Maximize Your Retirement Savings with the Best IRA CD Rates

Looking for predictable, low-risk returns for your retirement savings? This list of top IRA CD options and a helpful Certificate-of-Deposit Calculator will simplify your search. Find competitive IRA CD rates from leading banks like Ally, Marcus by Goldman Sachs, and more. Compare rates quickly and easily, and eliminate the guesswork of projecting your retirement savings growth. Stop wondering where to find the best rates and start planning for a secure retirement today.

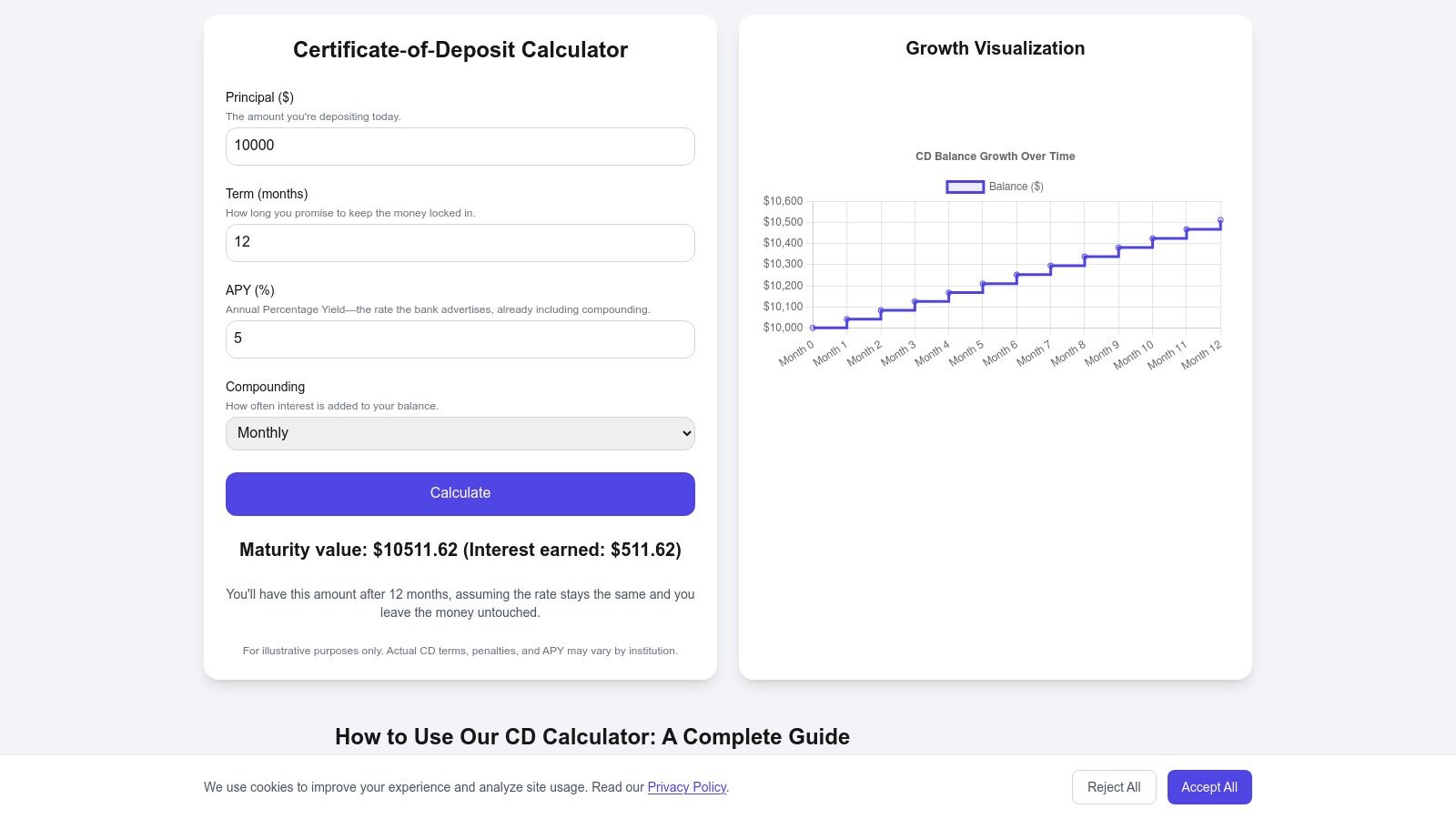

1. Certificate-of-Deposit Calculator

When considering IRA CD rates, understanding how your investment will grow is crucial. The Certificate-of-Deposit Calculator is a powerful tool designed to help you project the future value of your CDs, allowing you to make informed decisions about your IRA investments. This user-friendly calculator empowers you to explore various scenarios by inputting different principal amounts, term lengths (in months), advertised APYs, and compounding frequencies (daily, monthly, quarterly, or annually). Whether you're seeking to maximize returns within your IRA or simply understand the potential growth of your CD, this calculator provides instant and precise estimates of your maturity balance and the total interest earned.

Beyond basic calculations, this calculator offers valuable features for individuals interested in leveraging CDs within their IRAs. Visualizations of growth projections and detailed breakdowns clarify the impact of different compounding schedules on total returns, helping you see the long-term benefits of your IRA CD investment. Advanced features, including side-by-side APY comparisons, allow you to evaluate different IRA CD rates across various financial institutions. The tool even assists with estimating early withdrawal penalties, crucial for understanding the potential costs of accessing your funds before maturity. For those looking to optimize their IRA CD strategy, the calculator provides guidance on CD laddering, a technique that balances liquidity and yield by staggering CD maturity dates.

