Understanding Your Certificate of Deposit Calculator

A certificate of deposit (CD) is a popular savings tool offering a fixed interest rate over a specific time period. A CD calculator helps you project the growth of your investment based on factors like your initial deposit, the interest rate, and the term length. This knowledge empowers you to make smart decisions and maximize your returns. Understanding these tools is increasingly important given the size of the CD market, estimated at around USD 1 trillion in 2023 and projected to reach nearly USD 1.5 trillion by 2032. This growth reflects a global demand for low-risk investments. Learn more about this growing market: Global Certificate of Deposit Market.

How a CD Calculator Works

CD calculators use the principles of compound interest. Let's say you deposit $1,000 into a CD with a 2% annual percentage yield (APY) compounded annually. The calculator determines your first-year earnings. Then, it adds that interest to your principal, calculating the second year's interest on the new, higher balance. This process continues throughout your CD's term. Want to dive deeper? Check out this helpful resource: How to master the CD Calculator.

Key Inputs and Outputs

Using a CD calculator effectively requires a few key inputs:

- Principal: Your initial deposit amount.

- Interest Rate (APY): The annual percentage yield, reflecting the total interest earned over a year.

- Term Length: The CD's duration, usually in months or years.

- Compounding Frequency: How often the interest is calculated (e.g., daily, monthly, quarterly, annually).

After entering these values, the calculator generates important outputs:

- Future Value: Your total amount at the end of the term, including principal and interest.

- Total Interest Earned: The overall interest accumulated.

- Annual Interest Earned: The interest earned each year.

Different Types of CD Calculators

Various CD calculators cater to different investment strategies:

- Basic CD Calculator: This standard calculator focuses on future value calculations using simple and compound interest.

- CD Laddering Calculator: This tool helps you create a CD ladder, dividing your investment into multiple CDs with staggered maturity dates for improved liquidity and potentially higher returns.

- Early Withdrawal Penalty Calculator: This calculator helps you understand the potential costs of withdrawing funds before maturity.

Interpreting the Results

While using a CD calculator is straightforward, interpreting the results correctly is crucial. A higher APY and more frequent compounding lead to greater returns. However, longer-term CDs often offer higher APYs but also tie up your money longer. This involves balancing your need for access to funds with your desire for higher yields. Remember, projected returns are estimates. While CDs offer a fixed APY, factors like early withdrawals can impact your final return.

Mastering Key Variables That Drive Your Returns

A certificate of deposit (CD) calculator helps you project your investment growth. Understanding the key factors influencing these calculations is crucial for maximizing your returns. These variables interact to determine the final outcome of your CD, much like ingredients in a recipe.

Principal Amount: The Foundation of Your Investment

The principal amount is your initial deposit, the base upon which your interest earnings accumulate. It's the starting point of your CD journey. Depositing $5,000 versus $10,000, for example, will significantly affect your final return, even with identical interest rates and terms.

A larger principal generates more interest, accelerating your progress toward financial goals. This basic principle emphasizes the importance of saving diligently to maximize your initial investment.

Interest Rate (APY): Your Growth Engine

The annual percentage yield (APY) fuels your CD's growth. It represents the total interest earned annually, including compounding. A higher APY means greater earnings over the CD's term.

Even small APY differences can significantly impact returns, especially over longer periods. Comparing APYs from different financial institutions is a critical step before investing.

Term Length: Balancing Reward and Access

The term length, or duration of your CD, heavily influences your returns. Longer-term CDs generally offer higher APYs, rewarding you for a longer commitment. However, this also restricts access to your funds.

Shorter-term CDs provide greater liquidity, but may offer lower returns. Finding the right balance between reward and accessibility is crucial. This involves considering your financial goals and potential future expenses.

Compounding Frequency: The Power of Exponential Growth

Compounding frequency dictates how often earned interest is added back to your principal. More frequent compounding (daily or monthly) lets you earn interest on your interest faster, leading to greater returns over time.

This "snowball effect" can significantly boost earnings, especially with longer terms and higher APYs. Understanding compounding is essential for maximizing CD returns and demonstrates the power of exponential growth.

