The Power Behind Compound Interest Fundamentals

Understanding how your money grows is crucial for sound financial planning. This involves grasping compound interest, where your earned interest generates even more interest. Over time, this creates exponential growth, significantly outpacing simple interest. This phenomenon is why Albert Einstein reportedly called it the “eighth wonder of the world.” Several key factors influence the power of compound interest.

These key factors include your principal amount (initial investment), the interest rate, and the time horizon (length of investment). The compounding frequency, or how often interest is calculated and added to your principal, also plays a significant role.

Understanding Compounding Frequency

Compounding frequency determines how quickly your returns accumulate. More frequent compounding leads to faster growth. This might seem surprising, but the math behind compound interest shows that the frequency of compounding periods directly impacts your final amount. The standard formula is ( A = P \left(1 + \frac{r}{n}\right)^{nt} ). Here, ( P ) represents the principal, ( r ) is the annual nominal interest rate, ( n ) is the compounding frequency, and ( t ) is the number of years.

Increasing the compounding periods (daily is 365, monthly is 12) increases the final amount (( A )). Over long periods and with higher interest rates, this effect becomes even more pronounced. For instance, a $100,000 investment at 5% annual interest over 10 years would yield $50,000 in simple interest. With monthly compounding, however, the interest earned would be approximately $64,700. This clearly illustrates the power of compounding frequency. Learn more about compound interest at Investopedia.

Compounding can occur daily, monthly, quarterly, or annually. Each frequency affects your returns differently. With daily compounding, interest is calculated and added every day. With monthly compounding, this happens every month. You might find this article helpful: How to Calculate Interest on a CD. Optimizing processes like compound interest frequency is similar to the need for streamlined checkout experiences. Read more about this in: Ecommerce Checkout Optimization.

When choosing an investment product, understanding the compounding frequency is essential. Some products, such as certain high-yield savings accounts, offer daily compounding. Others, like many CDs, might offer monthly compounding. These seemingly small differences can significantly impact your long-term returns, especially with larger investments and higher rates.

Daily Compounding: How Your Money Grows Every 24 Hours

Daily compounding means your interest earns interest every single day. That's 365 times per year! This creates a snowball effect, leading to potentially significant returns over the long haul. Think of it like this: you deposit $1,000 into a high-yield savings account with a 2% annual interest rate, compounded daily.

Each day, the bank calculates interest on your balance, including the interest earned the previous day. This constant growth cycle allows your money to grow faster than with less frequent compounding.

Where You'll Find Daily Compounding

Looking for accounts that offer daily compounding? You have several options. Here are a few common examples:

- High-yield savings accounts: Many online banks and credit unions use these accounts to attract new customers.

- Certain Certificates of Deposit (CDs): Some CDs, especially short-term ones, feature daily compounding. Use a CD Calculator to see how daily compounding impacts CD returns.

- Specialized investment vehicles: Occasionally, money market funds and other investment products offer daily compounding.

Always double-check the terms and conditions of any financial product to confirm its compounding frequency.

Accrual vs. Crediting: A Key Distinction

It’s important to understand the difference between accrued interest and credited interest. Accrued interest refers to the interest that’s calculated. Credited interest is when that calculated interest is actually added to your balance.

Interest might be calculated daily, but that doesn't mean it will be added to your account daily. Some financial institutions might credit interest monthly, even with daily accrual. Your actual returns are based on the credited balance, not just the calculated interest.

The Real Impact of Daily Compounding

The difference in return between daily compounding and, say, monthly compounding, can seem small at first. But, over time, with larger sums and higher interest rates, the impact becomes more evident. Imagine a $5,000 initial investment over five years.

With a 4% APY compounded monthly, you’d earn approximately $1,082 in interest. Daily compounding at the same 4% APY results in about $1,083 – a small difference, but a difference nonetheless. Over longer periods and with larger amounts, this gap can become more substantial.

Let's look at the pros and cons of daily compounding to better understand its impact. The following table summarizes the key advantages and disadvantages:

Daily Compounding: Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Faster growth than less frequent compounding | The difference might be negligible for smaller balances or shorter timeframes |

| Maximizes earning potential over the long term | Requires careful attention to the terms and conditions to understand how interest is credited |

| Can be particularly beneficial with high-yield accounts |

This table illustrates how daily compounding can accelerate your returns, although the effect is more noticeable over time and with larger sums. This distinction is especially relevant when calculating CD interest. For more information on CD calculations, check out this link.

Understanding the annual percentage yield (APY) is essential, as it reflects the real return you'll receive, taking compounding frequency into account. Learn more about the difference between APY vs APR on this page.

