CD vs Money Market Account: Which is Best for You in 2025?

Deciding between a Certificate of Deposit (CD) and a Money Market Account (MMA) is a common challenge when aiming to grow your savings. This guide directly compares these two popular options to help you determine which, a CD vs Money Market Account, best fits your financial strategy for 2025. Understanding their distinct features is crucial for maximizing returns while ensuring appropriate access to your funds. We'll explore 6 key differences, covering interest earnings, liquidity, account requirements, risk protection, term lengths, and interest payment structures, empowering you to make an informed choice.

1. Interest Rate Structure and Earnings Potential

When considering a Certificate of Deposit (CD) versus a Money Market Account (MMA), the most fundamental difference lies in their interest rate structure and earnings potential. This single aspect dictates how your savings will grow and is a critical factor in deciding which account type best aligns with your financial goals. Understanding this distinction is paramount for individual savers seeking predictable returns, retirees planning secure income, conservative investors diversifying portfolios, and even small business owners looking to park surplus funds effectively. This item deserves its place at the top of our comparison because the interest rate mechanism is the engine driving returns in both "cd vs money market account" scenarios.

How Interest Rates Work: CDs vs. Money Market Accounts

A Certificate of Deposit (CD) offers certainty. You deposit funds for a set term (e.g., 6 months to 5+ years) and receive a fixed interest rate, expressed as an Annual Percentage Yield (APY), locked for that entire period. This guarantees predictable earnings, as your rate won't change with market fluctuations, and you'll know your exact interest at maturity.

Conversely, a Money Market Account (MMA) has a variable interest rate that fluctuates with market conditions, like Federal Reserve policy changes and the bank's own funding needs. If benchmark rates rise, your MMA's APY can increase, boosting earnings; if rates fall, your APY may decrease. This makes MMA earnings less predictable than CDs but offers potential benefits in rising rate environments. While some MMAs provide check-writing or debit cards, our focus here is on their interest structure and how it impacts your decision in the "cd vs money market account" choice.

Pros and Cons: Weighing Your Options

The distinct interest rate structures lead to a clear set of advantages and disadvantages for each account type when comparing a "cd vs money market account."

Certificates of Deposit (CDs):

- Pros:

- Guaranteed Returns: The fixed APY ensures you know exactly what your return will be upon maturity.

- Protection Against Rate Decreases: If market interest rates fall after you've opened your CD, your rate is locked in and protected.

- Predictable Earnings for Financial Planning: This predictability is invaluable for budgeting and long-term financial planning.

- Typically Higher Rates for Longer Terms: Generally, the longer you commit your money, the higher the APY the bank will offer.

- Cons:

- Missed Opportunity if Rates Rise: If market rates increase significantly after you've locked into a CD, you won't benefit from these higher rates until your CD matures.

- Early Withdrawal Penalties: Accessing your funds before the CD matures usually incurs a penalty, which can negate some or all of the interest earned.

Money Market Accounts (MMAs):

- Pros:

- Potential to Benefit from Rising Rates: As market interest rates go up, the APY on your MMA can also increase, boosting your earnings.

- No Long-Term Rate Lock: You're not committed to a specific rate for an extended period, offering flexibility.

- Cons:

- Risk of Declining Rates: If market rates fall, the APY on your MMA will likely decrease, reducing your earnings.

- Generally Lower Initial Rates than Long-Term CDs: Especially when compared to longer-term CDs, the initial APY on an MMA might be lower.

