Certificates of Deposit (CDs) have a well-earned reputation for being safe. But the real certificate of deposit risk isn't about losing your principal—that part is almost always protected. The true risks are the subtle, slow-moving forces that can quietly eat away at what your money is actually worth.

Think of it this way: your CD is like a valuable painting locked securely in a vault. The painting itself is safe. But if the currency it's valued in starts to lose its buying power, the real value of that painting drops, even though the artwork is untouched. This is the heart of understanding CD risk—your initial deposit is secure, but its purchasing power isn't immune to what's happening in the broader economy.

This guide moves beyond the simple "yes, CDs are safe" answer. We'll dig into the nuances that every saver should understand to make sure their CD works as hard as they expect it to.

Quick Overview of Key CD Risks

Before we dive deep, let's get a bird's-eye view of the main challenges your CD might face. Each one affects your money in a different way.

| Risk Type | What It Means for Your Money |

|---|---|

| Interest Rate Risk | You could miss out on higher earnings if market rates climb after you've locked in your CD. |

| Inflation Risk | Your savings could lose real-world buying power if inflation grows faster than your interest rate. |

| Liquidity Risk | You might need your cash before the CD matures, forcing you to pay a penalty that reduces your return. |

| Opportunity Cost Risk | You tied up money in a CD when another investment might have delivered a better return over the same period. |

These are the core concepts we'll be exploring. They don't threaten your principal, but they absolutely can impact the growth you were counting on.

