The Evolution of CD Rates: From Double-Digits to Near Zero

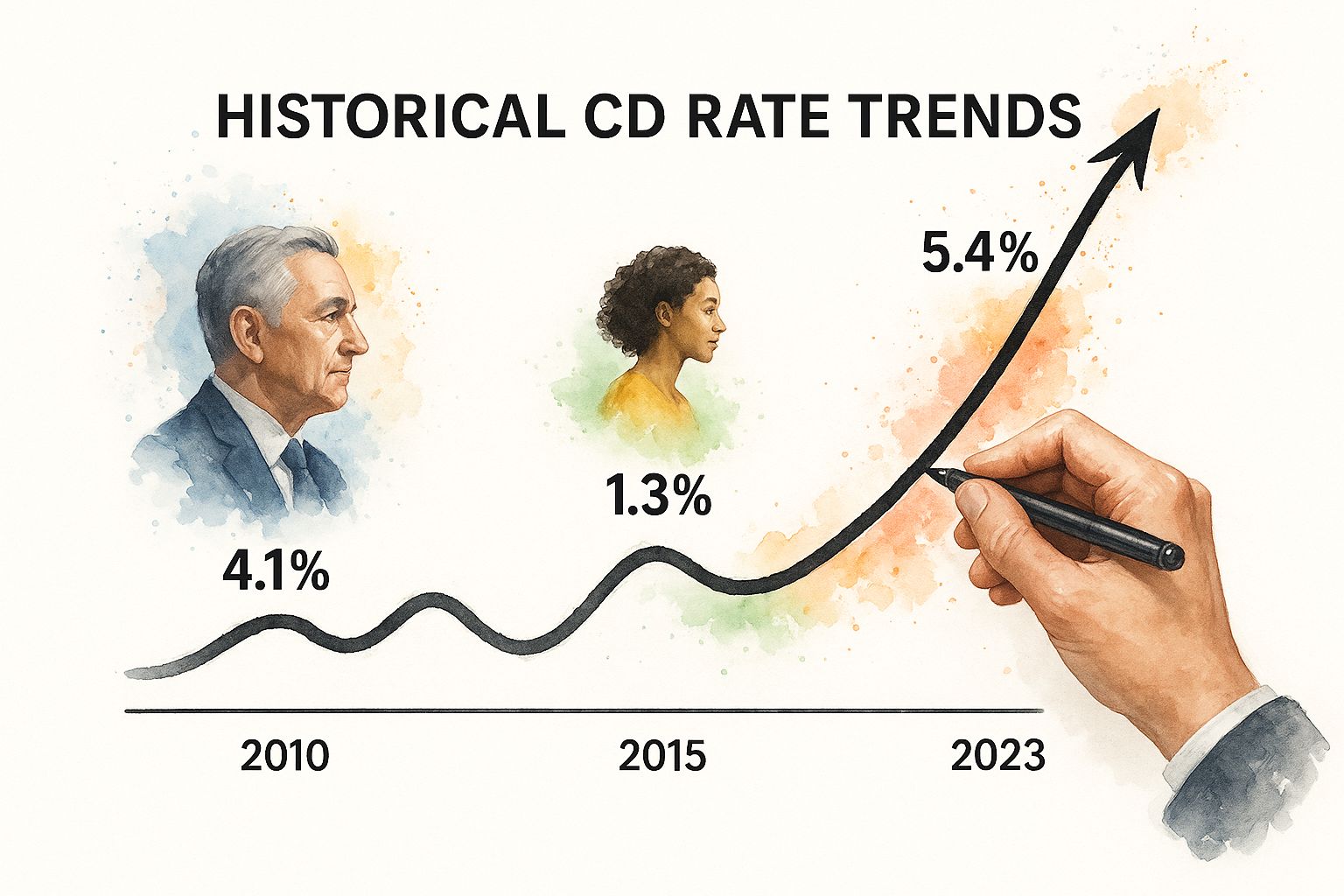

This infographic illustrates the historical path of certificate of deposit (CD) rates. It's clear that CD rates have seen significant fluctuations over the years, swinging from substantial highs to notable lows. Understanding these trends is key for making sound investment choices. For more information on current CD rates, visit this helpful resource: CD rates.

