Navigating Market Volatility: Why Protecting Your Principal is Paramount in 2025

In an economic landscape defined by uncertainty, the goal isn't just about growth, it's about safeguarding what you've already built. For savvy investors, retirees, and anyone with a low risk tolerance, understanding effective capital preservation strategies is the cornerstone of a resilient financial plan. This isn't about avoiding risk entirely; it's about making intelligent, calculated decisions to protect your principal from market downturns while still generating modest returns. As we move through 2025, the focus shifts from high-risk, high-reward gambles to stable, reliable methods that ensure your financial foundation remains unshakable.

This guide will explore seven of the most trusted and actionable strategies available today, moving beyond generic advice to provide the specific details you need to implement them effectively. From government-backed securities to innovative insurance products, we'll dissect the pros, cons, and practical steps for each approach. You will learn how to:

- Compare various low-risk instruments like Treasury securities and Certificates of Deposit.

- Implement specific techniques such as CD laddering for enhanced liquidity.

- Understand the role of specialized products like TIPS and fixed annuities.

Our goal is to empower you to build a defensive portfolio that can weather any storm.

1. High-Yield Savings Accounts and Money Market Accounts

For investors whose primary goal is protecting their principal, high-yield savings accounts (HYSAs) and money market accounts (MMAs) represent a foundational capital preservation strategy. These deposit accounts, typically offered by online banks and credit unions, provide interest rates significantly higher than those found at traditional brick-and-mortar banks. Their core appeal lies in combining competitive returns with unparalleled safety, as funds are insured by the FDIC (or NCUA for credit unions) up to $250,000 per depositor, per institution.

Unlike investments tied to market performance, the value of your principal in an HYSA or MMA does not fluctuate. Money market accounts often add a layer of convenience by offering check-writing privileges or a debit card, blending the returns of a savings account with the accessibility of a checking account. This makes them an excellent vehicle for parking emergency funds, saving for a short-term goal like a down payment, or holding cash reserves while waiting for other investment opportunities.

When and Why to Use This Strategy

This approach is ideal for conservative investors, retirees, or anyone who needs to ensure their cash is both safe and liquid. If you have a low risk tolerance or a short time horizon for your financial goals, the predictability of HYSAs and MMAs is invaluable. For example, a small business owner might use a money market account to hold operating cash, earning interest while keeping the funds readily accessible for payroll or expenses. Similarly, a retiree could use an HYSA to store a year's worth of living expenses, shielding it from market volatility.

Actionable Implementation Tips

To maximize this strategy, it's crucial to actively manage your accounts.

- Shop for Rates: Don't settle for the first offer. Use online comparison tools to find institutions consistently offering top-tier APYs. Online banks like Marcus by Goldman Sachs or Ally Bank often lead the market.

- Monitor Insurance Limits: If your cash holdings exceed $250,000, spread the funds across multiple FDIC-insured institutions to ensure full coverage for your entire principal.

- Understand Account Features: Compare the specifics. Some MMAs have minimum balance requirements to avoid fees or to earn the highest interest rate tier. For more details on these safe, short-term options, you can explore a comprehensive guide on safe short-term investments on bankdepositguide.com.

2. Treasury Securities (Bills, Notes, and Bonds)

For investors seeking the highest level of safety, U.S. Treasury securities are the gold standard among capital preservation strategies. These instruments are direct debt obligations of the U.S. government, meaning their principal and interest payments are backed by the full faith and credit of the United States. This guarantee makes them one of the safest investments in the world. They are issued in three main types: Bills (short-term, up to one year), Notes (intermediate-term, two to ten years), and Bonds (long-term, over ten years), offering a range of maturities to fit different financial timelines.

