Planning for a Secure Retirement: Minimizing Risk

Protecting your retirement savings requires careful planning and a focus on low-risk investments. This listicle presents eight reliable options for 2025, each designed to minimize risk and deliver stable returns. Learn about U.S. Treasury securities, Certificates of Deposit (CDs), high-yield savings accounts, fixed annuities, municipal bonds, Dividend Aristocrat ETFs and funds, bond ladder strategies, and target date retirement funds. We'll cover their features, benefits, drawbacks, and current yields. For those interested in CDs, try our Certificate-of-Deposit Calculator. This information empowers you to make informed decisions about low risk retirement investments and build a secure financial future.

1. U.S. Treasury Securities

For those seeking low risk retirement investments, U.S. Treasury securities stand out as a cornerstone of stability and security. These government debt instruments, issued by the U.S. Department of the Treasury, are widely considered among the safest investments globally. Backed by the "full faith and credit" of the U.S. government, they offer a haven for capital preservation, particularly appealing to risk-averse investors and retirees. This backing means the government is obligated to repay the principal and interest, making default extremely unlikely.

U.S. Treasury securities come in various forms, catering to different investment horizons and needs. Treasury bills (T-bills) are short-term securities maturing in one year or less. Treasury notes (T-notes) have maturities ranging from 2 to 10 years, while Treasury bonds (T-bonds) mature in 20 or 30 years. Finally, Treasury Inflation-Protected Securities (TIPS) offer protection against inflation by adjusting their principal based on the Consumer Price Index (CPI). This variety allows investors to tailor their holdings to match their specific retirement income strategies. You can purchase these securities directly through the government's TreasuryDirect website (https://www.treasurydirect.gov/) or through brokers.

Pros:

- Extremely low default risk: Backed by the U.S. government.

- High liquidity: Easy to buy and sell in the secondary market.

- TIPS offer inflation protection: Shielding your investment from the erosion of purchasing power.

- Tax Advantages: Exempt from state and local income taxes.

Cons:

- Generally lower returns: Compared to riskier investments like stocks.

- Non-TIPS may not keep pace with inflation: Fixed interest payments can lose value over time if inflation rises.

- Interest rate risk: If sold before maturity, their value can fluctuate based on prevailing interest rates.

Examples of Successful Implementation:

- A retiree seeking stable income might allocate 30% of their portfolio to 10-year Treasury notes to balance risk and return.

- Even seasoned investors like Warren Buffett utilize Treasury bills for managing Berkshire Hathaway's short-term cash needs, highlighting their role in preserving capital.

Actionable Tips:

- Build a Treasury ladder: Purchase securities with staggered maturity dates to manage interest rate risk and reinvestment opportunities.

- Utilize TIPS: Allocate a portion of your portfolio to TIPS to safeguard against inflation, especially for long-term retirement planning.

- Buy direct: Purchase through TreasuryDirect.gov to avoid broker fees and streamline the process.

When and Why to Use This Approach:

U.S. Treasury securities are ideal for individuals prioritizing safety and capital preservation within their retirement portfolios. They are particularly suitable for:

- Risk-averse investors: Seeking a predictable and reliable return with minimal risk.

- Retirees: Planning secure income streams for their future expenses.

- Conservative investors: Diversifying their portfolios with a low-risk component.

By including U.S. Treasury securities in a diversified retirement portfolio, individuals can create a solid foundation of stability and mitigate the impact of market volatility on their long-term financial well-being.

2. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a staple among low-risk retirement investments, offering a predictable and secure way to grow your savings. They are essentially time deposits offered by banks and credit unions. You agree to lend the institution a fixed sum of money for a specific period (the "term"), and in return, they pay you a fixed interest rate. This straightforward nature makes CDs ideal for retirees seeking preservation of capital with guaranteed returns.

CDs come with various term lengths, ranging from a few months to five years or more. Generally, the longer the term, the higher the interest rate offered. A key advantage of CDs is the FDIC (for banks) or NCUA (for credit unions) insurance, which protects your principal up to $250,000 per depositor, per institution. This makes them an exceptionally safe haven for your retirement funds.

Features and Benefits:

- Fixed Terms: Choose a term that aligns with your financial goals, from short-term needs to long-term planning.

- FDIC/NCUA Insurance: Enjoy peace of mind knowing your principal is protected up to $250,000.

