Demystifying CD Interest Calculations

Calculating CD interest might seem confusing at first, but grasping the basics is essential for maximizing your returns. It's not enough to simply glance at the advertised interest rate. You need to understand how the Annual Percentage Yield (APY) truly reflects your earnings. APY accounts for the impact of compounding, which is essentially earning interest on your accumulated interest.

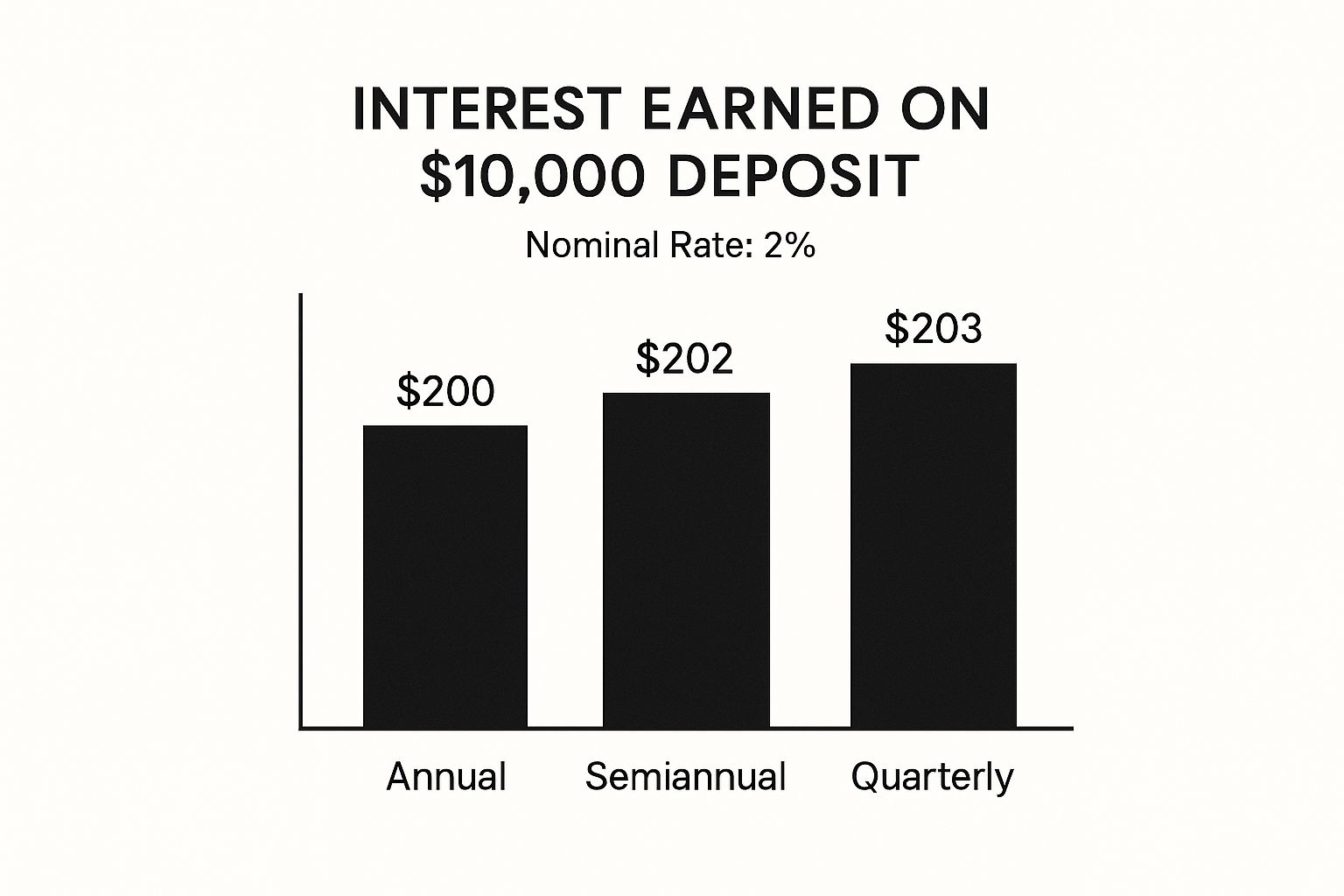

This means that the more frequently your interest compounds (daily, monthly, quarterly, or annually), the greater your actual return will be, even with the same initial interest rate.

