In a fluctuating interest rate environment, letting your savings sit in a standard account often means leaving money on the table. Certificates of Deposit (CDs) offer a secure, government-insured path to higher yields, but they introduce a common dilemma: your cash is locked up for a set term, limiting your liquidity. This is precisely where smart planning makes a difference.

CD laddering is a powerful yet straightforward technique that resolves this trade-off. It allows you to capture the higher interest rates typically offered by long-term CDs while ensuring portions of your money become accessible at regular, predictable intervals. This "best-of-both-worlds" approach creates a steady stream of maturing investments, reduces interest rate risk, and maximizes your earning potential without sacrificing access to your funds entirely. To integrate CD laddering effectively into your broader financial plan and truly 'Unlock Higher Returns,' it is crucial to begin by understanding asset allocation models and how different investment vehicles, including CDs, contribute to a diversified portfolio.

This guide will break down seven distinct CD laddering strategies, moving from foundational methods to more advanced, goal-oriented approaches. You will discover how each strategy works, its specific pros and cons, and clear implementation steps. Whether you are a conservative investor, a retiree planning for income, or simply want to make your savings work harder, there is a laddering strategy here to fit your financial objectives. We'll provide the practical examples and actionable insights needed to build a robust and effective CD ladder today.

1. Traditional Equal-Amount Laddering

The Traditional Equal-Amount Ladder is the most classic and widely used of all cd laddering strategies. It serves as the foundational approach for managing a portfolio of Certificates of Deposit (CDs). This strategy is praised for its simplicity, predictability, and balanced approach to capturing higher interest rates while maintaining regular access to funds. It’s an ideal starting point for anyone new to CDs or for conservative investors seeking stability.

How Traditional Laddering Works

The core principle involves dividing your total investment capital into equal portions and investing each portion into a CD with a different, sequential maturity date. For instance, you might create a "ladder" with rungs maturing in one year, two years, three years, four years, and five years. As the shortest-term CD (the first rung) matures, you reinvest the principal and interest into a new CD at the longest term of your ladder, in this case, a new five-year CD.

This process creates a consistent cycle. After the initial setup phase, you'll have a CD maturing every year, providing you with a predictable stream of liquidity. At the same time, you'll continuously be locking in the highest available rates offered for the longest-term CDs in your strategy.

Key Insight: This method systematically balances the need for liquidity with the goal of maximizing interest earnings. You avoid locking up all your money at a single rate, which protects you from interest rate fluctuations.

Implementation Example

Let's say you have $25,000 to invest. You would implement a traditional five-year ladder as follows:

- Year 1: Invest $5,000 in a 1-year CD.

- Year 2: Invest $5,000 in a 2-year CD.

- Year 3: Invest $5,000 in a 3-year CD.

- Year 4: Invest $5,000 in a 4-year CD.

- Year 5: Invest $5,000 in a 5-year CD.

When the 1-year CD matures, you reinvest the returned $5,000 (plus interest) into a new 5-year CD. The next year, when the original 2-year CD matures, you do the same. Eventually, your entire portfolio will consist of higher-yielding 5-year CDs, with one maturing every single year.

