Beyond Basic Math: How CD Calculators Transform Your Investing

Smart investing doesn't have to be complicated. CD calculators have become indispensable tools, helping investors understand and plan for Certificates of Deposit. These aren't your grandma's simple interest calculators; they offer sophisticated planning features. They provide a clear view of potential returns, empowering you to make informed decisions that align with your financial goals. Trying to compare CDs without a calculator is like navigating without a map – you might get there eventually, but it'll be a much more difficult journey.

Unveiling the Power of Projections

CD calculators take the mystery out of how different factors affect your investment. They show you precisely how compounding frequency and term length can significantly impact your final return. You can also experiment with various deposit amounts and interest rates, getting a realistic preview of potential earnings. This allows you to see the long-term benefits of even small increases in your initial investment or APY (Annual Percentage Yield). For a deeper dive into CD calculators, check out this helpful resource: How to master CD bank calculators.

Making Informed Decisions with Data

These digital tools are beneficial for everyone, from beginners to seasoned investors. A new investor can quickly grasp the basics of CD growth. An experienced investor can use advanced features to refine their investment strategy. This accessibility is particularly important in today's expanding market. The global certificate of deposit (CD) market is experiencing significant growth. Valued at approximately USD 1 trillion in 2023, it's projected to reach nearly USD 1.5 trillion by 2032, growing at a CAGR of around 4.5%. This highlights the increasing global demand for secure, low-risk investment options during times of economic uncertainty. For more detailed market statistics, see: Global Certificate of Deposit Market.

Visualizing Your Financial Future

Beyond just numbers, CD calculators often include valuable visualization features. Many platforms offer graphs that chart the growth of your investment over time. This visual representation makes it easier to grasp the power of compounding and compare different CD scenarios. For example, you can quickly see the difference between a 1-year CD and a 5-year CD with the same APY. This clear visual comparison is key for strategic decision-making.

Unlocking Strategic Advantages

CD calculators do more than just crunch numbers; they help you build a solid investment strategy. They can help determine the best CD term length based on your individual financial goals. You can also explore the potential advantages of CD laddering, a strategy that involves investing in multiple CDs with staggered maturity dates. This approach helps balance liquidity and yield, giving you more control over your investments.

By learning how to use a CD calculator effectively, you transform a simple tool into a powerful resource for financial growth. This knowledge allows you to make informed choices, maximize returns, and achieve your long-term financial objectives.

