Understanding The Foundation: How CD Interest Really Works

Let's break down how interest on a Certificate of Deposit (CD) is calculated. Understanding the process can help you maximize your earnings. Four key factors influence your CD returns: the initial deposit, the interest rate, how often the interest compounds, and the term length.

The initial deposit, also called the principal, is the starting point of your investment. This is the amount you initially put into the CD. The interest rate, expressed as an Annual Percentage Yield (APY), shows the yearly return you can expect. However, the APY doesn't tell the whole story.

This is where compounding comes in. Compounding frequency describes how often earned interest is added back to your principal. Essentially, you're earning interest on your interest. For example, a CD compounding daily generates more interest than one compounding annually, even if they have the same APY. Learn more about calculating CD interest: How to calculate interest on a CD.

How Compounding Impacts Your Returns

CD interest calculation revolves around compounding, which significantly affects your total earnings. Let's say you have a $10,000 CD with a 5% annual interest rate, compounded annually. In the first year, you earn $500, bringing your balance to $10,500.

In the second year, the interest is calculated on the new balance of $10,500, resulting in $525 earned. This process continues until the CD matures. Over five years, you'd earn a total of $2,762.82 in interest, thanks to the power of compounding. Explore compounding further: Learn more about how CD interest is compounded.

Finally, the term length, or the duration of your CD, plays a role in your overall return. Longer terms usually offer higher interest rates. However, your funds are also tied up for a longer period. Choosing the right term length involves balancing maximizing returns and accessing your money when needed. All these factors interact to determine your final CD payout.

The Magic of Compound Interest In Your CD Calculations

When it comes to CD investing, compound interest is a game-changer. It's the process of earning interest on your initial deposit, plus the accumulated interest from prior periods. This creates a snowball effect, leading to substantial growth over time. Let's delve into how different compounding schedules, such as daily, monthly, quarterly, or annually, can significantly influence your overall returns, even with the same interest rate.

Understanding Compounding Frequency

Compounding frequency refers to how often your earned interest is added back to your principal. This seemingly minor detail can make a substantial difference in your earnings. For instance, a CD compounding daily will yield more than one compounding annually, even if they have the same stated interest rate. This is because daily compounding calculates interest on a progressively increasing principal balance.

