Figuring out your potential CD earnings isn't rocket science, but you do need three key numbers: your principal (the amount you deposit), the Annual Percentage Yield (APY), and the term length. You can crunch the numbers yourself, but an online calculator is the fastest way to get a solid projection, especially since it can factor in how often your interest compounds.

Understanding What Drives Your CD's Growth

Before you can project your earnings, you need to know what makes the investment tick. The real return on your Certificate of Deposit (CD) comes down to just a few core elements working together.

Think of it like a simple recipe. You need the right ingredients in the right amounts. For a CD, those ingredients are your initial deposit, the interest rate, and how long you let it cook.

The Core Components of CD Earnings

Your journey to calculate CD interest starts with these three variables:

- Principal: This is your starting deposit—the money you lock into the CD. A bigger principal naturally means more interest earned.

- Term Length: This is how long you agree to leave your money untouched, typically ranging from a few months to several years. Longer terms usually earn higher interest rates.

- Annual Percentage Yield (APY): This is the most important number. APY is the actual rate of return you'll earn in a year because it already includes the effect of compound interest.

Key Takeaway: Always, always focus on the APY, not the simple interest rate. APY gives you a true, apples-to-apples comparison between different CDs because it accounts for how often interest is added to your balance.

The Power of Compounding

The real magic behind your CD's growth is compounding interest. This is when you earn interest not just on your initial principal, but also on the interest that has already been added to your account. It’s what helps your money grow at an accelerating pace over time.

How often this happens—the compounding frequency—can make a real difference in your final payout. A CD that compounds daily will earn slightly more than one with the same APY that compounds annually.

Beyond precise math, simple rules of thumb like the Rule of 72 can give you a quick estimate of how long it will take for your investment to double. Grasping these fundamentals is the first step to making smarter choices with your savings.

Manually Calculating Your CD Interest Earnings

While online calculators are wonderfully convenient, there's a real confidence that comes from knowing how to crunch the numbers yourself. Understanding the math behind your CD's growth isn't just an academic exercise; it gives you a gut-level feel for how your money really works.

The engine driving this growth is the classic compound interest formula: A = P(1 + r/n)^(nt).

It might look a little intimidating if you haven't seen it since high school, but it’s quite straightforward once you know what each part means. Let's break it down.

Decoding the Compound Interest Formula

Think of the formula as a recipe with a few key ingredients. Once you know what each letter stands for, you can plug in your CD's details and see the magic happen.

- A = Total Amount: This is the big number you care about—the final balance you'll have at maturity, which includes your initial deposit plus all the interest earned along the way.

- P = Principal: This one's easy. It’s your starting investment, the cash you put down to open the Certificate of Deposit.

- r = Annual Interest Rate: This is your rate, but it needs to be in decimal form for the math to work. A 4.5% interest rate becomes 0.045.

- n = Number of Compounding Periods per Year: This is a crucial one. It tells you how often the bank calculates and adds interest to your balance. For daily compounding, n=365; for monthly, n=12.

- t = Time (in years): This is the term length of your CD. For a 24-month CD, you'd use t=2.

Got all your values? Now you're ready to see a clear projection of your earnings. For a deeper dive into the math, check out our guide on how to calculate CD interest.

A Real-World Calculation Example

Let's put the formula to work with a practical scenario. Say you're looking to invest $5,000 in a 2-year CD that offers a 4.5% interest rate, compounded daily.

Here are our variables:

- P = $5,000

- r = 0.045

- n = 365 (for daily compounding)

- t = 2

Now, we just plug them into the formula: A = 5000(1 + 0.045/365)^(365*2)

After running the calculation, the total amount (A) works out to about $5,470.89. To figure out how much you earned in interest, simply subtract your original principal from that total: $5,470.89 - $5,000 = $470.89.

Pro Tip: Compounding frequency really does matter. If that same CD compounded only annually (n=1), your final balance would be $5,460.13. That switch to daily compounding put an extra $10 in your pocket. It's not a fortune, but it shows how the small details can add up.

Knowing how to do this manually is empowering. It lets you double-check the bank's own figures and gives you a much clearer picture of your investment's true potential.

How Compounding Frequency Shapes Your Final Payout

The real engine behind your savings growth often works quietly in the background. When you're trying to figure out how much a CD will earn, one of the most important details is its compounding frequency—that is, how often the bank adds your earned interest back into your principal balance.

Think of it as earning interest on your interest. The more often this happens, the harder your money works for you. A CD that compounds daily will always generate a bit more wealth than one that compounds monthly, even if they have the exact same APY. While the difference might seem tiny at first glance, it can definitely add up over a longer term.

