Understanding Calculator CD Basics For Smart Money Moves

A Certificate of Deposit (CD) calculator is a helpful tool for anyone wanting to grow their savings. These calculators project the growth of your investment based on factors like your initial deposit, the CD's interest rate, and the term length. This helps you make informed decisions about your money.

Why CD Calculators Matter

CD calculators are essential planning tools. They remove the guesswork from CD investments by showing precisely how your money will grow. This allows you to compare different CD offers and choose the best one for your financial goals. For example, you can quickly see the long-term impact of even a small difference in interest rate.

Key Variables in a CD Calculator

Several key variables influence the results of your CD calculator projections. The initial deposit is your starting investment amount. The interest rate, expressed as an Annual Percentage Yield (APY), determines your rate of return. The term length impacts how long your money is invested and earns interest. The compounding frequency (daily, monthly, quarterly, or annually) affects how quickly your interest earns interest.

Understanding how these factors interact is crucial. Small changes in any variable can significantly affect your final balance. This makes the calculator invaluable for refining your investment strategy. The use of CD calculators is increasing as people look to optimize their savings. Bankrate offers a calculator to estimate potential earnings based on deposit, term, and interest rate, reflecting this growing interest in financial planning. Find more detailed statistics here: Bankrate's CD Calculator.

The Power of Compound Interest

Compound interest is the key to CD growth. It's the concept of earning interest on your initial deposit plus accumulated interest. The more frequently interest compounds, the faster your money grows. Understanding compound interest mechanics is critical for maximizing your CD investments. A CD calculator clearly shows the benefits of compound interest, illustrating how your investment can grow significantly over time.

This understanding helps you strategize effectively, whether saving for a down payment, supplementing retirement, or building a safety net. By exploring different scenarios and comparing offers, you can use a CD calculator to make smart financial decisions.

How Calculator CD Features Shape Your Investment Success

Not all CD calculators are created equal. Knowing which features are important can significantly affect your investment results. This section explores the key functionalities that separate basic calculators from more comprehensive planning tools. We'll examine how different platforms handle crucial aspects like compound interest, early withdrawal penalties, and comparing rates.

Essential Calculator CD Features

Some features can be real game-changers when it comes to reaching your financial goals. Be sure to look for calculators offering the following:

Compound Interest Flexibility: The ability to modify the compounding frequency (daily, monthly, quarterly, annually) is essential for accurate projections. This lets you see how different compounding schedules impact your returns.

Early Withdrawal Penalty Calculations: Unexpected things happen. A good calculator helps you understand the potential costs of accessing your funds early. This feature empowers you to make informed choices if unexpected expenses arise.

Rate Comparison Tools: Easily compare rates from different banks and credit unions. This simplifies your search for the best CD rates. For further information, you can explore resources like How to master CD rates with our calculator.

