Think of CD investment strategies as different game plans for your savings. Instead of just buying one CD and calling it a day, these methods help you use multiple CDs to perfectly balance your need for cash, safety, and better returns. The three most popular approaches are the CD Ladder, the CD Barbell, and the CD Bullet, and each one is built for a different financial situation.

Your Guide to Core CD Investment Strategies

Ready to get more out of your savings? Moving beyond a single CD opens up a whole new world of strategic possibilities. Think of these strategies as different blueprints for building your savings—each with its own unique strengths.

You don't need to be a Wall Street pro to figure these out. They're just practical tools designed to solve common financial puzzles, like saving for a big purchase or creating a steady stream of income.

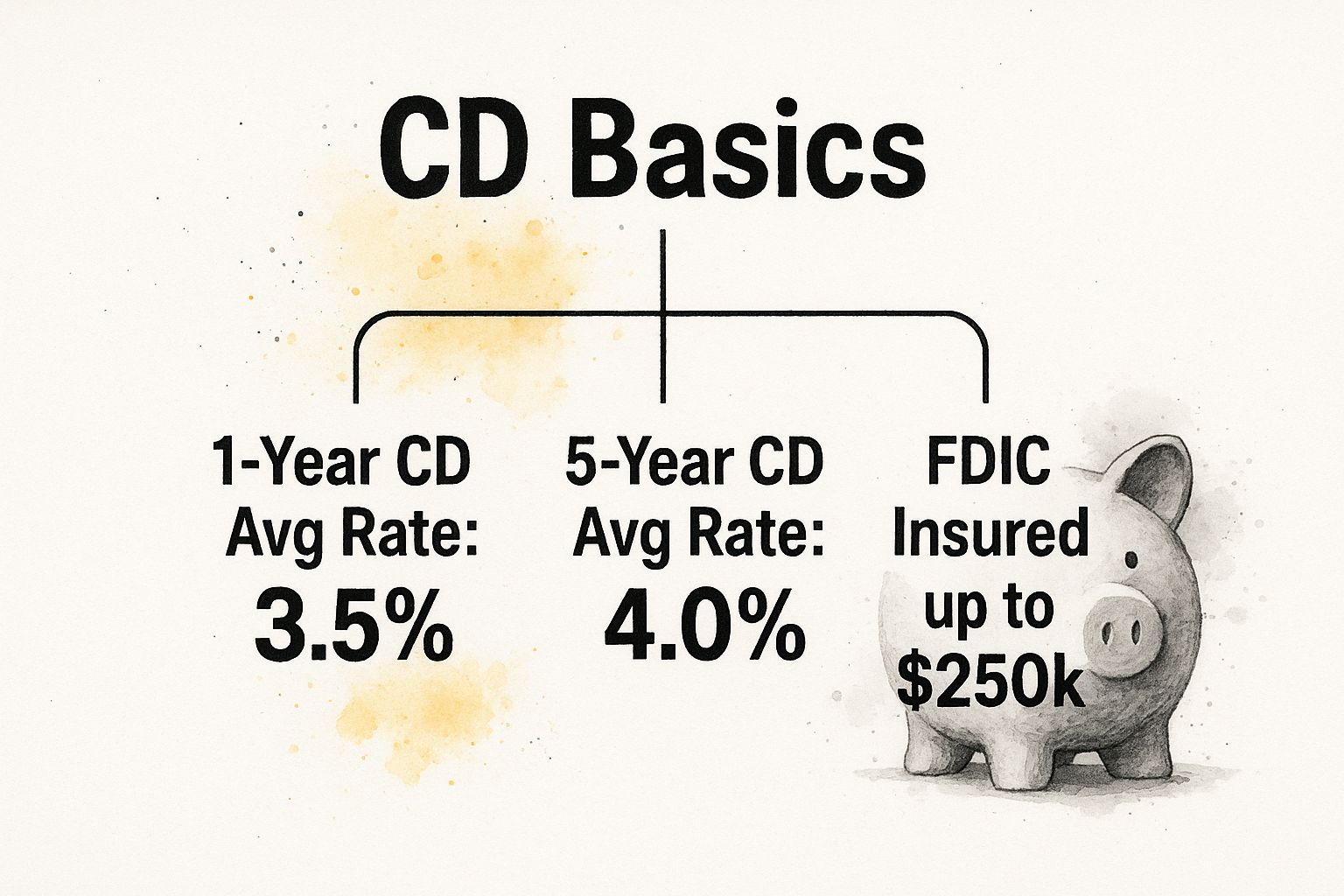

The image below breaks down the basic building blocks you'll be working with: different CD terms, their typical rates, and the all-important safety they offer.

The main thing to notice is that longer-term CDs usually pay more interest. But no matter the term, every single one is FDIC-insured up to $250,000, which means your original deposit is safe and sound.

Which CD Strategy Fits Your Financial Goals?

Choosing the right strategy comes down to what you're trying to achieve with your money. Are you looking for steady, predictable cash flow? Or are you saving for a single, major expense a few years from now? This table gives you a quick snapshot to help you decide.

| Strategy | Primary Goal | Best For | Complexity |

|---|---|---|---|

| CD Ladder | Steady cash flow & rate flexibility | Retirees or anyone needing regular, predictable access to funds while still earning good rates. | Low |

| CD Barbell | Balancing liquidity & high yields | Savers who want some cash available soon but also want to lock in the highest possible long-term rates. | Medium |

| CD Bullet | Maximum growth for a specific date | People saving for a major, one-time expense like a wedding, home down payment, or a car. | Low |

Each of these strategies solves a different financial problem, but they all start with the same basic building blocks. Let's take a closer look at how each one works.

The Three Main Approaches

To help you choose the right path, here's a quick introduction to the three core strategies we'll be exploring.

