Let's get one thing straight: an FDIC-insured CD rate is the interest you’re guaranteed to earn on your savings for a set amount of time. Think of it as a financial handshake with your bank. You agree to park your money in a Certificate of Deposit (CD) for a specific term, and in return, they give you a fixed interest rate.

The best part? It's all backed by a government promise. Your principal and all the interest you earn are protected up to $250,000 per depositor, per insured bank. That one-two punch of a guaranteed return and federal insurance makes CDs one of the safest ways to make your money work for you.

Anatomy of an FDIC Insured CD

To really understand CD rates, you first need to get what a CD actually is. It’s a special savings product offered by banks and credit unions. Unlike your everyday savings account where you can move money in and out, a CD holds a lump-sum deposit for a fixed period—the term length.

This isn't just a one-way street. The bank gets a predictable source of funds it can use for its own lending and investing. To thank you for that stability, they reward you with a fixed interest rate that’s almost always higher than what you’d find on a standard savings account.

To help you get a quick handle on this, here's a breakdown of the key parts of every CD and what they mean for your savings strategy.

| Component | What It Means for You | Key Takeaway |

|---|---|---|

| Principal | The starting amount of money you put into the CD. | This is the foundation of your investment—the amount that will grow. |

| Term Length | How long you agree to leave your money untouched. | Can range from 3 months to 5+ years. Longer terms usually mean better rates. |

| Interest Rate (APY) | The Annual Percentage Yield, your real yearly return including compounding. | This rate is fixed, so you know exactly what you'll earn from day one. |

| Maturity Date | The day your CD term officially ends. | On this date, you can access your original deposit plus all earned interest penalty-free. |

This table shows how each piece fits together to create a predictable and secure savings tool.

The Real Advantage: Predictability and Safety

That fixed interest rate is the secret sauce. It gives you a guaranteed return, completely insulated from the wild ups and downs of the stock market. You know precisely what your payout will be on the day your CD matures.

But the most important feature is the federal insurance. The Federal Deposit Insurance Corporation (FDIC) is a U.S. government agency that protects your money if your bank fails.

This insurance automatically covers your CD accounts—both the principal you deposited and the interest it accrues—up to the $250,000 limit. It’s an unbreakable safety net that provides total peace of mind, separating CDs from riskier investments like stocks or bonds. This makes them a cornerstone for anyone who wants to preserve their capital.

If you're looking to go deeper on the basics, our guide on certificate of deposit basics is a great place to start.

The Economic Forces That Shape CD Rates

Every FDIC insured CD rate you see reflects broader economic currents—with the U.S. Federal Reserve at the helm. Understanding those shifts shows why CD yields climb or dip, and it helps you become a smarter saver.

Think of the Fed as the orchestra conductor and the federal funds rate as its volume knob. Turn that dial up, and overnight bank-to-bank loans get pricier. Turn it down, and borrowing costs fall—rippling through the entire financial system.

The Federal Reserve And Your CD Rate

Imagine a giant volume dial controlling the economy’s tempo. The Federal Open Market Committee (FOMC) tweaks that dial to keep inflation in check and unemployment low.

- When Rates Rise: Banks often hike CD rates in anticipation. Locking in a CD now can secure you a higher yield.

- When Rates Fall: New CD offers tend to drop, making your existing high-rate CDs more valuable.

Savvy savers track Fed meetings and economic data closely. Those announcements are your roadmap for timing CD purchases.

Inflation: The Silent Rate Influencer

Inflation quietly erodes your purchasing power. A flashy CD rate loses its luster if rising prices outpace your earnings.

Real Return = CD Interest Rate – Inflation Rate

For example, a 4% APY CD with 3% inflation nets you just 1% in actual purchasing power.

Banks know this too. If they don’t keep CD rates above inflation, depositors will look elsewhere—forcing institutions to adjust their offerings.

Bank Competition And Your Bottom Line

Beyond Fed moves and inflation, simple supply and demand among banks shapes your CD rates. Lenders need deposits to fund loans, so they compete by sweetening CD offers.

- Online Banks: Lower overhead allows them to lead with top-tier CD yields.