The Highs and Lows of CD Returns

The 1980s stand out as a particularly lucrative period for CD holders. Some rates even reached double-digit figures, with returns sometimes exceeding 11% on a one-year CD. This was largely due to the Federal Reserve's proactive measures to control inflation. However, this period of high returns eventually transitioned to an era of much lower rates, reflecting the cyclical nature of interest rates and their connection to broader economic policies.

Following the 2008 financial crisis, CD rates dropped significantly. For a large portion of the following decade, one-year CD rates remained below 1% APY. This was a direct result of the Fed's near-zero benchmark interest rates, implemented to encourage economic recovery. This low-rate environment persisted throughout the 2010s, with only occasional small increases. One such minor rise followed the Fed's rate increase in December 2015, but the overall trend stayed low. You can explore historical CD interest rates for a more detailed perspective.

The Impact of Economic Events

The arrival of the COVID-19 pandemic added another layer of complexity to CD rate trends. In March 2020, the Federal Reserve again lowered rates to bolster the struggling economy, causing CD yields to fall. This move highlighted the strong influence of major economic events on CD rates. But the story doesn't end there.

Beginning in 2022, CD rates began a significant rebound. Driven by the Fed's aggressive rate hikes to combat inflation, one-year CD yields climbed from under 1% in early 2022 to over 4.4% by early 2025. This surge represented the highest CD returns seen in over a decade. While the average settled around 1.95% in January 2025, it demonstrates the considerable impact of Fed policy on CD yields. These rate changes, while positive for savers, introduce new factors to consider when optimizing CD investments.

To better illustrate these fluctuations over time, let's look at the following table:

Historical CD Rate Comparison by Decade

Average annual percentage yields (APYs) for 1-year CDs across different economic periods

| Decade/Period | Average 1-Year CD Rate | Key Economic Factors |

|---|---|---|

| 1980s | High (reaching double-digits, over 11%) | Federal Reserve's aggressive approach to combatting inflation |

| 2008-2010s | Low (below 1% APY) | Near-zero benchmark interest rates following the 2008 financial crisis |

| Early 2020s (during COVID-19 pandemic) | Initially very low | Federal Reserve rate cuts to stimulate the economy |

| 2022-Early 2025 | Significant rebound (reaching over 4.4%) | Fed's aggressive rate hikes to combat inflation |

This table summarizes the major trends in 1-year CD rates over several decades, highlighting the influence of key economic factors. The data clearly shows how economic events and policy decisions can significantly impact CD returns.

Navigating the Current CD Landscape

Today's CD market presents a unique set of opportunities and challenges. Understanding current CD rate trends requires looking beyond national averages. Factors such as regional differences, competitive offers from various institutions, and the yield curve all play a role in determining the true potential of CD investments. A CD Calculator can be a valuable tool for assessing potential returns.

As the rate environment continues to shift, strategic planning becomes even more important for maximizing returns. This includes understanding strategies like CD laddering, timing investments effectively, and selecting the right CD products aligned with your individual financial goals.

Following the Money: How Fed Decisions Shape CD Returns

The Federal Reserve (the Fed), the central bank of the U.S., has a significant impact on the American economy. A key tool they use is the federal funds rate, which is the target interest rate banks charge each other for overnight loans. This rate influences the entire financial landscape, including Certificate of Deposit (CD) rates. Understanding this connection is essential for anyone interested in CDs.

The Fed's Influence on Your CD Earnings

The Fed's decisions about the federal funds rate affect how much banks pay to borrow money. This, in turn, influences the interest rates they offer on savings products like CDs. When the Fed raises rates, banks usually increase CD rates to attract more deposits and offset their increased borrowing costs. Conversely, when the Fed lowers rates, CD rates tend to decrease.

Banks have less incentive to offer high yields when their borrowing costs are lower. This direct relationship makes CD rates a good indicator of the Fed's monetary policy.

Decoding Recent Rate Cycles

The impact of the Fed's decisions on CD rates is evident in recent history. The 2010s saw relatively stable CD rates until the Fed's first rate hike in December 2015. This was the first increase since the Great Recession and briefly created a rising-rate environment.

However, by the summer of 2019, economic concerns led the Fed to lower rates, pushing down CD rates. The COVID-19 pandemic further amplified this trend, resulting in near-zero Fed rates and a dramatic drop in CD yields in March 2020. NerdWallet Historical CD Rates provides a more detailed analysis.

