Mastering CD Interest Calculations: The Essential Foundation

Understanding how to calculate interest on a Certificate of Deposit (CD) is crucial for maximizing your returns. It involves understanding how the principal, interest rate, term length, and compounding frequency all work together. For example, a larger principal will generate more interest than a smaller one, given the same interest rate and term.

This emphasizes the importance of understanding each part of the calculation.

Key Factors Influencing CD Interest

Let's break down these core components:

- Your principal is the initial amount you invest in the CD.

- The interest rate, expressed as a percentage, determines how much your money grows.

- The term length is how long your money is locked in the CD.

- The compounding frequency dictates how often the earned interest is added back to your principal.

This "interest-on-interest" effect is the power of compounding.

Simple vs. Compound Interest: A Critical Difference

There are two primary ways interest is calculated: simple interest and compound interest. Simple interest is calculated only on the principal amount. Compound interest is calculated on the principal plus any accumulated interest.

This seemingly small distinction can significantly impact your earnings over longer terms. For example, a $10,000 CD with a 5% interest rate held for five years will earn significantly more with compound interest.

Historically, CD interest rates have been influenced by economic conditions. In the 1980s, CD rates often reached double-digit levels, peaking at over 11% APY for a one-year CD due to high inflation and monetary policy. By the early 2000s, these rates had dropped substantially. This variation highlights the impact of external economic factors on CDs. Find more detailed statistics here

Understanding How Banks Set CD Rates

Banks determine CD rates based on several factors, including prevailing market interest rates, competitive pressures, and their own funding needs. The term length also often influences the offered rate. Longer terms typically have higher rates to compensate for the reduced liquidity.

By understanding these factors, you can effectively evaluate different CD options. Choosing the best fit for your financial goals empowers you to make informed decisions and achieve optimal returns.

Calculate Interest On CD: Your Step-By-Step Blueprint

Understanding how to calculate interest on a CD is crucial for projecting your returns and making sound investment decisions. Let's break down the process, step by step.

Calculating Simple Interest On A CD

Simple interest, while not typically used with CDs, provides a foundational understanding of interest calculations. The formula is straightforward:

Simple Interest = Principal * Interest Rate * Term (in years)

Let's say you invest $5,000 at a 2% annual interest rate for one year. Your simple interest would be: $5,000 * 0.02 * 1 = $100.

Calculating Compound Interest On A CD

Compound interest is where your investment truly gains momentum. Earned interest is added back to the principal, resulting in "interest-on-interest." The formula is:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment, including interest

- P = the principal investment amount (the initial deposit)

- r = the annual interest rate (decimal)

- n = the number of times interest is compounded per year

- t = the number of years the money is invested

Here's an example: You deposit $10,000 in a CD with a 4% annual interest rate, compounded quarterly, for 2 years:

- P = $10,000

- r = 0.04

- n = 4 (quarterly compounding)

- t = 2

A = $10,000 (1 + 0.04/4)^(4*2) = $10,824.32

Your total interest earned is $10,824.32 - $10,000 = $824.32.

Calculating Interest With Different Compounding Frequencies

The frequency of compounding significantly impacts your returns. More frequent compounding generates higher returns. For a more in-depth look, check out this guide on calculating CD interest.

The following table illustrates the impact of different compounding frequencies on a $10,000 investment with a 4% interest rate over 2 years:

CD Interest Calculation Examples: Comparison of interest earnings across different CD terms and compounding frequencies

| Compounding Frequency | Final Balance (Approx.) | Total Interest (Approx.) |

|---|---|---|

| Annual | $10,816 | $816 |

| Quarterly | $10,824 | $824 |

| Monthly | $10,831 | $831 |

| Daily | $10,833 | $833 |

As you can see, even small differences in compounding frequency can make a difference over time.

Calculating Interest On Special CDs

Some CDs offer unique features like promotional rates or step-up interest. Calculating interest on these CDs might require adjustments to the standard formulas. For instance, with a step-up CD, you'll calculate interest separately for each period with its respective rate. Remember to consider any early withdrawal penalties when comparing CD options. This resource, How to master CD interest calculations, provides further insights and tools.

