Unlocking Your Savings Potential: CD vs. Money Market and Beyond

Deciding where to park your savings? This listicle compares six low-risk investment products, including CDs vs. money market accounts, to help you maximize returns. We'll cover Certificates of Deposit (CDs), Money Market Accounts (MMAs), High-Yield Savings Accounts, Treasury Bills (T-Bills), Brokered CDs, and I Bonds. Whether you're a retiree seeking stable income, a conservative investor, or simply want predictable growth, this guide clarifies the pros and cons of each option so you can make informed decisions aligned with your financial objectives.

1. Certificate of Deposit (CD)

In the ongoing debate of CD vs money market, Certificates of Deposit (CDs) stand as a cornerstone of conservative investing. A CD is a time deposit offered by banks and credit unions, providing a fixed interest rate for a specific term, typically ranging from three months to five years. Essentially, you agree to lend the institution money for a set period, and in return, they guarantee a predetermined return. This makes CDs attractive to those prioritizing safety and predictable income.

CDs work by locking in your funds for the agreed-upon term. In exchange for this reduced liquidity, you receive a fixed interest rate, often higher than those found in standard savings accounts. This interest accrues over the term, and at maturity, you receive your principal plus the earned interest. The fixed interest rate remains constant regardless of market fluctuations, offering a safe haven against potential losses. This predictability makes CDs an attractive option for individuals seeking a guaranteed return on their investment.

For example, Marcus by Goldman Sachs might offer a 5.15% Annual Percentage Yield (APY) on a 12-month CD. Alternatively, Ally Bank is known for its no-penalty CDs, providing the flexibility of early withdrawal without incurring fees. Credit unions often offer competitive CD rates, sometimes 0.25-0.50% higher than traditional banks. These examples highlight the range of CD options available, catering to varying needs and risk tolerances.

So, when and why should you consider a CD? CDs are ideal for:

- Preserving Capital: If avoiding market risk is paramount, CDs offer a safe haven for your funds.

- Predictable Income: The fixed interest rate ensures a steady, predictable income stream, helpful for budgeting and retirement planning.

- Short to Medium-Term Goals: Saving for a down payment, a future vacation, or other planned expenses within a defined timeframe aligns well with the fixed term of a CD.

However, like any investment, CDs have their drawbacks:

- Limited Liquidity: Early withdrawals typically incur penalties, eating into your returns.

- Potential for Missed Opportunities: If market interest rates rise significantly during your CD's term, you'll miss out on potentially higher returns.

- Inflation Risk: Over longer terms, inflation can erode the real value of your returns.

