The Real Story Behind APR vs APY: Why It Matters

Understanding the difference between Annual Percentage Rate (APR) and Annual Percentage Yield (APY) is crucial for smart financial decisions. Both represent annual interest rates, but they tell different stories. APR reflects the simple interest rate on a loan or investment, excluding the effects of compounding. This shows the base cost of borrowing or the baseline return on an investment.

However, APR doesn't show the full picture when interest compounds. This leads us to APY. APY factors in compounding, the process of earning interest on your earned interest. This reveals the true return on an investment or the actual cost of a loan over a year.

Imagine investing $1,000 at a 5% APR compounded monthly. With compounding, you earn interest not only on your initial $1,000 but also on the interest earned each month. This results in a higher actual return than 5%, which is reflected in the APY.

Why Lenders Use APR and Investors Focus on APY

The difference between APR and APY explains why lenders often advertise APR for loans, while investment products highlight APY. For lenders, APR presents the loan's cost in a simpler way. This is because APR doesn't include the added cost of compounding interest.

Conversely, highlighting APY benefits investment products by showcasing the higher returns generated through compounding. This attracts investors seeking to maximize earnings.

The Impact of Compounding Over Time

The difference between APR and APY becomes especially significant during periods of rising interest rates. In June 2013, the average APY on 1-year CDs was just 0.24%, while 5-year CDs reached 0.77% APY. This reflects how compounding over longer terms boosts yields compared to simple interest rates.

By January 2025, top 1-year CD APYs reached 4.40%—a dramatic increase from the 2020 pandemic lows below 1% APY. When the Federal Reserve raised rates aggressively during 2022-2023, 5-year CD APYs climbed to decade highs near 5%. This demonstrates how APY accounts for compound growth better than APR, especially for long-term investments where compounding can significantly increase returns.

Find more detailed statistics here: https://www.bankrate.com/banking/cds/historical-cd-interest-rates/

Understanding this difference is key to informed financial decisions. A seemingly small difference between APR and APY can create significant differences in actual returns or costs over time, especially with long-term loans or investments. Whether borrowing or investing, paying attention to both APR and APY helps accurately assess the true cost and potential benefits.

Cracking the Code: The Math That Powers APR vs APY

Understanding the difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield) is crucial for making sound financial decisions. It's more than just knowing definitions; it's about understanding the math behind them. This knowledge helps you accurately compare different financial products, whether you're taking out a loan or making an investment.

Calculating APR

Calculating APR is fairly straightforward. It represents the simple annual interest rate you'll pay on a loan or earn on an investment. For example, a 6% APR on a loan means you'll pay 6% of the principal amount in interest each year. This calculation doesn't factor in the effects of compounding, making it simpler than calculating APY.

Calculating APY

APY, on the other hand, takes into account the effect of compounding, which is the process of earning interest on your accumulated interest. The formula for APY is:

APY = (1 + r/n)^n - 1

Where:

- r represents the stated annual interest rate (APR)

- n represents the number of compounding periods per year

This formula illustrates how increased compounding frequency results in a higher APY. A 5% APR compounded monthly will yield a higher APY than the same APR compounded annually.

