You've probably heard people talk about "Retirement CDs," but here's the secret: there's no such thing as a special CD product just for retirement. A Retirement CD is simply a standard Certificate of Deposit that you hold inside a tax-advantaged retirement account, like an IRA.

It’s all about the combination. You're taking the predictable, fixed-rate growth of a CD and pairing it with the powerful tax benefits of a retirement account. This simple move creates an incredibly secure foundation for a portion of your savings.

What Are Retirement CDs and How Do They Work?

Think of your retirement account as a financial greenhouse. That greenhouse—whether it's a Traditional or Roth IRA—creates a special environment that protects your investments from the annual tax "weather." Inside this protected space, you can choose to grow different financial "plants."

A Certificate of Deposit is one of the steadiest, most reliable plants you can grow. The deal is straightforward: you agree to deposit a lump sum of money with a bank for a specific amount of time, known as the term length. This can be anywhere from a few months to several years. In exchange, the bank guarantees you a fixed interest rate for that entire term.

The real beauty of using CDs for retirement planning is this rock-solid predictability. You know exactly how much interest you’ll earn and precisely when your money will be available again. This takes the guesswork and market stress out of the equation, which is a huge source of peace of mind.

The Power of the Combination

The magic isn't in the CD itself, but in this strategic pairing. The CD acts as a stable anchor, providing guaranteed growth. The retirement account provides the tax shelter, letting that growth happen much more efficiently.

- The CD's Role: It brings a fixed Annual Percentage Yield (APY) for a set term to the table. Your principal is safe, and your return is guaranteed.

- The IRA's Role: It lets your interest earnings compound without being taxed each year. In a Traditional IRA, the growth is tax-deferred; in a Roth IRA, it's completely tax-free.

This one-two punch makes CDs a go-to for conservative savers who put capital preservation and predictable income first as they get closer to—or are already in—retirement. To get a better handle on the mechanics, you can dive into our guide to Certificate of Deposit basics.

Why the Interest Rate Environment Matters

CD rates aren't set in stone. They move up and down with the wider economy, mostly following the lead of the Federal Reserve. And the swings can be dramatic.

Almost 40 years ago, you could find one-year CDs with average APYs over 11%. But after the 2008 financial crisis, rates cratered, often struggling to get past 1%. More recently, after 11 consecutive rate hikes by the Fed in 2022 and 2023, CD yields shot up to their highest levels in over 15 years. You can see how historical CD interest rates have changed over time on Bankrate.com.

This is critical because the rate you get is the rate you're stuck with for the entire term. Locking in a good rate can make a huge difference, so timing is everything.

To bring it all together, here’s a quick summary of why this strategy works so well for retirement savers.

Retirement CD Quick Facts at a Glance

| Feature | Description | Benefit for Retirement |

|---|---|---|

| Safety | Deposits are FDIC or NCUA insured up to $250,000 per depositor. | Your principal investment is protected, minimizing risk to your nest egg. |

| Predictable Growth | Offers a fixed interest rate for a predetermined term. | Eases financial planning with guaranteed, easy-to-calculate returns. |

| Tax Advantages | When held in an IRA, earnings grow tax-deferred or tax-free. | Maximizes long-term growth by reducing the drag of annual taxes. |

| Flexibility | Terms range from months to years, allowing for staggered maturities. | You can align CD maturity dates with specific retirement income needs. |

As you can see, holding a CD inside a retirement account gives you a powerful tool for building a stable, predictable, and tax-efficient portion of your portfolio.

Understanding APY, Interest Rates, and Current Trends

The engine that makes your retirement CDs grow is the Annual Percentage Yield, or APY. It might sound a bit technical, but getting a handle on APY is critical because it shows you the real return you'll pocket over a year.

Think of it like this: a simple interest rate pays you once. APY, on the other hand, factors in the powerful effect of compounding. This is where your interest starts earning its own interest, creating a snowball effect that builds your savings much faster.

The Power of Compounding Your Interest

Compounding is the secret sauce that makes CDs such a reliable tool, especially inside a tax-advantaged retirement account. When your interest compounds, it gets added back to your principal. The next time interest is calculated, it's based on this new, slightly larger amount.

