When you're deciding between a Certificate of Deposit (CD) and a high-yield savings account (HYSA), it really boils down to a single trade-off: predictability versus flexibility.

A CD is all about locking in a guaranteed interest rate. You agree to leave your money untouched for a set period, and in return, the bank gives you a fixed, predictable return. On the other hand, a high-yield savings account offers a variable rate but gives you the freedom to pull your money out whenever you need it. It’s cash you can get to, no questions asked.

Understanding The Core Differences

The choice isn't about which one is flat-out "better." It's about matching the right tool to your specific financial goal and timeline. Getting a handle on how they're built is the first step to making a smart decision that actually works for you.

Think of a CD as a financial time capsule. You deposit a lump sum for a specific term—anywhere from three months to five years—and the bank rewards that commitment with a fixed Annual Percentage Yield (APY). That rate is set in stone for the entire term, shielding your earnings from the ups and downs of the market.

An HYSA, however, is built for quick access. These are typically offered by online banks that have lower overhead, allowing them to pay much higher interest than the savings account at your local brick-and-mortar branch. The catch? The APY is variable, so it can (and will) move up or down as the Federal Reserve adjusts interest rates.

The heart of the CD vs. high-yield savings debate is simple: Lock in a guaranteed rate with a CD for a goal in the future, or keep your cash liquid in an HYSA for needs that could pop up tomorrow.

CD vs High-Yield Savings At a Glance

To really see how these two stack up, it helps to put them side-by-side. The table below breaks down the key differences, showing where each product shines. This should make it easier to see how their strengths align with your savings strategy.

Both are fantastic, low-risk ways to make your money work for you, but they serve very different purposes. If you want to explore how these products fit into a larger financial picture, there are many excellent comprehensive personal finance strategies that can provide broader context.

| Feature | Certificate of Deposit (CD) | High-Yield Savings Account (HYSA) |

|---|---|---|

| Interest Rate | Fixed APY, locked for the entire term | Variable APY, changes with market rates |

| Access to Funds | Limited; incurs a penalty for early withdrawal | Highly liquid; funds can be withdrawn anytime |

| Best For | Specific, long-term goals (e.g., down payment) | Emergency funds, short-term savings |

| Minimum Deposit | Often requires a minimum (e.g., $500+) | Often has no or a low minimum deposit |

Ultimately, a CD is your pick for money you know you won't need for a while, letting you capture a guaranteed return. An HYSA is the go-to for your emergency fund or any short-term savings goal where you need to be able to access the cash without penalty.

How Certificates of Deposit (CDs) Work

A Certificate of Deposit, or CD, is built on a straightforward deal with your bank. You agree to deposit a sum of money and, crucially, promise not to touch it for a specific amount of time.

This lockdown period is the term length, and it can be as short as a few months or stretch out for five, sometimes even ten, years. In exchange for that commitment, the bank gives you a fixed Annual Percentage Yield (APY) that’s locked in for the entire term. This guarantee means your earnings are completely predictable, no matter what the economy does.

For a closer look at the mechanics, check out our guide to Certificate of Deposit basics.

The Role of Interest Rates

The APY a bank offers isn't just a random number; it’s heavily influenced by the Federal Reserve's interest rate policy. Over the years, CD rates have been on a wild ride. In the early 1980s, savers could lock in rates over 11% to combat high inflation.

Fast forward to the years after the 2008 financial crisis and the COVID-19 pandemic, and rates were stuck below 1% for what felt like an eternity. More recently, a series of 11 rate hikes by the Fed between 2022 and 2023 pushed top CD rates past 6% APY for the first time in 16 years.

This rate stability is a CD’s biggest superpower. If you open a 5-year CD today at 4.50% APY, you’ll earn that exact rate for all five years, even if market rates crash next month. It’s this predictability that makes CDs such a great tool for goals with a firm deadline.

Understanding the Tradeoff: Penalties and Liquidity

That guaranteed rate comes with one major string attached: your money isn't very accessible. If you absolutely need to withdraw your funds before the CD’s term is up, you’re going to get hit with an early withdrawal penalty.

