Ever thought about how you can make your money work for you without tossing it into the unpredictable stock market? Imagine a savings agreement with your bank: you promise to leave a chunk of cash with them for a set amount of time, and in return, they promise to pay you a guaranteed, fixed interest rate.

That’s a Certificate of Deposit (CD) in a nutshell. It’s a straightforward deal where you lock in a specific sum for a specific term, and the bank gives you a predictable return—one that’s almost always higher than what you’d get from a regular savings account.

What Is a Certificate of Deposit?

A Certificate of Deposit is a special savings product offered by banks and credit unions. You deposit a fixed amount of money for a fixed period of time—think of it as putting your cash into a financial time capsule.

Because you’re committing to leave the funds untouched, the bank rewards you with a guaranteed interest rate. This makes understanding certificate of deposit basics absolutely essential for anyone looking to grow their savings with minimal risk. Unlike stocks that can swing wildly, a CD’s return is locked in from day one, offering the kind of stability that’s a cornerstone for conservative savers and anyone with a clear financial goal in mind.

The Core Agreement of a CD

The entire deal boils down to three simple parts:

- Principal: This is your initial deposit—the lump sum you’re locking away.

- Term Length: This is the pre-agreed time you'll leave the money untouched. Terms can range from as short as a few months to as long as five years or more.

- Interest Rate (APY): This is the fixed annual percentage yield your principal will earn over the term.

Once the term is up—what bankers call the "maturity date"—you get back your original principal plus all the interest it generated. The process is designed to be transparent and secure. To see the numbers in action, check out our guide on how CD interest is calculated.

Key Takeaway: A Certificate of Deposit is a trade-off. You give up liquidity (immediate access to your cash) in exchange for a higher, guaranteed return compared to a standard savings account.

For a quick reference, here's a breakdown of what makes a CD tick.

Certificate of Deposit At a Glance

This table summarizes the fundamental aspects of a CD, helping you understand how each component works for you.

| Concept | What It Means For You | Why It Matters |

|---|---|---|

| Fixed Principal | You deposit a set amount of money at the start. | Your initial investment is secure and forms the basis for your interest earnings. |

| Fixed Term | You agree not to touch the money for a specific period. | This commitment allows the bank to offer you a better interest rate. |

| Fixed APY | Your interest rate is locked in for the entire term. | Provides predictable, guaranteed returns, shielding you from market fluctuations. |

| Early Withdrawal Penalty | You pay a fee if you take out money before the term ends. | This is the "catch" for getting the higher rate; it discourages breaking the agreement. |

| Maturity Date | The day your term ends and you can access your funds. | You can withdraw your principal and interest penalty-free or roll it into a new CD. |

Understanding these basics is the first step to using CDs effectively in your savings strategy.

Why CDs Remain Popular

CDs are a foundational piece of personal finance. For those just starting out, getting a handle on broader investment basics for beginners helps put CDs into the context of a larger financial plan. Their enduring popularity comes from their reliability, especially when the economy feels shaky.

This isn't just a local trend. The global demand for these steady savings tools is strong. In fact, market projections show the Certificate of Deposit market is on track to grow to USD 2.76 billion by 2034, which proves just how vital they are for savers around the world. It’s a clear signal that this simple, secure product continues to meet a real need for people who prioritize safety and predictability for their money.

Decoding the Language of CDs

Jumping into the world of Certificates of Deposit can feel a bit like learning a new language. You'll run into a bunch of acronyms and banking terms that aren't exactly part of everyday chatter. But don’t sweat it—think of this section as your personal translator.

Jumping into the world of Certificates of Deposit can feel a bit like learning a new language. You'll run into a bunch of acronyms and banking terms that aren't exactly part of everyday chatter. But don’t sweat it—think of this section as your personal translator.

We’re going to break down the essential vocabulary you'll see on any CD offer. Once you get these core concepts, you’ll be able to confidently compare different CDs and pick the one that actually fits your financial plan. Let's get you fluent.

Understanding Your True Earnings With APY

When you're comparing CDs, the single most important number to look at isn't just the interest rate; it's the Annual Percentage Yield (APY). You can think of the simple interest rate as the base ingredients, but the APY is the final, fully-prepared meal. It's what you actually get.