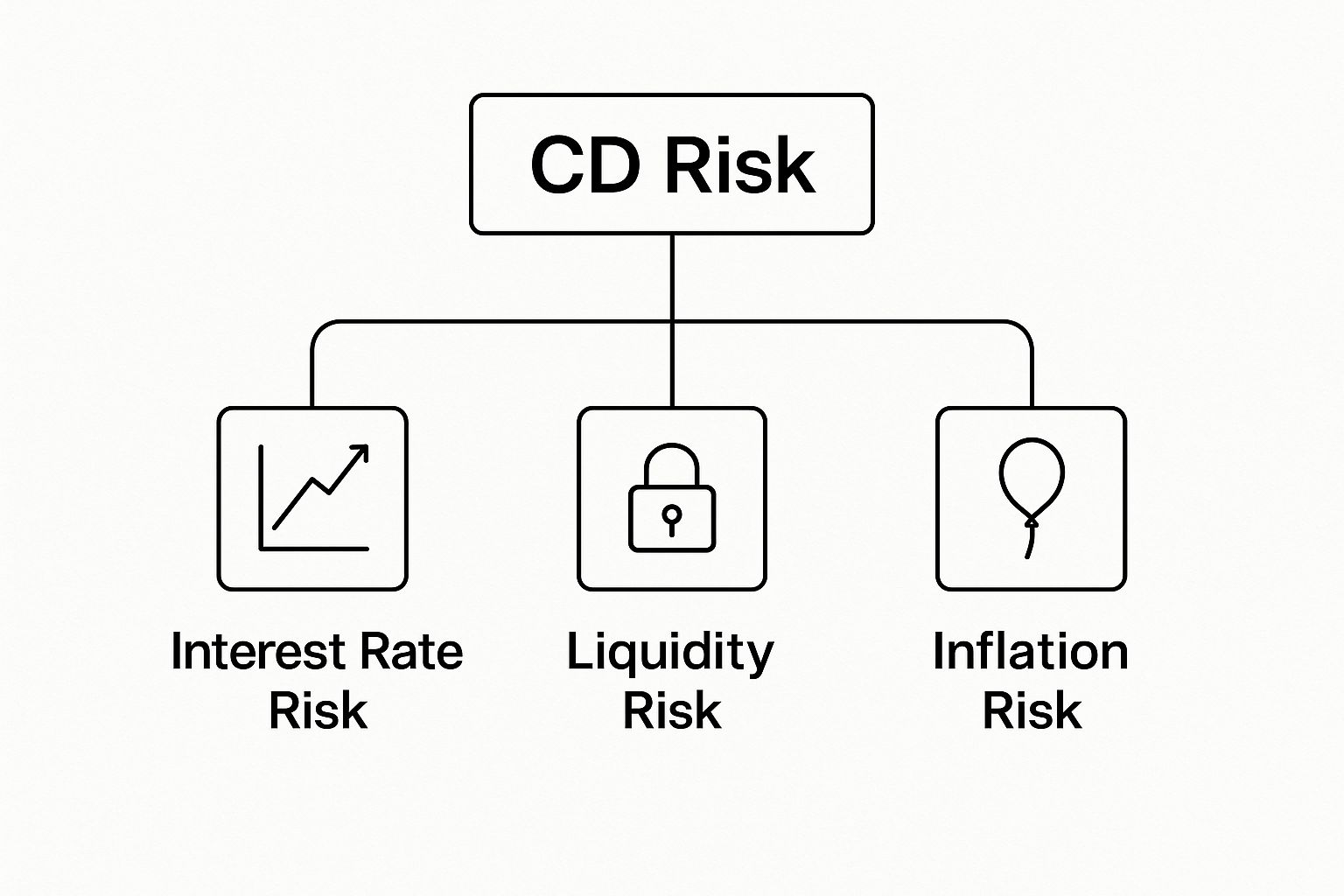

The infographic below offers a great visual breakdown of how these risks are connected.

As you can see, some risks are driven by the market (interest rates, inflation), while others are tied to your personal financial situation (needing cash unexpectedly). This is why the common question, "are CDs safe investments?," has a more complex answer than most people think.

Yes, your principal is safe. But protecting your returns and future purchasing power requires a bit more know-how. Let's get into it.

The Hidden Cost of Rising Interest Rates

Of all the risks that come with a CD, this is the one you’ll hear about most. Interest rate risk is the classic, and often frustrating, scenario where market rates go up after you’ve already locked your money into a fixed-rate CD.

Of all the risks that come with a CD, this is the one you’ll hear about most. Interest rate risk is the classic, and often frustrating, scenario where market rates go up after you’ve already locked your money into a fixed-rate CD.

Let’s say you open a 5-year CD at 3% APY, feeling pretty good about it. A year later, the economy shifts, and banks start advertising new 5-year CDs at 5% APY. Suddenly, your "safe" investment feels like a major missed opportunity. Your money is still safe, of course, but it’s now earning far less than it could be. That’s interest rate risk in a nutshell.

This highlights the concept of opportunity cost. By committing your money to that 3% CD, you gave up the chance—the opportunity—to earn a better return when rates improved. While it’s not a direct loss of your principal, it’s a very real loss of potential earnings. This is a critical aspect of certificate of deposit risk.

Understanding The Inverse Relationship

Think of it this way: your fixed-rate CD has an inverse relationship with the market. When new CD rates go up, the relative value of your older, lower-rate CD goes down. It's not that your balance shrinks; it's that your CD becomes less attractive compared to the new, higher-paying options on the shelf.

This is especially true for longer-term CDs. Locking in a rate for five or ten years gives the market a much wider window to climb past your fixed rate. A 1-year CD simply has less exposure to this risk than a 10-year CD does.

Key Takeaway: The longer your CD's term, the greater your exposure to interest rate risk. You're making a bigger bet that today's rates are good enough to commit to for the long haul.

The Federal Reserve is the main driver behind these swings. When the Fed hikes its target rate to cool down inflation, banks and credit unions usually follow by raising rates on savings products, including new CDs. When the economy slows, the Fed often cuts rates to encourage spending, which means CD yields fall.

A Case Study in Rate Volatility

History gives us a sharp picture of just how dramatic these shifts can be. In the early 1980s, savers could find one-year CDs yielding over 11% as the Fed battled runaway inflation. But after the 2008 financial crisis, rates tanked. For more than a decade, many one-year CDs paid less than 1%.

The COVID-19 pandemic pushed rates even lower, with some dipping below 0.5% APY. Then, in a complete reversal, aggressive Fed hikes by 2023 pushed some CD yields to 16-year highs, often breaking the 4% mark. You can see how economic events shape these trends by exploring the detailed history of CD rates on Bankrate.com.

This volatility exposes the core dilemma for savers: locking in a rate during a low-yield period can mean years of subpar returns.