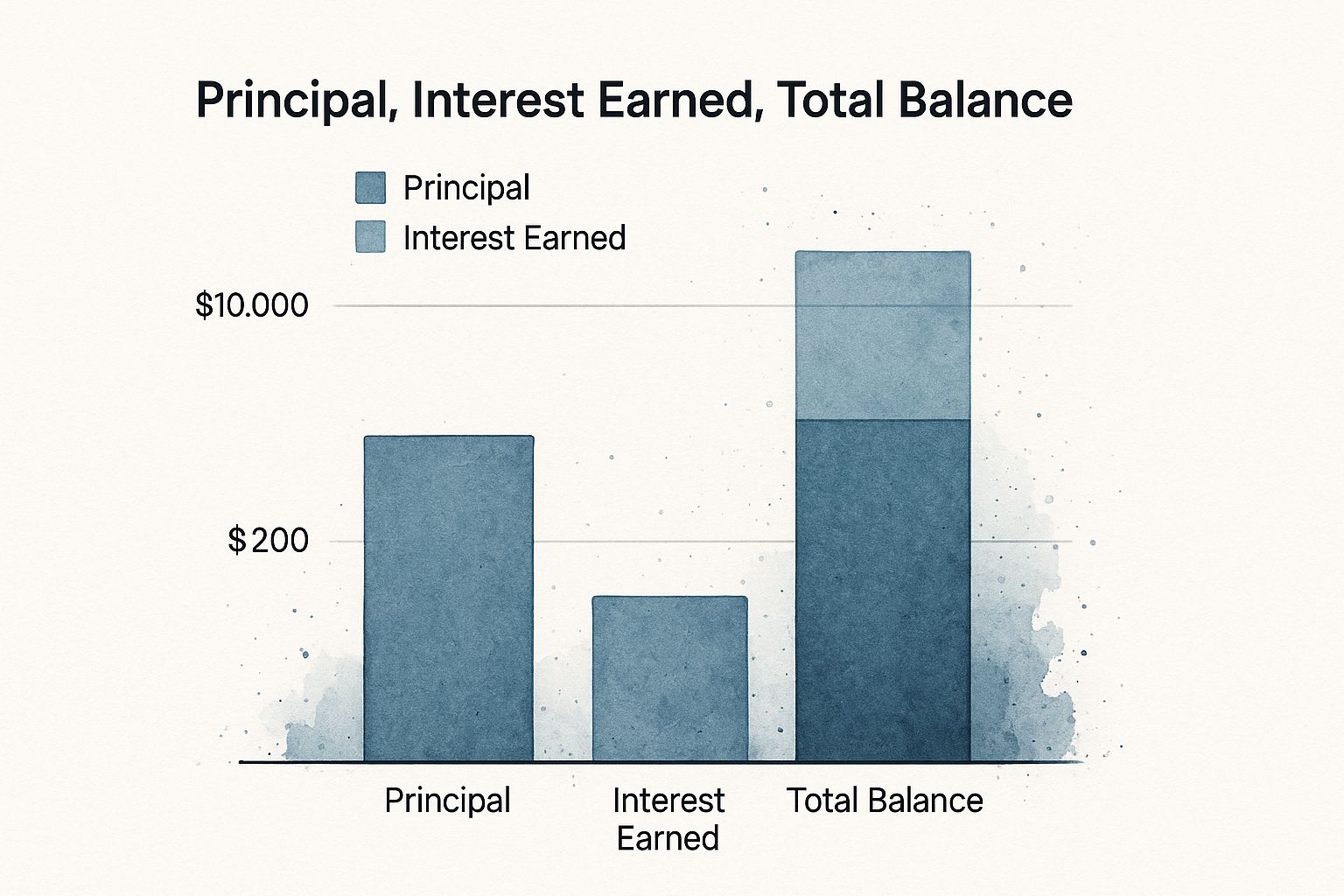

Visualizing Compound Interest

The infographic below provides a visual representation of how a CD grows over time. It illustrates the basic elements: Principal, Interest Earned, and Total Balance. It offers a simplified view of how your initial deposit increases.

As this simplified example demonstrates, even a small amount of earned interest contributes to the principal, resulting in a larger overall balance. Over time, and with more frequent compounding, this snowball effect becomes increasingly powerful.

Comparing Compounding Schedules

Let's consider a scenario where you invest $10,000 in a CD with a 2% APY. The table below, "Compound Interest Comparison by Frequency," shows how various compounding frequencies impact your returns after one, three, and five years. Remember that these figures are for illustrative purposes, and actual returns may differ.

To help you understand how compounding frequency affects your CD returns, we've created the following comparison table. It shows the total return on a $10,000 CD over various terms with different compounding schedules.

| Compounding Frequency | 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|---|

| Daily | $10,202.01 | $10,618.37 | $11,051.27 |

| Monthly | $10,201.84 | $10,617.57 | $11,050.74 |

| Quarterly | $10,201.51 | $10,616.52 | $11,049.92 |

| Annually | $10,200.00 | $10,604.00 | $11,040.81 |

This table clearly shows that even a small change in compounding frequency can have a noticeable effect on your earnings, especially over longer timeframes. The difference between daily and annual compounding on a $10,000 CD over five years can be significant. This underscores the importance of understanding how CD interest is calculated to maximize your investment returns. Use our CD Calculator to experiment with different scenarios and make well-informed decisions. You can quickly compare the total return of various CD offers with different compounding frequencies to pinpoint the best investment for your financial goals.

Master The Essential CD Interest Calculation Formula

Now that we understand the fundamentals of CD interest, let's explore the core calculation. Accurately projecting your CD earnings hinges on grasping the compound interest formula. While the formula itself (A = P(1 + r/n)^(nt)) may appear complex, we'll break it down into manageable components.