- Fixed Interest Rates: Lock in a guaranteed rate, eliminating the uncertainty of market fluctuations.

- Predictable Returns: Calculate your earnings precisely, simplifying retirement income planning.

Pros:

- Principal Protection: FDIC/NCUA insurance safeguards your investment.

- Higher Interest Rates than Savings Accounts: Earn more than traditional savings while maintaining low risk.

- Predictable, Guaranteed Returns: Eliminate market volatility and enjoy predictable growth.

- Various Term Options: Select a term that matches your specific time horizon.

Cons:

- Returns May Lag Behind Inflation: In high-inflation environments, the real return on CDs can be diminished.

- Limited Liquidity: Early withdrawal penalties can make accessing funds before maturity costly.

- Interest is Taxable: CD interest is considered ordinary income and is subject to taxes.

- Opportunity Cost: During periods of rising interest rates, locking in a fixed rate might mean missing out on higher potential returns elsewhere.

Examples of Successful Implementation:

- Ally Bank and other online banks frequently offer high-yield CDs with competitive rates and often no minimum deposit requirements.

- A retiree could create a "CD ladder" by spreading $100,000 across CDs with terms of 1 to 5 years, with one maturing each year. This strategy provides both regular access to funds and the benefit of higher rates on longer-term CDs.

Tips for Utilizing CDs:

- Build a CD Ladder: Balance liquidity with higher returns by staggering CD maturity dates.

- Compare Rates: Shop around and compare rates from different institutions, including online banks.

- Consider No-Penalty CDs: If you anticipate needing access to your funds, explore no-penalty CD options.

- Maximize FDIC/NCUA Coverage: For amounts exceeding $250,000, spread deposits across multiple institutions to maintain full insurance coverage.

CDs deserve a place on the list of low-risk retirement investments due to their principal protection, predictable returns, and various term options. They offer a safe and stable way to grow your savings, especially for those prioritizing capital preservation. Learn more about Certificates of Deposit (CDs) and use a CD calculator to determine the potential return on your investment. This approach is particularly suitable for individuals seeking predictable, risk-free returns and retirees planning secure income streams. CDs also serve as valuable diversification tools for conservative investors and offer small business owners a secure place to park surplus funds.

3. High-Yield Savings Accounts

For retirees seeking low-risk investment options, high-yield savings accounts offer a compelling blend of security, liquidity, and modest returns. These accounts function much like traditional savings accounts, but they offer significantly higher interest rates, making them ideal for parking funds you might need relatively soon while still earning more than a standard savings account. They are particularly well-suited for holding emergency funds or short-term savings goals. These accounts operate similarly to traditional savings accounts, but they typically reside with online banks that have lower overhead costs. This allows them to pass on higher interest earnings to their customers. As a low-risk retirement investment, they offer retirees a secure place to store funds while earning a respectable return.

High-yield savings accounts are FDIC (Federal Deposit Insurance Corporation) or NCUA (National Credit Union Administration) insured up to $250,000 per depositor, per insured bank, for each account ownership category. This means your principal is protected even if the bank fails, offering peace of mind crucial for retirement savings. Unlike some low-risk retirement investments that lock up your money, high-yield savings accounts provide full liquidity. You can easily access your funds with few, if any, withdrawal restrictions. They often boast no minimum balance requirements or monthly fees, further enhancing their appeal for retirees looking for simple, low-cost solutions.

Examples of popular high-yield savings accounts include:

- Marcus by Goldman Sachs High-Yield Online Savings Account

- Ally Bank Online Savings Account

- American Express High Yield Savings Account

Pros:

- Complete liquidity for emergency access: Withdraw your money when you need it.

- No risk to principal with federal insurance: Your money is safe up to $250,000.

- Higher yields than traditional savings accounts: Earn more interest on your savings.

- Easy to open and manage online: Convenient online platforms streamline account management.

- No lock-up periods or early withdrawal penalties: Access your funds without penalty.

Cons:

- Returns typically don't keep pace with inflation: The interest earned may not outpace rising prices.

- Interest rates can fluctuate: Rates are variable and can change based on market conditions.

- Some accounts have balance caps for the highest rates: You might earn a lower rate on balances above a certain threshold.

- May require linking to an external bank for deposits/withdrawals: Transfers may take a few business days.

Tips for Utilizing High-Yield Savings Accounts in Retirement:

- Emergency Fund: Maintain 3-6 months of living expenses in a readily accessible high-yield savings account.