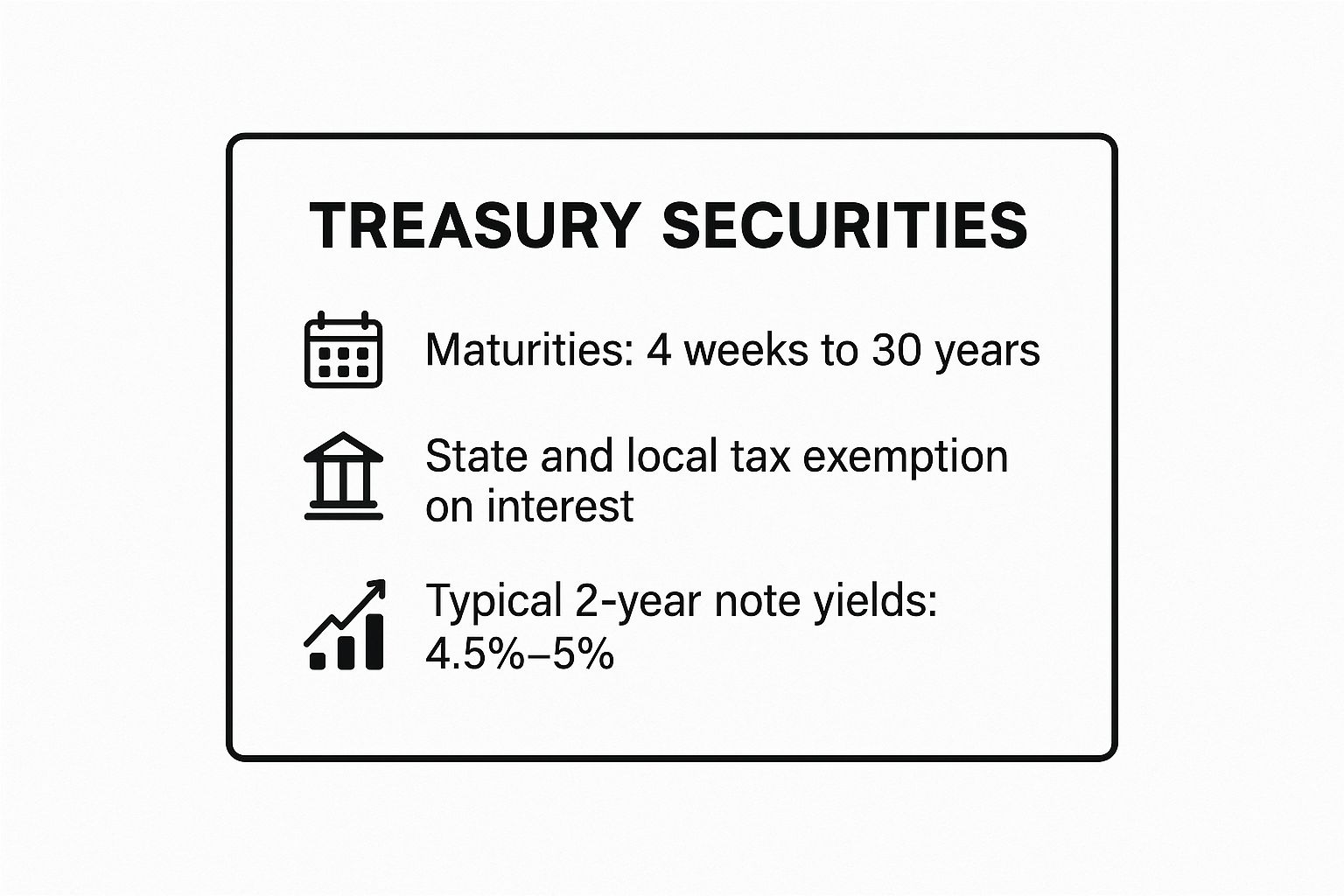

The infographic below highlights some of the key features that make Treasurys a cornerstone of low-risk investing.

As the data shows, the combination of tax advantages and competitive yields, such as those seen on 2-year notes, makes Treasurys a powerful tool for protecting purchasing power while ensuring principal safety. Unlike corporate bonds, interest income from Treasury securities is exempt from state and local taxes, which can significantly boost their after-tax return for investors in high-tax states.

When and Why to Use This Strategy

This strategy is exceptionally well-suited for retirees, institutional investors like pension funds, and anyone who prioritizes guaranteed principal return above all else. If you are building a diversified portfolio, Treasurys serve as a crucial stabilizing element, often performing well when riskier assets like stocks decline. For example, an investor planning for a major expense in five years could purchase a 5-year Treasury Note to lock in a predictable return and ensure the full principal is available on schedule, regardless of market conditions. Similarly, Series I Bonds are an excellent choice for individuals seeking to protect their savings from inflation.