How to Navigate Different Rate Environments

So, how do you manage this risk? The best strategy depends entirely on what you think rates will do next.

- In a Rising Rate Environment: If you expect rates to keep climbing, sticking with shorter-term CDs is usually the smarter play. A 6-month or 1-year CD frees up your money sooner, allowing you to reinvest at a higher rate when it matures.

- In a Falling Rate Environment: If you think rates have peaked and are about to head down, locking in a great APY with a longer-term CD (like a 3-year or 5-year) is a savvy move. You guarantee yourself that strong return even as the rates offered on new CDs start to drop.

Of course, reading the economic tea leaves isn't an exact science. But keeping an eye on Federal Reserve announcements and economic forecasts gives you clues. It helps you decide whether to stay flexible with short terms or go long to secure a great rate.

How Inflation Silently Erodes Your Savings

While interest rate risk is about missing out on better returns, inflation risk is far more dangerous. It doesn't just cap your potential earnings; it quietly eats away at the actual value of the money you’ve already saved. This is a crucial type of certificate of deposit risk that can make a "safe" investment lose you money in the real world.

While interest rate risk is about missing out on better returns, inflation risk is far more dangerous. It doesn't just cap your potential earnings; it quietly eats away at the actual value of the money you’ve already saved. This is a crucial type of certificate of deposit risk that can make a "safe" investment lose you money in the real world.

Think of inflation as a leak in your financial bucket. Even as your CD's interest slowly drips in, inflation might be draining your purchasing power out the bottom even faster.

Seeing your account balance tick up gives you a sense of progress. But if the cost of everything from groceries to gas is rising at an even faster clip, you're actually falling behind. Your savings are growing in dollars, but shrinking in what those dollars can actually buy.

Calculating Your True Gain or Loss

To see the real picture, you have to look past the advertised APY. That's just the nominal return. What truly matters is your real return—the number you get after inflation and taxes have taken their bite.

The formula is straightforward but incredibly revealing:

Real Return = CD's APY – Annual Inflation Rate – Your Tax Rate on Interest

This simple math tells you if your money is actually growing or just treading water. Sometimes, it shows you're losing ground even while earning interest.

Let's say you lock in a 1-year CD with a 3% APY. Looks like a decent, risk-free gain. But what happens when reality sets in?

- Scenario A (Good): Inflation for the year is 2%. After accounting for a 20% tax on your interest, your real return is still positive. Your purchasing power is growing.

- Scenario B (Bad): Inflation unexpectedly jumps to 4%. Suddenly, your 3% APY isn't keeping pace. Before you even think about taxes, your money’s buying power is already shrinking by 1%. You have more dollars, but each one is worth less.

This is the hidden trap of inflation risk. It’s a slow, silent drain on your wealth, and the damage gets worse over longer CD terms where inflation has more time to do its work.

A Look at Historical Real Returns

This isn't just a hypothetical exercise. History is filled with periods where CD investors earned what looked like a solid return, only to see it wiped out by inflation.

For example, data on CD yields from 2005 to 2016 shows this perfectly. In 2007, you could get a 12-month CD with a great 4.43% yield. But with inflation hitting 4.11% and a 25% tax rate, the real return was actually a loss of -0.79%. It was even worse in 2011, when a positive nominal gain turned into a staggering real loss of -2.48% after taxes. For a deeper dive into this data, check out the analysis on the real return of CDs from Hartford Funds.

The lesson here is clear: a CD’s fixed rate is its biggest strength and its greatest weakness. It can't adapt to rising prices, leaving it exposed during inflationary times. And don't forget to consider how taxes affect your overall savings, which further reduces what you actually keep.

Mitigating Inflation Risk

You can't stop inflation, but you can be smart about how you position your savings to weather it.

- Check the Forecasts: Before you lock in a rate, compare the CD’s APY to the current inflation rate and economic projections. If the APY is well below expected inflation, that CD might be a losing proposition.

- Keep It Short: When inflation is high or unpredictable, shorter-term CDs (like 6 or 12 months) are your friend. They give you the flexibility to reinvest your money sooner, hopefully at a better rate once the market adjusts.

- Diversify Your Defenses: For longer-term savings, consider pairing your CDs with investments specifically built to combat inflation, like Treasury Inflation-Protected Securities (TIPS).