- Maximize Returns: Compare Annual Percentage Yields (APYs) across multiple banks quarterly to ensure you’re getting the best rate.

- Account Requirements: Be mindful of account requirements that might impact your effective yield, such as minimum balance requirements.

- Targeted Savings: Consider using multiple accounts for different purposes (emergency fund, travel fund, healthcare fund).

- Easy Transfers: Link your high-yield savings account to your checking account for easy transfers.

Learn more about High-Yield Savings Accounts and how they compare to other options like Certificates of Deposit (CDs).

High-yield savings accounts deserve a place on the list of low-risk retirement investments because they offer a vital balance of security and accessibility. While they may not provide the highest returns, they play a crucial role in preserving capital and ensuring you have quick access to funds when unexpected expenses arise. This makes them an excellent choice for retirees seeking a safe and liquid option for a portion of their retirement portfolio.

4. Fixed Annuities: A Predictable Income Stream for Low-Risk Retirement

For those seeking low-risk retirement investments, fixed annuities offer a compelling solution focused on predictable income. A fixed annuity is essentially a contract with an insurance company. You deposit a sum of money, and the insurer guarantees a specific interest rate for a set period, typically 3-10 years. After this accumulation phase, you can convert the annuity into a stream of regular income payments, guaranteed for a chosen period or even for the rest of your life. This makes fixed annuities particularly attractive for retirees concerned about outliving their savings.

Fixed annuities deserve a place on this list because they directly address a key retirement concern: longevity risk. The guaranteed income stream, regardless of market fluctuations, provides peace of mind and financial security. They offer a level of predictability not found in market-dependent investments, making them a suitable component within a diversified, low-risk retirement portfolio.

Key Features and Benefits:

- Guaranteed Interest Rate: Your principal earns a fixed interest rate for the initial period, providing predictable growth.

- Guaranteed Income Payments: Convert your accumulated value into regular income payments for a specified period or for life.

- Tax-Deferred Growth: Your earnings grow tax-deferred until you begin withdrawals, potentially enhancing overall returns.

- Protection from Market Volatility: Unlike market-linked investments, fixed annuities are not subject to market fluctuations.

- Creditor Protection: In many states, annuities offer some level of protection from creditors.

- Longevity Protection: Lifetime income options mitigate the risk of outliving your savings.

- Inflation Protection (Optional): Some fixed annuities offer riders that adjust payments for inflation.

Pros:

- Guaranteed income stream, potentially for life

- Protection from market downturns

- Tax-deferred growth

- Addresses longevity risk

- Some offer inflation protection

Cons:

- Surrender charges for early withdrawals (typically 7-10 years)

- Generally lower returns compared to equity investments

- Limited liquidity once annuitized

- Insurance company financial strength is a crucial factor

- Fees can be complex and impact returns

Examples:

- New York Life's Secure Term Fixed Annuity

- Northwestern Mutual's Select™ Fixed Annuity

- A 70-year-old retiree might use a $200,000 Single Premium Immediate Annuity (SPIA) to generate $1,100 in monthly income for life.

Tips for Choosing a Fixed Annuity:

- Compare Quotes: Get quotes from multiple highly-rated insurance companies (A+ or better from agencies like A.M. Best).

- Partial Allocation: Consider allocating only a portion of your retirement savings to annuities to maintain portfolio diversification.

- Understand the Fine Print: Thoroughly review all fees, surrender charges, and contract terms before signing.

- Ladder Your Purchases: Consider purchasing multiple smaller annuities over time ("laddering") to diversify interest rate risk.

- Inflation Protection: Evaluate inflation-protected options, especially for longer retirement horizons.

When and Why to Use Fixed Annuities:

Fixed annuities are most appropriate for individuals prioritizing guaranteed income and security over potentially higher, but riskier returns. They are a valuable tool for:

- Risk-averse investors: Individuals seeking predictable, low-risk returns.

- Retirees: Planning secure income streams for the future.

- Conservative investors: Diversifying portfolios with low-risk options.

By understanding the features, benefits, and limitations of fixed annuities, you can determine if they align with your low-risk retirement investment strategy. Remember to consult with a qualified financial advisor to discuss your individual needs and circumstances before making any investment decisions.