Think of the early withdrawal penalty as the enforcement mechanism for your CD agreement. It's not some hidden fee; it’s a core feature of the product designed to ensure you hold up your end of the bargain.

The size of the penalty varies by bank and term length, but it's almost always calculated as a chunk of the interest you would have earned.

- For a 1-year CD: The penalty might be three months of interest.

- For a 5-year CD: The penalty could be six or even twelve months of interest.

This structure makes CDs a terrible place to stash your emergency fund or any cash you might need on short notice. They are built specifically for money you are confident you can lock away for the full term.

Understanding High-Yield Savings Accounts (HYSAs)

If a CD is about locking money away for a fixed return, a high-yield savings account (HYSA) is its complete opposite. It's built to keep your cash accessible while still earning a fantastic interest rate—often 20 to 25 times what a typical brick-and-mortar bank pays.

How do they pull this off? Most HYSAs come from online banks. With no expensive branches to run, they can pass those operational savings directly to customers in the form of a much higher Annual Percentage Yield (APY). It’s a leaner business model that directly benefits you.

The Power of Liquidity

The killer feature of any HYSA is liquidity. Plain and simple, your money isn't locked up. You can move funds in and out whenever you need to without getting hit with early withdrawal penalties. This freedom makes an HYSA the right tool for specific jobs.

When you need flexibility above all else, an HYSA is your best friend.

- Emergency Fund: This is the classic role for an HYSA. You need instant, penalty-free access to three to six months of living expenses.

- Short-Term Goals: Perfect for saving up for a vacation, a down payment on a car, or a home remodel where the final price tag and timeline might change.

- Sinking Funds: The ideal place to park cash for predictable but infrequent bills, like annual insurance premiums, property taxes, or holiday spending.

Navigating Variable Rates

Here’s the trade-off for all that flexibility: the APY on an HYSA is variable. That means your interest rate can—and will—change over time. HYSA rates tend to follow the federal funds rate, which is set by the Federal Reserve.

So, when the Fed hikes rates to cool the economy, your HYSA rate will likely rise, giving your savings a nice boost. But when the Fed cuts rates, your APY will probably drop, too. This is a crucial distinction in the cd vs high yield savings debate; you're swapping the rate guarantee of a CD for immediate access to your cash.

An HYSA offers dynamic growth that moves with the market. While this introduces variability, it also means you benefit automatically when interest rates rise—a feature a locked-in CD can't provide.

For most savers, this rate uncertainty is a small price to pay for having total control. The ability to pull money out for an unexpected repair or deposit a sudden windfall makes the HYSA an incredibly powerful and modern financial tool.

Comparing APY, Liquidity, and Risk Factors

When you put a CD and a high-yield savings account (HYSA) side-by-side, the real decision comes down to three things: the interest you earn (APY), how fast you can get your hands on your cash (liquidity), and the trade-offs you have to make (risk). There's no single "best" choice here—it all depends on your specific goals and financial situation.