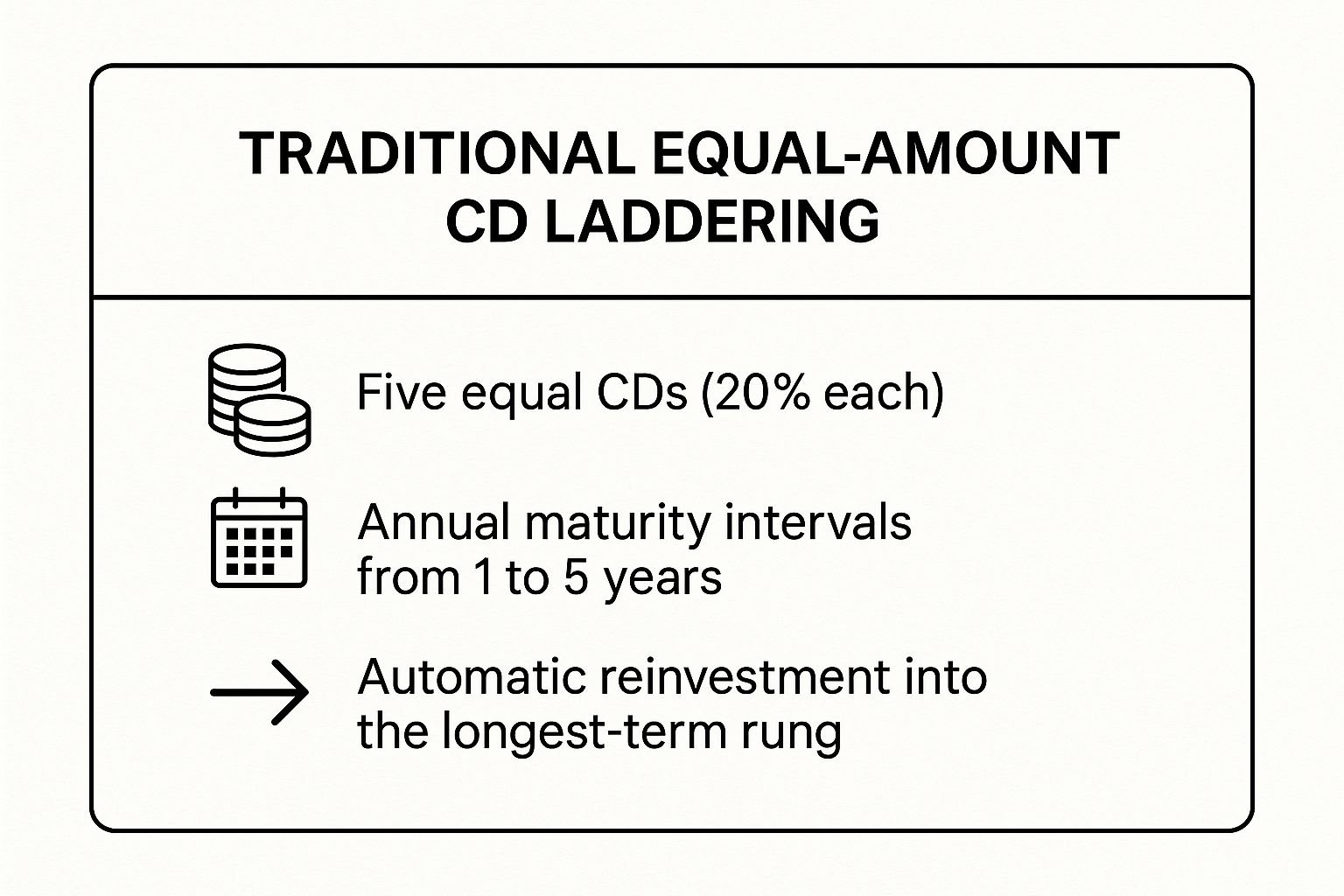

This summary box highlights the core mechanics of setting up a traditional equal-amount CD ladder.

As the infographic illustrates, the strategy is defined by its equal allocation, staggered maturities, and a disciplined reinvestment plan that keeps the ladder intact.

Who Should Use This Strategy?

The traditional ladder is best suited for:

- Conservative Investors: It's a low-risk way to earn better returns than a standard savings account without exposure to market volatility.

- Retirees: The predictable annual cash flow can supplement retirement income.

- First-Time Investors: Its straightforward structure makes it an excellent introduction to disciplined investing.

- Savers with Mid-Term Goals: If you have a goal 5-10 years away, this strategy allows you to save effectively while still having periodic access to your money without penalty.

2. Barbell CD Laddering

The Barbell CD Ladder is a more aggressive and specialized approach compared to its traditional counterpart, making it one of the most dynamic cd laddering strategies available. This method gets its name from its structure, which resembles a weightlifting barbell: heavy on both ends and empty in the middle. It focuses investments exclusively on short-term and long-term CDs, deliberately skipping the intermediate-term options. This strategy is designed for investors who want to balance immediate liquidity with the potential for higher long-term yields, offering a unique blend of flexibility and earning power.