In March 2022, the Fed started aggressively raising rates to combat inflation. This caused a surge in CD rates, with short-term CD yields jumping from around 1% to over 4% within a year and reaching 5% by March 2023. This upward movement slowed as the Fed later began cutting rates, signaling confidence in controlling inflation.

To illustrate the correlation, let's examine the following table:

Fed Funds Rate vs. Average CD Rates

Comparative analysis showing the correlation between Federal Reserve rate changes and resulting CD yield adjustments

| Time Period | Fed Funds Rate Change | 1-Year CD Rate Change | 6-Month CD Rate Change |

|---|---|---|---|

| Dec 2015 - Dec 2016 | +0.25% | +0.10% - 0.15% | +0.05% - 0.10% |

| Summer 2019 - Mar 2020 | -1.75% | -0.50% - 0.75% | -0.40% - 0.60% |

| Mar 2022 - Mar 2023 | +4.75% | +3.00% - 3.50% | +3.50% - 4.00% |

| Late 2023 - Late 2024 | -1.50% | -0.25% - 0.50% | -0.20% - 0.40% |

This table shows a general correlation between changes in the Fed Funds Rate and CD rates. The actual changes can vary based on various market factors. Note that these are illustrative ranges, and actual rate changes can be more specific.

Online vs. Traditional Banks: A Tale of Two Responses

How quickly and to what extent banks adjust their CD rates after a Fed announcement can differ. Online banks, with lower operating costs, often react faster and offer more competitive rates than traditional banks. They can pass on savings to customers more efficiently, resulting in higher CD yields.

Anticipating Rate Movements and Strategy Adjustments

Smart investors pay attention to Fed announcements and economic indicators to predict future rate changes. Understanding the Fed’s likely actions allows investors to adjust their CD investment strategies. If a rate hike is expected, locking in a CD before the announcement can secure a higher yield. If rates are expected to decline, waiting might be a better strategy. This proactive approach helps maximize returns regardless of market conditions.

Riding the CD Rate Cycle: Timing Your Investments

Certificate of deposit (CD) rate trends follow cycles, often reflecting broader economic conditions. Understanding these cycles is key to maximizing your CD returns. This involves recognizing the current economic phase – expansion, peak, contraction, or recovery – and adapting your CD strategy accordingly.

Understanding The Economic Cycle's Impact on CD Rates

During economic expansion, interest rates typically rise as the Federal Reserve attempts to manage inflation. This is an opportune time to consider short-term CDs. Opting for 6-month or 1-year CDs provides the flexibility to reinvest at higher rates as they mature.

At the peak of the economic cycle, interest rates tend to plateau or even decline. This presents a good opportunity to lock in longer-term CDs, securing the prevailing higher rates before they fall. A 2-year or 3-year CD could be a suitable option. Keeping an eye on economic news, such as U.K. inflation rates, can provide valuable context.

As the economy enters contraction, interest rates generally decrease as the Fed aims to stimulate economic activity. During this phase, it's advisable to stick with shorter-term CDs and wait for rates to reach their lowest point before committing to longer terms. This maintains flexibility for reinvestment at potentially higher rates when the cycle shifts.

Finally, during the recovery phase, interest rates begin to rise again, though often gradually. Similar to the expansionary phase, shorter-term CDs can be a good strategy. They offer liquidity for reinvestment as rates increase, allowing you to capitalize on improving economic conditions and their impact on CD rates. Examining historical CD rate data provides helpful perspective. For example, CD rates have fluctuated significantly since the 1960s, reaching double-digit returns in some periods and falling below 1% in others. More recently, rates climbed past 6% in 2022 and 2023 before moderating. This cyclical pattern emphasizes the importance of timing your CD investments. You can find more detailed statistics here.

Building A CD Ladder For Changing Environments

CD laddering is a useful strategy for navigating changing economic cycles. It involves distributing your investment across CDs with staggered maturity dates. You might structure your ladder with CDs maturing every 3, 6, 12, and 18 months, for instance.

This strategy provides two main benefits. First, it offers regular access to funds as CDs mature, increasing liquidity. Second, it allows reinvestment of maturing CD proceeds at the current interest rates, letting you benefit from rising rates during expansionary or recovery phases. A CD ladder can be especially helpful when CD rate trends are volatile, offering a balance between potential returns and access to funds.