Monthly Compounding: The Standard Growth Model Explained

Monthly compounding forms the basis of many financial products. This means interest is calculated and added to the principal twelve times a year. This consistent growth cycle provides a predictable pattern for savings to increase. Let's explore how this standard model works and where you might encounter it.

How Monthly Compounding Works

Imagine depositing $1,000 into a savings account with a 3% annual interest rate, compounded monthly. Each month, the bank calculates the interest earned on the balance and adds it to the principal.

The following month, the interest calculation includes the previous month's interest. This creates the compounding effect. This process repeats monthly, steadily increasing the balance. The regularity of monthly compounding makes it easy to track investment progress and project future returns.

Common Products With Monthly Compounding

Monthly compounding is a common practice across various financial instruments. You'll often find it in:

- Savings Accounts: Traditional savings accounts typically use monthly compounding to calculate interest.

- Certificates of Deposit (CDs): Many CDs, especially longer-term options, offer monthly compounding. The CD Calculator can help illustrate how different compounding frequencies affect CD earnings.

- Loans: Many loan products, such as mortgages and personal loans, calculate interest monthly.

- Corporate Bonds: These bonds often pay interest semi-annually, but the underlying calculations frequently use monthly compounding.

This widespread use makes monthly compounding a key comparison benchmark.

The APY Connection

Annual Percentage Yield (APY) is the standard method financial institutions use to present interest rates. The APY considers compounding frequency, offering a realistic view of potential return.

For example, an account with a 3% interest rate compounded monthly will have a slightly higher APY. This reflects the added benefit of compounding. This standardization highlights why understanding monthly compounding is vital for comparing different financial products.

The Impact of Compounding Frequency

Comparing products with different compounding frequencies becomes crucial. Daily compounding does offer higher returns than monthly compounding, though the difference is often small. For instance, one example showed daily compounding yielded $3,045.33 in interest compared to $3,041.60 with monthly compounding—a difference of only $3.73 annually. You can explore this comparison further here.

This reinforces the concept that while frequent compounding yields higher returns, the additional gains decrease as frequency increases. The difference between annual and monthly compounding is much more significant than between monthly and daily.

The Impact of Timing

The timing of when interest is added to an account, while subtle, can affect returns. If interest is calculated daily but credited monthly, the effective compounding frequency is monthly, not daily. This seemingly small difference can have substantial long-term effects.

Carefully reviewing the terms and conditions of any financial product is essential. The distinction between accrual and crediting can be confusing. By understanding monthly compounding, you’re better prepared to accurately assess a product's true earning potential and make well-informed financial choices.

Daily vs. Monthly Compounding: The Real Numbers Revealed

Beyond the theory, let's explore how daily versus monthly compound interest actually impacts your returns. This section presents realistic scenarios, highlighting where the frequency of compounding truly makes a difference. We'll examine various time horizons, from short-term goals (1-2 years) to long-term investments (20+ years). We'll also uncover how the principal, interest rate, and time interact to produce different outcomes, analyzing both modest savings and substantial investments to clearly illustrate the difference between compounding methods.