- The CD Ladder: This is the most popular strategy for a reason. You split your money into several CDs with staggered maturity dates—for example, in 1, 2, 3, 4, and 5-year terms. This gives you regular access to a portion of your cash and lets you take advantage of higher rates when you reinvest. It's fantastic for anyone who values a predictable income stream.

- The CD Barbell: This approach is all about the extremes. You invest your money in very short-term CDs (for liquidity) and very long-term CDs (for the high yields), skipping everything in the middle. Think of it as having the best of both worlds.

- The CD Bullet: Imagine aiming all your savings at a single target date. With the Bullet, you buy multiple CDs with different issue dates that all mature around the same time. This is the perfect strategy if you're saving for a specific, large future expense, like a house down payment in five years.

These methods are all built on the same principles, which you can read more about in our guide to certificate of deposit basics. And while CDs are a powerful tool, remember they're just one part of your overall financial plan. It's always a good idea to see how they fit into broader wealth building strategies.

Why Modern CD Strategies Became Essential

To really get a feel for today's CD investment strategies, it helps to look back at why they were created. They weren't just dreamed up in a boardroom; they were born from necessity when the entire world of saving money was turned on its head.

It’s hard to imagine now, but there was a time when saving was simple and incredibly profitable. Back in the early 1980s, the interest rate environment was a saver's dream. You could park your cash in a standard CD and pull in returns that sound unbelievable today.

Case in point: in December 1980, a basic three-month CD could net you a stunning 18.65% APY. In an environment like that, a simple "set it and forget it" strategy was all you needed.

But those days didn't last. After major economic shifts like the 2008 financial crisis, interest rates cratered. By 2012, that same CD was paying a paltry 0.42%. You can discover the full history of CD interest rates to see the dramatic change for yourself.

The Shift From Passive to Active Strategy

This collapse in yields meant the old way of doing things was broken. Earning less than 1% on your savings simply wasn't going to get you anywhere. Investors needed a new playbook.

This is precisely when the structured cd investment strategies we rely on today started to take shape, designed specifically for a low-rate, uncertain world.