The Magic Behind CD Calculators: Interest Math Made Simple

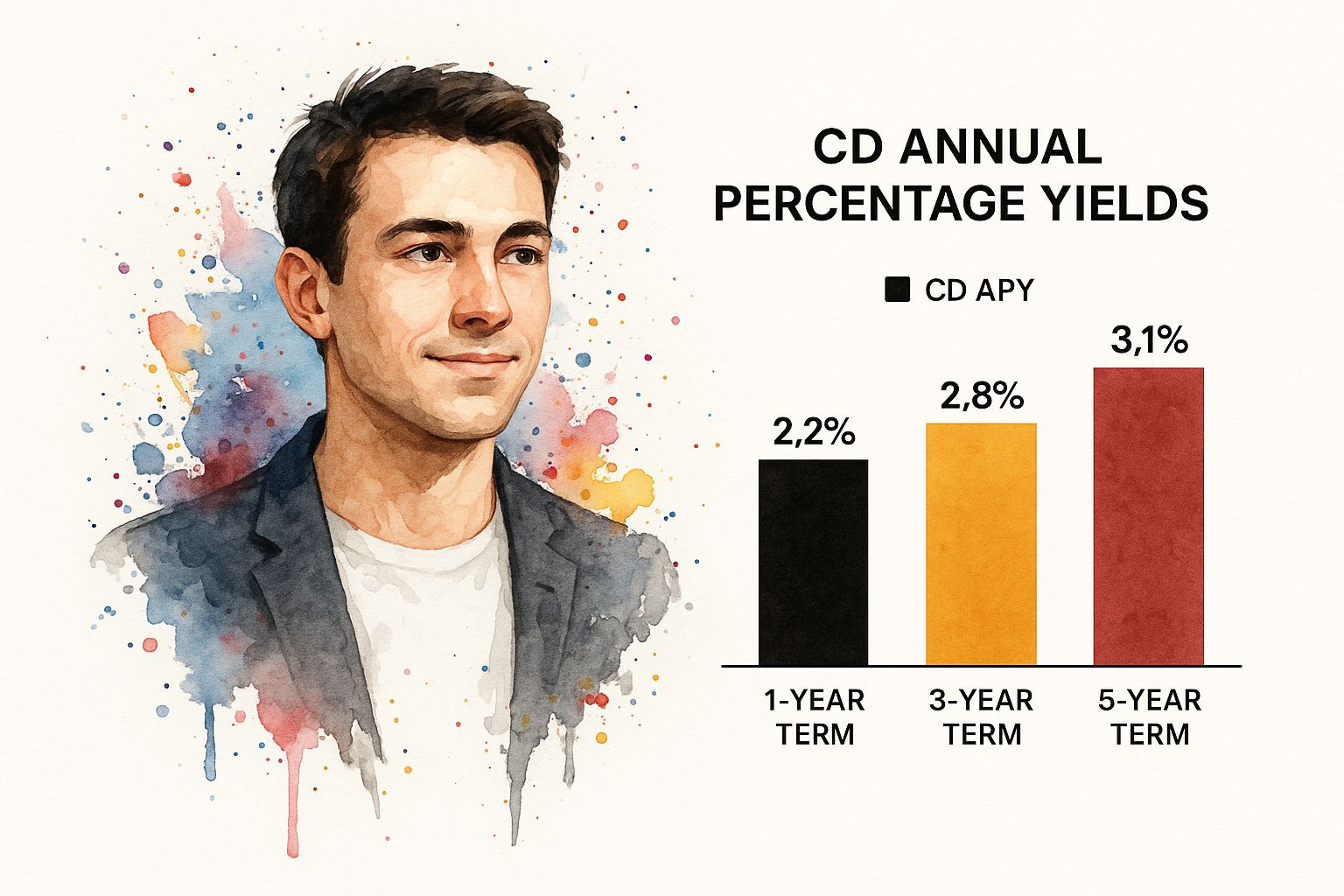

The infographic above illustrates the potential Annual Percentage Yield (APY) you could earn on a Certificate of Deposit (CD). It shows how returns can increase as the term length grows. A 5-year CD, for instance, might offer a higher APY than a shorter-term CD. This highlights the importance of aligning your CD choice with your financial goals and timeline.

Ever wondered how a CD calculator arrives at these figures? A CD calculator simplifies the process of calculating CD growth. It breaks down how your initial deposit, the interest rate, and the compounding frequency interact to generate returns. These tools make understanding compound interest easier for everyone.

Understanding Compound Interest

Compound interest fuels CD growth. It means your interest earns interest. For example, with annual interest, the earned interest is added to your principal at year-end. The following year, you earn interest on this new, higher balance. This accumulating effect is a key advantage of CDs.

Compounding Frequency: A Hidden Factor

Compounding frequency is a crucial factor that many people overlook. It refers to how often earned interest is added to your principal. Higher frequencies, like daily or monthly compounding, result in faster growth compared to quarterly or annual compounding. These seemingly small differences can significantly impact your returns over time, particularly with larger deposits and longer terms.

Let's take a look at a practical example. Imagine you have a $10,000 CD with a 3% annual interest rate over a 5-year term. The table below shows how different compounding frequencies influence the final return:

The following table demonstrates how different compounding frequencies affect the final return on a $10,000 CD at 3% annual interest rate over a 5-year term.

| Compounding Frequency | Final Balance | Total Interest Earned | Effective Annual Yield |

|---|---|---|---|

| Annual | $11,592.74 | $1,592.74 | 3.00% |

| Quarterly | $11,605.41 | $1,605.41 | 3.03% |

| Monthly | $11,611.84 | $1,611.84 | 3.04% |

| Daily | $11,618.34 | $1,618.34 | 3.05% |

As you can see, even though the stated interest rate is the same, the final balance and total interest earned increase with the compounding frequency. While the differences might seem small initially, they become more pronounced over longer durations.

The APY: Your True Earning Potential

The Annual Percentage Yield (APY) represents the total interest earned in one year, including the effects of compounding. This standardized measure allows for easy comparison of different CD offers, even with varying compounding frequencies. CD calculators readily compute the APY, clearly showing your true return.

Unmasking Hidden Fees and Penalties

Understanding CD calculators helps you identify potentially misleading offers. Some financial institutions may advertise enticing interest rates while imposing hidden fees or hefty early withdrawal penalties. A CD calculator can reveal the real impact of these charges on your final returns.

Putting the Power in Your Hands

By grasping the principles behind CD calculators, you gain greater control over your investments. You can negotiate effectively with financial institutions and avoid costly errors. This knowledge leads to better financial outcomes, empowering you to confidently achieve your financial aspirations.

What Separates Good CD Calculators From Great Ones

Not all CD calculators are created equal. Choosing the right one can significantly impact your investment strategy and potential returns. It's important to understand the features that make a tool truly valuable.