This calculator also serves as an educational resource, demystifying complex topics relevant to IRA CDs, such as the difference between APY and simple interest, key CD terms, FDIC insurance coverage, and the tax implications of holding CDs within an IRA. Whether you're a novice saver or a seasoned financial professional, this tool offers valuable insights. For individual savers looking for predictable returns within their IRAs, retirees planning for future income streams, conservative investors diversifying their portfolios, or financial advisors comparing CD products for clients, this calculator empowers informed decision-making. Even small business owners can benefit from this tool by exploring short-term CD options for parking surplus funds within their IRA.

Pros:

- Accurate and instant compound interest calculations with customizable inputs (principal, term, APY, compounding frequency).

- Visual and detailed breakdowns for easy understanding of growth and returns over time.

- Advanced tools including APY comparisons, early withdrawal penalty estimations, and CD laddering guidance.

- Comprehensive educational resources addressing CD basics, insurance, tax considerations.

Cons:

- While free to use, the lack of pricing information may indicate limited premium features or personalized advice.

- Projections assume fixed rates and no withdrawals; actual results may vary due to changing IRA CD rates or early withdrawal penalties.

Website: https://www.calculator.ninja/cd-calculator

This calculator deserves its place on this list because it provides a comprehensive and accessible way to evaluate IRA CD rates and their potential impact on your retirement savings. It empowers users with the knowledge and tools to make informed decisions about maximizing their returns with this low-risk investment strategy.

2. Ally Bank IRA CD

Ally Bank secures a spot on this list due to its accessible and competitive IRA CD offerings, catering to a wide range of retirement savers. If you're seeking predictable returns within a tax-advantaged account, Ally's IRA CDs are a compelling option worth considering, particularly if you value online convenience and no minimum deposit requirements. They offer a solid balance between competitive IRA CD rates and flexibility, fitting various investment strategies.

Ally Bank provides IRA CDs with competitive interest rates, making them an attractive choice for those seeking stable, tax-advantaged growth. One of the most significant advantages is the lack of a minimum deposit requirement. This feature makes Ally’s IRA CDs accessible to everyone, from beginners just starting their retirement savings journey to seasoned investors looking to diversify their portfolios with low-risk options. Whether you have a small amount to invest or a substantial lump sum, you can take advantage of their competitive IRA CD rates.