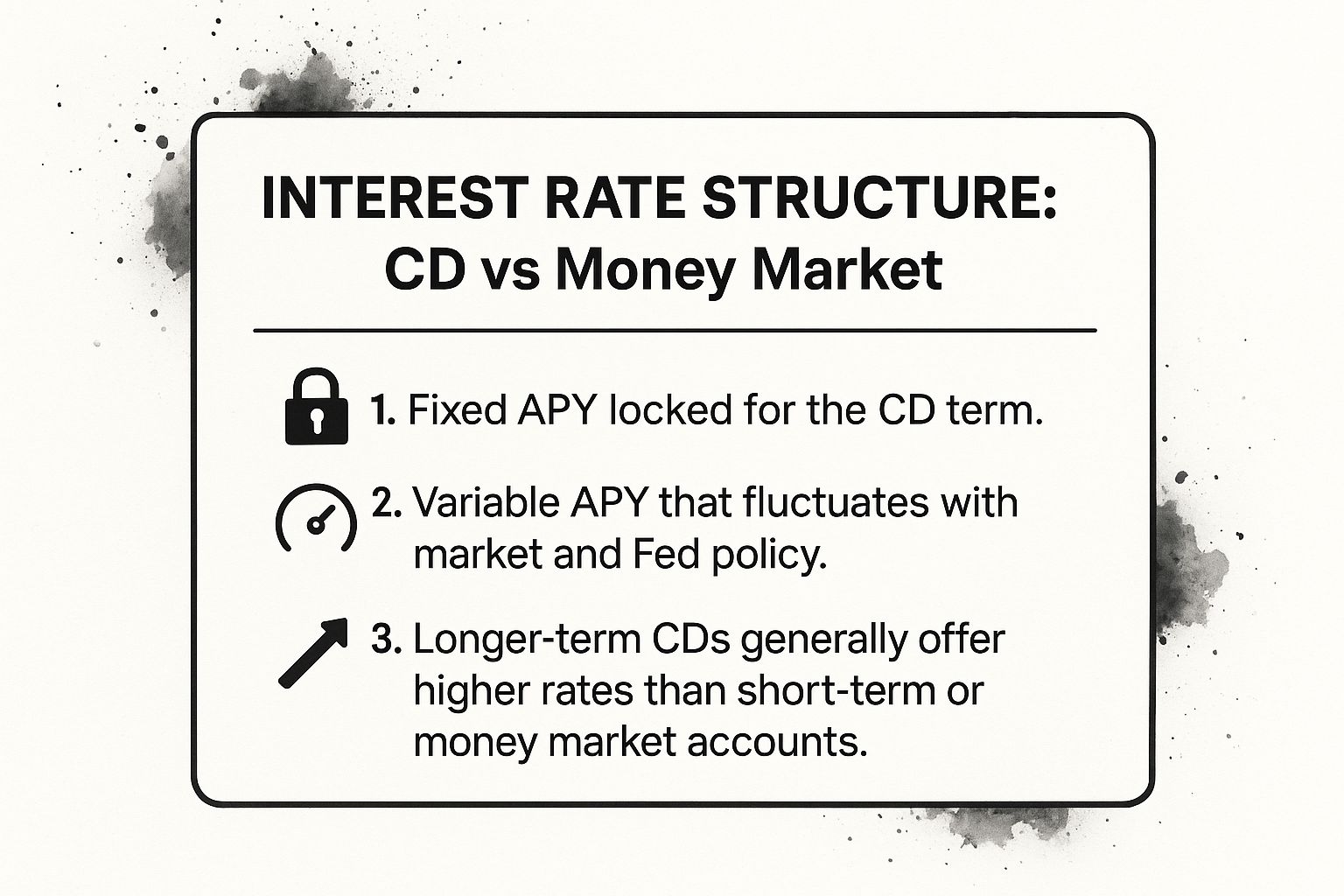

To distill these core concepts into a quick reference, the infographic below visually summarizes the key takeaways regarding the interest rate structures of CDs versus Money Market Accounts. This summary box is designed to highlight the essential differences at a glance.

As this visual summary box highlights, the fundamental choice hinges on whether you prefer a CD's fixed APY, locked for its term, or a money market account's variable APY that can adapt to market shifts, including Federal Reserve policy changes. Furthermore, it underscores that longer-term CDs typically aim to compensate for their reduced flexibility with higher initial rates compared to many money market accounts or shorter-term CDs. These key takeaways are crucial as you navigate the "cd vs money market account" landscape for your savings.

Real-World Examples and Strategic Considerations

The period between 2022 and 2023 provides a stark example of these dynamics. As the Federal Reserve aggressively hiked its benchmark rate to combat inflation, MMA rates soared. Savers who had funds in MMAs saw their APYs jump from near-zero levels (e.g., 0.05%) to upwards of 4% or even 5% at some institutions. For instance, online banks like Marcus by Goldman Sachs and Ally Bank significantly increased their MMA rates during this period, benefiting accountholders.

Conversely, someone who had purchased a 5-year CD in 2020, when rates were historically low (perhaps at 1% APY), found themselves locked into that lower rate while new CDs and MMAs were offering substantially higher returns in 2023. This illustrates the opportunity cost associated with CDs in a rapidly rising rate environment. However, had rates fallen further after 2020, that 1% APY CD would have looked attractive compared to even lower prevailing rates, demonstrating the security CDs offer against falling rates.

When to Choose Which Account

Your decision in the "cd vs money market account" dilemma hinges on your financial outlook and personal needs:

- Opt for a CD if:

- You prioritize absolute certainty in your returns and predictable income streams.

- You have a specific savings goal with a defined timeline (e.g., a down payment in 2 years).

- You believe interest rates might fall and want to lock in a current rate for protection.

- You won't need to access the funds before the term ends, avoiding early withdrawal penalties.

- Opt for an MMA if:

- You anticipate interest rates will rise and want to capitalize on that potential for higher earnings.

- You value liquidity and easy access to your funds (though be mindful of any transaction limits).

- You're building an emergency fund that needs to be readily available while still earning some interest.

Actionable Tips for Maximizing Earnings

- Consider CD Laddering: Instead of putting all your money into one CD, divide it among several CDs with staggered maturity dates (e.g., 1-year, 2-year, 3-year). This strategy provides a balance between earning higher rates on longer-term CDs and having portions of your money become available more frequently, allowing you to reinvest at potentially higher current rates.

- Monitor Fed Policy: Keep an eye on Federal Reserve announcements and economic indicators. This can help you anticipate interest rate trends, guiding your decisions on when to open an MMA or choose a CD term length.

- Compare Current Rates Actively: Before committing to a CD, compare its rate to prevailing MMA rates and the rates on CDs of different term lengths. Online banks often offer more competitive rates for both "cd vs money market account" products than traditional brick-and-mortar institutions.

- Shorter-Term CDs in Rising Rate Environments: If you suspect rates are on an upward trajectory but still prefer the security of a CD, consider shorter terms (e.g., 6 months or 1 year). This allows you to benefit from rate increases sooner when the CD matures and you can reinvest.

Ultimately, understanding how interest rates are structured for both CDs and MMAs is the first and most crucial step in making an informed decision. The differences in APY calculation and stability directly influence your earnings. Understanding the nuances between Annual Percentage Rate (APR) and Annual Percentage Yield (APY) is also crucial for accurately comparing potential returns. Learn more about Interest Rate Structure and Earnings Potential to deepen your understanding of how these rates are calculated and impact your savings. By weighing these factors against your personal financial situation and goals, you can confidently choose the savings vehicle that will best serve your needs in the ongoing "cd vs money market account" consideration.

2. Liquidity and Access to Funds

When evaluating the merits of a cd vs money market account, the ease and flexibility with which you can access your deposited funds emerge as one of the most significant practical differentiators. This aspect, known as liquidity, directly impacts how each product fits into various financial strategies, from everyday cash management to critical emergency planning. Understanding the nuances of liquidity for both CDs and Money Market Accounts (MMAs) is crucial for aligning your savings vehicle with your financial needs and goals.

Liquidity, in simple terms, refers to how quickly and easily an asset can be converted into cash without significant loss of value. For savings products, this translates to your ability to withdraw your money when you need it. Money market accounts are designed with high liquidity in mind. They function similarly to a hybrid of a savings and a checking account, typically allowing for a high number of withdrawals per month – often unlimited, depending on the bank's specific policies. Many MMAs come with features like check-writing privileges and debit cards, making your funds readily available for everyday transactions or unexpected expenses. This accessibility is a cornerstone of their appeal, particularly for individuals and businesses needing quick access to cash reserves.