Here’s a quick look at how different compounding schedules affect a $10,000 CD with a 4.5% APY over one year:

- Annually: Interest is calculated and added just once at the end of the year.

- Quarterly: Interest is added four times per year.

- Monthly: Interest is added twelve times per year.

- Daily: Your interest is added 365 times a year, giving you the most bang for your buck.

The more often your interest compounds, the harder your money is working for you. For a retiree, this means your stable investment grows that little bit more efficiently, maximizing your returns without adding a shred of risk.

What Drives Current CD Rates

CD rates aren't just pulled out of thin air. They're tied directly to the wider economy, especially the decisions made by the U.S. Federal Reserve.

When the Fed wants to fight inflation, it raises its benchmark federal funds rate. This makes it more expensive for banks to borrow money, so they try to attract more cash from savers like you by offering higher rates on products like CDs. That's why periods of Fed rate hikes are often fantastic times to lock in a high-yield retirement CD.

The link between the Federal Reserve's policy and your CD's APY is direct and fundamental. If you understand this relationship, you can spot the best times to open a CD and secure a strong, guaranteed rate for your retirement savings.

On the flip side, when the Fed cuts rates to boost the economy, CD yields usually follow them down. This makes locking in a good rate today all the more valuable, as it shields you from those potential future drops.

A Look at Today's Rate Environment

After a stretch of aggressive rate hikes, CD yields hit their most attractive levels in more than a decade. But the economic winds are always shifting. The latest CD rate forecast for 2025 suggests a modest decline as the rate-hike cycle cools off. For instance, the median one-year CD APY is projected to dip from 4.60% in September 2024 to 4.00% by June 2025.

Even with this gradual dip, today's rates are still miles ahead of the sub-1% yields we saw just a few years ago. You can dig deeper into this trend by exploring the latest CD rate forecast analysis on NerdWallet.com.

This all points to a clear window of opportunity. While the absolute peak might be behind us, current rates are still historically strong. It's a great chance for savers to lock in excellent, predictable returns for their retirement funds before rates potentially fall further.

The Strategic Power of CD Laddering for Retirement Income

Locking all your retirement savings into a single, long-term CD can feel restrictive. You get a great rate, but what if you need cash sooner? This is the classic retirement dilemma: how to get decent growth without sacrificing access to your money. That's exactly where a smart strategy called CD laddering comes into play.

Think of it like building an actual ladder to your financial goals. A single, long pole is hard to climb, but a ladder with multiple, evenly spaced rungs is perfect. In this case, each rung is a separate Certificate of Deposit, each maturing at a different time. This simple structure is the key to blending safety, yield, and much-needed liquidity.

How Does a CD Ladder Work?

The concept is surprisingly simple. You take a lump sum of money and divide it into equal portions. Then, you invest each piece into a CD with a different term length, creating a "ladder" of staggered maturity dates. For instance, you could build a five-year ladder with CDs maturing in one, two, three, four, and five years.

When the first, shortest-term CD matures, you have a decision to make. You can pull out the cash for living expenses or, if you don't need it, reinvest it into a new, long-term CD at the "top" of your ladder. This cycle gives you a predictable stream of cash becoming available every year, all while you consistently lock in the best long-term rates you can find.

By staggering your maturity dates, you cleverly avoid putting all your eggs in one interest-rate basket. If rates go up, you have cash maturing soon, ready to be reinvested at the new, higher yield. If rates fall, most of your money is still safe, earning at the older, better rates.

Building Your First CD Ladder: An Example

Let’s walk through a real-world scenario to make this concrete. Say you have $50,000 you want to put into safe, predictable retirement CDs. Instead of dumping it all into one 5-year CD, you decide to build a ladder.

Here’s a step-by-step look at how you'd construct a 5-year ladder with that $50,000 investment:

- Divide Your Funds: You split the $50,000 into five equal chunks of $10,000 each.

- Purchase Your CDs: You invest each $10,000 portion into a separate CD with a different term.

- $10,000 goes into a 1-year CD.

- $10,000 goes into a 2-year CD.