Actionable Implementation Tips

To effectively integrate Treasurys into your portfolio, consider these practical steps.

- Ladder Maturities: To manage interest rate risk, build a "bond ladder" by purchasing Treasurys with staggered maturity dates. This approach provides regular cash flow and allows you to reinvest maturing proceeds at potentially higher rates without locking all your capital into a single long-term security.

- Buy Directly from the Source: You can purchase Treasury securities directly from the government through the TreasuryDirect.gov website. This method is straightforward and allows you to avoid broker commissions and fees, maximizing your net return.

- Match Maturities to Goals: Align the maturity date of your Treasury security with your specific financial goal. For short-term cash management, Treasury Bills are ideal. For long-term goals like retirement, longer-dated Notes or Bonds can provide a steady income stream. For a deeper analysis of how these instruments fit into a conservative portfolio, consider exploring a guide on low-risk retirement investments on bankdepositguide.com.

3. Certificates of Deposit (CDs) and CD Laddering

Certificates of Deposit (CDs) are a cornerstone among capital preservation strategies for investors who prioritize certainty and security. A CD is a time deposit offered by banks and credit unions where you agree to leave your money untouched for a specific term, ranging from a few months to several years. In exchange, the financial institution pays a fixed interest rate that is typically higher than a standard savings account. Like HYSAs, CDs are FDIC or NCUA insured up to $250,000, guaranteeing your principal is protected.

The primary trade-off for this higher, guaranteed return is liquidity; withdrawing funds before the maturity date usually incurs a penalty. To counteract this, investors often use a technique called "CD laddering." This involves spreading a total investment across multiple CDs with staggered maturity dates. For instance, instead of putting $25,000 into a single 5-year CD, you could put $5,000 into a 1-year, 2-year, 3-year, 4-year, and 5-year CD. This provides access to a portion of your funds every year without penalty.

When and Why to Use This Strategy

CDs and CD laddering are ideal for investors with a defined time horizon who want to lock in a predictable rate of return without any market risk. This strategy is particularly effective for future planned expenses, such as a wedding in three years or a tuition payment. For retirees, a CD ladder can create a reliable, recurring income stream as each CD matures. It strikes a balance between earning a competitive yield and maintaining periodic access to cash, making it a powerful tool for conservative portfolio construction.

Actionable Implementation Tips

To effectively implement a CD strategy, consider the following steps.

- Build a Ladder for Liquidity: Start by dividing your total investment into several equal parts and purchase CDs with staggered terms (e.g., 1, 2, 3, 4, and 5 years). As each CD matures, you can reinvest it into a new 5-year CD to maintain the ladder and capture long-term rates.

- Compare Rates Diligently: Yields can vary significantly between institutions. Use online comparison tools to find the best rates from banks, credit unions, and even brokered CDs, which can offer access to a wider market of higher-yielding options.

- Beware of Callable CDs: Some CDs are "callable," meaning the bank can redeem them early if interest rates fall. Only consider these if the interest rate offered is substantially higher to compensate for this risk. For a deeper dive into structuring your investments, you can explore the CD ladder strategy on bankdepositguide.com.

4. Principal-Protected Notes (PPNs) and Structured Products

For investors seeking to shield their initial investment while still participating in potential market growth, Principal-Protected Notes (PPNs) and other structured products offer a sophisticated capital preservation strategy. These are complex financial instruments, typically issued by major investment banks, that combine a zero-coupon bond with a derivative, such as an option. The bond component grows to equal your initial principal by the maturity date, guaranteeing its return, while the derivative provides the potential for additional returns linked to the performance of an underlying asset like the S&P 500 or a specific commodity.

This structure creates a unique risk-return profile. You get downside protection on your principal while retaining a chance for upside, a feature not found in traditional savings vehicles. Examples include equity-linked notes from firms like JPMorgan or market-linked CDs from Bank of America. These products offer a customized way to invest, bridging the gap between the absolute safety of cash deposits and the higher-risk, higher-reward nature of direct market exposure.