Certificates of Deposit (CDs), on the other hand, operate on a different principle. When you open a CD, you agree to lock your funds away for a predetermined period, known as the term. This term can range from a few months to several years. In exchange for this commitment, banks usually offer a higher interest rate compared to standard savings accounts or even some money market accounts. However, this higher earning potential comes at the cost of liquidity. Accessing funds in a CD before its maturity date typically incurs an early withdrawal penalty. This penalty can be substantial, often equivalent to several months' or even a year's worth of interest, potentially negating the higher earnings you sought. In most cases, early access requires closing the CD account or paying the stipulated penalty to withdraw a portion of the funds.

The distinction in liquidity and access is precisely why this factor deserves a prominent place in any cd vs money market account comparison. It's not just a minor feature; it's a fundamental characteristic that dictates the suitability of each account type for different financial objectives.

Features and Benefits Deep Dive:

- Money Market Accounts (MMAs):

- Features: High liquidity, check-writing capabilities, debit card access, online transfers, often tiered interest rates (higher balances may earn more).

- Benefits: Funds are readily available for emergencies or unforeseen opportunities without penalty. They allow you to maintain a liquid cash reserve while still earning a competitive interest rate, often higher than traditional savings accounts. The flexibility to move funds easily is invaluable for active cash management.

- Certificates of Deposit (CDs):

- Features: Fixed term lengths (e.g., 6 months, 1 year, 5 years), fixed interest rates locked in for the term, substantial penalties for early withdrawal.

- Benefits: The primary benefit tied to their lower liquidity is often a higher, guaranteed interest rate. This predictability can be very attractive for savers who know they won't need the funds for a specific period. The "locked-in" nature also imposes a forced savings discipline, preventing impulsive spending of funds earmarked for future goals.

Pros and Cons of Liquidity Differences:

Money Market Accounts:

- Pros:

- Immediate Access: Perfect for emergencies or seizing time-sensitive financial opportunities.

- Liquid Interest: Earn interest while keeping your funds accessible.

- Strategic Flexibility: Easily move funds to other investments or accounts if better opportunities arise.

- Cons:

- Temptation to Spend: Easy access might encourage dipping into funds unnecessarily.

- Potential Transaction Limits/Fees: While many offer unlimited transactions, some banks may impose limits on certain types of withdrawals or charge fees if account balances fall below minimums or for excessive specific transactions (e.g., paper checks beyond a certain number).

Certificates of Deposit:

- Pros:

- Savings Discipline: The penalty for early withdrawal acts as a strong deterrent against impulsive spending, helping you stay on track with savings goals. (This is a behavioral benefit linked to illiquidity).

- Cons:

- Significant Penalties: Early withdrawal penalties can wipe out months, or even years, of accrued interest, and in some cases, even dip into the principal.

- Funds Tied Up: Your money is unavailable for unexpected emergencies or new investment opportunities without incurring a penalty.

When and Why to Prioritize Liquidity (or Not):

The choice between a cd vs money market account based on liquidity hinges on your individual circumstances and financial timeline.

Choose a Money Market Account When:

- You're building or maintaining an emergency fund (typically 3-6 months of living expenses).

- You need a temporary place to park a large sum of cash (e.g., proceeds from a house sale) before reinvesting or spending it.

- You anticipate needing access to your savings in the near future for planned expenses or unexpected needs.

- Businesses often use MMAs for their operating reserves due to the need for frequent access.

Choose a Certificate of Deposit When:

- You have a specific savings goal with a defined timeline (e.g., a down payment for a house in 3 years, a wedding in 18 months) and you are certain you won't need the funds before then.

- You want to lock in a fixed interest rate, especially if you believe rates might decline.

- You desire a "set it and forget it" savings approach where the funds are less accessible and therefore less tempting to spend.

- Portions of retirement funds, particularly those not needed for immediate income, might be allocated to longer-term CDs for their predictable returns.

Actionable Tips for Managing Liquidity:

- Emergency Fund First: Always prioritize building an emergency fund covering 3-6 months of essential living expenses in a highly liquid account, like a money market account. This is your first line of defense against financial shocks.

- Match CD Terms to Goals: If you opt for CDs, choose term lengths that align with when you'll need the money. For example, if you're saving for a car you plan to buy in two years, a 2-year CD makes sense.

- Consider No-Penalty CDs: Some banks offer "no-penalty" or "liquid" CDs. These provide the fixed rate of a CD but allow you to withdraw your funds before maturity without penalty, usually after an initial short waiting period (e.g., 7 days after funding). Rates might be slightly lower than traditional CDs, but they offer a good compromise between earning potential and access.

- Ladder Your CDs: For longer-term savings where you still want periodic access, consider a CD ladder. This involves dividing your total investment into multiple CDs with staggered maturity dates (e.g., 1-year, 2-year, 3-year, etc.). As each CD matures, you can either use the funds or reinvest them, providing regular access points without penalizing your entire savings.

- Balanced Approach: For many savers, the optimal strategy involves using both. Keep your emergency fund and short-term savings in an MMA for liquidity, and use CDs for longer-term goals where you can afford to lock up the funds in exchange for potentially higher returns.

Ultimately, the decision in the cd vs money market account debate regarding liquidity comes down to a personal assessment of your need for access versus your desire for potentially higher, fixed returns. By understanding these dynamics, you can make an informed choice that best supports your overall financial well-being.

3. Minimum Balance Requirements and Account Fees

When navigating the landscape of savings options, particularly when weighing a cd vs money market account, understanding the financial barriers to entry and ongoing costs is paramount. Minimum balance requirements refer to the least amount of money you must deposit to open an account or, in some cases, to earn a stated interest rate or avoid fees. Account fees are charges levied by financial institutions for maintaining the account, often triggered if your balance dips below a certain threshold. These two elements—minimums and fees—vary significantly between CDs and money market accounts, directly impacting their accessibility for different investor profiles and ultimately influencing the net returns you can expect.