- $10,000 goes into a 3-year CD.

- $10,000 goes into a 4-year CD.

- $10,000 goes into a 5-year CD.

After the first year, your 1-year CD matures, freeing up $10,000 plus the interest it earned. You can use that money or, to keep the ladder intact, reinvest the whole amount into a new 5-year CD. A year later, your original 2-year CD matures, and you do the same thing.

This table shows how the first few years of your ladder would play out.

Example of a 5-Year CD Ladder with a $50,000 Investment

| Year | Action | Available Cash Flow | Reinvestment Term |

|---|---|---|---|

| 1 | Original 1-Year CD matures. | $10,000 + Interest | New 5-Year CD |

| 2 | Original 2-Year CD matures. | $10,000 + Interest | New 5-Year CD |

| 3 | Original 3-Year CD matures. | $10,000 + Interest | New 5-Year CD |

| 4 | Original 4-Year CD matures. | $10,000 + Interest | New 5-Year CD |

| 5 | Original 5-Year CD matures. | $10,000 + Interest | New 5-Year CD |

After five years, your entire ladder is composed of high-yield 5-year CDs, yet you still have one maturing every single year, giving you that perfect blend of high returns and annual access.

This ongoing cycle gives you annual access to part of your capital while the rest of your money keeps growing, usually at those better long-term rates. For a deeper dive into fine-tuning this approach, check out our complete guide on the CD ladder strategy.