- Credit Unions: Member-owned, they often pass profits back as higher savings rates.

- Traditional Banks: Big names may trail on base rates but offset that with special CD promotions.

The lesson? Shop around. Identical CD terms can come with vastly different rates, and even a small spread can boost your earnings over time.

To really get a feel for today's FDIC insured CD rates, it helps to look back at where they've been. Rates aren't just random numbers; they’re a direct reflection of decades of economic booms and busts. Seeing them in their historical context is the key to building a smart savings strategy.

Just like the weather, interest rate environments are cyclical. We’ve seen times when CDs offered returns that sound like a fantasy today, and other long stretches when they barely beat stashing cash under a mattress. Understanding this up-and-down nature helps you set realistic expectations and know when to make your move.

The Highs of the 1980s

The early 1980s were a completely different world for savers. Inflation was out of control, and the Federal Reserve fought back by cranking its benchmark rate to levels we haven't seen since. For anyone with money to save, it was a golden age for CDs.

It wasn't strange at all to find CDs paying out double-digit returns. Savers who locked in those rates enjoyed massive, risk-free growth—a scenario that's hard to even imagine after the low-rate decades that followed. That era cemented the CD's reputation as a powerful way to protect your money when the economy gets rocky.

A look back at the full history of CD interest rates shows just how dramatic these swings have been. Back then, with the Fed fighting inflation, rates shot above 10%. That peak was followed by a long, slow decline as the economy cooled off.

The Long Decline and Near-Zero Rates

After the party of the '80s, rates started a long, steady march downward. That trend hit the accelerator after big economic shocks, especially the 2008 financial crisis.

To get the economy moving again, the Federal Reserve cut interest rates to practically zero and left them there for the better part of a decade. For savers, this was a tough time. It was nearly impossible to earn any real return from safe-havens like CDs.

This long "rate drought" completely changed how people saved, forcing many to take on more risk in the stock market just to find a decent return. It drove home a critical lesson: the broader economic climate is the single biggest driver of what your CD will earn.

The COVID-19 pandemic gave us another brief dip in rates as another round of economic stimulus hit the system. But that trend was about to do a complete 180.

