Understanding CD Penalties: The Real Cost of Breaking Your Promise

When you open a Certificate of Deposit, you're making a simple deal with your bank. You agree to leave your money untouched for a set amount of time, and in return, they give you a fixed, guaranteed interest rate. But what happens when life throws you a curveball and you need that cash early? That's where the early withdrawal CD penalty comes in. It’s the cost of breaking that agreement.

When you open a Certificate of Deposit, you're making a simple deal with your bank. You agree to leave your money untouched for a set amount of time, and in return, they give you a fixed, guaranteed interest rate. But what happens when life throws you a curveball and you need that cash early? That's where the early withdrawal CD penalty comes in. It’s the cost of breaking that agreement.

Think of it like a cancellation fee for a non-refundable plane ticket. The airline was counting on you being on that flight. In the same way, your bank doesn't just let your money sit in a vault; it actively lends out those funds to people buying homes or starting businesses. The penalty helps the bank manage its finances when you make an unexpected withdrawal, ensuring it can still meet its commitments to everyone else.

What Determines the Size of the Penalty?

Not all penalties are the same, and a couple of key things decide how much you might have to give up. The most important factor is your CD’s original term length. The longer you committed your money to the bank, the bigger the penalty will be if you pull out early.

A 6-month CD might have a fairly light penalty, while a 5-year CD often carries the heaviest one. This makes sense, as it compensates the bank for the disruption to its long-term financial planning. You can see detailed data on how penalties scale with term length to get a feel for the industry standards.

The other major factor is the financial institution’s specific policy. There are no federal rules that dictate the exact penalty amount, so each bank and credit union sets its own. This is why reading the fine print is so important before you commit. We break down these variations in our complete guide to CD early withdrawal penalties.

To give you a clearer picture, here’s a look at how penalties typically scale with the CD's term. Notice how the penalty period and severity grow alongside the commitment.

CD Term Length vs Average Early Withdrawal Penalties

Comparison of penalty structures across different CD term lengths showing how penalties increase with longer commitments

| CD Term | Typical Penalty Period | Average Interest Rate | Penalty Severity |

|---|---|---|---|

| 6-Month CD | 1 to 3 months' simple interest | 4.80% APY | Low |

| 1-Year CD | 3 to 6 months' simple interest | 5.00% APY | Moderate |

| 3-Year CD | 6 to 12 months' simple interest | 4.50% APY | High |

| 5-Year CD | 12 to 24 months' simple interest | 4.25% APY | Very High |

The pattern is clear: the longer you promise to keep your money deposited, the higher the cost for an early exit. This system ensures fairness for both the bank and its savers.

This structure isn't designed to be punitive. It creates a fair and predictable system where the bank gets the stability it needs to offer good rates, and you get a guaranteed return for holding up your end of the deal.

By understanding the "why" behind these penalties, you can move from seeing them as a risk to viewing them as a calculated part of your investment strategy.

The Math Behind CD Penalties: What You'll Actually Pay

Figuring out the penalty for cashing out a CD early can feel like trying to solve a puzzle. It's not a simple flat fee, though many people think it is. Instead, the cost of an early withdrawal CD action depends on a specific formula that uses your interest rate and the CD's original term.

While the calculation is usually straightforward, the variables mean the final penalty amount can change dramatically from one CD to another.