The Compounding Advantage: Boosting Your CD Earnings

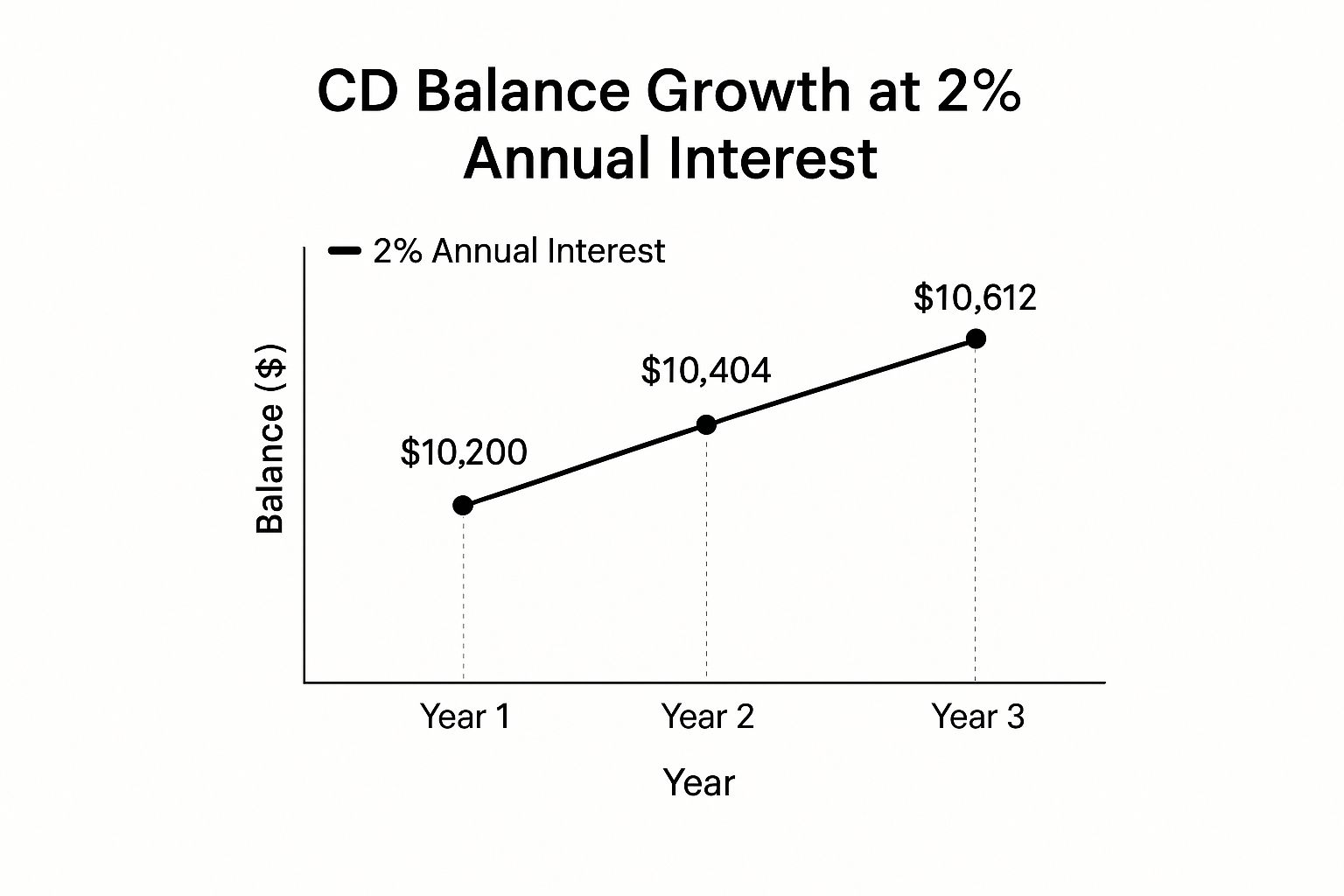

The infographic above illustrates CD balance growth at a 2% annual interest rate over three years. Notice how even a modest rate allows the balance to steadily increase thanks to the power of compound interest. This means your interest earns interest, leading to exponential growth over time.