5. Municipal Bonds: Tax-Advantaged Income for Retirement

Municipal bonds, often called "munis," offer a compelling option for low-risk retirement investments, especially for those in higher tax brackets. They represent loans you make to state and local governments to fund essential public projects like schools, hospitals, and infrastructure improvements. In return, the issuer pays you regular interest payments and returns your principal at maturity. Their key advantage lies in their tax-efficient nature, making them a valuable tool for generating income during retirement. This characteristic secures their spot on the list of low-risk retirement investments.

How Municipal Bonds Work:

When you purchase a municipal bond, you're effectively lending money to the issuing government entity. The bond has a defined maturity date, at which point the principal is repaid. Throughout the bond's term, the issuer makes regular interest payments, typically semi-annually. These interest payments are generally exempt from federal income tax, and, if you purchase bonds issued within your state of residence, they are often exempt from state and local taxes as well. This tax advantage significantly boosts the effective yield, especially for investors in high tax brackets.

Types of Municipal Bonds:

- General Obligation Bonds: Backed by the full faith and credit (taxing power) of the issuing government.

- Revenue Bonds: Repaid from the revenue generated by the specific project the bond financed (e.g., toll roads, water treatment facilities).

Features and Benefits:

- Tax Advantages: The primary appeal of munis. Tax-free income increases your after-tax return.

- Stability and Predictability: Offers a consistent income stream for retirement planning.

- Variety of Maturities: Choose bonds with maturities aligned with your time horizon, from short-term to 30+ years.

- Diversification: Adds diversification to a portfolio, reducing overall risk.

Pros:

- Tax-Efficient Income: Boosts your effective yield, potentially exceeding taxable bond returns after considering tax implications.

- Lower Default Risk (Generally): Munis historically have lower default rates than corporate bonds, especially those with high credit ratings.

- Predictable Income Stream: Supports consistent retirement income planning.

- Tailorable Maturities: Allows customization to match your specific financial goals and time horizon.

Cons:

- Lower Nominal Yields: The tax advantages come at the cost of lower stated interest rates compared to taxable bonds.

- Interest Rate Risk: Bond prices fluctuate inversely with interest rates. If you sell a bond before maturity, you may incur a loss if interest rates have risen.

- AMT Potential: Some municipal bonds may be subject to the Alternative Minimum Tax (AMT), so it's crucial to check.

- Liquidity Risk: Munis are generally less liquid than Treasury securities, meaning they might be harder to sell quickly.

- Credit Risk: While generally low, the creditworthiness of the issuing entity can impact the bond's value. Focus on high-quality issues (AA or better).

Examples:

- Vanguard Tax-Exempt Bond ETF (VTEB): A low-cost way to diversify across a broad range of municipal bonds.

- Fidelity® Municipal Income Fund (FHIGX): An actively managed mutual fund seeking high tax-exempt income.

- Individual Municipal Bonds: Available through brokerage accounts, offering more control over specific bond selection.

Tips for Investing in Municipal Bonds for Retirement:

- Focus on High-Quality Issues: Stick to bonds rated AA or better to minimize default risk.

- Consider Bond Ladders: Stagger bond maturities to manage interest rate risk and reinvestment risk.

- Use Municipal Bond Funds/ETFs: Provides instant diversification for smaller portfolios.

- Compare After-Tax Yields: Calculate and compare the after-tax yield of munis with taxable alternatives using your marginal tax rate.

- Research the Issuer's Fiscal Health: Understand the financial stability of the state or local government issuing the bond.

When and Why to Use This Approach:

Municipal bonds are particularly suitable for retirees in higher tax brackets seeking stable, tax-advantaged income. They are a valuable component of a diversified retirement portfolio aimed at preserving capital and generating a consistent income stream. However, they are not suitable for tax-sheltered accounts like 401(k)s or IRAs, as the tax advantages would be lost within these accounts. They are best held in taxable brokerage accounts.

6. Dividend Aristocrat ETFs and Funds

For retirees seeking low risk retirement investments that offer a blend of stability and growth potential, Dividend Aristocrat ETFs and funds deserve strong consideration. These investment vehicles focus on companies with a proven track record of increasing dividend payouts over extended periods, typically 25 years or more. This consistent dividend growth can provide a reliable income stream during retirement while also offering a degree of protection against inflation.