Visualizing the Impact of Compounding

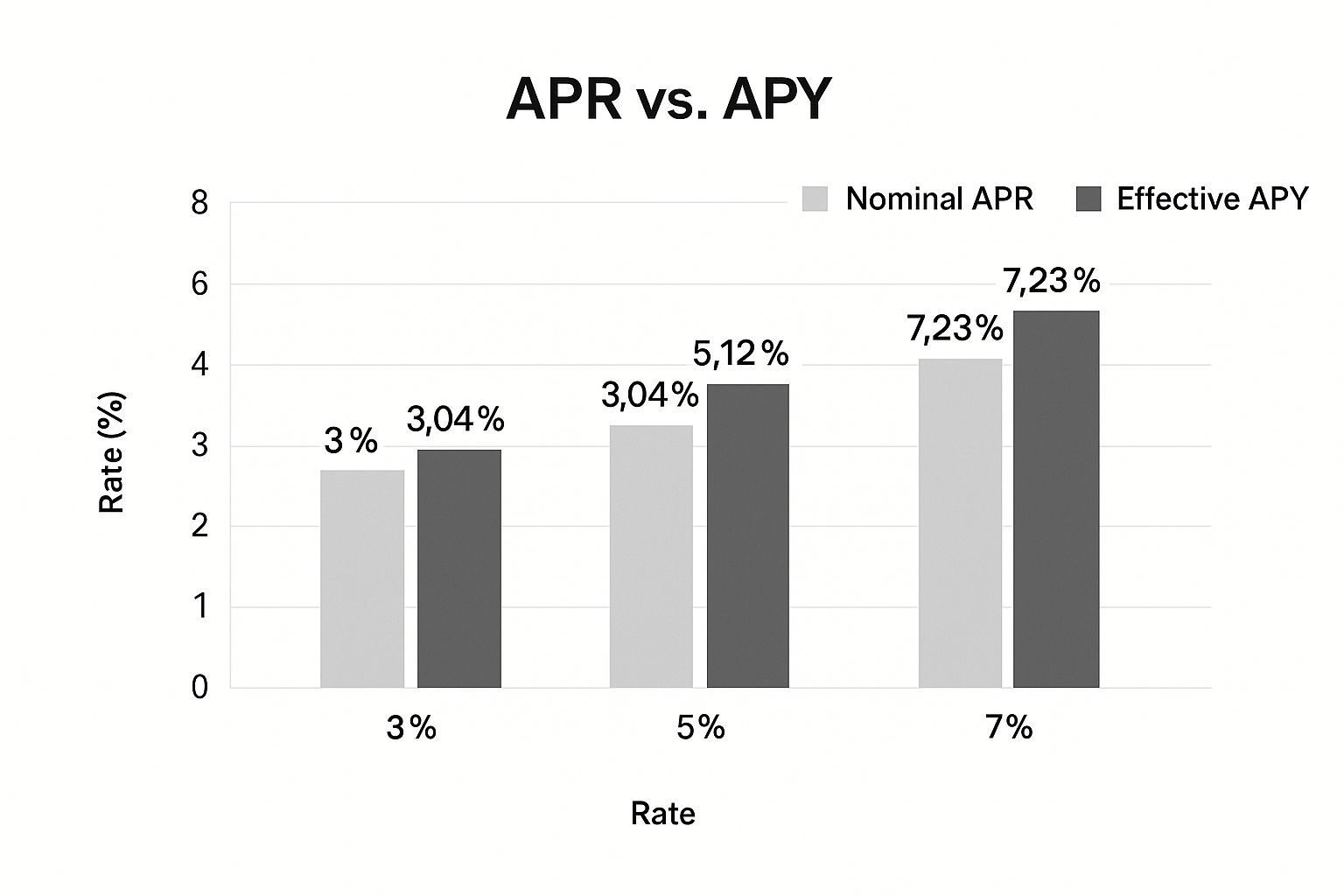

To better understand how compounding frequency affects your returns, let’s consider a $1,000 investment at a 5% APR over one year. The following data chart visualizes the impact of different compounding frequencies:

This bar chart clearly shows that as the compounding frequency increases, so does the APY and, consequently, the total return. The difference between annual and daily compounding, while seemingly small in percentage terms, results in a noticeable difference in dollars earned. Daily compounding yields $51.27 in interest, compared to $50.00 with annual compounding. This highlights why understanding APY is essential, especially for long-term investments. Let's clarify some common financial jargon to solidify these concepts.

To further illustrate this, the table below displays how different compounding frequencies affect the APY based on the same APR.