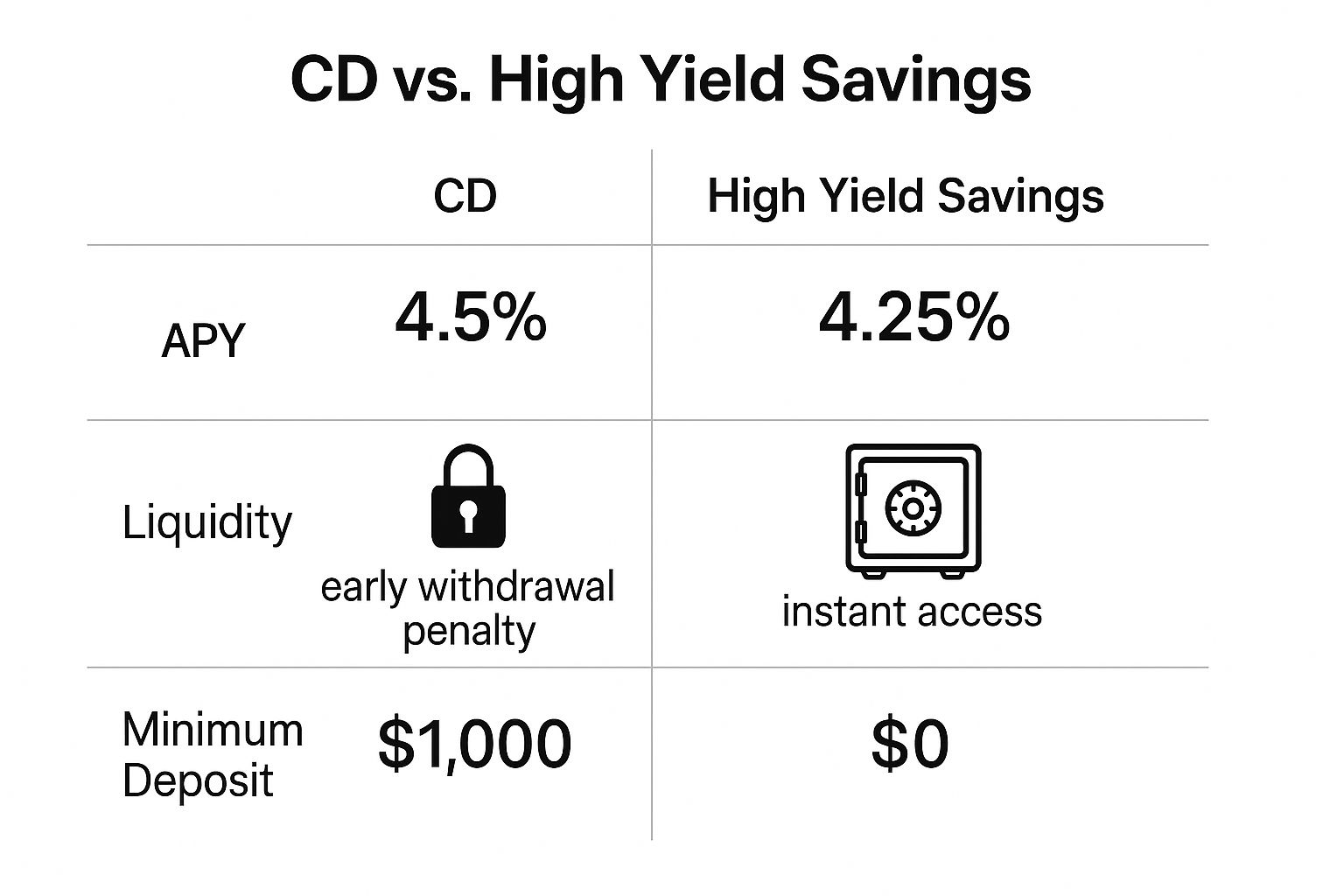

This quick chart breaks down the core differences in rates, access, and minimums between a typical CD and a high-yield savings account.

As you can see, a CD might give you a slightly better APY, but that comes at the cost of tying up your money and often needing a bigger deposit to get started.

The APY Tug-of-War: Certainty vs. Potential

The APY is the main event in the cd vs. savings account showdown. A CD offers a fixed rate for a set term. That gives you powerful certainty; you know exactly how much interest you'll earn, which makes planning a breeze.

An HYSA, on the other hand, comes with a variable rate that can (and does) change. This can work for you or against you. When interest rates are climbing, HYSA owners get a nice boost as their APY goes up. But when rates fall, their earning power drops right along with them.

To get a clearer picture of how your money might grow in either account, running the numbers through an investment calculator can be a huge help.

Head-to-Head Feature Analysis: CD vs. HYSA

Let's dive deeper into the specific features that set these two savings vehicles apart. This table provides a direct comparison of the key attributes you should consider.

| Attribute | Certificate of Deposit (CD) | High-Yield Savings Account (HYSA) | Key Takeaway |

|---|---|---|---|

| Interest Rate | Fixed for a specific term | Variable, fluctuates with market rates | CDs offer predictable returns, while HYSAs offer potential upside in a rising-rate environment. |

| Access to Funds | Locked in until maturity; penalties for early withdrawal | Fully liquid; access funds anytime without penalty | HYSA is king for emergency funds and flexible goals; CDs are for money you know you won't need. |

| Early Withdrawal | Subject to early withdrawal penalties (often 3-12 months of interest) | No penalty for withdrawals | Withdrawing from a CD early will cost you, erasing some of your interest gains. |

| Risk Profile | Interest rate risk: You might miss out if rates rise after you lock in. | Interest rate risk: Your APY could fall if market rates decline. | The primary risk for both is opportunity cost, not losing your principal. |

| Best For | Specific savings goals with a fixed timeline (e.g., a house down payment in 3 years). | Emergency funds, short-term savings, or parking cash you need to keep accessible. | Match the account's structure to your financial timeline and need for flexibility. |

