Understanding The Forces Behind CD Rate Movement

Think of CD rates like the price of gasoline. They seem to fluctuate constantly, but behind every change is a complex interplay of supply, demand, and economic signals. The question of how often do CD rates change doesn't have a simple answer because it’s driven by both large-scale market forces and the specific needs of each bank.

Think of CD rates like the price of gasoline. They seem to fluctuate constantly, but behind every change is a complex interplay of supply, demand, and economic signals. The question of how often do CD rates change doesn't have a simple answer because it’s driven by both large-scale market forces and the specific needs of each bank.

This constant adjustment is a balancing act. Banks need to attract your deposits to fund their lending operations, but they also have to manage the cost of paying you interest. This push and pull means that while one bank might change its rates weekly, another might only do so once a month.

To get a clearer picture, let's look at the key factors that influence these changes.

Factors Influencing CD Rate Changes

A breakdown of the primary economic and institutional factors that cause CD rates to fluctuate, with their typical impact frequency

| Factor | Impact Level | Change Frequency | Typical Response Time |

|---|---|---|---|

| Federal Reserve Policy | High | Every 6-8 weeks | Within 24-48 hours |

| Bank Liquidity Needs | Medium | Weekly to Monthly | Varies by institution |

| Competitive Pressure | Medium | Ongoing | Immediate to a few weeks |

| Treasury Yields | High | Daily | Daily to Weekly |

| Promotional Offers | Low to Medium | Sporadic/Seasonal | Instantaneous |

This table shows that while major economic events like a Federal Reserve meeting can cause immediate, widespread changes, a bank's internal needs create more frequent, localized adjustments.

The Fed's Role and Market Conditions

The single biggest influence on CD rates is the Federal Reserve. When the Fed raises or lowers its target for the federal funds rate—the rate at which banks lend to each other overnight—it sends a ripple effect across the entire financial system. Banks almost immediately adjust the rates they offer on savings products, including CDs, to align with this new cost of money.

This is because the Fed's rate acts as a benchmark for all other interest rates. If the benchmark goes up, the rates banks are willing to pay for your deposits will also rise. This is why you'll often see headlines about CD rates hitting new highs just a day or two after a Fed announcement.

Bank-Specific Needs and Marketing Strategies

Beyond the Fed, individual bank strategies play a huge role. A bank's primary goal is to manage its liquidity, which is just a fancy term for having enough cash on hand to make loans and cover withdrawals.

Here’s how it works:

- Need More Money? If a bank wants to ramp up its lending, it will raise CD rates to attract new deposits quickly. Think of it as putting cash "on sale" to bring in customers.

- Have Too Much Cash? Conversely, if a bank has more deposits than it can profitably lend out, it will lower its CD rates to discourage new money from coming in.

Sometimes, a rate change isn't about liquidity at all—it's pure marketing. A bank might launch a special, high-yield "promotional CD" for a limited time just to grab headlines and attract new customers. These deals are often temporary and may not reflect the bank's long-term rate strategy. Recognizing the difference is key to being a smart saver, especially since pulling out early could trigger fees. You can learn more by reading our guide on understanding the CD early withdrawal penalty.

How Federal Reserve Decisions Shape Your CD Returns

Think of the Federal Reserve as the conductor of the U.S. economy. Its decisions set the tempo that nearly all other interest rates, including those for CDs, follow. The Fed's main instrument is the federal funds rate, which is the interest rate banks charge each other for overnight loans. This master rate creates a ripple effect across the entire financial system.

When the Fed's Open Market Committee (FOMC) meets roughly every six weeks, its actions send a clear signal. If the goal is to cool down an overheating economy and fight inflation, the Fed raises the federal funds rate. This makes it more expensive for banks to borrow money, so they, in turn, offer higher yields on CDs to attract your deposits. Conversely, if the economy needs a boost, the Fed cuts rates, and CD returns typically fall soon after. This direct link means one of the most reliable answers to how often CD rates change is "right after a Fed meeting."

Following the Fed’s Footsteps

This isn't a new phenomenon; the connection between the Fed's policy and your savings account has deep historical roots. The rates you see on CDs are a direct reflection of the central bank's broader economic strategy.

Consider these historical examples:

- In the early 1980s, the Fed aggressively raised rates to combat runaway inflation, pushing three-month CD rates to an astonishing 18%.