How Barbell Laddering Works

The core idea is to allocate your capital into two distinct groups. A significant portion goes into very short-term CDs (e.g., 3-month or 6-month terms) to provide frequent access to cash and the ability to quickly capitalize on rising interest rates. The remaining portion is invested in long-term CDs (e.g., 4-year or 5-year terms) to lock in the highest possible interest rates currently available.

As your short-term CDs mature, you have a choice: reinvest them into new short-term CDs to maintain liquidity or, if rates have become more favorable, move that money into a new long-term CD. This dual approach gives you a strategic advantage, especially during periods of interest rate volatility or uncertainty. You can explore more about this specialized approach in this in-depth guide on Barbell CD Laddering.

Key Insight: The barbell strategy positions you to benefit from both ends of the interest rate spectrum. You get the safety and flexibility of short-term funds while simultaneously capturing the premium yields of long-term commitments.

Implementation Example

Imagine you have $50,000 to invest using a barbell strategy. You might decide on a 60/40 split between short-term and long-term CDs.

- Short-Term End: Invest $30,000 into a 6-month CD.

- Long-Term End: Invest $20,000 into a 5-year CD.

When the 6-month CD matures, you assess the current interest rate environment. If rates are rising, you might reinvest in another 6-month CD to wait for even better long-term rates. If rates seem to have peaked, you could move that matured cash into a new 5-year CD to lock in a high yield. This active management is a hallmark of the barbell approach.

Who Should Use This Strategy?

The barbell ladder is best for:

- Active Investors: Those who are comfortable monitoring interest rates and making strategic decisions more frequently.

- Savers Needing Liquidity: Individuals who want a portion of their funds available soon without sacrificing the growth potential of their entire portfolio.

- Rate-Conscious Investors: People who want to be prepared to act quickly when long-term interest rates become attractive.

- Investors in Uncertain Rate Environments: The strategy provides a "wait-and-see" component (the short-term end) while still earning solid returns (the long-term end).

3. Bullet CD Strategy

While most cd laddering strategies focus on creating a continuous stream of maturing CDs, the Bullet CD Strategy takes a different approach. It aligns all investments to mature around a single, specific target date. This strategy is less about ongoing liquidity and more about accumulating a specific lump sum for a major, predetermined financial goal. It’s an excellent tool for disciplined, goal-oriented saving.

How the Bullet Strategy Works

The core principle of the Bullet CD Strategy is to work backward from a future date when you’ll need a large amount of cash. You purchase multiple CDs with different term lengths, but you time their purchases so they all mature at roughly the same time. This allows you to take advantage of varying interest rate environments over time while ensuring the full principal and its accumulated interest become available exactly when planned.

Unlike a traditional ladder that provides annual access to funds, the bullet strategy consolidates your capital for a single, significant event. This makes it a powerful method for funding goals like a down payment on a house, a child's college education, or a planned business investment.

Key Insight: This method focuses all your investment power on a single maturity point. It’s a goal-driven strategy designed for maximum accumulation for a specific future expense, rather than for generating ongoing cash flow.

Implementation Example

Let's say you are saving for a down payment on a house you plan to buy in five years. You have $20,000 to invest today and plan to add $5,000 each year. Here’s how you might structure a bullet strategy:

- Now: Invest $20,000 in a 5-year CD.

- Next Year: Invest $5,000 in a 4-year CD.

- In 2 Years: Invest $5,000 in a 3-year CD.

- In 3 Years: Invest $5,000 in a 2-year CD.

- In 4 Years: Invest $5,000 in a 1-year CD.

In five years, all five CDs will mature simultaneously, providing you with a lump sum of $40,000 plus all the interest earned. This targeted approach ensures your funds are ready precisely when you need them for your down payment. The strategy’s effectiveness hinges on its precise timing and disciplined execution.