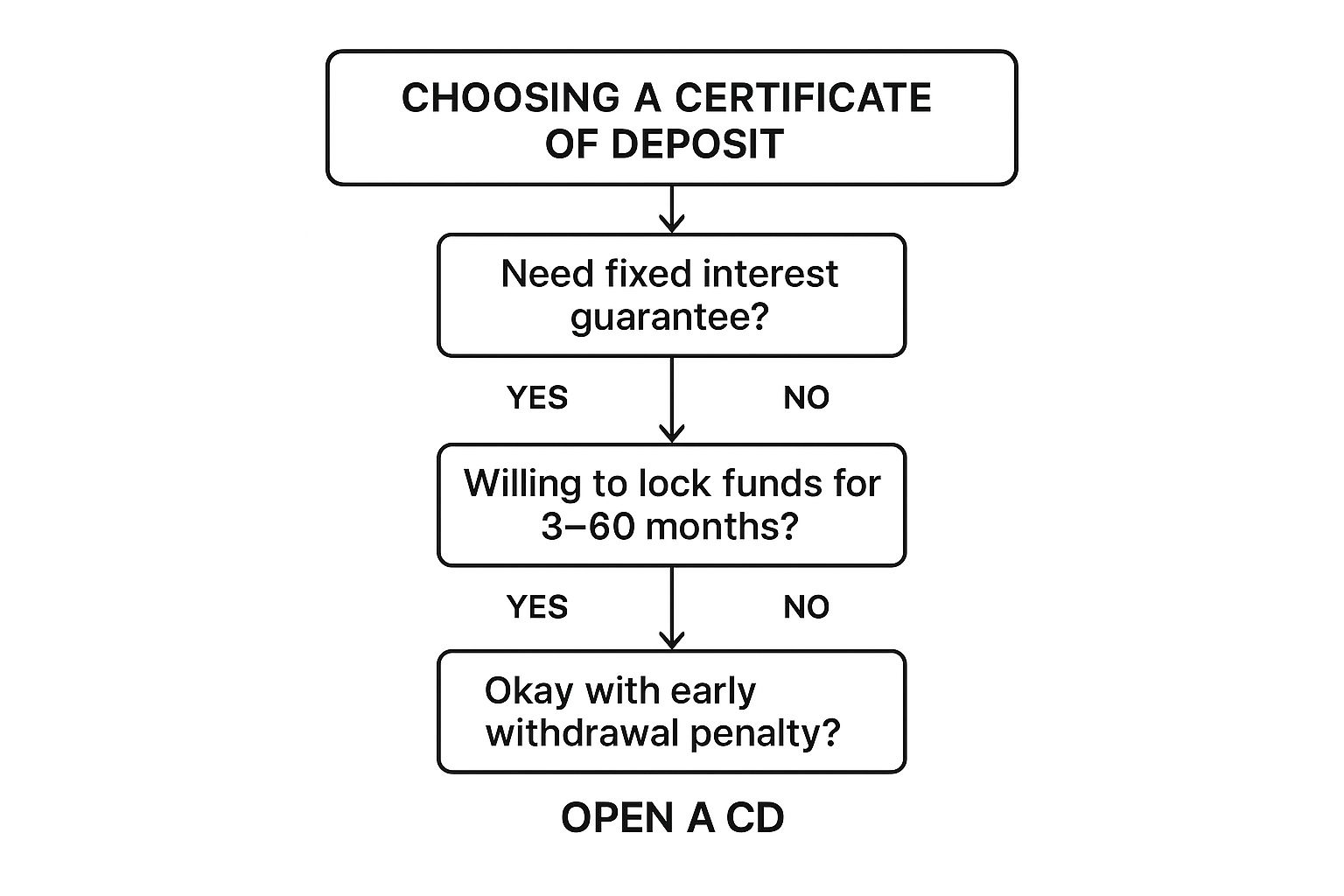

To help you navigate the decision-making process of choosing a CD, the following decision tree outlines the key considerations:

This decision tree visually represents the key questions to ask yourself when considering a CD. Starting with the need for a fixed interest guarantee and proceeding through willingness to lock funds and acceptance of potential penalties, the infographic guides you toward an appropriate decision. The key takeaway is to carefully assess your individual needs and risk tolerance.

Here are a few tips to maximize your CD returns:

- CD Laddering: Spreading your investment across multiple CDs with staggered maturity dates helps balance liquidity and return maximization.

- Rate Shopping: Interest rates vary significantly between institutions. Shop around for the best rates before committing.

- Timing: Consider aligning your CD purchases with anticipated interest rate changes.

- Penalty Review: Carefully review the early withdrawal penalty terms before investing.

- Consider Bump-Up/Step-Up CDs: In rising rate environments, these CDs offer the opportunity to increase your interest rate once or twice during the term.

To learn more about how to calculate potential CD returns, Learn more about Certificate of Deposit (CD). Understanding the nuances of CDs allows you to effectively leverage them within a broader financial strategy. By weighing the pros and cons against your individual financial goals, you can make informed decisions in the CD vs money market discussion. Choosing the right financial instrument is crucial, and a well-chosen CD can contribute to a secure and stable financial future.