The 'Months of Interest' Method

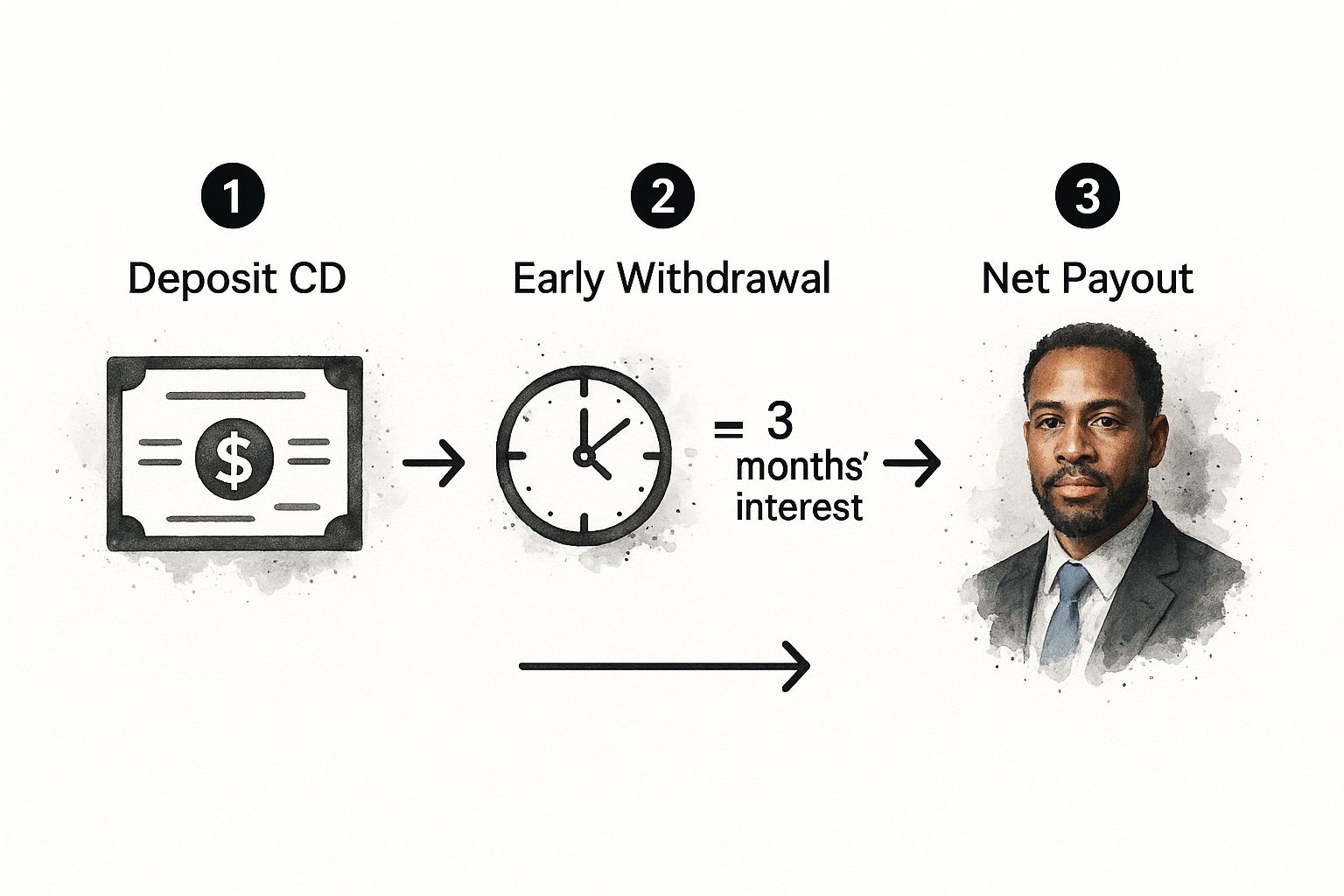

Most banks use a standard method to calculate penalties: they charge you a certain number of months' worth of simple interest. This is the most common approach you'll encounter. The critical detail here is that the penalty is charged whether you've actually earned that much interest yet or not. This is where savers can get an unwelcome surprise.

Let's walk through a common scenario. Suppose you opened a $10,000, 1-year CD with a 5.00% APY. The bank's policy for this CD is a penalty equal to three months of simple interest.

- Step 1: Find the total annual interest. $10,000 x 0.05 = $500 per year.

- Step 2: Figure out the monthly interest. $500 / 12 months = $41.67 per month.

- Step 3: Calculate the total penalty. $41.67 x 3 months = $125.01.

That $125.01 is what you owe for breaking the term. If you pull your money out after just one month, you would have only earned $41.67 in interest. The bank takes that interest, plus an additional $83.34 directly from your original principal investment.

How Term Length Dramatically Changes the Cost

Think of a longer CD term as a bigger commitment—and breaking that commitment comes with a bigger cost. The penalty formula scales up significantly with longer-term CDs, making the decision to withdraw much more impactful.