The Recent Resurgence and Modern Trends

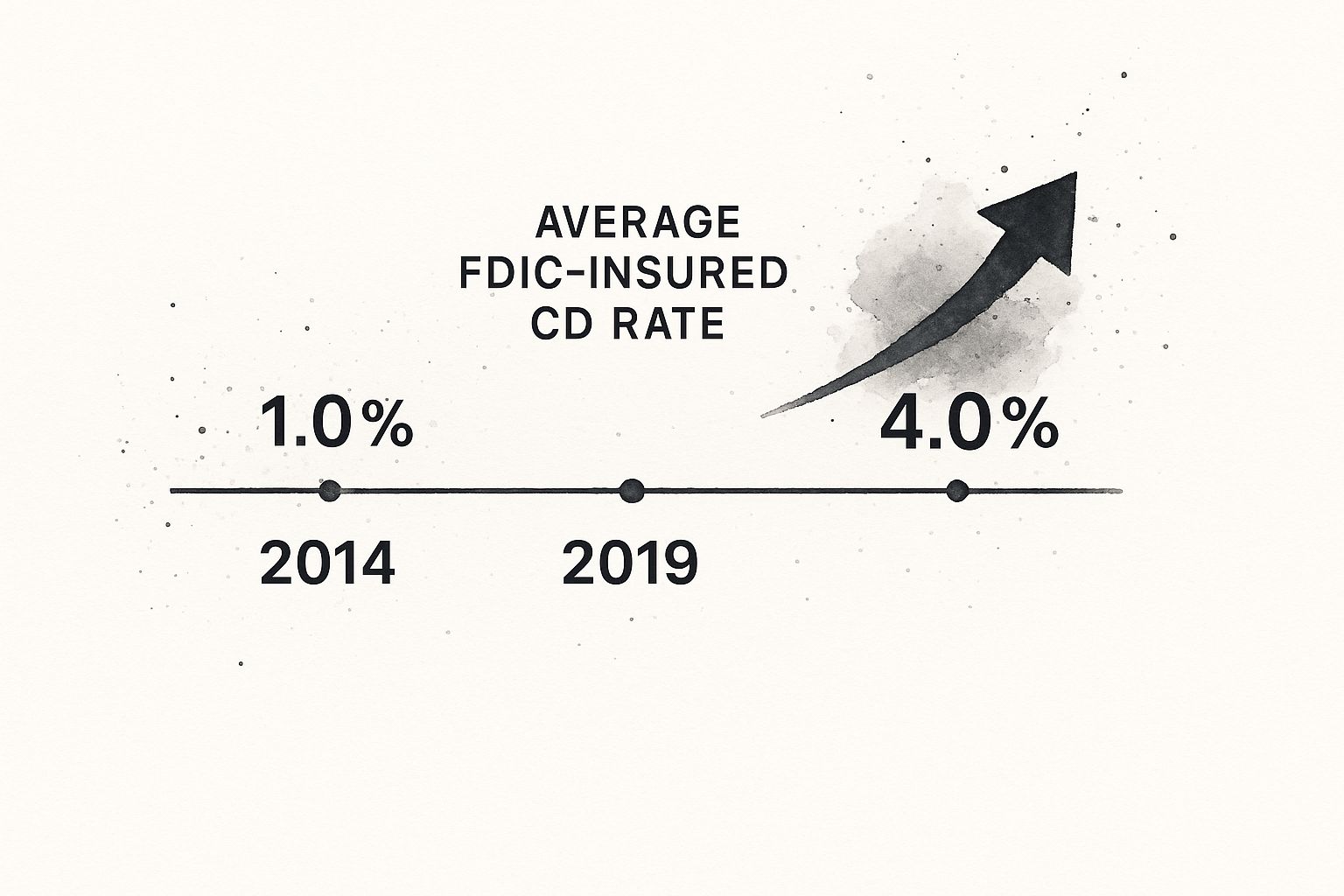

Starting in 2022, the script completely flipped. With inflation roaring back to life, the Federal Reserve launched one of its most aggressive rate-hiking cycles in modern history. As a direct result, FDIC insured CD rates shot up, hitting their highest levels in over 15 years.

Suddenly, top nationwide CD rates were climbing past 5% and even briefly touched 6% in late 2023. This rapid rise put the classic CD squarely back in the spotlight for savers who wanted both safety and a strong, predictable return.

This chart shows the journey perfectly—you can see the long, flat period give way to a dramatic spike over the last couple of years.

The visual makes it clear: while rates were asleep for years, recent economic shifts have created a fantastic new opportunity for CD savers. As we moved through 2024, rates started to level off a bit, which just goes to show how important timing can be when you're ready to lock in a great rate.

Actionable Strategies for Maximizing CD Returns

Knowing what FDIC insured CD rates are is one thing. Putting that knowledge to work with a real strategy is how you actually build wealth. Just grabbing the single highest rate you see isn't always the smartest play. A good strategy helps you balance earning high returns with your need for cash, all while positioning you for whatever interest rates do next.

Knowing what FDIC insured CD rates are is one thing. Putting that knowledge to work with a real strategy is how you actually build wealth. Just grabbing the single highest rate you see isn't always the smartest play. A good strategy helps you balance earning high returns with your need for cash, all while positioning you for whatever interest rates do next.

Instead of dumping all your savings into one CD and calling it a day, you can build a more sophisticated portfolio that works much harder. The three most effective methods are the CD ladder, the barbell, and the bullet. Each has a different job, giving you the flexibility to line up your savings plan with your actual life goals.

The CD Ladder Strategy for Liquidity and High Rates

The CD ladder is probably the most popular strategy, and for good reason—it’s a brilliant solution to the classic CD problem: liquidity vs. high rates. Rather than locking up a big chunk of cash in a single long-term CD, you split the money and "stagger" it across several CDs with different maturity dates.

Here’s a simple look at building a 5-year ladder with $25,000:

- Put $5,000 into a 1-year CD.

- Put $5,000 into a 2-year CD.

- Put $5,000 into a 3-year CD.

- Put $5,000 into a 4-year CD.