How Minimums and Fees Work in Practice:

The mechanics of minimum balances and fees differ quite a bit when comparing a cd vs money market account.

Certificates of Deposit (CDs):

- Minimums: The initial deposit required to open a CD can range widely. Many online banks and credit unions offer CDs with no minimum deposit or low minimums like $500 or $1,000. This makes them accessible to a broad range of savers. However, to access "jumbo" CDs or special promotional rates, minimums can climb to $5,000, $10,000, or even $100,000. Generally, the higher the deposit, the better the interest rate you might secure, though this isn't a universal rule.

- Fees: Once a CD is opened and funded, ongoing monthly maintenance fees are very rare, if not nonexistent. The primary "cost" associated with a CD is the early withdrawal penalty, which is charged if you pull your money out before the term ends. This isn't a maintenance fee but rather a penalty for breaking the contract.

Money Market Accounts (MMAs):

- Minimums: Money market accounts also have a spectrum of minimum balance requirements. Some online institutions offer MMAs with no minimum deposit to open. More commonly, you might see opening minimums from $100 to $2,500. However, to earn the most competitive interest rates or, crucially, to avoid monthly service fees, MMAs often require significantly higher sustained balances. These can range from $1,000 to $10,000, and for premium-tiered rates, minimums can reach $25,000 or more.

- Fees: This is a critical differentiator in the cd vs money market account discussion. MMAs frequently come with monthly maintenance fees, typically ranging from $5 to $25. These fees are usually waived if you maintain a specified minimum daily or average monthly balance. If your balance drops below this threshold, the fee is charged, potentially eroding, or even negating, any interest earned.

Shared Aspect – Tiered Rates: For both CDs (especially jumbo CDs) and MMAs, financial institutions often offer tiered interest rates. This means that larger balances can qualify for higher Annual Percentage Yields (APYs). So, while a higher minimum might be a barrier, it can also be a gateway to better returns if you have the funds.

Pros and Cons: Weighing the Financial Implications

Understanding the advantages and disadvantages of each account type's fee and minimum balance structure is vital for making an informed decision.

Certificates of Deposit (CDs):

- Pros:

- Lower Entry Barriers: Many institutions offer CDs with $0 or low minimums ($500-$1000), making them accessible for starting savers.

- No Monthly Maintenance Fees: Once opened, you generally don't have to worry about ongoing fees eating into your principal or interest during the term.

- Cons:

- Large Minimums for Best Rates: Promotional or jumbo CD rates often require substantial deposits, locking up significant funds for the entire term. This can be a drawback for those needing liquidity or having smaller amounts to save.

- Pros:

Money Market Accounts (MMAs):

- Pros:

- No Penalty for Balance Fluctuations (Above Fee Threshold): As long as you maintain the required minimum to avoid fees, you can typically deposit or withdraw funds (within federal limits, often six per month for certain transaction types) without direct penalties affecting your rate.

- Higher Rates with Higher Balances (Potentially): Tiered structures can reward larger balances with better interest rates without the fixed-term commitment of a CD.

- Cons:

- Monthly Fees Can Erode Earnings: If your balance dips below the required minimum, monthly fees can quickly diminish or wipe out any interest earned. This is a significant risk if your balance is prone to fluctuation.

- Higher Minimums for Fee Waivers/Best Rates: The minimum balance required to avoid fees or get the best rates can be substantial, potentially excluding savers with modest funds.

- Balance Requirements May Limit Spending Flexibility: Constantly worrying about maintaining a specific balance to avoid fees can restrict your ability to use your funds freely, somewhat negating the MMA's liquidity advantage over a CD.

- Pros:

Both Account Types:

- Pros (for those who qualify): Higher minimum deposit/balance levels frequently unlock more attractive interest rates, maximizing returns for those with larger sums to invest.

- Cons: Higher minimums invariably act as a barrier for smaller savers, preventing them from accessing the most competitive rates offered.

Examples: Seeing Minimums and Fees in Action

Real-world examples illustrate how these policies play out:

- Ally Bank is well-known for its accessible CDs, many of which have a $0 minimum deposit requirement, coupled with competitive rates. This approach has made them a popular choice for individuals starting their savings journey.

- Contrastingly, a bank like Schwab Bank might offer premium money market account rates, but these could require a substantial minimum balance, such as $25,000, to qualify. This targets a different saver profile with more capital.

- Credit unions often shine in this area. They frequently provide both CDs and money market accounts with lower minimum deposit requirements and more lenient fee structures for their members, reflecting their member-first philosophy.

- Generally, online banks (like Marcus by Goldman Sachs or Capital One 360, in addition to Ally) have become popular precisely because they tend to offer lower minimums and fewer fees on both CDs and MMAs compared to traditional brick-and-mortar banks, making the cd vs money market account decision easier for those concerned about costs.

Actionable Tips for Readers: Navigating the Financial Hurdles

To make the best choice in the cd vs money market account dilemma based on minimums and fees:

- Calculate Net Return After Fees: Don't just look at the advertised interest rate. For MMAs, calculate your potential earnings minus any likely monthly fees if you risk dipping below the minimum. A slightly lower APY with no fee risk might be better than a higher APY with a persistent fee threat.

- Start with Lower Minimum Options: If you're new to these savings vehicles or have limited funds, look for accounts with no or low minimums. You can always move your money to an account with higher minimums and better rates as your balance grows.

- Consider Credit Union Membership: If you're eligible, joining a credit union can open doors to products with lower minimum balance requirements and fewer fees, often with competitive rates.

- Explore Online Banks: Online-only banks typically have lower overhead costs, allowing them to offer more favorable terms, including lower minimums and reduced or no fees on many savings products.

- Always Read the Fine Print: Before opening any account, thoroughly review the account disclosure statement. Pay close attention to the minimum balance needed to open, the minimum to avoid fees (for MMAs), the fee schedule, and how interest is calculated and compounded.