Who Should Use This Strategy?

The bullet strategy is best suited for:

- Goal-Oriented Savers: Anyone saving for a large, one-time expense with a clear timeline, like a wedding, car, or home purchase.

- Future College Planners: Parents can use it to ensure tuition funds are available at the start of each academic year or semester.

- Pre-Retirees: Individuals aiming to have a specific cash amount available on their retirement date can use this to consolidate funds.

- Project Funders: Business owners who need capital for a future expansion or equipment purchase can align their savings with project timelines.

While this strategy is highly effective for planned expenses, it's generally not recommended for building an emergency fund due to its lack of staggered liquidity. For more on that topic, you can learn more about how a CD ladder can support an emergency fund on bankdepositguide.com.

4. Rising Rate Laddering

The Rising Rate Ladder is a defensive and opportunistic approach among cd laddering strategies, specifically designed for an economic environment where interest rates are on an upward trend. This strategy prioritizes liquidity and frequent reinvestment opportunities over locking in long-term rates. It allows investors to capitalize on increasing rates systematically, ensuring their capital doesn’t get stuck in lower-yielding CDs while better offers become available.

Unlike traditional ladders that span several years, this method focuses on very short-term CDs, often with maturities of one year or less. The goal is to have funds maturing as frequently as possible to capture new, higher rates as they are announced.

How Rising Rate Laddering Works

The core principle of a rising rate ladder is to build a ladder with very short and tightly spaced "rungs." Instead of using CDs that mature in one, two, or three years, you would use CDs with terms like three, six, nine, and twelve months. This structure ensures that a portion of your investment is freeing up every few months, ready to be reinvested at a more advantageous rate.

As each short-term CD matures, you roll it over into a new CD at the longest term of your short-term ladder (e.g., 12 months) to take advantage of the now-higher interest rate. This continuous, rapid cycling allows your overall portfolio yield to climb alongside the prevailing market rates.

Key Insight: This strategy is proactive, not passive. It requires you to actively monitor the interest rate environment, particularly central bank policies, to effectively time your reinvestments and capture the best possible returns.

Implementation Example

Suppose you have $20,000 to invest during a period of anticipated rate hikes. You could structure a rising rate ladder as follows:

- Rung 1: Invest $5,000 in a 3-month CD.

- Rung 2: Invest $5,000 in a 6-month CD.

- Rung 3: Invest $5,000 in a 9-month CD.

- Rung 4: Invest $5,000 in a 12-month CD.

When the 3-month CD matures, you check the current rates. If rates have indeed risen, you reinvest the principal and interest into a new 12-month CD to capture the higher yield. Three months later, your original 6-month CD matures, and you repeat the process. This keeps your money working hard for you in a rising-rate climate.

Who Should Use This Strategy?

The rising rate ladder is best suited for:

- Active Savers: Individuals who follow economic news and are willing to manage their investments more frequently.

- Investors Concerned About Inflation: In a rate-hiking cycle often meant to combat inflation, this strategy helps your savings keep pace.

- Short-Term Savers: If your financial goal is just 1-2 years away, this approach maximizes earnings without long-term commitments.

- Tactical Investors: Those who want to position their cash holdings to benefit from Federal Reserve policy changes will find this strategy highly effective.

5. Falling Rate Laddering

The Falling Rate Ladder is an aggressive and forward-looking approach among cd laddering strategies, designed specifically for an economic environment where interest rates are expected to decline. This strategy prioritizes locking in today's higher yields for as long as possible. It involves a calculated trade-off, sacrificing some short-term liquidity to maximize and preserve income before rates drop. It's a proactive method for savers who follow economic trends and want to secure favorable returns.

How Falling Rate Laddering Works

Unlike a traditional ladder that spreads investments evenly across various terms, this strategy heavily favors longer-term CDs. The goal is to allocate a larger portion of your capital to CDs with the longest maturities, such as four or five years, to capture the current high rates for an extended period. When rates eventually fall, a significant part of your portfolio will continue to earn the previously high yield, insulating you from the lower-rate environment.