How They Work:

Dividend Aristocrat ETFs and funds invest in a basket of companies known as "Dividend Aristocrats." These companies have demonstrated a commitment to shareholder returns through steadily rising dividends, indicating financial strength and stability. By investing in a diversified collection of these companies, the ETF or fund aims to provide both income and modest capital appreciation.

Why They Deserve a Place on the List:

Their focus on established, financially sound companies with a history of dividend growth makes Dividend Aristocrat ETFs and funds a relatively low-risk option within the equity market. While not as safe as fixed-income investments like bonds, they offer a higher potential return, making them appealing to retirees seeking to balance income needs with growth potential.

Features and Benefits:

- Reliable Income Stream: Consistent and growing dividends offer a predictable income source for retirees.

- Stability: Investments are focused on mature, financially robust companies, generally less volatile than growth stocks.

- Inflation Hedge: Growing dividends can help offset the impact of inflation on purchasing power.

- Diversification: ETFs and funds offer instant diversification across a portfolio of Dividend Aristocrats.

- Accessibility: Available through various investment platforms as ETFs, mutual funds, or even by building a portfolio of individual dividend aristocrat stocks.

Pros:

- Reliable income stream that historically increases over time.

- Companies tend to be stable, mature businesses with strong financials.

- Potential hedge against inflation through dividend growth.

- Generally lower volatility than growth-oriented equity investments.

- May offer preferential qualified dividend tax treatment.

Cons:

- Not immune to market downturns and bear markets.

- Higher risk than bonds and fixed-income investments.

- Limited exposure to growth sectors like technology.

- Can underperform during strong bull markets.

- Dividend policies can change, even for historical aristocrats.

Examples:

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- T. Rowe Price Dividend Growth Fund (PRDGX)

Actionable Tips for Investors:

- Complement, Don't Replace Fixed Income: Use Dividend Aristocrat ETFs and funds as part of a diversified portfolio that includes fixed-income investments for lower-risk stability.

- Allocate Strategically: Dedicate a portion of your equity exposure to dividend aristocrats for stability, balancing it with other investments based on your risk tolerance.

- Reinvest or Take Income: Reinvest dividends during the accumulation phase to maximize growth. During retirement, take the dividends as income.

- Minimize Expenses: Opt for low-expense ratio funds to maximize your returns.

- Consider Tax Implications: Be mindful of tax implications and choose between taxable and tax-advantaged accounts accordingly.

When and Why to Use This Approach:

Dividend Aristocrat ETFs and Funds are particularly well-suited for retirees and conservative investors looking for low risk retirement investments that generate a steady income stream without taking on excessive risk. They are an ideal choice for those seeking a balance between stability and growth potential within their equity allocation. They can be a valuable component of a long-term retirement plan, offering a reliable source of income to supplement other retirement savings.