Now, let's look at a $10,000, 5-year CD with a 4.25% APY. For this longer term, the bank's penalty is 12 months of simple interest.

- Annual interest: $10,000 x 0.0425 = $425.

- Since the penalty is a full 12 months of interest, the cost to withdraw early is $425.

Even with a lower interest rate, the penalty more than tripled compared to the 1-year CD. This shows the direct relationship between the length of your commitment and the financial risk you accept if you need your cash ahead of schedule.

The main takeaway is that the penalty is taken directly from your account balance. It will first consume any interest you've earned, and if that's not enough, it will dip into your principal.

Key Nuances: Partial Withdrawals and Interest Types

Beyond the basic formula, a couple of details in the fine print can make a big difference. For instance, what happens if you only need some of your money? The rules for partial withdrawals vary wildly from one bank to another.

Some banks will calculate the penalty based only on the amount you withdraw, which is the better outcome for you. Others, however, apply the penalty based on the entire original principal, even if you only take out a small portion. It's vital to check your CD agreement for this detail.

Another distinction is how the interest for the penalty is calculated. Thankfully, most banks use simple interest for the penalty calculation, as we did in our examples. This is a small but important benefit for the saver, as a penalty based on the slightly higher, compounding APY would be more costly.

Ultimately, your CD agreement holds all the specific numbers. Before you commit, running scenarios with a good Certificate-of-Deposit Calculator can help you visualize potential penalties. Understanding this math gives you a clear view of the risks and helps you make a smarter choice if you find yourself needing cash unexpectedly.

Real People, Real Penalties: What Early Withdrawal Costs

The formulas for CD penalties tell you the "what," but it's the real-world stories that show you the "why." An early withdrawal penalty isn't just a number in your account agreement; it's a real financial event that can either be a setback or a savvy move. To truly grasp the impact, we need to look past the math and see how these choices play out for actual people. Let's explore two very different situations to understand the human side of the equation.

The formulas for CD penalties tell you the "what," but it's the real-world stories that show you the "why." An early withdrawal penalty isn't just a number in your account agreement; it's a real financial event that can either be a setback or a savvy move. To truly grasp the impact, we need to look past the math and see how these choices play out for actual people. Let's explore two very different situations to understand the human side of the equation.

The Emergency Fund Dilemma: Sarah’s Story

Sarah felt smart putting $20,000 into a 5-year CD with a solid 4.0% APY. It was the cornerstone of her savings. But just six months later, life threw her a curveball: her car’s transmission died, leaving her with an unexpected $5,000 repair bill. With no other cash on hand, she had to break into her CD. Her bank’s penalty was steep: 12 months of simple interest.

That penalty cost her $800 ($20,000 x 0.04). In the six months her money was in the CD, she had only earned about $400 in interest. This meant the penalty wiped out all her earnings and then took another $400 directly from her principal. Sarah learned a painful lesson about the importance of having a separate, liquid emergency fund to protect long-term investments from life's surprises.

A Strategic Withdrawal: Michael’s Story

Michael’s situation was different. He had a $10,000 2-year CD earning a healthy 5.0% APY. At the same time, he was carrying a $10,000 balance on a credit card with a painful 22% APR. The high-interest debt was a constant weight on his finances. He ran the numbers and had a lightbulb moment: he was earning about $500 a year from his CD but paying $2,200 a year in credit card interest.

His CD’s early withdrawal penalty was six months of interest, a total of $250. Michael chose to take the hit. By paying the $250 penalty, he could use his CD funds to completely eliminate his credit card debt. This single decision saved him nearly $2,000 in interest payments in the next year alone. For Michael, the penalty wasn't a loss; it was the price of a calculated financial win.

Lessons From the Real World

These stories highlight that context is everything. An early withdrawal can be a costly error or a brilliant financial maneuver.

- Always do the math. The choice shouldn't be emotional. Compare the one-time cost of the penalty to the ongoing cost of the problem you're trying to solve, like crushing credit card interest.

- Ask about a partial withdrawal. If Sarah’s bank had allowed her to withdraw only the $5,000 she needed, her penalty might have been much smaller. Always check if this is an option.

