Navigating fixed-income investments can be complex, but a Certificate of Deposit (CD) ladder offers a powerful way to secure higher yields than a standard savings account while maintaining access to your funds. The core idea is simple: instead of locking all your money into one CD, you split it across multiple CDs with staggered maturity dates. This approach reduces interest rate risk and creates a predictable cash flow.

However, a single "best CD ladder strategy" doesn't exist; the right choice depends entirely on your financial goals, risk tolerance, and timeline. Are you saving for a specific purchase, building a flexible emergency fund, or generating retirement income?

This guide breaks down six distinct CD laddering strategies, from foundational methods for beginners to advanced tactics for seasoned investors. We will explore the mechanics, pros, cons, and ideal investor profile for each, providing clear, actionable insights. By comparing these approaches, you can confidently build the perfect ladder to achieve your financial objectives with guaranteed returns. We will cover everything from the traditional equal-interval ladder to more specialized options like the barbell and bullet strategies, ensuring you find the right fit for your portfolio.

1. Traditional Equal-Interval CD Ladder

The Traditional Equal-Interval CD Ladder is the foundational blueprint for this savings method and often considered the best CD ladder strategy for beginners due to its simplicity and effectiveness. It works by dividing your total investment into equal portions and distributing them across CDs with staggered, sequential maturity dates. This structure provides predictable access to a portion of your funds while allowing the rest to capture higher interest rates associated with longer-term CDs.

As each "rung" of your ladder matures, you reinvest the principal and earned interest into a new CD at the longest term in your original strategy. This creates a continuous cycle, ensuring you always have some cash becoming available while consistently "rolling up" to the highest available interest rates.

How It Works: A Practical Example

Imagine you have $25,000 to invest in a five-year ladder. You would split the funds equally:

- $5,000 into a 1-year CD

- $5,000 into a 2-year CD

- $5,000 into a 3-year CD

- $5,000 into a 4-year CD

- $5,000 into a 5-year CD

When the 1-year CD matures, you take that $5,000 (plus interest) and reinvest it into a new 5-year CD. The next year, when the original 2-year CD matures, you do the same. After five years, your entire ladder will consist of high-yield 5-year CDs, with one maturing every single year.

Who Is This Strategy For?

This approach is ideal for conservative investors, retirees, or anyone seeking a balance between liquidity and earning potential. It excels for those with a defined savings goal, like a down payment on a house in five years, or for generating a predictable annual income stream in retirement. Its straightforward nature makes it a perfect entry point into CD investing.

Key Insight: The primary benefit of the traditional ladder is mitigating interest rate risk. If rates rise, you can reinvest maturing funds at the new, higher rate. If rates fall, most of your money is already locked in at the previous, higher rates.

Actionable Tips for Implementation

- Start Small: If you're new to this, test the waters with a shorter, 12-month ladder. Invest a small amount each month for a year to get comfortable with the process of tracking maturities and reinvesting.

- Shop Around: Don't limit yourself to one bank. Use online rate comparison tools to find the best APYs from banks and credit unions, as rates can vary significantly.

- Automate and Remind: Many financial institutions allow you to set up automatic reinvestment instructions. Regardless, set calendar alerts for a week before each CD matures so you can decide whether to reinvest or use the funds.

2. Barbell CD Strategy

The Barbell CD Strategy is a more aggressive approach favored by investors who want to balance high-yield potential with near-term liquidity. Instead of spreading investments evenly across sequential terms, this method concentrates your funds at the two extremes: very short-term CDs and very long-term CDs, completely skipping the intermediate ones. This creates a "barbell" effect with weights on either end.

The short-term end provides frequent access to your cash and allows you to quickly capitalize on rising interest rates. Meanwhile, the long-term end locks in the highest possible yields available, maximizing your overall earnings. This bifurcated approach makes it a powerful, albeit more hands-on, CD ladder strategy.

