The smartest place to keep an emergency fund is in a dedicated account that balances two critical needs: immediate access and some potential for growth. A high-yield savings account (HYSA) is a top contender, ensuring your money is liquid enough for a crisis but also works to counter inflation—something your standard checking account just can't do.

Why The Right Account For Your Emergency Fund Matters

Picking a home for your emergency fund is more than just a box to check on your financial to-do list. It's about building your first line of defense. The location of these savings is a strategic choice that protects your money's value while keeping it ready for action.

This isn't just theory; it's a major focus for many households. A 2024 study found that 38% of people name unexpected expenses as their biggest financial worry, thanks to inflation and economic jitters. The good news? The same research showed that 80% believe having a plan in place helps them manage these costs, which underscores why a well-placed emergency fund is so important.

The Core Trade-Off: Liquidity vs. Yield

When deciding where to park your emergency cash, you're always balancing two key factors:

- Liquidity: How fast can you get your hands on the money without paying a penalty? A real emergency means you need funds within a day or two, not a week.

- Yield: How much interest is your money earning? A higher yield helps your savings keep pace with—or even beat—inflation, preserving its buying power over time.

Your emergency fund's primary job is safety, not aggressive growth. The goal is to find that sweet spot where your money is accessible but not sitting idle.

While a cash fund is a versatile safety net, it's also just one piece of the puzzle. It’s wise to understand how it fits with other protections, like the role of health insurance versus personal savings when facing medical bills.

Next, we'll compare the top options—high-yield savings accounts, money market accounts, and short-term CDs—to help you decide which is the right fit for you.

Comparing Your Emergency Fund Options

So, where should you actually keep your emergency fund? It's not a one-size-fits-all answer. The best spot for your cash comes down to a constant balancing act between liquidity (how fast you can get it), yield (how much it earns), and safety (how protected it is). Getting a handle on this trade-off is the first step.

A high-yield savings account (HYSA) is the classic choice for a reason. It offers a great mix of competitive interest rates and easy access. You can typically get your money via electronic transfer in one to three business days, which is fast enough for most emergencies. For many people, this is the perfect middle ground.

The Hybrid Approach of Money Market Accounts

A money market account (MMA) is an interesting hybrid, borrowing features from both savings and checking accounts. They often pay a slightly higher interest rate than a standard savings account and sometimes include a debit card or even check-writing privileges.

This extra convenience is a big deal. It gives you immediate, ATM-style access to your funds without having to sacrifice much in the way of yield.