When and Why to Prioritize Minimums and Fees in Your Decision

Understanding and scrutinizing minimum balance requirements and account fees is not just a minor detail; it's a critical step when choosing between a cd vs money market account. This aspect deserves its prominent place in any comparison because it directly impacts:

- Accessibility: Can you even open the account with the funds you have?

- Net Profitability: Will fees eat away at your interest earnings, especially in an MMA?

- Suitability: Does the account structure align with your financial habits and goals?

Why this item deserves its place: Financial barriers and ongoing costs are fundamental to any investment or savings decision. For individuals seeking predictable returns, retirees planning income, conservative investors, and even small businesses parking funds, the upfront requirements and potential for fees can make or break the suitability of an account. In the cd vs money market account debate, these factors often become key differentiators. Ignoring them can lead to unpleasant surprises, such as unexpected charges that diminish returns, or finding out you don't qualify for the advertised rate due to insufficient funds.

- Choose a CD if: You have a specific lump sum (even a small one, thanks to low/no minimum options) that you are certain you won't need for a defined period, and you want the peace of mind of no monthly maintenance fees.

- Choose an MMA if: You need more regular access to your funds and can confidently maintain the minimum balance required to avoid monthly fees. The potential for tiered rates might also be attractive if you have a larger, fluctuating balance.

Ultimately, a careful assessment of minimum balance requirements and associated fees will guide you to the savings vehicle that best aligns with your financial capacity, liquidity needs, and return expectations, ensuring your chosen path in the cd vs money market account landscape is both accessible and rewarding.

4. Risk Profile and FDIC Protection

When evaluating whether a Certificate of Deposit (CD) or a Money Market Account (MMA) is the right choice for your savings, understanding their respective risk profiles and the critical role of FDIC protection is paramount. Both options are celebrated for their safety and appeal to conservative savers. However, a deeper dive into the nuances of their risk characteristics—particularly concerning interest rate changes, inflation, and opportunity costs—is essential for making an informed decision in the "cd vs money market account" debate.

Understanding the Core Safety Net: FDIC Insurance

At the heart of the security offered by both CDs and bank-issued Money Market Accounts lies the Federal Deposit Insurance Corporation (FDIC). Established in 1933 during the Great Depression, the FDIC is an independent agency of the U.S. government that protects depositors against the loss of their insured deposits if an FDIC-insured bank or savings association fails.

- How it Works: FDIC insurance covers deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This means your principal investment in either a CD or an MMA (provided it's a bank account, not a money market fund from a brokerage) is secure up to this limit. This government-backed safety net effectively eliminates principal loss risk, a stark contrast to market-based investments like stocks or bonds where the value of your principal can fluctuate.

- Significance: The peace of mind provided by FDIC insurance is a primary reason why individuals, retirees, and even small businesses flock to these instruments. The 2008 financial crisis, for instance, starkly demonstrated the value of FDIC protection, as depositors in failed banks did not lose their insured funds. This assurance makes both CDs and MMAs foundational tools for capital preservation.

CD Risk Profile: Certainty with Caveats

Certificates of Deposit are time deposit accounts that offer a fixed interest rate for a specified term, ranging from a few months to several years.

- Principal Protection: As mentioned, FDIC insurance safeguards your principal.

- Interest Rate Risk Protection (Pro): A significant advantage of a CD is that its interest rate is locked in for the entire term. This protects you if market interest rates fall after you've opened your CD; your rate won't decrease. This feature provides predictable returns, superior to most standard savings accounts.

- Opportunity Cost Risk (Con): The flip side of a fixed rate is the opportunity cost if interest rates rise. If you lock into a 2-year CD at 3%, and market rates climb to 5% six months later, you're stuck earning the lower rate unless you incur an early withdrawal penalty. This was evident during the 2022-2023 period, where individuals holding older, lower-rate CDs missed out on significant rate increases that newer CD and MMA holders enjoyed.

- Inflation Risk (Con): While your nominal return is fixed, your real return (adjusted for inflation) can be eroded. If your CD earns 3% but inflation runs at 4%, your purchasing power is actually decreasing. This risk is present for any fixed-income investment during inflationary periods, like the one experienced in 2021-2022.

Money Market Account Risk Profile: Flexibility with Volatility

Money Market Accounts (MMAs) offered by banks are deposit accounts that typically offer higher interest rates than regular savings accounts and often come with check-writing privileges or debit card access, though usually with transaction limits.

- Principal Protection: Like CDs, MMAs at FDIC-insured banks are protected up to $250,000.

- Interest Rate Volatility (Potential Pro & Con): MMAs feature variable interest rates that can change with prevailing market conditions.

- Inflation Hedge Potential (Pro): In a rising interest rate environment, MMA rates tend to increase. This allows account holders to automatically capture higher yields without needing to open a new account, potentially helping to offset inflation. The 2022-2023 period saw many MMA holders benefit significantly as the Federal Reserve raised rates.

- Income Uncertainty (Con): Conversely, if interest rates fall, the rate on your MMA will likely decrease, reducing your interest income. This makes MMAs less predictable for income planning compared to the fixed rate of a CD.

- Inflation Risk (Con): While variable rates can help combat inflation, there's no guarantee they will always outpace it. If rates don't rise swiftly enough or if inflation is particularly aggressive, real returns can still be negative.

CD vs Money Market Account: Navigating the Risk Trade-offs

The choice between a "cd vs money market account" often boils down to your outlook on interest rates and your need for liquidity versus rate certainty.

- Choose a CD if: You prioritize a guaranteed return for a fixed period and believe interest rates are likely to fall or remain stable. You don't anticipate needing the funds before maturity. CDs are excellent for specific savings goals with a defined timeline.

- Choose an MMA if: You anticipate rising interest rates and want the potential to benefit from them. You also value having more access to your funds than a CD allows, perhaps for an emergency fund or for parking surplus business cash.

Both instruments eliminate principal loss risk (up to FDIC limits) and offer predictable returns compared to the stock market, making them suitable for conservative investors looking to diversify or retirees seeking secure income streams. Financial advisors often recommend allocating a portion of a conservative portfolio (e.g., 20-40%) to such safe havens.