7. Bond Ladder Strategy

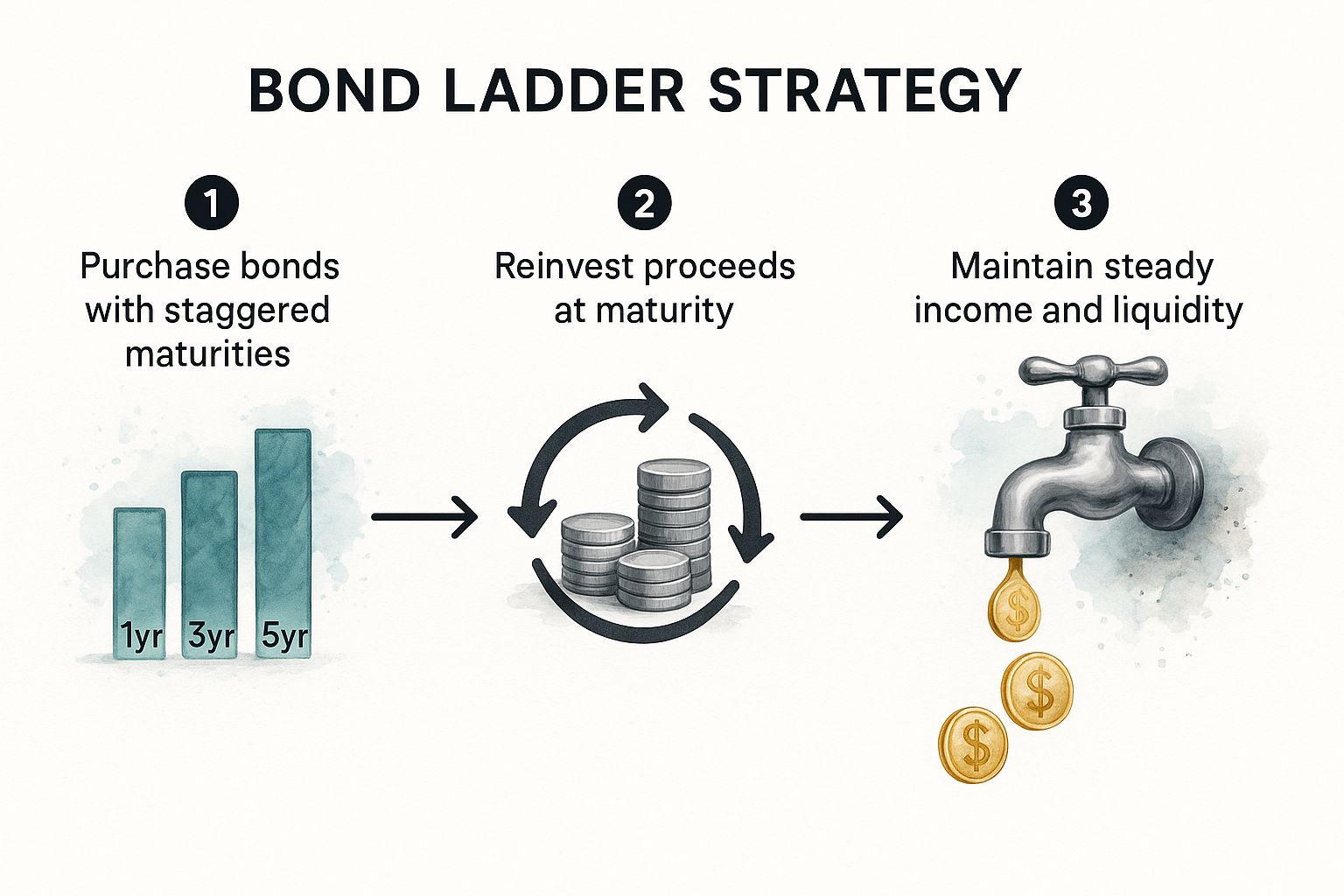

For retirees seeking a low-risk retirement investment strategy with predictable income, the bond ladder strategy offers an attractive solution. A bond ladder involves purchasing multiple bonds with varying maturity dates, creating a sequential stream of maturing investments. This approach provides a predictable income stream while mitigating interest rate risk and offering regular liquidity. This makes it a valuable tool for those seeking financial stability during retirement.

The infographic illustrates the process flow of a bond ladder strategy. It starts with investing equal amounts in bonds with different maturity dates, ranging from short-term to long-term. As each bond matures, the principal is returned. The investor can then choose to spend the returned principal or reinvest it in a new, longer-term bond at the prevailing interest rate, thus maintaining the ladder structure. This process continues over time, providing a steady stream of income and opportunities to reinvest at potentially higher rates. The visual representation emphasizes the staggered nature of the maturities and the cyclical reinvestment process, highlighting the predictable income stream and interest rate risk mitigation that a bond ladder offers.

This strategy deserves its place on this list of low-risk retirement investments due to its predictable income generation and relative safety. Instead of investing in a single bond fund, you diversify your holdings across various maturity dates. For example, a retiree with $300,000 could invest $60,000 each in 1, 2, 3, 4, and 5-year Treasury bonds. As each bond matures, the proceeds can be used for living expenses or reinvested at the current market rate. This structured approach smooths out the impact of interest rate fluctuations, a key concern for retirees relying on fixed income.

Features and Benefits:

- Staggered Maturities: Bonds are purchased with sequential maturity dates (e.g., 1, 2, 3, 4, and 5 years).

- Regular Liquidity: As each bond matures, proceeds can be spent or reinvested.

- Flexibility: Can be implemented using various bond types (Treasury, municipal, corporate, CDs).

- Customization: Tailored to specific income needs and time horizons.

- Reinvestment Opportunities: Provides regular opportunities to reinvest at current market rates.

Pros:

- Reduced Interest Rate Risk: Diversification across rates mitigates the impact of rate fluctuations.

- Predictable Income and Liquidity: Provides a consistent income stream and access to funds at regular intervals.

