Understanding CD Compounding Fundamentals

The real magic of a Certificate of Deposit (CD) lies in compound interest. This is the process where the interest you earn generates even more interest. Instead of growing linearly, like with simple interest, your money grows exponentially over time. Understanding how often your CD compounds is key to maximizing your returns.

This compounding frequency determines how quickly your interest earnings are added back to your principal. This, in turn, accelerates the growth of your investment.

The Mechanics of Compounding

Compounding frequency simply refers to how often the interest earned on your CD is added back to your principal balance. Common frequencies include daily, monthly, quarterly, or annually.

The more frequently interest is compounded, the faster your money grows. For example, if you have two CDs with the same interest rate, the one that compounds daily will generate more interest than the one that compounds annually.

Why is this? With daily compounding, the interest earned each day is added to the principal. The next day's interest is then calculated on this new, slightly larger balance.

Why Compounding Frequency Matters

The impact of compounding frequency might seem negligible at first. However, it becomes substantial over time, especially with longer-term CDs. Even a small difference in compounding frequency can result in a significant difference in earnings over the CD's term.

This is why it's crucial to consider compounding frequency alongside the stated Annual Percentage Yield (APY) when comparing CD offers. For more information on CD interest calculations, check out this helpful resource: How to master CD interest calculations.

Understanding the Effective Annual Rate (EAR)

To truly understand the power of compounding, you need to familiarize yourself with the Effective Annual Rate (EAR). The EAR represents the actual annual interest rate you earn after factoring in the effects of compounding.

It provides a more accurate measure of your CD's earning potential than the APY. The APY doesn’t fully reflect the benefits of more frequent compounding. The EAR is always equal to or greater than the APY. A higher EAR indicates a stronger compounding effect.

