlining the specific requirements to qualify for a bonus, such as direct deposit needs or minimum balance rules.

- Consider Opportunity Cost: Evaluate if meeting bonus requirements (like locking funds for a certain period) aligns with your financial goals. Sometimes the highest yield CDs may come from banks without a current bonus promotion.

While BankBonus.com provides excellent, targeted information, remember that its coverage may be limited to featured banks. It serves as a powerful tool for discovering promotional opportunities but should be used alongside a broader aggregator to ensure you have a complete market view.

Website: https://www.bankbonus.com

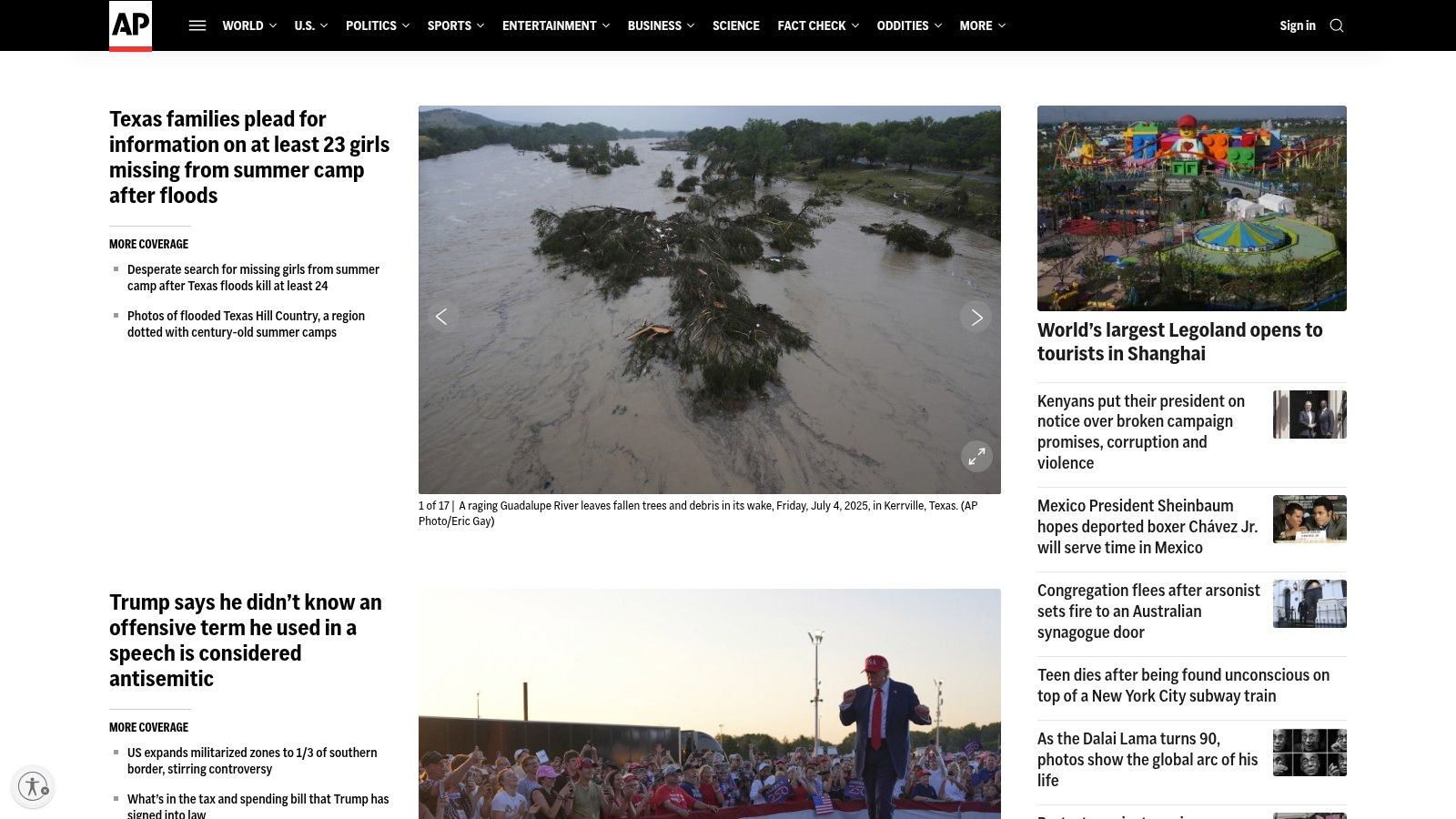

7. The Associated Press (AP) News

While not a direct provider or comparison tool, The Associated Press (AP) News serves a critical role for savvy investors by providing the essential "why" behind market movements. It offers timely, objective reporting on the financial landscape, including the economic factors that directly influence the direction of CD rates. For those looking to find the highest yield CDs, understanding these undercurrents is key to timing your investment for maximum return.

AP News is a resource for building financial literacy, not for transactions. Its content is freely accessible, offering expert analysis on Federal Reserve policy, inflation data, and general economic health. This information helps you anticipate rate shifts, empowering you to decide whether to lock in a long-term CD now or wait for potentially better offers.

Why The Associated Press (AP) News Stands Out

AP’s value is its unbiased, high-level perspective. Unlike platforms focused solely on rates, it provides the macroeconomic context you need to make informed, strategic decisions. It connects the dots between global economic events and your personal investment strategy, a crucial step often overlooked by those chasing rates alone.