- Flexibility: Adaptable to changing needs and market conditions.

- Tax Efficiency: Can be tailored to individual tax situations by utilizing municipal bonds.

Cons:

- Management: Requires more active management compared to a single bond fund.

- Transaction Costs: May involve higher transaction costs for individual bonds.

- Diversification: Smaller portfolios might find it difficult to achieve sufficient diversification.

- Discipline: Maintaining the ladder structure requires ongoing discipline.

- Inflation Risk: Still susceptible to the erosion of purchasing power due to inflation.

Tips for Implementing a Bond Ladder Strategy:

- Start Small: Begin with a 5-10 year ladder for retirement income planning.

- Diversify Bond Types: Consider using Treasury bonds for safety and corporate/municipal bonds for higher yields.

- Consider ETFs: Use bond ETFs or defined-maturity funds for smaller portfolios for easier diversification.

- Investment Policy: Maintain a clear investment policy to guide reinvestment decisions.

- Regular Review: Review and rebalance your ladder annually to maintain the intended structure.

Tools like Fidelity's Bond Ladder Tool and Vanguard's Target Maturity ETFs can simplify the implementation process. Learn more about Bond Ladder Strategy, including strategies involving CDs. This approach has been popularized by fixed income strategist Mary Pat Campbell, investment platforms like Fidelity and Vanguard, and championed by economist Zvi Bodie in his retirement planning books. By carefully constructing and managing a bond ladder, retirees can achieve a balance of predictable income, liquidity, and low risk, making it a suitable strategy for those seeking a stable and secure financial future.

8. Target Date Retirement Funds: A Simplified Approach to Low-Risk Retirement Investing

Target Date Retirement Funds (TDFs) are a popular choice for those seeking low-risk retirement investments, offering a streamlined, hands-off approach to building a diversified portfolio. These professionally managed mutual funds are designed to simplify the complexities of investing for retirement, making them an attractive option for individuals who prefer a more passive strategy. They deserve a place on this list because they offer a convenient way to manage risk, particularly for those nearing retirement.

How They Work:

TDFs function as a "fund-of-funds," meaning they invest in a collection of other mutual funds across various asset classes, primarily stocks and bonds. The key feature is their automatic adjustment of asset allocation over time. A TDF with a target date of 2040, for example, will currently hold a higher percentage of stocks for growth potential. As 2040 approaches, the fund automatically shifts its allocation toward a more conservative mix with a greater emphasis on bonds to preserve capital and reduce volatility. This "glide path" continues even after the target date, further adjusting the allocation for investors already in retirement.

Features and Benefits:

- Single-Fund Diversification: A single TDF provides instant diversification across multiple asset classes, simplifying investment choices.

- Automatic Rebalancing: The fund automatically rebalances its portfolio to maintain the desired asset allocation, eliminating the need for manual adjustments by the investor.

- Professional Management: Experienced portfolio managers handle all asset allocation decisions, minimizing emotional decision-making and promoting a disciplined investment strategy.

- Ongoing Management: The glide path continues to adjust asset allocation through retirement, addressing changing risk profiles as individuals age.

Pros:

- Simplicity: TDFs offer a complete, diversified portfolio within a single fund, ideal for those seeking a straightforward investment solution.

- Automatic Adjustments: The hands-off nature of automatic asset allocation eliminates the need for constant monitoring and adjustments by the investor.

- Professional Expertise: Professional management brings expertise in asset allocation and risk management to the table.

- Complete Portfolio Solution: For many, a TDF can serve as a comprehensive retirement portfolio, simplifying the entire investment process.

Cons:

- One-Size-Fits-All: The standardized glide path may not perfectly align with every individual's risk tolerance or specific financial circumstances.

- Expense Ratios: While improving, TDFs generally have higher expense ratios than individual index funds.

- Varied Glide Paths: The rate at which a TDF shifts from stocks to bonds (its glide path) can differ significantly between providers, impacting overall returns.

- Limited Customization: TDFs offer minimal customization options, making it difficult to tailor the portfolio to specific financial goals or situations.

Examples:

- Vanguard Target Retirement 2025 Fund (VTTVX)

- Fidelity Freedom® 2030 Fund (FFFEX)

- T. Rowe Price Retirement 2035 Fund (TRRJX)

Tips for Choosing a Target Date Retirement Fund:

- Target Date Alignment: Select a target date fund that aligns with your anticipated retirement year.

