Think of a Certificate of Deposit (CD) like a financial time capsule for your savings. The CD maturity date is the day you finally get to open it. It’s when the term you agreed to ends, letting you access your original deposit plus all the interest it’s earned—without paying an early withdrawal penalty.

What Is A CD Maturity Date And Why It Matters

The CD maturity date is the single most important milestone for your investment. It’s the finish line of the contract between you and your bank or credit union. Until that day, your money is locked in, working hard to generate a predictable return. On that date, you get the keys back.

Understanding what happens before, on, and after this date is key to making a smart financial move.

The CD Maturity Lifecycle At a Glance

The journey of a CD is fairly straightforward, from the day you open it to the day you decide its future. We can break it down into three distinct stages.

| Stage | What Happens | Your Key Action |

|---|---|---|

| The Term | Your money is deposited and earns interest at a fixed rate, locked away from your access. | Wait and let your money grow. |

| Maturity & Grace Period | The CD term ends. The bank notifies you that your funds are available and gives you a "grace period" (usually 7-10 days) to act. | Decide what to do next with your funds. |

| Post-Maturity | If you do nothing, the bank will typically auto-renew the CD into a new one with a similar term at whatever the current interest rate is. | Withdraw, renew, or reinvest your money based on your goals. |

This whole process is designed to be simple. The bank will usually send you a notice a few weeks before the maturity date, giving you plenty of time to weigh your options. You can read more about what happens when your CD account matures on CBS News.

Key Takeaway: The CD maturity date isn't just an end point; it's a decision point. It’s your chance to look at your financial goals, see what current interest rates are doing, and decide the next best step for your money.

Your Strategic Window of Opportunity

The choices you make during the grace period after your CD matures directly impact your financial future. This single date determines whether you lock in new rates, cash out your profits, or redirect that capital toward a different goal.

Thinking about the current market is essential. To help figure out your next move, check out our guide on whether CDs are a good investment right now. This context will help you line up your maturity strategy with your bigger financial picture, making sure every dollar you’ve saved works as hard as possible.

Ultimately, this date isn't just an entry on your calendar. It's a strategic checkpoint for your savings.

Your Three Choices When Your CD Matures

When your CD’s term ends, the clock starts ticking. You enter what’s known as a grace period—usually a short window of 7 to 10 days—where you need to tell your bank what to do with your money.

What you decide at this CD maturity date is a key moment for your savings strategy. You basically have three paths to choose from.

1. Cash Out Your Funds

The most straightforward option is to take the money and run. You can withdraw everything—your original principal plus all the interest it’s earned—and have it moved to your checking or savings account.

This is the right move if you had a specific goal in mind for that cash, like a down payment on a house, a car purchase, or another big expense. Once a CD matures, those funds become liquid cash. To make the most of this, it's smart to review some general strategies to improve cash flow and see where the money fits best in your financial picture.

2. Roll Over Into a New CD

Don't need the money right away? You can simply "roll it over," which means you reinvest the entire balance (principal and interest) into a brand-new CD.

Be aware: most banks will do this for you automatically if you don't give them other instructions. They'll lock your money into a new CD with a similar term, but at whatever the current interest rate is. This can be great if rates have gone up, but not so great if they've dropped. Always check the new rate before letting it roll over on autopilot.