2. Money Market Account (MMA)

When comparing CDs vs money market accounts, MMAs offer a compelling blend of accessibility and growth potential. A Money Market Account (MMA) acts as a hybrid between a checking and savings account, offering a higher interest rate than a traditional savings account while still providing some level of transactional convenience. It's designed for individuals who want a safe place to park their money while earning a decent return and maintaining some flexibility for accessing their funds. Unlike a Certificate of Deposit (CD), where your money is locked in for a specific term, an MMA allows you to withdraw and deposit funds more freely. This makes it a valuable tool for managing short-term savings goals and emergency funds.

MMAs typically offer tiered interest rates, meaning the more money you keep in the account, the higher the interest rate you'll earn. This incentivizes higher balances and can significantly boost your returns over time. While MMAs provide check-writing privileges and debit card access, they are subject to federal regulations limiting the number of transactions you can make each month. This is typically capped at six withdrawals or transfers per statement cycle. Understanding these limitations is crucial to avoid excess transaction fees.

One of the key advantages of an MMA is its liquidity. You can readily access your funds without facing the early withdrawal penalties that are common with CDs. This makes MMAs ideal for emergency funds or short-term savings goals where you might need quick access to cash. Furthermore, MMAs are FDIC insured up to $250,000 per depositor, per insured bank, providing peace of mind that your money is safe. This federal insurance protection is a significant benefit for risk-averse savers.

However, MMAs do have some drawbacks. The higher interest rates offered by MMAs often come with higher minimum balance requirements than regular savings accounts. Failing to maintain this minimum balance can lead to monthly fees that can erode your earnings. Additionally, while the interest rates are higher than traditional savings accounts, they are generally lower than the yields you could achieve with a CD of a comparable term. This is the trade-off for the increased liquidity and transactional flexibility that an MMA provides. Also, unlike CDs which typically lock in a fixed interest rate for the term, MMA interest rates are variable. This means they can fluctuate based on market conditions, potentially leading to lower returns than initially anticipated.

Several financial institutions have popularized MMAs, making them a readily available savings option. Capital One's 360 Money Market product is a well-known example, offering competitive rates and online convenience. Sallie Mae Bank has also targeted the high-yield savings market with its MMA offering, often attracting customers seeking more substantial returns. CIT Bank focuses on relationship banking benefits, offering additional perks and rewards for customers who hold multiple accounts with them. Learn more about Money Market Account (MMA) to compare different offerings and find the best fit for your needs.

When deciding whether an MMA is the right choice for you in the "cd vs money market" debate, consider your financial goals and priorities. If you value easy access to your funds and want a higher return than a traditional savings account, an MMA might be a good fit. However, if you are comfortable locking your money away for a specific period and prioritize maximizing your returns, a CD might be a more suitable option.

To maximize the benefits of an MMA, be sure to maintain the minimum balance to avoid fees and reach the highest interest rate tiers. Use it strategically for short-term savings or emergency funds, leveraging its liquidity advantage. Carefully monitor your transactions to stay within the monthly limit and avoid excess activity fees. Regularly compare APY tiers across different institutions to ensure you're earning the best possible return. Consider online banks, as they often offer more competitive rates than brick-and-mortar institutions. By following these tips, you can effectively utilize an MMA as part of a sound savings strategy.

3. High-Yield Savings Account

When comparing CDs vs money market accounts, a high-yield savings account often emerges as a compelling alternative. It offers a compelling blend of liquidity and growth potential, bridging the gap between the fixed terms of CDs and the fluctuating nature of money market accounts. Essentially, a high-yield savings account is a type of savings account that offers significantly higher interest rates than traditional savings accounts, typically offered by online banks and credit unions with lower overhead costs. These accounts offer the readily accessible funds of a regular savings account while providing a much better return on your deposits. This makes them strong competitors to both CDs and money market accounts, particularly for those prioritizing easy access to their funds.