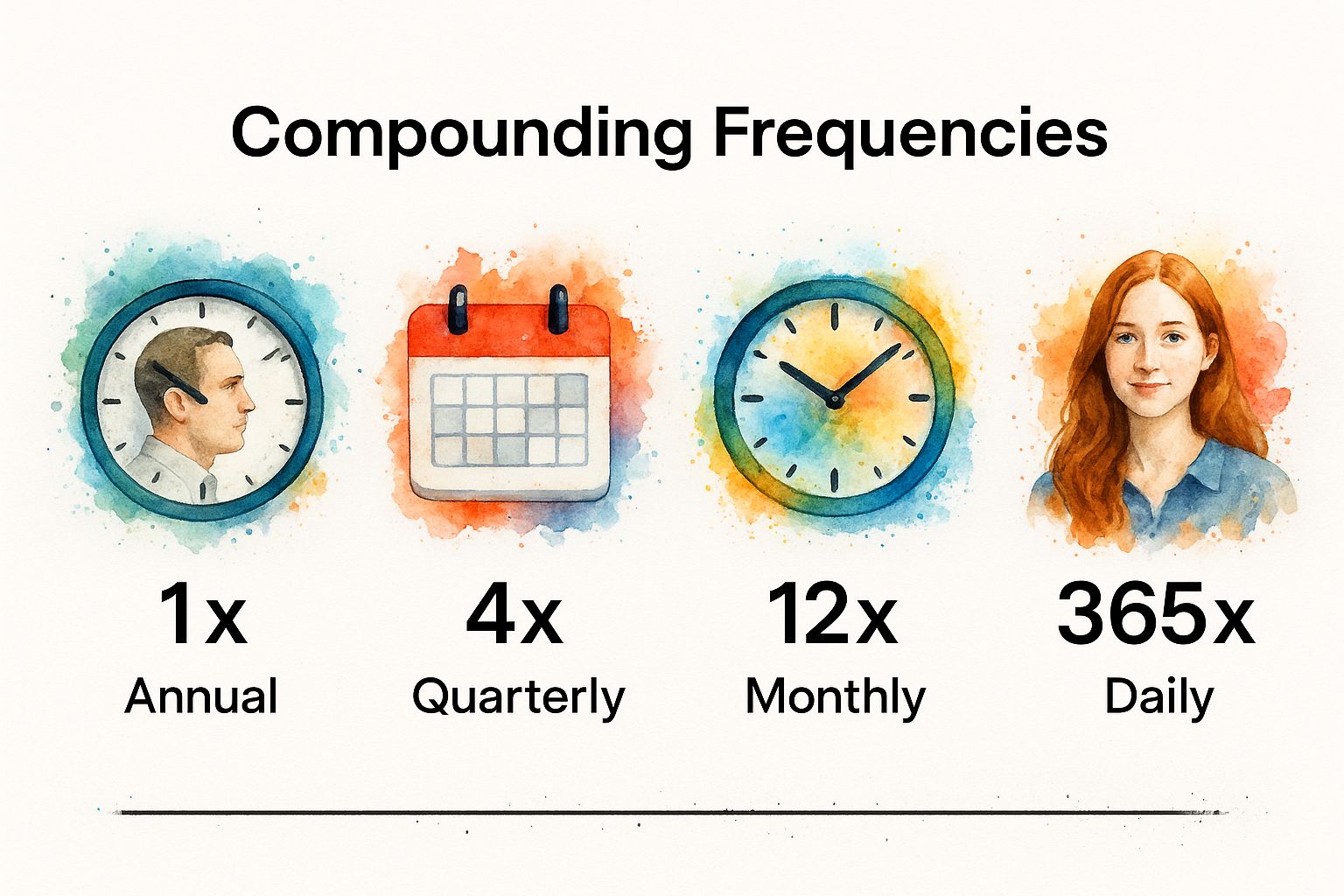

The Four CD Compounding Frequencies That Matter

This infographic illustrates the four main CD compounding frequencies: annually, quarterly, monthly, and daily. The icons visually represent how often interest is calculated, highlighting the impact of compounding frequency on your returns. Notice how the number of compounding periods increases, from just once a year to 365 times a day with daily compounding. This increase demonstrates how more frequent compounding can accelerate the growth of your investment.

When considering a Certificate of Deposit (CD), understanding compounding frequency is crucial. There are four primary options: daily, monthly, quarterly, and annually. Each frequency affects the growth of your CD differently. For instance, daily compounding calculates and adds interest to your principal every single day, maximizing the compounding effect.

Monthly Compounding

Monthly compounding, calculating interest 12 times per year, strikes a balance between growth and simplicity. Many online banks favor monthly compounding to offer competitive CD rates and attract new customers. This frequency allows your interest to earn interest more often than annual or quarterly compounding.

Quarterly Compounding

Quarterly compounding, adding interest four times a year, is another common practice. Although not as impactful as daily or monthly compounding, it still offers a noticeable advantage over annual compounding. Many traditional financial institutions continue to use this method.

Annual Compounding

Annual compounding is the simplest method, adding interest just once per year. While straightforward, it results in the slowest growth among the available frequencies. As savers become more aware of the benefits of frequent compounding, annual compounding is becoming less prevalent. Historically, compounding frequency was a key differentiator between financial institutions and regions. In the United States, with its large CD market (projected to be over $1 trillion in 2023), annual compounding was the norm. However, over the past decade, there's been a noticeable shift towards more frequent compounding options to attract savers.

Industry surveys indicate that approximately 40% of new CDs offered by U.S. banks in 2024 featured monthly compounding. Around 35% stuck with annual compounding, while the remaining 25% were divided between quarterly and daily compounding. For more detailed statistics, you can check out this report: Global Certificate of Deposit Market. Understanding compounding frequency is essential for maximizing CD returns. Choosing the right frequency, especially for longer-term CDs, can significantly impact your overall earnings.