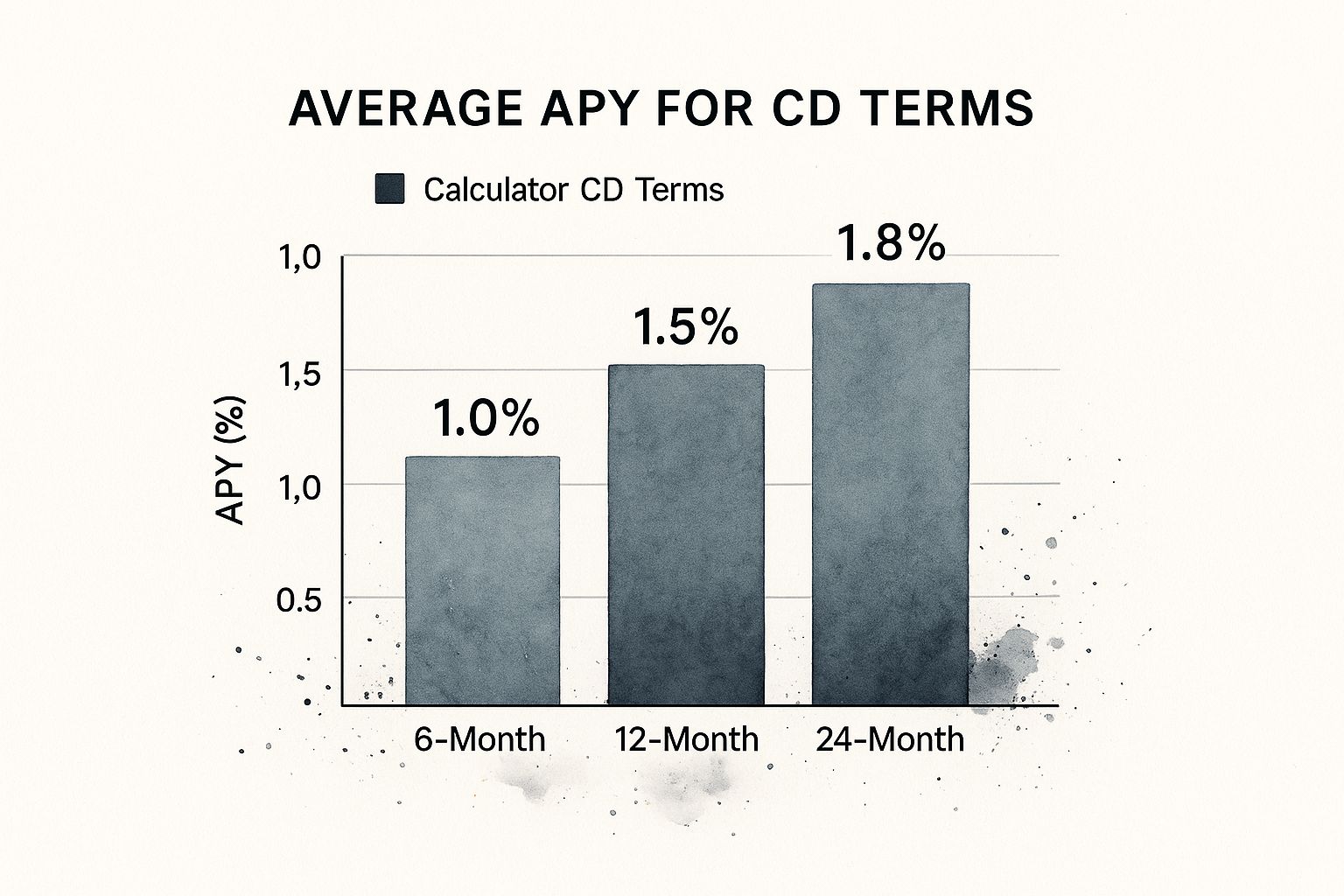

This bar chart compares average APYs for common CD terms. Longer terms generally offer higher returns, demonstrating the potential advantages of committing your funds for a longer duration.

Advanced Features for Strategic Investors

Experienced investors often use more advanced calculator features:

Scenario Modeling: Explore different possibilities by adjusting deposit amounts, interest rates, and terms. This helps you prepare for various market conditions.

Tax Impact Calculations: Understand the tax implications of your CD earnings. This helps you maximize your after-tax returns.

CD Ladder Planning: Model the setup of a CD ladder, a strategy that staggers CD maturity dates to balance accessible funds with yield.

To help you select the right CD calculator, the table below compares key features across popular platforms:

CD Calculator Feature Comparison

Compare essential features across popular CD calculator platforms to help you choose the right tool for your investment needs.

| Calculator Platform | Compound Interest Options | Early Withdrawal Penalties | Comparison Tools | Tax Calculations |

|---|---|---|---|---|

| NerdWallet | Daily, Monthly, Quarterly, Annually | Yes | Limited | No |

| Bankrate | Daily, Monthly, Quarterly, Annually | Yes | Yes | No |

| DepositAccounts | Daily, Monthly, Quarterly, Annually | Yes | Yes | No |

As shown in the table, most platforms offer robust compound interest options and calculate early withdrawal penalties. However, direct tax calculations and comprehensive comparison tools are less common.

Understanding Calculator Limitations

While extremely helpful, CD calculators have limitations. They typically assume fixed interest rates and no early withdrawals. For instance, NerdWallet's CD calculator projects total interest earned and the final balance assuming compounded interest and no early withdrawals, which can incur penalties. A $5,000 CD at 3% interest compounded annually for five years yields approximately $793 in interest, resulting in a $5,793 maturity balance. Remember to account for potential rate changes and penalties in your investment decisions. You can also find helpful information in resources like How to calculate your CD growth effectively. By understanding the capabilities and limitations of CD calculators, you can use them wisely to develop your investment strategy and achieve your financial objectives.