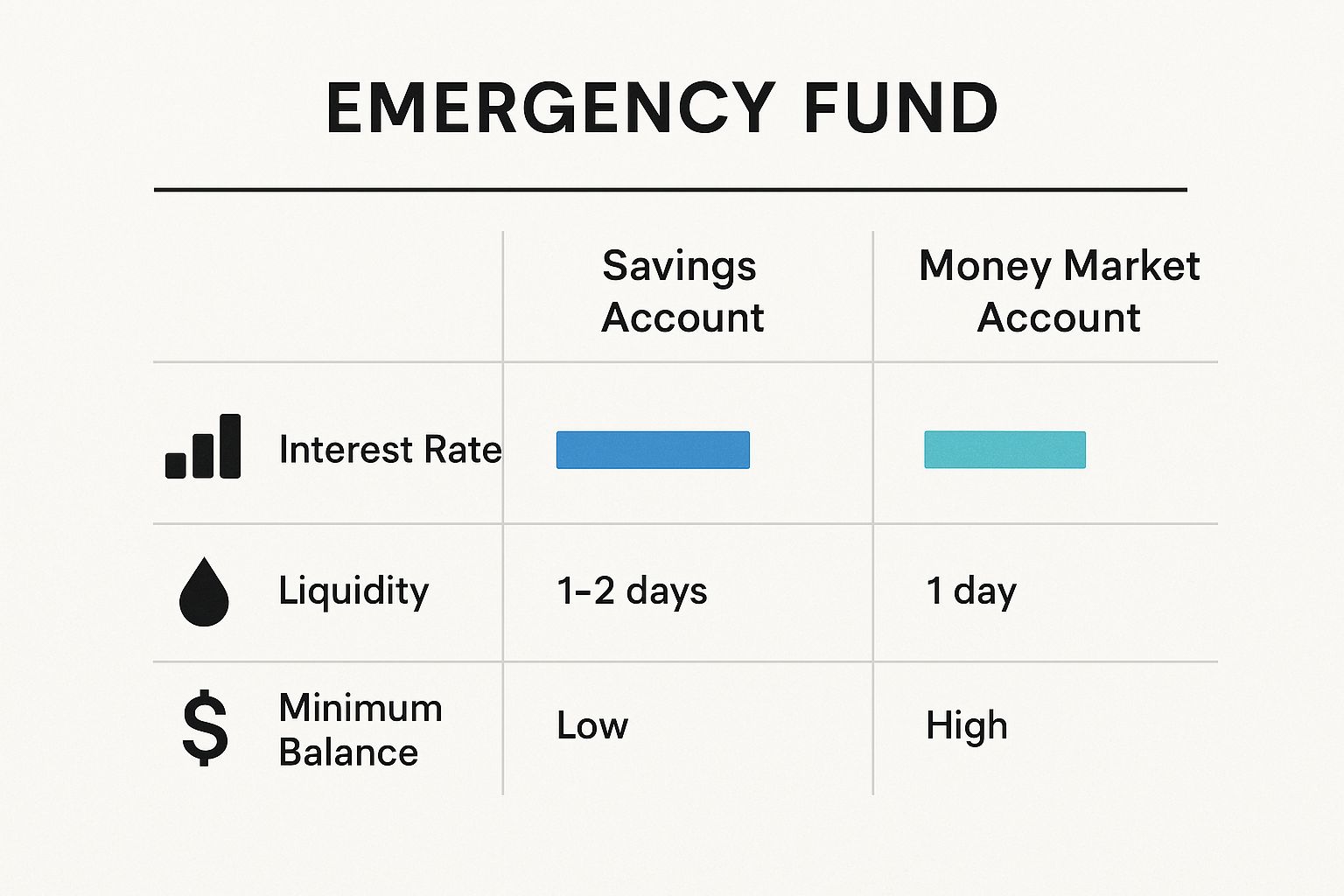

The image below breaks down the core differences between a garden-variety savings account and an MMA.

As you can see, the main catch with MMAs is that they often demand a higher minimum balance to earn the best rates and avoid fees. If you can comfortably meet that requirement, they’re a fantastic option.

Below is a quick-glance table comparing the most common account types for an emergency fund. It's designed to give you a high-level view of how each option stacks up across the key decision factors.

Emergency Fund Account Comparison

| Account Type | Typical Liquidity | Potential Yield | Key Feature |

|---|---|---|---|

| High-Yield Savings (HYSA) | Very High | Moderate | The ideal blend of solid yield and fast access. |

| Money Market Account (MMA) | Highest | Moderate | Savings-like rates with checking-like access. |

| Short-Term Certificate of Deposit (CD) | Low | High | Fixed, higher rates in exchange for locked funds. |

| Cash/Checking Account | Immediate | Very Low | Maximum liquidity but almost no growth. |

This table highlights the core trade-off: as you reach for higher yields (like with a CD), you generally have to give up some liquidity. The key is finding the right balance for your specific needs and comfort level.

The Role of Short-Term CDs

Finally, we have short-term certificates of deposit (CDs). With a CD, you agree to lock your money up for a specific term—anywhere from a few months to a year—and in return, the bank gives you a fixed, and often higher, interest rate. The big drawback? Penalties. You’ll pay a fee if you need to pull your money out before the term is up, which makes them much less liquid.

A short-term CD is best used as a secondary layer of your emergency fund—what's known as a tiered strategy. You might keep one to two months of expenses in a highly liquid HYSA and another few months' worth in a CD to capture a higher return.