Understanding APY and Compounding

APY provides a more complete picture of your return compared to a simple interest rate. For example, a CD with a 5% interest rate compounded annually will yield exactly 5% APY. However, a CD with a 5% interest rate compounded daily will have a slightly higher APY. This is because you're earning interest on a growing balance each day.

This seemingly small difference can significantly impact your earnings over the CD's term. Understanding this distinction is key to accurately calculating CD interest.

The Impact of Compounding Frequency

The frequency of compounding significantly influences how your CD grows. Let's imagine investing $1,000 in a 1-year CD with a 5% interest rate. If the interest is compounded annually, you'll earn $50 at the end of the year.

However, if it's compounded monthly, you'll earn slightly more. This happens because each month's interest is added to your principal, creating a larger base for subsequent interest calculations. Therefore, when calculating CD interest, knowing the compounding frequency is crucial.

Historical CD Interest Rates in Perspective

CD rates have experienced significant fluctuations over the past few decades. During the 1980s, CD rates reached remarkable highs. The average 1-year CD yielded over 11% APY at certain points as the Federal Reserve combatted inflation. By the mid-2000s, this dropped to 2-5% APY.

The 2008 financial crisis then triggered a sharp decline. From 2009 through 2021, short-term CDs often yielded below 1% APY, reaching a 2021 low of 0.17% for 1-year CDs. The post-COVID rate hike cycle reversed this trend. By late 2023, top 1-year CDs offered 5-6% APY, though averages remained lower at 1.92% (Sept 2023).

As of early 2025, even with the Fed cutting rates three times, competitive banks still offer up to 4.4% APY for 1-year CDs, with national averages around 1.95%. For more detailed information, refer to these historical CD interest rate statistics: https://www.bankrate.com/banking/cds/historical-cd-interest-rates/

This historical context underscores the importance of considering current market conditions when calculating CD interest and making investment choices. This knowledge helps you make more informed decisions about where and when to invest in CDs.

Mastering Practical CD Interest Formulas That Actually Work

Now that we understand the power of APY (Annual Percentage Yield) and the magic of compounding, let's explore the formulas used to calculate CD interest. Forget guesswork; we'll empower you with practical methods to determine precise returns. Through clear examples and realistic numbers, you'll gain confidence in calculating interest on any CD.

Simple Interest vs. Compound Interest

The most basic calculation uses simple interest, where interest accrues only on the principal. The formula is straightforward: Interest = Principal * Rate * Time. For instance, a $1,000 CD with a 4% annual interest rate held for one year would generate $1,000 * 0.04 * 1 = $40 in interest.

However, CDs typically employ compound interest, where earned interest is added back to the principal. This means you earn interest on your interest! The formula for compound interest is: A = P (1 + r/n)^(nt). 'A' represents the future value, 'P' the principal, 'r' the annual interest rate, 'n' the number of times interest compounds per year, and 't' the number of years.

Using Spreadsheets and Mobile Tools

Thankfully, you don't have to calculate compound interest manually. Spreadsheets like Microsoft Excel and Google Sheets offer built-in functions. In Excel, use the FV function (=FV(rate, nper, pmt, pv, [type])). Google Sheets uses the same formula.

Many specialized mobile apps also simplify CD interest calculations. These user-friendly tools often include APY comparisons and early withdrawal penalty calculators.

Analyzing the Impact of Compounding Periods

How often interest compounds significantly impacts your returns. To illustrate, let's consider a $1,000 principal, a 4% interest rate, and a 1-year term. The table below compares different compounding frequencies and their respective returns, calculated using the FV function in a spreadsheet program.

To further analyze different CD interest calculation methods, consider the following table:

CD Interest Calculation Methods Comparison

| Calculation Method | Best For | Accuracy Level | Complexity | Tools Required |

|---|---|---|---|---|

| Simple Interest | Short-term, basic calculations | Low | Simple | Basic calculator |

| Compound Interest (Annual) | Long-term, understanding overall growth | Moderate | Moderate | Scientific calculator or spreadsheet |

| Compound Interest (Monthly/Quarterly/Daily) | Maximizing returns, precise calculations | High | Complex | Spreadsheet or specialized calculator |

This table helps illustrate how different calculation methods can be useful in different scenarios, ranging from quick estimations to detailed analyses.

