Understanding Your Financial Parking Spaces

Choosing between a Certificate of Deposit (CD) and a savings account is a crucial financial decision. It's not a one-size-fits-all answer, but rather a careful consideration of your personal financial timeline and risk tolerance. Think of it as choosing a parking spot: short-term for quick in-and-out access, or long-term for a better rate but with some restrictions. This seemingly simple choice has significant long-term implications. Savvy savers look beyond just the interest rates and consider the bigger financial picture, factoring in opportunity costs and the value of having readily available cash.

The Time Value of Your Money

The key difference lies in when you anticipate needing access to your funds. A savings account offers instant liquidity. You can withdraw your money at any time without penalty. This flexibility typically comes at the cost of a lower interest rate. It's the ideal "short-term parking" for money you might need quickly, such as an emergency fund. Imagine an unexpected medical bill – a savings account ensures you have immediate access to the funds you need.

The Lure of Locked-In Rates

CDs, conversely, offer higher interest rates in exchange for locking your money away for a specific period. This is your "long-term parking," perfect for funds you won't need for months or even years. While the higher rates are enticing, early withdrawal penalties can offset any gains. This makes CDs unsuitable for short-term needs. Recent analyses from 2024 and 2025 reveal that while CDs generally offer higher yields than traditional savings accounts, their true advantage depends on several factors:

- Inflation

- Liquidity Needs

- Market Timing

During the first half of 2025, competitive high-yield one-year CD rates hovered around the mid-4% range. The best high-yield savings accounts offered similar, sometimes slightly lower, rates. For a deeper dive into current rate trends for deposit accounts, discover more insights.

Balancing Act: Access vs. Growth

Ultimately, the best choice hinges on your financial goals and personal preferences. Some prioritize immediate access and peace of mind, even if it means slightly lower returns. Others are comfortable locking away funds for a guaranteed higher yield. The "best" choice isn't always about chasing the highest number, but rather the strategy that aligns best with your individual needs.

Many savers adopt a combined approach, using both savings accounts and CDs to manage different financial objectives simultaneously. This balanced approach allows for both easily accessible funds and long-term growth potential.

The Rate Reality Check: When Numbers Tell Stories

Interest rates are far more than mere numbers; they represent the market's current sentiment. Deciphering this sentiment is crucial when comparing Certificates of Deposit (CDs) and savings accounts. The difference between CD and savings account rates isn't fixed; it shifts considerably, mirroring broader economic conditions. Understanding these shifts is key to making smart financial decisions.

For example, when the Federal Reserve raises interest rates, CD rates usually follow, often rising more significantly than savings account rates. This creates a larger gap, making CDs enticing for locking in higher returns. Conversely, when rates decline, the gap shrinks, and the flexibility of a savings account may become more valuable. This dynamic emphasizes the importance of understanding the prevailing rate environment.

CD interest rates have fluctuated dramatically over the past four decades, directly impacting their attractiveness compared to savings accounts. In the early 1980s, the average one-year CD interest rate soared to over 11%, making CDs a top choice for risk-averse savers. Discover more insights. This historical perspective highlights the potential for significant rate swings and their influence on the CD versus savings account decision.

Decoding the Rate Signals

Smart savers don't simply chase the highest advertised rates; they analyze the underlying trends. They consider factors like inflation and the overall economic outlook. Sometimes, a slightly lower rate on a savings account might be preferable for the flexibility to take advantage of future rate hikes or unexpected opportunities. Understanding the historical context can enhance your understanding of financial instruments like CDs and savings accounts. Learn more about the evolution of money.

Furthermore, don't overlook hidden costs. Early withdrawal penalties on CDs can negate any perceived rate advantage. Savings accounts, while offering lower rates, typically have no such penalties, allowing access to your funds when needed. This makes savings accounts a safer choice for short-term goals or during times of financial uncertainty. You can use a CD calculator to project potential returns and penalties.