Compounding Frequency Effects on APY

| APR | Annual Compounding APY | Quarterly Compounding APY | Monthly Compounding APY | Daily Compounding APY |

|---|---|---|---|---|

| 5% | 5% | 5.09% | 5.12% | 5.13% |

| 10% | 10% | 10.38% | 10.47% | 10.52% |

As demonstrated in the table, a higher compounding frequency results in a higher APY, maximizing returns for investors.

Converting Between APR and APY

Converting between APR and APY allows for accurate comparisons between different financial products. The APY formula can be rearranged to solve for APR:

APR = n * [(APY + 1)^(1/n) - 1]

This allows you to compare loans with different compounding periods or investments with varying interest rates. This is particularly useful when evaluating long-term investments where small APY differences can significantly impact overall returns. The difference between APR and APY becomes more pronounced with higher interest rates, making this conversion even more crucial.

How Fed Decisions Transform Your APR vs APY Reality

The Federal Reserve (Fed) significantly influences the financial landscape, and its decisions directly affect interest rates. This impact is evident in how the Fed's actions influence the APR (Annual Percentage Rate) and APY (Annual Percentage Yield) you see on financial products, from loans to savings accounts.

The Ripple Effect of Rate Changes

When the Fed adjusts interest rates, financial institutions usually follow suit. However, the speed and degree of these adjustments differ between products and institutions. Some banks swiftly raise or lower their rates, while others proceed more cautiously.

This difference in response creates opportunities for informed consumers. For instance, when rates rise, quickly moving funds to a high-yield savings account can substantially increase earnings.

Why Some Institutions Lag Behind

Several factors influence an institution’s speed in adjusting APRs and APYs. Competition plays a significant role. Banks competing for new customers may aggressively raise APYs on savings products or be slower to raise APRs on loans.

An institution’s financial health and its specific portfolio of loans and deposits also affect its responsiveness to Fed decisions.

Historical Impact and the APY/APR Spread

Past Fed rate actions directly influence the difference between APY and APR. The Fed's 11 rate hikes during 2022-2023 increased average 1-year CD APYs from 1% to over 5% by March 2023. Meanwhile, the federal funds rate (essentially an annualized APR) jumped from 0.08% in 2021 to 5.33% by July 2023.

This cascade highlights how APY on savings products adjusts more dynamically than loan APRs due to how often interest compounds. A 5% APR loan with monthly payments has a 5.12% APY equivalent. However, a 5% APY savings account with daily compounding effectively yields more than its stated rate. Explore this further: Federal Funds Data

Predictable Patterns and Strategic Advantages

Despite variations, some predictable patterns emerge. APYs on savings products, like our Certificate of Deposit Calculator demonstrates, tend to adjust more rapidly and closely follow Fed rate changes than APRs on loans. This is due to the competitive market for deposits. Understanding these trends allows consumers to anticipate market shifts and position themselves accordingly.

Maximizing Gains and Minimizing Costs

Recognizing these patterns lets you use Fed decisions to your benefit. During rising rates, prioritize high-APY savings vehicles to maximize returns. Conversely, when rates fall, focus on refinancing loans at lower APRs to minimize borrowing costs.

Analyzing the Impact on Your Financial Goals

Understanding how Fed decisions transform the APR vs APY reality directly affects your financial strategy. Whether you're saving for retirement, managing debt, or planning major purchases, this dynamic helps optimize your approach.

It enables informed choices and allows you to adjust your financial plan to the changing interest rate environment. Tools like a CD calculator offer valuable insights into how these changes affect your potential returns. By monitoring Fed announcements and understanding their impact, you can proactively manage your finances and achieve your financial goals.

Borrower's Guide: Mastering APR vs APY When Taking Loans

Understanding the true cost of a loan is crucial before you sign on the dotted line. This means looking beyond the interest rate and understanding the difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield). While APY is typically used for savings accounts and investments, it’s important to understand the distinction, especially when comparing the total cost of borrowing. Lenders are required to disclose the APR, which gives a more complete picture of your borrowing costs.