- Don't be afraid to ask for a waiver. It's rare, but some banks may reduce or waive penalties for documented hardships like a disability or the death of the account holder. It never hurts to inquire.

To see how these costs stack up, the table below provides a clear financial breakdown of each scenario.

Early Withdrawal Cost Comparison by Scenario Detailed breakdown of penalty costs across different withdrawal scenarios showing actual dollar amounts and percentages

| Scenario | Original Amount | CD Term | Time Before Withdrawal | Penalty Amount | Amount Received |

|---|---|---|---|---|---|

| Sarah (Emergency) | $20,000 | 5-Year | 6 Months | $800 | $19,600 |

| Michael (Debt) | $10,000 | 2-Year | 12 Months | $250 | $10,250 |

| Partial (Emergency) | $20,000 | 5-Year | 6 Months | $200 (on $5k) | $19,800* |

| *Assumes only the needed $5,000 was withdrawn, leaving $15,000 in the CD. |

These examples show that breaking a CD isn't automatically a bad idea. Think of it as a financial tool with a clear, defined cost. By understanding your situation, analyzing the numbers, and exploring your options, you can decide if that cost is a price worth paying to solve a bigger financial problem.

How Economic Shifts Shape Your CD Penalty Experience

The penalty you face for an early CD withdrawal feels like a personal sting, but its real impact is deeply connected to the wider economy. These fees aren't fixed in their severity; their true cost to you changes with economic currents. Grasping this connection helps you shift from a passive saver to a smart investor who sees how Federal Reserve moves and inflation affect your banking choices.

This isn't just theory—it's a practical way to view your CD investments and decide when, or if, cashing out early makes sense.

The High-Rate Era: When Penalties Were an Opportunity

It might sound odd, but there have been times when savers were actually happy to pay early withdrawal penalties. The high-inflation period of the early 1980s is a classic case. To fight soaring inflation, interest rates shot up to levels that are hard to imagine today.

For instance, in 1981, some three-month CDs offered a mind-boggling 18.3% APY. In a climate like that, paying a penalty on your existing 6% CD to lock in a new 18% rate wasn't just a good idea—it was a brilliant financial move. Explore the history of CD interest rates to see these trends.

Think of it like this: you'd gladly pay a small fee to break your apartment lease if a much nicer place opened up for the same rent. The penalty wasn't a punishment; it was the price of admission to a far better deal. This perfectly illustrates the concept of opportunity cost—the penalty was tiny compared to the massive gains you'd miss by staying put.

The Low-Rate Environment: Why Penalties Hurt More Today

Now, contrast that with the low-interest-rate world of more recent years. When rates are scraping the floor, the math completely flips. If you break a CD earning 1.5% APY, there isn’t a 5% or 10% alternative waiting for you. The next best safe option might only pay 1.6%.

In this situation, the early withdrawal penalty isn't a strategic cost; it’s a direct and painful loss. There's no blockbuster opportunity on the horizon to make up for the fee, which makes the penalty feel much more punishing. This is where Federal Reserve policies come into play. When the Fed keeps rates low to spur economic activity, it also removes the incentive for savers to break their CDs, making any penalty a significant financial step backward. Your early withdrawal CD decision is therefore shaped heavily by these larger forces.

How Banks Adjust During Economic Cycles

Banks aren't just bystanders; they adjust their strategies based on these economic cycles. During volatile times with rising interest rates, a bank might enforce stricter penalty terms. They want to discourage you from leaving because they need your deposit to remain stable to fund their loans. Their risk is higher, so they protect themselves by making it more costly to leave.

On the other hand, in a stable, low-rate environment, banks are all fighting for the same customer funds. Here, some might offer more forgiving penalty structures as a competitive edge. They might advertise a "60-day interest" penalty instead of a "180-day" one to attract savers who want more flexibility.

The key takeaway is that penalty clauses are a product feature, shaped by market competition and the health of the economy. Understanding these patterns can help you time your CD investments, looking for favorable terms when the economic conditions are in your favor.

Proven Strategies to Minimize Early Withdrawal CD Penalties

While you can't control the economy, you are in charge of your personal savings plan. Instead of simply hoping you won't need your money before a CD matures, you can build a financial strategy that prepares you for the unexpected. A bit of forward-thinking can help you avoid an early withdrawal CD penalty entirely.