Key Insight: Use AP News to understand the market sentiment. Reading its financial reports before you start shopping for a CD can help you interpret whether current high yields are a peak or part of a continuing upward trend. This knowledge is crucial for choosing the right CD term.

How to Maximize Your Research on AP News

To effectively use this resource, integrate it into the beginning of your research process.

- Follow the Business Section: Regularly read articles in the business and finance sections to stay informed about key economic indicators like the Consumer Price Index (CPI) and Fed meeting outcomes.

- Search for Specific Terms: Use the site's search function for terms like "CD rates," "interest rates," or "Federal Reserve" to find relevant articles and historical context.

- Synthesize Information: Combine the insights gained from AP News with the hard data from a comparison site. AP provides the "why," while aggregators provide the "what" and "where."

While AP News will not give you a list of banks offering the highest yields, its reporting gives you the intelligence to act decisively when opportunities arise. You must still visit bank websites or use a comparison tool to open an account, but you will do so with a much deeper understanding of the market.

Website: https://apnews.com

Top 7 Highest Yield CD Sources Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements | Expected Outcomes 📊 | Ideal Use Cases | Key Advantages ⭐ / ⚡ / 💡 |

|---|---|---|---|---|---|

| Cd Rates | Medium - Interactive calculator and personalized inputs required | Moderate - User input, updated rate data | Precise return projections with visual growth charts 📊 | Investors seeking detailed, customized CD projections | ⭐ Interactive calculator; 📊 Graphical visualizations; 💡 CD laddering strategy guidance |

| Bankrate | Low - Simple comparison tools | Low - Large CD rate database | Broad, up-to-date CD rate comparisons | Users wanting a centralized CD research platform | ⚡ Easy-to-use filtering; ⭐ Extensive CD listings; 💡 Educational articles |

| Investopedia | Low - Mainly content and rankings | Low - Content creation and curation | Expert analyses and contextual investment insights | Users preferring educational content and expert reviews | ⭐ Expert analyses; 💡 Detailed explanations; No registration required |

| Kiplinger | Low - Editorial content only | Low - Article research and writing | Informative articles with economic context | Users seeking practical financial advice around CDs | 💡 Economic context; ⭐ Practical investment strategies; Mostly free content |

| The Motley Fool | Low - Editorial and curated lists | Low - Content production | Expert opinions with broader investment strategy insights | Investors wanting expert commentary and curated CD lists | ⭐ Expert reviews; 💡 Investment insights; Extensive educational content |

| BankBonus.com | Low - Updated listings and promos | Low - Regular updates and curation | Maximized returns via CDs plus bank bonuses | Users focused on high-yield CDs plus bonuses/promotions | ⚡ Focus on bonuses & promotions; ⭐ Clear, concise info; No account needed |

| The Associated Press | Low - News reporting | Low - News gathering and publishing | Timely market updates and economic context | Users needing current financial market news and trends | 💡 Timely market insights; ⭐ Objective, reputable reporting; Mostly free access |

From Information to Action: Building Your High-Yield CD Portfolio

You've now explored a curated list of top-tier resources, from dedicated rate comparison sites like Bankrate and Investopedia to expert financial news outlets like Kiplinger and The Motley Fool. Each tool offers a unique lens through which to view the landscape of high-yield savings, empowering you to move beyond simply finding a good rate to strategically securing the highest yield CDs that align with your financial goals. The journey doesn't end with information; it begins with decisive, informed action.

The core takeaway is that a multi-faceted approach yields the best results. Relying on a single source can provide a snapshot, but using several in tandem, like cross-referencing Bankrate's comprehensive lists with The Motley Fool's in-depth analysis, gives you a panoramic view of the market. This ensures you not only see the advertised APY but also understand the institution's stability, the terms' flexibility, and any potential hidden fees.

Your Action Plan for Securing Top CD Rates

To translate this knowledge into tangible returns, consider these next steps:

- Define Your Timeline and Goals: Before revisiting any of the tools, clearly define your savings objective. Are you parking cash for a down payment in 12 months, or are you building a long-term income ladder for retirement? Your answer will immediately narrow your focus to specific CD terms.

- Create a Comparison Shortlist: Select two or three of the resources discussed that best fit your style. For instance, a data-driven investor might prefer Bankrate and Investopedia, while someone seeking more guidance might lean towards Kiplinger and The Associated Press. Use them to build a shortlist of three to five promising CD offers.

- Vet the Institutions: With your shortlist in hand, perform due diligence on the banks and credit unions. Confirm their NCUA or FDIC insurance, check customer service reviews, and understand their process for account opening and maturity.

Key Insight: The "highest" yield is only valuable if it comes from a secure, accessible, and reputable financial institution. Never sacrifice safety for a few extra basis points.

Remember, a high-yield CD is not just a standalone product; it's a component of your overall financial health. Integrating these stable, predictable assets into your portfolio requires a thoughtful approach. To effectively integrate high-yield CDs into your broader financial plan and optimize your investment mix, explore different smart asset allocation strategies. This broader perspective ensures your CD investments work in harmony with your other assets to achieve your long-term objectives.

Ultimately, the power of these tools lies in your hands. By using them strategically, you can confidently navigate the market, lock in exceptional rates, and build a robust CD portfolio that serves as a cornerstone of your financial security.

Ready to see exactly what those top rates mean for your wallet? Use the Certificate-of-Deposit Calculator to instantly compute your potential earnings based on different rates, terms, and deposit amounts. Turn today's best APYs into a concrete plan for your future with this essential Certificate-of-Deposit Calculator.