Strategic Positioning for Success

Experienced savers often use a hybrid strategy, utilizing both CDs and savings accounts. They might allocate a portion of their funds to a CD for long-term growth while keeping the rest in a savings account for easy access.

This diversified strategy balances the pursuit of higher returns with the need for financial flexibility. This balanced approach helps them navigate market changes and capitalize on opportunities as they arise. Ultimately, strategic planning, not simply chasing rates, leads to long-term financial success.

To illustrate the current rate landscape, let's look at a comparison table:

Let's take a look at current rate offerings for CDs and high-yield savings accounts:

| Product Type | Current Rate Range | National Average | Best Available |

|---|---|---|---|

| High-Yield Savings Account | 4.00% - 5.50% | 4.50% | 5.50% |

| 3-Month CD | 4.75% - 5.25% | 5.00% | 5.25% |

| 6-Month CD | 4.80% - 5.40% | 5.10% | 5.40% |

| 1-Year CD | 5.00% - 5.75% | 5.38% | 5.75% |

| 2-Year CD | 4.90% - 5.60% | 5.25% | 5.60% |

| 5-Year CD | 4.50% - 5.20% | 4.85% | 5.20% |

This table presents a snapshot of the current interest rate environment. As you can see, while longer-term CDs might offer slightly higher rates, high-yield savings accounts provide competitive returns with greater liquidity. It's important to shop around and compare offers from different financial institutions to find the best rates available.

Liquidity: The Price of Financial Flexibility

Liquidity, when comparing Certificates of Deposit (CDs) and savings accounts, is more than just penalty fees. It's about having financial flexibility and options when life throws you a curveball. True liquidity means being able to seize an opportunity or handle a financial emergency without restricted access to your money.

This becomes especially important during unexpected events. Imagine a sudden job loss requiring immediate access to cash. A savings account, with its penalty-free withdrawals, offers a crucial safety net. Having your funds locked in a CD, even with a higher interest rate, could add stress during a difficult time. This is where the true value of liquidity becomes clear.

Let's say a unique investment opportunity appears. Maybe a discounted property or a promising startup needs funding. Liquid funds in a savings account allow you to act decisively. A CD, while potentially offering higher long-term returns, might cause you to miss out due to its inherent illiquidity.

Historically, after the 2008 financial crisis, both savings accounts and CDs offered low yields, reflecting global efforts to stimulate economies. However, starting in 2022, with significant Federal Reserve rate hikes, CD rates surged. For more on historical CD rate trends, explore this informative resource. This highlights how economic conditions can impact the appeal of these financial instruments.

Balancing Liquidity and Yield

The key is balancing the desire for higher CD yields with the need for accessible funds. Savvy savers often use strategies to achieve this. A common approach is maintaining both savings accounts and CDs, allocating funds based on their purpose and timeline.

You might consider exploring the CD ladder strategy. This method staggers CD maturities to balance liquidity and yield optimization. It involves spreading investments across CDs with varying terms, providing access to some funds regularly while still benefiting from higher CD rates. This approach addresses both short-term needs and long-term goals.

Finally, consider the psychological impact of locked-in funds. Some savers prefer having readily available cash, even with slightly lower returns. This peace of mind can lead to better financial decisions by reducing anxiety about unexpected expenses or missed opportunities. The "best" choice isn't always about maximizing yield; it's about finding the right balance between financial growth and peace of mind.

Strategic Timing: Reading The Economic Tea Leaves

Timing the market, whether for stocks or deposit accounts like Certificates of Deposit (CDs) versus savings accounts, is notoriously difficult. Instead of trying to predict the future, focus on understanding the current economic climate and positioning yourself accordingly.

One key indicator is the Federal Reserve's communication. When the Fed signals rising interest rates, CD rates often follow, sometimes more dramatically than savings account rates. This makes CDs attractive for locking in higher returns.

For example, if the Fed hints at multiple rate hikes, a longer-term CD might be appealing. Conversely, if the Fed suggests a pause or rate cuts, the flexibility of a savings account becomes more advantageous.