Currently, Ally offers IRA CD rates up to 4.25% APY for 5-year terms, although these rates are subject to change. Shorter-term CDs offer slightly lower rates, providing flexibility depending on your investment horizon. For example, you might consider a shorter-term CD (3 or 6 months) if you anticipate needing access to the funds sooner, though this comes with the trade-off of lower IRA CD rates. Conversely, locking in a longer-term CD (2, 3, or 5 years) typically rewards you with higher IRA CD rates, ideal for long-term retirement planning. Be aware that early withdrawal penalties apply, varying by term length, so carefully consider your time horizon before committing.

Ally offers Traditional, Roth, and SEP IRA options with their CDs, providing flexibility to align with your specific tax strategy and retirement goals. A Traditional IRA offers tax-deductible contributions, while a Roth IRA provides tax-free withdrawals in retirement. SEP IRAs are designed for self-employed individuals and small business owners. This variety allows you to tailor your IRA CD investment to best suit your individual circumstances.

Features:

- No minimum deposit requirement: Start saving for retirement with any amount.

- Terms ranging from 3 months to 5 years: Choose the term length that aligns with your financial goals.

- Competitive interest rates: Currently up to 4.25% APY for 5-year terms.

- Available for Traditional, Roth, and SEP IRAs: Flexibility for various retirement plans.

- Early withdrawal penalties vary by term length: Carefully consider your investment timeline.

Pros:

- No minimum deposit makes it accessible to all investors.

- Online management with 24/7 customer service: Manage your IRA CD conveniently online.

- Automatic renewal options available: Simplify your long-term savings strategy.

- No maintenance fees: Keep more of your earnings.

Cons:

- No physical branch locations: All interactions are conducted online or by phone.

- Early withdrawal penalties can be significant: Plan carefully to avoid penalties.

- Not the absolute highest rates on the market: Shop around to compare IRA CD rates from various institutions.

Implementation Tip: When comparing Ally Bank's IRA CD rates with other institutions, pay close attention to the APY (Annual Percentage Yield), as this reflects the true earning potential, incorporating the effects of compounding. Also, consider your individual risk tolerance and financial goals when selecting a term length.

Ally Bank IRA CD

3. Marcus by Goldman Sachs IRA CD

Marcus by Goldman Sachs offers a compelling option for individuals seeking competitive IRA CD rates within a secure and user-friendly platform. Their IRA CDs provide a predictable, low-risk way to grow retirement savings, making them a suitable choice for various investors, from conservative savers to financial advisors seeking reliable options for their clients. This offering deserves a spot on this list due to its competitive rates, especially for longer-term CDs, combined with the reputation and stability of Goldman Sachs.

Marcus IRA CDs cater to both Traditional and Roth IRAs, allowing for tax-advantaged retirement savings. Whether you're looking to defer taxes on contributions now (Traditional) or enjoy tax-free withdrawals in retirement (Roth), Marcus offers an accessible entry point with a minimum deposit requirement of $500. This relatively low barrier to entry makes it a viable choice even for those just beginning their retirement savings journey. However, for individuals with very limited capital, this $500 minimum might still present a hurdle.

Key Features and Benefits:

- Competitive IRA CD Rates: Marcus offers attractive interest rates, especially on longer-term CDs, allowing your retirement savings to grow steadily over time. Currently, rates can reach up to 4.30% APY for longer terms, making them a competitive choice in the current IRA CD landscape. Be sure to check the Marcus website for the most up-to-date rates, as they are subject to change.

- Flexible Terms: With CD terms ranging from 6 months to 6 years, you can tailor your investment to your specific retirement timeline. Shorter-term CDs provide liquidity and access to funds, while longer-term options maximize interest earnings. This flexibility allows you to strategize based on your individual financial goals.

- 10-Day Rate Guarantee: Marcus offers a 10-day rate guarantee from the date you open or renew your IRA CD. This safeguards your investment against potential rate drops during this period, providing peace of mind.

- $500 Minimum Deposit: This relatively accessible minimum deposit makes it easier for individuals to start saving for retirement, even with limited initial capital.