Factoring in Inflation: Maintaining Real Returns

While CD calculators project nominal returns, considering inflation is vital for understanding your investment's true value. Inflation reduces purchasing power.

A CD calculator helps assess whether your CD's return will outpace inflation, preserving your investment's real value. Use realistic inflation estimates to determine if your CD’s APY provides a sufficient real return after accounting for inflation.

Risk and Return: The CD Advantage

CDs are generally low-risk investments, particularly compared to stocks or bonds. They offer a fixed interest rate, and your principal is typically insured.

However, a risk-return relationship still exists with CDs. Longer-term CDs typically offer higher APYs but tie up your money longer, increasing the risk of missing potentially higher future rates. Balancing these factors is crucial for optimizing your CD investments. CD term loans, secured by your CD, allow access to funds without early withdrawal penalties, mitigating risk while allowing your CD to continue earning.

Learning From Historical CD Rate Patterns

Understanding historical CD rate trends provides valuable context when using a certificate of deposit calculator. This knowledge helps validate projections and make informed investment decisions, especially regarding timing. While past performance doesn't guarantee future results, it offers crucial insights.

The Influence of Economic Cycles

CD rates are closely tied to economic cycles. During periods of economic expansion, interest rates tend to rise, leading to higher CD yields. Conversely, during recessions or economic slowdowns, rates typically decline. Recognizing these cyclical patterns can help you anticipate potential rate movements.

For example, during periods of high inflation, the Federal Reserve often raises interest rates to control rising prices. This action can lead to increased CD rates, creating attractive investment opportunities. However, following the 2008 financial crisis, rates plummeted. Shorter-term CDs even offered yields below 1% APY, while in the early 1980s, CD APYs could exceed 10% due to high inflation and tight monetary policy. Find more detailed statistics here.

Federal Reserve Policy and CD Rates

The Federal Reserve's monetary policy significantly influences CD rates. The Fed sets the federal funds rate, the target rate for overnight lending between banks. This rate influences other interest rates, including those offered on CDs. When the Fed raises rates, CD yields often follow.

Additionally, the Fed's quantitative easing programs, like those implemented after the 2008 financial crisis, can also impact CD rates. By injecting liquidity into the market, these programs can push down interest rates, including CD yields.

Market Conditions and CD Rate Fluctuations

Beyond economic cycles and Fed policy, various market conditions affect CD rates. Investor demand for CDs plays a role. High demand can drive up rates, while low demand can put downward pressure on yields. Competition among financial institutions also influences rates. Banks and credit unions compete for deposits, leading to more attractive CD offers.

Furthermore, global economic events can impact CD rates. International crises or significant economic shifts in other countries can affect interest rates in the United States.

Stress-Testing Your Calculator Results

Historical data empowers you to stress-test your certificate of deposit calculator projections. By inputting historical rates, you can see how your investment would have performed under different market conditions. This allows you to evaluate the potential range of outcomes for your current CD investments.

This approach helps you set realistic expectations and assess potential risks. It also informs decisions about term length. For instance, if historical data suggests rates are likely to rise, you might consider shorter-term CDs. Conversely, if rates appear poised to fall, locking in a longer-term CD at the current, potentially higher rate might be beneficial. This analysis, combined with insights from your CD calculator, provides a robust framework for making informed investment decisions.

Advanced Calculator Features That Change Everything

Beyond basic interest calculations, today's Certificate of Deposit (CD) calculators offer powerful features that can significantly improve your returns. These tools empower you to make informed decisions and optimize your CD investments.

CD Ladder Calculators: Maximizing Liquidity and Returns

CD Laddering involves splitting your investment across multiple CDs with staggered maturity dates. A CD Ladder Calculator simplifies this strategy, helping you determine the optimal allocation and maturity schedule to meet your investment goals. This allows you to access part of your funds regularly without substantial penalties. It also lets you capitalize on potential interest rate increases by reinvesting matured CDs at higher yields.

