Brokered vs. Bank CDs: Unlocking the Right CD for You

Choosing between a brokered CD and a bank CD requires understanding their key differences. This listicle clarifies six crucial distinctions between these investment options, helping you select the best CD for your needs. Learn how brokered CDs vs. bank CDs differ in FDIC insurance coverage, liquidity, interest rates, fees, minimum investments, and term variety. Whether you're saving for retirement or simply seeking safe, predictable returns, understanding these factors is critical. Using these insights, you can maximize your returns while aligning your choice with your risk tolerance and financial goals.

1. FDIC Insurance Coverage Complexity

When considering Certificates of Deposit (CDs), understanding FDIC insurance coverage is paramount. This seemingly simple aspect can become quite complex when comparing brokered CDs vs. bank CDs, directly impacting the safety and security of your invested funds. This difference in coverage structure is a crucial factor in deciding which type of CD best suits your needs.

With bank CDs, FDIC insurance is straightforward. You receive coverage up to $250,000 per depositor, per insured bank. This means if you have multiple accounts at the same bank, the combined balance of those accounts is insured up to the $250,000 limit. This simplicity makes calculating and managing your insured deposits easy and transparent.

Brokered CDs, while offering potentially higher coverage, introduce complexities. They offer the possibility of extended coverage because brokers often work with multiple banks. This allows you to spread your deposits across many institutions, potentially exceeding the $250,000 limit per bank. However, this "pass-through" insurance, where the coverage comes from the underlying banks issuing the CDs and not the brokerage itself, requires diligent management. You must carefully track the amount held at each bank through the broker to ensure all your funds remain fully insured. If your holdings at a single bank, even through a broker, exceed the $250,000 limit, the excess amount isn't covered.

For example, Charles Schwab offers brokered CDs from over 200 banks, coordinating FDIC coverage across those institutions. While this offers the potential for significantly higher overall coverage, it requires careful monitoring of your holdings at each individual bank within the Schwab platform. Conversely, a local community bank offering direct CDs provides clear $250,000 coverage per account, simplifying the insurance calculation. Platforms like Fidelity's BrokerageLink manage FDIC coverage across multiple CD issuers within their system, providing a degree of automated tracking, but it still requires careful review by the investor.