Recognizing Early Signals Of Rate Direction Changes

Staying informed about economic indicators and Fed announcements can help you anticipate rate changes. Looking beyond national averages can also provide valuable clues. For example, analyzing the current yield curve, which graphs interest rates against different maturities, can offer insights into future rate movements. A steep yield curve often indicates rising rate expectations, while a flat or inverted curve may suggest declining rates. These insights can inform your CD investment strategy and help you optimize your investment timing.

Today's CD Landscape: Where Smart Money Is Moving

The certificate of deposit (CD) market is a constantly shifting landscape for savers. To truly grasp current CD rate trends, it's essential to analyze several key factors, including which institutions offer the best returns and why. This means looking beyond the advertised rates and understanding the underlying market forces.

Deciphering the Yield Curve's Influence

The yield curve, a graph plotting interest rates against different timeframes, offers valuable insights into future rate movements and their effect on CD offerings. A steep yield curve often indicates rising rates, encouraging institutions to offer higher yields on longer-term CDs to attract funds. On the other hand, a flatter or inverted yield curve suggests potential rate declines, making shorter-term CDs more competitive. Analyzing the current yield curve can inform your CD term choices. Read also: How to Master CD Term Calculations.

The Diversity of CD Offerings

Financial institutions employ various strategies for their CD products. Some prioritize attracting long-term deposits with higher rates on longer maturities. Others focus on shorter-term CDs with competitive yields to appeal to savers who value liquidity. Online banks, often with lower overhead, frequently offer more competitive rates than traditional brick-and-mortar institutions. Understanding these differences allows you to choose the best option for your needs.

Beyond Advertised Rates: Unveiling the Real Opportunities

Advertised rates are a starting point, but the best CD opportunities often lie beneath the surface. Some institutions offer promotional rates or incentives, like tiered interest rates based on deposit size or relationship bonuses. Early withdrawal penalties also vary significantly, impacting the effective yield if you need access to your funds before maturity. Carefully evaluate these factors to identify the true cost and potential return of each CD.

Where Customer Interest Is Growing

Current trends reveal growing interest in shorter-term CDs, typically with maturities of 6 months to 2 years. Savers are seeking a balance between competitive yields and access to their funds. Brokered CDs, offered through brokerage firms rather than banks, are also gaining traction due to their potential for higher returns and a wider range of options. This shift reflects the current fluctuating interest rate environment and investor preferences for flexibility.

Understanding Institutional Strategies

Financial institutions' strategies in the CD market are driven by various factors. Local economic conditions, competition, and regulations all play a role in shaping CD offerings. Some institutions prioritize maintaining a specific net interest margin, balancing the cost of deposits with loan returns. Others focus on growth and market share, using competitive CD rates to attract new customers. Understanding these institutional motivations can empower you to make more informed saving decisions.

Beyond National Averages: Finding Rate Goldmines

The CD rates advertised nationally often represent just the starting point. Savvy investors understand that certificate of deposit rate trends fluctuate significantly depending on location, creating opportunities for higher returns. This section explores these geographic differences and how you can take advantage of them.

Regional Rate Variations: Why Location Matters

Why do certain regions consistently offer better CD rates? A number of factors contribute to these regional variations. Local economic conditions play a critical role. A booming regional economy, for example, might see banks offering higher CD rates to attract the increased deposits. Conversely, areas with slower economic activity may offer lower rates.

Competition among financial institutions is another key factor. In regions with a high density of banks and credit unions, competition for deposits can result in more appealing CD rates. This competitive pressure benefits consumers, motivating institutions to offer higher yields to stand out from the crowd. It's similar to competing grocery stores having sales – lower prices benefit everyone.

Even regulatory environments can impact CD rates. State and local regulations can affect bank operations and the rates they can offer. These differences, while often subtle, add to the overall rate variations across different areas.

Case Studies: Uncovering Regional Rate Advantages

Looking at specific regional banking markets illustrates these dynamics. For instance, some smaller community banks in the Midwest have historically offered CD rates that surpass national averages. This reflects local economic realities and the competitive landscape. These banks might offer higher rates to attract customers who might otherwise choose larger national banks.