Breaking Down the Formula

This formula calculates the total value (A) of your CD at maturity. Let's define each variable:

- P (Principal): Your initial investment.

- r (Interest Rate): Your annual interest rate, expressed as a decimal. For instance, 5% translates to 0.05.

- n (Compounding Frequency): How often the interest is compounded annually. Common frequencies include daily (365), monthly (12), quarterly (4), and annually (1).

- t (Term Length): The CD's term, measured in years. A 6-month CD represents a term of 0.5 years.

Applying the Formula: A Real-World Example

Let's illustrate with a practical example. Imagine you invest $5,000 (P) in a 1-year CD (t = 1) with a 4% annual interest rate (r = 0.04), compounded monthly (n = 12). Applying the formula:

A = 5000 (1 + 0.04/12)^(12*1) A = 5000 (1.003333)^12 A = $5,203.71

Your CD will mature at $5,203.71. For further insights into CD calculations, you can explore this resource: How to Master CD Calculations. This example demonstrates the formula's practical application.

Avoiding Common Calculation Errors

A frequent error involves using the APY directly within the formula. Remember, the APY represents the total return after one year of compounding. The formula, however, requires the stated annual interest rate. Carefully verify your inputs to ensure accuracy. Correctly converting the interest rate to a decimal and the term length to years is crucial for avoiding miscalculations. This precision helps ensure your projections are reliable.

Simplifying With a Calculator

While understanding the formula is essential, a CD calculator significantly simplifies the process. Numerous online tools, including dedicated CD calculators, allow you to input the required information and instantly calculate potential returns. This eliminates guesswork and provides a clear picture of your investment's growth.

Economic Forces That Drive CD Interest Rates Up and Down

CD interest rates aren't random; they're connected to major economic forces. Understanding these connections can give you an advantage when timing your CD investments. This allows you to have realistic expectations for your returns. Let's explore how the Federal Reserve, inflation, and economic growth cycles directly influence the interest rates banks offer on CDs.

The Federal Reserve's Influence

The Federal Reserve (Fed) plays a key role in setting interest rates. By adjusting the federal funds rate, the target rate banks charge one another for overnight loans, the Fed influences borrowing costs throughout the economy. This has a ripple effect on CD rates.

When the Fed raises rates, banks typically follow, offering higher APYs on CDs to attract deposits. Conversely, when the Fed lowers rates, CD rates usually decline.

Inflation's Impact

Inflation, the rate at which prices increase, also strongly influences CD rates. High inflation reduces purchasing power, so the Fed often raises interest rates to combat it. This can lead to higher CD rates as banks compete for savers seeking higher returns to counteract inflation’s effects.

During periods of low inflation, the Fed may lower interest rates, potentially decreasing CD rates.

Economic Growth and CD Rates

Economic growth also plays a significant role. During strong economic expansion, demand for credit rises, which can push interest rates, including CD rates, upward. Conversely, during economic slowdowns, demand for credit may decrease, and the Fed might lower rates to stimulate the economy.

This can lead to lower CD rates. The calculation of CD interest is heavily influenced by these economic conditions and Federal Reserve actions. For example, during the 2009 Great Recession, CD rates dropped to below 1% APY due to the Fed's efforts to stimulate the economy. Conversely, in 2022 and 2023, the Federal Reserve aggressively raised interest rates to combat inflation, significantly increasing CD rates. Explore this topic further: Find more detailed statistics here.

Interpreting Economic Indicators

Learning to interpret key economic indicators like inflation reports and Fed announcements can help you anticipate CD rate changes. This knowledge empowers you to decide whether to lock in current rates or wait for better options.

For example, if inflation is rising and the Fed signals further rate increases, it might be wise to consider a CD before rates climb higher.

By understanding these economic forces, you can strategically time your CD investments to maximize returns. This knowledge also helps you avoid locking in low rates right before they increase. Using tools like our CD Calculator can help you project potential earnings based on different interest rate scenarios. This allows you to make well-informed decisions and maximize your CD investments’ potential.