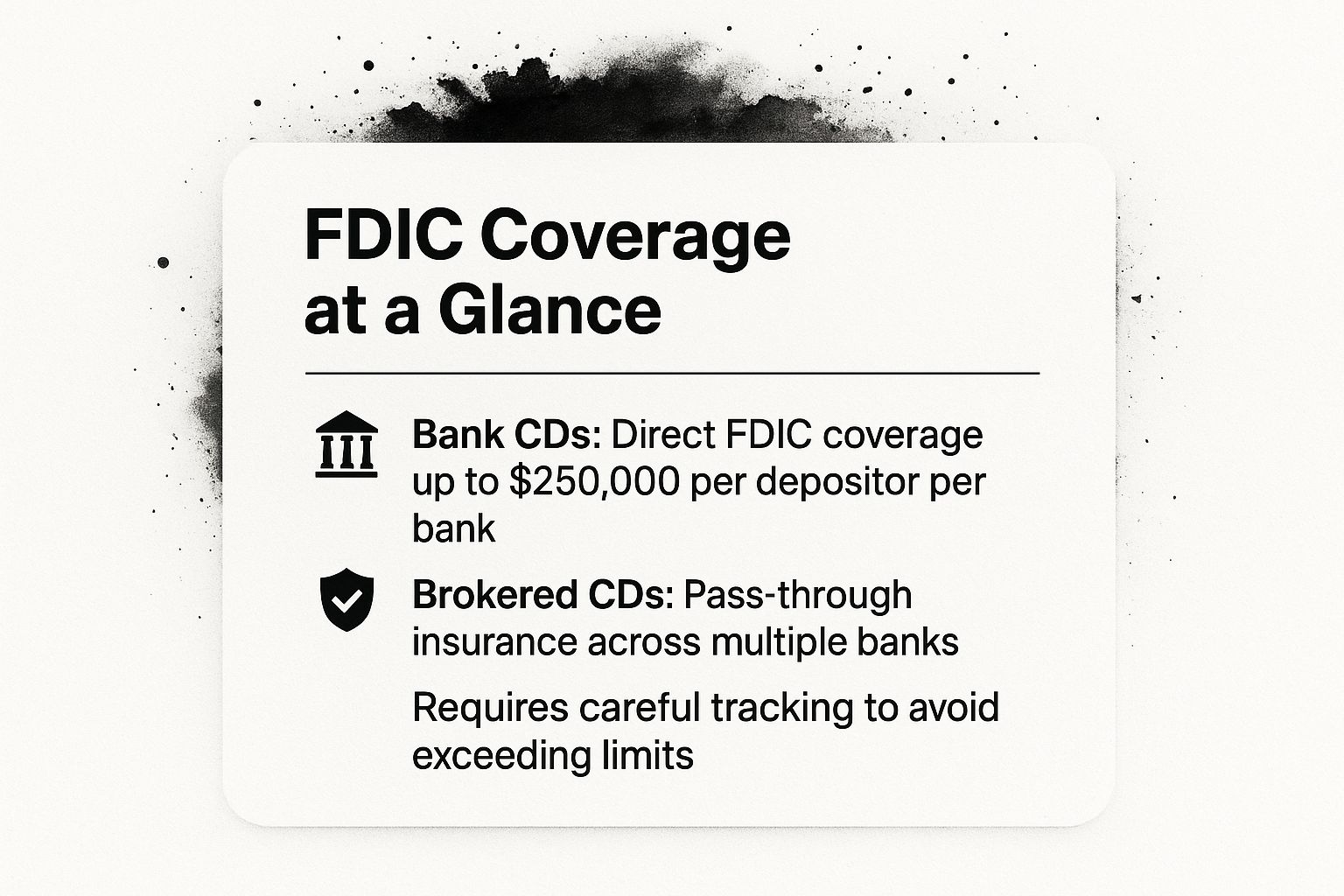

The following infographic provides a quick reference for the key differences in FDIC coverage between bank CDs and brokered CDs:

As this infographic illustrates, while bank CDs offer straightforward FDIC coverage, brokered CDs necessitate careful tracking across multiple banks to maximize insurance protection and avoid exceeding limits at any single institution.

This complexity makes brokered CDs more suitable for investors comfortable managing detailed records and performing regular reviews of their portfolio. It is crucial to verify the FDIC coverage for each underlying bank within a brokered CD portfolio and to understand how the broker handles the aggregation of coverage. This detailed tracking is essential to avoid exceeding the $250,000 limit at any single bank and potentially leaving a portion of your investment uninsured.

So, when should you consider which approach? If you prioritize simplicity and transparency in your FDIC coverage and your deposit amount is within the $250,000 limit, bank CDs offer a straightforward solution. If you have larger sums to invest and are comfortable with the complexities of managing holdings across multiple banks, brokered CDs can offer a way to potentially expand your FDIC coverage. However, the potential for higher coverage comes with the responsibility of meticulous tracking and verification.

Here are some actionable tips to ensure your CD investments are properly insured:

- Maintain detailed records: Keep a spreadsheet or use a financial tracking tool to record all your brokered CD holdings, specifying the issuing bank and the amount invested.

- Verify FDIC coverage: Regularly check the FDIC website or contact each bank directly to confirm their insurance status and coverage limits.

- Consider spreading deposits: If you have large deposits, consider spreading them across multiple direct bank relationships to maximize FDIC coverage without the complexities of brokered CDs.

- Review coverage annually: Your deposit amounts and bank relationships may change over time. Review your FDIC coverage annually, or whenever a significant change occurs, to ensure continued protection.

By understanding the nuances of FDIC coverage for both bank CDs and brokered CDs, you can make informed decisions that protect your investments and provide peace of mind.

2. Liquidity and Secondary Market Access

One of the most crucial distinctions between brokered CDs and bank CDs lies in their liquidity options. This factor significantly impacts your ability to access your funds before maturity without incurring substantial penalties. Understanding the nuances of liquidity for each type of CD is essential for making informed investment decisions aligned with your financial goals and risk tolerance. Bank CDs typically lock your funds in for a specific term, and accessing them prematurely often triggers a penalty, usually calculated as a percentage of the interest earned or a fixed number of months' worth of interest. Brokered CDs, on the other hand, offer a potential escape route through secondary markets, where they can be bought and sold like bonds. This provides greater flexibility but introduces market risk, as the value of your CD can fluctuate based on prevailing interest rates.