Ultimately, managing inflation risk means being realistic. The goal isn't just watching your balance grow—it's making sure your purchasing power grows right along with it.

Protecting Your Money from Life's Curveballs and Bank Failures

So far, we've talked about market forces like interest rates and inflation. But two other risks are just as critical for any CD holder to understand: liquidity risk and credit risk.

Liquidity risk is all about your own life—what happens if you need your cash back sooner than you planned? Credit risk, on the other hand, is about the bank itself—the small but serious chance it could fail. Let's break down how to handle both.

The Cost of Cashing Out Early

Liquidity risk has nothing to do with the stock market and everything to do with your personal circumstances. It’s the risk that an unexpected bill or a sudden opportunity pops up, forcing you to break the CD agreement and pull your money out before its maturity date. When that happens, you’ll get hit with an early withdrawal penalty.

Think of it like breaking a lease on an apartment. You signed a contract agreeing to stay for a set period, and leaving early comes with a cost. With CDs, that cost is almost always a chunk of the interest you've earned (or would have earned).

The exact penalty depends on the bank and the CD's term, but you’ll typically see structures like these:

- For CDs with terms of 1 year or less: The penalty is often 3 months' worth of simple interest.

- For CDs with terms over 1 year: The penalty might be 6 to 12 months' worth of simple interest.

Always read the fine print before you open the account. The penalty is calculated based on your principal balance, not just the interest you’ve managed to rack up so far.

Critical Warning: If you withdraw your money very early in the CD’s term—before you've earned enough interest to cover the penalty—the bank can and will dip into your original principal to pay the difference. This is one of the only ways you can lose your initial investment in an insured CD.

The best defense against this is a solid emergency fund. If you're trying to figure out how to keep cash accessible while still earning a decent return, our guide on using a CD ladder for your emergency fund has some practical strategies.

Your Ultimate Safety Net: Federal Insurance

The other, more fundamental risk is credit risk. This is the chance—however small—that your bank or credit union could become insolvent and go out of business. While bank failures are not common, they do happen. This makes it absolutely essential to know your money is protected.

This is where federal insurance steps in as your bulletproof vest. Two different agencies provide this protection, and they work the same way:

- FDIC (Federal Deposit Insurance Corporation): This is the one that insures deposits at banks.

- NCUA (National Credit Union Administration): This agency insures deposits at credit unions via its National Credit Union Share Insurance Fund (NCUSIF).

Both the FDIC and the NCUA provide the exact same rock-solid protection: up to $250,000 per depositor, per insured institution, for each account ownership category. This guarantee means your money is safe up to that limit, even if the bank or credit union fails.

Before you open an account, you should always confirm the institution is insured. You can use the FDIC's "BankFind Suite" or the NCUA's "Credit Union Locator" tool on their official websites. Insured institutions are also required to display the official FDIC or NCUA logo at their branches and on their websites.

Never assume; always verify. Taking this simple step completely neutralizes the credit risk part of your certificate of deposit risk analysis for any balance under the insurance limit.

Alright, knowing the risks is one thing. Putting that knowledge to work is another. Let's talk about the practical, hands-on strategies you can use to manage those risks and build a smarter CD portfolio. You don't have to just sit back and accept things like interest rate swings; you can get ahead of them.

The most powerful technique in the playbook is called CD laddering. It's a surprisingly simple but incredibly effective way to tackle both interest rate risk and liquidity risk in one go.

Think of it this way: instead of putting all your cash into a single, long-term CD, you split the money up. You build a "ladder" of several smaller CDs with staggered maturity dates. This setup gives you the best of both worlds—you get to capture the better interest rates that usually come with longer terms, but you also have a chunk of your money freeing up at regular, predictable intervals.

How to Build Your First CD Ladder, Step-by-Step

Let's walk through a classic example. Say you have $10,000 ready to invest. The old way would be to lock it all up in one 5-year CD and hope for the best. The laddering approach is much smarter.

You’d split that $10,000 into five equal $2,000 portions:

- $2,000 goes into a 1-year CD.

- $2,000 goes into a 2-year CD.

- $2,000 goes into a 3-year CD.