APY tells you the total interest you'll earn over one year, and it crucially includes the effects of compound interest. Compounding is the magic that happens when you start earning interest not just on your initial deposit, but on the interest that’s already been paid to you. It’s what helps your money grow faster.

This is why APY is the universal standard for comparing savings products. It gives you a true, apples-to-apples way to see which CD will pay you more over a year, no matter how the bank does its math behind the scenes.

The Trade-Off of Term Length

A CD’s term length is simply the amount of time you agree to leave your money with the bank untouched. It's your side of the bargain. Terms can be as short as three months or stretch out to five years or even longer.

The trade-off is usually pretty straightforward:

- Longer Terms: These typically offer higher APYs. Banks reward you with a better rate for giving them access to your funds for a longer, more predictable period.

- Shorter Terms: These give you more flexibility but usually come with lower interest rates. They’re a great fit if you think you might need the cash sooner rather than later.

Picking the right term is a balancing act. You have to weigh the temptation of a higher return against the reality of when you'll need access to your money. Locking up your cash for five years to get a fantastic rate is a terrible move if you're saving for a down payment you plan to make next year.

Why This Matters: Your term length defines your commitment. Choosing the right one makes sure your money is free right when you need it, which helps you avoid breaking the agreement and paying a penalty.

How Compounding Frequency Accelerates Growth

While APY already bakes this in, understanding compounding frequency shows you the nuts and bolts of how your earnings are calculated. It just means how often the bank crunches the numbers and adds the interest you've earned back into your account balance. This can happen daily, monthly, quarterly, or annually.

Imagine two identical CDs with the same interest rate. One compounds daily, the other annually. The one that compounds daily will end up earning slightly more because the interest starts earning its own interest much sooner and more often. The difference might look small on paper, but it can really add up, especially with larger deposits over longer terms.

For a deeper dive, our complete guide on how a certificate of deposit is explained breaks this down with more examples.

The Role of Early Withdrawal Penalties

An early withdrawal penalty is the fee you'll be charged if you pull your money out of the CD before it reaches its maturity date. It's not a punishment; it's just the bank upholding the deal. You promised to leave the money for a set term in exchange for a guaranteed return.

This penalty is almost always calculated as a certain number of months' worth of interest. For example, a common penalty for a 1-year CD might be three months of interest. Knowing this fee is critical. It helps you understand the real-world risk if your financial situation changes unexpectedly and you have to break the CD early.

The Surprising History of CD Interest Rates

Have you ever glanced at a CD rate and wondered, "Why that number?" It’s not random. The interest rate on your Certificate of Deposit is a direct reflection of what’s happening in the broader economy. Getting a handle on its history gives you powerful context, turning abstract percentages into a story about economic cycles and your own money.

The journey of CD rates is a rollercoaster, full of dramatic peaks and valleys that perfectly mirror the economic story of their time. By looking back, you can get a much clearer picture of why today’s rates are where they are—and set more realistic expectations for your own savings goals.

The High-Interest Era of the 1980s

Imagine a time when a simple, dead-safe savings product could deliver returns that gave the stock market a run for its money. That was the reality for savers in the early 1980s. The U.S. was fighting off runaway inflation, and the Federal Reserve responded by cranking interest rates to historic highs.

For everyday people, this meant Certificates of Deposit became one of the hottest tickets in town. Finding a CD that offered double-digit returns wasn’t just possible; it was common. This high-yield environment made them a top choice for anyone looking to grow their wealth without gambling on the market, cementing their reputation as a serious savings tool.

This era teaches us a core principle: when the Fed raises its key interest rate to cool down the economy, bank savings products like CDs become much more rewarding for savers.

The Great Rate Plunge and Its Aftermath

Now, fast-forward to the years after the 2008 financial crisis. The picture couldn't have been more different. To kickstart a stalled economy, the Federal Reserve slashed interest rates to nearly zero. While this made borrowing cheaper for businesses and homebuyers, it was a brutal time for savers.