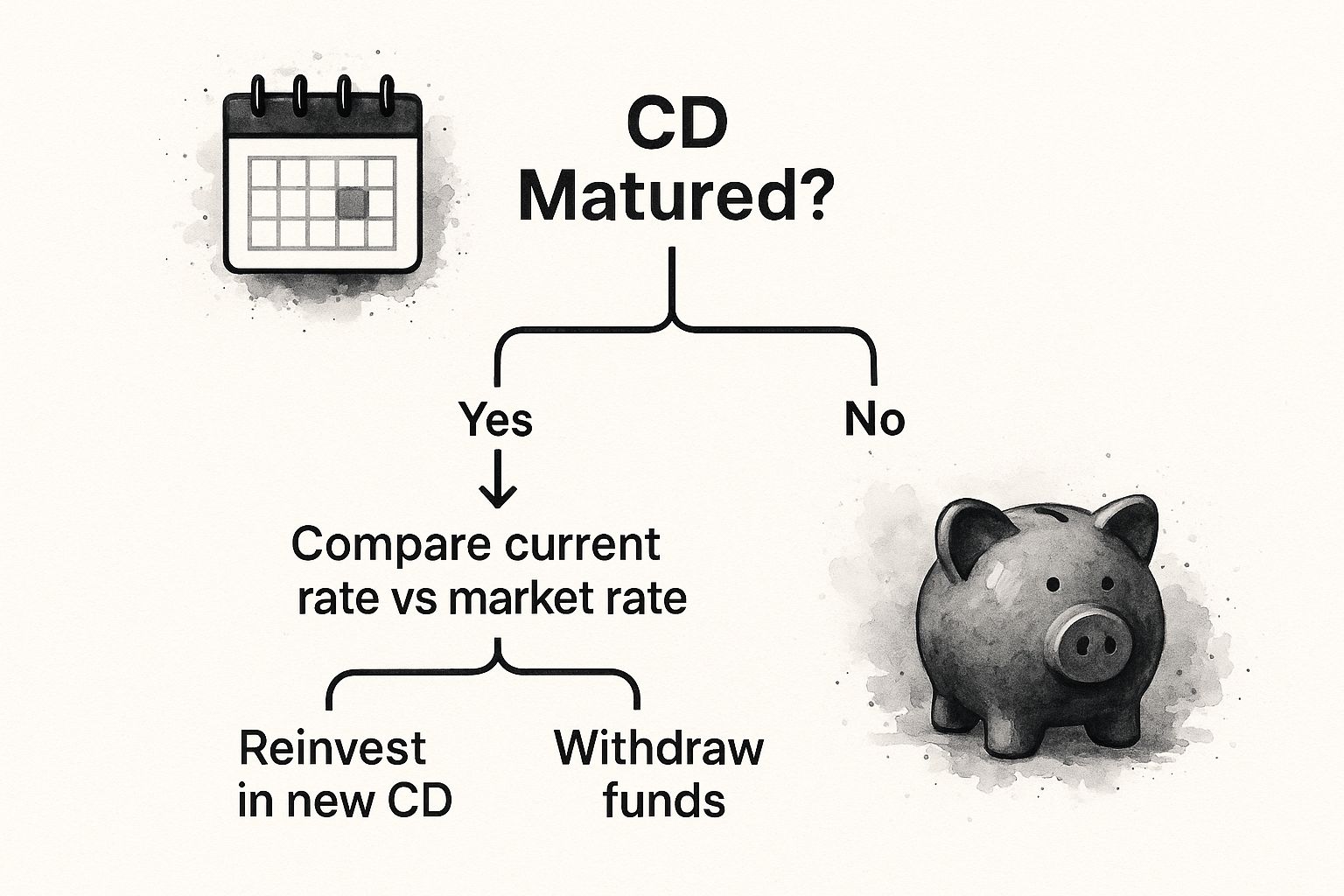

This decision tree shows the simple logic of comparing rates when your CD matures.

The takeaway is simple: before you commit to reinvesting, see what the market is offering. A quick comparison between the renewal offer and other available rates is the most critical step you can take.

3. Choose a Different CD Product

Your third choice is a bit of a mix-and-match. You can still roll the money over, but you don't have to stick with the same exact terms. You've got options.

During the grace period, you can:

- Change the term length. Maybe you had a 12-month CD, but now 5-year rates look fantastic. You can lock in that higher rate for a longer period.

- Add or withdraw funds. You could add more money to your initial principal to create a larger CD, or you could peel off the interest (or even some principal) and reinvest the rest.

This kind of flexibility lets you fine-tune your savings plan based on where you are financially and what the interest rate market is doing.

How Interest Rates Shape Your CD Strategy

The interest rate environment when your CD maturity date arrives is a huge deal. It can completely change what you do next and how much you earn. Think of it like a sailor navigating the winds—you can't control the market, but you can adjust your strategy to make the most of it.