Your Complete Calculator CD Strategy Blueprint

Ready to turn your calculator knowledge into investment success with Certificates of Deposit (CDs)? This guide walks you through proven strategies, from basic calculator inputs to sophisticated techniques for maximizing your returns. You'll learn how to interpret the results, handle conflicting projections, and navigate complex situations like CD laddering and interest rate changes.

Mastering Calculator CD Inputs

Every CD calculator needs specific information. Start with your principal, which is your initial deposit or the amount you plan to invest. Next, enter the annual percentage yield (APY) offered by the financial institution. The term, or the investment duration, is also crucial. Finally, specify the compounding frequency (daily, monthly, quarterly, or annually). The best input sequence is principal, interest rate, term, then compounding frequency.

Interpreting Calculator CD Results

Understanding the output is just as important as the input. The future value shows the total amount at maturity – your initial investment plus the interest earned. The total interest earned displays the overall interest accumulated during the CD's term. If different calculators give you conflicting projections, double-check your inputs. Small differences in interest rates or compounding frequency can significantly change the results.

Advanced Calculator CD Strategies

For complex situations like CD laddering, a CD calculator becomes invaluable. A CD ladder staggers CD maturity dates to balance liquidity and higher returns. You can use the calculator to model different ladder configurations and optimize your strategy. You might also be interested in learning more: How to master CD growth calculations. Predicting rate changes is difficult, but a calculator can help you assess the potential impact. By adjusting the interest rate input, you can visualize how different rate scenarios could affect your investment.

Practical Tips for Calculator CD Success

Start Small, Experiment: Test different scenarios by adjusting the inputs to understand how each variable affects the outcome.

Compare Multiple Offers: Use the calculator to compare CDs from different banks and credit unions to find the best rates and terms.

Consider Inflation: Keep in mind that inflation can erode the real value of your returns. Factor this into your financial planning.

Using a CD calculator effectively empowers you to make informed, data-driven investment decisions. These tools are essential for creating a sound investment strategy aligned with your financial goals. By following these guidelines, you can navigate the complexities of CD investments and maximize your returns.

Building Winning Investment Strategies With Calculator Insights

Transforming calculator results into actionable investment strategies is key for reaching your financial objectives. This section explores how experienced investors leverage CD calculator data to build balanced portfolios that combine growth and security. We'll delve into proven techniques for comparing CDs, identifying appropriate term lengths, and balancing liquidity needs with desired returns.

Comparing CD Options Across Institutions

A CD calculator empowers you to quickly compare offers from various banks and credit unions. By entering the same principal, term, and compounding frequency into the calculator for different CD offers, you can easily determine which institution provides the highest return. This direct comparison helps maximize your earnings by selecting the most competitive APY (Annual Percentage Yield). For instance, if you're investing $10,000 for 12 months, a calculator can pinpoint the bank offering the best return, even if the APY difference appears minimal.

Determining When Longer Terms Make Financial Sense

Longer-term CDs often offer higher interest rates, but they also lock up your funds for an extended period. A CD calculator can help you assess the trade-offs. By modeling different term lengths with your intended principal and expected interest rates, you can project earnings over various time horizons. This lets you evaluate the potential advantages of securing a higher rate for a longer term against maintaining greater liquidity with shorter-term CDs. Also, consider using the calculator to account for potential early withdrawal penalties if you might need access to your funds before maturity.

Balancing Liquidity and Returns

Balancing accessible funds and maximizing returns is a core investment planning challenge. CD laddering, a strategy involving investing in multiple CDs with staggered maturity dates, offers a solution. A CD calculator is crucial for designing an effective CD ladder. You could model a ladder with CDs maturing every six months over a three-year period. The calculator projects returns for each CD, allowing you to optimize fund allocation and ensure regular access to a portion of your investment while still benefiting from the typically higher yields of longer-term CDs.

Factoring in Inflation, Taxes, and Opportunity Costs

While a CD calculator emphasizes the nominal return, it's vital to consider other factors influencing your real returns. Inflation diminishes your earnings' purchasing power over time. Use inflation forecasts to estimate your CD returns' real value at maturity. Taxes also reduce earnings; remember that CD interest is usually taxable. Lastly, consider the opportunity cost of a CD investment. Compare potential CD returns with other investment options like bonds or Treasury bills to ensure you're strategically using your funds. By considering these factors, you can make informed decisions about whether a CD aligns with your overall financial goals.