The following data chart visualizes the interest earned with varying compounding frequencies.

As you can see, the data chart clearly shows that more frequent compounding results in higher overall returns. While the difference between monthly and daily compounding is minimal, the impact of compounding frequency is evident.

Understanding these calculations allows you to choose the best CD based on your financial goals.

The CD Rate Rollercoaster: What History Reveals

Understanding historical CD rate trends provides crucial context for calculating CD interest and making informed investment decisions. Analyzing economic cycles across decades reveals how the Federal Reserve's policies and inflation have dramatically impacted CD returns. This historical perspective helps us evaluate today's CD offerings with greater confidence.

The Fed's Influence on CD Rates

The Federal Reserve ("the Fed") plays a significant role in shaping interest rate environments. When the Fed raises its benchmark interest rate, banks often follow suit, increasing rates on products like CDs. Conversely, when the Fed lowers rates, CD rates typically decline. This interplay demonstrates the close relationship between Fed policy and the returns you can expect from a CD.

For example, the period following the 2008 financial crisis saw historically low CD rates. This was due in part to the Fed's policy of quantitative easing, which aimed to stimulate the economy by keeping interest rates low. As a result, many CDs offered meager returns, making it crucial to carefully calculate CD interest to understand the potential impact on long-term growth.

Inflation's Impact on CD Returns

Inflation also significantly influences CD rates. During periods of high inflation, banks tend to offer higher CD rates to attract investors seeking to preserve their purchasing power. However, if CD rates don't keep pace with inflation, the real return on your investment can be diminished. This underscores the importance of considering inflation when calculating CD interest and evaluating the true value of your potential earnings.

Historical CD Rate Volatility

Long-term CD rate trends demonstrate considerable volatility connected to the Fed's actions. Here's a look at the fluctuations:

- 1970s: 3-month CD returns averaged 4-5%, jumping to 12.25% during the inflation spikes of 1970-1974.

- 1980s: 3-month CD rates reached 8.36% during 1980-1984 before settling in the 5-7% range.

- Post-2008: Quantitative easing significantly suppressed yields, with 6-month CDs averaging 0.2-0.5% from 2010-2015.

- 2020s: COVID-era lows of 0.1-0.3% gave way to 2023's 6% peaks.

This historical data emphasizes the need to account for rapid Fed policy changes when calculating CD interest. Find more detailed statistics here: https://fred.stlouisfed.org/tags/series?t=cd%3Brate

Learning From Past CD Rate Cycles

Studying past CD rate cycles helps us anticipate potential future trends. By recognizing historical patterns, we can make more informed decisions about when to lock in rates and for how long. This historical context is invaluable when calculating CD interest and determining the most suitable CD terms for your investment goals.

Adapting to Changing Rate Environments

Savvy savers adapt their strategies to changing interest rate climates. During periods of low rates, they may explore alternative investment options or employ strategies like CD laddering to capture potential rate increases. Conversely, during periods of high rates, they may choose longer-term CDs to lock in favorable returns. This flexibility is essential for maximizing returns in any market condition. Understanding these historical trends empowers you to make proactive choices and optimize your CD investments.

Beyond the Rate: Hidden Factors That Transform Your Returns

Understanding how to calculate CD interest based on the APY and compounding frequency is just the start. Other factors can shift your real earnings. These often-overlooked elements may change the final amount you receive. To get a true picture, look beyond the advertised rate.

Early Withdrawal Penalties: A Costly Mistake

One of the biggest surprises is the early withdrawal penalty. CDs lock your money for a set term, and taking it out early usually triggers fees. These charges can erase several months of interest. For example, pulling funds from a 5-year CD after only 1 year may wipe out much of your accrued earnings.

CD Structures: Bump-Up, Step-Up, and No-Penalty Options

Different CD types will affect your return calculation:

- Bump-Up CDs let you increase your rate once if market rates climb.

- Step-Up CDs come with scheduled rate increases at set intervals.

- No-Penalty CDs allow early withdrawals without losing interest.

Each structure needs a tailored calculation. With a step-up CD, for instance, add the interest for each rate tier separately to gauge total earnings.

Tax Implications: Optimizing After-Tax Returns

Remember that CD interest is generally taxable. The APY you see doesn’t account for your tax bracket. Adjust your calculations to estimate the net amount you'll keep. To learn more about the current high-rate environment, see interest rate trends.