Actionable Tips for Managing Risk:

- Adhere to FDIC Limits: Ensure your total deposits at any single institution, across all ownership categories, do not exceed the $250,000 limit. If you have more, consider spreading funds across multiple FDIC-insured banks.

- Consider Inflation Hedges: For robust inflation protection beyond what typical CDs or MMAs can offer, explore options like U.S. Treasury Series I Savings Bonds (I-bonds), especially during high inflation periods.

- Diversify Conservatively: Don't put all your safe money in one basket. Consider a CD ladder (multiple CDs with staggered maturity dates) for a blend of yield and liquidity, complemented by an MMA for more immediate access.

- Monitor Real Returns: Always be aware of the current inflation rate and calculate your real return (nominal interest rate minus inflation rate) to understand if your savings are truly growing in purchasing power.

Why This Matters:

Understanding the distinct risk profiles and the shared benefit of FDIC protection is fundamental when comparing a "cd vs money market account." While both are low-risk, their reactions to interest rate environments and inflation differ significantly. Recognizing these subtleties allows you to align your choice with your financial goals, risk tolerance, and economic outlook, ensuring your conservative investments work effectively for you. This knowledge is why risk profile and FDIC protection is a crucial item in this listicle, helping individual savers, retirees, and even small business owners make sound financial decisions.

5. Term Flexibility and Investment Strategy Options

When evaluating the merits of a cd vs money market account, one of the most significant differentiators lies in their term flexibility and the consequent investment strategy options each allows. The fundamental difference in time commitment—fixed for Certificates of Deposit (CDs) versus open-ended for Money Market Accounts (MMAs)—directly influences how these tools can be applied to diverse financial goals, ranging from immediate cash management needs to more structured, long-term conservative investment plans. Understanding these distinctions is paramount to selecting the right savings vehicle for your specific financial situation and objectives.

CDs are time deposit accounts where you agree to leave your money with a financial institution for a predetermined period, known as the term. These terms can vary widely, typically ranging from as short as 3 months to as long as 5, 7, or even 10+ years. In exchange for this commitment, banks and credit unions generally offer a higher interest rate on CDs than on standard savings or money market accounts. The rate is usually fixed for the duration of the term, providing predictable returns. This fixed-term, fixed-rate nature is a cornerstone of CD strategy. However, this structure comes with a trade-off: accessing your funds before the maturity date usually incurs an early withdrawal penalty, which can negate some or all of the interest earned. For those considering CDs, it's crucial to be aware of these potential costs; you can Learn more about Term Flexibility and Investment Strategy Options and the implications of early withdrawals.

Money market accounts, on the other hand, offer considerably more liquidity and flexibility. They function much like savings accounts but often provide higher interest rates (though typically lower than CDs for comparable commitment levels, if CDs had such short, flexible terms) and may come with check-writing privileges or a debit card for easy access. Crucially, MMAs have no fixed term commitments. You can deposit or withdraw funds (within federal limits, usually up to six convenient withdrawals or transfers per month for certain types of MMAs) without penalty, making them an excellent choice for funds you might need to access unexpectedly or at short notice. Interest rates on MMAs are variable and can fluctuate with prevailing market conditions, meaning your returns aren't as predictable as with a CD.

The strategic implications of these term differences are vast.

For CDs, the structured approach is a key benefit:

- Pros:

- Matching Specific Future Financial Needs: If you know you'll need a certain amount of money at a specific future date (e.g., a down payment on a house in 3 years, a tuition bill due in 1 year), a CD maturing around that time can be an ideal fit. It locks in a rate and ensures the funds are available when needed, protected from your own temptation to spend them.

- CD Laddering for Regular Liquidity: A popular strategy is "CD laddering." This involves dividing your total investment into several CDs with staggered maturity dates (e.g., 1-year, 2-year, 3-year, 4-year, and 5-year CDs). As each CD matures, you can reinvest it into a new long-term CD (to capture potentially higher long-term rates) or use the cash if needed. This provides regular access to portions of your money while still benefiting from the generally higher rates of longer-term CDs.

- Cons:

- Locked-in Decisions: You're committed to the term and rate. If interest rates rise significantly after you've locked into a long-term CD, your investment might become suboptimal compared to newer, higher-yielding options.

- Complex Ladder Management: While effective, CD laddering requires ongoing attention to track maturity dates and make reinvestment decisions.

Money Market Accounts offer unparalleled flexibility:

- Pros:

- Adaptability: If your financial circumstances change or new investment opportunities arise, you can quickly access your funds from an MMA without penalty. This is vital for those whose income or expenses are variable.

- No Commitment for Quick Pivots: The lack of a fixed term allows you to pivot your financial strategy swiftly, perhaps moving funds into a higher-yielding investment if one becomes available or if you need to cover an unexpected expense.

- Cons:

- Reduced Disciplined Saving: The ease of access can sometimes work against disciplined saving. Without the "lock-in" feature of a CD, it might be tempting to dip into an MMA for non-essential purchases.

- Encouraging Short-Term Thinking: The variable rates and easy access might lead some to focus more on short-term rate fluctuations rather than adhering to long-term financial goals.

Examples of Successful Implementation:

- College Savings: A family planning for college tuition might build a CD ladder with 1-year, 2-year, 3-year, and 4-year CDs, timing the maturities to coincide with annual tuition payment dates. This ensures the funds are available and earning a predictable return.

- Business Seasonal Cash Flow: A small business experiencing seasonal peaks and troughs in revenue can use an MMA to park surplus cash during busy seasons, earning some interest while keeping the funds accessible for leaner months or unexpected business expenses.

- Retirement Planning: Individuals in their pre-retirement years might purchase a series of 5 or 10-year CDs to create a predictable income stream for their early retirement years, supplementing other retirement accounts.

- Emergency Fund Maintenance: A high-yield money market account is an excellent vehicle for an emergency fund. It keeps the money safe, liquid, and earning a competitive interest rate, ready for unforeseen circumstances like job loss or medical bills.