The core problem was a classic trade-off. Long-term CDs paid a bit more, but they locked your money up for years. Short-term CDs gave you flexibility, but their rates were next to nothing. Savers needed a way to get the best of both worlds.

This is where strategies like the CD ladder came to the rescue. Instead of dumping all your money into a single, low-yielding CD, laddering lets you strategically layer your cash across several CDs with staggered maturity dates.

This simple but brilliant approach gave savers the liquidity of short-term accounts while letting them capture some of the higher yields typically reserved for long-term commitments. It marked a fundamental change from passively taking whatever rate the bank gave you to actively managing your CD portfolio to navigate a tough economic climate. The goal was no longer just to save, but to make your savings work smarter for you.

Building a CD Ladder for Steady Cash Flow

Of all the CD investment strategies out there, the CD ladder is easily the most popular. There's a good reason for that: it’s a brilliant solution to two common problems. It gives you regular access to your cash while still letting you capture the higher interest rates usually reserved for long-term commitments.

Think of it like building a financial staircase. Each step is a single CD. When you build a ladder, you arrange the steps so that you arrive at a new one at perfectly regular intervals, creating a steady, predictable rhythm for your money.

The strategy is simple: divide your total investment into several equal pieces and spread them across CDs with different term lengths. This “staggering” of maturity dates is the secret sauce.

How to Construct Your First CD Ladder

Let's walk through a real-world example. Say you have $10,000 ready to invest and you want to build a classic five-year ladder. Instead of dumping the whole $10,000 into a single 5-year CD, you’d break it into five equal "rungs" of $2,000 each.

Here’s the initial setup:

- Rung 1: Put $2,000 into a 1-year CD.

- Rung 2: Put $2,000 into a 2-year CD.

- Rung 3: Put $2,000 into a 3-year CD.

- Rung 4: Put $2,000 into a 4-year CD.

- Rung 5: Put $2,000 into a 5-year CD.

Right now, you just have a mix of CDs with different end dates. The real power of the ladder kicks in after the first year.

When your 1-year CD matures, you have a choice. You can cash out the $2,000 plus the interest it earned, or you can reinvest it. This is where the strategy starts to sustain itself.

To keep your ladder going, you take the money from the matured CD and roll it into a new 5-year CD. Why five years? Because that term almost always offers the best interest rate, so you're maximizing your potential earnings.

Once that first year is up, you’ll have a CD maturing like clockwork every single year. This gives you a yearly chance to get a chunk of your cash penalty-free or reinvest at the best long-term rates available at the time.

The Ladder in Action Over Time

So, what does this look like down the road? A year from when you started, your 1-year CD matures. You reinvest that $2,000 into a new 5-year CD. The next year, your original 2-year CD is up, and you roll those funds into another 5-year CD.

You just keep repeating this process annually.

Fast forward five years, and your ladder is fully built. All your money is now working for you in high-yield, 5-year CDs, but you still have one maturing every single year. You've successfully built a system that gives you both liquidity and strong returns—a cornerstone of reliable CD investment strategies.

For anyone planning for retirement, a ladder can provide a stable, predictable income stream fully backed by FDIC or NCUA insurance. You can use our CD Calculator to project the earnings from each rung as you build it. This simple strategy turns a handful of basic savings products into a dynamic financial engine.

Using Barbell and Bullet Strategies for Specific Goals

While a CD ladder is a fantastic all-around strategy for steady, reliable returns, it’s not the only tool in the shed. Sometimes your financial goals demand a more specialized approach. That’s where the barbell and bullet strategies come in—two powerful ways to structure your CDs for very specific outcomes.

These aren't replacements for the ladder, but rather different blueprints. If a ladder is an escalator giving you continuous access, think of these as precision instruments built for a single, focused job.

Whether you need to balance immediate cash access with long-term growth or are aiming for a big expense down the road, one of these strategies might be a perfect fit.