This breakdown highlights the fundamental trade-off: CDs give you a guaranteed rate in exchange for locking up your money, while HYSAs prioritize access and flexibility over rate certainty.

Liquidity: The Price of Access

This is the most black-and-white difference. An HYSA is built for liquidity. You can move money in and out as you please, making it the undisputed champion for your emergency fund or any short-term goals where the timeline might change. Your cash is available on demand, penalty-free.

A CD works on the exact opposite principle. Think of it as a time-locked savings vault. If you need to break into it before the term is up, you'll pay an early withdrawal penalty, which usually means giving up several months' worth of interest.

The core trade-off is simple: An HYSA provides immediate, penalty-free access to your cash, while a CD pays you a premium (in the form of a guaranteed rate) for giving up that access for a predetermined period.

Understanding the Real Financial Risk

Since both CDs and HYSAs are usually FDIC-insured up to $250,000, the risk isn't about losing your initial deposit. The real risk is opportunity cost—the potential earnings you miss by picking one account over the other.

- CD Interest Rate Risk: Imagine you lock in a 5-year CD at a 3.5% APY. Six months later, new CDs are being offered at 5.0%. You're stuck earning that lower rate for the next four and a half years.

- HYSA Interest Rate Risk: You open an HYSA with a great 4.5% APY. But over the next year, the Federal Reserve cuts rates, and your APY slowly trickles down to 2.5%.

A recent analysis shows this perfectly. A $10,000 deposit in a 3-year CD at 4.25% would earn $1,329.96 in interest. The same $10,000 in an HYSA with a variable 4.30% APY would earn $1,346.27. While the HYSA earns a little more today, if rates fall as expected, locking in that CD rate could easily prove to be the smarter move over the full three years.

The right decision comes down to weighing these risks against your own financial timeline and your gut feeling about where interest rates are headed. For a more detailed look at these two popular savings options, check out our full comparison of CDs and savings accounts.

When to Choose a Certificate of Deposit

A Certificate of Deposit really comes into its own in a few key situations. If you value predictability and are willing to commit your cash for a set period, a CD often beats a savings account. In the CD vs. high-yield savings debate, the scale tips toward a CD when your goal has a firm deadline and you want to shield your savings from both market swings and your own temptation to spend.

Think about a big, planned expense a few years away, like a down payment on a house you plan to buy in exactly three years. Putting that money into a 3-year CD locks in a guaranteed interest rate. You'll know precisely how much you'll have on that future date, without worrying that a sudden drop in market rates will throw your plans off course.

Building a Predictable Financial Future

Another powerful use for CDs is creating a steady, predictable income stream—a strategy that's especially popular with retirees. The classic way to do this is by building a CD ladder.

- How it Works: Instead of locking all your money into a single large CD, you split it into several smaller CDs with staggered maturity dates. For example, you might open one-year, two-year, three-year, and four-year CDs all at the same time.

- The Benefit: As each CD matures, you get access to a chunk of your cash, giving you regular liquidity. You can then reinvest that money into a new, longer-term CD to keep the ladder going, often capturing the higher interest rates that come with longer commitments.

A CD’s secret weapon is its psychological benefit. That early withdrawal penalty isn't just a fee; it's a built-in disciplinary tool. It creates a barrier between you and your savings that helps stop impulse spending on things that aren't your primary goal.

This forced discipline can be a game-changer if you find it hard to leave a growing balance alone in a regular savings account. It turns the CD from a simple savings product into an automated commitment device, making sure the funds are there when you actually need them.

Before you decide, it's worth understanding if CDs are a good investment for your specific situation. They are an ideal match for goals you're truly serious about reaching.