Beyond The Fed: Other Signals

Beyond the Fed, market sentiment indicators like consumer confidence and inflation expectations also play a role. High inflation often leads to higher interest rates, potentially making CDs more attractive.

However, if inflation is expected to cool down, the flexibility of a savings account might be preferred. This allows you to reinvest at higher rates as they become available.

CD Laddering: A Balanced Approach

Consider CD laddering, a strategy that involves spreading your investment across CDs with varying maturity dates. This lets you benefit from potentially higher CD rates while maintaining some liquidity as CDs mature.

Laddering is particularly useful in a rising rate environment. As shorter-term CDs mature, you can reinvest the proceeds at the then-current higher rates.

The Pitfalls of Conventional Wisdom

Conventional wisdom often suggests locking in long-term CDs when rates are high. This can backfire if rates continue to rise, leaving you stuck with a lower rate. Experienced savers understand this and prioritize flexibility.

They maintain a balance between CDs and savings accounts, adjusting their strategy based on evolving market conditions. This dynamic approach allows them to capture potential upside while mitigating downside risk. It’s about making informed decisions based on current data, not perfect market timing. Understanding these nuances helps optimize your savings strategy according to real-world economic conditions.

Beyond The Basics: Tax Implications and Hidden Considerations

Choosing between a Certificate of Deposit (CD) and a savings account requires looking beyond the surface. While interest rates are a key factor, the real impact on your returns involves taxes, fees, and other often-overlooked details. Let's explore these critical nuances to help you make a more informed decision.

The Tax Impact on Your Returns

Interest earned in both CDs and savings accounts is taxable income. This means the interest you earn is added to your total income and taxed at your individual tax bracket. For those in higher tax brackets, a larger portion of earned interest goes towards taxes, reducing the net return.

This tax impact is generally more significant with CDs due to their typically higher interest rates. While these higher rates are appealing, it's essential to consider the tax consequences, especially for high-income earners. Understanding your personal tax situation is crucial when comparing CDs and savings accounts.

Unmasking Hidden Costs and Benefits

Beyond taxes, various factors can significantly affect your returns. Promotional rates, commonly used to attract new customers, can be misleading. These rates are temporary and often revert to a lower rate after a specific period. Be sure you understand the long-term rate, not just the initial offer.

Relationship banking benefits, such as fee waivers or bonus interest rates, can also influence your decision. Some banks offer perks for customers with multiple accounts or those who maintain certain minimum balances. These benefits can effectively boost your returns, making a seemingly lower-rate option more attractive.

Conversely, minimum balance requirements can introduce unexpected costs. If your balance dips below the required minimum, you may face monthly fees that diminish your earnings. This is especially important with savings accounts, which offer more flexibility with deposits and withdrawals. Carefully review fee structures and balance requirements before making your choice.

Let's look at a table summarizing some of these hidden costs and benefits:

Hidden Costs and Benefits Analysis Comprehensive comparison of fees, penalties, and additional features for CDs versus savings accounts

| Feature | CDs | Savings Accounts | Impact on Returns |

|---|---|---|---|

| Early Withdrawal Penalty | Substantial, often a percentage of the interest earned or a fixed number of months' interest | Usually minimal or none | Can significantly reduce returns for CDs if withdrawn early |

| Promotional Rates | Common, but temporary | Less common, but can be beneficial for short term | Can be misleading; focus on the long-term rate |

| Minimum Balance Requirements | Less common for standard CDs | More common, can incur fees if not met | Can erode returns with fees if minimums aren't maintained in savings accounts |

| Relationship Banking Benefits | Sometimes offered for larger deposits | More common, tied to bundled services | Can enhance returns with fee waivers and bonus rates |

This table highlights some key differences in how fees and benefits can affect your returns. Consider these factors carefully as you compare CDs and savings accounts.

FDIC Insurance and Larger Deposits

Both CDs and savings accounts are typically insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor, per insured bank. However, nuances exist for larger deposits. If your balance exceeds this limit, understanding FDIC insurance is critical. Strategies like distributing deposits across multiple banks or using joint accounts can ensure full coverage, a key consideration for high-net-worth individuals or those with substantial savings.

