Protecting Your Principal While Earning Interest

Looking for safe short-term investments to grow your savings without risking your principal? This listicle explores eight reliable options for predictable returns, ideal for conservative investors, retirees, and anyone seeking secure, short-term growth. Discover how high-yield savings accounts, Certificates of Deposit (CDs), Treasury Bills (T-Bills), and other low-risk instruments can help you achieve your financial goals. Compare potential returns using our CD Calculator and make informed decisions about the best safe short-term investments for your needs.

1. High-Yield Savings Accounts

When considering safe short term investments, high-yield savings accounts are an excellent starting point. These FDIC-insured deposit accounts offer a compelling blend of security, liquidity, and competitive returns, making them ideal for parking funds you may need in the near future while still earning interest. They operate much like traditional savings accounts, allowing deposits and withdrawals, but offer significantly higher annual percentage yields (APYs). This means your money grows faster than in a standard savings account, making it a smart choice for preserving and growing your capital. They are a particularly attractive option for those seeking safe short term investments with easy access to their funds.

High-yield savings accounts are readily available through both online banks and traditional brick-and-mortar institutions. However, online banks often offer more competitive APYs due to lower overhead costs. Currently, APYs range from 3.50% to 5.25%, significantly surpassing the average rates offered by standard savings accounts. This allows your savings to grow at a faster pace without exposing your capital to market fluctuations. While higher minimum balance requirements are sometimes a prerequisite for earning the top rates, many accounts offer competitive yields without such stipulations. Accessing your funds is typically quick and straightforward, though Federal Regulation D limits withdrawals to six per month for most savings accounts. However, you can usually make unlimited deposits.

Features and Benefits:

- FDIC Insurance: Your deposits are insured up to $250,000 per depositor, per insured bank, providing peace of mind and safeguarding your funds against potential bank failures.

- Competitive APYs: Earn significantly higher interest rates compared to traditional savings accounts, maximizing your returns on safe short term investments.

- Liquidity: Access your funds quickly and easily, usually within 1-2 business days, though be mindful of the withdrawal limits.

- No Market Risk: Your principal is not subject to market fluctuations, providing stability and predictable growth.

- Convenience: Manage your account online or via mobile apps, making it easy to track your balance, transfer funds, and monitor your interest earnings.

Pros & Cons:

Pros:

- Extremely low risk with FDIC protection

- Highly liquid

- No market volatility risk

- No penalties for withdrawing funds (within transaction limits)

- Easy to open and manage online

Cons:

- Returns may not keep pace with inflation

- Interest rates can change

- Some accounts require minimum balances

- Federal Regulation D limits withdrawals

- Lower rates at traditional banks

Examples of High-Yield Savings Accounts:

- Marcus by Goldman Sachs (currently around 4.30% APY)

- Ally Bank Online Savings Account (currently around 4.10% APY)

- American Express High-Yield Savings (currently around 4.25% APY)

- Capital One 360 Performance Savings (currently around 4.25% APY)

Tips for Maximizing Your Returns:

- Compare APYs: Shop around and compare rates from multiple institutions to secure the best possible return on your safe short term investments.

- Beware of Promotional Rates: Be aware of introductory offers that may expire after a specific period.

- Link Your Checking Account: Facilitate easy transfers between your checking and savings accounts.

- Automate Savings: Set up automatic recurring deposits to consistently build your savings.

- Mobile Accessibility: Choose a bank that offers a convenient mobile app for managing your account on the go.

High-yield savings accounts are a particularly good fit for those seeking a secure place to park funds needed in the short term, such as emergency funds, down payments, or other near-term financial goals. They offer a balance of accessibility and growth, making them an essential component of a well-rounded financial plan. Learn more about High-Yield Savings Accounts and how they compare to other options like Certificates of Deposit.

2. Money Market Accounts

When it comes to safe short term investments, money market accounts (MMAs) offer a compelling blend of security, liquidity, and yield. They bridge the gap between standard savings accounts and certificates of deposit (CDs), providing a higher return than savings accounts while still allowing limited access to your funds. MMAs invest in low-risk, short-term securities like Treasury bills and commercial paper, ensuring the safety of your principal. Moreover, they are FDIC-insured for up to $250,000 per depositor, providing an added layer of protection against potential bank failures. This makes them a valuable tool for preserving capital while still earning interest.