CD rates fell off a cliff, often struggling to even keep up with mild inflation. Savers who once enjoyed high, guaranteed returns now found their "safe" money was barely growing at all. This shows the other side of the economic coin—when the goal is to encourage spending and investment, traditional savings accounts lose their luster.

Key Insight: The interest rates you see on CDs aren't set in a vacuum. They are directly tied to the Federal Reserve's monetary policy, which it uses to manage inflation and steer the economy.

The historical numbers paint a stark picture. In the early 1980s, you could easily lock in a CD with an APY over 11%. By June 2013, the average five-year CD was paying a measly 0.77% APY. That long, low-rate winter lasted until 2022, when the Fed began one of its most aggressive rate-hiking cycles in four decades to fight a new surge in inflation. After 11 hikes, CD yields finally roared back to life.

Understanding Today’s CD Rate Environment

So, what does all this history mean for you today? It means that the CD rates you see now are just one point in a long, continuous economic cycle. The recent spike in APYs is a direct result of the Fed’s fight against inflation, bringing yields back to levels we haven’t seen in over a decade.

This context is your key to making smarter moves.

- When rates are high: It can be a fantastic time to lock in a long-term CD and guarantee yourself a strong return for years.

- When rates are low: Shorter-term CDs might make more sense. They give you the flexibility to cash out and reinvest at a better rate if the climate changes.

While our focus here is on CDs, it helps to see how interest works across the board. For example, learning about business loan interest rates reveals the same underlying principles of risk and economic influence.

Ultimately, seeing today’s rates as part of a historical pattern helps you shift from being a passive saver to a strategic one.

Finding the Right CD for Your Financial Goals

It’s a common misconception that all Certificates of Deposit are basically the same. While the classic, fixed-rate CD is a fantastic and straightforward savings tool, there’s a whole world of specialized CDs out there. Think of it less like a single wrench and more like a complete toolkit—each one is designed for a very specific job.

Picking the right type of CD is just as critical as choosing the right term length. The perfect fit hinges entirely on what you’re trying to accomplish. Are you chasing the highest possible return? Do you need flexibility? Are you saving for retirement or investing a large lump sum? Nailing these details is key to making sure your savings strategy actually works for you.