High-yield savings accounts operate much like traditional savings accounts. You deposit funds, earn interest on your balance, and can withdraw money as needed. The key difference lies in the interest rate. While traditional savings accounts might offer negligible returns, high-yield savings accounts boast competitive interest rates, often exceeding 4-5% Annual Percentage Yield (APY). This substantial difference in yield makes them a desirable option for individuals looking to maximize their returns without locking their money away. Because they are typically offered by online institutions, they often have lower overhead than brick-and-mortar banks, allowing them to pass those savings onto customers in the form of higher interest rates.

Several financial institutions are known for their competitive high-yield savings accounts. Marcus by Goldman Sachs has consistently been a leader in offering top-tier savings rates, making it a popular choice for those seeking high returns. American Express Personal Savings is another compelling option, particularly for those who value no minimum balance requirements. LendingClub High-Yield Savings also frequently targets an APY of 4.5% or higher, making it another strong contender in the high-yield savings space.

Features and Benefits:

- Competitive Interest Rates: Often exceeding 4-5% APY, significantly higher than traditional savings accounts.

- No Term Commitment: Unlike CDs, there are no maturity dates or penalties for withdrawing funds early.

- FDIC Insurance Protection: Deposits are typically insured up to $250,000 per depositor, per insured bank.

- Online and Mobile Banking Access: Easy account management and transfers through online platforms and mobile apps.

- No or Low Minimum Balance Requirements: Many high-yield savings accounts have no or very low minimum balance requirements.

Pros and Cons of High-Yield Savings Accounts:

Pros:

- Higher yields than traditional savings without term commitment. Enjoy competitive returns without locking your money away.

- Complete liquidity without withdrawal penalties. Access your funds whenever you need them.

- Low or no fees. Avoid the monthly maintenance fees often associated with traditional checking accounts.

- Easy account opening and management. Streamlined online applications and user-friendly digital platforms.

- Rates often adjust upward with Federal Reserve changes. Benefit from potential rate increases in a rising interest rate environment.

Cons:

- Variable rates that can decrease. Interest rates can fluctuate based on market conditions.

- Limited physical branch access. Primarily offered by online banks, limiting in-person banking options.

- May have transfer limitations. Some accounts may restrict the number of withdrawals or transfers per month.

- Promotional rates may be temporary. Be aware of introductory offers that may expire after a certain period.

- No check-writing privileges. Unlike money market accounts, high-yield savings accounts typically don't offer check-writing capabilities.

When to Consider a High-Yield Savings Account in the CD vs Money Market Debate:

High-yield savings accounts are an excellent choice when you need a combination of competitive returns and easy access to your funds. They are particularly well-suited for:

- Emergency funds: Keep your emergency savings readily available while earning substantial interest.

- Short-term savings goals: Save for a down payment, vacation, or other upcoming expenses.

- Supplementing retirement income: Generate a stream of interest income without locking your money away in long-term CDs.

- Parking funds between investments: Earn interest on your cash while waiting for other investment opportunities.

Actionable Tips:

- Monitor rates regularly: High-yield savings account rates can change frequently, so stay updated and be prepared to switch accounts if necessary.

- Use for emergency funds requiring immediate access: The liquidity of these accounts makes them ideal for emergency savings.

- Set up automatic transfers to build savings consistently: Automate your savings by scheduling regular transfers from your checking account.

- Compare with CD rates to determine the best option for your timeline: If you can lock your money away for a specific period, a CD might offer a slightly higher rate.

- Consider multiple accounts to maximize FDIC coverage: If your savings exceed $250,000, spread your funds across multiple banks to maintain full FDIC insurance coverage.

High-yield savings accounts offer a valuable alternative in the CD vs money market decision-making process, providing a balance of liquidity and growth potential that makes them an attractive option for a wide range of savers. By understanding the features, benefits, and drawbacks of these accounts, you can make informed decisions about how to best utilize them within your overall financial strategy.