Let's explore how compounding frequency significantly impacts your CD returns. Many investors focus solely on the advertised interest rate, often overlooking this crucial factor. However, the frequency of compounding—daily, monthly, quarterly, or annually—can significantly affect your earnings. Two CDs with identical interest rates can yield substantially different returns based solely on how often the interest is compounded.

APY vs. APR: Decoding the Difference

Understanding the difference between Annual Percentage Yield (APY) and Annual Percentage Rate (APR) is essential for accurately evaluating CD offers. APR represents the simple annual interest rate. APY, on the other hand, reflects the total amount you earn in a year, factoring in the compounding. Banks often highlight the APR, but the APY provides a more realistic view of your potential returns. A higher APY translates to more money in your pocket.

The Impact of Compounding Frequency

The more frequently interest is compounded, the higher your overall returns. This occurs because the interest earned is added back to the principal more often, resulting in greater growth. The difference might appear small initially, but its impact magnifies over time, especially with longer-term CDs.

The recent surge in CD interest rates further underscores the importance of understanding compounding. Driven by the Federal Reserve’s efforts to combat inflation, top CD rates climbed above 6% APY in 2022 and 2023, a level not seen in almost two decades. This represents a substantial increase from the lows experienced during the Great Recession and the COVID-19 pandemic. Explore this topic further

The following table illustrates how compounding frequency affects returns on a $10,000 CD at 4% for 5 years.

| Compounding Frequency | Effective Annual Yield | Final Balance | Additional Interest vs. Annual |

|---|---|---|---|

| Annual | 4.00% | $12,166.53 | $0.00 |

| Quarterly | 4.06% | $12,189.94 | $23.41 |

| Monthly | 4.07% | $12,201.90 | $35.37 |

| Daily | 4.08% | $12,213.99 | $47.46 |

As you can see, more frequent compounding results in a higher final balance. While the differences may seem small initially, they become more significant over longer time periods and with larger initial deposits.

Calculating Your Potential Earnings

Carefully considering the compounding frequency empowers you to make informed decisions about which CD is right for you. For example, a CD with daily compounding will typically outperform a CD with annual compounding, even if the advertised APR is the same. This knowledge allows you to optimize your returns and reach your financial goals. Once you understand compound interest, you may want to explore other financial calculations, like how to calculate holiday pay. Calculating potential returns can be complex, but with the right tools and understanding, you can confidently maximize your CD investments.

Digital Tools That Calculate Interest on CD Without the Math

Calculating interest earned on a Certificate of Deposit (CD) might seem complicated, but thankfully, several digital tools simplify this process. These resources help you accurately project your returns and make informed investment decisions without needing to memorize complex formulas. Let's explore a few reliable options.

Online CD Calculators: Instant Results at Your Fingertips

Online CD calculators are readily available and easy to use. You'll typically input basic information like the principal amount, interest rate, term length, and compounding frequency. The calculator then instantly generates the potential interest earned and the final balance at maturity. A good example is this powerful CD calculator.

Many online calculators offer extra features like visualizing interest growth over time and comparing different scenarios side-by-side. This lets you quickly assess how adjustments to your principal, interest rate, or term can affect your potential earnings.

Specialized Mobile Apps: CD Calculations On the Go

Several mobile apps are specifically designed for CD calculations. These apps provide the convenience of calculating interest on your smartphone or tablet, wherever and whenever you need.

Some apps also offer advanced features like tracking multiple CDs, setting maturity date alerts, and comparing rates from different financial institutions. This puts convenient financial planning tools directly in your pocket.

Spreadsheet Software: Creating Custom CD Trackers

Common spreadsheet software like Microsoft Excel or Google Sheets can be used to create personalized CD trackers. While they require a little more initial setup, spreadsheets offer significant customization.