To further illustrate the differences between compounding frequencies, let's look at the following table:

CD Compounding Frequency Comparison: A detailed comparison of how different compounding frequencies affect CD earnings over time.

| Compounding Frequency | Times Per Year | Typical Institutions | Best For |

|---|---|---|---|

| Daily | 365 | Online Banks, some national banks | Maximizing returns |

| Monthly | 12 | Online Banks, credit unions | Balancing growth and simplicity |

| Quarterly | 4 | Traditional banks, credit unions | A middle-ground approach |

| Annually | 1 | Some traditional banks | Simplicity, though less common now |

This table highlights the key differences between compounding frequencies, from the number of times interest is calculated per year to the types of institutions that typically offer each option. As you can see, daily compounding offers the highest growth potential, while annual compounding provides the simplest, though often least lucrative, approach. Choosing the right frequency depends on your individual financial goals and preferences.

How Compounding Frequency Transforms Your CD Returns

The frequency with which your CD compounds has a big impact on your total return. While the advertised Annual Percentage Yield (APY) provides a starting point, it doesn't tell the whole story. The real earning power lies in the Effective Annual Rate (EAR), which factors in how often your interest compounds.

The Power of Frequent Compounding

Let's look at an example. Suppose you invest $10,000 in a CD with a 5% APY. Over a 3-year term, the difference between annual and daily compounding is significant.

With annual compounding, you'd earn about $1,576 in interest. With daily compounding, you could earn around $1,618. That $42 difference demonstrates how small gains add up.

This effect is even greater with longer-term CDs. For the same $10,000 investment at 5% APY over 5 years, the difference between annual and daily compounding could be over $70. This shows why understanding compounding frequency is so important, especially for long-term savings.

Calculating Your Real Returns

The EAR is key to making informed CD decisions. It shows the true annual interest rate earned after compounding. Here's the formula to calculate EAR:

EAR = (1 + (APY / n))^n - 1

Where 'n' is the number of compounding periods per year. For monthly compounding, 'n' would be 12.

Making Compounding Work for You

How can you use this knowledge to maximize your CD returns? First, always ask about the compounding frequency when comparing CDs. Don't just look at the APY.

For short-term CDs, the difference in returns might be small. But for longer-term CDs, choose more frequent compounding if all other factors are the same. Our CD Calculator can help you compare different scenarios and find the best CD for your goals.

By understanding the relationship between compounding frequency, APY, and EAR, you can make smarter decisions and unlock the full potential of your CD investments. This helps you make the most of your savings and build wealth over time. Remember, the small details matter when it comes to long-term financial success.

Online Banks Versus Traditional Banks: The Compounding Factor

A notable difference is emerging in the banking world: how often Certificates of Deposit (CDs) compound interest. Online banks are at the forefront, frequently offering daily or monthly compounding to attract digitally focused savers. This allows customers to maximize their returns, making online CDs a compelling choice.

The Rise of Frequent Compounding

This approach caters to customers who appreciate the power of compound interest. For these individuals, even a small change in compounding frequency can result in significant gains over time. This competitive advantage has prompted traditional banks to re-evaluate their existing strategies.

Traditional Banks Adapting

Traditional banks, often using older systems, have historically preferred quarterly or annual compounding. However, the growth of online banking and increasing customer demand for higher returns are pushing them to modernize. While some still maintain less frequent compounding, many are beginning to provide more competitive CD options to keep and attract customers.

This shift means traditional banks are increasingly offering CDs with monthly or even daily compounding, though it's still less prevalent than with online institutions. This competition ultimately benefits consumers, driving banks to offer more attractive terms.

Beyond Compounding: A Broader Perspective

Choosing a CD involves considering more than just how often interest compounds. Customer service, account features, and overall CD terms are also essential. Online banks often excel in convenience and competitive rates, while traditional banks may offer personalized service and face-to-face support.

For instance, some traditional banks provide higher CD rates for customers with substantial balances or existing relationships. Wells Fargo is one example of a traditional bank offering a variety of CD options. Online banks might offer user-friendly online account management tools and round-the-clock customer support. These factors can influence your choice just as much as the compounding frequency. It’s about finding the right balance between maximizing returns and the overall banking experience.

