Understanding Early CD Withdrawal Penalties

A Certificate of Deposit (CD) offers a more attractive interest rate than a standard savings account. The trade-off? You agree to keep your money deposited for a specific timeframe, allowing the bank to invest those funds. But what if you need access to your cash before the CD matures? That's when early withdrawal penalties come into the picture. These penalties are essential for maintaining the bank's financial stability and aren't arbitrary fees.

Why Do Early CD Withdrawal Penalties Exist?

Early withdrawal penalties primarily compensate for potential losses banks incur when you withdraw prematurely. Banks use the money deposited in CDs for various lending and investment activities. An early withdrawal disrupts this process, often forcing them to seek alternative funding, which can be more expensive. The penalty helps cover these costs and allows them to maintain competitive interest rates for other CD holders. It also encourages savers to honor their commitment to the CD's full term, creating a stable funding base.

How Penalties Impact Your Returns

Early withdrawal penalties directly impact your overall return. Imagine you have a $10,000 CD earning 3% APY. If you withdraw early and the penalty equals three months' interest, you lose a chunk of your earnings. This loss can significantly reduce the benefit of the higher CD rate, possibly even resulting in less than what a regular savings account would have earned. Learn more about managing these penalties: How to master CD early withdrawal penalties.

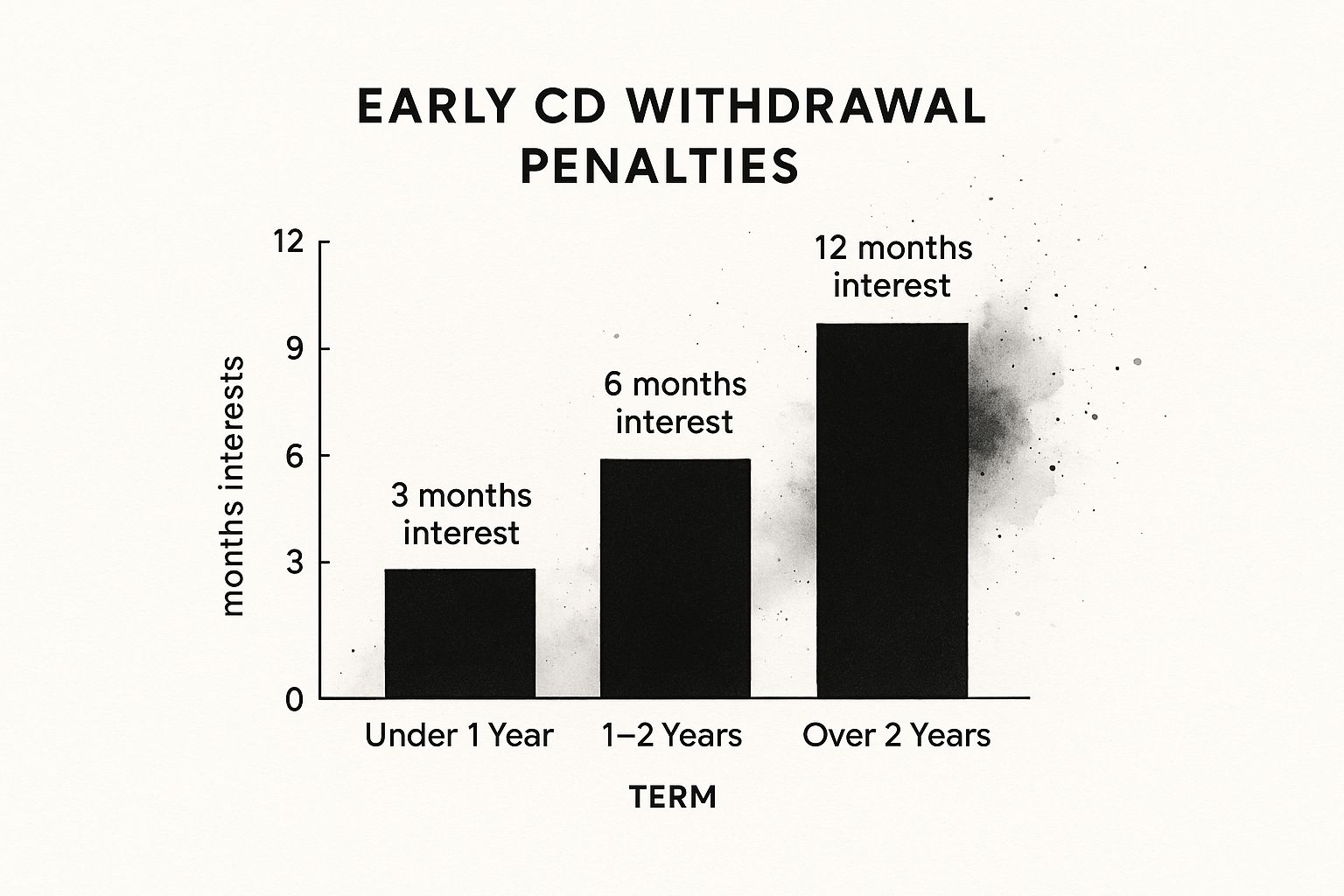

The penalties for early CD withdrawals vary based on the term length.