This tiered approach requires a bit more active management, but it’s a smart way to get more of your emergency savings working for you. If you want to dig deeper into CDs, you can check out our guide on whether CDs are a good investment right now. Each of these accounts has its place; it all depends on your personal strategy and how you weigh the need for growth against the need for immediate cash.

A Detailed Look at the Top Emergency Savings Accounts

Alright, let's move past the theory and get practical. Deciding where to park your emergency fund comes down to understanding the real-world trade-offs between High-Yield Savings Accounts (HYSAs), Money Market Accounts (MMAs), and short-term Certificates of Deposit (CDs). Each plays a very different role, and the "best" one depends entirely on your situation.

The need for this is more urgent than ever. Bankrate’s 2025 Annual Emergency Savings Report painted a pretty stark picture: a staggering 24% of U.S. adults have zero emergency savings. Only 46% have enough stashed away to cover three months of expenses. And with 37% having to dip into their funds in the past year, choosing the right account is critical. You can see the full breakdown in Bankrate's report here.

The Modern Simplicity of High-Yield Savings Accounts

There's a reason high-yield savings accounts have become the default choice for so many. They are the workhorses of the savings world. Because they're mostly offered by online banks with low overhead, they can pass those savings on to you with much higher interest rates than you'd find at a typical brick-and-mortar bank.

Their main draw is the killer combination of a competitive yield and excellent liquidity. You can link an HYSA to your checking account and pull money out electronically in just one to three business days. For most unexpected bills, that's a perfect timeline—you get a buffer without giving up meaningful growth.

Key Differentiator: The HYSA's strength is its simplicity. It offers one of the best blends of a strong interest rate and easy access, all with minimal fuss or high balance requirements. For most people building their first emergency fund, this is the place to start.

The Hybrid Power of Money Market Accounts

Money Market Accounts, or MMAs, sit in a unique middle ground, mixing features from both savings and checking accounts. They often pay rates that are right up there with HYSAs but add a layer of convenience you don't get elsewhere: a debit card and check-writing privileges.

This feature can be a lifesaver. Imagine your water heater bursts and the plumber needs payment on the spot. Instead of scrambling to transfer funds, an MMA lets you just write a check or swipe a card. That instant access is the MMA's biggest selling point.

Of course, there's a catch. This convenience sometimes requires a higher minimum balance to earn the best rates or to dodge a monthly fee. If your emergency fund is large enough to clear those hurdles, an MMA offers unmatched liquidity without much of a sacrifice in yield.

Comparing Key Account Features

| Feature | High-Yield Savings (HYSA) | Money Market Account (MMA) | Short-Term Certificate of Deposit (CD) |

|---|---|---|---|

| Primary Use Case | Your core emergency fund. A great balance of growth and access. | When you need instant access. Valuable for debit/check-writing. | A secondary savings tier to maximize yield on cash you won't need soon. |

| Typical Access | 1-3 day electronic transfer. | Instant (debit/check/ATM) or 1-3 day transfer. | Penalty for early withdrawal. Funds are locked for the term. |

| Best For | Savers who want a high, passive return with solid, easy access. | Savers with a large fund who prioritize instant, checking-like access. | Savers building a tiered fund who can afford to lock away a portion of cash. |

The Strategic Role of Short-Term CDs

Certificates of Deposit (CDs) play by a completely different set of rules. You agree to lock your money up for a specific term—say, three, six, or twelve months—and in return, the bank gives you a guaranteed, and often higher, fixed interest rate. That predictability is their biggest advantage.

The trade-off, however, is a major hit to liquidity. If you pull your money out before the CD matures, you'll get hit with an early withdrawal penalty, which usually wipes out a few months of interest. For that reason, a CD is a terrible place for your entire emergency fund. If you want to dive deeper into how they stack up against regular savings, check out our in-depth comparison of CDs versus savings accounts.