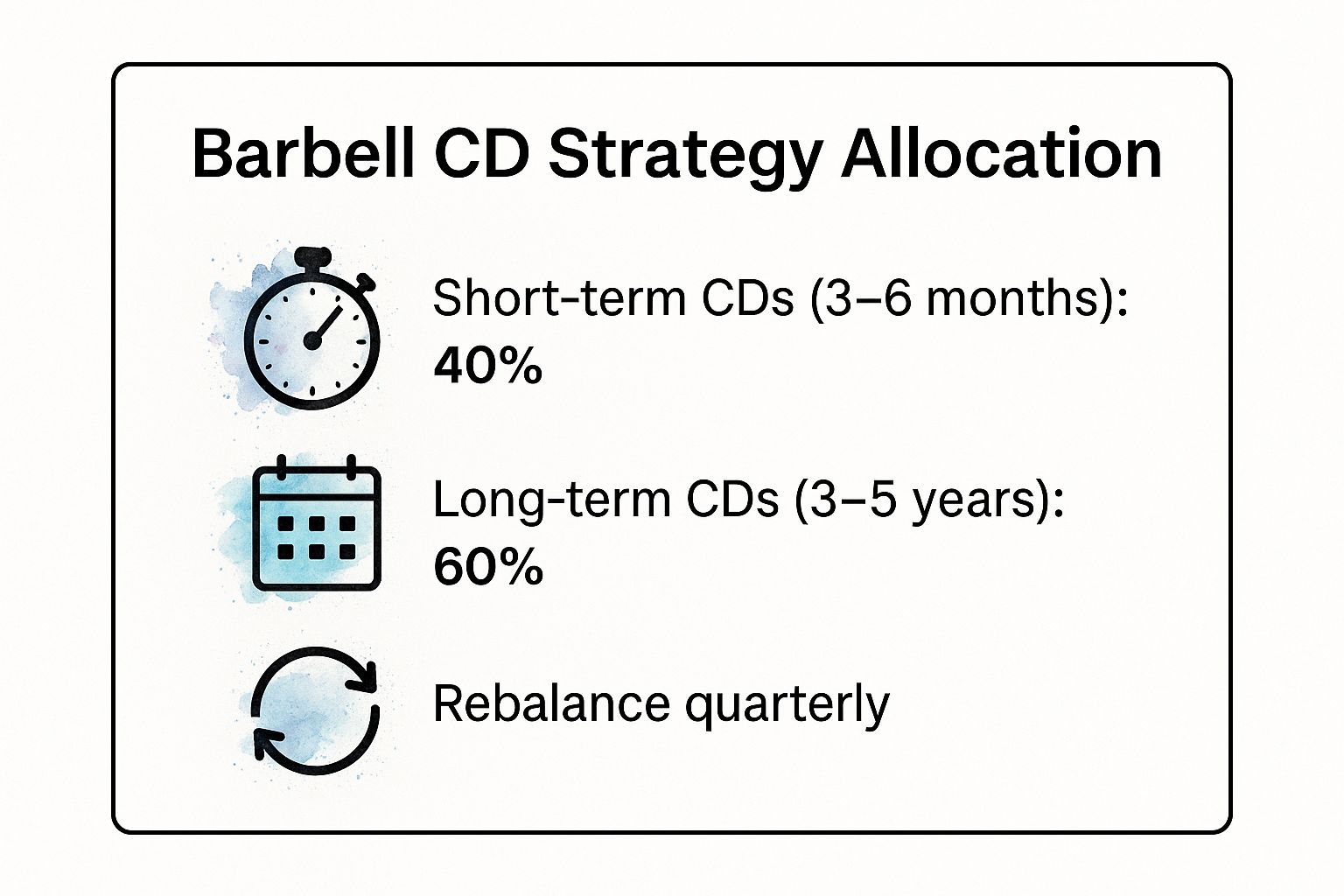

This infographic summarizes the typical allocation for a Barbell CD strategy.

The core principle is to commit a majority of funds to long-term, high-yield CDs while maintaining a significant portion in short-term vehicles for flexibility.

The core principle is to commit a majority of funds to long-term, high-yield CDs while maintaining a significant portion in short-term vehicles for flexibility.