Examining real-world examples further highlights the advantages of calculator insights. Investors have used CD calculators to time investments, build effective CD ladders, and achieve savings goals earlier than planned. These successes demonstrate the power of informed decision-making through effectively using a CD calculator.

Advanced Calculator CD Tactics For Serious Investors

Beyond basic calculations, sophisticated strategies exist for maximizing CD returns. This section explores how seasoned investors use CD calculators for complex scenarios, like callable CDs, bump-up CDs, and market-linked CDs. We'll also examine techniques for modeling interest rate environments and calculating the true cost of early withdrawals.

Navigating Callable CDs With a Calculator

Callable CDs offer enticing interest rates but can be redeemed by the issuing institution before maturity. A CD calculator can help determine the potential impact of an early call. By inputting the call date and the associated interest rate, you can project your return in a call scenario versus holding the CD to maturity. This allows you to carefully evaluate the risk-reward trade-off.

Evaluating Bump-Up CDs

Bump-up CDs provide the flexibility to increase your interest rate once during the CD term. A calculator can help you decide when to exercise this valuable option. By modeling projections with the initial rate and the potential higher rate, you can determine the optimal time to "bump up" based on interest rate forecasts. This strategic approach helps ensure you're maximizing your return in a fluctuating interest rate environment.

Understanding Market-Linked CDs

Market-linked CDs offer returns tied to the performance of a market index. While a standard CD calculator might not directly model these complex products, it can still be a useful tool. You can use the calculator to project a guaranteed minimum return, a common feature of market-linked CDs, and compare this with potential returns from traditional CDs. This establishes a helpful baseline for evaluating the market-linked CD's potential benefits and risks. Learn more in our article about How to master the CD ladder strategy.

Modeling Interest Rate Environments and Early Withdrawal Penalties

Modeling various interest rate scenarios is crucial for sound decision-making. By adjusting the interest rate input in your calculator, you can project how rising or falling rates might influence your investment. This proactive approach allows you to prepare for different market conditions and consider strategies like CD laddering to mitigate interest rate risk. Learn more about CD Laddering

Furthermore, a calculator is essential for calculating the true cost of an early withdrawal. Inputting the penalty terms and the time of withdrawal allows you to see the precise impact on your final balance. This knowledge empowers you to weigh the costs and benefits of accessing your funds prematurely.

To illustrate different CD scenarios, let's consider the following table:

CD Investment Scenarios Analysis

Real-world examples showing different CD investment amounts, terms, and projected returns to help guide your investment decisions.

| Initial Deposit | Interest Rate | Term Length | Compound Frequency | Final Balance | Total Interest Earned |

|---|---|---|---|---|---|

| $10,000 | 4.50% | 1 year | Monthly | $10,459.40 | $459.40 |

| $25,000 | 4.75% | 2 years | Quarterly | $27,483.63 | $2,483.63 |

| $50,000 | 5.00% | 3 years | Annually | $57,881.25 | $7,881.25 |

| $100,000 | 5.25% | 5 years | Monthly | $129,236.30 | $29,236.30 |

This table demonstrates how varying initial deposits, interest rates, and term lengths can significantly impact your final balance and total interest earned. It underscores the importance of using a CD calculator to understand the potential outcomes of your investment choices.

Optimizing CD Ladder Timing and Reinvestment Strategies

A CD calculator proves invaluable when optimizing a CD ladder. By projecting the maturity dates and returns of each CD in the ladder, you can fine-tune the timing of new CD purchases and reinvestments to align with your cash flow needs and interest rate outlook. This strategic approach ensures your ladder maintains a balanced mix of liquidity and yield.

Evaluating Promotional Rates and Hidden Costs

Be wary of promotional rates. Use the calculator to compare the advertised APY with the effective APY, accounting for any introductory bonuses or fees. This will reveal the true long-term return and prevent you from being swayed by short-term incentives. Also, be mindful of hidden costs, such as early withdrawal penalties or brokerage fees. Always review the fine print and use the calculator to factor these costs into your projections.

By mastering these advanced calculator tactics, you can refine your CD investment strategy and optimize your returns. Understanding the nuances of various CD products and strategically utilizing a calculator empowers you to make data-driven decisions and effectively navigate complex investment scenarios. You might be interested in: How to understand the ins and outs of CD ladders.