Let's delve deeper into the specifics. With bank CDs, the early withdrawal penalties are generally predictable, typically ranging from 3 to 12 months of interest, depending on the term and the issuing bank. This predictability allows for planning, as you can calculate the exact cost of early access. Brokered CDs, conversely, don't have a fixed penalty structure for early withdrawals. Instead, their liquidity relies on the secondary market. While you can potentially sell your brokered CD before maturity without the fixed penalties of a bank CD, the price you receive depends on market conditions. This market-based pricing creates the potential for selling your CD below its face value, particularly in a rising interest rate environment.

For instance, imagine you purchased a 5-year brokered CD. After two years, interest rates rise significantly. If you need to sell your CD on the secondary market, you might only receive 95% of its face value, resulting in a principal loss. Conversely, if interest rates were to fall after your purchase, you could potentially sell your brokered CD at a premium. This potential for gain or loss makes brokered CDs a somewhat riskier investment than bank CDs regarding liquidity. Compare this to a bank CD with a 6-month interest penalty for early withdrawal. While you lose a portion of your earnings, your principal remains protected.

Platforms like E*TRADE offer robust secondary markets for brokered CDs, displaying real-time bid and ask spreads, which represent the prices buyers and sellers are willing to transact at. Understanding these spreads is crucial for assessing the potential proceeds from a sale.

This distinction in liquidity underscores why comparing brokered CDs vs bank CDs is crucial for savers. The choice between the predictable penalty structure of a bank CD and the market-dependent liquidity of a brokered CD hinges on your individual circumstances, risk tolerance, and financial objectives. If you prioritize absolute safety of principal and predictable early withdrawal costs, a bank CD may be more suitable. However, if you value potential access to your funds with the understanding of market risk, a brokered CD might align better with your needs.

Pros of Brokered CDs:

- Potential to Sell Without Fixed Penalties: Avoid the structured penalties associated with bank CDs.

- Secondary Market Access: Provides liquidity options not available with bank CDs.

Cons of Brokered CDs:

- Potential for Principal Loss: Selling below face value is possible in rising rate environments.

- Market Risk: Secondary market pricing is subject to interest rate fluctuations.

Pros of Bank CDs:

- Predictable Penalty Structure: Allows for accurate planning of early withdrawal costs.

Cons of Bank CDs:

- Limited Flexibility: Penalty-based early withdrawal may restrict access to funds.

Tips for Navigating the Secondary Market for Brokered CDs:

- Monitor Interest Rate Trends: Understand how rate changes impact your CD's value.

- Calculate Total Cost: Include commissions and other fees when assessing potential sale proceeds.

- Compare to Bank CD Penalties: Weigh the potential market loss against the fixed penalty of a bank CD.

- Consider a CD Ladder: Learn more about Liquidity and Secondary Market Access Laddering can reduce your reliance on early withdrawals by staggering maturity dates.

By carefully considering these factors and understanding the dynamics of liquidity and secondary markets, you can make a well-informed decision when choosing between brokered CDs and bank CDs.

3. Interest Rate Shopping and Competitive Yields

One of the most critical factors when considering Certificates of Deposit (CDs) is the interest rate, which directly impacts your returns. A key difference between brokered CDs and bank CDs lies in the process of shopping for competitive yields. This difference can significantly impact your overall return and the effort required to manage your investments. Understanding how interest rate shopping works for each type of CD is essential for maximizing your earnings potential.

With brokered CDs, you gain access to a vast network of CD offerings from numerous banks, often hundreds, all aggregated onto a single platform. Platforms like those offered by Charles Schwab, Fidelity Investments, Vanguard, and Merrill Lynch exemplify this streamlined approach. Imagine browsing through CDs from banks across the country without needing to visit each institution individually. This centralized access allows for efficient comparison shopping and exposes you to smaller banks and credit unions that might offer highly competitive rates but lack the widespread visibility of larger institutions. For example, you might find a small community bank in another state offering a significantly higher yield than your local branch.