- Put $5,000 into a 5-year CD.

When that first year is up, your 1-year CD matures. You then take that $5,000 (plus the interest it earned) and reinvest it into a new 5-year CD. When your 2-year CD matures, you do the same. After five years, you'll have one CD maturing every single year, giving you regular access to your money while all of it is earning at the higher 5-year rate.

This strategy creates a powerful cycle. You get the liquidity of a short-term CD but the high interest rates of a long-term one. It’s the best of both worlds.

The CD Barbell for Balancing Short and Long Term Goals

The barbell strategy gets its name from its shape—weights on both ends and nothing in the middle. For your money, this means you invest in short-term and long-term CDs, but you skip the medium-term ones entirely.

This approach is perfect for savers who want to balance having cash available soon with locking in today’s best long-term rates.

- Short-Term End: You might put half your money into CDs with terms of one year or less. This keeps cash accessible and lets you reinvest quickly if rates climb.

- Long-Term End: The other half goes into long-term CDs, like 5-year terms, to capture the highest FDIC insured CD rates you can find.

This strategy is a great hedge when you aren't sure where rates are headed. It ensures you’re positioned to benefit whether rates go up or down. If you're trying to figure out your next move, you can dig deeper in our guide on if CDs are a good investment right now for more context.

The CD Bullet for Targeting Specific Goals

The bullet strategy is the most focused of the three. Here, you buy multiple CDs that are all set to mature around the same target date. This is the perfect move when you're saving for a specific, time-sensitive goal like a wedding, a down payment on a house, or a child's college tuition.

For example, if you know you need a lump sum in four years, you could:

- Buy a 4-year CD today.

- Next year, buy a 3-year CD.

- The year after that, buy a 2-year CD.

All your funds become available at once, timed perfectly for your big expense. This method helps you stay disciplined and guarantees your money is ready right when you need it, having earned a solid, predictable return. For more general advice on money management, checking out a personal finance blog can provide some useful perspectives.

Finding the Best FDIC Insured CD Rates

Now that you have a good handle on how market forces and history shape CD returns, you're ready to find the best FDIC insured CD rates out there. This isn't just about spotting the highest number on a list. It's about being strategic—knowing where to look and what to look for beyond that headline APY.

Your search will probably take you to three main places, and each has its own strengths:

Online-Only Banks: These banks don't have the overhead of physical branches, and they often pass those savings on to you with higher interest rates. More often than not, they lead the pack for the best CD yields.

Credit Unions: As not-for-profit organizations owned by their members, credit unions exist to return value back to those members. This focus often results in fantastic CD rates that can meet or even beat what the online banks offer.

Traditional Banks: While their standard, everyday rates might not always be the highest, big national and regional banks often run promotional CD specials. They use these attractive APYs to bring in new deposits, so it's always smart to check what they have on offer.

Look Beyond the Annual Percentage Yield

Snagging the best deal means looking at the whole package, not just the interest rate. A big, juicy APY is tempting, but the real value of a CD is hidden in the fine print. Before you lock in your money, you need clear answers to a few key questions.

The highest rate isn't always the best deal if it comes with restrictive terms that don't fit your financial life. A slightly lower rate with more favorable conditions, like a smaller early withdrawal penalty, might be the smarter choice for your situation.

For example, knowing how rates have behaved in the past gives you critical context. Looking at competitive FDIC-insured CD rates from 1980 through mid-2025 reveals just how much the economy matters. Rates shot past 15% in the high-inflation 80s, dropped below 1% during the pandemic, and then climbed back over 5% in 2023 as the Fed battled inflation. This shows just how cyclical these investments are. You can find more historical CD rate data on NerdWallet.com to see how today's offers compare.

Your Essential CD Shopping Checklist

As you compare different CDs, run through this checklist. It will help you make a smart, well-rounded decision based on all the details that affect your savings.

- Minimum Deposit Requirement: Can you actually meet the minimum? Some of the very best rates are tied to higher deposits, like $5,000 or $10,000.

- Early Withdrawal Penalty: What's the price if you need your cash early? The penalty is usually a certain number of months' interest—for instance, giving up six months of interest on a 2-year CD. Know this fee before you commit.