Ultimately, the best CD depends on your specific needs and priorities. Carefully weigh the advantages of frequent compounding against other factors to choose the right fit for your financial goals. This involves considering your preference for online banking versus in-person interactions, along with the specific terms and conditions of each CD.

Calculate Your CD's True Earning Potential

Understanding how often your CD compounds is crucial for maximizing returns. While the advertised Annual Percentage Yield (APY) provides a general idea of your earnings, it doesn't tell the whole story. To truly grasp your CD's earning potential, you need to understand compound interest and the Effective Annual Rate (EAR).

Understanding the Compound Interest Formula

The compound interest formula helps calculate your CD's future value based on the principal, interest rate, compounding frequency, and time:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment, including interest

- P = the principal investment amount (the initial deposit)

- r = the annual interest rate (decimal)

- n = the number of times interest compounds per year

- t = the number of years the money is invested

For example, if you invest $5,000 in a CD with a 4% APY for 2 years with quarterly compounding (n=4), the calculation would be: A = 5000 (1 + 0.04/4)^(4*2). This results in a future value of approximately $5,414.28.

Using Online CD Calculators

Manually calculating compound interest can be tedious. Online CD calculators simplify this process. These tools allow you to input your CD details and instantly see the impact of different compounding frequencies. You can quickly compare various scenarios and make informed decisions. Learn more about how to master CD calculations.

Identifying Key Variables

When using a CD calculator, pay close attention to how compounding frequency, interest rate, and term length affect your final balance. For instance, increasing the compounding frequency from annually to daily can significantly boost returns, especially with longer-term CDs.

To illustrate the impact of compounding frequency, consider the following table:

CD Earnings Comparison Calculator

Sample calculations showing earnings differences based on compounding frequency for various CD amounts and terms

| CD Amount | Annual Rate | Term (Years) | Annual Compound | Monthly Compound | Daily Compound |

|---|---|---|---|---|---|

| $1,000 | 5% | 1 | $1,050.00 | $1,051.16 | $1,051.27 |

| $5,000 | 4% | 2 | $5,408.00 | $5,414.28 | $5,416.43 |

| $10,000 | 3% | 5 | $11,592.74 | $11,618.34 | $11,621.83 |

This table shows how even small differences in compounding frequency can lead to noticeable variations in earnings over time. The benefits of more frequent compounding become more pronounced with larger CD amounts and longer terms.

Avoiding Common Mistakes

One common mistake is focusing solely on the APY and neglecting the EAR. The EAR represents the true annual interest rate earned after accounting for compounding. Comparing EARs of different CD offers, not just APYs, allows for a more accurate assessment. Another mistake is overlooking other CD features, such as early withdrawal penalties, in favor of a marginally higher interest rate. While a higher EAR is appealing, consider all factors before making a decision. By understanding these concepts and using the right tools, you can calculate your CD's true earning potential and make informed investment choices to achieve your savings goals.

Choosing The Perfect CD Compounding For Your Goals

How often do CDs compound? The answer depends on the specific CD and your financial institution. Not all compounding frequencies are created equal. Aligning your choice with your financial goals is key to maximizing your returns. Short-term investors often have different priorities than long-term investors.

Aligning Compounding Frequency With Your Strategy

For short-term goals, like saving for a down payment, the impact of compounding frequency may be less significant. You might prioritize a slightly higher base rate over more frequent compounding.

However, for long-term growth, the power of frequent compounding becomes more apparent. Even a small difference in compounding frequency can add up over time. This means that for longer-term CDs, more frequent compounding is generally preferable. The cumulative effect of reinvested interest becomes more substantial.