Finally, think about how these products fit into your overall financial goals. CDs, with their fixed returns, provide stability within a diversified portfolio. Savings accounts, with their readily available funds, offer flexibility. Each plays a distinct role in a comprehensive financial plan. Understanding this clarifies how CDs and savings accounts complement other investment choices, building a strong financial base.

Real-World Decision Framework: When Each Option Wins

Choosing between a Certificate of Deposit (CD) and a savings account isn't about finding the "best" product. It's about selecting the best fit for your specific financial goals. Let's dive into scenarios where each shines. For further reading, check out our guide on savings accounts vs. CDs.

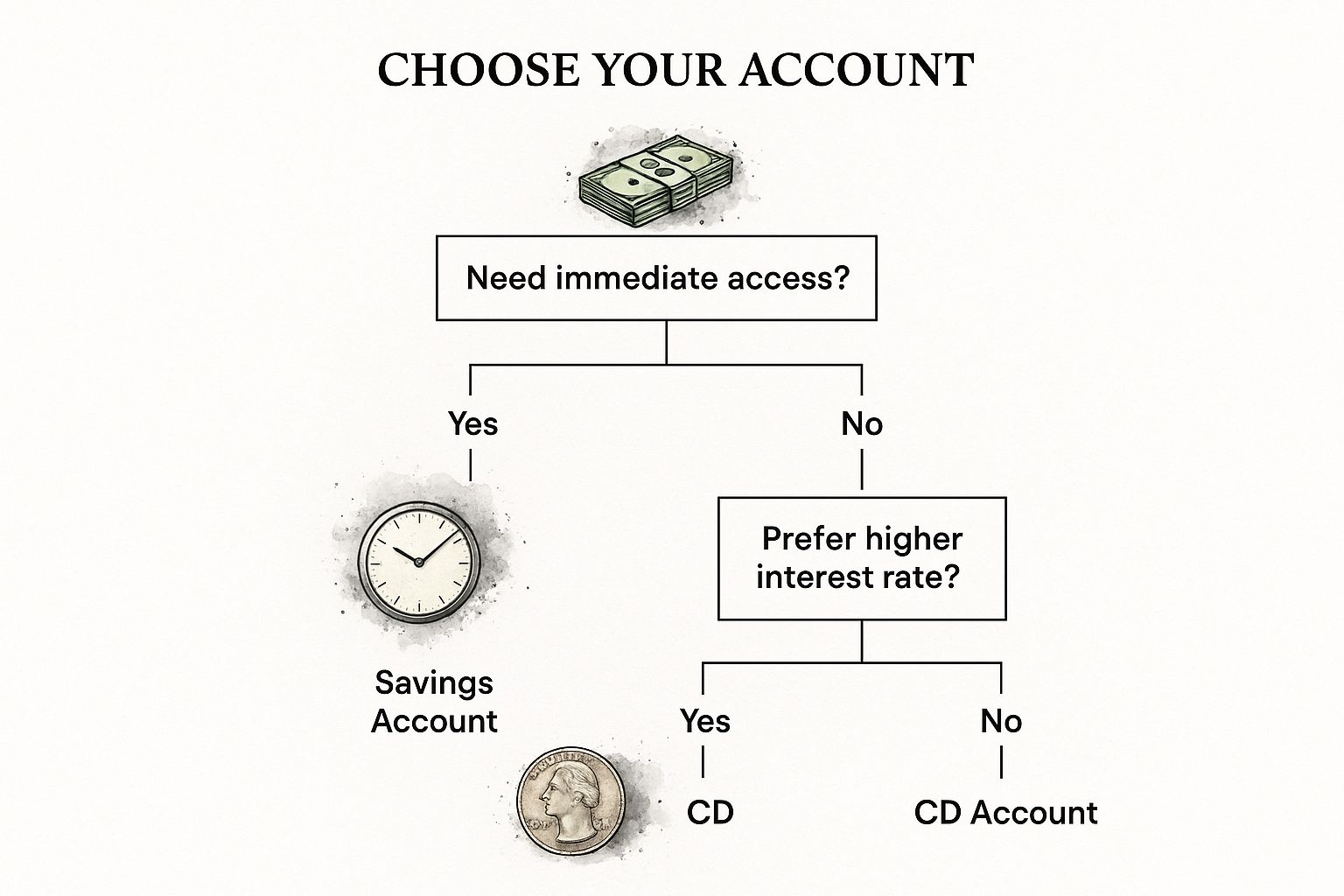

This infographic provides a simplified view of the decision-making process. If you need quick access, a savings account is the obvious choice. If access isn't a priority, then your decision hinges on your preference for a higher interest rate, typically found with CDs. This boils down to the fundamental trade-off: liquidity versus return.

Building an Emergency Fund

Picture this: an unexpected car repair or medical bill. In these situations, instant access to cash is paramount. A savings account is the clear winner here, offering penalty-free withdrawals. A CD, with its fixed term and early withdrawal penalties, could exacerbate financial stress during an emergency.

Saving for a Down Payment

Let's say you're saving for a down payment on a house in two years. A CD, with its fixed interest rate and predictable growth, could be a good fit, especially since your timeframe aligns with a typical CD term. However, if your timeline is flexible, the liquidity of a savings account might be more appealing.

Long-Term Retirement Savings

CDs hold a valuable place in long-term retirement planning, particularly within a diversified portfolio. CD laddering, a strategy involving staggering CD maturity dates, provides both predictable returns and regular access to funds. This balances liquidity with higher yields compared to standard savings accounts. Remember to consider fees as part of your overall cost assessment; exploring strategies to avoid credit card processing fees can be beneficial.

The Hybrid Approach: Combining Strategies

Savvy savers often use a combination of CDs and savings accounts. This hybrid approach allows them to maximize returns on funds they don't need immediately while keeping some money easily accessible for short-term expenses or emergencies. It recognizes that financial needs are rarely static.