- Expense Ratio Comparison: Carefully compare expense ratios across different providers, as these fees can impact long-term returns.

- Glide Path Review: Examine the fund's glide path to ensure it aligns with your risk tolerance and investment goals.

- Conservative Approach: If you have a lower risk tolerance, consider using a target date fund with a target date 5-10 years earlier than your planned retirement year.

- "To" vs. "Through" Retirement: Determine whether the fund is designed to manage assets up to your retirement date ("to") or continue adjusting throughout your retirement years ("through").

Target Date Retirement Funds offer a valuable, low-risk investment option for individuals seeking a simplified approach to retirement planning. While not perfect for everyone, their combination of diversification, professional management, and automatic adjustments makes them an attractive choice for many seeking predictable, long-term growth and capital preservation as part of their overall low-risk retirement investment strategy.

Low-Risk Retirement Investment Comparison

| Investment Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| U.S. Treasury Securities | Low - straightforward purchase via TreasuryDirect or brokers | Low - minimal management, accessible online | Low to moderate, stable returns around 3-5% | Capital preservation, portfolio stability, inflation protection (via TIPS) | Extremely low default risk, high liquidity, tax advantages |

| Certificates of Deposit (CDs) | Low - fixed terms, easy to set up at banks | Low - limited ongoing management | Predictable fixed returns, typically 3-5.5% APY | Safe capital preservation, laddering for income timing | FDIC/NCUA insured, guaranteed returns, various terms |

| High-Yield Savings Accounts | Very low - simple account opening online | Very low - no active management necessary | Variable moderate returns, typically 3-4.5% APY | Emergency funds, short-term cash needs | Full liquidity, federally insured, no penalties |

| Fixed Annuities | Medium - requires contract review and insurer selection | Medium - involves insurance provider interaction | Guaranteed income, generally 5-7% payouts | Lifetime retirement income, longevity risk management | Guaranteed income stream, tax-deferred growth, market protection |

| Municipal Bonds | Medium - requires bond selection and tax consideration | Medium - requires research, may need broker | Moderate yields, tax-exempt income often 3-4% | Tax-efficient income for higher tax brackets | Federal/state tax exemptions, relatively low default risk |

| Dividend Aristocrat ETFs/Funds | Low to Medium - buy and hold ETF or fund | Low - passive management via funds | Moderate returns with dividend growth, 7-9% historically | Balanced income & growth, inflation hedge for retirees | Reliable dividend growth, lower volatility vs. broader equities |

| Bond Ladder Strategy | Medium - requires purchase of multiple bonds with staggered maturities | Medium - ongoing reinvestment and rebalancing | Steady, predictable income with interest rate risk mitigation | Retirement income management, flexibility in reinvestment | Reduces interest rate risk, predictable income schedule |

| Target Date Retirement Funds | Very low - single-fund selection, automatic management | Very low - professionally managed | Balanced growth-to-preservation approach | Hands-off retirement investing, age-based asset allocation | Simplicity, professional management, automatic rebalancing |

Building Your Low-Risk Retirement Portfolio

Building a retirement portfolio with low-risk investments requires careful consideration and a clear understanding of your financial goals. This article explored several key options, from U.S. Treasury Securities and Certificates of Deposit (CDs) to Municipal Bonds and Dividend Aristocrat ETFs. Each offers a unique blend of security, income potential, and liquidity, making diversification within low-risk retirement investments a powerful strategy. Key takeaways include the importance of understanding interest rates, maturity dates, and the potential impact of inflation on your returns. Mastering these concepts empowers you to make informed decisions and build a portfolio aligned with your risk tolerance and retirement timeline.

As you build your portfolio, it's crucial to stay organized and monitor its performance. For a more comprehensive and automated way to manage your retirement investments, consider stop using spreadsheets to track your portfolio and explore dedicated portfolio tracking tools. By combining strategic low-risk investments with effective portfolio management, you can create a stable foundation for your financial future. Remember, securing a comfortable retirement is a marathon, not a sprint, and carefully chosen low-risk investments play a vital role in reaching the finish line.

Want to explore the potential returns of Certificates of Deposit (CDs) as part of your low risk retirement investments strategy? Use our Certificate-of-Deposit Calculator to estimate potential returns based on different deposit amounts and term lengths, helping you make informed decisions about incorporating CDs into your overall retirement plan.