- Goldman Sachs Backing: The financial strength and stability of Goldman Sachs provide a layer of security and confidence for investors concerned about the safety of their retirement funds.

- User-Friendly Online Platform: Managing your IRA CDs is straightforward with Marcus's intuitive online platform. This simplifies tracking your investment and managing your account.

- No Fees: Marcus doesn't charge any fees for their IRA CDs, which helps maximize your returns.

Pros and Cons:

- Pros: Goldman Sachs backing, user-friendly online platform, competitive rates, 10-day rate guarantee, no fees.

- Cons: $500 minimum deposit may be prohibitive for some, no physical branches (online only), limited IRA types (no SEP or SIMPLE IRAs).

Implementation Tip: When comparing IRA CD rates, consider your risk tolerance, time horizon, and overall financial goals. While Marcus offers competitive rates, particularly for longer terms, ensure that locking in your funds aligns with your individual circumstances.

Comparison: Compared to other financial institutions offering IRA CDs, Marcus often stands out with its competitive rates, especially for longer-term certificates. However, it's crucial to compare current rates from various institutions before making a decision.

If you are looking for a secure, FDIC-insured investment with competitive IRA CD rates and the backing of a reputable financial institution, Marcus by Goldman Sachs is worth considering. Visit their website for the latest rates and to learn more: https://www.marcus.com/us/en/savings/ira-cds

4. Synchrony Bank IRA CD

For savers prioritizing competitive IRA CD rates and a secure retirement strategy, Synchrony Bank offers a compelling option. Their IRA CDs combine attractive interest rates with the flexibility of different term lengths, making them a solid choice for various retirement planning needs. This makes them worthy of consideration for anyone looking to maximize their tax-advantaged savings growth.

Synchrony Bank IRA CDs provide a predictable and reliable way to grow your retirement nest egg. With terms ranging from as short as 3 months to as long as 5 years, you can tailor your investment to your specific timeframe. Whether you're a conservative investor seeking stable returns or a retiree looking for predictable income streams, Synchrony's IRA CD offerings cater to diverse needs.

Features and Benefits:

- Competitive IRA CD Rates: Synchrony frequently boasts some of the highest IRA CD rates in the market, especially for longer-term CDs. Currently, they offer APYs up to 4.50% for 5-year terms, allowing your retirement savings to grow steadily over time. This is a key factor for those seeking to maximize the power of compounding interest within their tax-advantaged accounts.

- Flexible Terms: Choose from CD terms spanning 3 months to 5 years, providing flexibility for different investment horizons and strategies. Shorter terms offer liquidity options, while longer terms lock in potentially higher rates for extended periods.

- IRA Options: Synchrony supports Traditional, Roth, and SEP IRAs, catering to different tax situations and retirement savings preferences. This allows you to align your CD investments with your overall retirement plan.

- $2,000 Minimum Deposit: While higher than some competitors, the $2,000 minimum deposit allows you to access these competitive IRA CD rates.

- FDIC Insured: Your deposits are FDIC insured up to applicable limits, providing peace of mind and security for your retirement funds.

- Easy Online Management: Manage your IRA CD account conveniently online, track your interest earnings, and handle transactions with ease.

- Dedicated Support: Synchrony provides dedicated retirement specialists to assist customers with their IRA CD needs and answer any questions.

Pros:

- Consistently offers among the highest IRA CD rates available.

- Easy online account management simplifies the investment process.

- No maintenance fees keep costs low and maximize returns.

- Dedicated retirement specialists offer personalized support.

Cons:

- The $2,000 minimum deposit may be a barrier for some savers.

- The lack of physical branch locations may not suit everyone's preferences.

- Early withdrawal penalties can be substantial, so careful planning is essential.

Comparison:

Compared to other banks offering IRA CDs, Synchrony often stands out with its highly competitive interest rates, particularly for longer-term CDs. However, it's crucial to compare current rates from various institutions before making a decision. Some competitors may offer lower minimum deposit requirements, but their rates may not be as attractive.