- Compounding Frequency: How often does your interest get calculated and added to the principal? Daily compounding will earn you a little more than monthly or quarterly compounding over the same term.

- Maturity Grace Period: Once the CD matures, how long do you have to make a move? Most banks give you a grace period of about 7 to 10 days to either withdraw your money or roll it over before they automatically renew it for you.

- Strategic Fit: Does this particular CD work with your bigger financial picture? If you're building a portfolio of CDs, you want to be sure each one fits into your plan. For a deeper look at this, you might be interested in our guide on what a CD ladder is and how to build one.

By methodically checking these points, you stop being a rate-chaser and become a savvy investor—someone ready to lock in a deal that truly maximizes your secure, guaranteed returns.

Common Questions About FDIC-Insured CDs

Even after you get the hang of how CDs work, it’s completely normal to have a few last-minute questions before locking up your cash. Thinking about FDIC-insured CD rates usually brings up practical "what if" scenarios about timing the market, penalties, and different CD types.

Getting these common questions answered is the final step to feeling confident you’re making a smart move. Let's walk through some of the biggest uncertainties savers run into.

Are FDIC-Insured CD Rates Likely to Rise or Fall?

Predicting interest rates is a bit like forecasting the weather—no one has a perfect crystal ball, but you can definitely spot the signs. The biggest signal comes straight from the Federal Reserve. When the Fed raises its benchmark rate to fight inflation, CD rates almost always follow suit.

On the flip side, if the economy looks like it's slowing down and the Fed starts cutting rates to give it a boost, CD rates will head south, too. Keeping an eye on Fed meetings and economic news is the best way to get a feel for where rates might be going, which helps you decide on the best time to lock one in.

The key is to match your CD term to your rate forecast. If you think rates will keep climbing, shorter terms are your friend—they let you reinvest sooner at a better rate. If you believe rates have peaked, a long-term CD locks in that high yield for years to come.

What Is the Penalty for Early CD Withdrawal?

Breaking up with your CD before its maturity date almost always comes with a fee. Banks charge an early withdrawal penalty if you need to pull your money out before the term is up. This isn't a random dollar amount; it's usually calculated as a set amount of interest you've earned.

For instance, a pretty standard penalty structure looks something like this:

- CDs with terms of 1 year or less: You might forfeit 90 days' worth of interest.

- CDs with terms over 1 year: The penalty could be 180 days' worth of interest.

These rules aren't universal—they vary from bank to bank. It is absolutely critical to read the fine print before you open the account. If you think there's even a small chance you'll need the cash for an emergency, you might want to look at a "no-penalty" or "liquid" CD. They offer more flexibility, though usually for a slightly lower rate.

Should I Choose a Short-Term or Long-Term CD?

The "right" term length is all about you: your financial goals and your take on the current interest rate scene. There’s no single best answer, just the one that fits your specific needs.

Short-term CDs (think under one year) are a strategic move when you expect rates to rise. They mature quickly, freeing up your money to be reinvested at what you hope will be a higher rate.

On the other hand, long-term CDs of three to five years are perfect for locking in a great rate when you think rates have hit their ceiling and might start falling. They give you a guaranteed return for a long time, which is ideal for big savings goals down the road.

Are Brokered CDs Also FDIC Insured?

Yes, they generally are. Brokered CDs—the kind you buy through a brokerage firm like Fidelity or Schwab instead of directly from a bank—are typically covered by FDIC insurance.

The protection works through a mechanism called "pass-through" insurance. Essentially, the FDIC coverage from the bank that originally issued the CD "passes through" the brokerage to you, the actual owner.

To be safe, you just need to confirm two things: first, that the issuing bank is an FDIC member, and second, that your brokerage holds the CD in an account structure that qualifies. This ensures your money has the same $250,000 safety net you'd get by walking into a local bank branch.

Ready to see how different FDIC-insured CD rates could grow your savings? The Certificate-of-Deposit Calculator makes it easy. Project your earnings, compare offers, and find the perfect CD for your financial goals. Try the free calculator now and plan your savings with confidence.