Early Withdrawal Penalty Analyzers: Assessing Potential Costs

Withdrawing from a CD before maturity often incurs an early withdrawal penalty. An Early Withdrawal Penalty Analyzer helps you understand the potential cost of early access. This feature compares the penalty against the potential interest earned if the CD were held to maturity, enabling informed decisions in unforeseen circumstances.

Multi-CD Portfolio Tools: Managing Complex Investments

For investors with multiple CDs, Multi-CD Portfolio Tools provide a comprehensive overview of your entire CD portfolio. This consolidated view helps you track interest rates, maturity dates, and overall performance, simplifying complex CD management and facilitating strategic investment decisions.

Comparison Features: Finding the Best Value

Modern CD calculators often include comparison features, letting you evaluate offers from different financial institutions side-by-side. This helps you identify the best Annual Percentage Yield (APY), minimum deposit requirements, and terms that suit your needs, ensuring maximized returns within your risk tolerance.

Specialized Calculators: Addressing Unique Needs

Some calculators cater to specific CD types, such as bump-up CDs, callable CDs, and variable-rate CDs. These specialized tools consider the unique features of these products, like the option to increase your rate with a bump-up CD or the potential for early call with a callable CD.

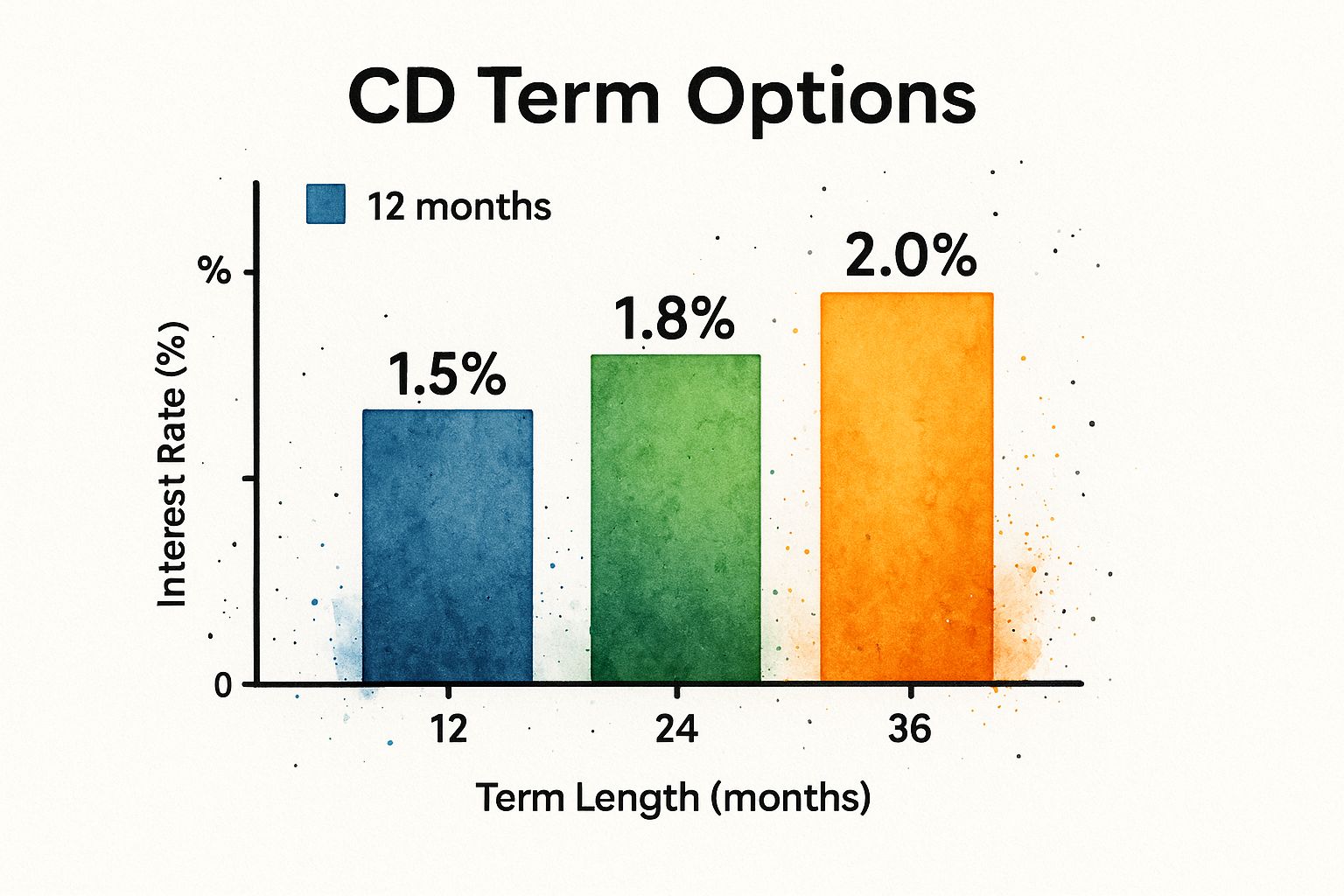

The infographic above compares interest rates for CDs with varying term lengths: 12 months, 24 months, and 36 months. Longer-term CDs generally offer higher interest rates, highlighting the potential trade-off between liquidity and return.

To help you choose the right CD calculator, let's look at a comparison of their features:

CD Calculator Feature Comparison This table compares features available in different types of CD calculators and their specific use cases.

| Calculator Type | Key Features | Best For | Limitations |

|---|---|---|---|

| Basic CD Calculator | Calculates total interest earned and final balance | Simple CD investments | Doesn't account for complex scenarios like early withdrawals or laddering |

| CD Ladder Calculator | Calculates returns for laddered CD portfolios | Maximizing returns while maintaining liquidity | Requires understanding of laddering strategies |

| Early Withdrawal Penalty Calculator | Calculates penalties for early CD withdrawals | Assessing the cost of early access | May not consider all penalty variations |

| Multi-CD Portfolio Calculator | Tracks and analyzes multiple CD investments | Managing complex CD portfolios | Requires detailed information on each CD |