- After the 2008 financial crisis, the Fed slashed rates to near-zero to encourage spending. As a result, CD rates often fell below 0.5% and remained low for the better part of a decade.

These examples show just how closely your potential earnings are tied to the Fed’s playbook. You can explore a detailed history to see how central bank decisions have impacted CD rates over the years and better understand the current rate environment.

Why Different Banks Change Rates At Different Speeds

While the Federal Reserve sets the overall direction for interest rates, not all financial institutions move in perfect lockstep. The answer to how often CD rates change often depends on where you bank. The speed of these adjustments is a direct reflection of a bank’s business model, its size, and how it operates.

Think of it as a race between different types of vehicles. Agile online banks are like race cars. With lower overhead and no physical branches, they can change their rates almost overnight to capture market share or respond to Fed changes. Their main goal is often to offer the most competitive rates nationally to attract deposits entirely through their websites and apps.

In contrast, large traditional banks are more like massive cargo ships. With complex internal structures and rate-setting committees, decisions can take days or even weeks to put into action. Their strategy often balances national competitiveness with the stability expected by their long-standing, local customer base.

Agility vs. Stability in Rate Setting

This difference in speed creates distinct opportunities for savers. You can't expect the same behavior from every institution. To help you understand what to expect, the table below compares the typical rate-setting habits of different bank types.

CD Rate Change Frequency by Bank Type

Comparison of how often different types of banks typically adjust their CD rates and the factors driving their update schedules

| Bank Type | Typical Update Frequency | Rate Competitiveness | Response Speed to Fed Changes |

|---|---|---|---|

| Online Banks | Weekly or even daily | High; often among the best available | Very Fast (sometimes within 24-48 hours) |

| Traditional Banks | Monthly or quarterly | Moderate; often trails online banks | Slow; can take weeks to implement changes |

| Credit Unions | Varies; often monthly | Member-focused; competitive but not always the highest | Moderate; may be quick to raise rates but slower to lower them |

As you can see, savers looking for the absolute highest yields will often find them at online banks, but they must be prepared for rapid changes. Meanwhile, credit unions can offer a beneficial middle ground, balancing member interests with market realities.

Here’s a more detailed breakdown of what this means for you:

- Online Banks: These institutions are usually the first to both raise and lower their rates. Their lean operating models allow for aggressive pricing, meaning they often feature the highest yields but also react fastest to downward trends. It’s common for them to adjust rates weekly or even daily.

- Credit Unions: As member-owned cooperatives, credit unions often prioritize serving their members over maximizing profits. This means they may be quick to pass on rate increases but slower to implement cuts, offering a helpful lag for savers.

- Traditional Banks: These institutions tend to be more conservative. While they may not always have the top rates, their changes are often less frequent, providing a more predictable, though potentially lower-yielding, environment. They might adjust rates only monthly or quarterly.

Learning From Five Decades Of CD Rate History

The story of how often CD rates change isn't a recent development; it's an economic saga that goes back decades. Understanding this history gives you a powerful lens to see that today’s rate environment is just one chapter in a much longer narrative. By looking back, we can spot patterns that help us make more informed guesses about future movements.

A Rollercoaster Ride Through Time

Since they became a popular savings tool, the ups and downs of CD rates have mirrored major economic cycles. In the late 1960s, a three-month CD might have paid around 5%. However, the high-inflation era of the 1970s and early 1980s sent rates on a wild ride, with frequent jumps between 5% and 15%. This turbulent period peaked in 1981 when rates hit an incredible 18.5%—a time when putting money in a CD could offer returns that competed with the stock market.

After that peak, rates began a long, steady decline through the following decades, mostly hovering in the 2–5% range. The financial crisis of 2008 introduced a new reality of historically low returns, with many CDs yielding less than 1% for years. You can see a full breakdown of how historical CD rates have tracked economic events to get a clearer picture of this journey.