How It Works: A Practical Example

Let's say you have $50,000 to invest. Instead of creating a 1, 2, 3, 4, and 5-year ladder, you would apply the barbell principle:

- $20,000 (40%) into a 6-month CD

- $30,000 (60%) into a 5-year CD

When the 6-month CD matures, you assess the current rate environment. If rates have risen, you can reinvest that portion into another short-term CD to stay flexible, or you could decide to open a new 5-year CD to lock in the better rate. This active management is key to the barbell's success.

Who Is This Strategy For?

This strategy is best suited for more active investors who are comfortable monitoring interest rate trends and adjusting their portfolio accordingly. It's excellent for business cash management, where a company needs operational liquidity (the short-term end) but also wants to put surplus cash to work for long-term growth (the long-term end). It's also a great option for individuals who anticipate needing a portion of their funds soon but want to maximize returns on the rest.

Key Insight: The Barbell CD Strategy is a bet on the yield curve. It performs best when short-term rates are expected to rise (allowing frequent reinvestment at higher yields) or when the yield curve is steep, meaning long-term CDs offer a significantly higher premium over short-term ones.

Actionable Tips for Implementation

- Monitor the Yield Curve: Pay close attention to the difference in yields between short-term and long-term CDs. A widening gap makes the barbell more attractive.

- Adjust Your Allocation: The 60/40 split is a guideline, not a rule. If you anticipate needing more liquidity soon, increase your short-term allocation. If you believe rates are peaking, shift more into the long-term end.

- Use Promotional Rates: Actively hunt for promotional or "special" CD rates for your long-term portion. Since you're making fewer, larger investments, a small rate increase has a significant impact.

- Rebalance Regularly: Review your strategy quarterly or semi-annually. As your short-term CDs mature, you have a built-in opportunity to re-evaluate and decide if the barbell structure still meets your financial goals.

3. Bullet CD Strategy

Contrary to a ladder that provides staggered payouts, the Bullet CD Strategy focuses all your investment power toward a single future date. It involves purchasing multiple CDs with the same maturity date, even though you might buy them at different times. This approach is less about generating regular income and more about accumulating a specific lump sum for a major, time-sensitive financial goal.

The "bullet" refers to the single, large payout you receive when all your CDs mature simultaneously. This method is a powerful tool for goal-oriented saving, ensuring you have a predetermined amount of capital ready for a specific purpose without being tempted to spend it early.

How It Works: A Practical Example

Imagine you're a parent saving for your child's first year of college tuition, which you estimate will be $40,000 in four years. You might implement a bullet strategy like this:

- Year 1: Purchase a $10,000 4-year CD.

- Year 2: Purchase a $10,000 3-year CD.

- Year 3: Purchase a $10,000 2-year CD.

- Year 4: Purchase a $10,000 1-year CD.

All four of these CDs will mature in the same year, just as your child is heading to college. This provides the full $40,000 (plus earned interest) precisely when you need it, creating a targeted savings plan with a locked-in return.

Who Is This Strategy For?

This strategy is perfect for investors with a clearly defined future expense. Think of parents saving for college, pre-retirees aiming to have a specific sum on their retirement date, or a small business owner saving for a major equipment purchase in three years. It's for anyone who says, "I need X amount of dollars on Y date."

Key Insight: The Bullet CD Strategy trades the liquidity of a traditional ladder for goal-specific precision. Its main advantage is eliminating the risk of spending the funds prematurely while locking in yields for a dedicated future liability.

Actionable Tips for Implementation

- Work Backwards: Start with your target date and amount. Calculate how much you need to invest each year and what term CDs you'll need to purchase for them all to mature together.

- Plan the Payout: Decide what you will do with the proceeds well before the maturity date. This prevents the large sum from sitting in a low-interest account while you figure out your next steps.

- Account for Inflation: When setting your savings goal, consider the impact of inflation. The $40,000 you need in four years might have less purchasing power than it does today, so you may need to adjust your target amount upwards.