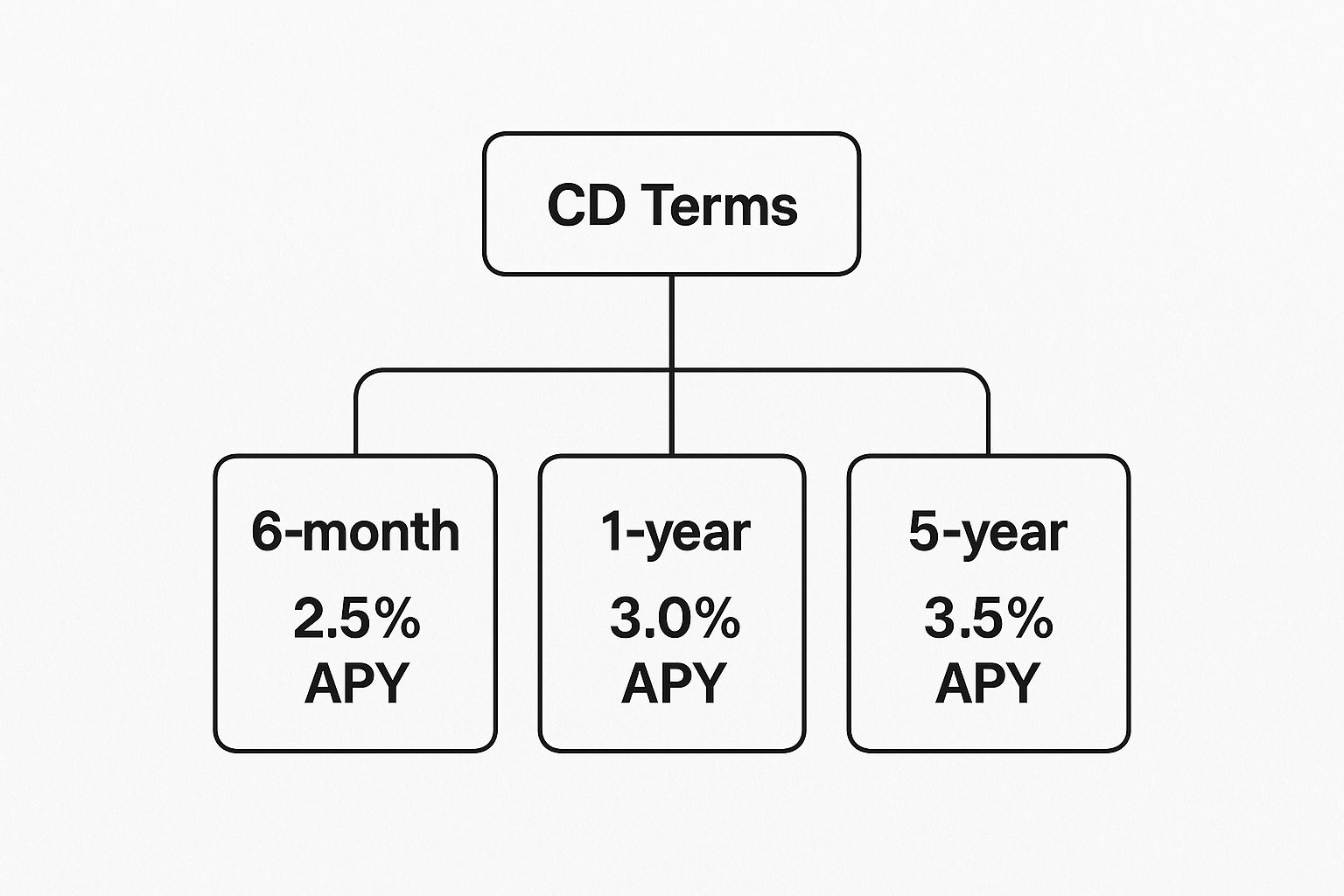

This chart shows the fundamental trade-off in the CD world: how term lengths and interest rates are related.

As you can see, banks and credit unions typically reward you with higher APYs for longer commitments. Now, let's dig into the specific CD types that can help you hit your goals.

Comparing Common Types of CDs

To help you decide, this table breaks down the most common CD variations. Each is built to solve a different financial problem, whether that's maximizing yield, maintaining access to your cash, or adapting to a changing rate environment.

| CD Type | Key Feature | Best For | Potential Drawback |

|---|---|---|---|

| High-Yield CD | Offers a higher-than-average APY for standard terms. | Savers focused purely on maximizing guaranteed returns. | Usually requires locking funds away for the full term. |

| No-Penalty CD | Allows one penalty-free withdrawal before maturity. | Savers who want better returns than a savings account but worry they might need the cash. | APY is typically a bit lower than a standard CD. |

| Bump-Up CD | Gives a one-time option to raise your rate if the bank's rates go up. | Locking in a rate when you're worried future rates might be higher. | The initial rate may be lower than a standard CD's rate. |

| Jumbo CD | Requires a high minimum deposit (e.g., $100,000). | Investors with a large sum of cash who want a premium interest rate. | The high minimum deposit is a barrier for many savers. |

| IRA CD | A standard CD held inside a tax-advantaged retirement account. | Conservative retirement savers who want guaranteed returns and tax benefits. | Subject to all IRA contribution limits and withdrawal rules. |

Choosing the right option from this menu is the first step. The next is running the numbers to see how your choice plays out over time.

CDs for Maximum Growth and Flexibility

For many savers, the two biggest priorities are getting the best possible return and keeping some access to their funds. A few specific CD types are designed to tackle exactly these concerns.

- High-Yield CDs: These are pretty straightforward. Often found at online banks that have lower overhead, they simply pay a higher-than-average APY for a given term. If your only goal is to squeeze every last drop of guaranteed return out of your money, this is your best bet.

- No-Penalty CDs: Sometimes called "liquid CDs," these products have a killer feature: you can withdraw your full balance before the maturity date without getting hit with a penalty. The trade-off is usually a slightly lower APY, but for anyone building an emergency fund, they’re a fantastic hybrid option.