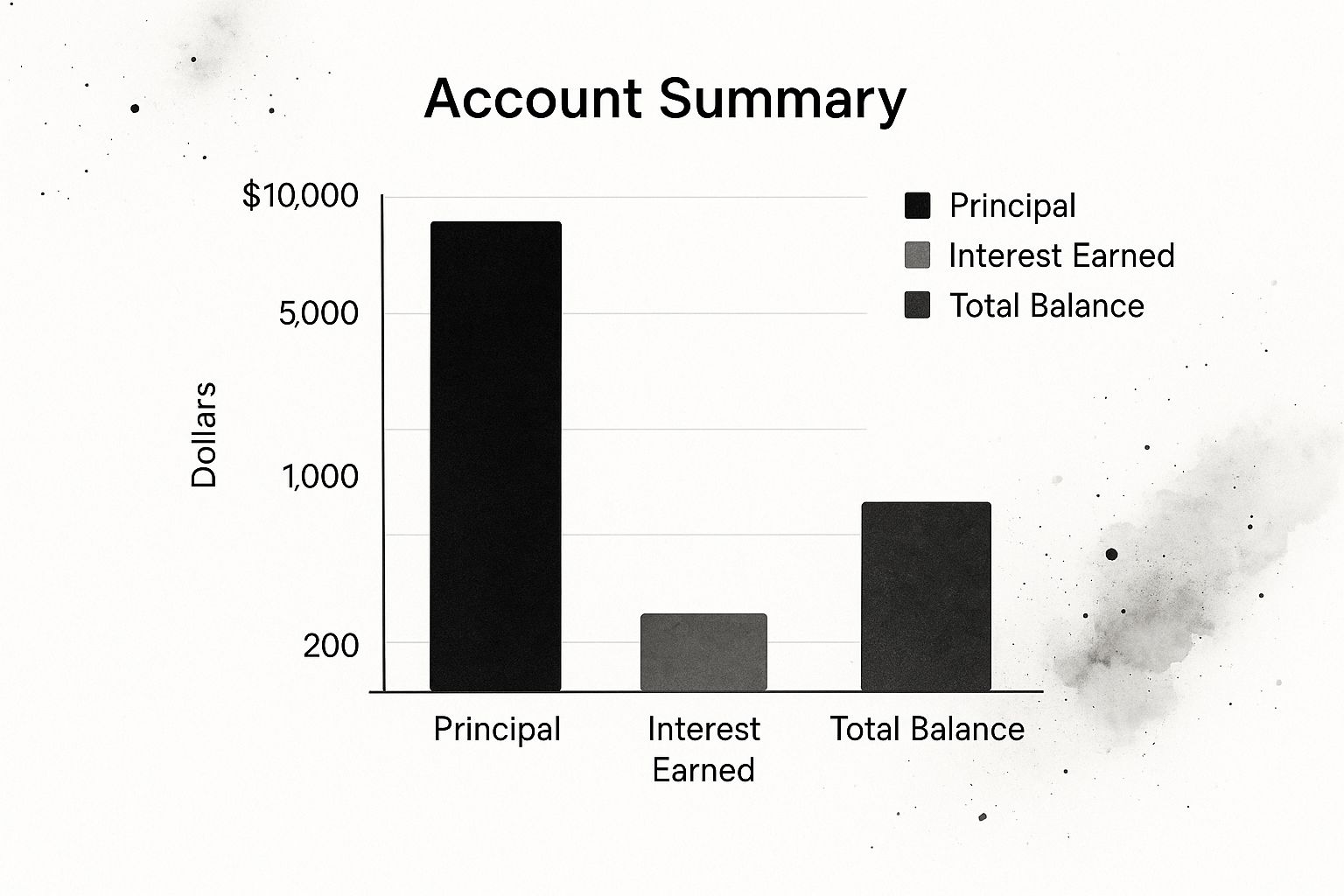

This infographic breaks down a simple CD scenario, showing how the initial principal and the earned interest combine to create your final balance.

As you can see, the visual neatly separates your starting cash from its growth, illustrating the tangible results of letting your investment sit and compound over time.

Daily vs. Monthly vs. Annual Compounding

Let's look at a real-world example to see how different compounding schedules affect a $10,000 CD with a 4.5% APY over a 5-year term. This side-by-side view really highlights the dollars-and-cents impact.

Compounding Frequency Impact on a $10,000 CD at 4.5% APY over 5 Years

This table shows just how much the total earnings can change based on how often the interest is compounded, even when the principal, term, and rate are identical.

| Compounding Frequency | Total Interest Earned | Final Balance |

|---|---|---|

| Annually | $2,461.82 | $12,461.82 |

| Monthly | $2,504.65 | $12,504.65 |

| Daily | $2,507.01 | $12,507.01 |

As the numbers show, daily compounding yields the highest return. In this scenario, the difference between annual and daily compounding is over $45. It might not sound like a fortune, but it's extra money earned with zero additional risk or effort on your part.

Key Takeaway: When you're shopping for CDs, don't just stop at the APY. Always ask about the compounding frequency. A slightly lower APY with more frequent compounding can sometimes outperform a higher rate that compounds less often.

This is exactly why understanding the fine print is so crucial for getting the best possible return. You can learn much more about the specifics of how often CDs compound and what it really means for your bottom line. Armed with this knowledge, you can compare offers from different banks and credit unions like a seasoned pro.