Essential Features For Effective CD Calculation

A good CD calculator should offer these core features:

Accurate Interest Calculations: This is fundamental. The calculator must accurately compute compound interest based on your deposit, interest rate, and term.

APY Calculation: The annual percentage yield (APY) is a standardized way to compare CDs with different compounding frequencies. A good calculator displays the APY clearly.

Flexibility With Inputs: You should be able to adjust the deposit amount, interest rate, and term length to see how different scenarios affect your returns.

Advanced Features That Elevate a CD Calculator

Great CD calculators go beyond the basics:

Mobile Responsiveness: Access on the go is essential. A great calculator works seamlessly on any device.

Visual Data Representation: Charts and graphs can help you visualize the growth of your investment and compare different scenarios.

Side-by-Side Comparisons: Easily compare multiple CD offers to find the best rates and terms.

Considering Tax Implications and Other Factors

Top-tier CD calculators often incorporate advanced considerations:

Tax Implications: Taxes affect your final returns. Some calculators estimate the tax burden on your CD earnings for a more realistic profit projection.

Inflation Adjustment: Inflation erodes purchasing power. Good calculators factor in inflation to show the real return on your investment.

Early Withdrawal Penalties: Breaking a CD early usually incurs penalties. Advanced calculators assess the impact of early withdrawals. CD calculators handle complex calculations, involving metrics like the Compound Annual Growth Rate. Historically, CD interest rates have fluctuated, influenced by factors like Federal Reserve policy. As of January 22, 2025, the national average APY for a one-year CD was 1.95%, while the five-year averaged 1.42%, down from the 2023 peak. More detailed statistics can be found here: Historical CD Interest Rates.

Real-Time Market Data Integration: Staying Ahead of The Curve

The best CD calculators integrate real-time market data. This keeps your planning current, allowing informed decisions based on the latest interest rate trends and economic conditions. This feature can make the difference between a good investment and a great one.

From Numbers to Strategy: Making CD Calculators Work for You

A CD calculator helps you create a personalized investment strategy. It transforms abstract numbers into a clear financial roadmap aligned with your goals and timeline. But how do you effectively use this tool?

Turning Insights Into Action

Smart investors use CD calculators to make informed decisions. For example, they determine the optimal CD term length. This involves balancing liquidity (access to your money) with return potential (how much your investment will grow). Longer terms often offer higher returns but tie up your funds for a longer period.

CD calculators also help you compare different investment strategies. You can analyze the benefits of a CD ladder. This strategy involves spreading your investment across multiple CDs with staggered maturity dates, offering a balance of liquidity and return. This contrasts with investing all your funds in a single, large CD. You can learn more about current CD rates: Our guide on CD rates.

Strategic Decision-Making in Different Scenarios

Imagine saving for a down payment on a house in five years. A CD calculator shows the impact of different deposit amounts and interest rates. This allows you to adjust your savings plan to reach your goal. If you’re nearing retirement, a CD calculator can project the income generated by a CD ladder, supplementing your retirement savings.

Strategic CD calculator use also includes evaluating the cost of breaking a CD early. While penalties exist, withdrawing early might sometimes increase your overall return, particularly in a rising interest rate environment. Reinvesting the principal (minus the penalty) in a higher-yielding CD could offset the penalty cost.

Navigating Market Dynamics

Market conditions significantly impact CD investing. In 2025, a large volume of CDs is expected to mature, creating both challenges and opportunities. About $1.9 trillion worth of CDs will mature, particularly in the early months. This could influence interest rates and competition among CD offerings. Learn more about this market trend: CD Maturities in 2025.

Implementing Your CD Strategy

Putting your CD strategy into action involves a few key steps:

Define your financial goals: Determine what you're saving for and when you need the money.

Use a CD calculator to explore different scenarios: Experiment with different deposit amounts, interest rates, and term lengths.

Compare CD offers from different financial institutions: Don't settle for the first rate you find.

Monitor your CD portfolio regularly: Adjust your strategy based on market changes and your evolving goals.

Let's look at how different strategies compare:

The table below compares different CD investment strategies based on a hypothetical $50,000 investment over 5 years, using a CD calculator for analysis.

CD Investment Strategy Comparison

| Strategy Type | Potential Return | Liquidity Level | Complexity | Best For |

|---|---|---|---|---|

| Single Large CD | Moderate | Low | Low | Long-term savers comfortable with low liquidity |

| CD Ladder | Moderate | Medium | Medium | Savers seeking a balance of return and liquidity |

| Short-Term CDs (rolled over) | Variable, potentially higher | High | High | Investors actively managing funds in a rising rate environment |

As this table illustrates, different CD strategies offer various levels of return potential and liquidity. Choosing the right strategy depends on your individual circumstances and goals.