When to Choose a High-Yield Savings Account

If a CD is about locking down a fixed rate for a future goal, a high-yield savings account (HYSA) is the undisputed champion of financial flexibility. Its superpower is giving you instant, penalty-free access to your cash. This makes it the go-to choice for any goal where the timeline is a bit fuzzy and you absolutely need to get your hands on the money right away.

The most critical job for an HYSA is housing your emergency fund. When the transmission goes out or a surprise medical bill lands in your mailbox, you need that money now, not after waiting out a term or paying a penalty. HYSAs are tailor-made for this job, and you can find many essential tips for building an emergency fund to get started. An HYSA ensures your safety net is both earning a competitive rate and ready to deploy at a moment's notice.

The Best Choice for Flexible Goals

Beyond true emergencies, an HYSA is perfect for short-term goals where costs and dates can shift. Think about saving for a vacation, a wedding, or a home renovation. The final bill for these kinds of goals can easily creep up (or down), and an HYSA lets you add or pull money as your plans firm up.

This same flexibility makes it the ideal hub for your sinking funds. These are just small pools of money you set aside for predictable but irregular expenses, like:

- Annual insurance premiums

- Holiday gift shopping

- Quarterly property taxes

- Scheduled car maintenance

In the CD vs. high-yield savings showdown, the HYSA wins any time liquidity trumps a guaranteed rate. It's the best tool for managing life's financial curveballs while still putting your cash to work.

Finally, an HYSA is the perfect "parking spot" for a large sum of cash you've just received, like from a home sale or an inheritance. It lets your money earn a solid return while you take a breath and figure out your next long-term financial move, keeping your options wide open without sacrificing growth.

Common Questions: CDs vs. High-Yield Savings Accounts

Even after you’ve compared the core features, a few specific questions always seem to pop up. Getting these sorted out is the final step before you can park your cash with total confidence.

Can You Lose Money in a CD or HYSA?

The short answer is no—at least not your principal. As long as your bank is FDIC-insured or your credit union is NCUA-insured, your deposits are protected up to the standard $250,000 limit. This federal insurance means your money is safe even in the highly unlikely event the institution fails.

The real risk isn’t losing your deposit but losing potential earnings. This is called opportunity cost. If you lock in a 5-year CD at 4.50% and rates jump to 5.50% a year later, you’ve effectively "lost" that extra 1% you could have been earning. The opposite is true for an HYSA; if rates fall, so will your earnings.

What Is a CD Ladder and How Does It Work?

A CD ladder is a simple but brilliant strategy for blending the high rates of long-term CDs with the liquidity of short-term ones. Instead of dumping all your money into a single 5-year CD, you split it into several smaller CDs with staggered maturity dates.

For example, if you have $20,000, you could build a four-rung ladder like this:

- $5,000 in a 1-year CD

- $5,000 in a 2-year CD

- $5,000 in a 3-year CD

- $5,000 in a 4-year CD

When the 1-year CD matures, you have access to that cash. You can then reinvest it into a new 4-year CD (the longest rung on your ladder) to capture the best available long-term rate. You repeat this each year, creating a system where a portion of your money becomes available annually while the rest continues earning high, fixed rates.

How Does a No-Penalty CD Compare to an HYSA?

A no-penalty CD is a fascinating hybrid. It gives you a fixed interest rate for a specific term, just like a standard CD, but it lets you withdraw your money before the maturity date without getting hit with a penalty.

The trade-off for this flexibility is a lower APY. A no-penalty CD will almost always pay less than a traditional CD of the same term. Its rate is often much closer to what a top-tier HYSA offers, which makes them direct competitors.

So, when would you choose one over the other? The key difference is the fixed-versus-variable rate. If you're convinced interest rates are about to drop but you still want easy access to your funds, a no-penalty CD is a smart move. It lets you lock in today's rate while keeping your options open.

Ready to see how much your money could grow in a Certificate of Deposit? The Certificate-of-Deposit Calculator from BankDepositGuide can help you instantly project your earnings based on different rates, terms, and compounding frequencies. Plan your savings goals with confidence by trying the free calculator today.