While you can't control the economy, you are in charge of your personal savings plan. Instead of simply hoping you won't need your money before a CD matures, you can build a financial strategy that prepares you for the unexpected. A bit of forward-thinking can help you avoid an early withdrawal CD penalty entirely.

By planning ahead, you can turn a seemingly restrictive savings product into a much more flexible part of your financial toolkit. These proven methods give you access to your money while still letting it grow.

Build a CD Ladder for Planned Liquidity

One of the most popular and effective strategies is CD laddering. The idea is simple: instead of locking one large sum into a single long-term CD, you split the money into several smaller CDs with staggered maturity dates. Think of it like building a small staircase for your savings—each step is a CD that matures, giving you access to cash at regular intervals without breaking any terms.

For example, if you have $10,000, you could build a four-rung ladder like this:

- $2,500 in a 1-year CD

- $2,500 in a 2-year CD

- $2,500 in a 3-year CD

- $2,500 in a 4-year CD

When the 1-year CD matures, you have a choice: take the cash penalty-free or reinvest it into a new 4-year CD at the top of your ladder. This creates a rolling cycle where a portion of your money becomes available every year, greatly reducing the odds you'll ever need to pay a penalty.

Explore Penalty-Free and Flexible CD Options

Not all CDs follow the same rigid rules. As banks and credit unions compete for savers, many have introduced products with built-in flexibility. When you're shopping for a CD, the penalty structure is just as important as the interest rate.

Look for these two standout options:

- No-Penalty CDs: These work exactly as the name suggests. You can withdraw your entire balance, including interest earned, before the official maturity date without paying a fee. The trade-off is often a slightly lower APY, but for those who value liquidity, the peace of mind is a major benefit.

- Bump-Up CDs: These are a great choice in a rising-rate environment. A bump-up CD lets you request a rate increase—usually once or twice during the term—if your bank starts offering higher rates on new CDs. This keeps you from feeling stuck with an old rate and wanting to withdraw early to reinvest elsewhere.

Use Your CD as Loan Collateral

What if you need cash but your CD is earning a fantastic rate you don't want to lose? A clever but often overlooked option is a CD-secured loan. Rather than cashing out your certificate, you use its value as collateral to borrow money from the same bank, much like a home secures a mortgage.

Because the loan is fully secured by the funds in your CD, the bank takes on very little risk. As a result, you often get a loan with a significantly lower interest rate than a standard personal loan or credit card cash advance. The best part is that your CD stays in place and continues to earn interest for you, preserving your original investment while you get the cash you need.

These strategies put you in control. While penalties are a real part of CDs, they don't have to be inevitable. By laddering, choosing flexible products, or using your CD as collateral, you can build a savings plan that works for you. To dig deeper into the specifics, read our article on what to expect from a certificate of deposit early withdrawal.

Early Withdrawal CD Planning for Retirement Success

For a retiree, a Certificate of Deposit isn't just another savings account—it's a critical gear in your fixed-income machine. During your career, an unexpected penalty might be a minor bump in the road. But in retirement, when you depend on steady, predictable cash flow, an early withdrawal CD penalty can cause real damage to your financial plan. It's not just about the fee; it's about disrupting a system you’ve carefully built to support you for decades.

Aligning CDs with Your Retirement Timeline

The main draw of CDs for retirees is their certainty. You know exactly what you’ll earn and when the money will be available. But this same feature can create a liquidity trap, where your money is safe but out of reach without paying a penalty. Think of it like a time-locked vault: your money is secure, but you can't open it early without a cost.

The best defense is to set multiple, smaller time-locks instead of one big one. By staggering your CD maturity dates, you can create a reliable stream of cash that becomes available when you need it. You can see how this works in our guide on the CD ladder strategy. This planning is essential for coordinating with other parts of your financial life. For instance, Required Minimum Distributions (RMDs) from an IRA or 401(k) create a predictable tax bill. If you have to break a CD unexpectedly, it can throw your entire budget off, forcing you to sell other investments at the wrong time just to cover the gap.