| Specialized CD Calculator | Addresses unique features of specific CD types (bump-up, callable, etc.) | Optimizing returns for specialized CDs | May not be applicable to all CD types |

| Comparison Tool | Compares offers from different institutions | Finding the highest APYs and best terms | Requires researching offers from multiple banks/credit unions |

This table summarizes the various CD calculator types and their benefits, helping you choose the tool best suited for your investment needs.

Integrating Calculators into Financial Planning

While CD calculators provide valuable insights for specific investments, they can also be integrated into broader financial planning. Use calculator projections to assess how CDs contribute to your overall portfolio diversification and income generation. Consider your financial goals, risk tolerance, and time horizon when allocating a portion of your investments to CDs. Strategically incorporating CDs helps balance security and growth, enhancing your overall investment strategy and supporting your long-term financial objectives.

Strategic Calculator Use For Maximum Returns

A certificate of deposit (CD) calculator is more than just a simple interest calculator. It’s a powerful tool for strategically building wealth. Instead of just crunching basic numbers, you can use these calculators to time your investments, optimize laddering strategies, and truly maximize the benefits of compound interest. This shifts your focus from simply saving to strategically planning for substantial returns.

Timing Your Investments for Optimal Returns

Savvy investors use CD calculators to model different scenarios. They're looking for the sweet spot between term length and interest rate optimization. For instance, a calculator might project higher returns with a longer-term CD. But if you expect interest rates to climb soon, a shorter-term CD could be a smarter move. This would allow you to reinvest at a higher rate later on. This type of strategic approach requires careful consideration of market trends and your personal financial goals.

Maximizing Compound Interest With Smart Reinvestment

The power of compound interest gets a boost from strategic reinvestment planning. CD calculators help you project returns over multiple reinvestment cycles, revealing the long-term impact of consistent, disciplined investing. You'll see how small, regular deposits, combined with the snowball effect of compounding, can accumulate significant wealth over time. For a deeper dive into calculating CD interest, check out this helpful resource: How to master calculating CD interest.