Actionable Tips for Readers:

- Align CD Terms with Known Expenses: If you have a specific, dateable future expense (e.g., property taxes, a planned vacation), select a CD term that matures just before you need the funds.

- Utilize MMAs for Uncertain Goals: For financial goals with uncertain timing or for funds you need to keep liquid (like an emergency fund or short-term savings for a large, unscheduled purchase), a money market account is generally more suitable.

- Construct CD Ladders for Balanced Liquidity and Returns: If you have a larger sum you want to keep relatively safe but also want periodic access and the potential for better rates, a CD ladder is a sound strategy.

- Combine Both for Comprehensive Management: Many individuals find that a combination of CDs (for specific, timed goals) and an MMA (for liquidity and emergency funds) offers the best approach to overall cash management when comparing cd vs money market account strategies.

This distinction in term flexibility is a cornerstone of why understanding the nuances between a cd vs money market account is critical for effective financial planning. The financial planning industry often promotes goal-based investing, and the concept of asset-liability matching (aligning the nature of your assets with your liabilities or future spending needs) is emphasized in investment education. CDs excel for fixed, known future liabilities, while MMAs are better suited for managing liquid assets needed for variable or uncertain expenses. Choosing wisely based on these term characteristics can significantly impact your ability to meet your financial goals efficiently and securely.

6. Interest Compounding and Payment Methods

When you're weighing the options in the cd vs money market account debate, it's easy to focus solely on the advertised interest rate. However, a crucial, often overlooked, factor that significantly impacts your total return and cash flow is how interest is compounded and paid out. This isn't just a minor detail; it's a core mechanic that differentiates these two popular savings vehicles and can make one a better fit for your financial goals than the other. For individual savers seeking predictable returns, retirees planning income streams, conservative investors, financial advisors, and even small business owners parking surplus funds, understanding these nuances is paramount.

Understanding the Mechanics: Compounding and Payment

At its heart, interest compounding is the financial equivalent of a snowball effect: your earned interest itself starts earning interest, making your savings grow at an accelerating rate. The frequency of this compounding—be it daily, monthly, or quarterly—dictates how often this calculation and addition to your principal occurs. Generally, more frequent compounding leads to slightly higher effective returns because interest is added to the principal more often, creating a larger base for the next interest calculation.

Alongside how interest is calculated, the payment method—when and how you receive or access that earned interest—also differs significantly. Some accounts automatically add the accrued interest to your balance, allowing it to compound further. Others might offer the option to have the interest paid out to you periodically (e.g., monthly or quarterly), providing a stream of income. This distinction is key when considering a cd vs money market account, especially for those who need regular access to their earnings versus those focused purely on growth.

Money Market Accounts (MMAs): Daily Compounding, Monthly Access

Money Market Accounts (MMAs) are well-regarded for their liquidity and typically offer interest that compounds daily. This daily compounding is a significant advantage as it mathematically maximizes the interest earned over time, even if by small increments initially. The accrued interest is then usually credited or paid out to your account monthly.

- Features: Daily compounding, monthly interest crediting/payment, interest usually added automatically to the account balance.

- Pros: The primary pro here is the potential for a regular, albeit often modest, monthly income stream from interest payments. This can be particularly appealing for individuals who want their savings to contribute to their monthly cash flow. Furthermore, the daily compounding ensures your money is working as hard as possible every single day. For anyone comparing a cd vs money market account for easily accessible, interest-bearing funds, these are strong points.

- Cons: The ease of receiving monthly interest payments might encourage spending rather than reinvesting, potentially slowing down long-term wealth accumulation if growth is the primary goal. Another critical factor is that MMAs typically have variable interest rates. This means your monthly interest income can fluctuate, making it less predictable than the fixed rates usually found with CDs, which can be a concern for those who rely on a stable income stream.

- Example: A classic example is a retiree who uses the monthly interest from their MMA to supplement their pension or Social Security payments, helping to cover everyday living expenses without dipping into their principal. Online banks often promote daily compounding on their MMA products.

Certificates of Deposit (CDs): Varied Compounding, Flexible Payouts

Certificates of Deposit (CDs) present a different picture regarding interest. The compounding frequency for CDs can vary more widely than MMAs, ranging from daily, monthly, to quarterly, or even semi-annually or annually, depending on the specific CD's terms and the financial institution. When it comes to interest payment, CDs offer more diverse options. Some CDs compound all earned interest and only pay it out along with the principal at maturity. Others allow for periodic interest payments, which can be disbursed monthly, quarterly, or annually, either into a linked account or via check.

- Features: Compounding can be daily, monthly, quarterly, or less frequent. Interest can be paid periodically or compounded until maturity.

- Pros: The biggest advantage for CDs, particularly those where interest is compounded until maturity, is the potential for maximized growth. By reinvesting all interest earned, you fully leverage the power of compounding over the CD's term. This is ideal for long-term savings goals where maximizing the final amount is key. Furthermore, the option for periodic interest payments gives CDs flexibility. Someone needing regular income but preferring the fixed-rate security of a CD can choose this payout method. This adaptability makes CDs a strong contender in the cd vs money market account discussion for diverse financial needs.

- Cons: If a CD compounds less frequently than daily (e.g., quarterly), it might yield slightly less in total returns compared to an account with the same nominal rate that compounds daily. While the difference might be small for shorter terms or lower amounts, it can add up. Another consideration is that if you opt for periodic interest payments from a CD, you then face the decision of what to do with that income. If not actively reinvested elsewhere, it won't contribute to further compound growth within the CD itself, and reinvesting these periodic payments requires additional decisions.

- Examples: Long-term savers, such as those accumulating a down payment for a house in five years, often choose compound-to-maturity CDs to ensure maximum growth without the temptation to spend the interest. Conversely, someone who has sold an asset and wants a steady, predictable income for a fixed period might opt for a CD that pays out interest quarterly. Credit unions, for example, often provide quarterly compounding on their longer-term CDs.