4. Treasury Bills (T-Bills)

When comparing CDs vs. money market accounts, Treasury Bills (T-Bills) often emerge as a compelling alternative, especially for those prioritizing safety and predictable returns. T-Bills are short-term securities issued by the U.S. Treasury Department, essentially representing a loan you make to the government. They are sold at a discount and mature at their face value, with the difference being your interest earned. This "discount-to-maturity" structure is a defining characteristic of T-Bills. Their maturities range from just four weeks to a maximum of 52 weeks, offering flexibility for short-term investment horizons.

T-Bills are considered one of the safest investments available because they are backed by the full faith and credit of the U.S. government. This backing effectively eliminates credit risk or the possibility of default, a key advantage when evaluating CD vs money market options. Unlike CDs, which are insured by the FDIC up to $250,000 per depositor, per insured bank, T-Bills carry the implicit guarantee of the entire U.S. government. This makes them particularly attractive for investors seeking absolute safety for even large sums of money.

How T-Bills Work:

Let's say you purchase a 52-week T-Bill with a face value of $1,000 at a discount of $950. At the end of the 52 weeks, the Treasury will pay you the full $1,000 face value. Your $50 profit represents the interest earned on your investment. This simple mechanism makes T-Bills easy to understand and manage.

Features and Benefits of T-Bills:

- Maturities: Available in 4, 8, 13, 26, and 52-week terms.

- Discount Purchase: Sold at a discount and mature at face value.

- Low Minimum Investment: You can purchase T-Bills starting at just $100, making them accessible to a wide range of investors.

- Government Guarantee: Backed by the full faith and credit of the U.S. government.

- Tax Advantages: Interest earned on T-Bills is exempt from state and local taxes, potentially boosting your after-tax returns, a significant factor when weighing CD vs money market choices.

- High Liquidity: T-Bills can be easily sold in the secondary market before maturity if you need access to your funds, although the price you receive may fluctuate depending on current interest rates.

Pros and Cons of T-Bills:

Pros:

- Highest level of safety: Government-backed guarantee minimizes risk.

- Competitive Yields: Often offer yields that are competitive with or exceed those of bank CDs and money market accounts.

- Tax Benefits: Interest is exempt from state and local taxes.

- High Liquidity: Easily tradable in secondary markets.

Cons:

- Federal Income Tax: Interest earned is subject to federal income tax.

- Interest Rate Risk: Selling before maturity may result in a loss if interest rates have risen.

- Lower Long-Term Potential: Typically offer lower yields than longer-term bonds.

- Account Requirement: Requires a TreasuryDirect account or a brokerage account.

Examples of T-Bill Usage:

- A retiree looking for a safe place to park funds for a short-term need, such as a down payment on a house in six months, could invest in a 26-week T-Bill.

- A small business owner with surplus cash flow could ladder T-Bills with different maturities to ensure access to funds while earning competitive interest.

- An individual investor looking for a safe, short-term investment could purchase 4-week T-Bills and roll them over as they mature, effectively creating a flexible cash management solution. This can be particularly attractive during periods of rising interest rates.

Tips for Investing in T-Bills:

- Use TreasuryDirect: Purchase T-Bills directly through TreasuryDirect to avoid brokerage fees.

- Consider Tax Advantages: The state and local tax exemption can be particularly beneficial for high-income earners.

- Ladder Your Investments: Purchase T-Bills with staggered maturities to manage liquidity and interest rate risk.

- Monitor Auction Schedules: Stay informed about upcoming T-Bill auctions to secure the best rates.

- Short-Term Parking: Utilize T-Bills for short-term parking of large sums of money before deploying them for other purposes.

Learn more about Treasury Bills (T-Bills)

The popularity of T-Bills has been fueled by the accessibility of the TreasuryDirect platform, which allows individual investors to purchase directly from the government. Brokerage firms like Fidelity and Charles Schwab further contribute to this accessibility by offering commission-free T-Bill purchases. Financial advisors often recommend T-Bills, especially in high-rate environments, as a secure and predictable component of a diversified portfolio. When considering CD vs money market options, the safety, competitive yields, and tax advantages of T-Bills make them a strong contender for your short-term investment needs.