This approach requires active monitoring of economic forecasts and Federal Reserve signals. When indicators suggest that rate cuts are on the horizon, you strategically build or adjust your ladder to be "top-heavy" with long-term CDs. This front-loading of longer terms ensures your returns don't immediately suffer when new, lower-rate CDs become the only option.

Key Insight: This strategy is about timing and foresight. By anticipating a drop in interest rates, you can position your CD portfolio to outperform standard savings accounts and even traditional ladders for several years to come.

Implementation Example

Imagine you have $25,000 to invest and economic forecasts strongly suggest the Federal Reserve will begin cutting rates within the next 12-18 months. Instead of an equal allocation, you might structure your ladder as follows:

- 1-year CD: Invest $2,500 (10% of capital)

- 2-year CD: Invest $2,500 (10% of capital)

- 3-year CD: Invest $5,000 (20% of capital)

- 4-year CD: Invest $7,500 (30% of capital)

- 5-year CD: Invest $7,500 (30% of capital)

In this scenario, 60% of your funds are locked into the highest-yielding 4- and 5-year CDs. As the shorter-term CDs mature in the now lower-rate environment, you can decide whether to reinvest for shorter terms while waiting for rates to rise again or simply use the cash. Your long-term holdings will continue to provide a strong return.

Who Should Use This Strategy?

The falling rate ladder is best suited for:

- Economically Savvy Investors: Individuals who are comfortable monitoring economic indicators like inflation reports, employment data, and Fed announcements.

- Income-Focused Savers: Those who want to secure a predictable and high income stream for the next several years, especially retirees.

- Investors with Low Liquidity Needs: Since this strategy emphasizes long-term commitments, it’s ideal for those who have a separate, robust emergency fund.

- Strategic Planners: Savers who are proactive rather than reactive and enjoy optimizing their returns based on market cycles.

6. Jumbo CD Laddering

The Jumbo CD Ladder is a high-powered variation of traditional cd laddering strategies, specifically designed for investors with significant capital. This approach leverages Jumbo Certificates of Deposit, which require a high minimum deposit, typically $100,000 or more. In exchange for this larger investment, financial institutions often reward savers with premium interest rates that are not available with standard CDs.

This strategy is built for high-net-worth individuals or corporate treasurers who prioritize capital preservation and enhanced, FDIC-insured returns. It combines the structural benefits of laddering, like staggered liquidity, with the superior yields offered by jumbo products. By doing so, investors can maximize their interest earnings on substantial cash reserves without taking on market risk.

How Jumbo CD Laddering Works

The mechanics are identical to a traditional ladder, but the scale is much larger and the "rungs" are jumbo CDs. An investor divides a large sum, for instance, $500,000 or more, into several $100,000 portions. Each portion is invested in a jumbo CD with a different maturity date, creating the ladder structure.

As each jumbo CD matures, the investor can either access the $100,000 plus interest or reinvest it into a new long-term jumbo CD to keep the ladder going. This maintains regular liquidity while consistently capturing the best available jumbo rates. The key difference is the potential for significantly higher overall portfolio yield due to the premium rates associated with jumbo deposits.

Key Insight: This strategy amplifies the earning potential of a standard CD ladder by using institutional-grade products. It's an effective way for those with large cash positions to beat standard savings rates while remaining fully insured.

Implementation Example

Imagine a corporate treasury manager needs to invest $500,000 in excess cash safely. They could implement a five-year jumbo CD ladder as follows:

- Year 1: Invest $100,000 in a 1-year jumbo CD.

- Year 2: Invest $100,000 in a 2-year jumbo CD.

- Year 3: Invest $100,000 in a 3-year jumbo CD.

- Year 4: Invest $100,000 in a 4-year jumbo CD.

- Year 5: Invest $100,000 in a 5-year jumbo CD.

As the 1-year jumbo CD matures, the manager reinvests the funds into a new 5-year jumbo CD, locking in the premium long-term rate. This cycle continues, eventually creating a portfolio where a high-yield, fully insured $100,000 jumbo CD matures every year, providing predictable access to working capital.