Conversely, shopping for bank CDs involves a more direct, albeit potentially more time-consuming, approach. You'll need to contact individual banks, either in person, online, or by phone, to inquire about their current CD rates. This can be advantageous if you have an existing relationship with a particular bank, as they may offer preferential rates to loyal customers. For example, a community bank might offer a 0.25% rate premium for existing customers. This personalized approach also allows for direct communication with the issuing institution, providing a clearer understanding of the terms and conditions.

While both brokered and bank CDs may offer promotional rates, the access point differs. With bank CDs, promotional rates are typically advertised directly by the institution. With brokered CDs, these same promotional rates from online banks and other institutions are often available through the brokerage platform. This means you can potentially snag a competitive promotional rate without opening a new account directly with each individual bank.

However, there are trade-offs to consider. Brokered CDs often limit your ability to negotiate rates, as the brokerage platform sets the terms. Furthermore, there's a potential for a markup in brokered CD rates, meaning the rate you receive might be slightly lower than what the issuing bank originally offered, as the brokerage takes a small cut. Bank CDs, while offering the potential for relationship-based rate improvements, require a significant time investment to shop effectively across multiple institutions.

To make the best decision, it’s vital to weigh the pros and cons based on your individual circumstances and financial goals. Are you prioritizing ease of access and a broad selection, or do you value the potential for personalized service and rate negotiation? This aspect of the "brokered CD vs bank CD" debate is crucial for optimizing your investment strategy.

Here are some actionable tips to consider when shopping for CD rates:

- Compare: Regularly compare brokered CD rates against direct bank offerings to ensure you're getting the best possible return. Don’t just assume one is always better than the other.

- Relationships Matter: Consider any relationship benefits you might have with existing banks. A small rate premium for loyalty could outweigh the convenience of a brokered CD.

- Factor in Fees: When comparing brokered CDs, factor in any brokerage fees to accurately assess the total return.

- Monitor Promotions: Keep an eye out for promotional rate periods and requirements for both brokered and bank CDs. Often, these offer the most attractive yields.

- Use Tools: Learn more about Interest Rate Shopping and Competitive Yields and utilize available tools to compare different scenarios and make informed decisions.

Understanding the nuances of interest rate shopping for brokered CDs versus bank CDs empowers you to make strategic choices that align with your financial objectives. Whether you're a seasoned investor or just starting to explore CDs, diligently comparing rates and considering the pros and cons of each option will pave the way for maximizing your returns.

4. Fees and Cost Structure: Unmasking the True Cost of Your CD

When comparing brokered CDs vs bank CDs, understanding the fee structure is crucial for maximizing your returns. While both offer a fixed interest rate over a specific term, their cost structures differ significantly, potentially impacting your overall earnings. A seemingly small difference in fees can erode your returns over time, particularly with longer-term CDs. This section delves into the nuances of fees associated with both brokered and bank CDs, empowering you to make informed investment decisions.

Bank CDs: Simplicity and Transparency (Mostly)

Bank CDs typically boast a straightforward fee structure. In most cases, you won't encounter any transaction fees for purchasing a CD directly from a bank. This simplicity makes it easy to calculate your potential returns. However, some banks may impose monthly or annual maintenance fees on your account, especially if your balance falls below a certain threshold. These fees can chip away at your interest earnings, particularly on smaller CD deposits. For example, a community bank might offer fee-free CDs but require a minimum deposit of $1,000 to avoid monthly maintenance charges.

Brokered CDs: Navigating the Fee Landscape

Brokered CDs introduce a more complex fee structure. While offering access to a wider range of CDs from various banks, they often come with transaction fees, typically ranging from $1 to $25 per transaction. Some brokerages, like TD Ameritrade, charge a $25 transaction fee for each brokered CD purchase. This can add up if you're laddering CDs or frequently trading. Beyond transaction fees, some brokerage accounts may also have annual or monthly maintenance fees, further impacting your net return.

A less transparent aspect of brokered CD fees lies in the potential for embedded markups within the stated interest rate. Brokers earn revenue by purchasing CDs from banks at a slightly lower rate and selling them to investors at a slightly higher rate. This markup, while not always explicitly disclosed, effectively reduces your overall return. Understanding this dynamic is essential when comparing brokered CD rates with those offered directly by banks.