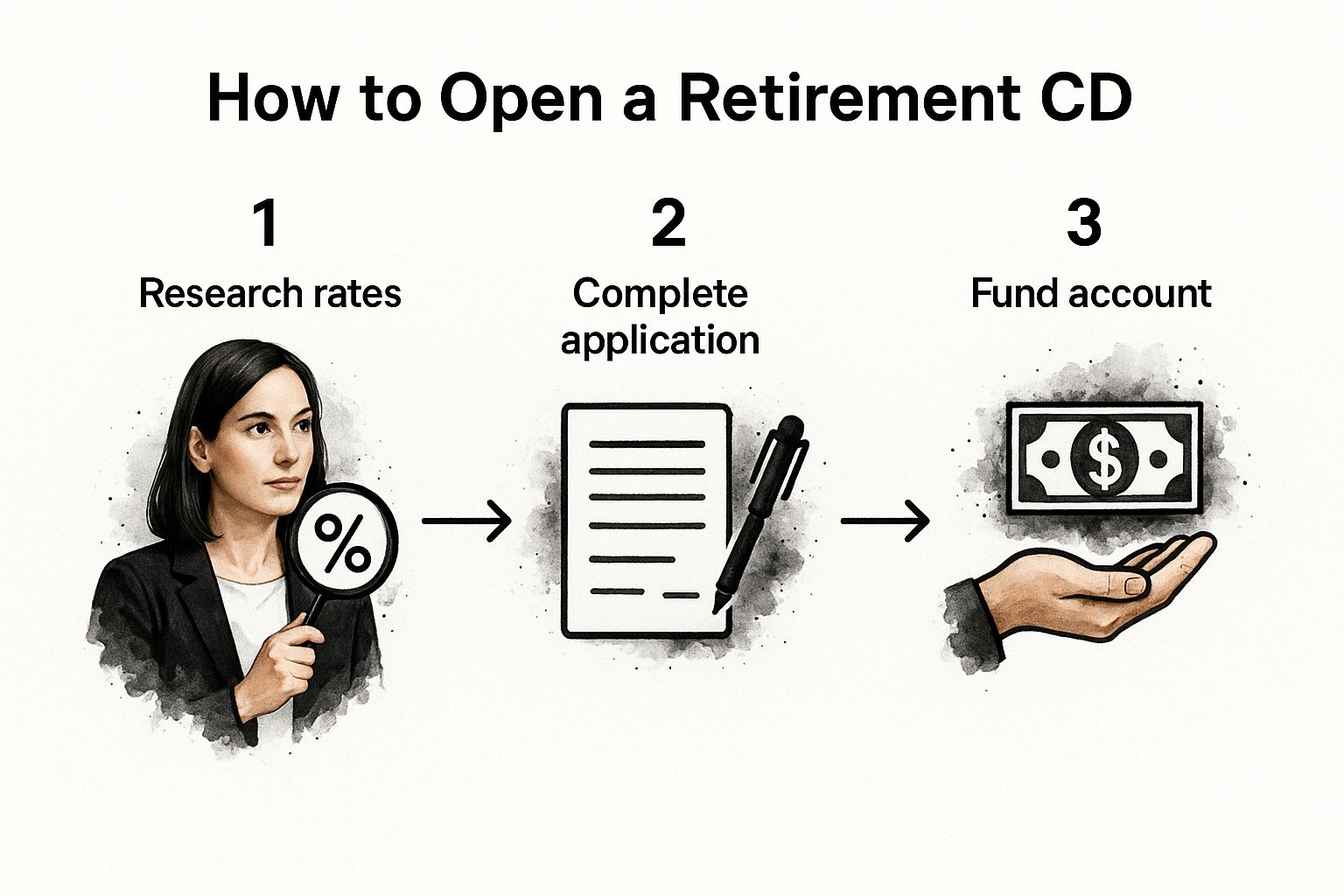

This simple infographic breaks down how easy it is to get started.

As you can see, opening a retirement CD isn't complicated. It's a straightforward process of finding the right CD, applying, and funding your account.

The Key Benefits of Laddering in Retirement

Laddering isn't just a neat financial trick; it’s a time-tested technique for generating predictable income and peace of mind in retirement. It tackles the biggest worries most retirees face.

- Enhanced Liquidity: Having a CD mature every year (or even more frequently if you build a tighter ladder) creates a reliable cash flow stream. This provides money for planned expenses, like property taxes or travel, without forcing you to raid other investments or pay early withdrawal penalties.

- Mitigated Interest Rate Risk: A ladder smooths out the highs and lows of interest rate cycles. You're never fully exposed to a sudden rate drop because most of your money is locked in. And you're never completely left out of a rate hike because you have a CD maturing soon. It creates a nice, balanced average return over time.

- Higher Overall Yield: This is the best part. The strategy lets you tap into the higher APYs that banks almost always offer on longer-term CDs. After the initial setup, your entire ladder can be made up of 5-year CDs, maximizing your interest while still giving you that crucial annual liquidity.

At the end of the day, CD laddering offers a disciplined framework for managing a core part of your retirement savings. It combines the rock-solid safety of FDIC-insured CDs with a structure that delivers liquidity and helps you capture better returns, making it a cornerstone of a stable financial plan.

Tax Implications and Insurance Protections for Your Savings

Beyond locking in a predictable return, any savvy saver—especially one planning for retirement—has two big questions: "What about taxes?" and "Is my money safe?" This is where using a CD inside a retirement account really proves its worth, offering powerful advantages on both fronts.

When you hold a standard CD in a regular savings or brokerage account, the interest you earn is generally taxable in the year you receive it. But if you hold that same CD inside an Individual Retirement Account (IRA), you're essentially wrapping it in a powerful tax shelter. This simple move can dramatically boost your long-term growth.

How an IRA Wrapper Supercharges Your CD Growth

Think of an IRA as a special container for your investments. The container itself changes the rules on how and when your earnings are taxed, which makes a huge difference over the years. You'll typically use one of two types of IRAs for this strategy.

- Traditional IRA: When you hold a CD in a Traditional IRA, its interest grows tax-deferred. You won't pay a dime in taxes on the growth year after year, which lets your money compound much more effectively. You only pay income tax when you pull the money out in retirement.

- Roth IRA: A Roth IRA works a bit differently. You contribute with after-tax dollars, but the payoff is incredible: your CD's interest grows completely tax-free. As long as you follow the rules for qualified withdrawals in retirement, every penny of that growth is yours to keep, tax-free.

This tax treatment is a game-changer. For a deeper look into the specifics, you can learn more about how CD interest is taxed in our detailed guide. Financial institutions also need to report this interest to the government. Before opening an account, they will require you to complete a Form W-9 to verify your taxpayer information.