Implementation Tip:

Before opening a Synchrony Bank IRA CD, carefully consider your retirement goals, time horizon, and risk tolerance. Compare current IRA CD rates from multiple banks to ensure you're securing the best possible return. Also, factor in the $2,000 minimum deposit requirement and the potential impact of early withdrawal penalties.

Website: https://www.synchronybank.com/banking/ira/ira-certificate-of-deposit/

5. Discover Bank IRA CD

Discover Bank carves a niche for itself in the IRA CD landscape by offering competitive IRA CD rates coupled with long-term options, making it a compelling choice for retirement savers seeking predictable returns. If you're looking for stability and tax advantages for your retirement savings, a Discover Bank IRA CD warrants consideration. They offer a variety of terms catering to different investment horizons, from short-term 3-month CDs to long-term 10-year CDs, a duration not readily available from many competitors. This flexibility allows you to tailor your investment strategy to your specific retirement goals.

Discover Bank’s IRA CDs are particularly well-suited for individuals seeking security and predictable growth within their retirement accounts. For example, someone nearing retirement might utilize a shorter-term CD (3-5 years) to preserve capital and generate a predictable income stream, while a younger investor could leverage the longer-term options (7-10 years) to benefit from potentially higher IRA CD rates and the power of compounding interest over time. Small business owners looking for a safe haven for surplus funds might also find the shorter-term CDs attractive.

A key advantage of Discover Bank is the range of IRA options available: Traditional, Roth, and SEP IRAs. This allows for flexibility depending on your individual tax situation and retirement plan. The competitive interest rates, currently up to 4.20% APY for longer terms, coupled with daily compounding, help maximize your returns. Furthermore, Discover Bank provides 24/7 U.S.-based customer service and a user-friendly online platform, streamlining the account management process.

The minimum deposit requirement of $2,500 is higher than some competitors, which might be a barrier for some savers. Also, as an online bank, Discover lacks physical branches, which might be a drawback for those who prefer in-person banking. While their rates are competitive, particularly for longer terms, it's always wise to compare current IRA CD rates across different institutions, including online-only banks, to ensure you're getting the best return.

Features and Benefits:

- Minimum Deposit: $2,500

- Terms: 3 months to 10 years

- Interest Rates: Competitive, up to 4.20% APY (rates subject to change)

- IRA Types: Traditional, Roth, SEP

- Compounding: Daily

- Fees: No account opening or maintenance fees

Pros:

- Wide range of term options, including longer 7-10 year terms

- 24/7 U.S.-based customer service

- User-friendly online platform

- No account opening or maintenance fees

Cons:

- Higher minimum deposit requirement

- No physical branches

- Rates may not be as competitive as some online-only banks

Website: https://www.discover.com/online-banking/ira-cd/

By offering a blend of competitive IRA CD rates, flexible terms (especially the long-term options), and a secure platform, Discover Bank presents a valuable option for those seeking a predictable and tax-advantaged path to retirement savings. However, it's crucial to weigh the minimum deposit requirement and compare current market rates before making a decision.

6. Capital One 360 IRA CD

Capital One 360 offers a compelling option for individuals seeking competitive IRA CD rates within a familiar banking environment. This makes it a worthy addition to our list, especially for those who value the stability of a well-known institution combined with the flexibility of online banking. If you’re looking for predictable returns for your retirement savings, the Capital One 360 IRA CD warrants serious consideration.

Capital One 360 IRA CDs offer a blend of online convenience and the option of in-person banking at select branches, catering to a wide range of investors. Their IRA CD rates are competitive, especially when compared to other institutions offering similar access to physical branches. They offer terms ranging from 6 months to 5 years, allowing you to align your investment with your specific timeframe. Currently, they offer APYs up to 4.10% for 5-year terms (rates are subject to change, so always check the latest rates on their website).

Who Benefits Most?