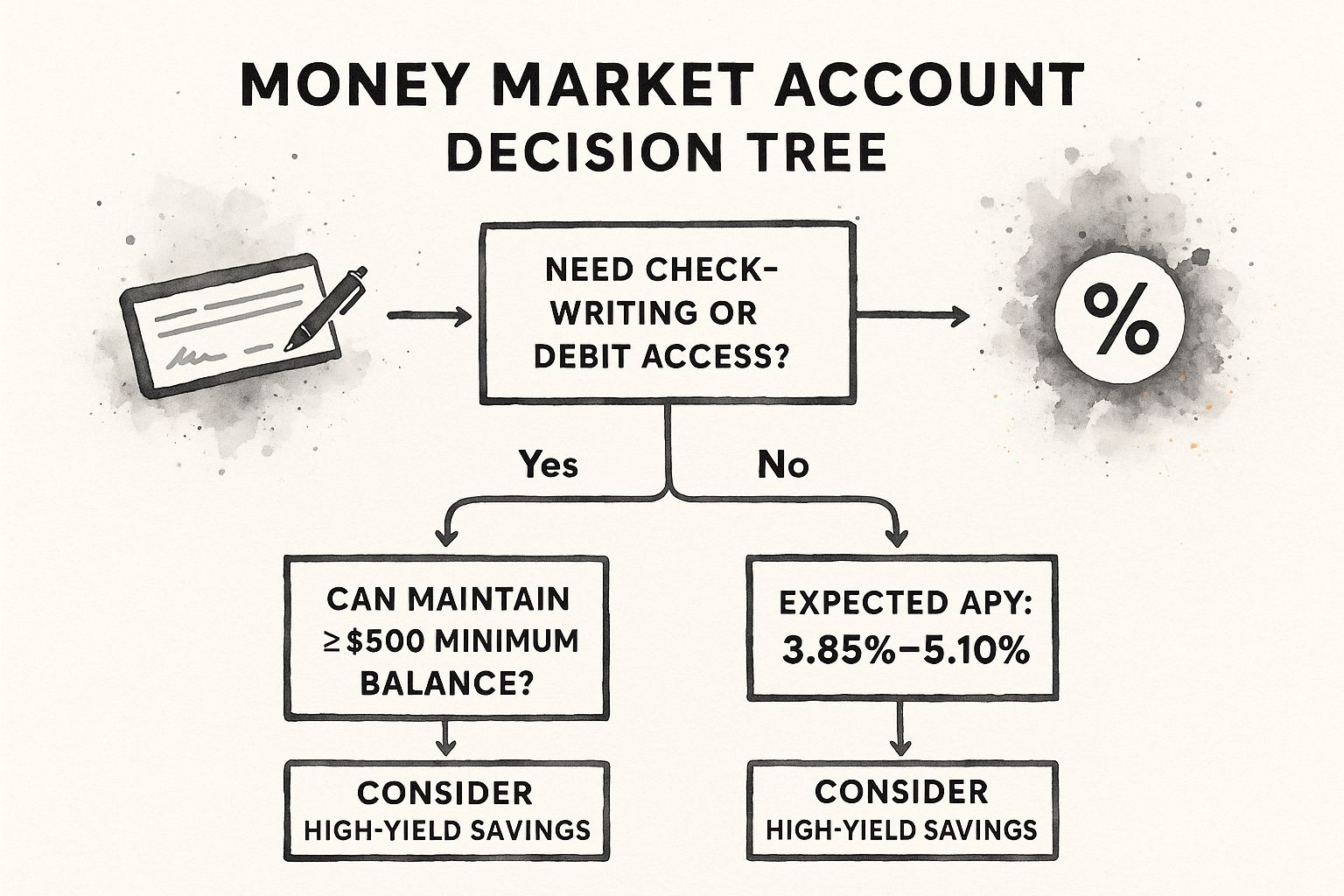

The infographic above presents a decision tree to help you determine if a money market account is the right short-term investment for you. It starts by asking if you need a safe place for your money, then progresses through questions regarding your need for access, desired interest rate, and comfort level with minimum balance requirements.

MMAs offer several advantages over basic savings accounts. They typically boast higher interest rates, currently ranging from 3.85% to 5.10% APY, allowing your money to grow more quickly. They also provide convenient access to your funds through debit cards and limited check-writing capabilities (usually 3-6 checks per month). This accessibility makes MMAs ideal for emergency funds or short-term savings goals where you may need to withdraw money occasionally. Many MMAs also feature tiered interest rates, meaning the more you deposit, the higher your APY.