Your Ultimate Safety Net: Federal Deposit Insurance

While tax efficiency helps your money grow faster, federal insurance ensures it doesn't disappear. For risk-averse savers, this is arguably the most compelling reason to use CDs for retirement savings. Your principal investment simply isn't exposed to market swings.

The core promise of a CD held at an insured institution is that you will not lose your initial deposit. This level of security is fundamental for retirees who depend on their savings and cannot afford to risk their principal.

This rock-solid protection comes from two government-backed agencies:

- FDIC (Federal Deposit Insurance Corporation): This agency insures deposits at member banks.

- NCUA (National Credit Union Administration): This agency provides the same insurance for deposits at member credit unions.

Both the FDIC and NCUA insure your deposits up to $250,000 per depositor, per insured institution, for each account ownership category. This means if you have an individual account and a joint account at the same bank, both could be insured for up to $250,000 each. It's a robust safety net that makes retirement CDs one of the most secure places to keep your nest egg.

Integrating Retirement CDs into Your Overall Financial Plan

Getting a handle on how retirement CDs work is the easy part. The real skill is knowing where they fit in your bigger financial picture. Think of your entire retirement portfolio like a well-balanced meal—you need a little bit of everything to stay healthy. Stocks are the protein for growth, bonds are the steady carbs for sustained energy, and CDs? They're the essential vitamins, providing a safe, reliable foundation that keeps the whole thing stable.

CDs act as the conservative anchor in your portfolio, the perfect counterweight to the sometimes-wild swings of the stock market. While stocks and mutual funds offer a shot at higher returns, they also bring the risk of loss. By setting aside a portion of your nest egg in FDIC-insured CDs, you build a safety net. You guarantee that part of your money is protected from market downturns, which is a key part of sleeping well at night.

Strategic Uses for Retirement CDs

A retirement CD isn't just a dusty old savings account; it's a strategic tool you can use for specific jobs. Because the returns are predictable, CDs are perfect for funding planned, non-negotiable expenses. This lets you meet your obligations without being forced to sell your other investments at a terrible time.

Here are a few powerful ways to put CDs to work in your retirement strategy:

- Funding Your First Few Years: One of the most popular and effective strategies is to build a CD ladder that matures each year to cover your living expenses for the first three to five years of retirement. This gives you a reliable income stream and allows your stock portfolio time to recover from any market dips that might happen right after you stop working.

- Bridging to Social Security: Maybe you plan to delay taking Social Security until you're 70 to get the biggest possible monthly benefit. A CD ladder can provide the income you need to "bridge" the gap between your retirement date and the day your Social Security checks start rolling in.

- Planning for Major Expenses: Know you’ll need a new car in three years? Planning a kitchen renovation in five? A CD timed to mature right when you need the cash is an ideal solution. You'll earn a better return than a standard savings account, and the money is guaranteed to be there for that specific goal.

The core idea is simple: use the certainty of a CD to cover the certainties in your life. This frees up your other, more growth-focused investments to do their job over the long haul without being sidetracked by short-term cash needs.

Finding the Right Allocation

So, how much of your portfolio should you really put in something as safe as a retirement CD? There’s no single magic number here. The right amount depends entirely on your personal situation—your age, your tolerance for risk, and what you’re trying to achieve financially.

A common rule of thumb is the "110 Rule," where you subtract your age from 110 to get a rough idea of the percentage of your portfolio that could be in stocks. The rest would go into safer assets like bonds and CDs.

- Example for a 65-Year-Old: 110 - 65 = 45. This suggests about 45% in stocks and 55% in more conservative investments like bonds and CDs.

- Example for a 55-Year-Old: 110 - 55 = 55. This person might be comfortable with 55% in stocks and 45% in safer assets.

Of course, this is just a starting point. If you have a lower tolerance for risk, you might lean more heavily into CDs. If you want to dig deeper into how this fits into a broader context, you can explore various long-term investing strategies.

Ultimately, weaving CDs into your plan is about building a resilient financial life. They provide the stability and predictable cash flow you need to balance out the inherent risks of growth investing, making sure your retirement is built on a foundation of rock-solid security.