The CD Barbell: A High-Yield Balancing Act

Picture a weightlifter's barbell: heavy weights on each end, nothing in the middle. The CD barbell strategy mirrors this perfectly. You divide your money between the two extremes of the time spectrum, skipping the medium-term CDs entirely.

- One End (Short-Term): A chunk of your cash goes into very short-term CDs (think 3-6 months) or even a high-yield savings account. This is your liquidity bucket, ensuring you have money on hand for emergencies or opportunities.

- The Other End (Long-Term): The rest of your funds are locked into very long-term CDs (like 5-7 years) to capture the highest possible interest rates.

Why do this? It's a clever way to play both offense and defense, especially when interest rates feel unpredictable. If rates drop, you’ve already secured a great yield on your long-term money. If rates climb, your short-term funds will mature quickly, letting you reinvest at the new, better rates.

The barbell is for savers who want to have their cake and eat it, too. It merges the security of short-term cash with the earning power of long-term rates, creating a dynamic balance between safety and growth.

The CD Bullet: Hitting a Financial Target

The bullet strategy isn't about creating ongoing cash flow. It’s about one thing: hitting a specific dollar amount on a specific future date. It's a financial heat-seeking missile aimed squarely at a goal, whether that’s a down payment, a wedding fund, or a future tuition bill.

With the bullet approach, you buy several CDs over a few years that all share the exact same maturity date.

Let's say you need $50,000 for a down payment in five years. A CD bullet would look something like this:

- Year 1: You buy a $10,000, 5-year CD.

- Year 2: You buy another $10,000 CD, this time with a 4-year term.

- Year 3: You purchase a $10,000, 3-year CD.

- Year 4: You add a $10,000, 2-year CD to the mix.

- Year 5: You make your final purchase: a $10,000, 1-year CD.

Fast-forward to the end of year five, and voila—all five of your CDs mature at once. You get your full principal back, plus all the interest they've earned, delivered in a single lump sum right when you need it.

This disciplined method is perfect for making sure the money is there when the bill comes due. You can use our Certificate-of-Deposit Calculator to run the numbers and see how the interest will stack up, ensuring you hit your goal.

Adapting Your Strategy to Today's Interest Rates

The best CD investment strategies aren't set-it-and-forget-it plans. They're living blueprints that need to adapt to the economic winds. And the single most important factor shaping your strategy right now is the interest rate environment, which is heavily steered by Federal Reserve policy.

We’ve seen a perfect example of this in action recently. CD returns, which had been in a long slumber, staged a major comeback starting in 2022 as policymakers shifted gears to fight inflation. By mid-2025, the average one-year CD yield hovered around 2.03%, with the top banks dangling rates as high as 4.40% APY. That's a world away from the near-zero rates we got used to in the previous decade.

This resurgence in yields makes your strategic choices more critical—and more rewarding—than ever. Staying informed about broader central bank policies and warnings can give you a real edge in deciding your next move.

Aligning Strategy with Rate Forecasts

Your game plan should shift depending on whether you think rates are heading up, down, or sideways. Each scenario calls for a different playbook, transforming your savings plan from a passive account into a proactive investment.

When Rates Are Rising: This is a CD ladder's time to shine. As each short-term "rung" of your ladder matures, you can reinvest that cash into a new, long-term CD at the latest—and higher—rates. This lets you continuously "climb" to better yields without locking up all your money at a now-outdated rate.

When Rates Are Falling: If you suspect rates have peaked and are on their way down, the CD barbell and CD bullet strategies become your best friends. The main goal here is to lock in today's high APY with long-term CDs before those rates disappear. A barbell secures a chunk of your money at a great long-term rate, while a bullet ensures you have a specific sum with a strong return ready for a future goal.

Think of it like this: a rising tide lifts all boats, but a ladder helps you climb onto the highest deck. When the tide is going out, you want to be safely anchored at the high-water mark. That's exactly what a long-term CD in a barbell or bullet strategy does for you.