However, MMAs do have some potential drawbacks. They often require higher minimum balances than regular savings accounts, typically ranging from $500 to $2,500. Failing to maintain this balance can lead to monthly maintenance fees and lower interest rates. Additionally, while MMAs offer some liquidity, they are subject to Regulation D, limiting withdrawals and transfers to six per statement cycle. Exceeding this limit may incur penalties. Finally, while their returns are competitive for safe investments, they are generally lower than those of riskier investment options.

Examples of competitive Money Market Accounts:

- Discover Bank Money Market Account: Currently offering around 4.15% APY.

- Axos Bank High-Yield Money Market: Currently offering around 4.50% APY.

- Ally Bank Money Market Account: Currently offering around 4.10% APY.

- CIT Bank Money Market Account: Currently offering around 4.65% APY.

Tips for maximizing your returns with a Money Market Account:

- Shop around: Compare interest rates, fees, and minimum balance requirements from different banks.

- Avoid fees: Look for accounts with no monthly maintenance fees or ways to waive them, such as maintaining a certain balance or setting up direct deposit.

- Maximize interest: Strive to maintain the minimum balance required to earn the highest interest rate tier.

- Strategic use: Utilize MMAs for emergency funds or short-term goals where some access is needed, but not frequent withdrawals.

- Transaction awareness: Be mindful of transaction limits to avoid excess withdrawal penalties.

- Easy transfers: Consider linking your MMA to your primary checking account for seamless fund transfers.

Money market accounts deserve their place on the list of safe short-term investments because they provide a balanced approach to saving. They offer a higher return than traditional savings accounts while maintaining FDIC insurance protection and reasonable liquidity. By understanding the features, benefits, and potential drawbacks, you can determine if a money market account aligns with your financial goals and risk tolerance. The decision tree infographic provides a simple framework for assessing your needs and determining if a money market account is a suitable choice. Consider your need for access, your desired return, and your ability to meet minimum balance requirements when making your decision.

3. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a popular choice among safe short term investments. They are essentially time deposits offered by banks and credit unions. You agree to lend your money for a specific period (term), and in return, the institution guarantees a fixed interest rate. Because your funds are locked in for a predetermined time, CDs generally offer higher interest rates than standard savings accounts. This makes them an attractive option for those seeking predictable returns with virtually no risk to their principal, as long as the CD is held until maturity.

CDs are a particularly good fit for several investor profiles. Individual savers looking for predictable, risk-free returns can benefit from the guaranteed interest. Retirees seeking to generate stable income streams can use CDs as a reliable component of their retirement plan. Conservative investors can utilize CDs to diversify their portfolios and mitigate risk. Even small business owners can find value in parking surplus funds in short-term CDs. Financial advisors often recommend CDs to clients who prioritize capital preservation.

Features and Benefits:

- FDIC-Insured: Your investment is typically insured by the FDIC (Federal Deposit Insurance Corporation) for up to $250,000 per depositor, per insured bank, providing peace of mind.

- Fixed Interest Rates: Lock in a fixed interest rate for the entire term. Currently, 1-year CDs offer APYs ranging from 4.50% to 5.50%.

- Variety of Terms: Choose a term length that suits your financial goals, from as short as 3 months to 5+ years.

- Predictable Returns: Knowing the exact interest rate and term allows for accurate financial planning.

Pros:

- Higher interest rates compared to traditional savings accounts.

- Guaranteed returns with no risk to principal if held until maturity.

- Various term options to align with your investment horizon.

- FDIC or NCUA insurance protection.

- Fixed rates provide certainty for financial planning.

Cons:

- Limited liquidity; penalties are imposed for early withdrawals.

- Interest rates may lag if overall market rates rise during your CD's term.

- Lower potential returns than investments with higher risk profiles.

- Minimum deposit requirements can range from $500 to $10,000.

- Interest earned is taxable annually, even if not withdrawn.

Examples of Current CD Rates:

- Synchrony Bank 12-month CD: Around 5.00% APY

- Marcus by Goldman Sachs 1-year CD: Around 5.05% APY

- Ally Bank High-Yield CD: Around 4.85% APY for 12 months

- Capital One 360 CD: Around 4.90% APY for 12 months

Tips for Maximizing Your CD Investments:

- Create a CD Ladder: Learn more about Certificates of Deposit (CDs) by staggering maturity dates to enhance both returns and liquidity.

- Shop Around: Compare APYs across multiple financial institutions to secure the best rates.

- Understand Penalties: Carefully calculate early withdrawal penalties to assess the true cost of accessing funds before maturity.