Who Should Use This Strategy?

The jumbo CD ladder is best suited for:

- High-Net-Worth Individuals: Investors with substantial cash who want to maximize safe returns.

- Corporate Treasurers: Businesses can use this strategy to earn higher yields on parked operational cash.

- Retirees with Large Nest Eggs: It provides a robust, secure, and high-yielding income stream.

- Trusts and Endowments: A safe, predictable method for preserving capital while generating income.

7. IRA CD Laddering

The IRA CD Ladder combines the structural benefits of laddering with the powerful tax advantages of an Individual Retirement Account (IRA). This is one of the most effective cd laddering strategies for conservative investors focused on capital preservation and predictable growth within their retirement portfolio. By holding CDs inside a Traditional or Roth IRA, you shield your interest earnings from annual taxation, allowing your savings to compound more efficiently over time.

How IRA CD Laddering Works

The mechanics are identical to a traditional ladder, but the entire process takes place within an IRA. You allocate your retirement funds into several CDs with staggered maturity dates. As each CD matures, the principal and tax-deferred (or tax-free, in a Roth) interest are rolled into a new long-term CD at the top of your ladder. This strategy provides the safety of FDIC insurance and the stability of fixed rates, all while benefiting from the tax-sheltered environment of a retirement account.

This approach is particularly powerful because it allows investors to avoid the tax drag that typically reduces the net returns on standard, taxable CDs. Over decades, this tax-free or tax-deferred compounding can lead to significantly greater wealth accumulation compared to holding a CD ladder in a regular brokerage or bank account.

Key Insight: This strategy transforms a simple savings tool into a powerful retirement vehicle, protecting your principal from market risk while maximizing growth through tax advantages.

Implementation Example

Imagine a 60-year-old investor wanting to de-risk their portfolio as they approach retirement. They decide to roll over $100,000 from a 401(k) into a Traditional IRA and build a five-year CD ladder:

- Rung 1: Invest $20,000 in a 1-year IRA CD.

- Rung 2: Invest $20,000 in a 2-year IRA CD.

- Rung 3: Invest $20,000 in a 3-year IRA CD.

- Rung 4: Invest $20,000 in a 4-year IRA CD.

- Rung 5: Invest $20,000 in a 5-year IRA CD.

When the 1-year IRA CD matures, the investor reinvests the proceeds into a new 5-year IRA CD. This process continues, creating an eventual portfolio of high-yield 5-year CDs, with one maturing each year to provide penalty-free access for withdrawals or Required Minimum Distributions (RMDs). When structuring your IRA CD ladder, it's equally important to consider how taxes will affect your retirement savings. Learn more about how to find the best IRA CD rates on bankdepositguide.com to maximize your returns.

Who Should Use This Strategy?

The IRA CD Ladder is ideal for:

- Retirees and Pre-Retirees: It offers a secure way to generate predictable income and meet RMDs without being exposed to stock market volatility.

- Highly Conservative Investors: Perfect for those who prioritize capital preservation above all else for their retirement funds.

- Investors Diversifying Retirement Portfolios: It serves as the stable, fixed-income anchor in a broader retirement strategy that may also include stocks and bonds.

- Anyone with a Low-Risk Tolerance: If market fluctuations cause you stress, an IRA CD ladder provides peace of mind for your long-term savings.

CD Laddering Strategies: 7-Point Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Traditional Equal-Amount Laddering | Low | Moderate | Predictable cash flow, moderate returns, steady diversification | Investors wanting simple, regular access to funds | Easy to implement; regular liquidity; reduces rate risk |

| Barbell CD Laddering | Medium | Moderate to High | Balanced liquidity and yield; potential outperformance in volatile rates | Those monitoring rates and seeking flexibility | Maximizes liquidity and yield; flexible rebalancing |

| Bullet CD Strategy | Medium | Moderate | Lump sum maturity; goal-specific timing; reduced reinvestment risk | Funding known future expenses (education, retirement) | Perfect for planned expenses; reduces reinvestment timing risk |