Where CDs really shine is as part of a "tiered" or "laddered" emergency fund strategy. You might put the first three months of expenses in a liquid HYSA, and then place the money for months four through six into a short-term CD. This lets you squeeze a better return out of the cash you're less likely to need in a hurry, optimizing your overall savings without putting your core fund at risk.

Choosing the Right Account for Your Life Stage

There’s no single “best” account for an emergency fund. The right choice is deeply personal—it hinges on your career, your income stability, and where you are in life. What works for a freelancer with a feast-or-famine income stream is completely different from what a homeowner with a predictable salary needs.

To make this tangible, let’s walk through a few real-world scenarios. By looking at how different people might solve this problem, you can see your own situation more clearly and pick a strategy that feels right.

The Freelancer With Unpredictable Income

Let's start with Alex, a freelance graphic designer. Some months, Alex lands a huge project; other months are crickets. Cash flow is a constant moving target. For someone in this position, liquidity and flexibility are everything.

A high-yield savings account (HYSA) is the clear winner here. It offers a decent interest rate, so the fund can still grow a bit during the good months. But the real benefit is instant, penalty-free access. If Alex gets hit with a surprise tax bill or needs to cover rent during a slow period, the money is available in a day or two.

A money market account might work, but some come with high minimum balance requirements that could add stress when work is slow. The sheer simplicity of an HYSA is perfect for anyone who needs their safety net to be simple and always on standby.

Key Takeaway for Flexible Earners: When your income is all over the map, you need maximum liquidity. An HYSA hits the sweet spot between easy access and reasonable growth, giving you a reliable safety net without the fuss.

The Established Homeowner Building Wealth

Now, let's look at Sarah and Tom. They're in their late 30s with stable jobs and a mortgage. They've already done the responsible thing and built a six-month emergency fund, which sits in an HYSA. Their immediate needs are covered. Now, they want to make any extra savings work a bit harder.

This is a textbook case for a tiered or laddered CD strategy. They could take three months' worth of additional savings and lock it into a 6-month or 1-year CD. This slice of their cash will earn a better, fixed interest rate. Since their core emergency fund is still liquid in the HYSA, they can afford to have this secondary layer tied up for a short time. It's a smart way to optimize their overall return without touching their primary safety net.

The Cautious Saver Nearing Retirement

Finally, meet David, who is about ten years from retirement. His priority has shifted from aggressive growth to capital preservation and stability. He’s already saved a substantial emergency fund and wants to avoid risk, but he doesn't want his cash eaten by inflation.

For David, a Money Market Account (MMA) at his main bank could be the perfect fit. MMAs often pay rates comparable to HYSAs but come with the convenience of a debit card and check-writing privileges. David values keeping his finances streamlined at one institution, and this feature is a big plus. The stability of an MMA, combined with its easy-access tools, gives him exactly the peace of mind he’s looking for at this stage.

How To Build A Tiered Emergency Fund

Let's move from theory to action. A tiered emergency fund is a smarter, more practical way to organize your savings. Instead of dumping all your cash into one account, you strategically split it across different account types. This setup perfectly balances your need for immediate cash with the chance to earn a decent return.

Think of it as organizing your money into layers, where each layer has a specific job. The first tier is for instant, "the-sky-is-falling" needs, while the outer tiers can afford to be a little less liquid in exchange for higher yields.

Calculating Your Tiers

First things first: you need a target number. The standard advice is to save three to six months of essential living expenses. Once you know your total, you can divide it into these three distinct tiers.

- Tier 1 (Immediate Access): This holds one month of expenses. This is your "fire extinguisher" money—cash you need instantly for a true crisis, like a burst pipe or an emergency vet visit.

- Tier 2 (Short-Term Crises): This is the core of your fund, holding two to three months of expenses. It's designed to cover bigger disruptions, like a temporary job loss or a surprise medical bill.

- Tier 3 (Long-Term Security): This is for any additional savings, usually 2+ months' worth. It's the part of your fund you're least likely to touch, making it the perfect candidate for chasing higher returns.