In contrast, some metropolitan areas saturated with large banks often have lower CD rates. The high level of competition, while seemingly positive, can sometimes lead to suppressed rates due to market saturation. This reinforces the need to look beyond the major banks when searching for competitive CD returns.

Accessing Favorable Rates: Strategies for Success

How can you find these higher rates no matter where you live? Online banking opens up access to institutions across the country, enabling you to compare and choose the best CD rates without geographic limitations. This expands your choices considerably, going beyond local rate restrictions.

Joining a credit union is another effective strategy. Credit unions, being member-owned, frequently offer more competitive rates than traditional banks. Their focus on member service, rather than profit maximization, can result in higher yields on savings products such as CDs.

Emerging fintech alternatives are also changing the traditional banking model. These platforms often work with numerous banks, offering a selected range of high-yield CDs to their users. This provides easy access to competitive rates without having to manage accounts at multiple institutions. As you explore today’s CD landscape, consider diversifying with options like a lifetime income annuity.

By using these strategies, you can substantially increase your CD returns. National averages only show part of the picture. By understanding regional variations and using the available tools, you can unlock the full potential of certificate of deposit rate trends and discover higher-paying options.

Strategic CD Investments: Maximizing Returns in Any Market

Investing in Certificates of Deposit (CDs) is often seen as a simple, hands-off approach. However, strategic CD investing can significantly boost your returns, no matter the market conditions. This means going beyond the basics and using techniques like laddering, barbell allocation, bump-up CDs, and carefully considering early withdrawal penalties.

Understanding the Power of CD Laddering

CD laddering spreads your investment across multiple CDs with different maturity dates. For example, you might invest equal amounts in CDs maturing in 6, 12, 18, and 24 months.

This strategy offers two main advantages:

- Increased Liquidity: As each CD matures, you access a portion of your funds, giving you more financial flexibility.

- Reinvestment Opportunities: When a CD matures, you can reinvest it at the current interest rates. This lets you take advantage of rising rates, maximizing returns over time. Check out this helpful resource: How to master CD interest calculations.

Exploring Barbell Allocation for CDs

The barbell strategy, often used with bonds, can also apply to CDs. This involves putting some of your funds in short-term CDs for liquidity and the rest in longer-term CDs for potentially higher yields. This balances access to funds with potential for growth.

For example, you could put 50% of your CD investment in a 6-month CD and 50% in a 5-year CD. This gives you access to half your investment in the short term while potentially earning more on the longer-term CD.

Utilizing Bump-Up CDs Strategically

Bump-up CDs let you increase your interest rate once during the CD's term if rates go up. While they might start with slightly lower rates than standard CDs, they offer flexibility in a rising rate environment.

However, carefully review the terms. Some bump-up CDs limit how many times or how much the rate can be increased. Understanding these restrictions helps you decide if a bump-up CD fits your investment goals and expected certificate of deposit rate trends.

Evaluating Promotional Rates and APYs

Banks often advertise promotional rates and higher Annual Percentage Yields (APYs) to attract new customers. While these offers can be tempting, look beyond the advertised numbers. Sometimes a high APY comes with limitations, like a very short term or a low maximum deposit.

Consider this: one bank offers a 5% APY on a 3-month CD, while another offers 4.5% on a 1-year CD. The 5% looks better at first, but the shorter term means you'll need to reinvest sooner, possibly at a lower rate. The 4.5% APY, while slightly lower, offers a more stable return for longer.

Analyzing Early Withdrawal Penalties: A Key Consideration

CDs usually have penalties for early withdrawals. These penalties can significantly impact your return, sometimes even wiping out the interest earned. Carefully consider your liquidity needs before investing in a CD.

For example, a CD with a 3% early withdrawal penalty might seem appealing. But if you need the money before the term ends, you could lose a significant portion of your interest. A lower-yielding CD with a smaller penalty, or even a high-yield savings account, might be a better fit.

Balancing Liquidity Needs With Yield Maximization

Successful CD investing is about balancing liquidity and maximizing yield. This balance depends on your financial goals, risk tolerance, and time horizon. If liquidity is key, shorter-term CDs and laddering are good strategies. If maximizing yield is your priority, longer-term CDs and barbell allocation might be more suitable.

Ready to take control of your CD investments? Our Certificate of Deposit Calculator helps you analyze different scenarios, compare rates, and make informed decisions to maximize your returns.