The Penalty's Impact on Sustainable Withdrawals

Financial planners often refer to a "safe withdrawal rate" to make sure your savings last throughout your retirement. These strategies are built on a stable principal that generates dependable returns. An unplanned CD penalty is a direct hit to this foundation. Research suggests that withdrawing 3% to 4% from a portfolio each year generally provides long-term financial security. An early CD withdrawal disrupts this careful balance. You can explore the data behind sustainable withdrawal rates in this research.

The penalty isn't just a one-time loss. When you lose principal, you also lose all the future growth that money could have generated. If a $500 penalty is taken from a $100,000 portfolio, it means that $500 is gone forever. It can no longer work for you, and over 20 or 30 years of retirement, the lost compounding on that small amount can add up, slowly weakening your financial footing.

Practical Strategies for Retirees

To use CDs effectively in retirement, you need a plan that takes advantage of their safety while preparing for life's surprises. This means looking past just the interest rate and thinking about how each CD fits into your overall financial picture.

Here are a few smart approaches:

- Map Maturities to Known Expenses: Don't let your maturity dates be random. Line them up with big, predictable bills. If you know your annual property tax is due in November, set a CD to mature in October. This turns your CDs into a purpose-built cash flow generator.

- Inquire About Age-Related Waivers: Some banks and credit unions will waive penalties under specific conditions, like the death of an account owner or a diagnosis that requires long-term care. It's vital to ask about these policies before you open the account, as they are not always standard.

- Balance Security with Flexibility: Your CDs should be just one part of your financial toolkit. Pair your secure, high-yield CDs with a more accessible high-yield savings account for emergencies. This creates a financial buffer that protects your long-term CD investments from sudden cash demands, giving you security and flexibility at the same time.

When Breaking Your CD Makes Perfect Financial Sense

Paying a penalty can feel like taking a step backward, but in some situations, it's the smartest financial move you can make. The key is to stop thinking of an early withdrawal as a mistake and start seeing it as a calculated decision. A clear-eyed analysis can show you when paying that fee is actually a ticket to a much better financial outcome. This approach helps you evaluate the situation with confidence, turning a potential loss into a strategic gain.

The Cost-Benefit Analysis: Penalty vs. Opportunity

One of the best reasons to break a CD is to wipe out high-interest debt. Think about this common scenario: someone pays a $200 early withdrawal penalty to clear a credit card balance. That same credit card was costing them over $800 in interest every year. By taking the one-time $200 hit, they immediately stopped the bleeding and saved themselves from a much larger, ongoing expense. The net gain was $600 in the first year alone.

Another case is when a unique investment or business opportunity appears that promises returns far greater than your CD's fixed rate. An early withdrawal could fund a down payment on an investment property or provide seed money for a new business. The decision comes down to a simple question: will the potential profit be significantly larger than the penalty plus the interest you're giving up? For the right venture, the penalty is simply the cost of putting your money to work more effectively.

A Practical Framework for Your Decision

To make the right call, you need to replace emotion with objective data. Use this framework to make sure your decision is based on sound financial reasoning.

- What is the exact penalty? Before doing anything else, calculate the precise dollar amount you will pay. Don't estimate or guess.

- What are my alternatives? How does the penalty compare to the interest on a personal loan or the cost of using a line of credit? The penalty might be the cheapest option.

- How much time is left on the term? If your CD matures in two months, it almost always makes sense to wait. If it has four years left, the math changes completely.

- What is the current rate environment? If interest rates are rising, you might be able to break your CD, pay the penalty, and reinvest the money in a new CD at a higher rate that more than makes up for the fee over time.

- What does my full financial picture look like? Have you already used other sources of cash, like a liquid emergency fund? A CD should not be your first line of defense.

Can You Negotiate the Penalty?

While it’s never guaranteed, it is possible to ask your bank or credit union for a waiver. Some institutions may reduce or waive penalties in specific, documented situations, such as a sudden disability or the death of the account holder. Having a long and positive history with your bank can also help your case. However, you should not rely on this possibility. The real power is in your analysis—making a choice based on hard numbers, not hope.

Before you act, get a clear picture of the cost. Use our free Certificate-of-Deposit Calculator to see your exact penalty and make the most informed decision for your financial future.