Your Questions on Retirement CDs Answered

Once you start thinking seriously about using retirement CDs for your savings, the practical questions quickly follow. It's one thing to understand the concept, but it's another to feel confident about the "what ifs." Moving from theory to real-world scenarios is key.

Let's walk through some of the most common concerns savers have. Getting these questions answered is how you build a financial plan you can truly trust.

What Happens if I Need My Money Before the CD Matures?

This is the big one. It's probably the number one worry for anyone considering locking up their cash. Life happens, and sometimes you need access to your funds unexpectedly. So, what if you put money into a 3-year CD but have an emergency after just one year?

The short answer is: you can almost always get your money back, but it will cost you. That cost is called an early withdrawal penalty.

When you open a CD, you're making a deal with the bank. You agree to leave your money with them for a set term, and they agree to give you a guaranteed rate of return. If you need to break that deal and pull your money out early, the bank will charge a penalty, which is almost always calculated as a portion of the interest you've earned.

The penalty structure is a critical detail to look up before you open any CD. It’s not a hidden fee, but you absolutely need to know what it is. Understanding the penalty upfront helps you weigh the risk of needing early access against the benefit of locking in a great rate.

The exact penalty varies from one bank to another, but it's usually tied to the CD's term length.

- For shorter-term CDs (under 1 year): A common penalty is about three months' worth of simple interest.

- For longer-term CDs (over 1 year): The penalty might be six months' or even a full year's worth of interest.

In very rare situations, if you withdraw right after opening the account before much interest has built up, the penalty could technically dip into your principal. But for the most part, banks structure these penalties to only affect your earnings.

Can I Lose Money in a Retirement CD?

This question gets right to the heart of why CDs are so popular for retirement savers: safety. For the most part, the answer is no—you can’t lose your principal investment in a retirement CD, as long as you stick to the federal insurance limits. Your deposit is protected up to $250,000 by the FDIC (for banks) or NCUA (for credit unions).

But it's important to be clear about what "losing money" means. You won't lose your initial deposit if the stock market crashes or the bank has a problem. That's what the insurance is for.

However, you could run into two other kinds of "loss":

- Early Withdrawal Penalties: Just like we discussed, cashing out early means the penalty will eat into your interest. In a worst-case scenario, it could take a tiny bite out of your principal, too.

- Opportunity Cost: This is the more common issue. Let's say you lock in a 5-year CD at a 3% APY. A year later, rates jump, and new 5-year CDs are paying 5%. You haven't lost your money, but you are missing out on the chance to earn that much higher rate. This is exactly why a strategy like CD laddering is so powerful—it helps you manage this exact risk.

How Do I Choose the Right CD Term for My Retirement Goals?

Picking the right term length isn't just about grabbing the highest APY you can find. It's about matching the CD to a specific job in your financial life. Your choice should line up with your retirement timeline, how much cash you need to keep available, and how you feel about interest rates changing.

Think of it like picking the right tool for a specific task.

- Short-Term Goals (1-2 Years): Perfect if you're saving for something specific and predictable in the near future. Maybe you're bridging the gap until your Social Security starts or covering your first year of retirement living expenses. You'll get a better rate than a standard savings account without tying up the money for too long.

- Medium-Term Goals (3-5 Years): These are the workhorses of a classic CD ladder. They often hit the sweet spot, offering a great balance between higher yields and reasonable access to your funds. They're ideal for building the stable core of your retirement income plan.

- Long-Term Goals (5+ Years): These CDs typically come with the highest rates. They are best for money you are absolutely certain you won't need to touch for a good long while. Think of them as a long-term anchor for your portfolio, quietly and steadily compounding interest year after year.

In the end, the smartest strategy for many people is using a mix of different terms. By building a CD ladder, you get to take advantage of the higher rates from long-term CDs while still having the flexibility of a CD maturing every single year.

Ready to see how these concepts apply to your own savings? The Certificate-of-Deposit Calculator is a powerful tool that can help you visualize your potential earnings. Experiment with different deposit amounts, APYs, and term lengths to find the perfect strategy for your retirement goals. Take control of your financial future and calculate your CD growth today.