- Bump-Up CDs: This type gives you a one-time "do-over." If interest rates rise after you've locked in your CD, you can ask the bank to "bump up" your rate to the new, higher one for a similar term. It’s perfect if you have rate-hike FOMO.

It’s always a good idea to forecast your potential earnings. You can play with different scenarios and see exactly how these features would affect your final balance using our powerful CD calculator.

Specialized CDs for Large Deposits and Retirement

Sometimes, you need a tool for a very specific, large-scale job. Certain CDs are structured to handle big investment amounts or to give you major tax advantages for your long-term goals. For newcomers to the U.S. banking system, finding a financial institution is the first step; some great online resources list banks that accept ITINs.

Key Consideration: The right CD is one that aligns perfectly with your financial timeline and goals. A Jumbo CD is great for a large inheritance, while an IRA CD is built specifically for your future self.

Here’s a closer look at these heavy hitters:

- Jumbo CDs: These work just like standard CDs, but they come with a high barrier to entry—a minimum deposit of $100,000 or more. In exchange for parking that much cash, banks will often reward you with a premium interest rate that you wouldn't get on a smaller deposit.

- IRA CDs: This isn't really a separate type of CD. It's just a regular CD that you hold inside an Individual Retirement Account (IRA). This simple move combines the safety and guaranteed returns of a CD with the powerful tax advantages of an IRA. Your interest can grow tax-deferred (Traditional IRA) or tax-free (Roth IRA), making it a go-to for conservative retirement savers who want to protect their principal above all else.

When to Use a Certificate of Deposit

Knowing what a Certificate of Deposit is helps, but knowing when to use one is how you turn financial knowledge into a real-world strategy. A CD isn't the right tool for every job. Its real power comes out when you have a specific, time-sensitive goal where keeping your money safe is the top priority.

Think of it like this: you wouldn't use a sledgehammer to hang a picture, and you wouldn't bet your house down payment on a volatile stock you need to sell in 18 months. CDs shine when the goal is clear, the timeline is set, and protecting your principal is non-negotiable.

Let's walk through a few common situations where a CD is probably the smartest place for your cash.

Saving for a Major Purchase

Eyeing a new car or saving for a down payment on a house in the next one to five years? This is a textbook case for using a CD. You've got a definite goal and a pretty firm timeline.

The last thing you want is for your carefully saved down payment to drop by 20% because the market took a nosedive right before you planned to make an offer. A CD takes that risk completely off the table. By locking your money in a CD with a term that lines up with your buying timeline, you can guarantee your principal is safe and will grow by a predictable amount when it's time to write the check.

Building a More Flexible Emergency Fund

A standard emergency fund needs to be liquid, which is why most people use a high-yield savings account. That makes sense. But for a portion of that fund, a strategy called a "CD ladder" can squeeze out higher returns without giving up too much access.

Here's the basic recipe:

- Step 1: Split your emergency savings into smaller, equal chunks (say, four piles of $2,500).

- Step 2: Invest each chunk into a CD with a different maturity date—maybe a 3-month, 6-month, 9-month, and 12-month CD.

- Step 3: As each CD comes due, you get access to that cash. If no emergency popped up, you can roll it into a new 12-month CD to capture the best rate available.

Before you know it, you've built a "ladder" where one of your CDs matures every few months. This gives you regular chances to get cash penalty-free, while the rest of your money earns a better APY than it would sitting in a savings account.

Protecting Capital During Retirement

For retirees or anyone getting close, the game changes from aggressive growth to protecting what you've built. A CD is a cornerstone of a capital preservation strategy because it provides a reliable, fixed income without exposing your nest egg to market swings.

A retiree can use the guaranteed interest payments from a portfolio of CDs to supplement their income, knowing that their core principal is protected by FDIC or NCUA insurance. This security provides immense peace of mind.

This approach ensures a slice of their savings is not only safe but also kicking off predictable cash flow for living expenses. It’s a foundational move for anyone who can’t afford to gamble with their money anymore. The CD's job here is to act as an anchor, steadying the riskier parts of a portfolio with a guaranteed return.