Proven Strategies To Maximize Your CD Returns

Now that we understand how CD interest is calculated, let's explore how to optimize your CD investments. Smart strategies can significantly impact your earnings over time. This involves understanding APY, advertised rates, term length, and CD laddering.

CD Laddering: Capturing Rising Rates and Maintaining Liquidity

CD Laddering is a technique that lets you benefit from potentially rising interest rates while still keeping access to some of your funds. It involves spreading your investment across multiple CDs with different maturity dates.

For example, with $10,000 to invest, you could create a ladder with five CDs of $2,000 each. These would mature in one, two, three, four, and five years, respectively. As each CD matures, you can reinvest at the current rate or withdraw the funds.

This offers flexibility and the potential for higher returns as rates increase.

APY vs. Advertised Rates: Unmasking the True Return

Understanding the difference between Annual Percentage Yield (APY) and the advertised interest rate is critical. The APY shows the total earned in a year, including compounding. The advertised rate often doesn't reflect compounding, potentially underestimating your actual return.

Always compare APYs when evaluating CDs. This ensures an accurate comparison based on the true potential return. For more information on finding competitive rates, check out Finding the highest CD rates available.

Term Length and Rate Optimization: Finding the Sweet Spot

A CD's term length directly impacts its interest rate. Longer terms usually offer higher rates. However, your money is also tied up longer.

Finding the right balance involves weighing your desire for higher returns against your need for liquidity. Consider your financial goals and timeframe. If you anticipate needing the funds soon, a shorter-term CD might be better, even with a slightly lower rate.

Promotional Rates: Opportunity or Trap?

Banks often use promotional rates to attract new customers. While tempting, carefully evaluate the terms. Some promotional rates are short-lived or require large minimum deposits.

Ensure the promotional rate aligns with your goals and offers long-term benefits. Don't be swayed solely by a high initial rate.

Timing and Structuring Your CDs: Playing the Market

Timing your CD purchases can also improve returns. Consider economic forecasts and interest rate trends. If rates are projected to rise, delaying your investment might capture higher yields.

Using multiple CDs with staggered maturity dates balances growth and liquidity. This lets you access some of your investment regularly without losing the higher returns of longer-term CDs. Strategic implementation of these tactics can optimize your CD portfolio for both growth and stability.

Avoid These Costly CD Interest Calculation Mistakes

Even savvy investors can sometimes stumble when calculating CD interest. These missteps can cost them money or lead to less-than-ideal financial decisions. Let's explore some common pitfalls and how to steer clear of them.

APY Vs. Simple Interest: Understanding the Difference

A frequent mistake is confusing Annual Percentage Yield (APY) with the simple interest rate. APY represents the total amount you'll earn in a year, including the effects of compounding. The simple interest rate, however, doesn't factor in compounding. This means a CD with a 4% simple interest rate compounded monthly will actually have a higher APY than 4%. For accurate comparisons, always use the APY.

The Importance of Considering Early Withdrawal Penalties

Failing to account for early withdrawal penalties can significantly impact your actual return. If you withdraw funds before the CD matures, you'll likely incur a penalty, often forfeiting some earned interest. This can drastically reduce your overall return. Factor in potential penalties when comparing CD options, especially if you might need access to the funds before maturity.

Looking Beyond the Highest Advertised Rate

Focusing solely on the highest advertised rate can be misleading. Some institutions offer enticing promotional rates that may be short-term or require large minimum deposits. This means the high rate might not apply to your investment or timeframe. Always consider the full terms and conditions, including the APY, the term length, and any associated fees.

Remembering Uncle Sam: Factoring in Taxes

CD interest is taxable income. Forgetting to factor in taxes can lead to overestimating your net return. You'll owe federal income tax on your CD earnings, and depending on your state and local taxes, you might owe even more. Accurately calculating your after-tax return gives you a realistic picture of your investment's true profitability.

Scrutinizing Promotional Rates

Be wary of promotional rates that seem exceptionally high compared to market averages. While some promotions offer genuine value, others have hidden drawbacks, such as very short terms or high minimum deposit requirements. Always read the fine print to fully understand the terms and conditions before investing.