| Rising Rate Laddering | Medium | Moderate | Faster capture of rising rates; high liquidity | Rising interest rate environments | Captures rate increases quickly; maintains liquidity |

| Falling Rate Laddering | Medium | Moderate | Income maximization in falling rate markets; locked rates | Declining rate environments | Locks in high rates; predictable long-term returns |

| Jumbo CD Laddering | Medium | High (large capital required) | Higher yields with FDIC insurance limits | High-net-worth investors | Access to premium rates; better terms; insured up to limits |

| IRA CD Laddering | Medium | Moderate (subject to limits) | Tax-advantaged, predictable retirement income | Retirement planning with capital preservation | Tax benefits; capital preservation; steady retirement income |

Choosing Your Path: Which CD Laddering Strategy Is Right for You?

You’ve explored the structured world of Certificates of Deposit and discovered that “laddering” isn't a single, one-size-fits-all approach. It's a versatile financial toolkit. From the foundational Traditional Ladder to the goal-oriented Bullet strategy, the power of these methods lies in their adaptability. Mastering these cd laddering strategies transforms a simple savings product into a dynamic instrument for wealth preservation, liquidity management, and predictable growth. The key is moving from understanding the concepts to applying the one that best serves your personal financial narrative.

The journey to building an effective CD ladder begins with a candid assessment of your individual needs. There is no universally "best" strategy, only the one that is best for you. Your decision should be guided by a few core questions: What is your primary objective? Are you seeking a steady stream of accessible cash, maximizing long-term yields, or saving for a specific, time-bound expense? How actively do you want to manage your funds in response to economic forecasts?

Matching the Strategy to Your Financial Goals

To help you crystallize your decision, let's recap the core strengths of the strategies we've discussed. This will help you align a specific approach with your unique circumstances.

- For the Steady Saver: If your goal is simplicity, consistent liquidity, and a set-it-and-forget-it approach, the Traditional Equal-Amount Ladder is your anchor. It’s the perfect entry point for beginners and a reliable foundation for any conservative portfolio.

- For the Strategic Opportunist: If you want to balance immediate access to cash with high-yield potential, the Barbell CD Ladder is your ideal choice. This strategy empowers you to keep some funds liquid for short-term opportunities while locking in higher rates on the long end.

- For the Goal-Oriented Planner: When you have a large, specific expense on the horizon, like a wedding or a down payment on a home, the Bullet CD Strategy provides unmatched precision. It ensures your entire principal, plus interest, becomes available exactly when you need it.

- For the Rate-Conscious Investor: In an environment of anticipated interest rate hikes, the Rising Rate Ladder allows you to strategically reinvest maturing CDs at progressively higher yields. Conversely, the Falling Rate Ladder helps you lock in today’s higher rates before they decline.

Beyond the Basics: Advanced Applications

Don't overlook the specialized applications we covered. For those with significant capital, the Jumbo CD Ladder offers a way to secure premium rates not available with standard CDs. Similarly, integrating laddering within a retirement account through an IRA CD Ladder provides a powerful method for generating predictable, tax-advantaged income during your retirement years, offering peace of mind when you need it most.

Ultimately, the true value of understanding these diverse cd laddering strategies is empowerment. You are no longer just a passive saver; you are an active architect of your financial security. By selecting and implementing the right ladder, you create a system that works tirelessly for you, balancing safety, liquidity, and return in a way that aligns perfectly with your life's goals. The first step is to move from theory to action. Define your objective, choose your strategy, and begin building your ladder one rung at a time. This deliberate, structured approach is one of the most reliable paths to achieving secure and predictable financial growth.

Ready to see how these strategies would look with your own money? Before you commit, model your potential returns with our Certificate-of-Deposit Calculator. This powerful tool at Certificate-of-Deposit Calculator helps you visualize earnings, compare different APYs, and project the performance of your chosen laddering strategy, ensuring you make the most informed decision possible.