You can input the details of each CD you own—principal, interest rate, term length, and compounding frequency. The spreadsheet can then calculate the interest earned and the projected final balance. Spreadsheets are also easily updated if interest rates or your investment strategy changes, giving you a flexible tool for managing your CD portfolio. For instance, you can create formulas to calculate the blended yield of a CD ladder or project returns based on different interest rate scenarios.

Choosing the Right Tool for Your Needs

The right tool depends on your comfort level with technology and the level of detail you need. If you need quick, straightforward calculations, an online calculator or mobile app might be sufficient.

However, if you prefer more control and customization, a spreadsheet program like Excel or Google Sheets is likely the better choice. Regardless of your chosen method, accurately calculating interest on a CD is crucial for maximizing your returns and reaching your financial goals. With so many helpful digital tools available, projecting your potential earnings is easier than ever. Understanding these projections allows you to compare CD offerings and choose options that align with your financial strategy.

Strategic CD Laddering: Calculating Your Optimal Approach

Building a CD ladder involves strategically investing in multiple CDs with varying maturity dates. This approach balances maximizing returns and maintaining access to your funds. Think of it as constructing a ladder, with each rung representing a CD with a different term length. As one CD matures, you can reinvest it at the current prevailing interest rate, potentially capitalizing on higher rates.

Calculating Your Blended Yield

A key metric for assessing CD ladder performance is the blended yield. This represents the average return across all CDs in your ladder. Calculating it requires considering the principal and interest rate of each CD. For example, with three CDs and varying principals and interest rates, the blended yield is a weighted average, prioritizing CDs with higher principals.

Imagine a three-rung ladder with CDs maturing in one, two, and three years. If interest rates increase over this period, you reinvest at the higher rate as each CD matures, effectively boosting your overall return. This flexibility is a primary benefit of CD laddering.

Designing Your Customized CD Ladder

Creating a customized CD ladder begins with identifying your financial goals and timeline. If you anticipate needing access to some funds within a year, allocate a portion of your investment to a short-term CD. For long-term goals, consider placing a larger portion in longer-term CDs for potentially higher interest rates. Tools like a Consumables Subscription Calculator can be helpful for planning.

A conservative ladder might primarily consist of short-term CDs for more frequent access to funds. An aggressive ladder, conversely, might favor longer-term CDs to pursue potentially higher returns, accepting less liquidity.

Adapting to Changing Interest Rate Environments

CD laddering provides flexibility in navigating fluctuating interest rates. As CDs mature, adjust your ladder by reinvesting in CDs with different terms or at institutions offering more competitive rates. This allows you to benefit from rising rates and mitigates the risk of being stuck with lower rates for an extended time.

Comparing Laddering Configurations: Conservative vs. Aggressive

Different laddering configurations present trade-offs between liquidity and return. A conservative ladder, with mostly short-term CDs, offers more frequent access to funds but may yield lower overall returns. An aggressive ladder, with mostly long-term CDs, has the potential for higher returns but sacrifices liquidity.

Consider two scenarios: a ladder of short-term, one-year CDs, and another with longer-term, five-year CDs. If interest rates rise significantly, the short-term ladder allows more frequent reinvestment at higher rates. However, if rates remain stable or decline, the longer-term ladder locks in the initially higher rate for longer. Calculating potential outcomes for various scenarios allows you to make informed decisions aligned with your risk tolerance and financial objectives, empowering you to manage your CD investments strategically.

Avoiding Costly Mistakes When Calculating CD Returns

Accurately calculating interest on a Certificate of Deposit (CD) is crucial for smart investing. Even experienced investors can make errors that reduce their returns. Let's explore some common pitfalls and how to steer clear of them.

APY Vs. APR: Understanding The Difference

A common mistake is confusing Annual Percentage Yield (APY) with Annual Percentage Rate (APR). These terms look similar but have distinct meanings. APR is the simple annual interest rate. APY shows the total earned in a year, including compounding.

Always use the APY when comparing CDs for a true picture of potential returns. A CD with a 4% APR compounded monthly will have a higher APY than one compounded annually. This seemingly small difference can significantly impact earnings over time, especially with larger deposits.