Hidden Fees: Eroding Your Earnings

Some CDs carry fees beyond penalties. These might include:

- Maintenance fees charged monthly or annually

- Administrative charges for account management

Review every term and condition to spot these costs. Accurate CD interest calculations depend on knowing all potential fees.

When you factor in penalties, structures, taxes, and hidden fees, you’ll achieve a more realistic return estimate. Accurate calculations lead to smarter CD investments.

Finding CD Rates Worth Your Investment

Not all CDs deliver the same return, so knowing how to calculate CD interest and spotting standout yields is essential. Comparing rates across institutions helps you lock in the best possible growth for your funds.

In this section, we’ll outline clear steps to evaluate CD offers and guide you toward decisions that match your financial goals.

Identifying High-Yield CDs

Online banks often have lower overhead, allowing them to pass higher returns to customers. Local community banks and credit unions may also offer competitive rates to attract depositors in their region.

• Online Banks: Generally top in 1-year and 5-year rates

• Community Banks: Combine local service with above-average yields

• Credit Unions: Member-focused perks, sometimes better rates

Below is a table comparing current CD rates across these institution types.

Current CD Rate Comparison by Institution Type

This table shows average and top CD rates across different types of financial institutions for various term lengths.

| Institution Type | Average 1-Year Rate | Top 1-Year Rate | Average 5-Year Rate | Top 5-Year Rate |

|---|---|---|---|---|

| Online Banks | 4.50% | 5.00% | 4.00% | 4.60% |

| Community Banks | 3.50% | 4.25% | 3.25% | 4.10% |

| Credit Unions | 3.75% | 4.30% | 3.50% | 4.20% |

| Brokerage Firms (Brokered CDs) | 2.75% | 3.50% | 3.00% | 4.00% |

In this comparison, online banks lead on both 1- and 5-year CD rates, while community institutions offer solid mid-range returns and brokered CDs add variety.

Evaluating Promotional CD Rates

Promotional offers can be tempting, but read the fine print before committing. High introductory rates may apply only for a few months, then revert to a lower yield.

• Check the introductory period length

• Review any early withdrawal restrictions

• Compare the long-term APY rather than just the teaser rate

Balancing Term Length And Rate Premium

Longer terms usually carry a rate premium, but locking up funds for years may not suit your timeline. Analyzing current yield curves helps you choose the right maturity.

In the 2022–2023 rate cycle, 1-year CDs jumped from 0.5% to over 6%, then fell to 1.78% by March 2025. Such swings underline the value of staying informed. Explore this topic further.

Leveraging Relationship Banking And Brokered CDs

A strong history with your bank or credit union can earn you preferred CD rates and exclusive offers. Meanwhile, brokered CDs—available through many brokerage platforms—unlock access to a wider rate spectrum.

• Relationship Banking: Special rates for loyal customers

• Brokered CDs: Broader issuer diversity and potentially higher yields

Making Informed CD Investment Decisions

By comparing institution types, weighing promotional terms, and aligning term lengths with your objectives, you’ll select CDs that fit your needs. Accurate interest calculations paired with the right rate research will maximize your return.

Strategic CD Investing: Maximize Returns, Minimize Risks

Knowing how to calculate CD interest is essential, but maximizing returns requires a strategic approach. This involves looking beyond the highest advertised Annual Percentage Yield (APY) and using techniques to balance your needs for accessible funds with managing risk and optimizing your entire investment portfolio. Let's explore some advanced strategies to improve your CD investment results.

CD Laddering: Balancing Liquidity and Yield

CD laddering is a popular strategy where you divide your investment across several CDs with different maturity dates. For example, you could split a $5,000 investment into five $1,000 CDs, each maturing at a different time (e.g., one, two, three, four, and five years).

This approach provides regular access to a portion of your funds while also allowing you to potentially earn higher yields. As each CD matures, you have the flexibility to withdraw the money or reinvest it in a new CD, perhaps with a better interest rate, depending on the current market conditions. CD laddering provides a good balance between accessing your money when you need it and pursuing opportunities for higher yields.

Barbell Strategy: Combining Short-Term Flexibility and Long-Term Growth

The barbell strategy involves putting some of your money into short-term CDs for quick access, and the rest into longer-term CDs for greater potential returns. This gives you the advantages of both short-term and long-term CDs.