When rates are high, a maturing CD is a golden opportunity. You can take that principal and roll it right into a new CD, locking in a fantastic return for the next several months or years. It's a clear win, putting your money to work much harder for you. To see just how big a difference a higher rate makes, check out our guide on how to calculate your potential CD earnings.

On the other hand, a low-rate environment calls for a more defensive game plan. If your CD matures when rates have cratered, just letting it automatically renew could mean settling for a disappointingly low return for the entire next term.

Navigating Rate Fluctuations

History shows just how wild the ride can be. In the early 1980s, you could find one-year CDs offering incredible yields over 11%. Fast forward to the years after the 2008 financial crisis, and those same yields often struggled to break 1%. Then, after the Federal Reserve's rate hikes in 2022 and 2023, rates shot up to levels not seen in over a decade. For a deeper dive, Bankrate offers a detailed look at historical CD interest rates.

This volatility highlights a key point: The rate you secure at the start of your CD term is just one part of the equation. The rates available on your maturity date are what determine your next move and future earnings.

So, how do you manage this uncertainty? One of the most popular and effective methods is CD laddering. Instead of dumping all your cash into a single CD, you split it up across multiple CDs with different maturity dates—say, one-year, two-year, and three-year terms.

This clever approach accomplishes two critical goals:

- Reduces Risk: You avoid the nightmare of locking up all your money right when rates hit rock bottom.

- Creates Opportunity: A chunk of your money becomes available every year, giving you a regular shot to reinvest at whatever the current market rates are.

Suddenly, your simple CD isn't just a "set it and forget it" savings account. It becomes an active, adaptable part of your investment portfolio, ready for whatever the economic climate throws at it.

The Hidden Cost of Ignoring Your Maturity Date

Doing nothing when your CD matures is a decision in itself—and it’s often a costly one. In fact, simply ignoring this critical date is one of the most common mistakes savers make. It's like setting a calendar reminder for a big meeting and then sleeping right through it.

The main danger comes from a standard feature in most CD agreements: automatic rollover. If you don't give the bank instructions during the grace period, it will almost always renew your entire balance into a brand new CD. This new CD typically has the same term as your old one, but at whatever interest rate the bank is offering at that exact moment.

The Automatic Rollover Trap

Let's play this out. Say you were smart and locked in a 1-year CD with a fantastic 5.00% APY. A year goes by, rates across the market have dropped, and the new 1-year CD rate is just 2.50%. If you miss the maturity notice from your bank and the grace period slips by, your money gets automatically locked into that new CD at 2.50% for another full year.

This simple mistake—doing absolutely nothing—just cut your potential earnings in half. You’ve not only missed the boat on shopping around for better rates but also given up access to your cash for another 12 months unless you want to pay a penalty.

This isn’t just a "what if" scenario; it happens to people all the time. Your once-great investment quietly starts underperforming, all because of a missed deadline.

Your Pre-Maturity Checklist

The best way to avoid this trap is to be proactive. As your CD's maturity date approaches, use this simple checklist to stay in the driver's seat.

- Mark Your Calendar: The day you open a CD, put the maturity date on your calendar. Even better, set a reminder for 30 days before it matures.

- Watch for Notices: Banks are required to send you a maturity notice, so keep an eye on your email and physical mail. This notice will outline your options.

- Research Current Rates: A week or two before the big day, use a tool like our Certificate-of-Deposit Calculator. See what other banks are paying—knowledge is power.

- Review Your Goals: Is locking this money up still the right move? Your financial goals might have changed. Maybe you need the cash for something else, or a different CD term makes more sense now.

- Act During the Grace Period: Once your CD matures, you have a short window—usually 7 to 10 days—to act. Call your bank or log in to your account and give them your instructions.

Staying on top of your CD maturity ensures your savings keep working hard for you, not against you.

Aligning CD Maturity With Your Financial Goals

A CD’s maturity date isn't just some technical detail buried in the fine print—it’s the key to making your money work for you. Don't just think of a CD as another savings account. Instead, see it as a precision tool for hitting your financial targets.