- Consider Tax Implications: Since all your CDs will mature and pay out interest in the same year, this could create a significant taxable event. Consult with a tax professional to understand the impact and plan accordingly.

4. Mini CD Ladder Strategy

The Mini CD Ladder strategy adapts the core principles of laddering for those with smaller amounts of capital or a need for greater flexibility. This approach uses shorter time frames and lower investment minimums, making it an exceptionally accessible and nimble version of the traditional model. It focuses on creating liquidity over a much shorter cycle, typically using CDs with terms ranging from 3 months to 2 years.

This structure allows you to benefit from slightly higher rates than a standard savings account without locking up significant funds for long periods. As each short-term CD matures, you can either use the cash or reinvest it, maintaining a constant flow of accessible money while earning interest. It's a fantastic way to practice the discipline of laddering before committing larger sums.

How It Works: A Practical Example

Imagine you want to build a more dynamic emergency fund with $4,000. Instead of letting it sit in a low-yield savings account, you could build a one-year mini ladder:

- $1,000 into a 3-month CD

- $1,000 into a 6-month CD

- $1,000 into a 9-month CD

- $1,000 into a 12-month CD

After the first three months, your first CD matures, giving you access to $1,000 plus interest. You can then reinvest this into a new 12-month CD. By following this pattern, you will soon have a ladder of 12-month CDs, with one maturing every three months, providing regular liquidity while maximizing your short-term yields.

Who Is This Strategy For?

This strategy is perfect for beginners, students, or anyone building an emergency fund. It's also ideal for savers with limited starting capital who want to get their money working harder for them without long-term commitments. If you have a short-term savings goal, like a vacation or a small project, the mini ladder provides a structured way to save and earn. For a deeper look, you can learn more about how a CD ladder can supercharge an emergency fund.

Key Insight: The Mini Ladder prioritizes liquidity and accessibility over maximizing long-term returns. Its strength lies in turning your short-term savings or emergency fund into a more productive asset without sacrificing your ability to access cash relatively quickly.

Actionable Tips for Implementation

- Focus on Online Banks: Online-only banks and credit unions typically offer higher APYs and lower minimum deposit requirements (sometimes as low as $0 or $500), which are perfect for a mini ladder.

- Consider Bump-Up CDs: For your longer rungs (like a 2-year CD), a bump-up option can provide protection. If interest rates rise, you can request a rate increase for the remainder of the term.

- Track Everything: Use a simple spreadsheet or a finance app to keep track of your different CDs, maturity dates, and interest rates. Set calendar reminders so you don't miss a maturity date.

- Graduate Your Ladder: As your savings grow, you can gradually transition your mini ladder into a more traditional, longer-term ladder to capture even higher interest rates.

5. Promotional Rate CD Ladder

The Promotional Rate CD Ladder is a more aggressive and opportunistic approach designed for savvy investors willing to actively hunt for the best deals. This method involves building your ladder by capitalizing on special, high-yield promotional CD rates that banks and credit unions offer to attract new customers or deposits. Instead of sticking with one institution, you strategically open CDs across multiple banks to capture these often short-lived, above-market yields.

This strategy requires more active management but can significantly boost your overall returns. By constantly seeking out these premium rates for each new and maturing rung, you ensure your ladder is always working as hard as possible, making it a potentially lucrative spin on a traditional savings plan.

How It Works: A Practical Example

Imagine you have $20,000 to invest in a four-year ladder. Instead of opening all four CDs at one bank, you actively search for promotions. Your initial setup might look like this:

- $5,000 into a 1-year promotional CD at an online bank offering 0.50% above the national average.

- $5,000 into a 2-year CD at a local credit union with a special rate for new members.

- $5,000 into a 3-year CD at a large national bank running a limited-time offer.

- $5,000 into a 4-year CD at another institution with the best long-term rate you can find.

When the 1-year promotional CD matures, your task is to hunt for the next best deal. You might find a different credit union offering a fantastic 4-year rate and move your funds there. This active "rate chasing" ensures each rung of your ladder is optimized for maximum yield at the time of investment.

Who Is This Strategy For?