Recent History in Focus

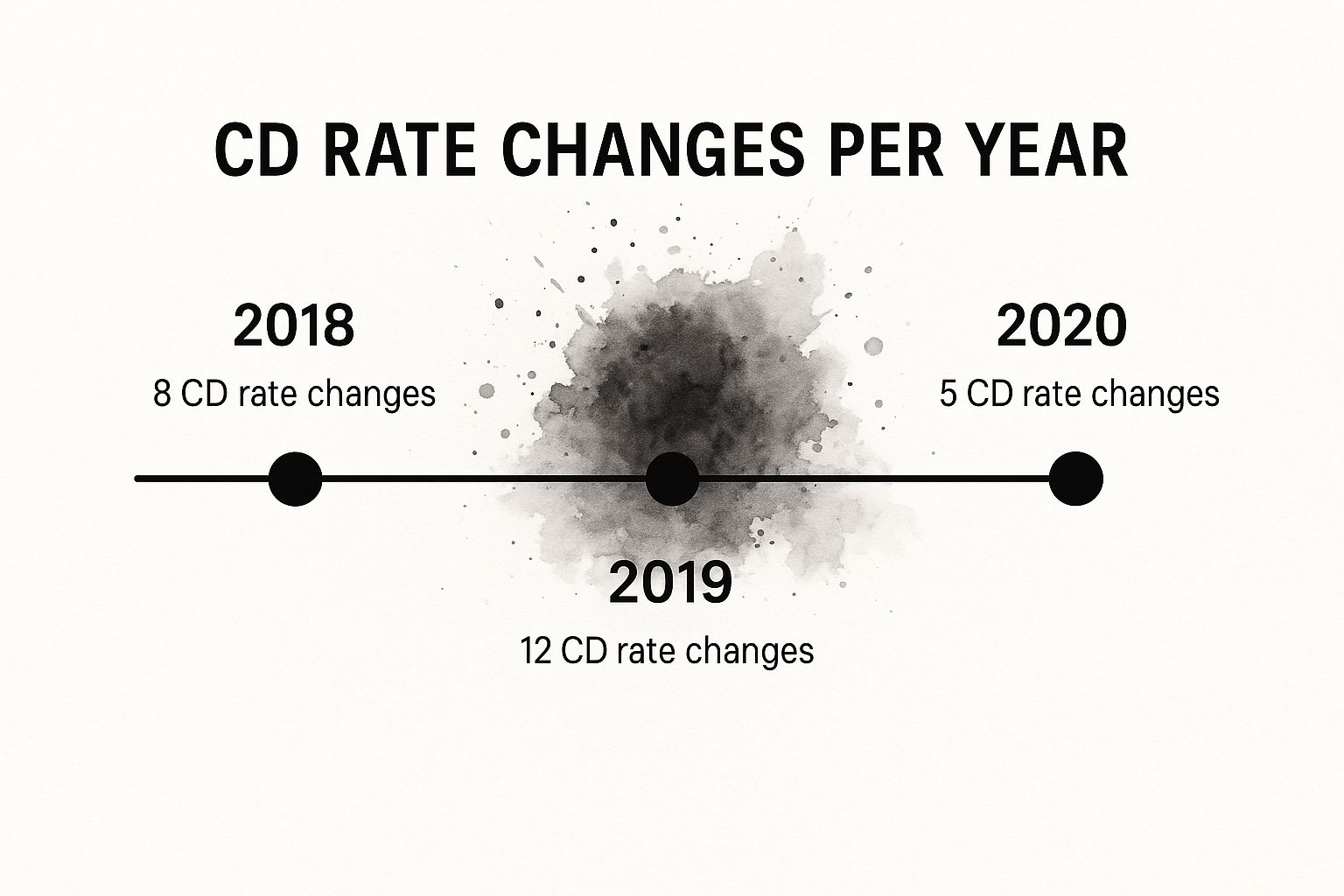

Even in more stable periods, CD rates can change more often than you might expect. The infographic below shows just how active banks can be with rate adjustments in a few recent years.

This visual makes it clear how an active economic year like 2019 can lead to almost monthly changes. In contrast, a year marked by a major event, like 2020, might see fewer but more significant shifts as the economy reacts.

Mastering The Art Of CD Rate Timing

Timing your Certificate of Deposit purchase isn't about perfectly predicting the future; it's about understanding the factors that influence rates and positioning yourself for success. Think of it less like trying to catch a falling knife and more like surfing. You can't control the waves (rate changes), but you can learn to spot the right one to ride. Knowing how often do CD rates change is the first step, but mastering when to act is what generates better returns.