You might, for instance, allocate 50% of your investment in a 3-month CD and the remaining 50% in a 5-year CD. The short-term CD provides flexibility, while the long-term CD takes advantage of the typically higher rates offered for longer maturities. This strategy allows you to adapt to market changes and potentially benefit from increasing interest rates.

Purpose-Driven CD Portfolios: Aligning With Financial Goals

Creating a purpose-driven CD portfolio means aligning your CD investments with your specific financial goals and their timelines. This involves carefully calculating potential CD interest and projecting future returns to ensure they meet your needs.

Think about your financial goals. Are you saving for a down payment on a house in three years? Planning for retirement in twenty? By accurately calculating CD interest and selecting maturities that match your goals, you create a focused, effective plan. This targeted approach can help you distribute your funds across various maturities to optimize your portfolio's performance.

Calculating and Projecting Returns Under Different Scenarios

To make the most of these strategies, use a CD calculator, like the one available at Calculator.ninja, to project potential returns under various interest rate scenarios. This tool lets you compare the possible outcomes of different strategies and adjust your approach based on your risk tolerance and financial goals.

By exploring these various scenarios, you can make well-informed decisions about how to structure your CD investments and choose the strategy that best fits your individual needs. These calculations are vital for accurately projecting returns and maximizing the benefits from your CD investments.

Avoiding the Calculation Mistakes That Cost You Money

Even seasoned investors sometimes make errors when calculating CD interest. Overlooking crucial details can result in inaccurate projections and, ultimately, lower returns. This section highlights common pitfalls and offers practical strategies to ensure your calculations are accurate and support your financial goals.

The Tax Trap: Calculating Your Real Return

One frequent mistake is forgetting about taxes. While the advertised APY (Annual Percentage Yield) is useful for comparing CDs, it doesn't show your true earnings after taxes. CD interest is typically taxable, so a portion of your earnings goes to the IRS. For example, if you're in a 22% tax bracket and earn $100 in interest, you'll only keep $78.

This means calculating your after-tax return is essential. Use a CD calculator that lets you input your tax bracket for a more realistic estimate. This helps you avoid overestimating potential earnings and allows you to make better-informed investment decisions.

Early Withdrawal Penalties: A Costly Miscalculation

Many investors underestimate the impact of early withdrawal penalties. These penalties, meant to discourage premature withdrawals, can severely reduce your earnings. Withdrawing from a 5-year CD after just one year could wipe out a significant portion of your accumulated interest.

Therefore, it's important to consider potential penalties when calculating CD interest. Think about your financial situation and the chance you'll need the funds before the CD matures. If you anticipate needing access to the money, a shorter-term CD or a no-penalty CD might be more suitable.

The Compound Frequency Error: Small Difference, Big Impact

Another common error is overlooking the compounding frequency. The difference between daily and monthly compounding might seem small, but it can noticeably affect your overall returns, particularly over longer periods.

For instance, consider a $1,000 CD with a 4% APY. Over five years, daily compounding will earn slightly more than monthly compounding because interest is added to the principal more often. Accurately incorporating the compounding frequency in your calculations is crucial for precise projections. A reliable CD calculator will handle this automatically, giving you a more accurate future return estimate.

Checklist for Accurate CD Interest Calculations

To prevent costly errors, use this checklist:

- Account for Taxes: Adjust your calculations based on your tax bracket to find your after-tax return.

- Factor in Penalties: Consider possible early withdrawal penalties and choose a CD term that fits your needs.

- Verify Compounding Frequency: Ensure your calculations use the correct compounding period (daily, monthly, quarterly, or annually).

- Use a Reliable Calculator: Utilize a reputable CD calculator, such as the one at Calculator.ninja, for accurate and comprehensive calculations.

By following these steps, you can calculate CD interest accurately, make informed investment decisions, and maximize your returns. Don't let calculation mistakes diminish your earnings; understand all the factors influencing your CD's potential growth.

Ready for precise CD earnings calculations? Try our Certificate of Deposit Calculator at https://www.calculator.ninja/cd-calculator and make informed investment decisions today. This comprehensive tool simplifies complex calculations, helping you project returns, compare CD offers, and plan for your financial future.

Article created using Outrank