5. Brokered CDs

When comparing CDs vs. money market accounts, brokered CDs often emerge as a compelling option, particularly for investors seeking higher yields and more flexibility than traditional bank CDs. Essentially, brokered CDs are certificates of deposit purchased through brokerage firms like Fidelity, Charles Schwab, or Vanguard, rather than directly from a bank. This distinction opens up a world of advantages, but also introduces complexities that require careful consideration.

Brokered CDs work much like traditional CDs: you invest a principal amount for a specified term (ranging from a few months to several years) and receive a fixed interest rate. At maturity, you receive your principal plus the accrued interest. The key difference lies in the intermediary role of the brokerage firm. Instead of depositing your money directly with a bank, you purchase a CD issued by a bank through the broker's platform. This allows you to access CDs from banks across the nation, often with more competitive interest rates than your local bank offers. Furthermore, brokered CDs offer the significant advantage of secondary market liquidity.

Imagine you hold a traditional bank CD and need access to your funds before maturity. You'll likely face hefty early withdrawal penalties, potentially wiping out a significant portion of your earned interest. With brokered CDs, you can avoid these penalties by selling the CD in the secondary market through your brokerage account. This flexibility makes them a valuable tool when weighing the CD vs. money market decision, especially if you anticipate potentially needing access to your funds before the CD matures.

Several brokerage firms have popularized brokered CDs, making them increasingly accessible to individual investors. Fidelity Investments, for example, frequently offers brokered CDs with yields significantly higher than traditional banks, broadening their fixed-income offerings. Charles Schwab has also been a pioneer in providing access to a wide selection of CDs from banks nationwide through their CD marketplace. Vanguard has integrated brokered CDs into their portfolio management platform, streamlining the process for their clients.

Features of Brokered CDs:

- Purchased through brokerage accounts: Integrating CDs into your existing brokerage account simplifies management and reporting.

- Often higher yields than direct bank CDs: Access to nationwide competition among banks drives higher rates.

- Secondary market trading capability: Offers liquidity and avoids early withdrawal penalties.

- Access to CDs from multiple banks nationwide: Expands your choices beyond local banks.

- Same FDIC insurance as traditional CDs: Your investment remains protected up to the FDIC limits.

Pros:

- Higher yields than traditional bank CDs: Potentially maximizing your returns within a relatively low-risk investment.

- Liquidity through secondary market sales: Avoids penalties and offers access to your funds if needed.

- Access to nationwide CD offerings: Greater choice and the ability to find the best rates and terms.

- No early withdrawal penalties (sell instead): Flexibility to manage your funds without sacrificing earned interest.

- Consolidated reporting through brokerage statements: Simplifies tracking and management within your overall portfolio.

Cons:

- Market risk if sold before maturity: Fluctuations in interest rates can impact the price you receive when selling.

- Potential broker fees and commissions: Factor these costs into your overall return calculations.

- More complex than traditional CDs: Requires understanding of secondary market dynamics.

- Interest rate risk in secondary market: Selling when interest rates are rising could result in a loss.

- May have call features allowing early redemption by issuer: The issuing bank might redeem the CD before maturity if interest rates fall, potentially limiting your earnings.

Tips for Investing in Brokered CDs:

- Understand call features before purchasing: Research and compare call provisions to assess potential risks.

- Compare total costs including any broker fees: Factor in any commissions or fees charged by the brokerage.

- Monitor secondary market prices if early sale is needed: Stay informed about market conditions to make informed selling decisions.

- Verify FDIC coverage limits across multiple banks: Ensure adequate insurance coverage if you hold CDs from multiple institutions through your brokerage.

- Consider as part of a broader portfolio strategy: Integrate brokered CDs into your overall investment plan based on your risk tolerance and financial goals.