Capitalizing on Calendar and Promotional Cycles

Banks often have predictable funding needs tied to the calendar. For instance, many institutions push for deposits near the end of a financial quarter (March, June, September, and December) to make their balance sheets look stronger for their reports. This pressure can lead to short-term promotional CD rates that are higher than what's typically available. Similarly, a bank might see higher loan demand in the spring and offer better CD rates to bring in the cash needed to fund those loans.

The screenshot below shows a typical comparison of CD rates from various banks. Keeping an eye on lists like this is a great way to spot these promotional opportunities as they appear.

This comparison shows how different institutions, especially online-only banks, often compete aggressively on rates for various CD terms.

Building a Strategy That Works in Any Market

Instead of trying to time the market perfectly with a single large deposit, many savvy investors use a CD laddering strategy. This approach involves splitting your investment into multiple CDs with staggered maturity dates (for example, 1-year, 2-year, and 3-year CDs). As each CD matures, you can reinvest the funds into a new, long-term CD at the current rate, which will hopefully be higher.

This method offers several key benefits:

- Captures Rising Rates: You aren't stuck with a single low rate for many years. A portion of your money gets a chance to capture new, higher rates annually.

- Provides Liquidity: Because a CD matures every year, you have regular access to a part of your funds without paying an early withdrawal penalty.

- Reduces Regret: It protects you from the stress of locking in all your money right before rates go up.

Building a ladder takes some initial planning, but it creates a systematic way to benefit from rate changes without having to guess the market's next move. Understanding the math behind your potential earnings is key, and you can explore our guide on how to calculate CD interest to see how different rates and terms affect your final return.

Reading Economic Signals That Predict Rate Changes

The smartest CD investors don't just react to rate adjustments; they learn to see them coming. While the Federal Reserve's decisions are the biggest influence, banks study a wider range of economic signals to get ahead of those moves. By watching the same indicators, you can go from being a passive saver to an informed investor.

Think of it like being a weather forecaster. You look at atmospheric pressure, wind direction, and humidity to predict a storm. In the same way, you can monitor key economic reports to get a sense of where CD rates are heading next.

The Most Influential Economic Reports

Certain economic reports have a strong connection to future Fed policy and, as a result, CD rate movements. Paying attention to these can give you a real advantage.

Key reports to watch include:

- Consumer Price Index (CPI): This is the main measurement of inflation. A consistently high CPI number often suggests the Fed may raise rates to cool down the economy, which usually leads to higher CD yields.

- Jobs Reports: Strong employment figures and wage growth can also point to inflationary pressure, encouraging the Fed to think about rate hikes. A weakening job market might signal that rate cuts are on the horizon.

- Retail Sales Data: This report shows what consumers are spending their money on. Strong spending can fuel inflation, while a sharp drop might indicate an economic slowdown that calls for lower interest rates.

By tracking these signals, you learn to separate market noise from real indicators that come before rate changes. This foresight helps you strategically time your CD purchases to get the best returns. Just as important as timing is understanding how your returns are calculated, and you can find out more about how often CDs compound interest in our detailed guide.

Your Action Plan For Navigating Rate Changes

Understanding what drives CD rates is one thing, but turning that knowledge into better returns requires a plan. Instead of letting rate changes create uncertainty, you can use them to your advantage with a structured approach.

Build a Personal Monitoring System

You don't need fancy software to keep an eye on the market. A simple, consistent routine is far more effective.

- Create a Watchlist: Pick three to five banks or credit unions to follow. Make sure to include at least one online-only bank and one credit union, as they often lead the pack with competitive rates.

- Set Calendar Alerts: Schedule a recurring reminder to check rates at your chosen institutions. A good rhythm is once every two weeks, plus an extra check the day after any Federal Reserve meeting. This keeps you informed without feeling like a chore.

Know When to Break a CD

It can sometimes be profitable to break an existing CD and pay the early withdrawal penalty, especially if you can lock in a much higher rate. The key is to avoid making emotional decisions based on small rate bumps.

Create a clear, personal rule to guide you. For example: "I will only consider breaking my CD if a new one with a similar term offers a rate that is at least 1.5% higher." Having a specific threshold like this removes the guesswork and prevents you from reacting to minor market noise.

Turning these strategies into real-world returns means running the numbers. Our free Certificate-of-Deposit Calculator lets you compare different scenarios, model your potential earnings, and see exactly how a new rate could boost your savings.