A tiered strategy is about making your entire emergency fund work harder. By segmenting your cash based on how quickly you might need it, you ensure you’re never caught short but also never leave too much money earning next to nothing.

Structuring Your Tiered Fund

With your amounts calculated, the next step is picking the right home for each tier's cash. This is where you match the account type to the tier's purpose.

Tier 1 Account: Linked Savings or Checking

Your first month of expenses belongs in the most liquid account you have. A basic savings account linked directly to your primary checking is perfect. The goal here isn't yield; it's 100% immediate access. You need to be able to move this money in seconds, not days.

Tier 2 Account: High-Yield Savings or Money Market

Here’s where you’ll stash the next two or three months of expenses. A high-yield savings account (HYSA) is an ideal fit, offering a competitive interest rate while keeping the money accessible within one to three business days. A money market account (MMA) is also a great choice, especially if you value the added convenience of a debit card or check-writing privileges.

Tier 3 Account: Short-Term CDs

For your final tier—the money you hope you never need—a short-term CD makes a lot of sense. A 3-to-6-month CD will almost always offer a higher, fixed interest rate than a variable-rate HYSA. Since you have Tiers 1 and 2 as a buffer, you can afford to lock this portion up to earn a better, guaranteed return.

For those interested in a more advanced technique, you could explore building a CD ladder. You can learn more about how a CD ladder for an emergency fund can systematically boost your returns while still managing liquidity.

The final, crucial step? Automate it. Set up weekly or monthly transfers to build each tier without having to think about it.

Common Questions About Storing Your Emergency Fund

Even with a solid plan, a few questions always seem to pop up right when you're ready to commit. Getting clear answers is the final step to building a financial backstop you can truly rely on.

Let's walk through the most common sticking points to clear up any lingering confusion.

How Much Money Should I Actually Save?

This is usually the first question on everyone's mind. While the perfect number is personal, financial experts give us a solid rule of thumb: aim to save three to six months of essential living expenses.

What does that look like in real dollars? For an average U.S. household, the target for 2025 is around $35,000.

Of course, there's a big difference between the ideal and the reality. The median balance in U.S. household transaction accounts is just $8,742—enough for about a month and a half of expenses. You can find more details on these emergency fund statistics on Investopedia.

This gap just proves how important it is to start. Don't get hung up on the final number. Aiming for one month's worth of expenses is a fantastic first goal.

Can I Just Invest My Emergency Fund Instead?

It’s a tempting thought. Why settle for a modest return in a savings account when you could chase much higher gains in the stock market?

The short answer is no. Investing your emergency fund is a huge, unnecessary risk.

The whole point of this money isn't growth—it's safety and immediate access. The stock market is famously volatile. Imagine the market tanks right when you lose your job. You'd be forced to sell your investments at a steep loss at the exact moment you need that cash the most. It's a worst-case scenario.

Key Takeaway: Think of your emergency fund as your financial insurance policy. You wouldn't cancel your car insurance to invest the premiums, and you shouldn't expose your safety net to market risk, either.

Keep your investments and emergency savings in separate buckets. Each has a distinct and critical job in your financial life.

Are Online-Only Banks a Safe Place for My Money?

It's a fair question. The best rates for HYSAs and money market accounts are almost always found at online-only banks, which can make some people nervous. Are they as safe as the big brick-and-mortar bank on the corner?

The good news is, yes—they are just as safe, as long as they have the right insurance.

Here’s what to check for:

- For banks: Look for FDIC Insurance from the Federal Deposit Insurance Corporation.

- For credit unions: Look for NCUA Insurance from the National Credit Union Administration.

This insurance protects your deposits up to $250,000 per depositor, per insured institution, for each account ownership category. If an online bank has that FDIC or NCUA logo, your money is just as secure as it would be at a local branch. The only real difference is the lack of a physical building.

Ready to see how a Certificate of Deposit could fit into your tiered savings strategy? Use the Certificate-of-Deposit Calculator to project your earnings and compare different rates and terms. Calculate your potential CD returns now.