Decoding the APR

The APR represents the annual cost of borrowing, including the interest rate and certain fees. For example, a 5% APR on a $10,000 loan doesn't just mean you’ll pay $500 in interest each year. The APR factors in fees like origination fees, closing costs, or mortgage insurance, providing a more accurate representation of the loan’s total cost. This comprehensive view allows you to compare loans with different fee structures more effectively.

Hidden Costs Within the APR

While the APR incorporates many fees, it's important to remember that some costs might not be included. Prepayment penalties, late payment fees, and other variable charges aren't always reflected in the APR. Carefully review your loan agreement for any potential extra costs. For instance, a prepayment penalty for paying off your loan early is sometimes not included in the APR.

Real-World Loan Examples: Mortgages, Credit Cards, and Personal Loans

Let's illustrate how APR applies to different loan types. With mortgages, the APR includes fees like points and mortgage insurance, enabling clearer comparisons between loan offers. For credit cards, the APR incorporates annual fees and other charges. This makes comparing cards based on their APRs, rather than just the interest rate, essential. Finally, personal loans often include origination fees within the APR, simplifying comparisons across lenders.

Impact of Payment Structures and Fees

Varying payment structures also influence the overall borrowing cost. A loan with more frequent payments—bi-weekly instead of monthly, for example—can result in slightly lower total interest paid over the loan's life, even with the same APR. This happens because you're reducing the principal balance faster, accruing less interest. Understanding how various fees are factored into the APR is vital for informed borrowing decisions.

Spotting Misleading Advertisements

Be cautious of advertisements emphasizing low interest rates without mentioning the APR. A low advertised rate might exclude important fees, creating a misleading impression of the true borrowing cost. Always prioritize the APR when comparing loan options for a more comprehensive understanding of the total cost.

Questions to Ask When Comparing Loans

When evaluating loans, inquire about all associated fees, even those potentially excluded from the APR. Discuss different repayment schedules and their effect on the total cost. Don't hesitate to negotiate fees or seek clarification on any loan terms. This proactive approach can potentially save you significant money.

Strategies for Evaluating the Real Cost

Comparing loan offers based on their APRs and using a loan amortization calculator can help you understand the real cost implications of various repayment schedules. By inputting different payment frequencies, you can see how the total interest paid changes. This empowers you to select the loan that aligns best with your financial situation and goals.

To further understand how APR is calculated, consider using online tools and resources.

Introducing a table comparing APR to APY can be helpful for illustrating how these concepts differ, even though APY isn't typically used for loans. The table below compares typical APR ranges and associated fees for common loan products.

Comparing APR vs APY on Common Loan Products

| Loan Type | Typical APR Range | Equivalent APY Range | Compounding Frequency | Additional Fees Included in APR |

|---|---|---|---|---|

| Mortgage | 3% - 7% | Not typically used | N/A | Origination fees, points, mortgage insurance |

| Credit Card | 15% - 25% | Not typically used | N/A | Annual fees, balance transfer fees |

| Personal Loan | 6% - 15% | Not typically used | N/A | Origination fees, late payment fees |

This table illustrates the typical APR ranges for various loan types and highlights the fees often included in the APR calculation. Keep in mind that APY is not generally used with loans. By understanding the difference between APR and APY, and by carefully evaluating loan offers, you can make sound borrowing decisions that contribute to your financial well-being.

Investor's Playbook: Leveraging APR vs APY for Higher Returns

For investors, understanding the difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield) is crucial. APY is particularly important for maximizing returns. This section explores how financial institutions calculate and present their yields, highlighting why seemingly small APY differences can significantly impact long-term results.

Unmasking the True Value of APY

Financial institutions calculate APY to reflect the true return on an investment. It takes into account the effect of compounding, where interest earned is added back to the principal. Subsequent interest calculations are then based on this new, higher balance.