Visualizing the Impact

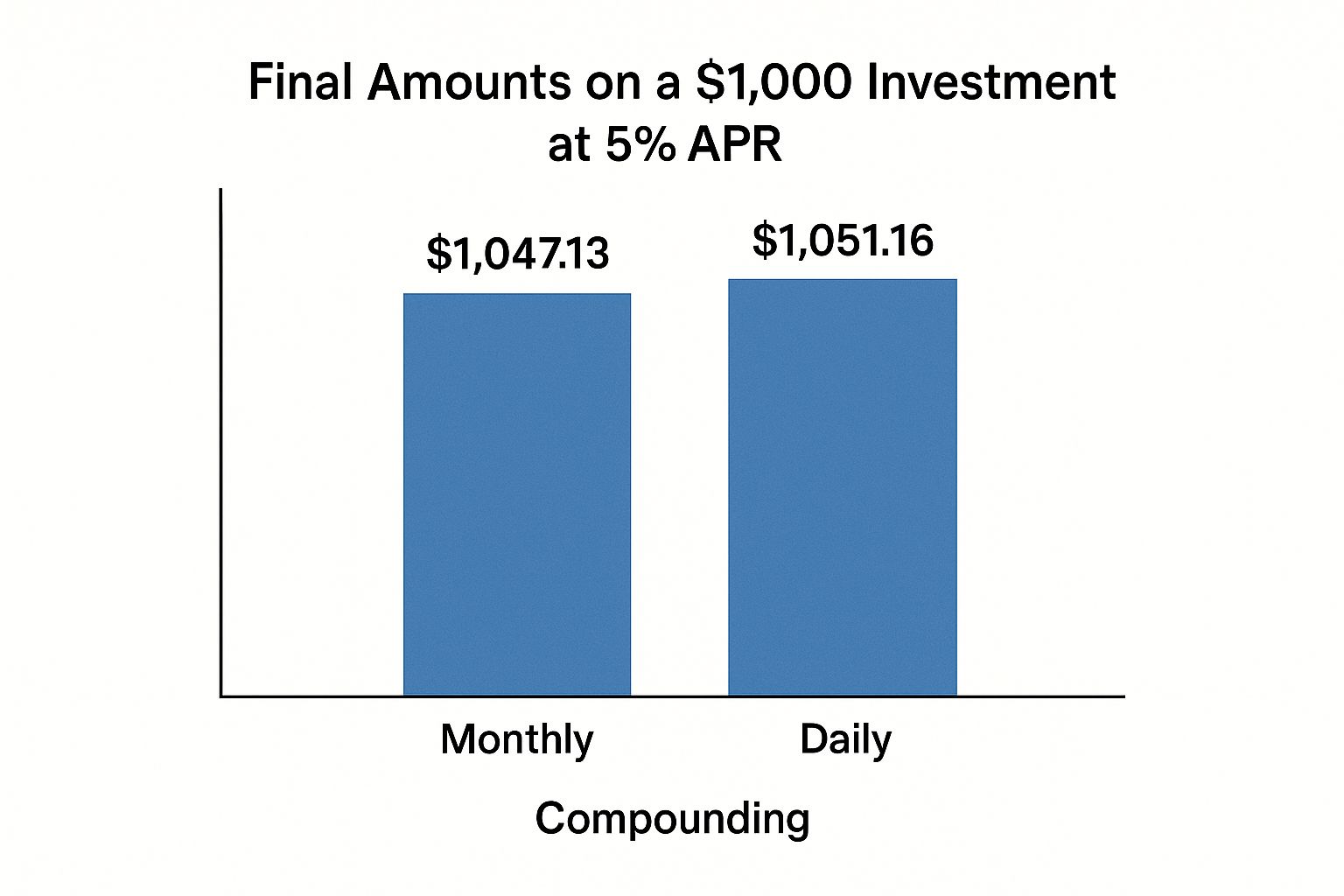

To better understand this difference, let's consider a simple example. The following infographic compares the final amounts of a $1,000 investment at 5% APR, compounded monthly versus daily.

As the infographic demonstrates, even with a modest investment, daily compounding results in a slightly higher return—$1,051.16 compared to $1,047.13 with monthly compounding. While the difference might appear small initially, it becomes more significant over time and with larger investments.

Real-World Examples

Let's look at a high-yield savings account with a 4% APY. Suppose you deposit $10,000 and contribute an additional $100 monthly for five years. With monthly compounding, your total would reach approximately $18,861.96. However, daily compounding would result in about $18,867.01. This example demonstrates that even with regular contributions, daily compounding adds value, although the difference is modest in this specific case—around $5.05. Learn more about daily vs. monthly compounding. You can also learn how to calculate CD interest with this CD interest calculator.

Time Horizon and Principal Amounts

The impact of compounding frequency becomes more pronounced with longer timeframes. A 10-year investment of $20,000 at 6% interest will show a greater difference between daily and monthly compounding than a 2-year investment. Similarly, larger principal amounts amplify the effects of compounding.

Interest Rates

The interest rate itself plays a crucial role. A higher interest rate, when combined with daily compounding, can significantly increase your returns. For instance, a $50,000 investment at 8% interest compounded daily over 15 years will yield substantially more than the same investment compounded monthly.

Let's take a closer look at the actual numbers. The following table compares daily and monthly compounding returns across several scenarios:

Daily vs Monthly Compounding Returns Comparison Comparison of returns with different principal amounts, interest rates, and time periods

| Scenario | Principal | Interest Rate | Time Period (Years) | Monthly Compounding Return | Daily Compounding Return | Difference |

|---|---|---|---|---|---|---|

| 1 | $1,000 | 5% | 1 | $1,051.16 | $1,051.27 | $0.11 |

| 2 | $10,000 | 4% | 5 | $12,209.97 | $12,210.20 | $0.23 |

| 3 | $20,000 | 6% | 10 | $36,122.27 | $36,204.37 | $82.10 |

| 4 | $50,000 | 8% | 15 | $165,185.88 | $165,760.11 | $574.23 |

As you can see, the difference in returns between daily and monthly compounding becomes increasingly significant as the principal, interest rate, and time horizon increase.