Red Flags: Choosing The Wrong Option

Locking your emergency fund in a CD is a major misstep. Conversely, relying solely on a savings account for long-term goals, where predictable growth is crucial, could significantly limit your overall returns. The key is to carefully assess your individual circumstances and financial objectives.

Your Money Strategy Moving Forward

Deciding between a Certificate of Deposit (CD) and a savings account is the first step. Managing your strategy over time is crucial for reaching your financial goals. This means adapting to changing interest rates and life events.

Building Your Personalized Roadmap

First, define your financial goals. Are you building an emergency fund, saving for a down payment, or planning for retirement? Each goal has different timelines and needs for accessing your money, which will influence your choice.

Next, think about your risk tolerance. Are you comfortable locking away funds for a higher return with a CD, or do you prefer the easy access of a savings account? This helps determine your comfort level with CDs and their fixed terms. Someone comfortable with less access might allocate more to longer-term CDs, while someone wanting quick access might prefer a savings account.

After you have a strategy, create a plan. This includes separate accounts for different goals, automating regular contributions, and setting benchmarks to track your progress. Regularly review and adjust. If interest rates rise, you might shift more funds into CDs. If you anticipate needing quick access, a savings account might be better.

Monitoring Market Conditions Without Obsession

Staying informed about market trends is helpful, but don't obsess over daily changes. Look at broader economic indicators, such as Federal Reserve announcements and inflation trends. These give a bigger picture of how rates might affect your savings.

Maintaining Balance and Flexibility

Find a balance between easily accessible savings and money locked in for better returns. This ensures you have funds for unexpected expenses while maximizing returns on long-term savings. A hybrid approach, combining both CDs and savings accounts, is often the best solution.

Consider tools like the Certificate-of-Deposit Calculator to project potential CD returns and compare offerings. This helps you analyze different scenarios and make informed choices, such as exploring CD laddering to optimize returns while maintaining access to some funds.