When and Why to Use This Strategy

PPNs are best suited for moderate-to-conservative investors with a longer time horizon (typically 5-10 years) who are willing to forgo liquidity and regular interest payments for principal protection and potential market-linked gains. This strategy is particularly useful when market volatility is high or when an investor wants exposure to a specific asset class, like equities or commodities, without risking their base investment. For instance, a retiree might use a PPN linked to a broad market index to capture potential stock market growth without exposing their essential nest egg to downside risk. It is a calculated move for those who want to dip a toe into the market's potential without fully submerging their capital.

Actionable Implementation Tips

Implementing this strategy requires careful due diligence due to the complexity of these products.

- Scrutinize the Issuer's Credit Risk: Your principal guarantee is only as strong as the financial institution that issues the note. If the issuer defaults, you could lose your entire investment. Stick to PPNs from large, stable, and highly-rated banks.

- Understand All Terms: Read the prospectus thoroughly. Pay close attention to the maturity date, participation rate (the percentage of the underlying asset's return you will receive), any caps on returns, and call features that allow the issuer to redeem the note early.

- Assess Opportunity Cost and Fees: PPNs typically do not pay dividends or interest. The opportunity cost is the guaranteed return you could have earned in a CD or high-yield savings account over the same period. Also, compare embedded fees and commissions, as they can significantly impact your potential upside.

5. Ultra-Short Bond Funds and Stable Value Funds

For investors seeking a slight step up in yield from cash equivalents without taking on significant market risk, ultra-short bond funds and stable value funds offer compelling capital preservation strategies. These investment vehicles aim to protect principal while generating modest returns, positioning them as a conservative bridge between savings accounts and traditional bond funds. Ultra-short bond funds achieve this by investing in a diversified portfolio of high-quality, short-duration debt instruments, minimizing sensitivity to interest rate fluctuations.

Stable value funds, commonly found in 401(k) and other retirement plans, take a different approach. They typically hold a portfolio of high-quality bonds and then use insurance contracts, known as "wrappers," to guarantee the principal and provide a steady, predictable interest rate. This structure is specifically engineered to deliver low volatility and preserve capital, making these funds a cornerstone for risk-averse retirement savers.

When and Why to Use This Strategy

This strategy is best suited for investors who want a higher return than cash but have a very low tolerance for price volatility. It's an excellent option for holding funds designated for near-term goals (1-3 years) or for the conservative portion of a diversified portfolio. For instance, an investor planning a major purchase in two years might use an ultra-short bond fund like the Vanguard Short-Term Treasury Fund (VFISX) to earn more than a savings account while keeping the risk of principal loss exceptionally low.

Retirees often rely on stable value funds within their 401(k)s as a secure anchor, providing steady growth insulated from stock market swings. These funds serve as a powerful cash alternative, delivering safety and liquidity with an enhanced yield profile compared to money market funds.

Actionable Implementation Tips

To effectively integrate these funds, a careful review of their characteristics is essential.

- Scrutinize Expense Ratios: Even small differences in fees can erode modest returns. Compare the expense ratios of similar funds, such as the Fidelity Conservative Income Bond Fund (FCONX), to ensure you are not overpaying for management.

- Check Credit Quality and Duration: Review the fund’s portfolio to understand its credit risk. Look for funds holding primarily investment-grade debt. Also, check the fund's duration; a lower duration (typically under one year) indicates less sensitivity to interest rate changes.

- Consider Tax Implications: Ultra-short bond funds can be taxable at the federal and state levels. For those in high tax brackets, a tax-exempt option like the Schwab Ultra-Short Tax-Free Income Fund (SWUSX) might offer a better after-tax return. Stable value funds within retirement accounts offer tax-deferred growth.

6. TIPS (Treasury Inflation-Protected Securities)

For investors concerned that inflation will erode the value of their fixed-income holdings, Treasury Inflation-Protected Securities (TIPS) offer a direct and powerful capital preservation strategy. These are U.S. government bonds specifically designed to protect your investment's purchasing power. The principal value of a TIPS bond increases with inflation, as measured by the Consumer Price Index (CPI), and decreases with deflation. Since the semi-annual interest payments are calculated based on this adjusted principal, both your underlying investment and your income stream are shielded from inflation.