Weighing the Pros and Cons

Bank CDs:

- Pros: Transparent fee structure, often fee-free, simplifying return calculations.

- Cons: Potential account fees for low balances can diminish returns on smaller deposits. Limited CD options compared to brokerage platforms.

Brokered CDs:

- Pros: Access to a broader selection of CDs with varying rates and terms. Consolidated reporting and management through a single brokerage account. Competitive pressure among brokers can help keep fees relatively low. Some brokerage platforms, such as Schwab, offer no-fee brokered CD programs for qualifying accounts, enhancing their appeal.

- Cons: Multiple fee layers, including transaction fees and potential markups, can reduce overall returns. Less transparent fee structure in some cases, requiring careful scrutiny.

Making Informed Decisions: Tips for Minimizing Fees

- Calculate the Total Cost of Ownership: Factor in all potential fees, including transaction fees, account maintenance fees, and potential markups, to accurately assess the true cost of your CD investment.

- Explore Fee Waivers: Many brokerages offer fee waivers for larger deposits or for specific account types. Look for these opportunities to minimize your costs.

- Short-Term CD Considerations: Be particularly mindful of fees when investing in shorter-term CDs. Since the overall return is lower on shorter-term instruments, fees represent a larger percentage of your earnings.

- Negotiate Fee Reductions: For large or multiple CD transactions, don't hesitate to negotiate with your broker for potential fee reductions.

- Compare Apples to Apples: When comparing brokered CD vs bank CD rates, ensure you are comparing the net yield after accounting for all fees. This allows for a more accurate assessment of the true return on your investment.

By carefully considering the fee structure of both brokered and bank CDs, you can make informed decisions that maximize your returns and align with your investment goals. Whether you’re a retiree seeking a stable income stream or a conservative investor diversifying your portfolio, understanding the nuances of CD fees is crucial for successful financial planning.

5. Minimum Investment Requirements

One of the key differentiators between brokered CDs and bank CDs lies in their minimum investment requirements. Understanding these requirements is crucial for choosing the CD that best aligns with your investment goals and available capital. This aspect is especially important when comparing brokered CDs vs bank CDs, as it directly impacts accessibility and potential returns.

How Minimum Investments Work

A minimum investment requirement is simply the smallest amount of money you can deposit to open a specific CD. This threshold varies depending on the financial institution and the type of CD being offered. For bank CDs, the minimum is usually set by the individual bank. Brokered CDs, on the other hand, often reflect the minimums set by the issuing institutions offering the CDs through the brokerage platform.

Bank CDs: Lower Entry Points

Traditional bank CDs generally have lower minimum investment requirements, making them accessible to a wider range of savers. These minimums typically range from $500 to $2,500, allowing individuals with smaller amounts of capital to benefit from the security and fixed returns of CDs. For example, your local credit union might offer CDs starting at $500, providing a low barrier to entry for building a CD ladder or simply setting aside savings. While some online banks might advertise enticing promotional rates, these often come attached to higher minimum deposits, sometimes $25,000 or more. Therefore, it's important to shop around and compare offers carefully.

Brokered CDs: Access to Institutional Rates

Brokered CDs typically require higher minimum investments, often ranging from $1,000 to $10,000 per CD. However, this higher entry point grants access to a wider selection of CDs, including institutional-quality CDs that might not be directly available to individual investors through traditional banks. These institutional CDs can sometimes offer slightly more competitive interest rates. For instance, a brokerage platform like Fidelity might require a $1,000 minimum investment for its brokered CDs, but this gives you access to a marketplace of CDs from various banks and institutions, potentially unlocking better yields. Some brokered CDs are even available in $1,000 increments above the minimum, providing flexibility for structuring larger investments.

Jumbo CDs: A Special Case

Jumbo CDs are CDs with significantly higher minimum deposit requirements, often starting at $100,000. Both banks and brokerages offer Jumbo CDs, but the specific thresholds and associated rates can differ substantially. It's essential to compare offers from both channels to ensure you're securing the best possible return for your large deposit.

Pros and Cons of Minimum Investment Requirements

Bank CDs - Pros: Lower entry points for smaller investors, providing access to CD benefits even with limited capital.