The trick is to work backward from your big life moments. By picking CD terms that end right before you need the cash, you turn a passive savings vehicle into a goal-oriented machine.

Timing CDs for Life's Big Moments

Are you planning a wedding in two years? Saving up for a down payment on a house in three? A CD is a fantastic way to get there. By choosing a term that lines up with your timeline—say, a 24-month or 36-month CD—you make sure the money is ready and waiting exactly when you need it.

This approach gives you two huge benefits:

- Locked-in Growth: Your money earns a guaranteed, fixed rate of return, so you don't have to worry about market swings derailing your plans.

- Reduced Temptation: Since the money is locked up until maturity, it puts a stop to impulse buys that could otherwise drain your savings.

Timing your CD to mature right before a major purchase is one of the smartest ways to enforce savings discipline. It virtually guarantees the funds will be there for their intended purpose.

Creating Predictable Income with a CD Ladder

If you’re planning for retirement or just want a reliable income stream, a CD ladder is an incredible strategy. Instead of dumping all your money into a single CD, you split it across several CDs with staggered maturity dates. A classic setup might involve 1-year, 2-year, 3-year, 4-year, and 5-year terms.

This creates a system where one of your CDs matures every single year, giving you predictable access to cash. You can take the money as income or roll it into a new CD at whatever the current rates are. Smartly managing your CD maturity dates is a powerful piece of broader wealth preservation strategies.

To see exactly how to build one yourself, check out our in-depth guide on building a successful CD ladder strategy.

It's strategies like these that highlight the growing appeal of CDs. The global market for CDs was valued at roughly USD 1 trillion in 2023 and is expected to hit nearly USD 1.5 trillion by 2032. This isn't just a random trend; it reflects a real shift toward secure, predictable investments.

When you align your CD strategy with your real-life goals, you’re doing more than just saving—you’re building a stronger, more resilient financial future.

Common Questions About CD Maturity

Even after you've picked the perfect CD, a few questions can pop up as the maturity date gets closer. Let's walk through the most common ones so you know exactly what to expect.

What Happens if I Need My Money Before the CD Matures?

Life happens, and sometimes you need your cash sooner than planned. But be warned: pulling money out before the official CD maturity date almost always triggers an early withdrawal penalty.

This isn't a surprise fee; it's spelled out in your account agreement. A very common penalty for a one-year CD is giving up three months' worth of interest. The exact penalty depends on the bank and the length of the CD term. If you withdraw right after opening the account, the penalty could be large enough to eat into your original principal. This is why CDs are really meant for money you're confident you can leave untouched.

How Will My Bank Notify Me About My Maturing CD?

Don't worry, your bank won't let the date sneak up on you. Financial regulations require them to send you a heads-up. You should expect a maturity notice in the mail or your email inbox about 20 to 30 days before the term ends.

This notice is your call to action. It lays out all your choices, tells you how long your grace period is, and details what will happen if you let the CD automatically renew—including the new interest rate. Make sure your contact info is current with your bank so this important message finds you.

Key Takeaway: Banks are required to send a notice, but it's your job to act on it. Think of the renewal letter as your cue to check current rates and decide if your goals have changed before that grace period starts ticking.

Can I Add More Money to My CD at Maturity?

Absolutely. The grace period is the perfect time to beef up your investment. If you decide to renew or roll over the CD into a new term, you can add more cash to the principal and interest you've already earned.

It's a simple way to grow your savings without opening a brand-new account. Just remember, you can't top up a CD in the middle of its term—you have to wait for it to mature.

Will My Rollover CD Have the Same Interest Rate?

No, and this is a really important point to understand. When a CD rolls over, it doesn't keep its old interest rate. It renews at whatever the bank is currently offering for that specific term.

If rates have climbed since you first opened the CD, great! You'll lock in a better yield. But if rates have dropped, your new rate will be lower. This is exactly why you should never let a CD renew on autopilot without first reviewing the new terms.

Ready to compare different CD options and project your earnings? The Bank Deposit Guide offers a powerful and easy-to-use tool to help you make the smartest decision for your money. Try our free Certificate-of-Deposit Calculator today.