Using Online Calculators for Fast and Accurate Projections

While doing the math by hand helps you understand how your money grows, let's be honest—most of the time, you just want a quick, reliable answer. For speed and simplicity, nothing beats a good online calculator. It's the perfect tool for comparing different CD offers side-by-side without digging out a pencil and paper.

These digital tools do the heavy lifting for you, instantly running the compound interest formula. You just plug in your initial deposit, the CD's term length, and its APY to get a projection of your final balance. It’s a completely painless way to see what you’ll earn.

Getting The Most From Your Calculator

To make sure your projections are truly accurate, you need to pay attention to a couple of key details. The best calculators, like the Certificate-of-Deposit Calculator on our site, give you more granular control.

Here’s what to check before you trust the numbers:

- Compounding Frequency: Does the calculator let you select daily, monthly, or annual compounding? This is critical. A tool that assumes annual compounding will shortchange the earnings on a CD that actually compounds daily.

- APY vs. Interest Rate: Always, always use the Annual Percentage Yield (APY). This figure already includes the effect of compounding, giving you the true annual return. Plugging in the simple interest rate will give you a lower, inaccurate result.

Pro Tip: Remember that a standard online calculator shows you a CD's potential before taxes and penalties. The interest you earn is taxable income. And if you have to pull your money out early, you'll almost certainly face a penalty—something these tools don't typically account for.

While a dedicated CD calculator is great for this specific job, you can also track your investments with broader tools. For instance, popular financial software like Quicken can help you see how your CDs fit into your overall portfolio. Using these tools correctly gives you fast, reliable figures for smart financial planning.

How Economic Shifts Impact Your CD's Earning Potential

The Annual Percentage Yield (APY) on a Certificate of Deposit isn't a random number. It's a direct reflection of what's happening in the wider economy. When you sit down to calculate CD interest earnings, the rate you’re getting is heavily tied to the Federal Reserve's monetary policy. This relationship is the real key to understanding why CD rates rise and fall.

For instance, when the Federal Reserve jacks up its benchmark interest rate to fight inflation, banks and credit unions almost always follow. They have to. They raise the APYs on their savings products, including CDs, to attract more of your cash.

On the flip side, when the economy is sluggish and the Fed cuts rates to get people spending again, CD rates predictably drop.

Reading the Economic Tea Leaves

Once you grasp this connection, you can start building a much smarter CD strategy.

If you think the Fed is likely to keep hiking rates, you might lean toward a shorter-term CD. This simple move lets you get your money back sooner to reinvest it at what could be a much better rate.

But if economic signs point to falling rates ahead, locking in a high APY with a long-term CD can be a brilliant move. You're essentially securing your earning power before the rates drop for everyone else.

This isn't just theory; the historical link between Fed actions and CD rates is crystal clear. We've seen rates fluctuate wildly, even soaring to a staggering 13.90% in the early 1980s as the Fed battled runaway inflation. More recently, after years near zero, rates shot past 6% in 2022 and 2023 in another response to an inflationary spike. You can see more on the history of CD interest rates on Investopedia.

This knowledge transforms you from a passive saver into a strategic investor. Instead of just taking whatever rate is on offer, you can begin to anticipate market shifts and position your money to benefit.

Pairing this economic awareness with the right tools is fundamental to maximizing your returns. For a deeper dive, check out our guide on how to calculate CD earnings with precision.

Even after you've run the numbers, a few common questions always seem to come up. Getting these points straight is key to feeling confident about your CD investment.

APY Versus Interest Rate

You'll see two rates advertised: the interest rate and the Annual Percentage Yield (APY). What's the real difference? The interest rate is just the base rate paid on your principal. The APY, however, is the number that truly matters.

APY shows your actual earnings over a year because it includes the effect of compounding. It’s the only way to make a true apples-to-apples comparison between different CDs.

Always, always compare CDs using the APY. It cuts through the marketing noise and tells you exactly which account will grow your money faster, no matter how they calculate the interest behind the scenes.

Tax Implications for CD Earnings

So, do you have to pay taxes on the interest you make? Yes, you absolutely do. The IRS considers CD interest as taxable income for the year it's earned.

Your bank or credit union will send you a Form 1099-INT at the end of each tax year detailing every dollar of interest they paid you. You'll need to report that income on your tax return. This is true even if you don't touch the money and just roll the CD over at maturity.

Early Withdrawal Penalties

What if you need to get your cash out before the CD's term is up? This is a big one. Cashing out early will almost always cost you an early withdrawal penalty.

These penalties are usually calculated as a set number of months' worth of interest—say, three or six months' worth. The exact penalty can vary quite a bit from one bank to another, so it's critical to read the fine print before you open the account. Don't get caught by surprise.

Ready to see what your money could actually earn? The best way is to run the scenarios yourself.

Use our Certificate-of-Deposit Calculator for a fast, accurate picture of your potential returns and to compare different CD options side-by-side. Find the best return for your money at https://www.bankdepositguide.com/cd-calculator.