Balancing Liquidity and Returns With CD Laddering

CD laddering involves spreading investments across multiple CDs with different maturity dates. A CD calculator can help you optimize this strategy. By entering different term lengths and interest rates, you can model various laddering scenarios. This helps you strike the right balance between accessible funds and maximized returns. You'll have access to some of your money regularly while still benefiting from the higher rates usually offered by longer-term CDs.

Factoring in Taxes and Inflation for Realistic Projections

For truly accurate projections, you need to consider the effects of taxes and inflation. A good CD calculator lets you adjust for these factors, providing a more realistic view of your potential returns. This means your projected earnings will reflect the true purchasing power of your investment after taxes and inflation are taken into account. Looking at historical CD interest rates from 1980-2025 shows how much these rates can fluctuate due to macroeconomic conditions, including Federal Reserve policies. The dramatic increase from about 1% in early 2022 to over 5% APY by March 2023 for short-term CDs reflects the Fed's response to rising inflation. You can learn more about historical CD rates here.

Maintaining Liquidity While Maximizing Returns

Maximizing returns is a primary goal, but maintaining liquidity is just as crucial. CD calculators help you strategically plan your CD investments so you can access funds when needed. By staggering maturity dates and considering shorter-term CDs, you create a portfolio that balances earning potential with accessibility. This means you can handle unexpected financial needs without sacrificing your long-term investment goals.

Building Long-Term Wealth With Strategic Calculator Use

By using these advanced techniques, you can transform the CD calculator from a simple tool into a strategic instrument for building long-term wealth. Modeling different scenarios, optimizing reinvestment cycles, and incorporating tax and inflation considerations empowers you to make informed decisions. This proactive approach helps you maximize returns and ensure your CD investments align with your overall financial plan, building a secure financial future.

Smart Rate Shopping Using Calculator Analysis

A certificate of deposit (CD) calculator is an invaluable tool for anyone considering CD investments. These calculators help you compare different CD offers, understand the impact of varying terms and rates, and ultimately, make more informed investment decisions. They empower you to move beyond advertised rates and discover the true potential of each CD.

Comparing Rates Across Financial Institutions

CD rates can vary significantly between financial institutions. A CD calculator allows you to quickly compare the annual percentage yield (APY) offered by different banks and credit unions. By inputting the same principal and term length, while changing only the APY, you can easily identify which institution offers the highest return for your specific investment.

Beyond the Headlines: Factoring in Promotional Rates and Minimum Deposits

Many financial institutions offer attractive promotional rates on CDs. However, these rates typically last for a limited time. A CD calculator helps you project your earnings both during and after the promotional period, giving you a clearer picture of the long-term return. It also allows you to factor in minimum deposit requirements, ensuring the CD aligns with your available funds.

Assessing Institution Reliability

While a high APY is attractive, the reliability of the financial institution offering the CD is equally important. Consider the institution's financial health and reputation alongside the offered rate. A slightly lower APY at a well-established institution might offer greater security than a higher rate at a less stable one.

Online vs. Traditional: Using Calculators to Weigh Your Options

Online banks often offer competitive, sometimes higher, APYs compared to traditional banks. This is often due to their lower overhead costs. However, traditional banks may provide personalized service and a wider range of financial products. A CD calculator can help you compare rates from both online and traditional institutions, enabling you to weigh the potential return difference against your preference for in-person service or online convenience.

Credit Unions vs. Commercial Banks: Understanding the Differences

Credit unions, member-owned financial cooperatives, can sometimes offer competitive CD rates compared to commercial banks. However, they may have membership requirements. A CD calculator lets you compare rates from both credit unions and banks, factoring in any membership fees or restrictions. This empowers you to make an informed choice based on your individual circumstances. You might be interested in learning more about CD laddering strategies: How to master CD laddering.

Brokered CDs vs. Direct Offerings: Expanding Your Options

Brokered CDs are offered through brokerage firms and can provide access to a wider selection of CDs from different institutions. However, they may come with associated fees. A CD calculator allows you to compare the net return of a brokered CD (after fees) with the return of a direct CD offering from a bank or credit union. This helps ensure you choose the option with the highest actual yield.