- 12-Month CD: Typically around three months of interest.

- 2-Year CD: The penalty is usually about six months of interest.

- 5-Year CD: Often forfeits about 8.5 months of interest.

These penalties are meant to discourage early withdrawals and ensure the bank maintains the necessary liquidity to meet its obligations. The varying penalty amounts emphasize the importance of understanding the terms before investing in a CD. For example, a shorter-term CD with a smaller penalty might be better if you anticipate needing access to your funds sooner.

Historically, these penalties have remained consistent, with variations primarily occurring in the interest rates offered on CDs rather than the penalty structure. Learn more: CD Withdrawal Penalties - Often More Than Worth the Risk. For a broader understanding of CD investments, consider exploring general financial concepts: Money. Understanding these penalties is essential for making sound decisions about your savings.

The Hidden Math Behind CD Penalty Calculations

This infographic illustrates typical early CD withdrawal penalties, comparing the penalty duration across different CD term lengths. Notice how longer-term CDs generally have higher penalties. This is because withdrawing early from a longer-term CD disrupts the bank's investment strategy more significantly. Therefore, carefully considering your financial needs and the CD's term is crucial.

How Banks Calculate Early CD Withdrawal Penalties

Understanding how these penalties are calculated helps you make informed choices. Most banks base the early withdrawal penalty on a percentage of the interest earned or a fixed number of months' worth of interest.

For instance, a common penalty is six months' interest. If you withdraw from a 5-year CD earning 4% APY after just one year, you would lose six months' worth of that 4% return.

This penalty is subtracted directly from your accrued interest, reducing your overall profit. The good news is that, in most cases, early withdrawal penalties do not touch your principal. Your initial deposit remains safe, though your earnings will be reduced.

CD Term Length and Penalties: A Closer Look

The length of your CD term significantly impacts the penalty. Shorter-term CDs, like 6-month or 1-year CDs, usually have smaller penalties, often around 3 months' interest.

Longer-term CDs, like 3-year or 5-year CDs, typically have stiffer penalties, sometimes as high as a full year's interest. The actual penalty can vary quite a bit between institutions.

To illustrate, the penalties for 5-year CDs can range from 90 days to 540 days of interest, averaging about 242 days. Comparing terms before committing to a CD is essential. More detailed statistics can be found here.

To better understand the potential impact of penalties based on term length, let's look at the following table:

Early CD Withdrawal Penalty Comparison by Term Length

This table compares typical early withdrawal penalties across different CD term lengths, showing how the penalty increases with longer commitment periods.

| CD Term | Typical Penalty | Example Calculation on $10,000 at 3% APY |

|---|---|---|

| 6 Months | 1 Month Interest | $25 |

| 1 Year | 3 Months Interest | $75 |

| 3 Years | 6 Months Interest | $150 |

| 5 Years | 12 Months Interest | $300 |

As you can see, the penalty amount increases significantly as the CD term length increases. Choosing the right term length is a crucial factor to consider when opening a CD, especially if there's a chance you might need to access the funds early.

Variability in Penalty Calculation

Even for the same CD term, different banks might use different penalty formulas. This can result in substantially different outcomes for you. This is why it's so important to carefully review the specific terms and conditions of each CD before making a decision.

A CD calculator can be invaluable in these situations. You can use a CD calculator to estimate the potential impact of penalties and compare CD offerings from various financial institutions.

How Rising and Falling Rates Transform Penalty Impact

The impact of an early CD withdrawal penalty isn't fixed. It changes along with interest rates. This dynamic can significantly affect your returns. Identical penalties can feel very different depending on the economy. Understanding this is key for smart CD investing.

The Low-Rate Environment: Penalties Bite Harder

When interest rates are low, the cost of an early withdrawal penalty is more noticeable. This is because the potential interest earned on the CD is already low. Losing some of those earnings due to a penalty takes a bigger chunk out of your overall return.