This particular IRA CD shines for several target audiences:

- Individual savers: Those new to IRA CDs will appreciate the ease of use and no minimum deposit requirement, making it simple to start building a retirement nest egg, regardless of the initial investment amount.

- Retirees: The predictable returns and various term lengths make Capital One 360 IRA CDs suitable for generating a stable income stream during retirement. Shorter-term CDs offer liquidity, while longer-term CDs can lock in higher rates.

- Conservative investors: For those prioritizing capital preservation over high-risk investments, Capital One 360 IRA CDs provide a safe and reliable avenue for diversifying their portfolios.

- Financial advisors: When comparing IRA CD rates for clients, Capital One 360’s offerings, particularly their blend of online and branch access, provides a valuable option to consider.

Features and Benefits:

- No minimum deposit: This eliminates a significant barrier to entry for many investors, enabling even small contributions.

- Flexible terms: Terms range from 6 months to 5 years, allowing you to tailor your investment strategy to your specific needs and risk tolerance. Shorter terms offer greater liquidity, while longer terms typically provide higher IRA CD rates.

- Competitive rates: Capital One 360 consistently offers competitive IRA CD rates, making them a strong contender in the market.

- Traditional and Roth IRAs: You can choose the IRA type that best suits your tax situation and long-term retirement goals.

- Online and branch access: Enjoy the convenience of online banking combined with the option of visiting a physical branch if needed.

- No fees for IRA accounts: This helps maximize your returns by eliminating unnecessary costs.

Pros:

- Accessible to all investors with no minimum deposit.

- Physical branch locations available for those who prefer in-person banking.

- User-friendly online and mobile banking platforms.

- No fees associated with IRA accounts.

Cons:

- IRA CD rates might be slightly lower than those offered by some online-only banks.

- Limited branch locations compared to large national banks.

- Currently does not offer SEP IRA options.

Implementation and Setup Tips:

Opening an IRA CD with Capital One 360 is straightforward. You can apply online through their website, and the process is typically quick and efficient. Ensure you have the necessary information readily available, such as your Social Security number and funding source details.

Comparing to Similar Options: While several online-only banks may offer marginally higher IRA CD rates, Capital One 360's combination of competitive rates, no minimum deposit, and access to physical branches distinguishes it. This makes it a particularly attractive option for those seeking the security of a well-established institution alongside digital convenience.

Visit Capital One 360 IRA page

7. PenFed Credit Union IRA Certificate

Looking for competitive IRA CD rates? PenFed Credit Union offers IRA Certificates that might be just what you need for a secure retirement savings strategy. These certificates, essentially PenFed's version of CDs, provide a predictable, low-risk way to grow your retirement nest egg. They deserve a spot on this list because they offer a compelling combination of competitive interest rates, flexible terms, and accessibility, even if you aren't already a credit union member.

What makes PenFed IRA Certificates stand out?

PenFed frequently boasts some of the highest IRA CD rates in the market, often outpacing traditional banks. This is a major advantage for those seeking to maximize their returns within a safe investment vehicle. Currently, they offer APYs up to 4.35% for longer-term certificates. This makes them an attractive option for individuals seeking predictable, risk-free returns for their retirement savings.

Features and Benefits:

- $1,000 Minimum Deposit: While this is higher than some IRA CD options, it's still accessible for many savers.

- Flexible Terms: Choose a term that aligns with your retirement timeline, from as short as 6 months to as long as 7 years. This allows for both short-term parking of funds and long-term, stable growth. Retirees planning secure income streams might find the shorter terms appealing for managing cash flow, while younger savers can take advantage of the longer terms for compounded growth.

- Variety of IRA Types: Whether you have a Traditional, Roth, or SEP IRA, PenFed offers certificates compatible with your needs.

- Accessibility: While PenFed is a credit union, membership is now open to everyone, making their competitive IRA certificate rates accessible to all retirement savers.

- Competitive Rates: Earn a competitive APY on your savings, helping your retirement funds grow steadily over time. These competitive rates are a significant draw for conservative investors aiming to diversify their portfolios with low-risk options.