Bank CDs - Cons: May require larger amounts for the best promotional rates, potentially limiting earning potential for smaller investors. Limited flexibility in terms of CD denominations available.

Brokered CDs - Pros: Access to institutional rates and terms, potentially earning higher yields. Flexibility in structuring investment amounts across various CDs.

Brokered CDs - Cons: Higher barriers to entry for small investors, potentially excluding those with limited savings. Finding the optimal combination of CDs to meet minimums can require more research and effort.

Actionable Tips for Navigating Minimum Investments

- Start Small: If you are working with smaller amounts, starting with bank CDs is often the best approach. This allows you to gain experience with CDs and gradually increase your investments.

- Pool Funds: If you are interested in brokered CDs but don't meet the minimum investment requirements for a single CD, consider pooling funds with family members or friends. This can allow you to access higher rates and diversify your holdings. However, be aware of the implications of joint ownership.

- CD Laddering: Implementing a CD ladder can help manage minimum requirements effectively. By staggering your CD maturities, you can reinvest smaller amounts as CDs mature, gradually increasing your overall investment in brokered CDs over time.

- Rate Comparisons: Always compare the potential rate improvements against the minimum investment increases. A slightly higher rate might not be worth it if it requires a substantially larger investment.

By understanding the minimum investment requirements of both brokered CDs and bank CDs, you can make informed decisions that align with your financial goals and available resources. Careful consideration of these requirements is crucial for maximizing your returns while maintaining a suitable level of investment risk.

6. Term Variety and Callable Features

When comparing brokered CDs vs bank CDs, a key differentiator lies in the variety of terms and the presence of callable features. This aspect can significantly impact your investment strategy and potential returns, making it a crucial factor to consider when choosing between the two. Understanding the nuances of term variety and callable features empowers you to make informed decisions aligned with your specific financial goals.

Bank CDs typically offer standardized terms, most commonly 6, 12, 24, and 36 months. This predictability can be advantageous for individuals seeking straightforward, easily understood investment options. However, this limited selection might not cater to every investor's needs, especially those looking for more flexibility in aligning CD maturities with specific financial goals.

Brokered CDs, on the other hand, open up a world of possibilities with a much wider range of terms. You can find brokered CDs with maturities ranging from a few months to several years, including unusual terms like 7 months, 18 months, or even 21 months. This flexibility allows you to fine-tune your CD portfolio to better match your anticipated expenses or other investment timelines. For example, if you anticipate needing a lump sum in 15 months for a down payment, a brokered CD with a matching term could be an ideal solution. This granular control over maturity dates is a distinct advantage offered by brokered CDs and is particularly valuable for building CD ladders, a strategy we’ll discuss shortly.

A critical feature often associated with brokered CDs, and less common with bank CDs, is the "callable" feature. A callable CD allows the issuing institution to redeem the CD before its maturity date. This typically happens when interest rates fall, allowing the issuer to refinance their debt at a lower rate. While callable CDs often offer higher initial interest rates to compensate for this call risk, it's essential to understand the implications.

Imagine a scenario where you invest in a 15-month callable CD paying 4.5%, while a comparable non-callable CD offers 3.8%. The higher yield of the callable CD is attractive, but if interest rates decline significantly within that 15-month period, the issuer might call the CD. This means you'll receive your principal and accrued interest, but you’ll then face the challenge of reinvesting your funds at potentially lower rates. This is known as reinvestment risk. Conversely, if you had opted for the non-callable CD at 3.8%, your rate would be locked in for the entire term, providing predictable returns regardless of market fluctuations. Bank CDs offer this rate protection throughout the term, shielding you from the uncertainty of potential early redemption. Learn more about Term Variety and Callable Features

The broader range of terms offered by brokered CDs also allows for greater flexibility in structuring CD ladders. A CD ladder involves investing in multiple CDs with staggered maturity dates. This strategy provides both liquidity and potentially higher returns. The varied terms available through brokers make it easier to construct a ladder tailored to your specific needs. For instance, you could purchase brokered CDs maturing every six months over a five-year period. As each CD matures, you can either reinvest it at the prevailing rate or use the funds for planned expenses.