- Consider Bump-Up CDs: These offer the flexibility of a one-time rate increase should market interest rates climb.

- Explore No-Penalty CDs: If flexibility is paramount, consider no-penalty CDs, though these may offer slightly lower rates.

CDs deserve their place on the list of safe short-term investments due to their combination of predictable returns, FDIC insurance, and flexible term options. They are an excellent choice for those prioritizing capital preservation and seeking a steady, reliable return on their investment. By understanding the features, benefits, and potential drawbacks, you can determine whether CDs are the right fit for your financial goals.

4. Treasury Bills (T-Bills)

For investors seeking safe short-term investments, Treasury Bills (T-Bills) stand out as a beacon of stability and security. These short-term debt obligations issued by the U.S. government offer a virtually risk-free way to park your funds for periods ranging from a few weeks to a year. T-Bills are a cornerstone of many conservative portfolios and are particularly attractive to those prioritizing capital preservation and predictable returns.

How T-Bills Work

T-Bills are sold at a discount to their face value, meaning you purchase them for less than what they'll be worth at maturity. The difference between the purchase price and the face value represents your return. For example, you might buy a $1,000 T-Bill for $990. When it matures, you receive the full $1,000, earning a $10 profit. This straightforward mechanism makes T-Bills easy to understand and manage.

Why Choose T-Bills for Safe Short-Term Investments?

T-Bills deserve their place on the list of safe short-term investments due to their unparalleled safety and backing by the full faith and credit of the U.S. government. This means the risk of default is practically nonexistent. They also offer several key features and benefits:

- Short Maturities: Choose from maturities of 4, 8, 13, 17, 26, and 52 weeks, allowing you to align your investments with your short-term financial goals.

- Accessibility: The minimum purchase is just $100, with increments of $100 thereafter, making T-Bills accessible to a wide range of investors.

- Tax Advantages: T-Bills are exempt from state and local income taxes, enhancing your after-tax returns. (Note that they are still subject to federal taxes.)

- Liquidity: A highly liquid secondary market allows you to sell your T-Bills before maturity if needed, though early sale may result in a different return than expected if interest rates have changed.

- Direct Purchase Option: You can purchase T-Bills directly from the U.S. Treasury through TreasuryDirect.gov, eliminating broker fees. This platform also allows you to set up automatic reinvestment for continued holding.

Pros and Cons of Investing in T-Bills

Pros:

- Extremely low risk, considered virtually risk-free.

- Exempt from state and local taxes.

- Highly liquid secondary market.

- No fees when purchased directly from TreasuryDirect.

- Competitive yields, especially in the current interest rate environment.

- Automatic reinvestment option.

Cons:

- Returns may not keep pace with inflation over the long term.

- Lower yields than some riskier investments like corporate bonds.

- Potential for lower than expected return with early sale.

- Requires TreasuryDirect account setup for direct purchase.

Examples of T-Bill Yields (Illustrative – Rates fluctuate):

While specific yields vary depending on market conditions, recent examples include:

- 4-week T-Bill: Around 5.35%

- 13-week T-Bill: Around 5.30%

- 26-week T-Bill: Around 5.29%

- 52-week T-Bill: Around 5.10%

Tips for Investing in T-Bills:

- Buy Direct: Purchase through TreasuryDirect.gov to avoid broker fees.

- Ladder Your Investments: Consider a laddering strategy, purchasing T-Bills with staggered maturity dates to create a regular income stream.

- Automate: Set up automatic reinvestment if you wish to continually hold T-Bills.

- Compare Rates: Compare current T-Bill rates with other safe short-term investments like Certificates of Deposit (CDs).

- Consider the Secondary Market: For larger investments, explore the secondary market for potentially better pricing.

When to Use T-Bills:

T-Bills are an excellent choice for:

- Short-term savings goals: Saving for a down payment, a vacation, or other near-term expenses.

- Emergency funds: Holding readily accessible cash for unexpected events.

- Conservative portfolio diversification: Balancing riskier investments with the stability of T-Bills.

- Parking funds temporarily: Holding funds securely while awaiting other investment opportunities.

5. Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) offer a unique approach to safe short-term investments, particularly in an inflationary environment. While they are typically issued with longer maturities (5, 10, or 30 years), their presence on the secondary market allows investors to buy and sell them before maturity, making them a viable option even for shorter-term goals. TIPS deserve a place on this list because they provide a powerful hedge against inflation, a crucial feature for preserving the purchasing power of your savings, especially during periods of rising prices.