- Focus on Customer Service: As a member-owned institution, PenFed prioritizes customer service, providing a potentially more personalized banking experience.

Pros:

- Generally higher IRA CD rates than traditional banks.

- Longer-term options (up to 7 years).

- Member-owned institution with a focus on customer service.

- Some physical branch locations are available for those who prefer in-person banking.

Cons:

- $1,000 minimum deposit required.

- Limited branch locations compared to large national banks.

- Requires becoming a credit union member (though the process is now simplified and open to all).

Implementation/Setup Tips:

- Compare PenFed's current IRA CD rates with other institutions offering similar products to ensure you're getting the best deal.

- Consider your retirement timeline and risk tolerance when selecting a term length.

- Factor in the $1,000 minimum deposit requirement when planning your IRA contributions.

For whom are PenFed IRA Certificates suitable?

PenFed IRA Certificates are a good fit for:

- Individual savers looking for predictable, risk-free returns.

- Retirees planning secure income streams for the future.

- Conservative investors diversifying portfolios with low-risk options.

- Financial advisors and planners comparing CD products for clients.

- Small business owners seeking a safe place to park surplus funds in the short term.

For more information and to check the latest IRA CD rates, visit the PenFed website: https://www.penfed.org/accounts/ira-certificates

8. Barclays Online IRA CD

Barclays Online IRA CDs offer a competitive option for individuals seeking predictable returns within a tax-advantaged retirement account. If you're looking for secure growth within your IRA and prioritize stability over high-risk investments, Barclays' offering could be a good fit. This option earns a spot on our list due to its competitive IRA CD rates, combined with the backing of a well-established international financial institution. Let's explore the details.

Barclays provides IRA CDs with terms ranging from as short as 3 months to as long as 5 years, offering flexibility for various investment horizons. This makes them suitable for both short-term parking of funds and longer-term retirement planning. A significant advantage is the absence of a minimum deposit requirement, making these IRA CDs accessible even to those just starting their retirement savings journey. Currently, Barclays offers competitive IRA CD rates up to 4.15% APY for 5-year terms, though these are subject to change. Interest is compounded daily, maximizing your returns over time. These CDs are available for both Traditional and Roth IRAs, catering to different tax strategies.

Practical Applications and Use Cases:

- Short-Term Savings Goals within an IRA: The short-term CD options (3-6 months) can be utilized within an IRA to hold funds earmarked for near-term retirement expenses or while evaluating other investment opportunities.

- Laddered IRA CD Strategy: Using a laddering strategy, where you invest in CDs with staggered maturity dates, can help you take advantage of potentially rising IRA CD rates in the future while still having access to some funds at regular intervals.

- Conservative, Low-Risk IRA Growth: For risk-averse investors and retirees, Barclays IRA CDs offer a safe and predictable way to grow retirement savings within a tax-advantaged account.

Pricing and Technical Requirements:

- No minimum deposit: This is a key advantage, opening up IRA CD investing to all.

- IRA CD rates: Up to 4.15% APY (as of the latest update; check the Barclays website for current rates).

- Terms: 3 months, 6 months, 1 year, 2 years, 3 years, 4 years, and 5 years.

- Online Application: The entire process is managed online through Barclays' user-friendly interface.

Comparison with Similar Tools:

While some competitors might offer slightly higher IRA CD rates for specific terms, Barclays often stands out with its lack of minimum deposit requirements. This makes it more accessible than institutions requiring significant initial investments. However, it's crucial to compare current IRA CD rates across different banks and credit unions to ensure you're getting the best return for your risk tolerance.

Implementation and Setup Tips:

- Compare Current IRA CD Rates: Always check the Barclays website (https://www.banking.barclaysus.com/ira-cd.html) for the most up-to-date IRA CD rates before investing.

- Choose the Right Term: Select a CD term that aligns with your retirement goals and cash flow needs.

- Consider Laddering: If you're unsure about the direction of interest rates, a CD ladder can be a beneficial strategy.

Pros:

- No minimum deposit required.