Unlike nominal Treasury bonds where the return is fixed, TIPS provide a "real" return, a rate of interest paid in addition to the inflation adjustment. This dual-return structure ensures that your investment not only keeps pace with rising consumer prices but also grows in real terms. Because they are backed by the full faith and credit of the U.S. government, they carry minimal credit risk, making them a secure haven for long-term capital.

When and Why to Use This Strategy

This strategy is particularly effective for long-term investors, such as retirees or those saving for a far-off goal like a child's education, who need to ensure their savings maintain their purchasing power over decades. If you anticipate a period of high or unexpected inflation, allocating a portion of your fixed-income portfolio to TIPS can provide a crucial hedge that nominal bonds cannot. For example, a retiree planning their income for the next 20-30 years can use TIPS to ensure their living expenses are covered, regardless of how much prices rise over that period.

Actionable Implementation Tips

To effectively integrate TIPS into your portfolio, consider the following tactical approaches.

- Consider Tax Implications: The annual inflation adjustments to the principal are considered taxable income for that year, even though you don't receive the cash until the bond matures. To avoid this "phantom income" tax liability, it is often advantageous to hold individual TIPS or TIPS funds within a tax-deferred account like an IRA or 401(k).

- Analyze the Breakeven Rate: Before buying, compare the yield on a TIPS to a nominal Treasury bond of the same maturity. The difference is the "breakeven inflation rate," which is the market's expectation for future inflation. If you believe actual inflation will be higher than this rate, TIPS are likely the better investment.

- Use Funds for Simplicity: For most investors, a TIPS mutual fund or ETF, such as the Vanguard Inflation-Protected Securities Fund (VIPSX), offers an easier solution. Funds provide instant diversification across various maturities and handle the complexities of reinvesting principal and interest. You can find more information about these securities directly from the source at TreasuryDirect.gov.

7. Cash Value Life Insurance and Fixed Annuities

For investors seeking capital preservation strategies that extend beyond traditional banking products, cash value life insurance and fixed annuities offer a unique combination of principal protection, tax-deferred growth, and other insurance-based benefits. These products are contracts with insurance companies, where the safety of your principal is backed by the insurer's financial strength and reserves, along with state-level guaranty associations. This structure provides a different layer of security compared to FDIC insurance.

Cash value life insurance, such as whole life, builds a tax-deferred cash component alongside a death benefit. Fixed annuities, including multi-year guarantee annuities (MYGAs), function more like CDs, offering a guaranteed fixed interest rate for a specific term. In both cases, the core promise is that your principal will not decline due to market fluctuations, making them a cornerstone for conservative, long-term financial planning.

When and Why to Use This Strategy

This approach is best suited for individuals with a long time horizon who have already maximized contributions to other tax-advantaged retirement accounts like 401(k)s and IRAs. It is particularly valuable for those seeking tax-deferred growth and a way to pass wealth to heirs efficiently. For example, a high-earning professional might use a whole life policy to build a supplemental, tax-free retirement income stream while securing a death benefit for their family.

A retiree seeking predictable income might choose a fixed annuity to convert a lump sum into a guaranteed stream of payments, protecting them from outliving their assets. MYGAs are excellent for investors who want CD-like returns but may have more than the FDIC limit to invest, as annuity contracts can often accommodate larger sums under a single agreement.

Actionable Implementation Tips

Effectively using insurance products for capital preservation requires careful due diligence.

- Scrutinize Insurer Ratings: Your principal's safety is directly tied to the insurance company's ability to meet its obligations. Only consider products from companies with high financial strength ratings, such as A+ or better from rating agencies like A.M. Best or S&P.

- Understand Surrender Periods and Fees: These are long-term products. Be fully aware of surrender charges, which are fees for withdrawing money before a specified period, typically lasting several years. Also, understand all administrative fees and agent commissions involved.

- Compare to Alternatives: Before committing, compare the net returns of an insurance product against direct investment alternatives. A fixed annuity from a top-rated company like New York Life should be weighed against the returns from a portfolio of Treasury bonds or CDs to ensure it aligns with your goals.