- $2,000 goes into a 4-year CD.

- $2,000 goes into a 5-year CD.

In the beginning, this structure means you have $2,000 (plus the interest it earned) coming due every single year. When that first 1-year CD matures, you have a decision to make. If you don't need the cash, you simply reinvest it into a new 5-year CD. The next year, when the original 2-year CD matures, you do the same thing.

After a few years, your ladder hits its stride. You'll have a portfolio where one CD matures every year, but every single one is a high-yield 5-year CD. This gives you regular access to your cash while maximizing your long-term returns and smoothing out the bumps from interest rate changes.

This method pretty much solves the problem of trying to time the market. You're never completely stuck if rates shoot up, because you always have a CD maturing soon that can be reinvested at the new, better rate. And since cash becomes available annually, you're far less likely to get hit with an early withdrawal penalty.

Other Smart Tactics for Managing Risk

While laddering is the cornerstone of a solid CD strategy, it’s not the only tool you have. Depending on what you're most concerned about, a few specialized CDs can offer targeted protection against specific risks.

Here are a couple of alternatives to consider:

No-Penalty CDs (for Liquidity Risk): Sometimes called liquid CDs, these are your escape hatch. They let you withdraw your entire balance without paying a penalty after a short waiting period (often just seven days). The catch? The APY is usually a bit lower than a standard CD. But for stashing an emergency fund, they’re perfect—they eliminate withdrawal penalties entirely.

Bump-Up CDs (for Interest Rate Risk): These are built for times when you think rates are heading up. They give you the option, typically once or twice during the term, to "bump up" your rate to whatever the bank is currently offering for a similar CD. They might start with a lower APY, but they act as a valuable insurance policy against missing out on future rate hikes.

By mixing and matching these strategies, you can build a CD portfolio that isn't just safe, but is also resilient. A well-built ladder, maybe with a no-penalty CD on the side for immediate cash needs, creates a powerful framework for secure, flexible growth.

Common Questions About CD Investment Risks

Now that we’ve walked through the different kinds of risk that come with CDs, let's tackle some of the practical questions that pop up most often. Here are some straightforward answers to help you feel confident in your decisions.

Can I Lose My Original Investment in a CD?

It is extraordinarily rare to lose your principal in a CD, as long as your money is with an insured institution and you stay within the FDIC or NCUA insurance limits ($250,000). In fact, your initial deposit is one of the safest places you can put your money.

That said, there is one scenario where you could see a small loss. If you absolutely have to cash out early and the withdrawal penalty is bigger than the interest you've earned so far, the bank can dip into your principal to cover the difference. It's a simple fix: always confirm your bank is insured and get a clear explanation of its penalty rules before you open the account.

How Do I Verify if My Bank Is Insured?

Checking a bank or credit union's insurance status is a crucial step that takes just a moment. Never assume an institution is covered—always verify it yourself.

- For banks: Head to the FDIC's official website and use their "BankFind Suite" tool.

- For credit unions: Use the NCUA's "Credit Union Locator" over at MyCreditUnion.gov.

You should also see the official FDIC or NCUA logo proudly displayed on the institution’s website and in its physical branches. Taking this one simple step completely eliminates credit risk.

Key Takeaway: While federal insurance keeps your principal safe from a bank failure, it doesn't protect your returns from being eroded by inflation or taxes. It’s also important to learn about how CD interest is taxed to get a true picture of your net earnings.

Is a CD Ladder Always the Best Strategy?

A CD ladder is a fantastic strategy for balancing higher yields with regular access to your cash, but it’s not a one-size-fits-all solution. It truly shines when you want to smooth out the bumps of changing interest rates and ensure a portion of your money is always becoming available.

But what if you have a strong feeling that interest rates have hit their peak and are about to head down? In that case, locking in a single, long-term CD at today's high rate might actually deliver a better return. The right strategy really comes down to your personal financial situation and what you think interest rates will do next.

Ready to see how these risks could play out with your own savings? The Certificate-of-Deposit Calculator lets you model different scenarios, from the sting of an early withdrawal penalty to the power of compounding. Plan your CD strategy with confidence by visiting our free tool at https://www.bankdepositguide.com/cd-calculator.