Balancing Compounding Frequency With Other Factors

While frequent compounding is generally advantageous, it's crucial to consider other CD characteristics. Don't let the allure of daily compounding overshadow other important factors like the institutional reputation and customer service quality of the bank or credit union.

Additionally, consider the accessibility of your funds. Standard CDs typically restrict access until maturity. Some offer penalty-free early withdrawal options. This is important if you anticipate needing access to your funds before the CD term ends. You might be interested in: How to master CD laddering.

CD Laddering and Compounding Frequency

CD laddering is a strategy that involves spreading your investment across multiple CDs with varying maturity dates. This provides both liquidity and higher potential returns. You can further optimize this strategy by considering the compounding frequency of each CD in the ladder.

For instance, you might choose CDs with more frequent compounding for the longer-term rungs of your ladder. This helps capitalize on the long-term benefits of compounding.

Making Informed Decisions

Choosing the right CD involves careful evaluation of several factors. When comparing CDs, ask about the compounding frequency and calculate the Effective Annual Rate (EAR). This helps understand the true earning potential.

By considering your investment timeline, financial goals, and the overall CD offering, you can make informed decisions. This requires a holistic approach that looks beyond the headline interest rate. Make choices that align with your specific needs and maximize your returns.

Your CD Success Strategy: Expert Tips And Key Takeaways

Your journey to maximizing CD returns starts with understanding how compounding frequency affects your earnings. This knowledge, paired with smart shopping habits, creates the foundation for successful CD investments. Let's explore some expert tips and key takeaways to help you get the most out of your CDs.

Key Questions To Ask Before Investing In A CD

Smart investors look beyond the advertised APY. They ask important questions:

How often are the CDs compounded at this institution? This reveals the true earning potential, shown by the Effective Annual Rate (EAR).

What are the early withdrawal penalties? Knowing these is crucial, particularly if you may need the money before the CD matures.

Is the interest rate fixed or variable? A fixed rate offers predictability, while a variable rate fluctuates with market conditions.

What is the minimum deposit required? Some CDs require higher minimum deposits than others.

Spotting Red Flags And Subpar CD Products

Be cautious of CDs with:

Unusually high APYs with hidden fees: If it seems too good to be true, it probably is. Read the fine print carefully.

Extremely long terms without suitably high returns: Locking up your money for an extended time should offer a significant incentive.

Poor customer service reviews: Difficulty accessing your funds or resolving problems can overshadow the benefits of a high interest rate.

The Importance Of FDIC Insurance

Remember, FDIC insurance covers deposits up to $250,000 per depositor, per insured bank. This protects your money if the bank fails. For amounts exceeding this limit, consider spreading your deposits across several insured institutions.

Actionable Steps For CD Shopping

Follow these steps to optimize your CD investments:

Shop around and compare offers: Don't settle for the first CD you find. Compare rates, terms, and compounding frequencies at different banks.

Negotiate better terms: Don't hesitate to ask for a higher rate or other benefits, particularly if you have a large deposit.

Consider CD laddering: This strategy balances liquidity and higher potential returns by staggering your CD maturity dates.

Essential Metrics For Measuring Your Success

Track these metrics to ensure your CDs are performing well:

Effective Annual Rate (EAR): This shows the real annual interest rate you're earning after compounding.

Total Interest Earned: Monitor your interest earnings to evaluate the overall performance of your CD portfolio.

Time to Maturity: Be aware of your CD maturity dates to take advantage of better rates as they become available.

Identifying A Truly Competitive Offer

A competitive CD offer generally includes:

A competitive EAR: This reflects the actual return, considering compounding frequency.

Reasonable early withdrawal penalties: These should be appropriate for the potential returns.

Strong institutional reputation and dependable customer service: Choose a bank with a good history and positive customer reviews.

By following these tips and strategies, you'll be prepared to maximize your CD returns and grow your wealth through consistent, strategic saving.

Ready to calculate the potential of your CD? Try our Certificate-of-Deposit Calculator today: Calculate Your CD Earnings Now!