The Importance of Compounding Periods

Another frequent oversight is misunderstanding compounding. More frequent compounding (e.g., daily vs. annually) results in higher returns. This happens because earned interest is added back to the principal more often, leading to greater growth.

Failing to account for compounding frequency can lead to underestimating potential earnings. A $10,000 CD with a 2% interest rate compounded daily yields slightly more than the same CD compounded annually.

Early Withdrawal Penalties: A Costly Trap

Early withdrawal penalties can severely impact CD returns. These penalties, often a certain number of months' interest, apply if you withdraw funds before maturity. Always consider these penalties when evaluating CDs.

A CD with a slightly higher rate might not be best if it has a high early withdrawal penalty. This is especially true if you might need the funds early. Withdrawing $5,000 early from a CD with a six-month interest penalty could negate any interest earned.

Taxes: Calculating Your True Return

Remember to consider taxes. Interest earned on CDs is typically taxable. Calculate your after-tax return to understand your true earnings. The tax impact depends on your tax bracket.

A higher tax bracket means more of your interest goes to taxes. This is especially important when comparing CDs to tax-advantaged investments. A higher pre-tax yield might not be as beneficial after taxes.

By understanding these potential pitfalls and using accurate calculations, you can make informed CD investment decisions. Avoiding these mistakes can significantly improve overall returns, helping you achieve your financial goals. Use tools like the Certificate-of-Deposit Calculator to simplify calculations and better understand your potential CD earnings.

Insider Techniques to Maximize Your CD Interest Returns

Calculating interest on a CD is easy enough, but truly maximizing your returns requires a more strategic approach. Let's explore some insider techniques that financial advisors use to help their clients get the most out of their CD investments.

Timing the Market: Riding the Interest Rate Wave

Even though CDs offer fixed interest rates, timing your investment can still significantly impact your overall return. Keep a close eye on interest rate trends and general economic indicators. For example, if interest rates are predicted to rise, you might consider delaying your CD purchase to lock in a higher rate later. On the other hand, if rates are falling, it's a good idea to secure a CD before they drop further. Resources like this comparison of savings accounts vs. CDs can give you valuable insights into the current savings landscape.

Negotiation Tactics: Don't Accept the First Offer

Many people mistakenly believe that CD rates are set in stone. However, especially at local banks and credit unions, there's often some wiggle room for negotiation. Don't be afraid to ask for a better rate, particularly if you have a long-standing relationship with the institution or are investing a significant sum. If you find a competitor offering a higher rate, use that information as leverage in your negotiations.

Relationship Banking: Unlocking Hidden Perks

Building a strong relationship with your bank can sometimes unlock preferred rates not available to the public. Some banks offer higher CD rates to loyal customers with substantial deposits or multiple accounts. This highlights the importance of building trust and a solid banking relationship over time.

Specialty CDs: Exploring Advanced Options

Beyond traditional CDs, consider exploring specialty products like bump-up CDs, step-up CDs, and liquid CDs. A bump-up CD allows you to increase your interest rate once during the term if market rates rise. With a step-up CD, you'll see pre-determined rate increases over time. Liquid CDs often offer lower rates, but they provide the flexibility to withdraw funds without incurring a penalty.

Calculating the potential benefits of these CDs involves carefully comparing their potential returns against traditional CD options. A bump-up CD might be advantageous in a rising-rate environment, while a step-up CD could outperform a fixed-rate CD over a longer term. Liquid CDs are best suited for those who might need access to their funds before maturity.

Strategic Portfolio Allocation: Finding the Right CD Mix

Finally, think about how CDs fit into your overall investment portfolio. The ideal percentage of CDs in your portfolio will depend on your individual risk tolerance and financial goals. If you're risk-averse, a larger allocation to CDs might be appropriate. However, if you're comfortable with more risk, consider balancing your CDs with other investments like stocks or bonds to potentially achieve higher returns.

Maximize your CD earnings with the Certificate-of-Deposit Calculator! This helpful tool allows you to project your returns, compare different CD offers, and make informed decisions to reach your financial goals.