Capital Preservation Strategies Comparison

| Investment Type | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| High-Yield Savings & Money Market Accounts | Low 🔄 | Low (minimal balance $100-$1,000) 💡 | Moderate yields, variable rates 📊 | Short-term liquidity, emergency funds | FDIC insured, principal protection, easy access ⭐⚡ |

| Treasury Securities (Bills, Notes, Bonds) | Moderate 🔄 | Moderate (purchase via TreasuryDirect or brokers) 💡 | Predictable income, government-backed returns 📊 | Safe, long or short-term fixed income investments | Zero default risk, tax advantages ⭐📊 |

| Certificates of Deposit (CDs) & Laddering | Moderate 🔄 | Moderate (fixed deposits, staggered terms) 💡 | Fixed, guaranteed returns, penalty on early withdrawal 📊 | Medium-term stable income, low risk with laddering | FDIC insured, higher yields for term ⭐📊 |

| Principal-Protected Notes & Structured Products | High 🔄 | High (complex products, issuer credit risk) 💡 | Potential higher returns with principal protection 📊 | Conservative growth with market upside participation | Principal protection + market-linked upside ⭐ |

| Ultra-Short Bond & Stable Value Funds | Moderate 🔄 | Moderate (mutual fund fees, credit analysis) 💡 | Modest yields with daily liquidity 📊 | Cash alternatives, short-duration bond exposure | Professional management, higher yield than money markets ⭐⚡ |

| TIPS (Treasury Inflation-Protected Securities) | Moderate 🔄 | Moderate (buy via TreasuryDirect or funds) 💡 | Inflation-adjusted returns preserving real value 📊 | Long-term inflation hedge | Inflation protection, government-backed ⭐📊 |

| Cash Value Life Insurance & Fixed Annuities | High 🔄 | High (complex fees, long-term commitment) 💡 | Principal protection with tax-deferred growth 📊 | Estate planning, tax-deferred growth, income guarantees | Principal protection, tax deferral, added insurance benefits ⭐ |

Building Your Financial Fortress: Final Thoughts on Capital Preservation

The journey through the landscape of capital preservation strategies reveals a fundamental truth: protecting your wealth is not a passive activity. It is an active, ongoing process of building a financial fortress, brick by brick, with tools designed for stability and resilience. Throughout this guide, we have dismantled the idea that you must accept high risk for meaningful results. Instead, we have shown how a deliberate approach can secure your principal while still combating the corrosive effects of inflation and market volatility.

We explored the foundational safety of Treasury securities and high-yield savings accounts, the predictable income streams from CD ladders, and the inflation-hedging power of TIPS. We also ventured into more specialized instruments like stable value funds and fixed annuities, each offering unique benefits for specific financial situations. The common thread among all these powerful tools is that they shift the focus from speculative gains to dependable security.

Key Takeaways for Your Defensive Strategy

Mastering capital preservation is about making informed choices that align with your personal financial blueprint. The most crucial takeaway is that there is no one-size-fits-all solution. Your ideal mix of capital preservation strategies will be a unique blend, carefully calibrated to your specific:

- Time Horizon: Are you saving for a down payment in two years or protecting your nest egg in retirement? Shorter timelines demand higher liquidity and lower risk.

- Liquidity Needs: How quickly might you need to access these funds without penalty? Money market accounts offer immediate access, while a CD ladder provides it in planned stages.

- Risk Tolerance: Even within the low-risk spectrum, there are variations. Understanding your comfort level with factors like interest rate risk is essential.

Your Actionable Next Steps

Building this fortress requires more than just knowledge; it demands action. Do not wait for market turmoil to fortify your defenses. Start today by reviewing your current asset allocation. Identify the portion of your portfolio that you cannot afford to lose and designate it for capital preservation.

Begin by evaluating just one or two strategies that resonated most with you. Perhaps it's opening a high-yield savings account to make your emergency fund work harder or researching current Treasury bill rates. For those seeking broader financial planning and wealth management resources, you may also find information on the Silvercrest Finance homepage. The goal is to take a concrete step, no matter how small, to transform these concepts into a tangible part of your financial life. By proactively implementing these strategies, you build a foundation of security that provides not just financial stability, but invaluable peace of mind.

Ready to see how one of the most reliable strategies could work for you? Before you commit your funds, model your potential earnings with precision. Use this free Certificate-of-Deposit Calculator to compare different rates and terms, helping you build the perfect CD ladder for your capital preservation goals.