This strategy is perfect for detail-oriented, proactive savers who enjoy the process of finding the best financial products. It suits investors who are comfortable managing accounts at multiple institutions and are diligent about tracking maturity dates and promotional terms. If you want to squeeze every last basis point of interest out of your savings, this hands-on approach offers the highest potential returns.

Key Insight: This strategy’s power lies in compounding at a higher rate. By consistently securing promotional yields, your reinvested principal and interest grow faster, significantly outperforming a ladder built with standard rates from a single bank over the long term.

Actionable Tips for Implementation

- Become a Rate Hunter: Regularly use online tools to compare CD rates from various banks and credit unions. Bookmark rate comparison sites and check them weekly.

- Read the Fine Print: Promotional rates often come with specific conditions, such as new money requirements, minimum deposit amounts, or being tied to opening a checking account. Understand all terms before committing.

- Stay Organized: Use a spreadsheet or financial app to meticulously track all your CDs, including the institution, maturity date, interest rate, and any specific promotional requirements. Set multiple calendar alerts for each maturity date.

6. Callable CD Ladder Strategy

The Callable CD Ladder Strategy is an advanced method designed for investors willing to navigate additional complexity for the potential of higher yields. It involves using callable CDs, which offer the issuing bank the right to "call" or redeem the CD before its maturity date. This feature is typically exercised when interest rates fall, allowing the bank to avoid paying a higher-than-market rate. In exchange for this risk, callable CDs usually offer a more attractive initial APY than their non-callable counterparts.

This strategy requires a calculated approach. By building a ladder with a mix of callable and non-callable CDs, or exclusively with callable CDs, an investor aims to capture these premium rates. The goal is to benefit from the higher yield for as long as possible before the CDs are potentially called, while still maintaining the staggered maturity structure of a traditional ladder.

How It Works: A Practical Example

An experienced investor with $50,000 wants to maximize yield in a potentially declining rate environment. Instead of a standard 5-year ladder, they might construct a ladder consisting entirely of 5-year callable CDs, but with different call protection periods.

- $10,000 into a 5-year callable CD with a 1-year call protection period.

- $10,000 into a 5-year callable CD with a 2-year call protection period.

- $10,000 into a 5-year callable CD with a 3-year call protection period.

- And so on.

If interest rates fall significantly after 18 months, the bank might call the CD with the 1-year protection. The investor would receive their principal plus earned interest and would then need to reinvest those funds at the new, lower market rates. However, their other CDs would remain locked in at the higher original rates until their own call protection periods end, or until maturity.

Who Is This Strategy For?

This approach is best suited for sophisticated investors, often working with brokerage firms, who have a deep understanding of interest rate movements and product-specific terms. It appeals to those actively managing their portfolios who are comfortable with the "call risk" of having their investment returned early. This is not a "set it and forget it" strategy and is generally not recommended for beginners.

Key Insight: The trade-off is clear: you accept the risk of early redemption (call risk) in exchange for a higher initial interest rate. Success hinges on carefully selecting CDs with favorable terms and call protection periods to maximize the time you earn the premium yield.

Actionable Tips for Implementation

- Read the Fine Print: Meticulously review the call provisions. Understand exactly when the CD can be called, the "call protection" period (the initial time during which it cannot be called), and any notification requirements.

- Limit Your Exposure: Consider allocating only a specific portion of your portfolio, such as 20-30%, to callable CDs to manage the associated risks. You can find more information about understanding the nuances of certificate of deposit risk on bankdepositguide.com.

- Prioritize Call Protection: Look for callable CDs with longer call protection periods, such as one or two years. This guarantees you'll receive the higher yield for at least that minimum duration, protecting you from immediate calls if rates drop quickly.

- Monitor Rate Trends: Stay informed about the Federal Reserve's monetary policy and general interest rate forecasts. This will help you anticipate whether your CDs are likely to be called.