Your Top CD Questions, Answered

Once you get the hang of how savings products work, the real questions start to bubble up. It's one thing to know the definitions, but it’s another to figure out how a CD fits into your own financial life. This section tackles the most common questions savers ask about Certificates of Deposit, with straightforward answers to give you the confidence you need.

We'll cover everything from timing the market to what happens at maturity and how your earnings are taxed. Think of this as the final piece of the puzzle, clearing up any lingering doubts about certificate of deposit basics.

Are CDs a Good Investment Right Now?

Whether a CD is a "good" investment depends entirely on your goals, your time horizon, and the current rate environment. There's no single right answer, but you can figure out if it's the right move for you.

When interest rates are high, locking in a great, guaranteed APY with a CD can be a brilliant strategy. You're essentially shielding your return from future rate cuts. On the flip side, if you think rates are still climbing, a long-term CD might cause you to miss out on better yields down the road. In that case, a short-term CD or even a no-penalty CD could be a smarter play.

The real test is comparing CD rates against two benchmarks:

- The Current Inflation Rate: Is the CD's APY high enough to actually grow your purchasing power, or is inflation quietly eating away at your returns?

- Other Savings Options: How do the best CD rates stack up against a high-yield savings account, which offers instant access to your cash?

Weighing these factors will tell you if now is the right time for you to open a Certificate of Deposit.

What Happens When My CD Matures?

When your CD's term is up, you've hit the maturity date. This is your chance to access your original deposit and all the interest it earned, penalty-free. Your bank or credit union is required to notify you before this date and will usually give you a grace period—often 7 to 10 days—to decide what to do next.

You generally have three choices:

- Cash Out: Withdraw your principal and interest and do whatever you want with it.

- Roll It Over: Reinvest the full amount into a new CD at the current rates.

- Move the Money: Transfer the balance to a different account, like your checking or savings.

Crucial Tip: Don't ignore your maturing CD. Most banks have an automatic renewal policy. If they don't hear from you during the grace period, they'll lock your money right back into a new CD for the same term. The catch? It will be at whatever the new rate is, which might be much lower than what you want.

Is My Money Safe in a CD?

Yes, completely. When it comes to safety, CDs are among the most secure places for your money, right up there with a standard savings account. Your funds are protected by federal insurance, even in the unlikely event your bank or credit union goes under.

This robust insurance comes from one of two federal agencies:

- For Banks: The Federal Deposit Insurance Corporation (FDIC) provides the insurance.

- For Credit Unions: The National Credit Union Administration (NCUA) offers the same level of protection.

This insurance covers your deposits up to $250,000 per depositor, per institution, for each ownership category. It means your principal is totally safe from market swings and bank failure, up to that limit. This guarantee is why CDs are a bedrock for conservative savers who put capital preservation first.

Do I Pay Taxes on CD Interest?

Yes, the interest you earn in a standard Certificate of Deposit is considered taxable income. It's a key detail to remember when figuring out your real, after-tax return. You'll need to report CD interest on your federal tax return and potentially on state and local returns, too.

Each year, the bank or credit union will send you a Form 1099-INT if you earned more than $10 in interest. This form spells out exactly how much income to report to the IRS. For multi-year CDs, you typically owe taxes on the interest earned each year, even if you don't get the cash until the CD matures.

But there’s a major exception. If you hold the CD inside a tax-advantaged retirement account, the rules change for the better.

- Traditional IRA CD: Your interest grows tax-deferred. You only pay taxes when you withdraw the funds in retirement.

- Roth IRA CD: Your interest grows completely tax-free, and your qualified withdrawals in retirement are also tax-free.

Using an IRA to hold your CD is a powerful strategy, combining the safety of a guaranteed return with the huge tax advantages of a retirement account.

Ready to see how much your savings could grow with a Certificate of Deposit? The Certificate-of-Deposit Calculator is a powerful, easy-to-use tool that lets you visualize your earnings based on different rates, terms, and compounding frequencies. Stop guessing and start planning with precision by visiting the Certificate-of-Deposit Calculator today.