For example, a $10,000 investment with a 5% APY compounded annually will yield $500 in the first year. In the second year, interest is calculated on $10,500, resulting in a slightly higher return. This compounding effect contributes significantly to growth over time.

The Power of Compounding: A Case Study

Let's look at two similar investments: one offering a 4.9% APR compounded annually and another offering a 5% APY compounded daily. The APY investment, despite a seemingly small difference in the headline rate, will produce significantly higher returns over the long term.

This difference comes down to the frequency of compounding. More frequent compounding, like daily compounding, leads to faster growth. Using a Certificate of Deposit Calculator can help you model these differences and make informed decisions.

Deciphering Investment Offers

Savvy investors know that maximizing returns involves more than just looking at the advertised APY. It's important to dig into the details of each investment offer. This includes understanding the compounding method, how often interest is credited, and whether any promotional rates are involved.

For example, a promotional rate may initially seem attractive, but it's essential to understand the rate after the promotional period ends. A lower regular rate can significantly reduce the long-term benefits.

Comparing Offers and Strategies

To maximize returns, compare offers from different institutions. Don't just focus on the APY. Consider other factors such as the investment's term length, potential penalties for early withdrawals, and the financial stability of the institution.

Strategies like CD laddering can help balance liquidity and yield. This involves spreading investments across multiple CDs with different maturity dates, providing access to funds at regular intervals while still benefiting from compounding.

Structuring Savings for Optimal Growth

Different financial goals require different investment strategies. Short-term goals might benefit from high-yield savings accounts or short-term CDs. Long-term goals, such as retirement, may be better suited to longer-term investments with higher APYs. A CD Calculator can help you model different scenarios.

Regardless of your investment timeline, understanding APY and the nuances of compounding is essential for making informed decisions. Ask questions about the offer details. Don’t just look at the advertised APY – understand how it's calculated and what it truly means for your financial future.

Exposing APR vs. APY Myths: What Financial Institutions Won't Tell You

The financial world is full of confusing terms. Understanding the difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield) is crucial for making smart decisions. This confusion isn't always accidental. Financial institutions sometimes leverage this complexity, highlighting either APR or APY depending on whether they're selling loans or investments. Let's break down these tactics and empower you to navigate the financial landscape with confidence.

The Art of Selective Emphasis

Think about those tempting credit card offers with low APRs. These ads often focus on the APR because it represents the simple interest rate, excluding the effects of compounding. This makes the loan seem cheaper. However, the true cost is reflected in the APY, which includes compounding.

Conversely, advertisements for savings accounts or investments emphasize the APY. This is because APY shows the total amount earned after interest is compounded, making returns appear more attractive. This selective emphasis can create a misleading picture.

Decoding Real-World Examples

Let’s look at some examples. A credit card might advertise an 18% APR. With monthly compounding, the actual cost is closer to a 19.56% APY. This difference can significantly impact your finances, especially with large balances.

On the other hand, a savings account might advertise a 2% APY. While this sounds good, the actual return depends on the compounding frequency. Daily or monthly compounding yields more than annual compounding. This highlights the importance of reading the fine print. Understanding different investment strategies, like those discussed in this article on Crypto Investment Strategies, can help you maximize returns through compounding.

Developing Critical Thinking Skills

To avoid marketing traps, develop critical thinking skills. Always ask: "Are they showing me APR or APY, and why?" If you're considering a loan, calculate the APY yourself. For investments, understand the compounding frequency and its impact on your returns.

When the Distinction Truly Matters

The APR vs. APY difference is crucial in certain situations. For long-term loans like mortgages, a small difference can significantly impact the total cost over time. Similarly, for long-term investments, a slightly higher APY with frequent compounding can dramatically increase your overall return.

Practical Frameworks for Confident Decisions

Develop a framework for evaluating offers. Always calculate the APY for loans and consider the compounding frequency for investments. Tools like our Certificate of Deposit Calculator can help you estimate future value and compare CD offers. By understanding these key distinctions, you can make informed financial decisions.