Avoiding Calculator CD Mistakes That Cost You Money

Even savvy investors can sometimes stumble when using a CD calculator. This section highlights common pitfalls and offers strategies to ensure your calculations accurately reflect your potential returns. Understanding these mistakes is key to maximizing your CD investments.

Overlooking Fees and Penalties

Many CD calculators don't automatically include fees or penalties. Forgetting about early withdrawal penalties, for instance, can significantly impact your actual returns. Always review the terms and conditions of your CD for any applicable fees.

Input these fees into the calculator or manually subtract them from your projected earnings. This provides a more realistic estimate and a clearer picture of your potential profit.

Relying Solely on Promotional Rates

Promotional rates can be tempting, but they are usually short-lived. Using a CD calculator with only the promotional rate can lead to inflated projected earnings.

Make sure to input the standard rate that takes effect after the promotional period. This will give you a more accurate long-term return assessment and a better understanding of your investment growth. For example, a 6-month CD might offer an introductory 5% APY, which then drops to 2%. Calculating with only the 5% will overestimate your earnings.

Ignoring the Impact of Inflation

Inflation gradually reduces your money's purchasing power. A CD calculator projects nominal returns, but it's important to consider inflation's impact on your real returns.

Use an inflation calculator along with your CD calculator. This dual approach provides a more complete picture of your future buying power and how inflation might affect your investment’s value.

Not Verifying Calculator Results

Blindly trusting a CD calculator without verifying the results can result in inaccurate projections. Double-check all inputs, especially the interest rate, term length, and compounding frequency. Even small input errors can significantly alter the results.

Try using multiple reputable CD calculator tools to compare projections. Discrepancies might indicate an input error or a difference in the calculators’ underlying assumptions. You can compare CD options and learn more at BankDepositGuide's CD calculator.

Failing to Seek Professional Advice

While a CD calculator is a helpful tool, it shouldn't replace professional financial advice. For complex investment decisions, consult a qualified financial advisor.

A financial advisor can provide personalized guidance tailored to your financial situation and goals. They can also help you navigate complex CD products and strategies, such as CD laddering, ensuring your choices align with your overall financial plan. By avoiding these common CD calculator mistakes, you can make more informed investment decisions and improve your chances of reaching your financial objectives. Remember, careful planning and realistic projections are essential for long-term success.

Key Takeaways For Calculator CD Success

Your journey to financial security begins with understanding how to use a CD calculator. This section breaks down essential strategies into actionable steps you can use right away. We'll cover key checklists for evaluating CDs, warning signs in calculator results, and benchmarks for tracking your progress.

Essential Checklist for Evaluating CD Opportunities

Before you start using a CD calculator, gather this important information:

- Principal: How much will you invest?

- Interest Rate (APY): What annual percentage yield (APY) is the institution offering?

- Term Length: How long will your funds be locked up?

- Compounding Frequency: How often is the interest compounded (daily, monthly, quarterly, annually)?

Having these details will streamline the calculation process and help you compare different CDs.

Warning Signs in Calculator CD Results

CD calculators are powerful tools, but it's important to interpret results carefully. Here are some potential red flags:

- Unrealistic APYs: If the APY looks too good to be true, it probably is. Compare it to average rates at other financial institutions.

- Neglecting Penalties: Ensure the calculator includes early withdrawal penalties. Overlooking them can significantly underestimate the cost of early access to your money.

- Ignoring Inflation: Remember, inflation can erode your returns over time. Consider using an inflation calculator with your CD calculator to assess the impact on your investment's purchasing power.

A healthy skepticism toward attractive offers is critical for successful CD investing.

Benchmarks for Measuring Your CD Investment Progress

Track your progress against realistic expectations. Don't focus on short-term market changes, concentrate on your long-term goals.

- Regularly compare actual returns with projected returns: This helps you identify discrepancies and adjust your strategy.

- Monitor interest rates: Understand how interest rate changes can impact your CD investments. Consider strategies like CD laddering to manage interest rate risk.

- Review your CD portfolio annually: Re-evaluate your holdings and make adjustments based on your financial goals and market conditions.

By tracking these metrics, you can be confident your CD strategy is working effectively and moving you closer to your financial objectives. Ready to maximize your returns? Use our Certificate-of-Deposit Calculator and take control of your financial future.