Brokered CDs also often feature step-up CDs, where the interest rate increases at predetermined intervals throughout the term. For example, a five-year step-up CD might increase its rate annually, offering the potential for higher returns as time progresses. While some banks offer step-up CDs, they are more commonly available through brokers.

Before investing in brokered CDs, especially callable CDs, carefully evaluate the call provisions. Understand the conditions under which the CD can be called and how the call price is calculated. Consider the potential impact of call risk, particularly in declining rate environments. Diversifying your CD holdings between callable and non-callable CDs can help mitigate this risk. Finally, factor potential call scenarios into your overall investment planning to avoid unexpected disruptions to your financial goals.

When choosing between brokered CDs vs bank CDs, consider your individual needs and risk tolerance. If you prioritize predictability and rate protection, bank CDs with their standard terms and non-callable nature might be a better fit. However, if you seek higher potential yields, greater flexibility in terms, and the ability to fine-tune your CD portfolio, brokered CDs, despite the complexities of callable features, could be a more suitable option.

Brokered CD vs Bank CD: Key Feature Comparison

| Feature / Difference | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| FDIC Insurance Coverage Complexity | Medium - requires careful tracking of multiple banks for brokered CDs | Moderate - record-keeping and verification needed | High protection if managed properly; risk of gaps if not | Investors seeking maximized FDIC coverage across banks | Bank CDs: Simple FDIC coverage; Brokered CDs: Extended coverage potential |

| Liquidity and Secondary Market Access | Medium - brokered CDs allow secondary market sales; bank CDs have penalties | Moderate - monitoring market and penalties | Flexible liquidity for brokered CDs; penalty costs for bank CDs | Investors needing potential early liquidity without penalty | Brokered CDs: Sell before maturity; Bank CDs: Predictable penalty costs |

| Interest Rate Shopping and Competitive Yields | Low to Medium - brokered platforms simplify rate comparison | Low - one platform access vs. multiple banks | Potentially higher yields via brokered CDs; bank CDs benefit from relationship rates | Yield-focused investors shopping across many banks quickly | Brokered CDs: Wide rate access; Bank CDs: Relationship perks |

| Fees and Cost Structure | Low - generally straightforward for bank CDs, variable for brokered CDs | Low to Moderate - transaction and maintenance fees possible | Possible reduced net returns due to fees on brokered CDs | Cost-conscious investors preferring transparency | Bank CDs: Usually no fees; Brokered CDs: Consolidated management |

| Minimum Investment Requirements | Low - bank CDs lower minimums; brokered CDs often higher minimums | Low - depends on investment size and platform | Accessible for small investors with bank CDs; better institutional rates via brokered CDs | Small investors and those seeking institutional terms | Bank CDs: Lower entry; Brokered CDs: Access to institutional rates |

| Term Variety and Callable Features | Medium - callable and unusual terms in brokered CDs require understanding | Low to Moderate - evaluating terms and call risk | Higher yields possible but with call/reinvestment risk | Investors wanting diversified term options and yield optimization | Brokered CDs: Callable and step-up options; Bank CDs: Rate stability |

Making the Choice: Brokered or Bank?

Deciding between a brokered CD vs bank CD requires careful consideration of your individual financial circumstances and goals. We've explored six key differences: FDIC insurance nuances, secondary market accessibility, interest rate competitiveness, fee structures, minimum investment requirements, and term variety, including callable CDs. Understanding these factors is crucial for maximizing your returns while minimizing risk. For example, if immediate access to your funds is paramount, a bank CD might be preferable due to potential penalties associated with selling brokered CDs on the secondary market. Conversely, if you prioritize the highest possible yield and access to a broader range of terms and issuers, brokered CDs could be the better choice. Mastering these concepts empowers you to align your CD investments with your broader financial plan, whether you're seeking predictable returns, building a secure retirement income stream, or diversifying your portfolio with low-risk options.

Ultimately, the best CD for you depends on your unique needs. By carefully weighing the pros and cons of brokered CDs vs bank CDs, you can confidently navigate the CD market and make informed decisions that pave the way for financial success. Ready to explore your options? Our Certificate-of-Deposit Calculator allows you to model various scenarios and compare rates for both brokered and bank CDs, helping you pinpoint the ideal investment for your specific financial objectives.