Maximizing Your Returns Through Smart Comparisons

Before investing in a CD, use a calculator to explore all available options. By comparing rates, considering promotional periods and minimum deposits, and assessing the reliability of the financial institution, you can make informed decisions and maximize your returns.

Let's take a look at some current CD rates:

Current CD Rate Comparison By Term Length: Analysis of current average CD rates across different term lengths and institution types.

| Term Length | National Average APY | Top Rate APY | Minimum Deposit |

|---|---|---|---|

| 3 months | 1.50% | 5.35% | $500 |

| 6 months | 1.75% | 5.50% | $1,000 |

| 12 months | 2.00% | 5.65% | $1,000 |

| 24 months | 1.75% | 5.30% | $1,000 |

| 36 months | 1.50% | 5.00% | $1,000 |

| 60 months | 1.25% | 4.75% | $1,000 |

This table represents a sample of current CD rates and may not reflect all available offers. Always check with individual financial institutions for the most up-to-date information.

As you can see, even with a modest minimum deposit, the top rates significantly outpace the national average. It pays to shop around! Using a CD calculator and comparing offerings across different institutions can help you pinpoint the best CD for your financial goals.

Key Takeaways

This guide offers practical advice on using Certificates of Deposit (CD) calculators to reach your financial goals. We'll cover everything from choosing the right tools to comparing offers, tracking performance, and maximizing your fixed-income strategy.

Choosing the Right CD Calculator

The first step to maximizing your CD returns is selecting the right calculator. A basic CD calculator works well for simple interest calculations. However, for strategies like CD laddering, a specialized CD ladder calculator is essential. If you might need access to your funds early, an early withdrawal penalty calculator can help you understand the potential costs.

Setting Up Comparison Systems

Comparing CD offers from different banks and credit unions is key to finding the best rates. Use online comparison tools like Bankrate or create a spreadsheet to track APY, term length, and minimum deposit. This helps you quickly pinpoint the CDs with the highest potential return for your needs.

Tracking Portfolio Performance

Once you've invested, tracking your CD performance is essential. Monitor interest earned, maturity dates, and renewal opportunities. You can do this manually or with portfolio management software like Personal Capital. Actively tracking your portfolio helps you identify opportunities to reinvest maturing CDs at potentially better rates.

Monitoring Rate Changes and Renewal Opportunities

Interest rates are always changing. A system for monitoring these changes is crucial. Sign up for rate alerts from financial institutions or use online resources that track current CD rates. This keeps you informed about market conditions and helps you spot good times to invest. When your CDs near maturity, actively evaluate renewal options. Don't just automatically renew; compare current offers to ensure you're getting the best return.

Actionable Checklists for Different Investment Scenarios

Short-Term Goals: Prioritize liquidity with shorter-term CDs and competitive rates. Use a CD calculator to project returns and ensure they align with your target.

Long-Term Savings: Focus on maximizing returns with longer-term CDs. A CD laddering calculator helps balance liquidity and higher yields.

Retirement Planning: Integrate CDs into your retirement portfolio for stable income. A CD calculator helps project long-term growth and assess their contribution to your retirement goals.

Templates for CD Laddering Success

A CD ladder involves investing in multiple CDs with staggered maturity dates. This offers both liquidity and the potential for higher returns. Use a CD laddering template or calculator to customize a ladder based on your investment and desired maturity schedule.

Decision Frameworks for Maximizing Your Fixed-Income Strategy

Risk Tolerance: Assess your comfort level with tying up funds. Balance potential returns with your need for access to your money.

Investment Goals: Clearly define your financial objectives. Use a CD calculator to determine the investment and term needed to reach them.

Market Conditions: Stay informed about current and projected rates. Use historical data to guide your decisions about term length and investment timing.

By following these takeaways, you can effectively use CD calculators to maximize your returns and achieve your financial objectives. From selecting the right tools to monitoring market conditions, these strategies empower you to make smart decisions and optimize your CD investments.

Ready to start maximizing your returns? Use our Certificate-of-Deposit Calculator to project your earnings and make informed decisions.