Practical Considerations

While daily compounding offers a slight advantage, it's important to consider other factors. Fees, minimum balance requirements, and early withdrawal penalties can all diminish the benefits of more frequent compounding. Therefore, it’s essential to evaluate these factors when comparing different financial products. Furthermore, understanding how taxes affect your returns is vital, as taxes can reduce the benefits of compounding, especially in taxable accounts.

By considering these real-world examples and understanding the interplay of principal, interest rate, and time, you can make well-informed decisions to maximize your investment returns. Don't just focus on the compounding frequency—consider the entire financial picture.

When Compounding Frequency Actually Matters

Not all financial decisions require a deep dive into the intricacies of compounding frequency. But sometimes, it's a crucial factor. This section clarifies when the difference between daily and monthly compounding truly makes a difference. We'll explore three key factors that amplify these differences: high interest rates, substantial principal amounts, and extended time horizons.

The Impact of High Interest Rates

The importance of compounding frequency increases as interest rates climb. For instance, the difference between daily and monthly compounding on a $1,000 deposit at 1% interest is minimal. However, if that rate increases to 5% or 8%, the effect of daily compounding becomes much more noticeable. This happens because daily calculations allow the earned interest to earn even more interest faster, boosting overall growth.

Principal Amounts: Bigger Balances, Bigger Impact

The principal amount, your initial investment, also plays a significant role. The larger the principal, the more impactful the compounding frequency becomes. A small principal might see a difference of mere cents between daily and monthly compounding. But with a substantial investment, this difference can accumulate into hundreds or even thousands of dollars over the years. This underlines the importance of maximizing compounding benefits, particularly with larger investments.

Time: The Compounding Amplifier

Time is perhaps the most significant factor influencing compounding. The longer your investment timeframe, the more substantial the difference between daily and monthly compounding becomes. Over shorter periods, like a year or two, the variation might be small. However, over decades, the advantage of daily compounding can generate substantially greater returns than monthly compounding. This highlights the power of long-term investment strategies, especially when combined with frequent compounding. You might be interested in: How to master APY vs. APR.

High-Yield Environments and Debt

The effect of compounding is magnified in high-yield environments. Think high-yield savings accounts, certain CDs, or specific investment vehicles. While the percentage difference between daily and monthly compounding might seem small, the actual dollar amounts can accumulate significantly over time.

However, daily compounding can be detrimental with high-interest debt, such as credit cards and certain loans. Interest accumulates rapidly with daily compounding, potentially adding substantial costs. Aggressively paying down these debts minimizes the negative impact of daily compounding and saves you money in the long run.

Beyond Frequency: What Actually Drives Your Returns

While the frequency of compounding matters, focusing too much on it can obscure the bigger picture of financial growth. This section offers a broader look at the factors that truly drive returns, starting with the baseline interest rate itself. This is often a much more significant factor than how often the interest compounds. While frequency is important, different business models also impact returns. Take a look at these Top Subscription Models Examples For Business Success.

Hidden Costs and Terms

Fees, minimum balance requirements, and early withdrawal penalties can quickly diminish any advantage gained from daily versus monthly compounding. For example, a high-yield savings account with daily compounding might seem attractive. However, if it has a monthly maintenance fee, this could negate the benefits of more frequent compounding. Similarly, early withdrawal penalties on CDs can offset any gains if you need access to your money before maturity.

The Tax Impact

Taxes also play a role in your actual returns. In taxable accounts, annual tax obligations can significantly reduce the benefits of compounding. Understanding the tax implications of various investment vehicles becomes a critical aspect of your financial strategy. For instance, tax-advantaged accounts like Roth IRAs offer tax-free growth, allowing the full potential of compounding to work for you.

Liquidity, Risk, and Your Timeline

Your individual liquidity needs, risk tolerance, and financial timeline are far more important than the compounding schedule alone. If you need quick access to your cash, a daily-compounding savings account might be a better fit than a long-term CD. This is true even if the CD offers a slightly higher rate of return. Your risk tolerance should also guide your investment choices more than minor differences in compounding frequency.

Prioritizing the Right Factors

Focusing solely on daily versus monthly compounding can distract you from more crucial factors that impact your financial growth. Some of these key factors include:

- Choosing investments that align with your overall financial goals

- Diversifying your portfolio to manage risk effectively

- Minimizing investment expenses and fees

- Regularly rebalancing your portfolio based on market conditions and your personal circumstances

This holistic approach ensures you're focusing on strategies that genuinely maximize long-term financial success. Understanding these crucial factors allows you to make informed choices that significantly contribute to your overall financial well-being.

Ready to see how compounding can work for you? Use our Certificate-of-Deposit Calculator to explore how different interest rates, terms, and compounding frequencies can affect your returns. It's a great tool for planning your financial future.