How TIPS Work:

Unlike conventional Treasury bonds, TIPS offer a guaranteed real return by adjusting their principal value based on the Consumer Price Index for All Urban Consumers (CPI-U). This means that when inflation rises, the principal value of your TIPS increases. Conversely, during deflationary periods, the principal adjusts downwards, although it will never fall below the original par value. A fixed interest rate is applied to this adjusted principal, and interest payments are made semi-annually.

Features and Benefits:

- Inflation Protection: The principal adjustment mechanism provides a direct hedge against inflation, ensuring your investment maintains its real value.

- Guaranteed Real Return: The fixed interest rate, while typically lower than conventional bonds, provides a known real return above inflation.

- Government Backing: TIPS are backed by the full faith and credit of the U.S. government, making them virtually risk-free in terms of default.

- Tax Advantages: Interest earned on TIPS is exempt from state and local taxes.

- Liquidity: The active secondary market allows you to sell TIPS before maturity, providing flexibility for short-term needs.

- Accessibility: You can purchase TIPS directly through TreasuryDirect without paying broker fees.

Examples:

- A 5-year TIPS auction in April 2023 offered a real yield of approximately 1.55%.

- 10-year TIPS traded at around a 1.60% real yield as of mid-2023.

- For simplified access and diversification, investors can consider TIPS mutual funds like the Vanguard Inflation-Protected Securities Fund (VIPSX) or ETFs such as the iShares TIPS Bond ETF (TIP) or Schwab U.S. TIPS ETF (SCHP).

Pros and Cons:

Pros:

- Direct inflation hedge

- Extremely low default risk

- State and local tax-exempt interest

- Available through TreasuryDirect (no fees)

- Liquid secondary market

- Preserves purchasing power

Cons:

- Lower fixed rates than conventional Treasuries

- Principal can decrease during deflation (though not below par)

- Complex tax treatment ("phantom income")

- May underperform in low-inflation environments

- Price volatility in secondary market due to interest rate changes

- Less suitable for very short-term goals (under 1 year)

Tips for Utilizing TIPS for Safe Short Term Investments:

- Strategic Timing: Consider buying TIPS when inflation expectations are low, but you anticipate future inflation.

- Tax-Advantaged Accounts: Hold TIPS in tax-advantaged accounts like IRAs to avoid paying annual taxes on the inflation adjustments to principal.

- Yield Comparison: Compare the real yield of TIPS with the nominal yield of regular Treasury bonds minus your expected inflation rate.

- Short-Term Use: For shorter-term horizons, consider TIPS ETFs or mutual funds for easier liquidity and diversification.

- Portfolio Allocation: Use TIPS as a portion of your fixed-income allocation, not your entire portfolio.

When and Why to Use TIPS:

TIPS are particularly valuable when you want to protect your savings from the erosive effects of inflation. If you're saving for a short-term goal within a few years and are concerned about rising prices, TIPS, especially through ETFs or mutual funds, can be a valuable component of your safe short-term investment strategy. While not ideal for investments of less than a year, their liquidity on the secondary market makes them accessible even for shorter time horizons than their maturity dates suggest. They provide a predictable real return, making them suitable for conservative investors, retirees seeking stable income, and anyone looking to maintain the purchasing power of their savings during inflationary periods.

6. Short-Term Corporate Bond Funds

For investors seeking safe short term investments that offer a balance of stability and yield, short-term corporate bond funds present a compelling option. These funds pool money from multiple investors to invest in a diversified portfolio of corporate bonds with maturities typically ranging from one to three years. This shorter maturity timeframe makes them a suitable choice for those with a shorter-term investment horizon, as they offer relatively low volatility compared to longer-term bonds or stocks.

How They Work:

Short-term corporate bond funds invest in debt securities issued by corporations. Essentially, you're lending money to these companies, and they pay you interest in return. Because these are short-term bonds, the loan period is relatively brief (1-3 years), reducing the risk of significant price fluctuations due to interest rate changes. The fund manager actively selects bonds based on credit quality, maturity, and other factors, aiming to maximize returns while managing risk.

Why Choose Short-Term Corporate Bond Funds?

These funds deserve a place on the list of safe short-term investments because they offer several key advantages:

- Higher Yields Than Government Bonds or Bank Products: Currently, investment-grade short-term corporate bond funds offer yields in the range of 4.50-5.75%, significantly higher than comparable government securities or traditional bank savings accounts. This allows you to potentially grow your money faster while maintaining a moderate risk profile.