Brokered CDs deserve a place in the "CD vs. money market" conversation because they bridge the gap between the two. They offer the predictable, fixed returns of CDs with a degree of liquidity akin to money market accounts, albeit with some added complexity. For investors seeking to maximize their returns while maintaining relative safety and some flexibility, brokered CDs are a worthy consideration. By carefully evaluating the features, pros, and cons, and following the tips outlined above, you can make informed decisions about whether brokered CDs fit your individual financial goals.

6. I Bonds (Series I Savings Bonds)

When comparing CDs vs. money market accounts, I Bonds (Series I Savings Bonds) offer a unique approach to saving and investing, particularly during periods of inflation. These U.S. government savings bonds provide a compelling alternative, especially for those seeking predictable returns and a hedge against rising prices. Unlike CDs and money market accounts, I Bonds feature a composite interest rate structure that directly combats inflation, making them a valuable tool in preserving purchasing power. This feature alone warrants their place on this list, distinguishing them from other fixed-income options.

I Bonds work by combining two separate interest rates: a fixed rate and an inflation rate. The fixed rate remains constant for the life of the bond, providing a base level of return. The inflation rate, however, is adjusted semi-annually based on changes in the Consumer Price Index (CPI). This dynamic structure allows I Bonds to keep pace with inflation, offering a level of protection not found in traditional CDs or most money market accounts. This makes them a particularly attractive option when comparing a CD vs. money market during times of inflationary pressure.

For example, during the high inflation period of 2022-2023, I Bonds offered yields as high as 9.62%, significantly outpacing the returns offered by many CDs and money market accounts. This real-world performance underscores the value proposition of I Bonds, demonstrating their ability to maintain purchasing power when inflation erodes the value of traditional fixed-income investments. Had you invested the maximum $10,000 allowed at that time, you would have earned substantial interest while also safeguarding your principal.

Features and Benefits:

- Inflation Protection: The semi-annual inflation adjustments ensure your investment keeps pace with rising prices.

- Government Guarantee: Backed by the U.S. government, I Bonds carry no default risk, providing a level of security often lacking in corporate bonds or even some money market funds. This makes them a stronger contender in the CD vs. money market debate for risk-averse investors.

- Tax Advantages: Interest earned is exempt from state and local taxes. Furthermore, federal taxes can be deferred until redemption and may be excluded altogether if used for qualified higher education expenses. This tax advantage sets I Bonds apart in the CD vs. money market comparison, particularly for long-term savers.

- Preservation of Principal: Your initial investment is never at risk, ensuring you won't lose money even if inflation falls.

Pros:

- Excellent inflation hedge.

- Guaranteed by the U.S. government.

- Tax benefits at the state and federal levels.

- Competitive yields during inflationary environments.

- No loss of principal.

Cons:

- Annual Purchase Limit: Currently capped at $10,000 per person electronically through TreasuryDirect and an additional $5,000 in paper I bonds with your tax refund. This limits the amount you can invest annually, potentially making it less suitable for large-scale investments compared to some CDs or money market options.

- Holding Period Requirements: You cannot redeem I Bonds within the first 12 months. Redeeming before five years incurs a three-month interest penalty. This lock-up period should be considered when evaluating a CD vs. money market for short-term needs.

- Electronic Purchase: I Bonds are primarily purchased electronically through TreasuryDirect (www.treasurydirect.gov), which can be slightly less convenient for some investors compared to purchasing CDs or accessing money market accounts through their banks.

- Complex Interest Calculation: The composite rate structure, while beneficial, can be more complex to understand than the simple interest calculations of many CDs and money market accounts.

Tips for Utilizing I Bonds:

- Purchase Timing: Buy early in the month to receive a full month's interest.

- Long-Term Strategy: Plan for a five-year holding period to avoid penalties and maximize the benefits.

- Emergency Fund Component: Consider I Bonds as part of a diversified emergency fund strategy, providing inflation protection for your reserves. This makes them a worthy contender when considering a CD vs. money market for emergency savings.