For example, if your CD earns only 1% APY, a penalty equal to three months' interest is a large part of your yearly return. This makes the penalty feel much larger.

Riding the Rate Wave: When Penalties Matter Less

On the other hand, when interest rates are high, the impact of an early withdrawal penalty decreases. For example, if your CD earns 5% APY, that same three-month penalty is a smaller percentage of your overall return.

This can make the penalty seem less of a problem, especially if breaking the CD lets you reinvest at an even higher rate.

To illustrate this further, let's consider some real-world data:

This table illustrates how the same early withdrawal penalty affects investors differently depending on the prevailing interest rate environment.

| Interest Rate Environment | Example CD Rate | 3-Month Penalty Cost | Relative Impact |

|---|---|---|---|

| Low (e.g., 2020) | 1% APY | 0.25% | Significant (25% of annual return) |

| High (e.g., 2023) | 5% APY | 1.25% | Less significant (25% of annual return, but on a larger base) |

As you can see, the relative impact of the penalty is greater in a low-rate environment even though the percentage remains the same.

Historically, CD rates have changed a lot, affecting how penalties are perceived. From June 2020 to June 2021, the average one-year CD rate dropped from 0.41% APY to 0.17% APY. The five-year rate fell from 0.6% APY to 0.31% APY.

This low-rate period, linked to the COVID-19 pandemic, made early withdrawals less costly. But as rates rose due to Fed rate hikes in 2022 and 2023, the cost of early withdrawals increased because the potential interest earned was higher. You can explore historical CD rates further on Bankrate.

Strategic Adjustments for Savvy Investors

Smart investors understand these changes and adjust their CD strategies. During low rates, they might choose shorter-term CDs to lessen the impact of penalties. They may also use a CD calculator to analyze the potential costs and benefits of early withdrawal.

During high rates, these investors might be more willing to accept a penalty if it means getting even higher rates elsewhere. This helps them get the most from their returns while reducing the impact of penalties.

When Breaking Your CD Actually Makes Financial Sense

Contrary to popular belief, there are times when paying the early CD withdrawal penalty is the smartest financial move. It might seem counterintuitive, but sometimes absorbing that penalty results in better long-term financial outcomes. Let's delve into some scenarios where breaking your CD might actually be a good idea.

The Allure of Higher Interest Rates

One compelling reason to break a CD is the emergence of substantially higher interest rates. Imagine you locked in a 1% APY on a 5-year CD, and rates suddenly jump to 4%. Paying the penalty to reinvest in a new, higher-rate CD for a similar term could be a wise decision. Calculating the break-even point, where the increased return outweighs the penalty, is crucial. A CD calculator can help you determine if this strategy will work for you.

Escaping the Burden of High-Interest Debt

Using CD funds to eliminate high-interest debt is another scenario where breaking a CD might be warranted. If you’re carrying credit card debt at 18% APR, for instance, paying it off with CD funds—even with a penalty—can be a sound financial move. This strategy can free up cash flow and significantly reduce the total interest paid over the long haul. When considering financial decisions like early CD withdrawals, explore other retirement withdrawal strategies you might employ.

Unexpected Investment Opportunities

Sometimes, unexpected investment opportunities appear, offering a higher potential return than your existing CD. While CDs offer predictable returns, other investments might present greater growth potential. However, carefully evaluate the risks and potential rewards before liquidating your CD for alternative investments. Comparing potential long-term gains against the early CD withdrawal penalty is key.

Overcoming Psychological Barriers

Many investors hesitate to break a CD due to an aversion to penalties. Financial decisions should be rooted in rational analysis, not emotions. Remember, penalties are usually calculated as a percentage of the interest earned, or a fixed number of months' worth of interest. They rarely touch your principal.

Decision Frameworks for Rational Choices

To make well-informed decisions about early CD withdrawal, consider these factors:

- Calculate the break-even point: Determine when a new CD or investment's higher return surpasses the penalty.

- Compare interest rates: Assess the difference between your current CD rate and available rates on new CDs or other investments.

- Evaluate debt: Consider high-interest debt's impact on your overall financial health.

- Assess investment opportunities: Weigh the risks and rewards of alternative investments against the CD’s guaranteed return and the early withdrawal penalty.

By carefully considering these factors, you can make rational choices about breaking your CD that truly align with your financial goals.

Strategic Approaches to Sidestep CD Penalties Entirely

Minimizing the impact of early CD withdrawal penalties is helpful, but avoiding them altogether is even better. This section explores strategies for accessing your money while still enjoying the benefits of CDs. These methods balance liquidity and maximizing returns.