- Diversification: By investing in a fund, you gain instant diversification across numerous companies and sectors, minimizing the impact of a single company defaulting on its debt.

- Professional Management: Fund managers conduct in-depth credit analysis and actively manage the portfolio, relieving individual investors of the burden of bond selection and monitoring.

- Liquidity: Short-term corporate bond funds typically offer daily liquidity, meaning you can easily access your money without incurring withdrawal penalties.

- Variety: Options are available for various risk tolerances, ranging from funds focused on investment-grade bonds (lower risk) to those holding high-yield bonds (higher risk, higher potential return).

Examples of Short-Term Corporate Bond Funds:

- Vanguard Short-Term Corporate Bond ETF (VCSH): Current yield ~5.2%, expense ratio 0.04%

- iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB): Current yield ~5.0%, expense ratio 0.04%

- Fidelity Short-Term Bond Fund (FSHBX): Current yield ~5.1%, expense ratio 0.45%

- PIMCO Enhanced Short Maturity Active ETF (MINT): Current yield ~5.4%, expense ratio 0.36%

Pros and Cons:

Pros:

- Higher yields than government bonds or bank products

- Diversification across many issuers

- Professional credit analysis and portfolio management

- Daily liquidity

- Low volatility compared to longer-term bonds or stocks

- Options for various risk tolerances

Cons:

- Not FDIC-insured; principal can fluctuate

- Management fees reduce returns (typically 0.30-0.75% annually)

- Some interest rate risk if rates rise sharply

- Credit risk if economic conditions deteriorate

- Generally taxable at ordinary income rates

- Potential capital gains distributions

Tips for Investing:

- Focus on low expense ratios: Minimize costs to maximize returns.

- Check the credit quality breakdown: Higher-quality portfolios offer more stability.

- Consider tax-exempt municipal bond funds if in a high tax bracket: This can help you keep more of your earnings.

- Use dollar-cost averaging: Build a position gradually to mitigate timing risk.

- Monitor the fund's duration: Lower duration means less interest rate risk.

- Hold in tax-advantaged accounts when possible: Avoid annual tax on distributions.

When to Use This Approach:

Short-term corporate bond funds are ideal for investors who:

- Need their money within a few years.

- Seek higher returns than bank savings or CDs, but with relatively low risk.

- Want professional management and diversification.

- Are comfortable with some level of price fluctuation.

By carefully considering the features, benefits, and potential risks, investors can effectively utilize short-term corporate bond funds as part of a well-rounded and secure investment strategy.

7. Money Market Funds: A Safe Haven for Short-Term Investments

Money market funds (MMFs) are a smart choice for parking your cash safely while still earning a decent return. They are a type of mutual fund that invests in extremely low-risk, short-term debt instruments like U.S. Treasury bills (T-bills), certificates of deposit (CDs), and commercial paper. These funds aim to maintain a stable $1.00 net asset value (NAV) per share, meaning your principal is generally safe. Because of this stability and easy access to your money, they deserve a place on any list of safe short term investments.

How Money Market Funds Work:

MMFs pool money from multiple investors to purchase a diversified portfolio of these short-term debt securities. The interest earned on these securities is passed on to investors as dividends, typically paid out monthly. You can easily buy and sell shares in a money market fund, offering high liquidity—often with same-day or next-day access to your funds. While not FDIC-insured like bank money market accounts, MMFs are subject to strict SEC Rule 2a-7 regulations, which dictate the quality, maturity, and diversification of their holdings, making them a very low-risk investment.

Types of Money Market Funds:

- Government: Invest primarily in U.S. government securities, offering the highest level of safety.

- Prime (Corporate): Invest in a mix of government and corporate debt, offering slightly higher yields but with marginally increased risk.

- Tax-Exempt: Invest in municipal bonds, offering tax-advantaged income for those in higher tax brackets.

Benefits of Investing in Money Market Funds:

- Higher Yields: Currently, many MMFs offer yields ranging from 4.75% to 5.25%, significantly more than traditional savings accounts.

- High Liquidity: Access your funds quickly and easily, usually without penalty.

- Professional Management: Benefit from expert management of a diversified portfolio.

- Tax Advantages: Tax-exempt funds can reduce your tax burden.

- Convenience: Many offer check-writing privileges or debit card access.

- Low Expenses: Expense ratios are generally low, particularly for larger funds.