- Education Planning: The tax advantages make I Bonds an appealing option for education funding.

- Stay Informed: Monitor inflation announcements for updates on rate changes.

I Bonds have been popularized through the accessibility of the TreasuryDirect platform, recommendations from personal finance experts like Suze Orman, and media attention during periods of high inflation, such as the surge in 2021-2022. When considering the CD vs. money market decision, I Bonds provide a valuable alternative, especially for those prioritizing inflation protection and tax advantages.

6-Product Financial Comparison Chart

| Financial Product | 🔄 Implementation Complexity | 🧰 Resource Requirements | 📊 Expected Outcomes | 🎯 Ideal Use Cases | ⚡ Key Advantages |

|---|---|---|---|---|---|

| Certificate of Deposit (CD) | Low - straightforward bank product | Moderate - requires lump sum deposit & term lockup | ⭐⭐⭐⭐ Fixed, guaranteed returns with low risk | Stable, predictable income; funds can be locked 3–60 months | 💡 Fixed interest; FDIC insured; predictable income |

| Money Market Account (MMA) | Medium - account setup similar to savings | Moderate - higher minimum balances & transaction monitoring | ⭐⭐⭐ Moderate returns with higher liquidity | Emergency funds requiring check writing and debit access | 💡 Higher rates than savings; easier access to funds |

| High-Yield Savings Account | Low - like traditional savings but online | Low - minimal balance, easy management | ⭐⭐⭐⭐ Higher yields than savings with full liquidity | Flexible savings needing competitive yields | 💡 No lock-in; frequent rate adjustments; low fees |

| Treasury Bills (T-Bills) | Medium - requires Treasury Direct or broker | Moderate - minimum purchase $100, auction timing | ⭐⭐⭐⭐⭐ Very safe, government-backed short-term returns | Short-term parking of funds; tax-sensitive investors | 💡 Highest safety; tax advantages; high liquidity |

| Brokered CDs | High - brokerage account and market monitoring | High - fees, secondary market knowledge | ⭐⭐⭐⭐ Higher yields than bank CDs with some liquidity | Investors seeking higher returns with flexible exit strategies | 💡 Access to nationwide CDs; no early withdrawal penalty via sale |

| I Bonds (Series I Bonds) | Medium - purchase via Treasury Direct only | Low to moderate - annual purchase limits | ⭐⭐⭐⭐ Inflation-protected returns with tax benefits | Inflation hedge; education funding; preserving purchasing power | 💡 Inflation adjustment; tax exemptions; guaranteed principal |

Making the Right Choice for Your Savings Journey

Deciding where to park your savings requires careful consideration of your individual circumstances and financial goals. This article explored several options, from the fixed-rate security of a Certificate of Deposit (CD) to the liquidity and flexibility of a money market account (MMA). We also touched on alternatives like high-yield savings accounts, Treasury Bills, brokered CDs, and I Bonds, each with its own set of advantages and disadvantages. The key takeaway when comparing a CD vs money market account, or any other savings vehicle, is to prioritize factors such as your risk tolerance, the timeframe of your savings goals, and your need for access to funds.

Mastering these concepts is essential for building a strong financial foundation. Whether you're a retiree seeking stable income, a conservative investor diversifying your portfolio, or a small business owner managing surplus funds, understanding the nuances of these savings instruments empowers you to make informed decisions that maximize your returns while minimizing risk. Choosing the right savings strategy can significantly impact your ability to achieve your long-term financial objectives, from funding a comfortable retirement to securing your financial future.

Ultimately, the best choice for your savings journey is the one that aligns perfectly with your unique needs and aspirations. To help you visualize the potential returns of different CD terms and interest rates, use our Certificate-of-Deposit Calculator. This tool allows you to model various CD scenarios and compare them against other options, like money market accounts, giving you the data you need to make a confident decision on your path to financial success.