- Backed by a global financial institution.

- No hidden fees or maintenance charges.

- User-friendly online interface.

Cons:

- No physical branches in the U.S.

- Customer service sometimes rated below competitors.

- Limited IRA options (no SEP or SIMPLE IRAs).

By carefully weighing these pros and cons and comparing current IRA CD rates, potential investors can make informed decisions about whether Barclays Online IRA CDs are the right choice for their retirement savings strategy.

Top 8 IRA CD Rates Comparison

| Product | Core Features/Benefits | User Experience & Quality ★ | Target Audience 👥 | Unique Selling Points ✨ | Pricing/Value 💰 |

|---|---|---|---|---|---|

| 🏆 Certificate-of-Deposit Calculator | Instant, accurate compound interest & APY comparison | Visual growth charts, detailed breakdowns ★★★★☆ | Novices, investors, advisors, businesses | Advanced penalty & laddering tools, educational content | Free, online tool 💰 |

| Ally Bank IRA CD | No minimum deposit; terms 3m–5y; Traditional, Roth, SEP | 24/7 service, easy online management ★★★☆☆ | Retirement savers 👥 | No fees, auto-renewal, accessible for all | Competitive rates, no fees 💰 |

| Marcus by Goldman Sachs IRA CD | $500 min deposit; terms 6m–6y; Traditional & Roth IRAs | User-friendly, 10-day rate guarantee ★★★★☆ | Retirement savers 👥 | Goldman Sachs backing, rate guarantee | Competitive rates, no fees 💰 |

| Synchrony Bank IRA CD | $2,000 min deposit; terms 3m–5y; Traditional, Roth, SEP | High rates ★★★★☆ | Savers seeking high returns 👥 | Among highest rates, retirement specialists | High rates, no fees 💰 |

| Discover Bank IRA CD | $2,500 min deposit; terms 3m–10y; daily compounding | 24/7 US support, intuitive platform ★★★☆☆ | Long-term savers 👥 | Longest terms available (up to 10 years) | Competitive rates, no fees 💰 |

| Capital One 360 IRA CD | No minimum deposit; terms 6m–5y; Traditional & Roth | Online + physical branches, mobile app ★★★☆☆ | Preference for hybrid banking 👥 | Physical branches, no fees | Competitive rates 💰 |

| PenFed Credit Union IRA Cert. | $1,000 min deposit; terms 6m–7y; Traditional, Roth, SEP | Member-owned, customer-focused ★★★☆☆ | Credit union members & retirees 👥 | Membership open to all, higher rates than banks | Competitive rates 💰 |

| Barclays Online IRA CD | No minimum deposit; terms 3m–5y; daily compounding | Global institution, online interface ★★★☆☆ | Savers valuing global brand 👥 | No fees, backed by international bank | Competitive rates, no fees 💰 |

Securing Your Future with Smart IRA CD Choices

Finding the right IRA CD involves balancing several factors, including interest rates, term lengths, and any potential penalties. This article has explored a variety of IRA CD options, from institutions like Ally Bank, Marcus by Goldman Sachs, Synchrony Bank, Discover Bank, Capital One 360, PenFed Credit Union, and Barclays, each offering unique features and IRA CD rates. Remember, the best IRA CD for you depends on your individual financial goals and risk tolerance. Whether you’re a retiree seeking stable income, a conservative investor diversifying your portfolio, or a small business owner managing surplus funds, understanding current IRA CD rates is crucial for maximizing your returns. Consider the tools mentioned above to research specific offerings and compare IRA CD rates effectively. Be sure to factor in early withdrawal penalties and how the chosen term length aligns with your overall financial plan.

By leveraging resources and comparing IRA CD rates, you can confidently make well-informed decisions to build a secure and prosperous retirement. Ready to take control of your savings? Use our Certificate-of-Deposit Calculator to project potential IRA CD earnings based on different interest rates and terms, empowering you to choose the best option for your financial future. Accurate calculations are vital when planning with IRA CD rates, and this tool provides the precision you need.