Pros and Cons of Money Market Funds:

| Pros | Cons |

|---|---|

| Higher yields than savings accounts | Not FDIC insured (though risk is minimal) |

| High liquidity - no withdrawal penalties | Returns fluctuate with market interest rates |

| Professional management | Potential redemption gates/fees during extreme market stress |

| Tax-exempt options available | Minimum investment requirements may apply ($500-$3,000) |

| Check-writing capabilities | May underperform inflation in low-interest environments |

| Low expense ratios | Annual operating expenses reduce effective yield |

Examples of Money Market Funds:

- Fidelity Government Money Market Fund (SPAXX): Current yield ~5.05%, $1 minimum investment

- Vanguard Federal Money Market Fund (VMFXX): Current yield ~5.10%, $3,000 minimum investment

- Schwab Value Advantage Money Fund (SWVXX): Current yield ~5.18%, $1 minimum investment

- Federated Hermes Government Obligations Fund (GOSXX): Current yield ~5.07%, $500 minimum investment

Tips for Choosing a Money Market Fund:

- Compare Expense Ratios: Small differences can significantly impact your returns over time.

- Consider Risk Tolerance: Government funds offer greater stability than prime funds, albeit with slightly lower yields.

- Tax Implications: Utilize tax-exempt funds if you're in a high tax bracket.

- Brokerage Sweep Funds: Check your brokerage's sweep fund yields as a convenient cash management option.

- Yield Comparison: Understand the difference between 7-day yield (current) and 30-day yield (recent average).

- Withdrawal Restrictions: Be aware of any potential limitations on withdrawals or the number of transactions.

When to Use Money Market Funds:

MMFs are ideal for:

- Short-term savings goals: Like down payments, emergency funds, or upcoming expenses.

- Preserving capital: When you need a safe place to park your money and minimize risk.

- Supplementing retirement income: Providing a stable and accessible source of funds.

Learn more about Money Market Funds (This link provides further information on APR vs. APY, which can be helpful when comparing different yield figures.) Understanding these differences is crucial for maximizing your returns on safe short term investments like money market funds.

8. Short-Term Municipal Bond Funds

Looking for safe short term investments that offer tax advantages? Short-term municipal bond funds could be a suitable option, especially for those in higher tax brackets. These funds pool money from investors to purchase a diversified portfolio of short-term debt securities issued by state and local governments, typically with maturities between 1 and 5 years. They offer a compelling blend of relative safety and tax-efficient income, securing their place on our list of safe short-term investments.

How They Work: Municipal bonds, often called "munis," represent loans investors make to municipalities to fund public projects like schools, hospitals, and infrastructure. In return, the municipality pays interest to bondholders. Short-term municipal bond funds invest in a collection of these bonds, allowing you to diversify your investment across various issuers and projects.

Tax Advantages: The primary appeal of municipal bond funds lies in their tax-exempt interest income. This income is generally free from federal income tax, and if you invest in a fund focused on bonds issued in your state of residence, you may also avoid state and local taxes. This feature makes them particularly attractive to high-income investors seeking to maximize their after-tax returns.

When and Why to Use This Approach: Short-term municipal bond funds are a smart choice for investors seeking:

- Tax-efficient income: If you're in a high tax bracket, the tax-equivalent yield of a municipal bond fund can often outpace comparable taxable investments.

- Relative safety: While not entirely risk-free, municipal bonds historically have a lower default rate than corporate bonds.

- Diversification: Funds provide instant diversification across numerous municipal issuers, mitigating the risk associated with holding individual bonds.

- Liquidity: You can typically buy and sell shares of municipal bond funds daily without penalty.

- Lower volatility: Compared to longer-term bond funds, short-term funds are less sensitive to interest rate fluctuations.

Features and Benefits:

- Interest income exempt from federal income tax

- Potential exemption from state and local taxes for in-state bonds

- Maturities typically between 1-5 years

- Available as mutual funds or ETFs

- Professional management and broad diversification

- Focus on investment-grade municipal securities

- Options for national or state-specific portfolios

Pros:

- Tax advantages leading to competitive tax-equivalent yields, especially for high-income earners.

- Lower default risk than corporate bonds.

- Diversification across many issuers and projects.

- Professional credit research and portfolio management.

- Daily liquidity with no withdrawal penalties.

- Lower volatility compared to intermediate or long-term bond funds.

Cons:

- Not FDIC-insured; principal can fluctuate.

- Lower pre-tax yields than taxable bonds of similar quality.