Why This Matters in Your CD vs. Money Market Account Choice

The divergence in interest compounding and payment methods is a fundamental reason why this item deserves its place in any comprehensive comparison of a cd vs money market account. Your choice significantly hinges on your financial objectives:

- For Income Seekers: If your priority is a regular stream of income to supplement your cash flow, an MMA with its typical monthly interest payments (despite variable rates) or a CD with periodic interest payouts might be more suitable. Retirees, for instance, often lean this way.

- For Growth-Oriented Savers: If your goal is to maximize your savings over a set period, a CD that compounds interest and reinvests it until maturity is generally superior, especially if it also offers daily compounding. Young professionals saving for a long-term goal would benefit here.

- For Cash Flow Management & Business Owners: The automatic crediting of interest in an MMA simplifies things if you want your liquid savings to grow with minimal fuss. For small business owners parking surplus funds short-term, this ease of management combined with daily compounding is attractive.

The way interest accrues and is made available directly impacts not just the total return (Annual Percentage Yield - APY, which reflects compounding, versus Annual Percentage Rate - APR, which doesn't) but also how you can integrate these savings vehicles into your broader financial plan. Ignoring these mechanics when choosing between a cd vs money market account means you might not be optimizing your funds according to your specific needs, whether that's predictable income, maximum growth, or a balance of both.

Actionable Tips for Optimizing Interest Earnings

To make the most informed decision when comparing a cd vs money market account based on their interest mechanics, consider these actionable tips:

- Prioritize Daily Compounding: Whenever possible, opt for accounts that offer daily compounding. While the difference might seem negligible day-to-day, over time, especially with larger sums, it can lead to higher overall returns. Many online banks now offer this on both MMAs and CDs.

- Align Payment Methods with Your Goals: If your primary objective is growing your savings, choose a CD that compounds interest until maturity or ensure your MMA interest is effectively reinvested by remaining in the account. Conversely, if you need supplementary income, select a CD with periodic interest payments or leverage the monthly payouts from an MMA.

- Factor Compounding into APY Comparisons: Always compare accounts using the Annual Percentage Yield (APY), not just the Annual Percentage Rate (APR). APY accounts for the effect of compounding, giving you a truer picture of your potential earnings. Understanding this difference is key; you can Learn more about Interest Compounding and Payment Methods and how different compounding frequencies influence your effective yield.

- Consider Automatic Reinvestment for Growth: If you choose a CD with periodic interest payouts but still want to grow that interest, set up an automatic transfer from your checking account (where the interest is typically paid) to another savings or investment vehicle. This helps maintain a compound growth strategy.

- Understand the Trade-offs: Recognize that the convenience of monthly MMA interest payments might come at the cost of a variable rate and potentially lower overall growth if that interest is consistently spent. Similarly, locking interest into a CD until maturity offers growth but sacrifices immediate access to those earnings. Your choice in the cd vs money market account decision should reflect which trade-off you're more comfortable with based on your individual financial situation and objectives.

6-Factor Comparison of CDs vs Money Market Accounts

| Aspect ⚙️ | CDs (Certificates of Deposit) | Money Market Accounts |

|---|---|---|

| Implementation Complexity 🔄 | Medium – Requires selecting term length and possibly laddering strategies | Low – Open account with flexible terms, no fixed commitment |

| Resource Requirements 💡 | Moderate – Funds locked for set terms, minimum balances vary | Moderate to High – Requires maintaining minimum balances, active management |

| Expected Outcomes 📊 | ⭐⭐⭐⭐ Fixed, predictable returns with higher rates for longer terms | ⭐⭐⭐ Variable returns with potential to capture rising rates |

| Ideal Use Cases 💡 | Goal-based saving with fixed time horizons (e.g., college, retirement) | Emergency funds, short-term savings, funds needing liquidity |

| Key Advantages ⭐ | Guaranteed fixed APY, protection against rate decreases, disciplined saving | Liquidity and flexibility, debit/check access, benefit from rate hikes |

| Key Disadvantages ⚡ | Early withdrawal penalties, opportunity cost in rising rate environments | Variable rates risk, possible monthly fees, may encourage overspending |

Making Your Choice: CD vs Money Market Account

Armed with a clearer understanding of the six key distinctions between these savings vehicles, you're now better equipped to navigate the "cd vs money market account" decision for your financial future. We've explored how Certificates of Deposit (CDs) typically offer fixed interest rates for a set term, potentially leading to higher earnings, while Money Market Accounts (MMAs) provide greater liquidity and easier access to your funds, often with variable rates. Both benefit from FDIC protection, but differ in minimum balance requirements, fee structures, and term flexibility, influencing how interest compounds and is paid.

The most crucial takeaway when considering a "cd vs money market account" is that the optimal choice hinges on your individual financial needs and goals. If your priority is locking in a predictable return and you don't need immediate access to the funds, a CD might be more suitable. Conversely, if flexibility and the ability to withdraw funds easily are paramount, a money market account often takes the lead.

To make your choice, carefully assess your personal circumstances. Consider:

- Your timeline: How soon might you need these funds? This will guide your preference for liquidity (MMA) or a fixed term (CD).

- Your return expectations: Are you seeking the potentially higher, fixed rates of a CD, or are you comfortable with the variable rates and accessibility of an MMA?

- Your financial strategy: Is this money for an emergency fund, short-term savings, or a longer-term, low-risk component of your investment portfolio? Answering these questions will clarify whether a CD or a money market account aligns best with your plans.

Understanding the nuances between a CD vs money market account empowers you to make strategic decisions that enhance your financial security and optimize your savings. For individual savers seeking predictable returns, retirees planning secure income streams, conservative investors diversifying their portfolios, or small business owners parking surplus funds, choosing wisely ensures your money is working effectively towards your specific objectives. By thoughtfully weighing these factors, you can confidently select the account that best supports your journey to financial well-being.

To further explore your CD options and project potential earnings based on different terms and rates for your 2025 planning, our Certificate-of-Deposit Calculator can be an invaluable tool. This calculator helps you visualize the CD side of the "cd vs money market account" comparison, providing concrete figures to inform your decision.