Making Your Move Today

Ultimately, adapting your strategy is about reading the economic tea leaves and making an informed call. With rates much higher than they've been in recent memory, now is a fantastic time to put one of these powerful CD investment strategies to work.

To get started, your first step should be to compare the best current CD rates across different banks and credit unions. This simple act of comparison ensures you’re squeezing every last drop of potential out of whichever strategy you choose. A smart decision today can make a world of difference for your returns tomorrow.

Understanding the True Value of Your CD Returns

Certificates of Deposit are famous for one thing: predictable, safe returns. When a bank advertises a great APY on a new CD, it feels like a simple, straightforward deal.

But that headline number isn't always what lands in your pocket. Two quiet but powerful forces are always at work, chipping away at your actual earnings: inflation and taxes.

Getting a handle on these two factors is the key to setting realistic expectations for any CD investment strategy. Think of the advertised APY as your "gross" return. Your "real" return is what's left after the cost of living (inflation) and Uncle Sam take their share.

Calculating Your Real Return

Figuring out your true, take-home return isn't as complicated as it sounds. While we cover the math in detail in our guide on how to calculate CD returns, the core idea is simple. First, you subtract the inflation rate from your CD's APY. Then, you account for the taxes you'll owe on the interest.

For instance, a 5% APY looks fantastic on paper. But if inflation is humming along at 3%, your actual purchasing power only grew by 2%. Once you pay taxes on that interest income, your real gain shrinks even more.

The real value of a CD isn't always about massive growth. It's about providing stability and a predictable, guaranteed return in a balanced portfolio—something other investments can't always promise.

This reality check is crucial. While CDs are an exceptionally safe place to park your cash, they've historically struggled to beat these erosive forces. In fact, research shows that over the last two decades, 12-month CDs have often delivered negative real returns after accounting for inflation and taxes. If you want to see the numbers yourself, you can explore the long-term performance of CDs.

This doesn't make CDs a bad investment—far from it. It just clarifies their proper role. They are the bedrock of a portfolio, built for capital preservation and predictability, not as the primary engine for aggressive growth.

Common Questions About CD Strategies Answered

Even with the best-laid plans, a few practical questions always pop up when you start putting your money to work. Let’s tackle some of the most common ones savers ask, so you can move forward with confidence.

What happens if I need my money before a CD matures? This is the number one worry for most people. The short answer is you’ll face an early withdrawal penalty. This usually means giving up a certain amount of interest—often three or six months’ worth—which the bank deducts from your balance.

But here’s the thing: a smart CD strategy is specifically designed to avoid this exact scenario.

- A CD ladder frees up a portion of your money every year, giving you predictable access.

- The barbell strategy parks some of your cash in short-term CDs, keeping it liquid for unexpected needs.

- You could also choose a no-penalty CD. These let you pull your money out early without a fee, but they almost always come with slightly lower APYs as a trade-off.

Key Strategic Decisions

Choosing the right structure can feel like a major commitment, but it really just boils down to your personal financial outlook and what you want to achieve.

How do I choose between a CD ladder and a CD barbell? This depends entirely on your need for cash and what you think interest rates will do next.

Think of it this way: Pick a ladder for steady, predictable access to your cash. It’s perfect if you think rates might climb, as you can reinvest each maturing rung at a higher rate. Go with a barbell to get the best of both worlds—immediate liquidity and high long-term yields. This works well if you think rates will fall or just bounce around.

Are brokered CDs a better option than bank CDs? It really comes down to your comfort level with a bit more complexity. Brokered CDs, which you buy through a brokerage firm, can sometimes snag you a higher rate and can be sold on a secondary market if you need cash. The catch? Their value can fluctuate, so you could lose some of your principal if you sell at the wrong time.

Bank CDs are the simpler, more direct route for most savers. They offer a guaranteed return with no fuss.

Ready to see how these strategies could play out with your own savings? Use our Certificate-of-Deposit Calculator to project your earnings, run different scenarios, and build a plan that fits your goals.