- Management fees (typically 0.35-0.75% annually).

- Some interest rate risk if rates rise sharply.

- Potential Alternative Minimum Tax (AMT) liability for some municipal bonds.

- Less beneficial for investors in lower tax brackets.

Examples:

- Vanguard Short-Term Tax-Exempt Fund (VWSUX)

- Fidelity Short-Term Municipal Income Fund (FSTFX)

- iShares Short-Term National Muni Bond ETF (SUB)

- SPDR Nuveen Bloomberg Short Term Municipal Bond ETF (SHM)

Actionable Tips:

- Calculate your tax-equivalent yield: Use the formula TEY = tax-exempt yield / (1 - marginal tax rate) to compare with taxable investments.

- Consider state-specific funds: Maximize tax benefits if you live in a high-tax state.

- Look for low expense ratios: Minimize fees to maximize after-fee returns.

- Check the fund's average credit quality: Higher quality portfolios offer greater stability.

- Evaluate average maturity and duration: Lower figures generally mean less interest rate risk.

- Consider laddered maturity funds: Create more predictable cash flows.

By carefully considering these factors, you can determine if short-term municipal bond funds are the right fit for your safe short term investment strategy.

Safe Short-Term Investment Options Comparison

| Investment Option | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| High-Yield Savings Accounts | Low - easy to open online with minimal setup | Low - requires minimum balance, online access | Moderate returns (3.50% - 5.25% APY) | Short-term savings, emergency funds | Very low risk, FDIC-insured, highly liquid |

| Money Market Accounts | Low to Moderate - requires minimum balances and some transaction limits | Moderate - higher minimum balances, access to checks/debit | Moderate returns (3.85% - 5.10% APY) | Short-term goals needing check/debit access | FDIC-insured, check-writing, debit card access |

| Certificates of Deposit (CDs) | Moderate - fixed term commitment and setup | Low to Moderate - minimum deposit varies | Higher fixed returns (4.50% - 5.50% APY) | Medium-term with planned holding period | Guaranteed returns, no principal risk if held |

| Treasury Bills (T-Bills) | Moderate - requires TreasuryDirect setup or broker use | Low - minimum $100, bought at discount | Moderate returns (5.00% - 5.50% annually) | Ultra-safe short-term government investment | Virtually risk-free, tax advantages, highly liquid |

| Treasury Inflation-Protected Securities (TIPS) | Moderate to High - longer terms, tax complexity | Moderate - minimum purchase $100, account needed | Real returns 1.5% - 2.0% plus inflation | Inflation hedge, long-term fixed income | Inflation protection, government-backed, low risk |

| Short-Term Corporate Bond Funds | Moderate - requires brokerage account and fund selection | Moderate to High - no FDIC, management fees | Moderate returns (4.50% - 5.75% annually) | Short to medium-term investors accepting credit risk | Higher yields, diversification, professional management |

| Money Market Funds | Low to Moderate - brokerage account needed | Moderate - may require minimum investments | Moderate returns (4.75% - 5.25% annually) | Very short-term cash management, taxable accounts | High liquidity, professional management, higher yields |

| Short-Term Municipal Bond Funds | Moderate - brokerage account and fund selection | Moderate - management fees, taxable status | Tax-exempt yields ~2.75% - 3.25% (TEY ~4.25%-5.0%) | Tax-efficient income for high-income investors | Tax advantages, diversification, low default risk |

Start Investing Smarter Today

Safe short-term investments provide a reliable path to preserving capital and generating modest returns. From high-yield savings accounts and money market accounts to certificates of deposit (CDs), Treasury Bills, and short-term bond funds, the options discussed in this article offer varying degrees of liquidity, risk, and potential return. Understanding these nuances is key to selecting the best safe short-term investments aligned with your financial goals. Whether you're seeking predictable income streams for retirement, diversifying your portfolio with low-risk options, or simply parking surplus funds securely, mastering these concepts empowers you to make informed decisions and maximize your returns. For those working in the financial sector, attracting clients through a strong online presence is essential. Optimizing your digital reach can significantly impact your success, and resources like the guide on SEO for Financial Services from Outrank, which explores top SEO strategies for financial services to drive results, can be invaluable for increasing visibility. Ultimately, choosing the right safe short-term investments can significantly contribute to your overall financial well-being and provide a solid foundation for long-term success.

Considering a CD? Use our Certificate-of-Deposit Calculator to project your potential returns and find the best CD rates for your safe short-term investment strategy. Start making your money work harder for you today!