The Power of CD Laddering

CD laddering is a highly effective strategy. It involves splitting your investment across multiple CDs with varying maturity dates. For instance, you could invest equal amounts in 6-month, 12-month, 18-month, and 24-month CDs. Learn more about this approach: How to master CD laddering.

As each CD matures, you can withdraw the funds penalty-free or reinvest them in a new CD at the end of the ladder. This provides regular access to some of your money while earning competitive CD interest rates. It's a useful tool for balancing access and higher returns.

No-Penalty CDs: Weighing the Trade-Offs

No-penalty CDs are another option. These allow penalty-free withdrawals at any time. However, this flexibility often comes with lower interest rates than traditional CDs.

Careful analysis of the cost-benefit equation is key. If access is your priority, a no-penalty CD might be suitable. If you prefer a fixed term and maximum yield, a traditional CD may be better. A CD calculator can help you compare potential returns.

Bump-Up CDs: Adapting to Rising Rates

Bump-up CDs offer another way to avoid penalties while potentially capitalizing on rising interest rates. These CDs usually let you "bump up" your interest rate once during the term if the bank's rates increase.

This offers some protection against rising rates without breaking your CD and incurring a penalty. While not universally available, they can be a valuable tool for managing interest rate risk.

Leveraging Relationship Banking and Negotiation

A strong bank relationship might unlock penalty waivers or reductions, especially for long-term customers. While not a guarantee, discussing your situation with a bank representative could lead to a better outcome.

Some institutions offer more flexible terms, like partial penalty-free withdrawals. Researching different banks and their CD offerings can help you find institutions that prioritize customer flexibility.

Strategic Emergency Fund Positioning

Minimizing the need for early withdrawals can be the most effective approach. This involves having enough money in an accessible emergency fund before investing in a CD.

This designates CD funds for longer-term goals, reducing the risk of needing them unexpectedly. Strategic emergency fund placement lets you maximize CD returns while maintaining necessary liquidity.

Institution Showdown: Who Charges The Fairest Penalties?

Not all early CD withdrawal penalties are the same. Knowing the differences between financial institutions can save you a substantial amount of money. This look into penalty structures across various financial institutions will highlight where the most favorable terms can be found.

Traditional Banks Vs. Online Banks

Traditional banks often have higher operating costs than online banks. This can result in higher early CD withdrawal penalties to cover these expenses. Online banks, with their lower overhead, can sometimes provide more competitive penalty structures.

For example, some online banks might charge a penalty equal to three months of interest on a 1-year CD, while a traditional bank might charge six months of interest for the same product. This difference can become even more significant with longer-term CDs.

Credit Unions: A Different Approach

Credit unions, being member-owned, sometimes focus on member benefits rather than profit maximization. This can result in more flexible early CD withdrawal penalty structures compared to traditional banks.

However, it's important to remember that not all credit unions are alike. Their penalty structures can differ, so comparing terms before committing to a CD is crucial. You might find this helpful: Highest CD Rates Available.

Neobanks and Fintechs: The New Players

Neobanks and other fintech companies are often changing traditional banking models. This includes offering different CD products with varied penalty structures. Some might have reduced penalties, tiered penalties, or even no-penalty CDs.

However, it's important to research these newer institutions carefully before investing. Make sure they are FDIC-insured and understand their specific CD terms and conditions.

Negotiating Penalty Reductions

Negotiating a penalty reduction may be possible in certain circumstances. This is more likely with smaller institutions or credit unions where personal service is often a priority. Developing a good relationship with your financial institution can sometimes be advantageous in these situations.

Understanding why early CD withdrawal penalties exist can also help you present your case. Explaining your circumstances and demonstrating that you understand the bank's perspective can sometimes lead to a better outcome.

The Impact of Competition

Competition within the banking industry has affected penalty structures. As more institutions offer CDs, they compete on factors like interest rates and penalties. This competition generally benefits consumers, often leading to more favorable terms.

Identifying Customer-Friendly Policies

Before investing in a CD, review the institution's disclosure documents carefully. Pay close attention to the early withdrawal penalty details and don't hesitate to ask for clarification.

Look for clear language explaining how the penalty is calculated. Avoid institutions with complex or confusing penalty terms.

Choosing The Right Institution For You

The institution with the "fairest" penalties will depend on individual needs and circumstances. If flexibility is important, an online bank or credit union with lower penalties or no-penalty CDs might be a good fit. If you value stability and a long-term relationship with one institution, a traditional bank with clearly defined penalties could be a better option. A CD Calculator can help you evaluate your needs and choose the right CD for you.