CD Ladder Strategies Comparison Overview

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Traditional Equal-Interval CD Ladder | Low - Simple setup and reinvestment | Moderate - Requires equal investments across multiple CDs | Steady, predictable cash flow with moderate yields | Conservative investors, retirees, emergency funds | Predictable schedule, reduces interest rate risk, FDIC insured |

| Barbell CD Strategy | High - Active management & market timing | Moderate to High - Split between short & long terms | Potentially higher yields with liquidity balance | Volatile or changing rate environments | Maximizes yields, maintains liquidity, flexible allocation |

| Bullet CD Strategy | Moderate - Staggered purchases to one maturity | Moderate - All funds concentrated in one maturity date | Large lump sum at specific future date | Goal-oriented savers (e.g., tuition, retirement) | Eliminates reinvestment risk, simple final value calculation |

| Mini CD Ladder Strategy | Low to Moderate - Smaller amounts, more frequent reinvestment | Low - Lower minimum investment per CD | More flexible ladder with faster adaptation | Beginners, limited capital, young professionals | Low entry barrier, greater liquidity, easier to adjust |

| Promotional Rate CD Ladder | High - Requires ongoing monitoring & switching | Moderate to High - Managing multiple institutions | Potentially higher returns via promotional rates | Yield-focused investors willing to monitor rates | Can boost returns above market, diversification, bonuses |

| Callable CD Ladder Strategy | High - Complex products and call risk management | Moderate to High - Mix of callable and non-callable CDs | Higher initial yields but with reinvestment risk | Advanced investors and brokers | Higher yields, FDIC insured, benefits from rate premiums |

Building Your Ladder: From Strategy to Action

Throughout this guide, we've explored the diverse landscape of CD laddering, moving beyond a one-size-fits-all approach to reveal a suite of powerful techniques. From the steady, reliable cadence of the Traditional Equal-Interval Ladder to the opportunistic, yield-seeking nature of the Promotional Rate Ladder, the central theme remains constant: control. Choosing the best cd ladder strategy is ultimately about aligning a specific method with your unique financial goals, timeline, and risk tolerance.

We've seen how the Barbell Strategy excels for investors who need both short-term liquidity and long-term growth, while the Bullet Strategy provides a laser-focused approach for saving toward a specific future expense. For those just starting out or working with smaller sums, the Mini Ladder offers a low-barrier entry point to the world of structured savings. Finally, the Callable CD Ladder presents a higher-risk, higher-reward option for sophisticated investors comfortable with its unique mechanics.

Key Takeaways for Building Your Financial Future

Your journey doesn't end with choosing a name. True success lies in the execution and ongoing management of your ladder. Remember these core principles as you move forward:

- Your Goals Dictate the Strategy: Never choose a laddering method simply because it seems popular or complex. Are you saving for a down payment in three years? The Bullet strategy is likely your best fit. Are you a retiree seeking a steady, predictable income stream? The Traditional Ladder offers unparalleled stability.

- Flexibility is a Feature, Not a Flaw: A CD ladder is a living part of your financial plan. As interest rates fluctuate and your personal circumstances change, be prepared to adjust. This might mean pivoting from a traditional ladder to a barbell approach to capture higher long-term yields while maintaining some liquidity.

- The Power of Projections: Don't build your ladder blind. Before you lock in a single dollar, it is crucial to model your potential returns. Understanding the precise impact of different APYs, term lengths, and compounding frequencies transforms your strategy from an abstract idea into a concrete, actionable plan.

From Theory to Tangible Returns

Mastering these concepts empowers you to take a proactive role in your financial security. Instead of passively accepting a standard savings account's minimal returns, you are actively constructing a resilient, income-generating portfolio. This shift in mindset is the most valuable takeaway. You are not just saving money; you are building a disciplined system that works for you, providing predictable returns and peace of mind in an often-unpredictable economic environment. The best cd ladder strategy is the one that you understand, implement with confidence, and manage with diligence.

Ready to put these strategies to the test? Before you open your first CD, use the Certificate-of-Deposit Calculator to model different ladder scenarios and project your exact earnings. This powerful tool at Certificate-of-Deposit Calculator helps you compare APYs and term lengths, ensuring you make the most informed decision to maximize your returns.