Minimum Deposit Requirements: A Potential Roadblock

Overlooking minimum deposit requirements can be a frustrating oversight. Some CDs have substantial minimums, potentially excluding investors with limited funds. Before getting excited about a CD's rate, ensure you meet the minimum deposit requirement.

To help you compare different CD options, let's look at typical rates and terms across various financial institutions:

To help you compare different CD options, let's look at typical rates and terms across various financial institutions:

Let's look at a comparison of CD rates across different types of financial institutions:

CD Rate Comparison: Big Banks vs Credit Unions vs Online Banks

This table compares typical CD rates and terms across different types of financial institutions to help you find the best fit for your savings goals.

| Institution Type | Average 1-Year APY | Average 5-Year APY | Minimum Deposit | Special Features |

|---|---|---|---|---|

| Big Banks | 0.50% - 1.50% | 1.00% - 2.50% | $500 - $1,000 | Convenient branches, wide range of services |

| Credit Unions | 1.00% - 2.00% | 1.50% - 3.00% | $500 - $1,000 | Lower fees, personalized service |

| Online Banks | 1.50% - 2.50% | 2.00% - 3.50% | $0 - $1,000 | Higher rates, 24/7 online access |

As you can see, online banks often offer the most competitive rates, while credit unions provide a balance of decent returns and personalized service. Big banks, while convenient, generally lag behind in terms of APY.

By avoiding these common mistakes and using helpful tools like a CD calculator, you can make more informed decisions and maximize your CD returns. This will help you effectively compare different CD offers and choose the best option for your financial goals.

Key Takeaways For CD Investment Success

Your journey to successful CD investing starts with understanding how interest is calculated and making informed decisions. This guide provides a roadmap to mastering CD calculations and maximizing your returns.

Mastering the CD Interest Calculation

The foundation of successful CD investing lies in accurately calculating potential returns. The compound interest formula, A = P(1 + r/n)^(nt), is essential. Here's a breakdown:

- A is the final amount (initial deposit plus earned interest).

- P is the principal (your initial deposit).

- r is the annual interest rate (expressed as a decimal).

- n is the number of times interest is compounded per year.

- t is the term length in years.

For example, a $2,000 investment at a 3% annual interest rate compounded monthly for 2 years calculates as follows: A = 2000 (1 + 0.03/12)^(12*2), resulting in approximately $2,123.68.

Understanding Compounding Frequency

Compounding frequency significantly impacts CD returns. More frequent compounding (like daily) generates more interest than less frequent compounding (like annually), even with the same APY. This happens because interest is calculated on a growing principal balance. Always compare compounding frequencies when evaluating CDs.

Strategic Timing and Economic Factors

CD interest rates are influenced by economic conditions, including decisions made by the Federal Reserve and inflation. When the Fed raises interest rates, CD rates tend to rise as well. Conversely, if the Fed lowers rates, CD yields may decrease. Understanding these dynamics can help you strategically time your CD investments. For example, if inflation is high and the Fed signals rate increases, consider locking in a CD before rates climb higher.

Maximizing Returns With CD Laddering

CD laddering is a strategy for maximizing returns and maintaining access to funds. It involves dividing your investment among multiple CDs with staggered maturity dates (e.g., one, two, three, and five years). This approach lets you take advantage of potentially rising interest rates as each CD matures. You can then reinvest at higher rates or access a portion of your funds without early withdrawal penalties.

Avoiding Common Pitfalls

Several common mistakes can reduce CD returns. These include confusing APY with the simple interest rate, overlooking early withdrawal penalties, and chasing the highest advertised rate without considering all terms. Always compare APYs, factor in potential penalties, and read the fine print.

Utilizing Tools for Success

A CD calculator simplifies calculating potential returns and comparing CD offers. Experiment with different scenarios, including varying deposit amounts, interest rates, compounding frequencies, and term lengths. Using this tool, along with the strategies outlined above, can help optimize your CD investments for maximum growth and financial security. Start planning your investment strategy today with our free online calculator! Calculate your CD earnings now!