By using a CD calculator strategically, you can transform data into a personalized action plan, achieving your financial goals with confidence and efficiency.

Dangerous Mistakes Even Smart Investors Make With CD Calculators

Even seasoned investors can stumble when using CD calculators. Understanding these potential pitfalls is essential for protecting your investment. Knowing your return on investment is key, similar to understanding SMS marketing ROI.

Overlooking Early Withdrawal Penalties

One common mistake is forgetting about early withdrawal penalties. CDs have fixed terms. Withdrawing early often means losing a percentage of the interest earned, or even a fixed number of months' worth of interest. This can significantly impact your returns. Imagine withdrawing from a 5-year CD after just one year – a large chunk of your earnings could be wiped out.

Ignoring the Impact of Taxes

Many investors overlook tax implications. Interest earned on CDs is taxable income. Not factoring this in can lead to overestimating your actual returns. This is particularly important for those in higher tax brackets. A 4% yield might only be a 3% net yield (or even less) after taxes are considered.

Failing to Account For Inflation

Inflation reduces your money's purchasing power over time. A CD calculator may show a positive return. However, without adjusting for inflation, you could have a negative real yield. This means your investment grows slower than the rising cost of goods and services. You’re effectively losing purchasing power.

Mismatched Compounding Assumptions

CD calculators use different compounding assumptions. Ensure the calculator's frequency matches your financial institution's CD terms. A mismatch creates inaccurate return expectations. Assuming daily compounding when the CD compounds annually will inflate your projected returns.

Unrealistic Interest Rate Projections

Using unrealistic interest rate projections can severely impact long-term CD investments. CD rates fluctuate with market conditions. While calculators allow you to input any rate, being overly optimistic can lead to bad decisions. Research current CD rates and consider future trends. Check out this helpful resource: How to master calculating CD interest.

Correcting These Mistakes: Strategies For Success

Here's how to avoid these common CD calculator pitfalls:

Carefully read the CD terms and conditions: Understand the early withdrawal penalties, compounding frequency, and any fees.

Use a reputable CD calculator: Choose a calculator that allows for tax rate input and inflation adjustments.

Research current and historical CD rates: Base projections on realistic interest rate expectations.

Consult with a financial advisor: Get professional guidance to align your CD investments with your overall financial goals.

By understanding these common mistakes and following these strategies, you can use CD calculators effectively to maximize returns and make informed financial decisions.

Advanced CD Calculator Strategies The Pros Don't Share

Sophisticated investors know that maximizing CD returns involves more than just basic calculations. They use advanced strategies, often overlooked by mainstream financial advice, to consistently outperform market averages. Let's explore some of these powerful techniques.

Stress-Testing Your Portfolio With Sensitivity Analysis

One advanced strategy is sensitivity analysis. This helps you understand how changes in interest rates impact your CD portfolio's overall value. Suppose you're considering a 5-year CD. Using a CD calculator, you can model various interest rate scenarios, such as a 0.5% increase or a 1% decrease. This prepares you for potential market fluctuations and allows you to make informed decisions.

Optimizing CD Ladder Structures

Another valuable approach is optimizing CD ladder structures based on yield curve projections. The yield curve shows the relationship between interest rates and the time to maturity of debt instruments like CDs. A CD Calculator helps you model different laddering scenarios, balancing liquidity needs with potential returns. For instance, if the yield curve suggests rising rates, a ladder with shorter-term CDs might be preferable.

Strategically Timing CD Purchases

Timing is crucial in investing. Smart investors use CD calculators to strategically time their purchases. By monitoring interest rate trends and projecting potential returns, you can capitalize on favorable rate environments. This could mean delaying a purchase if you expect rates to rise further.

Blending CDs of Varying Durations

Blending CDs with different maturities creates a balanced portfolio. A CD calculator helps you analyze the trade-offs between accessibility and returns when combining short-term and long-term CDs. This lets you customize your portfolio based on your financial needs. For example, blending some 1-year CDs with 3-year and 5-year CDs provides access to some funds while still capturing the higher yields of longer-term instruments.

Managing FDIC Insurance Limits

Considering FDIC insurance limits is important. The standard coverage is $250,000 per depositor, per insured bank. Advanced investors often use CD calculators to manage investments across multiple institutions. This maximizes FDIC coverage without sacrificing yield, protecting their principal.

By using these advanced CD calculator strategies, you can go beyond basic calculations and optimize your CD investments for maximum returns. These techniques provide a robust approach to navigating the CD market and reaching your financial goals.

Ready to take control of your CD investments? Start maximizing your returns today with our comprehensive Certificate-of-Deposit Calculator! It's designed to help you explore scenarios, compare CD offers, and make informed decisions based on your financial goals.